White Biotechnology Market Synopsis

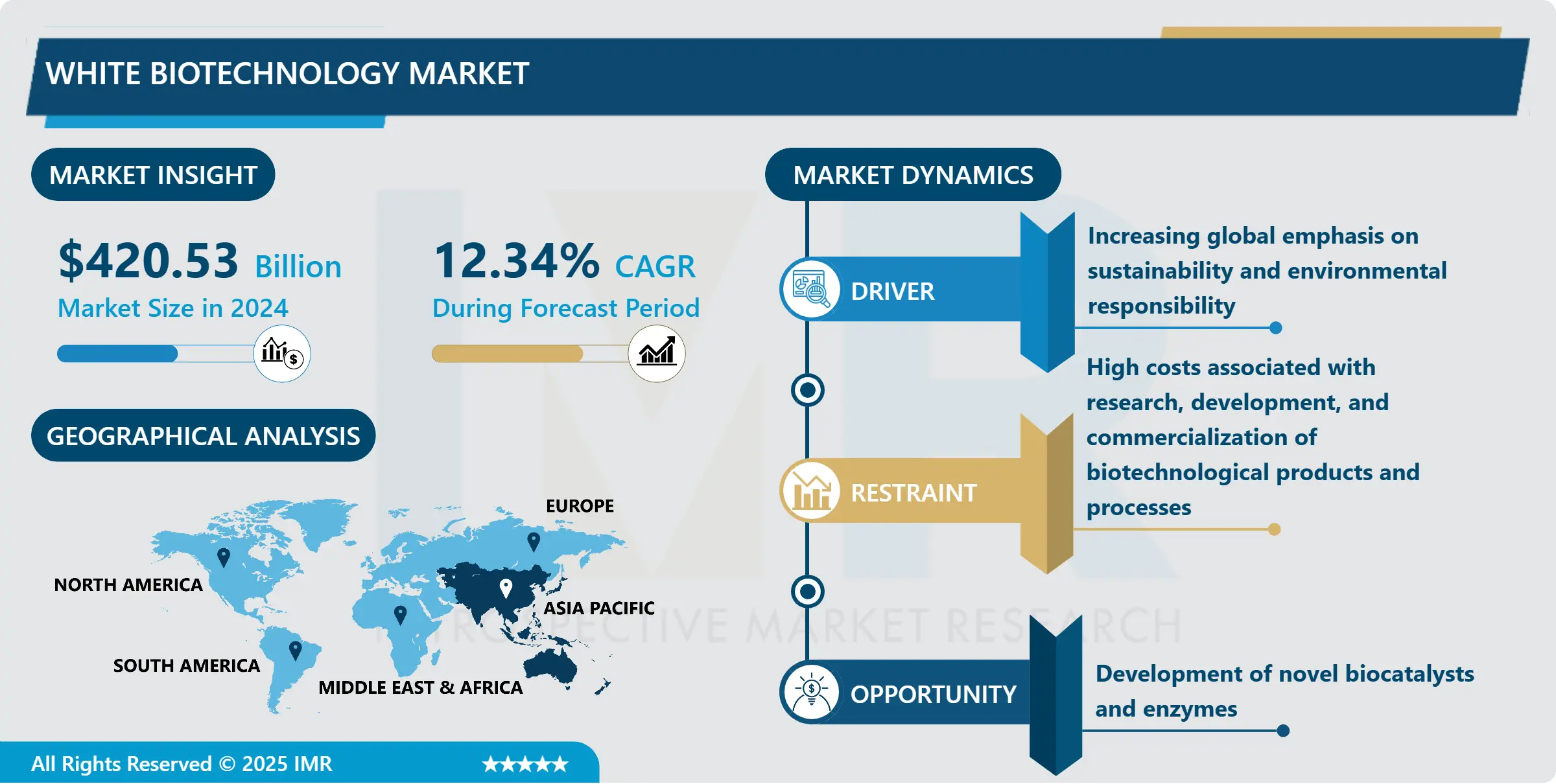

White Biotechnology Market Size Was Valued at USD 420.53 Billion in 2024 and is Projected to Reach USD 1512.43 Billion by 2035, Growing at a CAGR of 12.34% From 2025-2035

White biotechnology or industrial biotechnology is the application of living systems and biological processes towards production of goods and services in key industrial segments including chemical and material and energy. This field covers the utilization of enzymes, microorganisms, and plants in the sustainable method for the generation of green products for usage in industries. Some of the important uses are, manufacturing of biofuels, biodegradable plastics, and biopharmaceuticals. On the other hand, white biotechnology seeks to find out specific biological methodologies with the goal of lowering environmental effects, improving resource utilization in the production practices and supporting the creation of a more sustainable industrial environment.

