Global Wireless Mesh Network Market Overview

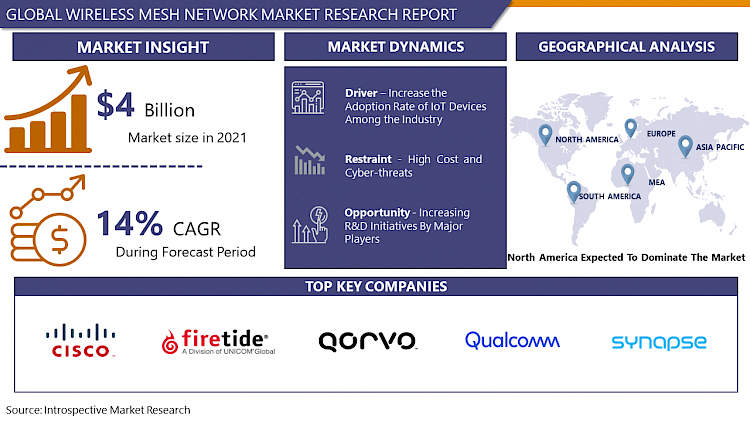

The Wireless Mesh Network Market is projected to reach USD 10.01 Billion by 2028, up from an anticipated USD 4 billion in 2021, with a CAGR of 14%.

A Wireless Mesh Network (WMN) is a communication network designed by several stationary wireless mesh routers, these routers are wirelessly connected by using a mesh-like backbone structure and through this backbone mesh network, the client can receive or transmit the data. For each node there is a need of transmitting to the next node, thus networking infrastructure is decentralized and simplified. A wireless mesh network may or may not be connected to the internet. The wireless mesh networks also termed wireless ad hoc networks (WANET) and it is used for home Wi-Fi networks, cities and municipalities offered public Wi-Fi access, Wi-Fi, and networking in temporary locations and connecting internet of things (IoT) devices. These applications of WMN support the growth of the market.

Market Dynamics and Factors For Wireless Mesh Network Market

Drivers:

Increase the Adoption Rate of IoT Devices Among the Industry

The adoption of developed technology such as IoT technology is growing in most industries. For the connection of infrastructure nodes mesh network is used. For the transportation of data, the nodes communicate with one another and connect to other nodes. The mesh network offers several advantages for IoT devices such as Self-healing, self-configuring, scalability, and dependability. For all kinds of IoT applications, WMN provides a powerful network. For a mesh network, there is no need for a network connection. Thus, for IoT devices mesh networks become cost-effective. In addition to this, WMN also offers advantages for IoT devices like better management, optimization of resource usage, and sending the information in the fastest route. These all beneficial factors of a mesh network for IoT devices are anticipated for the growth of the wireless mesh network market in the forecast period.

Restraints:

High Cost and Cyber-threats

The installation of wireless mesh technology is expensive because it contains multiple units. It is the main barrier in the market for entries of key players. Thus, it hampers the growth of the market. In addition to this, data security is the major issue that is also hindering the market growth. The data security problem increase the privacy concern is limits the growth of wireless mesh networks for small and medium enterprises.

Opportunity:

Increasing R&D Initiatives By Major Players

The market players of the wireless mesh network are engaged in expanding their services in the government and defense sectors which provides a gainful opportunity for the market of the wireless mesh network in the analysis period. To strengthen the market, position the industries involved in the wireless mesh network market that expand the research and development facilities in the undeveloped region. For instance, the C4000 cnMaestro management appliance was introduced by Cambium Networks. These all factors offer the remunerative opportunity for the wireless mesh network in the forecast year.

Segmentation Analysis Of Wireless Mesh Network Market

By Operating frequency, the 2.4 GHz operating frequency sector is anticipated to have high market growth in the forecast period. The frequency of the 2.4 GHz wireless mesh has a better range and it can penetrate easily to solid objects. The devices have a frequency of 2.4 GHz, lower in cost than other devices. These all factors contributed to the market growth of wireless mesh networks. In addition to this, IoT devices can connect only 2.4 GHz. The IoT devices adoption rate is increased in most organizations in the world. Thus, the 2.4 GHz operating frequency sector is projected to increase market growth in the forecast year.

