Welding Helmet Market Synopsis

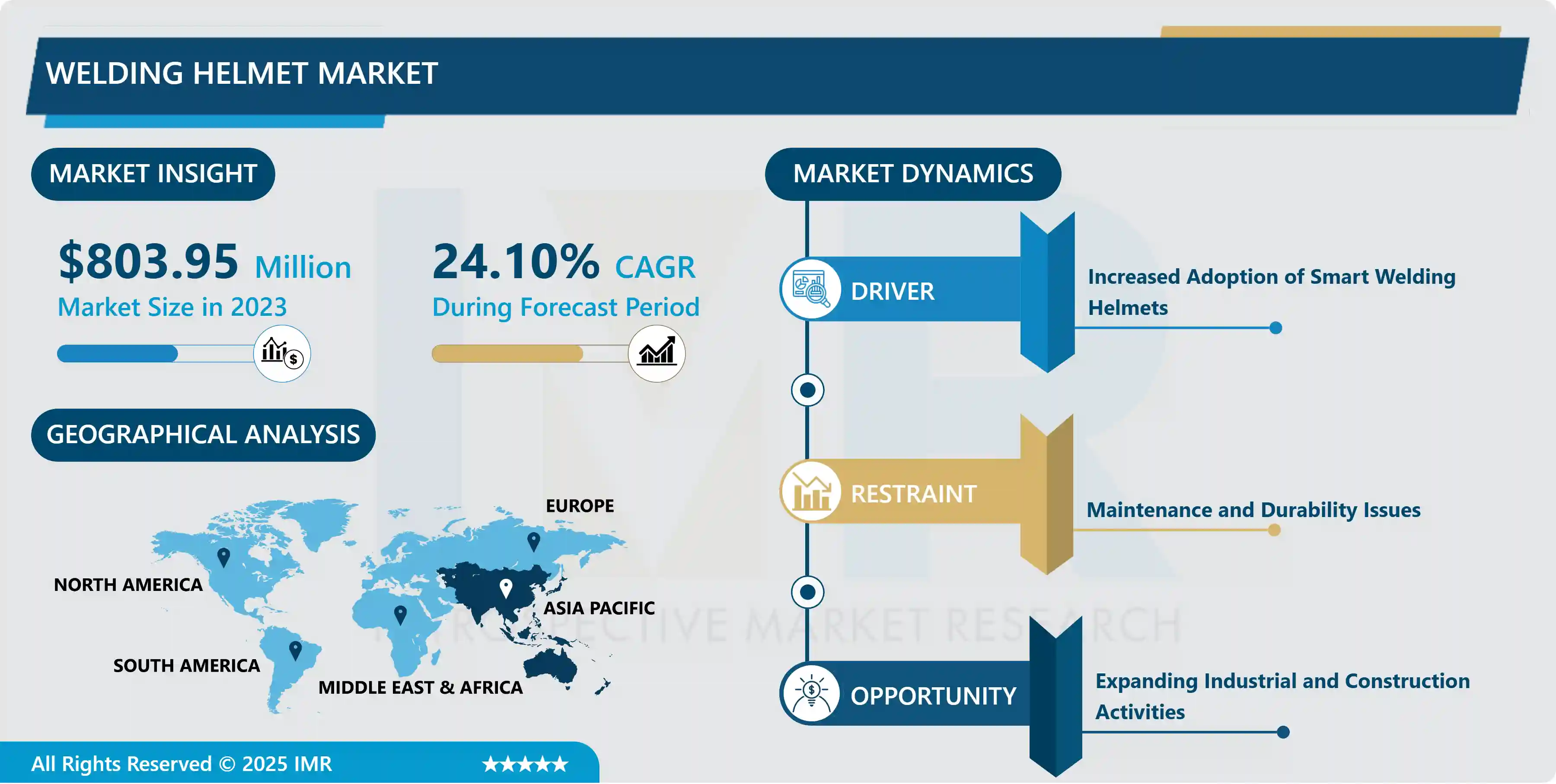

Welding Helmet Market Size Was Valued at USD 803.95 Million in 2023, and is Projected to Reach USD 5612.74 Million by 2032, Growing at a CAGR of 24.10% From 2024-2032.