This report focuses on determining the current state and potential for growth for the white biotechnology market and its products where it identified that the market is growing, especially due to growing globalization and public awareness of ecological issues. This sector includes numerous purposes in the spheres of agriculture and food and beverages, medications and chemicals production. These are areas for example calls for usage of renewable energy resources, use of biodegradable materials and clean production processes. White biotechnology takes advantage of innovations in recombinant DNA technology, metabolic engineering and fermentation processes to provide bio-based products which could provide better solutions to analogous chemical products.

There is a propagation of vigorous research in various aspects such as the discovery of new areas for the use of white biotechnology and efficiency in manufacturing processes. Government funding through scheme and policy support and regulation therefore foster the actualization of more funding initiatives to fuel the market growth. Due to the advancement in technology and shifting towards more sustainable products, the market for white biotechnology is expected to exhibit more potential in the future contributing to the development of different industries across the world.

White Biotechnology Market Trend Analysis

Increasing focus on biorefineries

- On one hand, biorefineries combine different types of biomass resources and apply enzymatic or microbial means to transform them into numerous valuable goods which includes biofuels, biochemicals and bioplastics on the other. This trend corresponds the shift towards the sustainability and the circular economy, which strive to get the most out of resources, minimizing the use of hydrocarbons. Biorefineries are not merely a way of providing bio-based substitutes but they also help in lowering the emission of greenhouse gases and in waste management or elimination. It is the biorefineries that are assumed to bear the brunt of the future industrial processes with the help of consistent improvements in the technologies and the economies of scale.

Development of novel biocatalysts and enzymes

- Regarding the opportunities for white biotechnology the existing analysis indicated that the use of novel biocatalysts and enzymes is one of the greatest potential prospects. Such enzymes can be considered as promising agents for creating new effective and environmentally friendly processes in industry to replace existing chemical catalysts. They can promote selective and individual alterations at lower temp and thus decrease the use of energy and emission of waste. Furthermore, biocatalysts are normally harvested from renewable resources and can always be elaborately designed and modified genetically to fit specific functions of industries.

- Expenditure on R & D targeting biocatalists both identification and improvement comes as opportunities for development of novel bio-products and bio-processes for different sectors pharmaceutical, food and beverage, fine chemicals. Given the increasing demands of the regulation and consumers for environmentally friendly products, the production and marketing of the biocatalysts is a noteworthy solution to these problems as well as the way to promote the develop of the novelties in the field of biotechnology and contribute to the economic growth.

White Biotechnology Market Segment Analysis:

White Biotechnology Market Segmented on the basis of product and application.

By Product, Bio fuels segment is expected to dominate the market during the forecast period

- It is also noteworthy that for the entire period of this forecast, the biofuels segment will maintain a high, and, in many cases, the most significant, share in the development of white biotechnology. This is more evident given the growing emphasis on cutting down on the use of fossil based energy and the wants to reduce on emission of carbon and other green house gases. Bioenergy, which is obtained from renewable resources like agricultural waste, algae, waste oil is among the renewable resources that can replace the traditional fossil fuels. They are expected to be welcomed due to the knocks they possess regarding reducing greenhouse emissions and energy insecurity.

- Biotechnological developments in the processes of enzymatic and microbial conversions have improved the efficiency of the biofuel production making it cheaper. This segment is expected to experience steady increase and rapid growth as governments across the globe continue to introduce renewable energy and biofuels initiatives besides increasing research and infrastructure investment for biofuels out of which the biofuels segment forms the key sector of white biotechnology market.

By Application, Bio energy segment expected to held the largest share

- In so far as the application is concerned, the bioenergy segment is predicted to have largest market share in the white biotechnology market. Bioenergy refers to the range of renewable energy generated from biological materials such as; bio fuels, biogas and electricity generated from biomass. This segment is on the rise due to growing international activities such as global shift to renewable energy, emissions reduction, and energy security among others. Bioenergy has several advantages, including being carbon balanced where the CO2 produced during the burning of bioenergy is reinoculated into the air by plants that form the sources of fuel.

- Furhtermore, new technologies in biotechnological processes of bioenergy generation through enzymatic hydrolysis and fermentation have accorded high yields and low cost from multiplicative biomasses. Due to continuous improvement and diversification in efficiency of the bioenergy technologies and broadening the range of the bioenergy application areas, the bioenergy segment, in turn, has potential to remain a leader in the white biotechnology segment and help to develop the necessary actions towards the more sustainable energy future on the global level.