By Component, the physical appliances segment has maximum growth in the wireless mesh network. The physical appliances include mesh routers, switches, access points, and controllers. The traditional routers were replaced by mesh routers and the heterogeneous devices in the mesh network, it offers policy-based applications that support market growth.

By End-Users, the Healthcare segment has the highest market growth in the wireless mesh network. This is owing to the rising application of wireless mesh networks in the healthcare industry. Healthcare companies can use the wireless mesh network for low-frequency applications like asset tracking and automating certain building operations. In the healthcare sector, asset monitoring is more popular because it saves money and time by decreasing physicians’ need to looking gadgets. These all factors supported the market growth of the wireless mesh network.

Regional Analysis Of Wireless Mesh Network Market

North America is expected to dominate the market for Wireless Mesh Network over the forecast period. The North American region including the US, and Canada has the highest growth in the market owing to the increase in the adoption of wireless mesh technologies, well-established economies, and the growing investment in research and development activities that contain the development of new technologies. The rising usage of Software-as-a-Service (SaaS) based applications, cloud networking, network analytics, virtualization, and Internet of Things (IoT) in enterprises in this region tends to increase the use of wireless mesh network technologies. In addition to this, increase the adoption and building of cost-effective and consistent networks in this region. These all factors involved in propels the growth of the market of the wireless mesh network in this region.

The Asia Pacific is the second dominant region in the wireless mesh network market owing to the adoption of new advanced technology. The increasing growth of telecom sectors in the APAC region is contributed to the market growth. The providers of Telecom services in this region connectivity solutions supply to the government initiatives. The adoption of IoT technology and Artificial Intelligence (AI) is used in various sectors such as the healthcare sectors, education sectors, government, and manufacturing sectors. The wireless mesh network is used in AI and IoT devices. The growing use in oil and gas industries in this region. These all factors supported market growth over the forecasted period.

Covid 19 Impact Analysis On Wireless Mesh Network Market

The outbreak of covid 19 is considered public health emergency that has impacted each industry in the world. Wireless mesh networks are mostly utilized for IoT devices. During the pandemic, the IoT solution was mostly used in the healthcare sector for remote health monitoring. IoT devices record the automatic heart rate, blood pressure, temperature, and more. Thus, it declines the need of travelling to patients for a health check-ups. Because of lockdown, an increase in the demand for IoT devices helps to increase the market of the wireless mesh network. Thus covid 19 positively impacted the market growth.

Top Key Players Covered In Wireless Mesh Network Market

- Cisco Systems, Inc.(US)

- Firetide, Inc. (US)

- Qorvo, Inc. (US)

- Qualcomm, Inc. (US)

- Strix Systems (US)

- Synapse Wireless, Inc. (US)

- Wirepas Oy (Finland)

- Rajant Corporation (US)

- ABB Ltd. (Switzerland)

- Aruba Networks(US)

- Cambium Networks, Inc. (US)

- Ruckus Wireless, Inc. (US) and other major players.

Key Industry Development In The Wireless Mesh Network Market

In April 2020, Cisco bought Fluidmesh Networks to expand its wireless solution for the Industrial Internet of Things (IoT). This will strengthen the market share of the mesh network firm.