A welding helmet is a protective gear designed to safeguard the welder’s face and eyes from the intense light, heat, and debris generated during welding operations. It is an essential piece of personal protective equipment (PPE) used in various welding processes. Rapid expansion of global infrastructure boosts demand for welding services, leading to market growth and underscoring the significance of welding helmets. Modern welding helmets now incorporate auto-darkening filters and better ergonomics to increase safety, comfort, and productivity, and encourage market acceptance. The construction and manufacturing sectors are experiencing more stringent safety rules, leading to a higher need for top-notch welding helmets to protect workers. OSHA mandates the use of safety welding helmets for protection purposes.

There has been a rise in adherence to regulations in various sectors. Businesses are putting money into high-quality personal protective equipment because there is a universal emphasis on safety worldwide. The EU Directive requires welding helmets that meet strict safety standards to safeguard workers. The demand for welding helmets has increased in Europe as a consequence. There has been a 15% increase in the use of personal protective equipment in high-risk industries over the past five years, showing a growing global focus on occupational safety. Welding helmets have an important function in safeguarding workers. Government and private organizations have also enhanced safety measures through education programs. The use of polycarbonate and other modern materials has enhanced welding helmets, resulting in lighter weight, increased comfort, and improved impact resistance. Users are pleased with custom options such as enhanced airflow and visibility, leading to higher demand for these innovative products. The standardization of safety practices in manufacturing and construction industries has been a result of globalization in supply chains. This has increased the need for top-notch welding helmets that meet global safety standards. 3M, Lincoln Electric, and Honeywell have extended their presence into developing markets.

Welding Helmet Market Trend Analysis

Increased Adoption of Smart Welding Helmets

- The increased adoption of smart welding helmets is a significant driver in the welding helmet market. These advanced helmets are equipped with features like auto-darkening filters (ADF), which provide real-time protection by automatically adjusting the lens shade based on the welding arc's intensity. This technology enhances worker safety and comfort, reducing the risk of eye injuries from harmful UV and IR radiation.

- Smart helmets offer ergonomic designs, lightweight materials, and improved visibility, enhancing overall productivity. Welders can work efficiently with less downtime for adjustments, as these helmets adapt quickly to changing light conditions, allowing continuous operation without manual intervention.

- The rising emphasis on worker safety regulations and the demand for high-quality welding in industries such as automotive, construction, and manufacturing drive the market for smart welding helmets. As a result, more companies are investing in innovative protective gear to improve workplace safety and efficiency, fueling the market's growth.

Expanding Industrial and Construction Activities

- The welding helmet market is witnessing significant growth due to the expanding industrial and construction activities worldwide. As industries ramp up production and construction projects gain momentum, the demand for welding processes is surging. This increased activity necessitates the use of protective equipment, particularly welding helmets, to ensure the safety of workers engaged in welding tasks.

- Moreover, the construction sector is increasingly adopting advanced welding technologies, which not only enhance efficiency but also require specialized protective gear. The integration of smart technologies in welding helmets, such as auto-darkening lenses and augmented reality features, is becoming more prevalent, attracting new customers and encouraging existing users to upgrade their equipment. This trend is expected to drive market expansion as companies prioritize worker safety and compliance with stringent regulations.

- Additionally, government initiatives aimed at promoting infrastructure development and manufacturing activities further bolster the welding helmet market. As investments in these sectors continue to rise, the need for robust safety solutions will remain paramount, creating lasting opportunities for manufacturers and suppliers in the welding helmet industry.

Welding Helmet Market Segment Analysis:

- Welding Helmet Market Segmented on the basis of Product, Power Type, Application, Lens Technology, Material, and Region

By Product, the Darkening Welding Helmets Segment Is Expected to Dominate the Market During the Forecast Period

- The auto-darkening welding helmets segment is anticipated to lead the welding helmet market during the forecast period, driven by the growing demand for enhanced protection and convenience in welding operations. These helmets automatically adjust their lens shade based on the intensity of the welding arc, offering welders improved visibility and reducing eye strain. Their ability to provide hands-free operation without manual adjustments makes them ideal for both professional and hobbyist welders, further boosting their adoption across industries.

