Wireless Surgical Cameras Market Synopsis

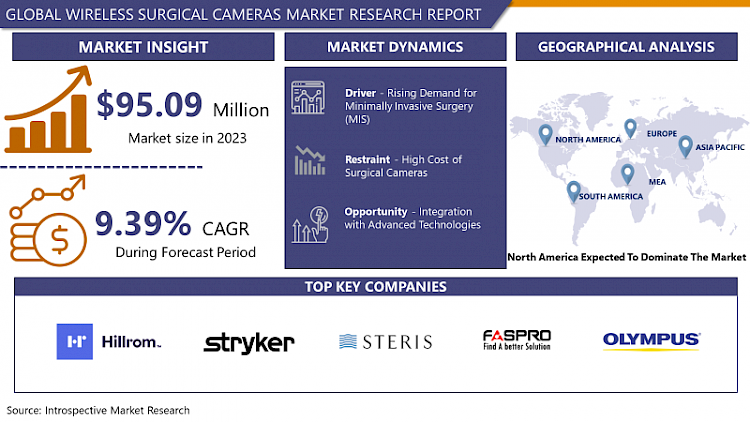

Wireless Surgical Cameras Market Size Was Valued at USD 95.09 Million in 2023 and is Projected to Reach USD 213.27 Million by 2032, Growing at a CAGR of 9.39% From 2024-2032.

Wireless surgical cameras are innovative medical imaging equipment that provides high-definition photos and movies during surgical procedures, allowing surgeons to get and cross complicated anatomical systems. These wireless cameras eliminate large cables, enhancing mobility and versatility. Improved imagining helps surgeons make more accurate decisions, important for better patient results and lower risks.

- The wireless surgical camera market has expanded rapidly due to advancements in medicine, less invasive procedures, and improved vision. These modern instruments help surgeons accomplish difficult operations by providing real-time, high-definition photos and videos for accuracy and efficiency in a variety of medical specialties, including orthopedics, neurology, gastrointestinal, and gynecology.

- This invention substitutes the standard two-cable camera system used in minimally invasive procedures, with one cable providing power and the other providing fiber-optic light. By removing these bulky cables, surgeons may operate with greater dexterity, accuracy, and focus, reducing disruptions and contamination issues and freeing them up to focus on patient care.

- Wireless surgical cameras are primarily used in minimally invasive surgery (MIS) due to their high-definition video streams, enabling surgeons to visualize the surgical site with precision. They are also utilized in remote surgical training and education utilize these tools, enabling medical workers to observe and learn from real-time procedures, and promoting continuous learning and skill growth among surgeons and medical students.

- Advancements in technology are expected to continue evolving wireless surgical cameras, with AI-powered algorithms improving precision and identifying anomalies. Miniaturization and wearable devices may lead to smaller, portable cameras, while Augmented Reality and Virtual Reality technologies offer immersive views. Remote collaboration will enable seamless real-time communication, expanding the reach and impact of wireless surgical cameras in global healthcare.

Wireless Surgical Cameras Market Trend Analysis

Rising Demand for Minimally Invasive Surgery (MIS)

- The surge in demand for Minimally Invasive Surgery (MIS), characterized by reduced incisions and patient stress, is a driving force behind the growth of the Wireless Surgical Cameras Market. This shift in surgical approaches has required the adoption of modern imaging technologies, particularly wireless surgery cameras. MIS techniques are extensively utilized across various medical sectors, including orthopedic surgery, where wireless cameras deliver detailed intra-articular images for precise surgical interventions. In laparoscopic procedures addressing abdominal conditions, wireless cameras empower surgeons with enhanced visualization of complex anatomies, leading to improved patient outcomes and accelerated recovery times.