In December 2020, the Wurth Elektronik Business a well-known Finnish software company developed and launched several 2.4GHz wireless mesh network components for IoT applications on a huge scale.

|

Global Wireless Mesh Network Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 4 Bn. |

|

Forecast Period 2022-28 CAGR: |

14% |

Market Size in 2028: |

USD 10.01 Bn. |

|

Segments Covered: |

By Operating Frequency |

|

|

|

By Component |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Operating Frequency

3.2 By Component

3.3 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Wireless Mesh Network Market by Operating Frequency

5.1 Wireless Mesh Network Market Overview Snapshot and Growth Engine

5.2 Wireless Mesh Network Market Overview

5.3 Sub 1 GHz Band

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Sub 1 GHz Band: Grographic Segmentation

5.4 2.4 GHz Band

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 2.4 GHz Band: Grographic Segmentation

5.5 4.9 GHz Band

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 4.9 GHz Band: Grographic Segmentation

5.6 5 GHz Band

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 5 GHz Band: Grographic Segmentation

Chapter 6: Wireless Mesh Network Market by Component

6.1 Wireless Mesh Network Market Overview Snapshot and Growth Engine

6.2 Wireless Mesh Network Market Overview

6.3 Physical Appliances

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Physical Appliances: Grographic Segmentation

6.4 Mesh Platforms

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Mesh Platforms: Grographic Segmentation

6.5 Services

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Services: Grographic Segmentation

Chapter 7: Wireless Mesh Network Market by End-User

7.1 Wireless Mesh Network Market Overview Snapshot and Growth Engine

7.2 Wireless Mesh Network Market Overview

7.3 Hospitality

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitality: Grographic Segmentation

7.4 Mining

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Mining: Grographic Segmentation

7.5 Oil & Gas

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Oil & Gas: Grographic Segmentation

7.6 Transportation & Logistics

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Transportation & Logistics: Grographic Segmentation

7.7 Education

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Education: Grographic Segmentation

7.8 Government

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Government: Grographic Segmentation

7.9 Healthcare

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size (2016-2028F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Healthcare: Grographic Segmentation

7.10 Smart Cities & Smart Warehouses

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size (2016-2028F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 Smart Cities & Smart Warehouses: Grographic Segmentation

7.11 Others

7.11.1 Introduction and Market Overview

7.11.2 Historic and Forecasted Market Size (2016-2028F)

7.11.3 Key Market Trends, Growth Factors and Opportunities

7.11.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Wireless Mesh Network Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Wireless Mesh Network Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Wireless Mesh Network Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 CISCO SYSTEMS INC.

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 FIRETIDE INC.

8.4 QORVO INC.

8.5 QUALCOMM INC.

8.6 STRIX SYSTEMS

8.7 SYNAPSE WIRELESS INC.

8.8 WIREPAS OY

8.9 RAJANT CORPORATION

8.10 ABB LTD.

8.11 ARUBA NETWORKS

8.12 CAMBIUM NETWORKS INC.

8.13 RUCKUS WIRELESS INC.

8.14 OTHER MAJOR PLAYERS

Chapter 9: Global Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Operating Frequency

9.2.1 Sub 1 GHz Band

9.2.2 2.4 GHz Band

9.2.3 4.9 GHz Band

9.2.4 5 GHz Band

9.3 Historic and Forecasted Market Size By Component

9.3.1 Physical Appliances

9.3.2 Mesh Platforms

9.3.3 Services

9.4 Historic and Forecasted Market Size By End-User

9.4.1 Hospitality

9.4.2 Mining

9.4.3 Oil & Gas

9.4.4 Transportation & Logistics

9.4.5 Education

9.4.6 Government

9.4.7 Healthcare

9.4.8 Smart Cities & Smart Warehouses

9.4.9 Others

Chapter 10: North America Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Operating Frequency

