Wireless Gigabit Market Synopsis

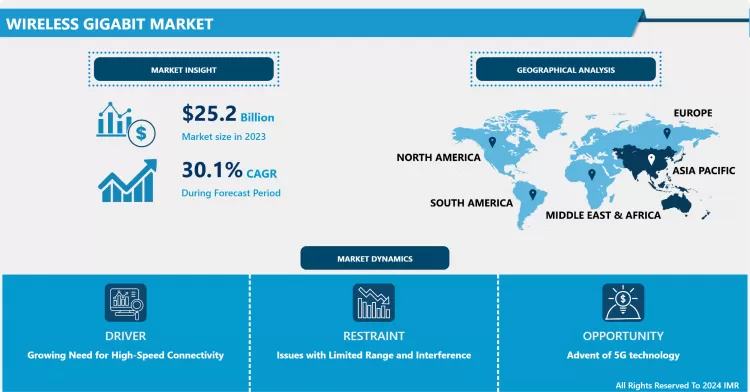

Wireless Gigabit Market Size Was Valued at USD 25.2 Billion in 2023, and is Projected to Reach USD 269.1 Billion by 2032, Growing at a CAGR of 30.1% From 2024-2032.

The wireless gigabit is considered as one of the most developed stages of wireless technology that can run under the wireless platform. This technology is particularly used for fast transfer of information and faster communication. The following wireless technology has more datarate than that of WiFi.

- The consumers are moving towards larger screen sizes with higher resolutions of even more than 720p. The smartphones that have evolved over the recent past have recorded a rapid expansion across the regions hence expanding the market for wireless gigabit. According to norm, smartphone is defined to possess the wireless connectivity feature. This has led to demand for the adding of wireless chipsets supplementing the cellular link. This demand of more connectivity and the need for higher data rates have been forcing the industry to adapt better technologies.

- Wireless gigabit market has just emerged and is expected to benefit from a lot of factors like sustained technology development and improvement in communications technology. Also, the growing development in demand for secure network communication will have impactful changes on the global market over the forecast period.

- Wireless gigabit is expected to transform communication promising to deliver internet speeds 10 X faster than the current Wi-Fi based technology. This great improvement in data communication is expected to revolutionize telecommunications in the society and bring about more effective and secure wireless communication.

- Integrating wireless gigabit technology with future technologies such as augmented reality and virtual reality is a sorted opportunity because it creates a high speed data transmission which would lead to better and enhanced user experience and new possibilities of applications.

- Another trend is the increasing interest in smart city programs and use of sophisticated communication networks, to which the wireless gigabit solutions are helpful to support the rising connectivity needs of the cities and enhance productivity.

Wireless Gigabit Market Trend Analysis

High Demand for Consumer Electronics

- Wireless Gigabit can enable fast exchange of data and immediate saving and synchronization that is characteristic of consumer electronics. The application of the technology in the consumer electronics devices inclusive of HD televisions, superior smartphones, digital units, tablets and the rest act as drivers to the market.

- Also, factors such as, the increase in population, urbanization rate, changes in people’s lifestyle and the need for data centers, the increasing use of cloud computing platform, increase in investment and the growing market of smart devices also contribute to the growth of wireless gigabit market. The development of the next generation wireless Gigabit solutions having a very low latency is facilitated by new advancements in wireless communications technology like WiGig 802. 11ad/ay, which in overall is fueling growth of this market.

Faster communication and quick data transmission and rising popularity of cloud storage solution

- This wireless gigabit market is fuelled by faster communication and capability to transmit data more than the Wi-Fi technology. Further, wireless gigabit has possibilities to provide fast synchronization along with the fast data transfer which is necessary for consumer electronics items like hi-definition television, digital equipments, tablets and high end smart phones. This, in turn, is expected to create a positive impact on the portions of wireless gigabit market while over the forecast period. In addition, opportunities arising from cloud storage solution due to its affordable nature are going to fuel the opportunity for wireless gigabit. As the use of computing, storage and other applications become more cloud based so also there is a growing need for wireless Gigabits because, wired and wireless connections have to be assured a level of mega speed to ensure a good access to and use of cloud data.

Wireless Gigabit Market Segment Analysis:

Wireless Gigabit Market Segmented based on Technology, Product, and Application.

By Product, network infrastructure devices segment is expected to dominate the market during the forecast period

- With respect to Product, the market is classified into Network Infrastructure Devices along with Display Devices. That is why the market for network infrastructure devices is expected to increase at the highest compound annual growth rate from 2021 to 2026. Wireless Gigabit network infrastructure devices are categorized in routers, adapters, back haul stations and docking stations. The driver influencing the Wired Gigabit Market during the forecast period could be the requirement of devices which have the capability to transfer data at a very fast rate. The 60GHz band can be described by such features as low reflection, a high amount of the license-free frequency band, and thin beams, suitable for dense links. This also makes the products/solutions operating in this spectrum ideal for an upgrade from the 5 Ghz networks, which are slowly getting squeezed by the limit of the spectrum.

By Application, networking segment held the largest share in 2023

- Based on Application, the market is segmented as Networking, Consumer Electronics and Commercial. The networking segment is projected to generate a huge market growth rate in the course of the forecast period and accounted for the largest market share in 2023. This growth mainly attributes to the use of WiGig for backhaul applications. For configuration Asymmetric distribution is encouraged mainly because 60 GHz FWA solutions on hand are believed to remove the requirement of fiber deployment particularly in inadequate circumstances. With the increase in the requirements of fiber-grade connectivity worldwide, there would be a demand for cheaper FWA solutions. It will probably help to drive the expansion of the Wireless Gigabit Market over the mentioned time period.