- A rise in the use of minimally invasive surgery (MIS) methods and a growing inclination for less intrusive treatments have resulted in a need for wireless surgical cameras. this demand and offer the best possible patient care, healthcare providers are investing in new imaging technology. Surgeons can see vital tissues, navigate complicated anatomy, and conduct difficult treatments with more accuracy because of wireless cameras' real-time imaging and precision during surgeries. Wireless cameras are extremely important in neurosurgery, for instance, for minimally invasive operations such as endoscopic pituitary surgery, where accurate imaging is critical to effective results. The integration of wireless surgical cameras with digital health platforms and telemedicine systems has increased their application outside the operating room. Surgeons may remotely watch surgeries, interact with colleagues in distant places, and conduct virtual consultations, demonstrating the flexibility and usefulness of wireless imaging technology in current healthcare settings.

Integration with Advanced Technologies

- Wireless surgical cameras, which are crucial in modern medical procedures, can revolutionize the healthcare industry by integrating advanced technologies like artificial intelligence (AI), augmented reality (AR), and 5G connectivity. AI algorithms can analyze real-time imaging data, aiding surgeons in making informed decisions during surgeries. This can identify anomalies, highlight critical areas, and provide predictive analytics, ultimately improving surgical outcomes and patient safety. This integration is a key advancement in the field of medical imaging.

- Augmented reality (AR) and 5G connectivity are revolutionizing the medical field. AR systems enhance the visualization of anatomical structures and surgical targets, providing surgeons with interactive 3D models, real-time guidance, and procedural checklists. This leads to more precise surgeries and reduced errors. 5G connectivity enables high-speed data transfer and low-latency communication, allowing surgeons to stream high-definition video feeds in real time, collaborate with remote experts, and access cloud-based medical records, enhancing surgical teamwork and global access to specialized medical expertise. Wireless surgical cameras, thanks to miniaturization and battery technology advancements, are now more portable and versatile, allowing surgeons to use them in various settings like operating rooms, ambulances, and field hospitals, enhancing healthcare efficiency, particularly in emergencies or remote areas.

Wireless Surgical Cameras Market Segment Analysis:

Wireless Surgical Cameras Market is Segmented on the basis of Product and End-User.

By Product, Endoscopic Wireless Surgical Cameras segment is expected to dominate the market during the forecast period

- Endoscopic wireless surgical cameras are poised to dominate the medical imaging market, Wireless Video Endo-Camera is a special-purpose digital video camera combined with a universal coupler, designed for various endoscopic applications. Powered by a rechargeable lithium-ion battery, this innovative device streams high-quality live video (at 30fps) to a computer, enabling the user to view and record crystal-clear images or videos Wireless Endoscope Camera is being routinely used in otolaryngology (ENT), Gynecology, Urology, and Cosmetic practices worldwide. The most common uses are for diagnostics, client communication and education, tracking changes over time, and general examinations.

- Endoscopic wireless surgical cameras are being developed and improved through research and development. Manufacturers are investing in image resolution, wireless connectivity, and artificial intelligence algorithms for real-time image analysis. These advancements not only enhance surgical imaging quality but also in better decision-making during procedures. its technological advancements, and increased demand for minimally invasive procedures.

By End-User, Hospitals segment held the largest share of 63.22% in 2023

- The Hospitals segment dominates the wireless surgical cameras market due to the high volume of surgical procedures performed in hospitals, which demand advanced medical equipment like wireless surgical cameras. Hospitals are often at the forefront of adopting innovative technologies to improve patient care and surgical outcomes. Wireless surgical cameras offer flexibility, mobility, and real-time imaging, making them indispensable tools for modern surgical practices. Hospitals specializing in minimally invasive surgeries rely heavily on wireless cameras for precise visualization and navigation, leading to better patient outcomes and shorter recovery times/

- They focus on technological innovation Large hospitals have dedicated budgets for acquiring advanced medical devices, such as wireless surgical cameras, to stay competitive and deliver high-quality healthcare services. Regulatory standards often require hospitals to use advanced imaging technologies that meet stringent quality and safety standards, further driving the adoption of wireless surgical cameras in hospital settings. These factors underscore the critical role of hospitals in driving the adoption and advancement of wireless surgical camera technologies.

