Global Warehouse Robotics Market Overview

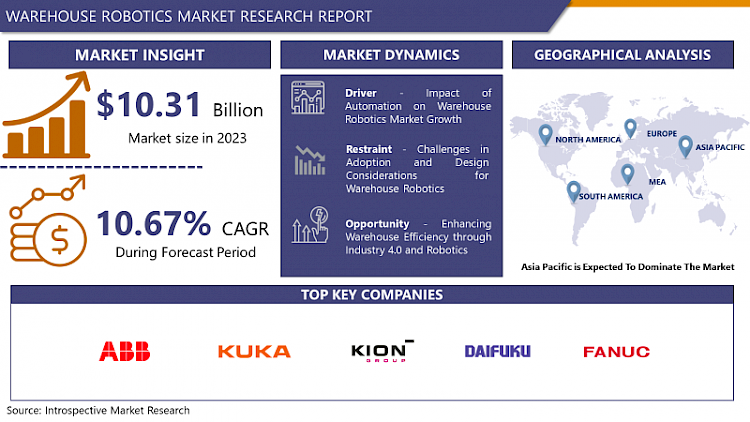

Warehouse Robotics Market size is projected to reach USD 10.31 billion by 2032 from an estimated USD 4.14 billion in 2023, growing at a CAGR of 10.67% globally.

- Warehouse robotics signifies a significant advancement in industrial automation, utilizing cutting-edge computer-based technologies to enhance and improve warehouse activities. These systems are created to efficiently manage a variety of tasks, from retrieving items and packing to transporting materials and palletizing. Sophisticated machinery and software solutions play a key role in their operations, allowing for autonomous decision-making and execution to significantly boost warehouse productivity.

- Various cutting-edge technologies are the foundation of warehouse robotics. Industrial robots, which have robotic arms and grippers, carry out tasks such as selecting and positioning objects with impressive precision. AMRs roam around warehouse floors independently, utilizing built-in sensors and mapping technology to navigate without obstacles and efficiently move merchandise. Automated storage and retrieval systems (AS/RS) make use of vertical storage units and conveyors to quickly retrieve items, decreasing retrieval times and optimizing storage capacity. These technologies function together smoothly, led by computer systems and utilizing magnetic strips and infrared cameras to ensure smooth operation.

- Warehouse robotics have a wide-ranging impact on various industries. In the food and beverage industry, these systems improve inventory control and order processing, guaranteeing that perishable goods are managed accurately and quickly. Robotics in automotive production optimize assembly line processes, enabling efficient just-in-time manufacturing. Pharmaceutical warehouses gain advantages from the careful management of delicate materials, ensuring adherence to strict regulatory criteria. Retail operations experience enhanced inventory precision and quicker order processing to accommodate the requirements of online shopping and multifaceted distribution channels.

Market Dynamics and Forecast for the Warehouse Robotics Market:

Drivers:

The warehouse robotics market is anticipated to be turned by a combined effect of the rising retail and e-commerce industries and energy efficiency-driven technological changes in automation. Major key players are incorporating robotics and automation for the expansion of their warehouses. For example, Amazon, Inc. had over 100,000 robotics systems deployed over about 25 fulfillment centers in the U.S. in 2019. In the next year, the company also deployed 800 Pegasus and Xanthus robotic systems in some implementation centers and developed the robotic drive to about 200,000 robots globally.

The growing number of stock-keeping units is quite common in the warehouse robotics industry, as there is a constant launching of the latest products regularly. The luxury of customization and the rising number of consumer choices by the e-commerce platform has encouraged the demand for an expanded inventory, with a host of options and styles accessible at the disposable of the e-commerce retailers for dispatch on request. As per the Materials Management & Distribution Report, Just-in-time ordering, direct-to-consumer distribution, and switching retailer-wholesaler relationships are declining the number of large-pallet orders received by distributors. In turn, the growth of small, multiple stock-keeping units orders is driving warehouses to automate.