10.4.1 Sub 1 GHz Band

10.4.2 2.4 GHz Band

10.4.3 4.9 GHz Band

10.4.4 5 GHz Band

10.5 Historic and Forecasted Market Size By Component

10.5.1 Physical Appliances

10.5.2 Mesh Platforms

10.5.3 Services

10.6 Historic and Forecasted Market Size By End-User

10.6.1 Hospitality

10.6.2 Mining

10.6.3 Oil & Gas

10.6.4 Transportation & Logistics

10.6.5 Education

10.6.6 Government

10.6.7 Healthcare

10.6.8 Smart Cities & Smart Warehouses

10.6.9 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Operating Frequency

11.4.1 Sub 1 GHz Band

11.4.2 2.4 GHz Band

11.4.3 4.9 GHz Band

11.4.4 5 GHz Band

11.5 Historic and Forecasted Market Size By Component

11.5.1 Physical Appliances

11.5.2 Mesh Platforms

11.5.3 Services

11.6 Historic and Forecasted Market Size By End-User

11.6.1 Hospitality

11.6.2 Mining

11.6.3 Oil & Gas

11.6.4 Transportation & Logistics

11.6.5 Education

11.6.6 Government

11.6.7 Healthcare

11.6.8 Smart Cities & Smart Warehouses

11.6.9 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Operating Frequency

12.4.1 Sub 1 GHz Band

12.4.2 2.4 GHz Band

12.4.3 4.9 GHz Band

12.4.4 5 GHz Band

12.5 Historic and Forecasted Market Size By Component

12.5.1 Physical Appliances

12.5.2 Mesh Platforms

12.5.3 Services

12.6 Historic and Forecasted Market Size By End-User

12.6.1 Hospitality

12.6.2 Mining

12.6.3 Oil & Gas

12.6.4 Transportation & Logistics

12.6.5 Education

12.6.6 Government

12.6.7 Healthcare

12.6.8 Smart Cities & Smart Warehouses

12.6.9 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Operating Frequency

13.4.1 Sub 1 GHz Band

13.4.2 2.4 GHz Band

13.4.3 4.9 GHz Band

13.4.4 5 GHz Band

13.5 Historic and Forecasted Market Size By Component

13.5.1 Physical Appliances

13.5.2 Mesh Platforms

13.5.3 Services

13.6 Historic and Forecasted Market Size By End-User

13.6.1 Hospitality

13.6.2 Mining

13.6.3 Oil & Gas

13.6.4 Transportation & Logistics

13.6.5 Education

13.6.6 Government

13.6.7 Healthcare

13.6.8 Smart Cities & Smart Warehouses

13.6.9 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Wireless Mesh Network Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Operating Frequency

14.4.1 Sub 1 GHz Band

14.4.2 2.4 GHz Band

14.4.3 4.9 GHz Band

14.4.4 5 GHz Band

14.5 Historic and Forecasted Market Size By Component

14.5.1 Physical Appliances

14.5.2 Mesh Platforms

14.5.3 Services

14.6 Historic and Forecasted Market Size By End-User

14.6.1 Hospitality

14.6.2 Mining

14.6.3 Oil & Gas

14.6.4 Transportation & Logistics

14.6.5 Education

14.6.6 Government

14.6.7 Healthcare

14.6.8 Smart Cities & Smart Warehouses

14.6.9 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Wireless Mesh Network Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD 4 Bn. |

|

Forecast Period 2022-28 CAGR: |

14% |

Market Size in 2028: |

USD 10.01 Bn. |

|

Segments Covered: |

By Operating Frequency |

|

|

|

By Component |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WIRELESS MESH NETWORK MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WIRELESS MESH NETWORK MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WIRELESS MESH NETWORK MARKET COMPETITIVE RIVALRY

TABLE 005. WIRELESS MESH NETWORK MARKET THREAT OF NEW ENTRANTS

TABLE 006. WIRELESS MESH NETWORK MARKET THREAT OF SUBSTITUTES

TABLE 007. WIRELESS MESH NETWORK MARKET BY OPERATING FREQUENCY

TABLE 008. SUB 1 GHZ BAND MARKET OVERVIEW (2016-2028)

TABLE 009. 2.4 GHZ BAND MARKET OVERVIEW (2016-2028)

TABLE 010. 4.9 GHZ BAND MARKET OVERVIEW (2016-2028)

TABLE 011. 5 GHZ BAND MARKET OVERVIEW (2016-2028)

TABLE 012. WIRELESS MESH NETWORK MARKET BY COMPONENT

TABLE 013. PHYSICAL APPLIANCES MARKET OVERVIEW (2016-2028)