Wireless Surgical Cameras Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is set to dominate the wireless surgical cameras market due to its advanced healthcare infrastructure and high adoption rates of innovative medical technologies. Healthcare facilities in the region prioritize using cutting-edge equipment for superior patient care. The region is home to leading medical device manufacturers and technology companies specializing in surgical imaging solutions, fostering continuous innovation and the development of advanced wireless surgical cameras with enhanced features. Companies like Stryker Corporation and Intuitive Surgical invest in research and development to improve their surgical camera offerings.

- North America is attributed to favorable reimbursement policies and government initiatives promoting healthcare innovation. These policies encourage healthcare providers to invest in advanced equipment, such as wireless cameras, to improve patient care and operational efficiency. The region's large patient population and prevalence of chronic diseases drive the demand for advanced medical imaging technologies.

Wireless Surgical Cameras Market Top Key Players:

- Sunoptics (United States)

- Faspro Systems Co Ltd. (fasmedo) (United States)

- Stryker (United States)

- Firefly Global (United States)

- General Scientific Corporation (United States)

- North Southern Electronics Limited (United States)

- Hill-Rom Services, Inc (United States)

- Genscript (United States)

- Leica Microsystems (Germany)

- Steris PLC (UK)

- Precision Surgical Ltd (UK)

- Surgiris (France)

- Xenosys (Korea)

- Olympus Corporation (Japan)

- Denyers International (Australia), and Other Major Players

Key Industry Developments in the Wireless Surgical Cameras Market:

- In August 2023, STERIS Plc completed the previously announced acquisition of the surgical instrumentation, laparoscopic instrumentation, and sterilization container assets from BD.

- In July 2023, Stryker announced the launch of its Ortho Q Guidance system, enabling advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field. The system combines new optical tracking options via a redesigned, state-of-the-art camera with sophisticated algorithms of the newly launched Ortho Guidance software to deliver additional surgical planning and guidance capabilities.

|

Global Wireless Surgical Cameras Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 95.09 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.39% |

Market Size in 2032: |

USD 213.27 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WIRELESS SURGICAL CAMERAS MARKET BY PRODUCT (2017-2032)

- WIRELESS SURGICAL CAMERAS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HEAD MOUNT WIRELESS SURGICAL CAMERAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ENDOSCOPIC WIRELESS SURGICAL CAMERAS

- SURGICAL LIGHT MOUNTED WIRELESS SURGICAL CAMERAS

- WIRELESS SURGICAL CAMERAS MARKET BY APPLICATION (2017-2032)

- WIRELESS SURGICAL CAMERAS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AMBULATORY SURGICAL CENTERS

- SPECIALTY CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wireless Surgical Cameras Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SUNOPTICS (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Faspro Systems Co Ltd. (fasmedo) (United States)

- Stryker (United States)

- Firefly Global (United States)

- General Scientific Corporation (United States)

- North Southern Electronics Limited (United States)

- Hill-Rom Services, Inc (United States)

- Genscript (United States)

- Leica Microsystems (Germany)

- Steris PLC (UK)

- Precision Surgical Ltd (UK)

- Surgiris (France)

- Xenosys (Korea)

- Olympus Corporation (Japan)

- Denyers International (Australia)

- COMPETITIVE LANDSCAPE

- GLOBAL WIRELESS SURGICAL CAMERAS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wireless Surgical Cameras Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 95.09 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.39% |

Market Size in 2032: |

USD 213.27 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WIRELESS SURGICAL CAMERAS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WIRELESS SURGICAL CAMERAS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WIRELESS SURGICAL CAMERAS MARKET COMPETITIVE RIVALRY

TABLE 005. WIRELESS SURGICAL CAMERAS MARKET THREAT OF NEW ENTRANTS

TABLE 006. WIRELESS SURGICAL CAMERAS MARKET THREAT OF SUBSTITUTES

TABLE 007. WIRELESS SURGICAL CAMERAS MARKET BY PRODUCT

TABLE 008. HEAD MOUNT WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

TABLE 009. ENDOSCOPIC WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

TABLE 010. SURGICAL LIGHT MOUNTED WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