Furthermore, according to the Bank of America, it is expected that by 2025, 45% of all production tasks will be accomplished by robotic technology. With this developing trend, large firms, such as Raymond Limited, which is a major Indian textile company, and Foxconn Technology which is a China-based supplier for large technology manufacturers such as Samsung and others have restored 10,000 and 60,000 employees, respectively, by including automated technology into their production units.

Therefore, these factors have had a direct impact on the growing adoption of warehouse robotics as well. The growing number of warehouses, raising funding in warehouse automation, integrated with the global growth in labor costs and accessibility of scalable technological solutions, have been turning the warehouse robotics market for warehouse robotics over the world. For instance, major logistics brands in the United States, such as XPO Logistics, DHL, and NFI Logistics, are funding in developmental operations, despite the adverse commercial renting climate.

Restraints:

High investment is required to establish and install warehouse robotics. An approximate cost of a mobile robot ranging from USD 25,000 to USD 100,000, whereas the average cost of a fixed robot ranges from USD 40,000 to USD 400,000. The high costs of these robots restrain their adoption, which, as a result, affects the development of the warehouse robotics market during the forecast period. Moreover, the warehouse operators require to alter their warehouse layouts to support the warehouse robotics system to carry out their operations effectively. While designing a new layout, companies require to target major attributes such as the space utilization, safety of workers, and easy availability of items.

Opportunities:

The incorporation of Industry 4.0 with warehouse robotics aims at producing an operational environment in which people and robots can work together. It also enables robots to receive specific instructions and respond to the environment around them. Industry 4.0 allows warehousing facilities to transform to significant changes in their business. Moreover, the incorporation of Industry 4.0 and warehouse robotics systems enables effective communication between warehouse operations. This increased coordination between warehouse systems is supporting warehouse operators to operate time-critical and high-velocity operations at a cheap cost in the highly demanding and continuously developing ecosystem. It is also enabling key players to perform an extensive range of tasks, such as processing customized orders and high-speed delivery of products.

Market Segmentation

Based on the product type, the warehouse robotics market for AMRs is anticipated to dominate and indicate the highest warehouse robotics market share over the forecast period. The rising preference for e-commerce shopping platforms and the increasing requirement for improving the efficiency of warehouses have led companies to target automation of operations. Apart from this rising affordability and return on investment (ROI) are anticipated to turn the growth of the warehouse robotics market. Flexibility and efficiency have become primary differentiators in the e-commerce fulfillment market as retailers and logistic companies are competing to cope up with changing demands, seasonal peaks, and growing delivery expectations. Furthermore, mobile robots form a vital fragment of the global warehousing sectors, as they are used for moving small payloads in the facility, especially in the retail and consumer electronics industry, while offering more flexibility than most of the traditional automation systems. Mobile robotic systems provide high operational flexibility. Additionally, the development in artificial intelligence, deep learning, and robotic mechanics are rising their capabilities.

Based on the function, the picks and place segment recorded for the maximum revenue share of the warehouse robotics market and is anticipated to continue its dominance during the forecast period. The different businesses are installing robotic systems for improving packaging performance by installing sustainable and future-proof solutions. Companies are put back their manual case packing by robotic case packing and using robots at length for loading containers into the Form Fill Seal (FFS) machines. The reason for the development of transportation is owing to development or expansion in mobile robots and rise in utilization in various industries such as food & beverage, pharmaceutical, e-commerce, metal & machinery, and automotive which leads the growth of the warehouse robotics market during the forecast period.

Based on the payload capacity, the below 10 kg payload capacity segment recorded considerable revenue warehouse robotics market share and is expected to affirm its dominance during the forecast period. This is assigned to the fact that the robots with lower payload capacities can carry a majority of the items in a typical facility offering various end-use industries.

Based on the software type, the Warehouse Management System (WMS) software segment is projected to register the maximum warehouse robotics market share and is expected to assert its dominance during the forecast period, due to its ability to manage the overall activity and processes within a facility. These processes incorporate moving the consignment from one place to another within the facility, receiving, cycle counting, order selection, put-away, and shipping. The Warehouse Control System (WCS) and Warehouse Execution System (WES) software segments are expected to witness significant warehouse robotics market growth during the forecast period, as many businesses are investing in these solutions, which supports them in managing consumers as well as the intricacy of the unit.