TABLE 014. MESH PLATFORMS MARKET OVERVIEW (2016-2028)

TABLE 015. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 016. WIRELESS MESH NETWORK MARKET BY END-USER

TABLE 017. HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 018. MINING MARKET OVERVIEW (2016-2028)

TABLE 019. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 020. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 021. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 022. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 024. SMART CITIES & SMART WAREHOUSES MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA WIRELESS MESH NETWORK MARKET, BY OPERATING FREQUENCY (2016-2028)

TABLE 027. NORTH AMERICA WIRELESS MESH NETWORK MARKET, BY COMPONENT (2016-2028)

TABLE 028. NORTH AMERICA WIRELESS MESH NETWORK MARKET, BY END-USER (2016-2028)

TABLE 029. N WIRELESS MESH NETWORK MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE WIRELESS MESH NETWORK MARKET, BY OPERATING FREQUENCY (2016-2028)

TABLE 031. EUROPE WIRELESS MESH NETWORK MARKET, BY COMPONENT (2016-2028)

TABLE 032. EUROPE WIRELESS MESH NETWORK MARKET, BY END-USER (2016-2028)

TABLE 033. WIRELESS MESH NETWORK MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC WIRELESS MESH NETWORK MARKET, BY OPERATING FREQUENCY (2016-2028)

TABLE 035. ASIA PACIFIC WIRELESS MESH NETWORK MARKET, BY COMPONENT (2016-2028)

TABLE 036. ASIA PACIFIC WIRELESS MESH NETWORK MARKET, BY END-USER (2016-2028)

TABLE 037. WIRELESS MESH NETWORK MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA WIRELESS MESH NETWORK MARKET, BY OPERATING FREQUENCY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA WIRELESS MESH NETWORK MARKET, BY COMPONENT (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA WIRELESS MESH NETWORK MARKET, BY END-USER (2016-2028)

TABLE 041. WIRELESS MESH NETWORK MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA WIRELESS MESH NETWORK MARKET, BY OPERATING FREQUENCY (2016-2028)

TABLE 043. SOUTH AMERICA WIRELESS MESH NETWORK MARKET, BY COMPONENT (2016-2028)

TABLE 044. SOUTH AMERICA WIRELESS MESH NETWORK MARKET, BY END-USER (2016-2028)

TABLE 045. WIRELESS MESH NETWORK MARKET, BY COUNTRY (2016-2028)

TABLE 046. CISCO SYSTEMS INC.: SNAPSHOT

TABLE 047. CISCO SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 048. CISCO SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 049. CISCO SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. FIRETIDE INC.: SNAPSHOT

TABLE 050. FIRETIDE INC.: BUSINESS PERFORMANCE

TABLE 051. FIRETIDE INC.: PRODUCT PORTFOLIO

TABLE 052. FIRETIDE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. QORVO INC.: SNAPSHOT

TABLE 053. QORVO INC.: BUSINESS PERFORMANCE

TABLE 054. QORVO INC.: PRODUCT PORTFOLIO

TABLE 055. QORVO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. QUALCOMM INC.: SNAPSHOT

TABLE 056. QUALCOMM INC.: BUSINESS PERFORMANCE

TABLE 057. QUALCOMM INC.: PRODUCT PORTFOLIO

TABLE 058. QUALCOMM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. STRIX SYSTEMS: SNAPSHOT

TABLE 059. STRIX SYSTEMS: BUSINESS PERFORMANCE

TABLE 060. STRIX SYSTEMS: PRODUCT PORTFOLIO

TABLE 061. STRIX SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SYNAPSE WIRELESS INC.: SNAPSHOT

TABLE 062. SYNAPSE WIRELESS INC.: BUSINESS PERFORMANCE

TABLE 063. SYNAPSE WIRELESS INC.: PRODUCT PORTFOLIO

TABLE 064. SYNAPSE WIRELESS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. WIREPAS OY: SNAPSHOT

TABLE 065. WIREPAS OY: BUSINESS PERFORMANCE

TABLE 066. WIREPAS OY: PRODUCT PORTFOLIO

TABLE 067. WIREPAS OY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. RAJANT CORPORATION: SNAPSHOT

TABLE 068. RAJANT CORPORATION: BUSINESS PERFORMANCE

TABLE 069. RAJANT CORPORATION: PRODUCT PORTFOLIO

TABLE 070. RAJANT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ABB LTD.: SNAPSHOT