Wireless Gigabit Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to have higher growth owing to the manufacturers of the consumer electronics industry to enter the markets with cheaper gadgets. Another key driver of the wireless gigabit market in the Asia Pacific region is the rising usage of Internet connected devices and the development that is going on since Asia Pacific is a production center.

- The economies in the Asia Pacific regions such as the India and China are strating efforts to technologize themselves as that of the developed nations. These two economies are thus directing resources towards the development of technology in various industries which, in turn, will propel the wireless gigabit market.

Active Key Players in the Wireless Gigabit Market

- Qualcomm Atheors

- Samsung Electric Co. Ltd.

- Intel Corporation

- Cisco Systems Ltd.

- Marvell Technology Group Ltd.

- Broadcom Corporation

- NEC Corporation

- Panasonic Corporation

- AzureWave Technologies

- NVIDIA

- MediaTek.

- Skyworks Solutions Inc.

- Qorvo Inc.

- NXP Semiconductors N.V.

- Texas Instruments Inc.

- STMicroelectronics NV

- Analog Devices Inc.

- Microchip Technology Inc. Other Key Players

|

Global Wireless Gigabit Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

30.1% |

Market Size in 2032: |

USD 269.1 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wireless Gigabit Market by Technology (2018-2032)

4.1 Wireless Gigabit Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Integrated Circuit Chip

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 System on Chip

Chapter 5: Wireless Gigabit Market by Product (2018-2032)

5.1 Wireless Gigabit Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Network Infrastructure Devices

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Display Devices

Chapter 6: Wireless Gigabit Market by Application (2018-2032)

6.1 Wireless Gigabit Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Networking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Consumer Electronics

6.5 Commercial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Wireless Gigabit Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 QUALCOMM ATHEORS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SAMSUNG ELECTRIC CO. LTDINTEL CORPORATION

7.4 CISCO SYSTEMS LTDMARVELL TECHNOLOGY GROUP LTDBROADCOM CORPORATION

7.5 NEC CORPORATION

7.6 PANASONIC CORPORATION

7.7 AZUREWAVE TECHNOLOGIES

7.8 NVIDIA

7.9 MEDIATEKSKYWORKS SOLUTIONS INCQORVO INCNXP SEMICONDUCTORS N.VTEXAS INSTRUMENTS INCSTMICROELECTRONICS NV

7.10 ANALOG DEVICES INCMICROCHIP TECHNOLOGY INC.OTHER KEY PLAYERS

7.11

Chapter 8: Global Wireless Gigabit Market By Region

8.1 Overview

8.2. North America Wireless Gigabit Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Technology

8.2.4.1 Integrated Circuit Chip

8.2.4.2 System on Chip

8.2.5 Historic and Forecasted Market Size by Product

8.2.5.1 Network Infrastructure Devices

8.2.5.2 Display Devices

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Networking

8.2.6.2 Consumer Electronics

8.2.6.3 Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Wireless Gigabit Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Technology

8.3.4.1 Integrated Circuit Chip

8.3.4.2 System on Chip

8.3.5 Historic and Forecasted Market Size by Product

8.3.5.1 Network Infrastructure Devices

8.3.5.2 Display Devices

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Networking

8.3.6.2 Consumer Electronics

8.3.6.3 Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Wireless Gigabit Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Technology

8.4.4.1 Integrated Circuit Chip

8.4.4.2 System on Chip

8.4.5 Historic and Forecasted Market Size by Product

8.4.5.1 Network Infrastructure Devices

8.4.5.2 Display Devices

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Networking

8.4.6.2 Consumer Electronics

8.4.6.3 Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Wireless Gigabit Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Technology

8.5.4.1 Integrated Circuit Chip

8.5.4.2 System on Chip

8.5.5 Historic and Forecasted Market Size by Product

8.5.5.1 Network Infrastructure Devices

8.5.5.2 Display Devices

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Networking

8.5.6.2 Consumer Electronics

8.5.6.3 Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Wireless Gigabit Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Technology

8.6.4.1 Integrated Circuit Chip

8.6.4.2 System on Chip

8.6.5 Historic and Forecasted Market Size by Product

8.6.5.1 Network Infrastructure Devices

8.6.5.2 Display Devices

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Networking

8.6.6.2 Consumer Electronics

8.6.6.3 Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Wireless Gigabit Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Technology

8.7.4.1 Integrated Circuit Chip

8.7.4.2 System on Chip

8.7.5 Historic and Forecasted Market Size by Product

8.7.5.1 Network Infrastructure Devices

8.7.5.2 Display Devices

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Networking

8.7.6.2 Consumer Electronics

8.7.6.3 Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Wireless Gigabit Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

30.1% |

Market Size in 2032: |

USD 269.1 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wireless Gigabit Market research report is 2024-2032.

Qualcomm Atheors, Samsung Electric Co. Ltd., Intel Corporation, Cisco Systems Ltd., Marvell Technology Group Ltd., Broadcom Corporation, NEC Corporation, Panasonic Corporation, and Other Major Players.

The Wireless Gigabit Market is segmented into technology, product, application, and region. By technology, the market is categorized into integrated circuit chip and system on chip. By product, the market is categorized into network infrastructure devices and display devices. By application, the market is categorized into networking, consumer electronics, and commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wireless Gigabit (WiGig) is a technology of wireless data communication appeared in 2013 and working at the frequency of 60 GHz, which allows for data transfer at rates up to 7 Gbps. Its intended use is for short-range, high-speed wireless applications that include uses like HD video streaming, wireless docking, virtual reality and the like. WiGig uses self-advanced beamforming to ensure that the connection is always strong and not easily interrupted by surrounding sources.

Wireless Gigabit Market Size Was Valued at USD 25.2 Billion in 2023, and is Projected to Reach USD 269.1 Billion by 2032, Growing at a CAGR of 30.1% From 2024-2032.