Wireless IoT Sensors Market Synopsis:

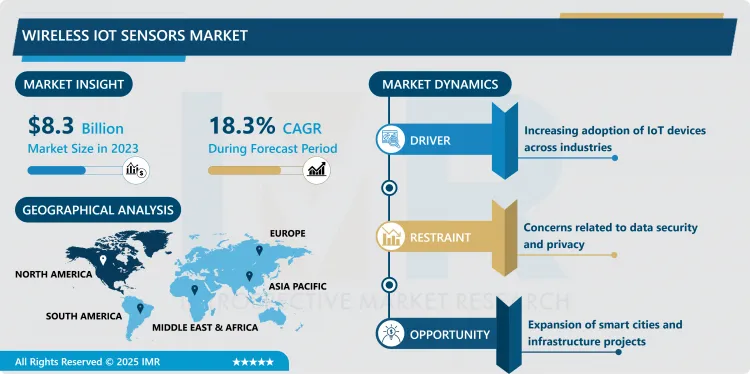

Wireless IoT Sensors Market Size Was Valued at USD 8.3 Billion in 2023, and is Projected to Reach USD 37.67 Billion by 2032, Growing at a CAGR of 18.3% From 2024-2032.

Wireless IoT Sensors Market can be defined as the growing marketplace of Sensors that require no cables or wires for their physical connections, in order to monitor and transmit data through wireless network channels. These sensor work in conjunction with the IoT environment allowing for real time data acquisition, assessment, and interaction within many applications. They include industrial automation, healthcare, transport sector, smart city, agriculture, and even retail. These are IoT Sensors based on the wireless technologies like Bluetooth, Zigbee, LoRaWAN or Wi-Fi reducing cabling complexity while enhancing performance and general expandability. It is powered by the increasing use of Internet of Things across industries, the rising focus on automation and Industrial IoT, need for efficient, low power consumption solutions that enable digital transformation.

Wireless IOT Sensors Market is growing at a very fast rate currently, as organizations and governments are adopting the IoT solutions in order to increase efficiency and accuracy of business operations. Such Sensors represent key points within the IoT context that help facilitating the exchange of information between IoT connected devices, clouds, and applications. They have become integrated and indispensable to enhance productivity and slash expenses while addressing critical structures’ predict and prevent maintenance needs. Forecasts can be attributed to growth and development of wireless communicational technologies, having a broad access to smart devices, trend toward industry 4.0 across the globe.

It has been particularly seen in 2023 that the wireless IoT Sensors have been used successfully in healthcare in patient observation and diagnosis and in farming in tracking of crops. Further, smart cities are particularly popular consumers of wireless IoT Sensors using them for traffic control, security and innovations in waste management. Being developing and concerned by both the governments and private organizations, it can be forecasted that the market for Wireless IoT Sensors will maintain its present pace of growth in the next coming years.

Wireless IoT Sensors Market Trend Analysis:

Rising Integration of AI and Wireless IoT Sensors

- One of the biggest trends that define the development of this market is the combination of Artificial Intelligence (AI) with wireless IoT Sensors. Intelligent Sensors increase the capability of data acquisition by offering superior analytics and forecast data, and decision support. These smart Sensors are slowly finding their way across industries to perform data processing and provide real-time responses without having to rely so much on the cloud. For example in industrial automation, with the use of AI IoT sensor, failure of equipment can be foreseen hence minimizing on the time when equipment are offline. Likewise, in healthcare, AI integrated Sensors are bending the space of remote patient monitoring through providing comprehensive to sho health information and alerting. The merging between the AI and the IoT is enabling advancement, creating opportunities for the development of the autonomous systems, and diversifying the range of the wireless IoT Sensors.

Expansion of Smart Cities and Infrastructure Development

- Smart city implementation provides a grand challenge and prospect for the Wireless IoT Sensors Market. With the rapid advancement of technology and increase in the population, urbanization continues to be a major factor and IoT is being adopted by governments and municipal bodies to deal with factors such as traffic congestion, energy consumption, safety and environmental concerns as the population increases. These initiatives hugely rely on Wireless IoT Sensors to relay relevant data into smart lighting, ITS, and efficient water and waste management. Further, as the infrastructure development gets more investment, especially in the growth markets, the demand for such Sensors rises. Advanced solutions such as smart metering, connected parking solutions, and smart video surveillance create the market need and bring enormous opportunities for market participants.

Wireless IoT Sensors Market Segment Analysis:

Wireless IoT Sensors Market is Segmented on the basis of Type, Application, and Region

By Type, Traditional Wireless Technology segment is expected to dominate the market during the forecast period

- It has been predicted in the Wireless IoT Sensors Market report that the traditional wireless technologies consisting of Wi-Fi, Bluetooth, and Zigbee, will continue to have more demand in the upcoming years. These technologies provide reliability, energy efficiency, and strong communication in a way that suits several processes in various fields. Wi-Fi Sensors, particularly, are intensively employed in industries for tracking and transmitting data in real-time, while Bluetooth and Zigbee Sensors are widely used in smart residences and wearables as they have low power usage.

- The continued prevalence of wireless technologies is linked to their stable development environments, relatively inexpensive solutions, and the ability to flexibly operate in various conditions. Due to the constant enhancement of these technologies and the additional features like extended range, enhanced security features and faster transmission speeds these are the cheapest solutions for organizations interested in IoT implementation. In particular, traditional wireless technologies will retain their major market share as industries shift toward digitalization.

By Application, Smart Cities segment expected to held the largest share

- Out of the various segments identified, the Smart Cities segment is expected to dominate the Wireless IoT Sensors Market due to heightened focus by governments across the world on refurbishing their cities. In smart cities, the IoT wireless Sensors are used in monitoring energy consumption, transport system and environment. Smart devices like connected street light, smart parking, air quality measuring devices and many more are only possible because of the data these Sensors offer for making resource management efficient.

