Global Wireless Mesh Network Market Overview

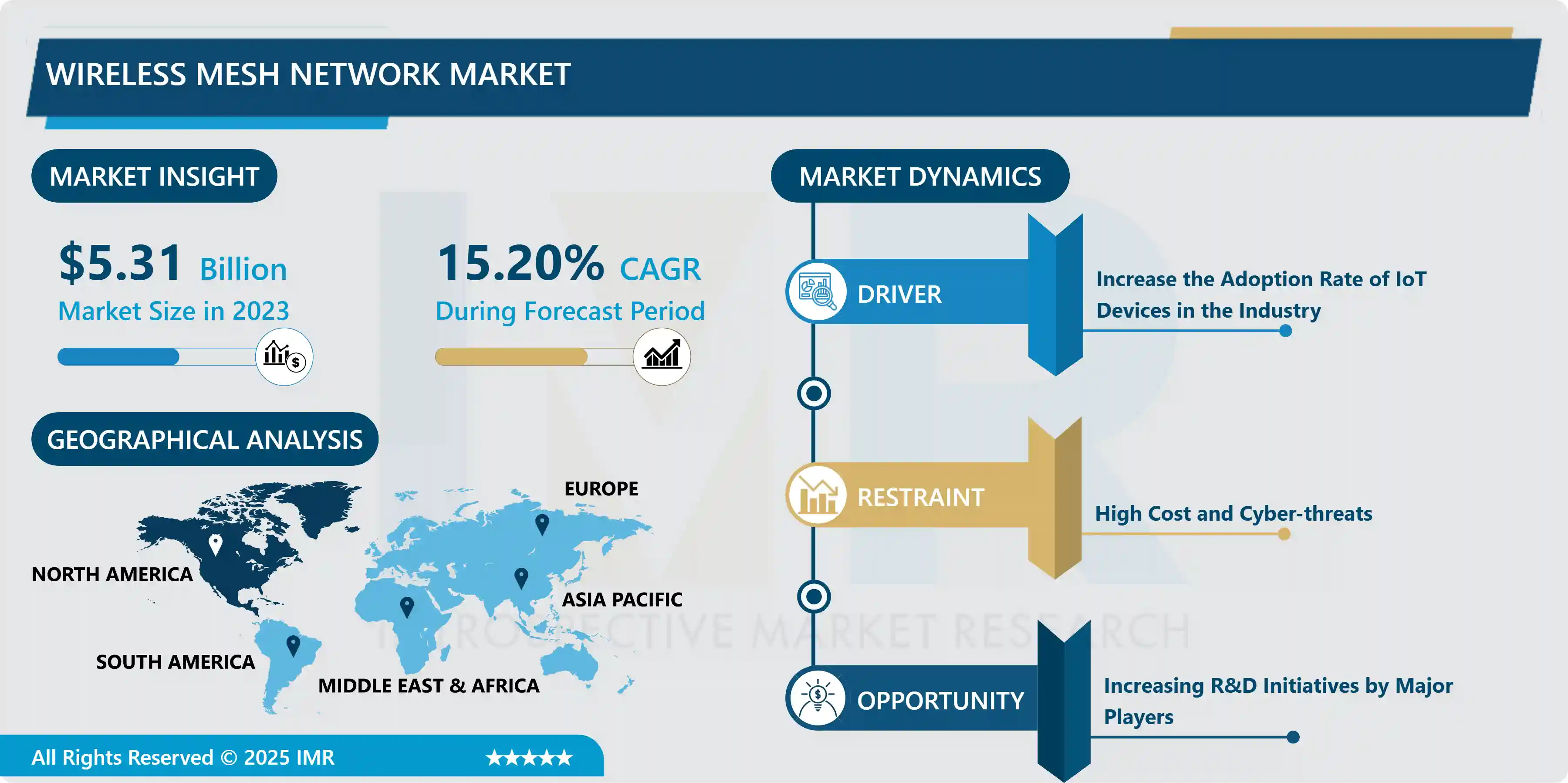

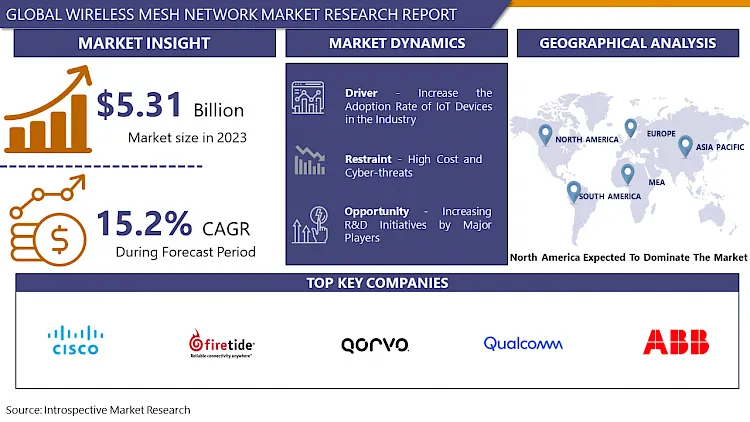

The Wireless Mesh Network Market Size Was Valued at USD 5.31 Billion in 2023, and is Projected to Reach USD 18.97 Billion by 2032, Growing at a CAGR of 15.2 % From 2024-2032.

A Wireless Mesh Network (WMN) is a communication network designed by several stationary wireless mesh routers, these routers are wirelessly connected by using a mesh-like backbone structure and through this backbone mesh network, the client can receive or transmit the data. For each node there is a need of transmitting to the next node, thus networking infrastructure is decentralized and simplified. A wireless mesh network may or may not be connected to the internet. The wireless mesh networks also termed wireless ad hoc networks (WANET) and it is used for home Wi-Fi networks, cities and municipalities offered public Wi-Fi access, Wi-Fi, and networking in temporary locations and connecting internet of things (IoT) devices. These applications of WMN support the growth of the market.

Market Dynamics and Factors For Wireless Mesh Network Market

Drivers:

Increase the Adoption Rate of IoT Devices Among the Industry

-

The adoption of developed technology such as IoT technology is growing in most industries. For the connection of infrastructure nodes mesh network is used. For the transportation of data, the nodes communicate with one another and connect to other nodes. The mesh network offers several advantages for IoT devices such as Self-healing, self-configuring, scalability, and dependability. For all kinds of IoT applications, WMN provides a powerful network. For a mesh network, there is no need for a network connection. Thus, for IoT devices mesh networks become cost-effective. In addition to this, WMN also offers advantages for IoT devices like better management, optimization of resource usage, and sending the information in the fastest route. These all beneficial factors of a mesh network for IoT devices are anticipated for the growth of the wireless mesh network market in the forecast period.

Restraints:

High Cost and Cyber-threats

-

The installation of wireless mesh technology is expensive because it contains multiple units. It is the main barrier in the market for entries of key players. Thus, it hampers the growth of the market. In addition to this, data security is the major issue that is also hindering the market growth. The data security problem increase the privacy concern is limits the growth of wireless mesh networks for small and medium enterprises.