TABLE 011. WIRELESS SURGICAL CAMERAS MARKET BY END-USER

TABLE 012. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 013. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

TABLE 014. SPECIALTY CLINICS MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA WIRELESS SURGICAL CAMERAS MARKET, BY PRODUCT (2016-2028)

TABLE 017. NORTH AMERICA WIRELESS SURGICAL CAMERAS MARKET, BY END-USER (2016-2028)

TABLE 018. N WIRELESS SURGICAL CAMERAS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE WIRELESS SURGICAL CAMERAS MARKET, BY PRODUCT (2016-2028)

TABLE 020. EUROPE WIRELESS SURGICAL CAMERAS MARKET, BY END-USER (2016-2028)

TABLE 021. WIRELESS SURGICAL CAMERAS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC WIRELESS SURGICAL CAMERAS MARKET, BY PRODUCT (2016-2028)

TABLE 023. ASIA PACIFIC WIRELESS SURGICAL CAMERAS MARKET, BY END-USER (2016-2028)

TABLE 024. WIRELESS SURGICAL CAMERAS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA WIRELESS SURGICAL CAMERAS MARKET, BY PRODUCT (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA WIRELESS SURGICAL CAMERAS MARKET, BY END-USER (2016-2028)

TABLE 027. WIRELESS SURGICAL CAMERAS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA WIRELESS SURGICAL CAMERAS MARKET, BY PRODUCT (2016-2028)

TABLE 029. SOUTH AMERICA WIRELESS SURGICAL CAMERAS MARKET, BY END-USER (2016-2028)

TABLE 030. WIRELESS SURGICAL CAMERAS MARKET, BY COUNTRY (2016-2028)

TABLE 031. SUNOPTICS (UNITED STATES): SNAPSHOT

TABLE 032. SUNOPTICS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 033. SUNOPTICS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 034. SUNOPTICS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. FASPRO SYSTEMS CO LTD (UNITED STATES): SNAPSHOT

TABLE 035. FASPRO SYSTEMS CO LTD (UNITED STATES): BUSINESS PERFORMANCE

TABLE 036. FASPRO SYSTEMS CO LTD (UNITED STATES): PRODUCT PORTFOLIO

TABLE 037. FASPRO SYSTEMS CO LTD (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. STRYKER (UNITED STATES): SNAPSHOT

TABLE 038. STRYKER (UNITED STATES): BUSINESS PERFORMANCE

TABLE 039. STRYKER (UNITED STATES): PRODUCT PORTFOLIO

TABLE 040. STRYKER (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. FIREFLY GLOBAL (UNITED STATES): SNAPSHOT

TABLE 041. FIREFLY GLOBAL (UNITED STATES): BUSINESS PERFORMANCE

TABLE 042. FIREFLY GLOBAL (UNITED STATES): PRODUCT PORTFOLIO

TABLE 043. FIREFLY GLOBAL (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SURGIRIS (EUROPE): SNAPSHOT

TABLE 044. SURGIRIS (EUROPE): BUSINESS PERFORMANCE

TABLE 045. SURGIRIS (EUROPE): PRODUCT PORTFOLIO

TABLE 046. SURGIRIS (EUROPE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. GENERAL SCIENTIFIC CORPORATION (UNITED STATES): SNAPSHOT

TABLE 047. GENERAL SCIENTIFIC CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 048. GENERAL SCIENTIFIC CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 049. GENERAL SCIENTIFIC CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. NORTH SOUTHERN ELECTRONICS LIMITED (UNITED STATES): SNAPSHOT

TABLE 050. NORTH SOUTHERN ELECTRONICS LIMITED (UNITED STATES): BUSINESS PERFORMANCE

TABLE 051. NORTH SOUTHERN ELECTRONICS LIMITED (UNITED STATES): PRODUCT PORTFOLIO

TABLE 052. NORTH SOUTHERN ELECTRONICS LIMITED (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. XENOSYS (KOREA): SNAPSHOT