- Additionally, the increasing use of auto-darkening helmets in sectors like automotive, construction, and shipbuilding, where precision and safety are critical, is expected to drive market growth. As industries continue to modernize and prioritize worker safety, the superior features of auto-darkening helmets, such as variable shade controls and lightweight designs, position them as the preferred choice among welding professionals globally.

By Application, Industrial Segment Held the Largest Share In 2023

- The industrial segment held the largest share of the welding helmet market in 2023, driven by the extensive use of welding operations across various industries such as automotive, construction, shipbuilding, and aerospace. Welding processes in these sectors require high safety standards and precision, which has fueled the demand for advanced welding helmets that ensure both protection and comfort for workers. The growing focus on worker safety and strict regulations regarding protective gear in industrial environments have further contributed to the segment’s dominance.

- The increasing adoption of automation and robotics in industrial welding has created a need for helmets that can accommodate advanced welding techniques. Industrial users prioritize durability, advanced features like auto-darkening, and high-impact resistance, making the segment a key driver of the market. As industrial activities continue to expand globally, the industrial segment is expected to maintain its leadership in the welding helmet market.

Welding Helmet Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the welding helmet market over the forecast period, driven by rapid industrialization and infrastructure development in countries like China, India, and Japan. The growing demand for welding helmets in industries such as automotive, construction, and shipbuilding is contributing significantly to market growth. The region's large manufacturing base, coupled with increasing investments in industrial safety, is boosting the adoption of advanced welding helmets, including auto-darkening models.

- Furthermore, government initiatives promoting worker safety standards and the expansion of heavy industries are also supporting the market’s dominance in Asia Pacific. As the region experiences continued economic growth, the rising need for protective equipment in industrial settings is expected to fuel demand. This, combined with the increasing availability of cost-effective, high-quality welding helmets from local manufacturers, positions Asia Pacific as the leading region in the global welding helmet market.

Welding Helmet Market Active Players

- 3M Company (USA)

- Lincoln Electric Holdings, Inc. (USA)

- Honeywell International Inc. (USA)

- ESAB Corporation (Sweden)

- Miller Electric Mfg. LLC (USA)

- Kempston Controls Ltd. (UK)

- Optrel AG (Switzerland)

- Jackson Safety (USA)

- DeWalt (USA)

- Walter Surface Technologies (Canada)

- Riland Welding (China)

- EWM AG (Germany)

- ABICOR BINZEL (Germany)

- Bessey Tools (Germany)

- Trafimet (Italy)

- Sungold Power (USA)

- Welding Alloys Group (France)

- STIHL Inc. (Germany)

- Arcos (Sweden)

- Hobart Brothers Company (USA)

- GYS (France)

- Draper Tools Ltd. (UK)

- Panasonic Welding Systems (Japan)

- Babcock & Wilcox (USA)

- Aceros C.A. (Venezuela), and Other Active Players

Key Industry Developments in the Welding Helmet Market:

- In January 2024, 3M will debut the world's first self-charging protective communications headset that converts outdoor and indoor light into clean electrical energy. The headset uses a patented solar cell technology called Powerfoyle™ that recharges a built-in lithium-ion battery and eliminates the need for single-use batteries. So, whether you are working outdoors in the sun or inside with artificial light, your headset will continuously charge.

- In June 2024, Honeywell announced the completion of its acquisition of Carrier Global Corporations, Global Access Solutions business for $4.95 billion. The deal positions Honeywell as a leading provider of security solutions for the digital age with opportunities for accelerated innovation in the fast-growing, cloud-based services and solutions space. This transaction also strengthens Honeywell's alignment of its portfolio around three compelling megatrends, including automation, and complements Honeywell's Building Automation segment.