Opportunity:

Increasing R&D Initiatives By Major Players

-

The market players of the wireless mesh network are engaged in expanding their services in the government and defense sectors which provides a gainful opportunity for the market of the wireless mesh network in the analysis period. To strengthen the market, position the industries involved in the wireless mesh network market that expand the research and development facilities in the undeveloped region. For instance, the C4000 cnMaestro management appliance was introduced by Cambium Networks. These all factors offer the remunerative opportunity for the wireless mesh network in the forecast year.

Segmentation Analysis Of Wireless Mesh Network Market

- By Operating frequency, the 2.4 GHz operating frequency sector is anticipated to have high market growth in the forecast period. The frequency of the 2.4 GHz wireless mesh has a better range and it can penetrate easily to solid objects. The devices have a frequency of 2.4 GHz, lower in cost than other devices. These all factors contributed to the market growth of wireless mesh networks. In addition to this, IoT devices can connect only 2.4 GHz. The IoT devices adoption rate is increased in most organizations in the world. Thus, the 2.4 GHz operating frequency sector is projected to increase market growth in the forecast year.

- By Component, the physical appliances segment has maximum growth in the wireless mesh network. The physical appliances include mesh routers, switches, access points, and controllers. The traditional routers were replaced by mesh routers and the heterogeneous devices in the mesh network, it offers policy-based applications that support market growth.

- By End-Users, the Healthcare segment has the highest market growth in the wireless mesh network. This is owing to the rising application of wireless mesh networks in the healthcare industry. Healthcare companies can use the wireless mesh network for low-frequency applications like asset tracking and automating certain building operations. In the healthcare sector, asset monitoring is more popular because it saves money and time by decreasing physicians’ need to looking gadgets. These all factors supported the market growth of the wireless mesh network.