TABLE 053. XENOSYS (KOREA): BUSINESS PERFORMANCE

TABLE 054. XENOSYS (KOREA): PRODUCT PORTFOLIO

TABLE 055. XENOSYS (KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DENYERS INTERNATIONAL (AUSTRALIA): SNAPSHOT

TABLE 056. DENYERS INTERNATIONAL (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 057. DENYERS INTERNATIONAL (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 058. DENYERS INTERNATIONAL (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LEICA MICROSYSTEMS (GERMANY): SNAPSHOT

TABLE 059. LEICA MICROSYSTEMS (GERMANY): BUSINESS PERFORMANCE

TABLE 060. LEICA MICROSYSTEMS (GERMANY): PRODUCT PORTFOLIO

TABLE 061. LEICA MICROSYSTEMS (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PRECISION SURGICAL LTD (UNITED KINGDOM): SNAPSHOT

TABLE 062. PRECISION SURGICAL LTD (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 063. PRECISION SURGICAL LTD (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 064. PRECISION SURGICAL LTD (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. STERIS PLC (UNITED KINGDOM): SNAPSHOT

TABLE 065. STERIS PLC (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 066. STERIS PLC (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 067. STERIS PLC (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OLYMPUS CORPORATION (JAPAN): SNAPSHOT

TABLE 068. OLYMPUS CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 069. OLYMPUS CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 070. OLYMPUS CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. GENSCRIPT (UNITED STATES): SNAPSHOT

TABLE 071. GENSCRIPT (UNITED STATES): BUSINESS PERFORMANCE

TABLE 072. GENSCRIPT (UNITED STATES): PRODUCT PORTFOLIO

TABLE 073. GENSCRIPT (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. HILL-ROM SERVICES INC (UNITED STATES): SNAPSHOT

TABLE 074. HILL-ROM SERVICES INC (UNITED STATES): BUSINESS PERFORMANCE

TABLE 075. HILL-ROM SERVICES INC (UNITED STATES): PRODUCT PORTFOLIO

TABLE 076. HILL-ROM SERVICES INC (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY PRODUCT

FIGURE 012. HEAD MOUNT WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

FIGURE 013. ENDOSCOPIC WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

FIGURE 014. SURGICAL LIGHT MOUNTED WIRELESS SURGICAL CAMERAS MARKET OVERVIEW (2016-2028)

FIGURE 015. WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY END-USER

FIGURE 016. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 017. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 018. SPECIALTY CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA WIRELESS SURGICAL CAMERAS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wireless Surgical Cameras Market research report is 2024-2032.

Sunoptics (United States), Faspro Systems Co Ltd. (fasmedo) (United States), Stryker (United States), Firefly Global (United States), General Scientific Corporation (United States), North Southern Electronics Limited (United States), Hill-Rom Services, Inc (United States), Genscript (United States), Leica Microsystems (Germany), Steris PLC (UK), Precision Surgical Ltd (UK), Surgiris (France), Xenosys (Korea), Olympus Corporation (Japan), Denyers International (Australia), and Other Major Players.

The Wireless Surgical Cameras Market is segmented into Product, Application, and region. By Product, the market is categorized into Head Mount Wireless Surgical Cameras, Endoscopic Wireless Surgical Cameras, and Surgical Light Mounted Wireless Surgical Cameras. By Application, the market is categorized into Hospitals, Ambulatory Surgical Centers, and Specialty Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wireless surgical cameras are innovative medical imaging equipment that provides high-definition photos and movies during surgical procedures, allowing surgeons to get and cross complicated anatomical systems. These wireless cameras eliminate large cables, enhancing mobility and versatility. Improved imagining helps surgeons make more accurate decisions, important for better patient results and lower risks.

Wireless Surgical Cameras Market Size Was Valued at USD 95.09 Million in 2023 and is Projected to Reach USD 213.27 Million by 2032, Growing at a CAGR of 9.39% From 2024-2032.