TABLE 071. ABB LTD.: BUSINESS PERFORMANCE

TABLE 072. ABB LTD.: PRODUCT PORTFOLIO

TABLE 073. ABB LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ARUBA NETWORKS: SNAPSHOT

TABLE 074. ARUBA NETWORKS: BUSINESS PERFORMANCE

TABLE 075. ARUBA NETWORKS: PRODUCT PORTFOLIO

TABLE 076. ARUBA NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. CAMBIUM NETWORKS INC.: SNAPSHOT

TABLE 077. CAMBIUM NETWORKS INC.: BUSINESS PERFORMANCE

TABLE 078. CAMBIUM NETWORKS INC.: PRODUCT PORTFOLIO

TABLE 079. CAMBIUM NETWORKS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. RUCKUS WIRELESS INC.: SNAPSHOT

TABLE 080. RUCKUS WIRELESS INC.: BUSINESS PERFORMANCE

TABLE 081. RUCKUS WIRELESS INC.: PRODUCT PORTFOLIO

TABLE 082. RUCKUS WIRELESS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WIRELESS MESH NETWORK MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WIRELESS MESH NETWORK MARKET OVERVIEW BY OPERATING FREQUENCY

FIGURE 012. SUB 1 GHZ BAND MARKET OVERVIEW (2016-2028)

FIGURE 013. 2.4 GHZ BAND MARKET OVERVIEW (2016-2028)

FIGURE 014. 4.9 GHZ BAND MARKET OVERVIEW (2016-2028)

FIGURE 015. 5 GHZ BAND MARKET OVERVIEW (2016-2028)

FIGURE 016. WIRELESS MESH NETWORK MARKET OVERVIEW BY COMPONENT

FIGURE 017. PHYSICAL APPLIANCES MARKET OVERVIEW (2016-2028)

FIGURE 018. MESH PLATFORMS MARKET OVERVIEW (2016-2028)

FIGURE 019. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 020. WIRELESS MESH NETWORK MARKET OVERVIEW BY END-USER

FIGURE 021. HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 022. MINING MARKET OVERVIEW (2016-2028)

FIGURE 023. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 024. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 025. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 026. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 027. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 028. SMART CITIES & SMART WAREHOUSES MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA WIRELESS MESH NETWORK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE WIRELESS MESH NETWORK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC WIRELESS MESH NETWORK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA WIRELESS MESH NETWORK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA WIRELESS MESH NETWORK MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wireless Mesh Network Market research report is 2022-2028.

Cisco Systems, Inc. (US), Firetide, Inc. (US), Qorvo, Inc. (US), Qualcomm, Inc. (US), Strix Systems (US), and other major players.

The Wireless Mesh Network Market is segmented into frequency, end-user, component, and region. By Frequency, the market is categorized into Sub 1 GHz Band, 2.4 GHz Band, 4.9 GHz Band, and 5 GHz Band. By Component, the market is categorized into Physical Appliances, Mesh Platforms, and Services. By End-users, the market is categorized into Hospitality, Mining, Oil & Gas, Transportation & Logistics, Education, Government, Healthcare, Smart Cities and Smart Warehouses, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A wireless mesh network (WMN) is a communication network designed by several stationary wireless mesh routers, these routers are wirelessly connected by using a mesh-like backbone structure and through this backbone mesh network, the client can receive or transmit the data.

The Wireless Mesh Network Market is projected to reach USD 10.01 Billion by 2028, up from an anticipated USD 4 billion in 2021, with a CAGR of 14%.