Regional Analysis Of Wireless Mesh Network Market

- North America is expected to dominate the market for Wireless Mesh Network over the forecast period. The North American region including the US, and Canada has the highest growth in the market owing to the increase in the adoption of wireless mesh technologies, well-established economies, and the growing investment in research and development activities that contain the development of new technologies. The rising usage of Software-as-a-Service (SaaS) based applications, cloud networking, network analytics, virtualization, and Internet of Things (IoT) in enterprises in this region tends to increase the use of wireless mesh network technologies. In addition to this, increase the adoption and building of cost-effective and consistent networks in this region. These all factors involved in propels the growth of the market of the wireless mesh network in this region.

- The Asia Pacific is the second dominant region in the wireless mesh network market owing to the adoption of new advanced technology. The increasing growth of telecom sectors in the APAC region is contributed to the market growth. The providers of Telecom services in this region connectivity solutions supply to the government initiatives. The adoption of IoT technology and Artificial Intelligence (AI) is used in various sectors such as the healthcare sectors, education sectors, government, and manufacturing sectors. The wireless mesh network is used in AI and IoT devices. The growing use in oil and gas industries in this region. These all factors supported market growth over the forecasted period.

Top Key Players Covered In Wireless Mesh Network Market

- Cisco Systems, Inc.(US)

- Firetide, Inc. (US)

- Qorvo, Inc. (US)

- Qualcomm, Inc. (US)

- Strix Systems (US)

- Synapse Wireless, Inc. (US)

- Wirepas Oy (Finland)

- Rajant Corporation (US)

- ABB Ltd. (Switzerland)

- Aruba Networks(US)

- Cambium Networks, Inc. (US)

- Ruckus Wireless, Inc. (US) and other major players.

Key Industry Development In The Wireless Mesh Network Market

- In July 2024, Cisco, the worldwide leader in networking and security, and HTX (Home Team Science and Technology Agency) announced that they had signed a Memorandum of Understanding (MOU) to pilot 5G and AI technologies to enhance Singapore’s homeland security. HTX Chief Executive Mr. Chan Tsan and Cisco Executive Vice President and General Manager, Cisco Networking Mr. Jonathan Davidson signed the MOU at a ceremony held at Cisco’s global headquarters in San Jose, United States.

- In July 2024, Core42, a G42 Company and leading provider of sovereign cloud, AI infrastructure, and services, and Qualcomm Technologies, Inc., a global leader in high-performance, low-power AI solutions, announced the launch of Compass 2.0. The Compass platform was soft-launched in January 2024 and has successfully processed approximately 150 billion tokens since its inception.

|

Global Wireless Mesh Network Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 5.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.2 % |

Market Size in 2032: |

USD 18.97 Bn. |

|

Segments Covered: |

By Operating Frequency |

|

|

|

By Component |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wireless Mesh Network Market by Operating Frequency (2018-2032)

4.1 Wireless Mesh Network Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sub 1 GHz Band

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 2.4 GHz Band

4.5 4.9 GHz Band

4.6 5 GHz Band

Chapter 5: Wireless Mesh Network Market by Component (2018-2032)

5.1 Wireless Mesh Network Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Physical Appliances

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mesh Platforms

5.5 Services

Chapter 6: Wireless Mesh Network Market by End Users (2018-2032)

6.1 Wireless Mesh Network Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitality

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mining

6.5 Oil & Gas

6.6 Transportation & Logistics

6.7 Education

6.8 Government

6.9 HealthCare

6.10 Smart Cities and Smart Warehouses

6.11 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Wireless Mesh Network Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 K12 INC. (HERNDON

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VA)