Based on the application, the e-commerce segment is accelerating the growth of the warehouse robotics market owing to an upsurge in the number of online shopping customers and their rising demands for the speedy delivery of orders in an undamaged and precise form, growing competition in the e-commerce industry. The healthcare segment, on the other hand, is anticipated to witness the fastest warehouse robotics market share during the forecast period, due to the constant improvements in the medicine and pharmaceutical sector. The food and beverage and automotive segments are also expected to observe considerable growth throughout the forecast period owing to growing funding in robotic systems to automate their distribution centers for better productivity and safety.

Players Covered in Warehouse Robotics market are :

- ABB Ltd. (Switzerland)

- KUKA AG (Germany)

- KION GROUP AG (Germany)

- Daifuku (Japan)

- FANUC Corporation (Japan)

- Geekplus Technology (China)

- GreyOrange Pte. Ltd. (US)

- Murata Machinery Ltd. (Japan)

- Omron Corporation (Japan)

- Toyota Industries Corporation (Japan)

- Shopify Inc. (Canada)

- Hikrobot (China)

- IAM Robotics (US)

- inVia Robotics Inc. (US)

- JBT (US)

- Knapp AG (Austria)

- Locus Robotics (US)

- Magazino GmbH (Germany)

- Scallog (France)

- Shanghai Quicktron Intelligent Technology Co. Ltd. (China)

- SSI Schaefer AG (Germany)

- Teradyne Inc. (US)

- Vecna Robotics (US)

- Yaskawa Electric Corporation (Japan)

- and Zebra Technologies Corp. (US)

Regional Analysis for the Warehouse Robotics Market:

The Asia Pacific region is expected to dominate the warehouse robotics market during the forecast period. The growing trend of online retail shopping, the increasing number of start-ups in China that are emerging mobile robots, a high attrition rate of warehouse laborers, and active investment by venture capitalists for the expansion of mobile robots are some of the major factors tuning the growth of the APAC warehouse robotics market. The Growing investments in the deployment of warehouse robotics in various industries are other key factors turning the growth of the market in APAC. Additionally, China remains the maximum industrial robot market with a market share of 36% of total installations. As per the IFR, the operational stock of industrial robots is anticipated to gain 3788 (in thousand units) by 2021 from 2408 (in thousand units) in 2018. For example, Alibaba, the world's largest retailer based out of China, has upgraded to robotic labor in one of its warehouses, which has resulted in drastically declining the labor workforce by 70%, producing an opportunity for a highly skilled workforce.

North America region is expected to register a significant warehouse robotics market share during the forecast period, due to the intensification of the latest technologies at a higher rate coupled with the vital presence of warehouse operatives. Furthermore, the Europe region is expected to be stagnant growth of the warehouse robotics market during the forecast period. This slow growth pace is accredited to the brutal competition, market saturation, and challenging economic situation. Within Europe, Germany is anticipated to observe considerable growth throughout the forecast period.

Key Industry Developments in the Warehouse Robotics Market:

- In July 2023, Maersk, integrator of logistics, announced that it is implementing an AI-enabled robotic solution in one of the warehouses in East Midlands, UK. According to the company, this state-of-the-art Robotic Shuttle Put Wall System by Berkshire Grey, a US-based company, will significantly automate, enhance, and accelerate warehouse operations in the 685,000 sq ft facility.

- In March 2023, LexxPluss, a Japan-based startup that designs and develops autonomous mobile robots for warehouses & logistics sites, announced their plans to enter the US market with a fresh injection of approximately USD 10.7 million in Series A funding. The funding round was led by Drone Fund and SOSV's HAX, Incubate Fund, SBI Investment, and DBJ Capital.

|

Global Warehouse Robotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.67 % |

Market Size in 2032: |

USD 10.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Payload Capacity |

|

||

|

By Payload Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WAREHOUSE ROBOTICS MARKET BY TYPE (2017-2032)

- WAREHOUSE ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT1A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMATIC STORAGE & RETRIEVAL SYSTEM {AS/RS}