White Biotechnology Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Accordingly, over the forecast period, the Asia Pacific region is expected to be the most eminent in the white biotechnology market. These are some of the factors that have necessitated the growth of the market such as; the rate of industrialization, population, and awareness of the environment among countries in a region. Asian pacific governments are shifting gears to more sustainable development and emission control which are well supported by the objective of white biotechnology. Also, the biomass sources are plenty and agricultural areas are comparatively stronger in the region which in turn makes the feedstock available for biotechnological potential in the form of bio-process like biofuels and biorefining.

- In addition, Asia Pacific is experiencing tremendous investment in researching and development to enhance the advancement of biotechnological uses. The Asian countries like China, India, Japan and South Korea are using biotechnological options in chemical, pharmaceutical, and food industries. Easy policies, favorable government programs regarding bio based products and technologies are the prime drivers helping Asia Pacific dominate the white biotechnology market and thus provides a huge growth prospect for the participants of the white biotechnology market along with the development of the Asian economy.

Active Key Players in the White Biotechnology Market

- Abengoa Bioenergy (Spain)

- Amyris, Inc. (USA)

- BASF SE (Germany)

- Cargill, Incorporated (USA)

- Chr. Hansen Holding A/S (Denmark)

- Codexis, Inc. (USA)

- DSM Nutritional Products AG (Switzerland)

- DuPont (USA)

- Evonik Industries AG (Germany)

- Genomatica, Inc. (USA)

- Green Plains Inc. (USA)

- INEOS Bio (UK)

- LanzaTech (USA)

- Lonza Group AG (Switzerland)

- Novozymes A/S (Denmark)

- Other key Players

|

Global White Biotechnology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 420.53 Bn. |

|

Forecast Period 2025-35 CAGR: |

12.34% |

Market Size in 2035: |

USD 1512.43 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: White Biotechnology Market by Product (2018-2035)

4.1 White Biotechnology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bio fuels

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bio materials

4.5 Biochemicals

Chapter 5: White Biotechnology Market by Application (2018-2035)

5.1 White Biotechnology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bio energy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food & Feed Additives

5.5 Pharmaceutical ingredients

5.6 Personal Care & Household Products

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 White Biotechnology Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABENGOA BIOENERGY (SPAIN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMYRIS INC. (USA)

6.4 BASF SE (GERMANY)

6.5 CARGILL INCORPORATED (USA)

6.6 CHR. HANSEN HOLDING A/S (DENMARK)

6.7 CODEXIS INC. (USA)

6.8 DSM NUTRITIONAL PRODUCTS AG (SWITZERLAND)

6.9 DUPONT (USA)

6.10 EVONIK INDUSTRIES AG (GERMANY)

6.11 GENOMATICA INC. (USA)

6.12 GREEN PLAINS INC. (USA)

6.13 INEOS BIO (UK)

6.14 LANZATECH (USA)

6.15 LONZA GROUP AG (SWITZERLAND)

6.16 NOVOZYMES A/S (DENMARK)

6.17 OTHER KEY PLAYERS

6.18

Chapter 7: Global White Biotechnology Market By Region

7.1 Overview

7.2. North America White Biotechnology Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Bio fuels

7.2.4.2 Bio materials

7.2.4.3 Biochemicals

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Bio energy

7.2.5.2 Food & Feed Additives

7.2.5.3 Pharmaceutical ingredients

7.2.5.4 Personal Care & Household Products

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe White Biotechnology Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Bio fuels

7.3.4.2 Bio materials

7.3.4.3 Biochemicals

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Bio energy

7.3.5.2 Food & Feed Additives

7.3.5.3 Pharmaceutical ingredients

7.3.5.4 Personal Care & Household Products

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe White Biotechnology Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Bio fuels

7.4.4.2 Bio materials

7.4.4.3 Biochemicals

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Bio energy

7.4.5.2 Food & Feed Additives

7.4.5.3 Pharmaceutical ingredients

7.4.5.4 Personal Care & Household Products

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific White Biotechnology Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Bio fuels

7.5.4.2 Bio materials

7.5.4.3 Biochemicals

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Bio energy

7.5.5.2 Food & Feed Additives

7.5.5.3 Pharmaceutical ingredients

7.5.5.4 Personal Care & Household Products

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa White Biotechnology Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Bio fuels

7.6.4.2 Bio materials

7.6.4.3 Biochemicals

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Bio energy

7.6.5.2 Food & Feed Additives

7.6.5.3 Pharmaceutical ingredients

7.6.5.4 Personal Care & Household Products

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America White Biotechnology Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Bio fuels

7.7.4.2 Bio materials

7.7.4.3 Biochemicals

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Bio energy

7.7.5.2 Food & Feed Additives

7.7.5.3 Pharmaceutical ingredients

7.7.5.4 Personal Care & Household Products

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global White Biotechnology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 420.53 Bn. |

|

Forecast Period 2025-35 CAGR: |

12.34% |

Market Size in 2035: |

USD 1512.43 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||