- In June 2024, Honeywell announced that it had agreed to acquire CAES Systems Holdings LLC (CAES) from private equity firm Advent International for approximately $1.9 billion in an all-cash transaction. This represents approximately 14x the estimated 2024 EBITDA on a tax-adjusted basis.

|

Welding Helmet Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 803.95 Mn. |

|

Forecast Period 2024-32 CAGR: |

24.10% |

Market Size in 2032: |

USD 5612.74 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Power Type |

|

||

|

By Application |

|

||

|

By Lens Technology |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Welding Helmet Market by Product (2018-2032)

4.1 Welding Helmet Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Auto Darkening Welding Helmets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Passive Welding Helmet

Chapter 5: Welding Helmet Market by Power Type (2018-2032)

5.1 Welding Helmet Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Solar

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Battery

5.5 Hybrid

5.6 Hard-Wired

Chapter 6: Welding Helmet Market by Application (2018-2032)

6.1 Welding Helmet Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Construction

6.6 Ship building

6.7 Energy

Chapter 7: Welding Helmet Market by Lens Technology (2018-2032)

7.1 Welding Helmet Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Liquid Crystal Display (LCD)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Light-emitting diode (LED)

Chapter 8: Welding Helmet Market by Material (2018-2032)

8.1 Welding Helmet Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Thermoplastic

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Thermostat

8.5 Metal

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Welding Helmet Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 3M COMPANY (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 LINCOLN ELECTRIC HOLDINGS INC. (USA)

9.4 HONEYWELL INTERNATIONAL INC. (USA)

9.5 ESAB CORPORATION (SWEDEN)

9.6 MILLER ELECTRIC MFG. LLC (USA)

9.7 KEMPSTON CONTROLS LTD. (UK)

9.8 OPTREL AG (SWITZERLAND)

9.9 JACKSON SAFETY (USA)

9.10 DEWALT (USA)

9.11 WALTER SURFACE TECHNOLOGIES (CANADA)

9.12 RILAND WELDING (CHINA)

9.13 EWM AG (GERMANY)

9.14 ABICOR BINZEL (GERMANY)

9.15 BESSEY TOOLS (GERMANY)

9.16 TRAFIMET (ITALY)

9.17 SUNGOLD POWER (USA)

9.18 WELDING ALLOYS GROUP (FRANCE)

9.19 STIHL INC. (GERMANY)

9.20 ARCOS (SWEDEN)

9.21 HOBART BROTHERS COMPANY (USA)

9.22 GYS (FRANCE)

9.23 DRAPER TOOLS LTD. (UK)

9.24 PANASONIC WELDING SYSTEMS (JAPAN)

9.25 BABCOCK & WILCOX (USA)

9.26 ACEROS C.A. (VENEZUELA)

9.27 AND

Chapter 10: Global Welding Helmet Market By Region

10.1 Overview

10.2. North America Welding Helmet Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product

10.2.4.1 Auto Darkening Welding Helmets

10.2.4.2 Passive Welding Helmet

10.2.5 Historic and Forecasted Market Size by Power Type

10.2.5.1 Solar

10.2.5.2 Battery

10.2.5.3 Hybrid

10.2.5.4 Hard-Wired

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Automotive

10.2.6.2 Industrial

10.2.6.3 Construction

10.2.6.4 Ship building

10.2.6.5 Energy

10.2.7 Historic and Forecasted Market Size by Lens Technology

10.2.7.1 Liquid Crystal Display (LCD)

10.2.7.2 Light-emitting diode (LED)

10.2.8 Historic and Forecasted Market Size by Material

10.2.8.1 Thermoplastic

10.2.8.2 Thermostat

10.2.8.3 Metal

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Welding Helmet Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product