- However, with the latest in communication technologies like 5G, organizations are boosting the use of the IoT Sensors in smart city projects. This is evidenced by relatively high current smart city adoption indexes in the developed North American and European countries while countries of the Asia-Pacific region, including China and India, are advancing rapidly toward technological developments in the sphere of smart cities. Consequently, it is projected that this sustained growth will strengthen the structure of the smart cities segment in the subsequent years.

Wireless IoT Sensors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The research found that North America dominated the Wireless IoT Sensors Market in 2023 with an approximated 35% market share in the Wireless IoT Sensors Market. The region’s dominance originated from higher levels of IoT connection across most industries including healthcare, manufacturing, and retail and a vigorous government drive towards smart infrastructure. North America region particularly the US has been the most progressive in the wireless IoT Sensors implementation for industrial applications, smart farming, connected cars among others.

- Moreover, the North America region has many significant providers in the market that has increased the pace of advancement and the production of innovative solutions. IOT infrastructure in the North American region, alongside the increased investment in IoT R&D activities, acts as a propeller of the market. Since the application of IoT will proceed in industries for better operational efficiency and sustainability, the regional supremacy remains certain.

Active Key Players in the Wireless IoT Sensors Market:

- ABB (Switzerland)

- Bosch Sensortec (Germany)

- Cisco Systems (USA)

- Honeywell International (USA)

- Huawei Technologies (China)

- Intel Corporation (USA)

- NXP Semiconductors (Netherlands)

- Schneider Electric (France)

- Sensirion AG (Switzerland)

- Siemens AG (Germany)

- STMicroelectronics (Switzerland)

- Texas Instruments (USA)

- TE Connectivity (Switzerland)

- Other Active Players

|

Wireless IoT Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.3 Billion |

|

Forecast Period 2024-32 CAGR: |

18.3% |

Market Size in 2032: |

USD 37.67 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wireless IoT Sensors Market by Type (2018-2032)

4.1 Wireless IoT Sensors Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Traditional Wireless Technology

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LPWANs Technology

Chapter 5: Wireless IoT Sensors Market by Application (2018-2032)

5.1 Wireless IoT Sensors Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Smart Cities

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Smart Industrial

5.5 Smart Building

5.6 Smart Connected Vehicles

5.7 Smart Energy

5.8 Smart Healthcare

5.9 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wireless IoT Sensors Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BOSCH SENSORTEC (GERMANY)

6.4 CISCO SYSTEMS (USA)

6.5 HONEYWELL INTERNATIONAL (USA)

6.6 HUAWEI TECHNOLOGIES (CHINA)

6.7 INTEL CORPORATION (USA)

6.8 NXP SEMICONDUCTORS (NETHERLANDS)

6.9 QUALCOMM (USA)

6.10 ROCKWELL AUTOMATION (USA)

6.11 SCHNEIDER ELECTRIC (FRANCE)

6.12 SENSIRION AG (SWITZERLAND)

6.13 SIEMENS AG (GERMANY)

6.14 STMICROELECTRONICS (SWITZERLAND)

6.15 TEXAS INSTRUMENTS (USA)

6.16 TE CONNECTIVITY (SWITZERLAND)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Wireless IoT Sensors Market By Region

7.1 Overview

7.2. North America Wireless IoT Sensors Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Traditional Wireless Technology

7.2.4.2 LPWANs Technology

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Smart Cities

7.2.5.2 Smart Industrial

7.2.5.3 Smart Building

7.2.5.4 Smart Connected Vehicles

7.2.5.5 Smart Energy

7.2.5.6 Smart Healthcare

7.2.5.7 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wireless IoT Sensors Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Traditional Wireless Technology

7.3.4.2 LPWANs Technology

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Smart Cities

7.3.5.2 Smart Industrial

7.3.5.3 Smart Building

7.3.5.4 Smart Connected Vehicles

7.3.5.5 Smart Energy

7.3.5.6 Smart Healthcare

7.3.5.7 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wireless IoT Sensors Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Traditional Wireless Technology

7.4.4.2 LPWANs Technology

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Smart Cities

7.4.5.2 Smart Industrial

7.4.5.3 Smart Building

7.4.5.4 Smart Connected Vehicles

7.4.5.5 Smart Energy

7.4.5.6 Smart Healthcare

7.4.5.7 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wireless IoT Sensors Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Traditional Wireless Technology

7.5.4.2 LPWANs Technology

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Smart Cities

7.5.5.2 Smart Industrial

7.5.5.3 Smart Building

7.5.5.4 Smart Connected Vehicles

7.5.5.5 Smart Energy

7.5.5.6 Smart Healthcare

7.5.5.7 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wireless IoT Sensors Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Traditional Wireless Technology

7.6.4.2 LPWANs Technology

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Smart Cities

7.6.5.2 Smart Industrial

7.6.5.3 Smart Building

7.6.5.4 Smart Connected Vehicles

7.6.5.5 Smart Energy

7.6.5.6 Smart Healthcare

7.6.5.7 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wireless IoT Sensors Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Traditional Wireless Technology

7.7.4.2 LPWANs Technology

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Smart Cities

7.7.5.2 Smart Industrial

7.7.5.3 Smart Building

7.7.5.4 Smart Connected Vehicles

7.7.5.5 Smart Energy

7.7.5.6 Smart Healthcare

7.7.5.7 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Wireless IoT Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.3 Billion |

|

Forecast Period 2024-32 CAGR: |

18.3% |

Market Size in 2032: |

USD 37.67 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||