7.4 CONNECTIONS ACADEMY (MARYLAND)

7.5 MOSAICA EDUCATION (US)

7.6 PANSOPHIC LEARNING (VIRGINIA)

7.7 FLORIDA VIRTUAL SCHOOL(FLVS) (US)

7.8 CHARTER SCHOOLS USA (US)

7.9 LINCOLN LEARNING SOLUTIONS (US)

7.10 INSPIRE CHARTER SCHOOLS (US)

7.11 ABBOTSFORD VIRTUAL SCHOOLS (CANADA)

7.12 ALASKA VIRTUAL SCHOOLS

7.13 BASEHOR-LINWOOD VIRTUAL SCHOOL (US)

7.14 ACKLAM GRANGE (UK)

7.15 ILLINOIS VIRTUAL SCHOOL (IVS) (US)

7.16 VIRTUAL HIGH SCHOOL (VHS) (US)

7.17 AURORA COLLEGE (CANADA)

7.18 WEY EDUCATION SCHOOLS TRUST (UK)

7.19 N HIGH SCHOOL

7.20 BEIJING CHANGPING SCHOOL (CHINA)

7.21

Chapter 8: Global Wireless Mesh Network Market By Region

8.1 Overview

8.2. North America Wireless Mesh Network Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Operating Frequency

8.2.4.1 Sub 1 GHz Band

8.2.4.2 2.4 GHz Band

8.2.4.3 4.9 GHz Band

8.2.4.4 5 GHz Band

8.2.5 Historic and Forecasted Market Size by Component

8.2.5.1 Physical Appliances

8.2.5.2 Mesh Platforms

8.2.5.3 Services

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 Hospitality

8.2.6.2 Mining

8.2.6.3 Oil & Gas

8.2.6.4 Transportation & Logistics

8.2.6.5 Education

8.2.6.6 Government

8.2.6.7 HealthCare

8.2.6.8 Smart Cities and Smart Warehouses

8.2.6.9 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Wireless Mesh Network Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Operating Frequency

8.3.4.1 Sub 1 GHz Band

8.3.4.2 2.4 GHz Band

8.3.4.3 4.9 GHz Band

8.3.4.4 5 GHz Band

8.3.5 Historic and Forecasted Market Size by Component

8.3.5.1 Physical Appliances

8.3.5.2 Mesh Platforms

8.3.5.3 Services

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 Hospitality

8.3.6.2 Mining

8.3.6.3 Oil & Gas

8.3.6.4 Transportation & Logistics

8.3.6.5 Education

8.3.6.6 Government

8.3.6.7 HealthCare

8.3.6.8 Smart Cities and Smart Warehouses

8.3.6.9 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Wireless Mesh Network Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Operating Frequency

8.4.4.1 Sub 1 GHz Band

8.4.4.2 2.4 GHz Band

8.4.4.3 4.9 GHz Band

8.4.4.4 5 GHz Band

8.4.5 Historic and Forecasted Market Size by Component

8.4.5.1 Physical Appliances

8.4.5.2 Mesh Platforms

8.4.5.3 Services

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 Hospitality

8.4.6.2 Mining

8.4.6.3 Oil & Gas

8.4.6.4 Transportation & Logistics

8.4.6.5 Education

8.4.6.6 Government

8.4.6.7 HealthCare

8.4.6.8 Smart Cities and Smart Warehouses

8.4.6.9 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Wireless Mesh Network Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Operating Frequency

8.5.4.1 Sub 1 GHz Band

8.5.4.2 2.4 GHz Band

8.5.4.3 4.9 GHz Band

8.5.4.4 5 GHz Band

8.5.5 Historic and Forecasted Market Size by Component

8.5.5.1 Physical Appliances

8.5.5.2 Mesh Platforms

8.5.5.3 Services

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 Hospitality

8.5.6.2 Mining

8.5.6.3 Oil & Gas

8.5.6.4 Transportation & Logistics

8.5.6.5 Education

8.5.6.6 Government

8.5.6.7 HealthCare

8.5.6.8 Smart Cities and Smart Warehouses

8.5.6.9 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Wireless Mesh Network Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Operating Frequency

8.6.4.1 Sub 1 GHz Band

8.6.4.2 2.4 GHz Band

8.6.4.3 4.9 GHz Band

8.6.4.4 5 GHz Band

8.6.5 Historic and Forecasted Market Size by Component

8.6.5.1 Physical Appliances

8.6.5.2 Mesh Platforms

8.6.5.3 Services

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 Hospitality

8.6.6.2 Mining

8.6.6.3 Oil & Gas

8.6.6.4 Transportation & Logistics

8.6.6.5 Education

8.6.6.6 Government

8.6.6.7 HealthCare

8.6.6.8 Smart Cities and Smart Warehouses

8.6.6.9 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Wireless Mesh Network Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Operating Frequency

8.7.4.1 Sub 1 GHz Band

8.7.4.2 2.4 GHz Band

8.7.4.3 4.9 GHz Band

8.7.4.4 5 GHz Band

8.7.5 Historic and Forecasted Market Size by Component

8.7.5.1 Physical Appliances

8.7.5.2 Mesh Platforms

8.7.5.3 Services

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 Hospitality

8.7.6.2 Mining

8.7.6.3 Oil & Gas

8.7.6.4 Transportation & Logistics

8.7.6.5 Education

8.7.6.6 Government

8.7.6.7 HealthCare

8.7.6.8 Smart Cities and Smart Warehouses

8.7.6.9 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Wireless Mesh Network Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 5.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.2 % |

Market Size in 2032: |

USD 18.97 Bn. |

|

Segments Covered: |

By Operating Frequency |

|

|

|

By Component |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

A wireless mesh network (WMN) is a communication network designed by several stationary wireless mesh routers, these routers are wirelessly connected by using a mesh-like backbone structure and through this backbone mesh network, the client can receive or transmit the data.