10.3.4.1 Auto Darkening Welding Helmets

10.3.4.2 Passive Welding Helmet

10.3.5 Historic and Forecasted Market Size by Power Type

10.3.5.1 Solar

10.3.5.2 Battery

10.3.5.3 Hybrid

10.3.5.4 Hard-Wired

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Automotive

10.3.6.2 Industrial

10.3.6.3 Construction

10.3.6.4 Ship building

10.3.6.5 Energy

10.3.7 Historic and Forecasted Market Size by Lens Technology

10.3.7.1 Liquid Crystal Display (LCD)

10.3.7.2 Light-emitting diode (LED)

10.3.8 Historic and Forecasted Market Size by Material

10.3.8.1 Thermoplastic

10.3.8.2 Thermostat

10.3.8.3 Metal

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Welding Helmet Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product

10.4.4.1 Auto Darkening Welding Helmets

10.4.4.2 Passive Welding Helmet

10.4.5 Historic and Forecasted Market Size by Power Type

10.4.5.1 Solar

10.4.5.2 Battery

10.4.5.3 Hybrid

10.4.5.4 Hard-Wired

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Automotive

10.4.6.2 Industrial

10.4.6.3 Construction

10.4.6.4 Ship building

10.4.6.5 Energy

10.4.7 Historic and Forecasted Market Size by Lens Technology

10.4.7.1 Liquid Crystal Display (LCD)

10.4.7.2 Light-emitting diode (LED)

10.4.8 Historic and Forecasted Market Size by Material

10.4.8.1 Thermoplastic

10.4.8.2 Thermostat

10.4.8.3 Metal

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Welding Helmet Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product

10.5.4.1 Auto Darkening Welding Helmets

10.5.4.2 Passive Welding Helmet

10.5.5 Historic and Forecasted Market Size by Power Type

10.5.5.1 Solar

10.5.5.2 Battery

10.5.5.3 Hybrid

10.5.5.4 Hard-Wired

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Automotive

10.5.6.2 Industrial

10.5.6.3 Construction

10.5.6.4 Ship building

10.5.6.5 Energy

10.5.7 Historic and Forecasted Market Size by Lens Technology

10.5.7.1 Liquid Crystal Display (LCD)

10.5.7.2 Light-emitting diode (LED)

10.5.8 Historic and Forecasted Market Size by Material

10.5.8.1 Thermoplastic

10.5.8.2 Thermostat

10.5.8.3 Metal

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Welding Helmet Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product

10.6.4.1 Auto Darkening Welding Helmets

10.6.4.2 Passive Welding Helmet

10.6.5 Historic and Forecasted Market Size by Power Type

10.6.5.1 Solar

10.6.5.2 Battery

10.6.5.3 Hybrid

10.6.5.4 Hard-Wired

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Automotive

10.6.6.2 Industrial

10.6.6.3 Construction

10.6.6.4 Ship building

10.6.6.5 Energy

10.6.7 Historic and Forecasted Market Size by Lens Technology

10.6.7.1 Liquid Crystal Display (LCD)

10.6.7.2 Light-emitting diode (LED)

10.6.8 Historic and Forecasted Market Size by Material

10.6.8.1 Thermoplastic

10.6.8.2 Thermostat

10.6.8.3 Metal

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Welding Helmet Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product

10.7.4.1 Auto Darkening Welding Helmets

10.7.4.2 Passive Welding Helmet

10.7.5 Historic and Forecasted Market Size by Power Type

10.7.5.1 Solar

10.7.5.2 Battery

10.7.5.3 Hybrid

10.7.5.4 Hard-Wired

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Automotive

10.7.6.2 Industrial

10.7.6.3 Construction

10.7.6.4 Ship building

10.7.6.5 Energy

10.7.7 Historic and Forecasted Market Size by Lens Technology

10.7.7.1 Liquid Crystal Display (LCD)

10.7.7.2 Light-emitting diode (LED)

10.7.8 Historic and Forecasted Market Size by Material

10.7.8.1 Thermoplastic

10.7.8.2 Thermostat

10.7.8.3 Metal

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Welding Helmet Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 803.95 Mn. |

|

Forecast Period 2024-32 CAGR: |

24.10% |

Market Size in 2032: |

USD 5612.74 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Power Type |

|

||

|

By Application |

|

||

|

By Lens Technology |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||