- AUTOMATED GUIDED VEHICLES {AGV}

- UNIT LOAD TRANSPORT AUTONOMOUS MOBILE ROBOTS {AMR}

- CARTESIAN ROBOTS

- ROBOTIC ARMS

- COLLABORATIVE BOTS {CO-BOTS}

- MOBILE RACK GOODS-TO-PERSON {GTP} AMR

- ROAMING SHUTTLE AMRS

- BOT SORTER AMRS

- SORTATION SYSTEMS

- CONVEYORS

- PALLETIZERS

- AND OTHERS

- WAREHOUSE ROBOTICS MARKET BY FUNCTION (2017-2032)

- WAREHOUSE ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT2A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PICK & PLACE

- PALLETIZING & DEPALLETIZING

- TRANSPORTATION

- PACKAGING

- WAREHOUSE ROBOTICS MARKET BY PAYLOAD CAPACITY (2017-2032)

- WAREHOUSE ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BELOW 10 KG

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 11 KG TO 80 KG

- 81 KG TO 400 KG

- 401 KG TO 900 KG

- ABOVE 900 KG

- WAREHOUSE ROBOTICS MARKET BY PAYLOAD CAPACITY (2017-2032)

- WAREHOUSE ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WAREHOUSE MANAGEMENT SYSTEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WAREHOUSE CONTROL SYSTEM

- AND WAREHOUSE EXECUTION SYSTEM

- WAREHOUSE ROBOTICS MARKET BY APPLICATION (2017-2032)

- WAREHOUSE ROBOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- E-COMMERCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- ELECTRICAL & ELECTRONICS

- METAL & MACHINERY

- CHEMICAL

- RUBBER AND PLASTICS

- FOOD & BEVERAGE

- PHARMACEUTICAL

- OTHER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Warehouse Robotics Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB LTD. (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KUKA AG (GERMANY)

- KION GROUP AG (GERMANY)

- DAIFUKU (JAPAN)

- FANUC CORPORATION (JAPAN)

- GEEKPLUS TECHNOLOGY (CHINA)

- GREYORANGE PTE. LTD. (US)

- MURATA MACHINERY LTD. (JAPAN)

- OMRON CORPORATION (JAPAN)

- TOYOTA INDUSTRIES CORPORATION (JAPAN)

- SHOPIFY INC. (CANADA)

- HIKROBOT (CHINA)

- IAM ROBOTICS (US)

- INVIA ROBOTICS INC. (US)

- JBT (US)

- KNAPP AG (AUSTRIA)

- LOCUS ROBOTICS (US)

- MAGAZINO GMBH (GERMANY)

- SCALLOG (FRANCE)

- SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO. LTD. (CHINA)

- SSI SCHAEFER AG (GERMANY)

- TERADYNE INC. (US)

- VECNA ROBOTICS (US)

- YASKAWA ELECTRIC CORPORATION (JAPAN)

- ZEBRA TECHNOLOGIES CORP. (US)

- COMPETITIVE LANDSCAPE

- GLOBAL WAREHOUSE ROBOTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Payload Capacity

- Historic And Forecasted Market Size By S Payload Capacity

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Warehouse Robotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.67 % |

Market Size in 2032: |

USD 10.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Payload Capacity |

|

||

|

By Payload Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WAREHOUSE ROBOTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WAREHOUSE ROBOTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WAREHOUSE ROBOTICS MARKET COMPETITIVE RIVALRY

TABLE 005. WAREHOUSE ROBOTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. WAREHOUSE ROBOTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. WAREHOUSE ROBOTICS MARKET BY TYPE

TABLE 008. AUTOMATIC STORAGE & RETRIEVAL SYSTEM {AS/RS} MARKET OVERVIEW (2016-2028)

TABLE 009. AUTOMATED GUIDED VEHICLES {AGV} MARKET OVERVIEW (2016-2028)

TABLE 010. UNIT LOAD TRANSPORT AUTONOMOUS MOBILE ROBOTS {AMR} MARKET OVERVIEW (2016-2028)

TABLE 011. CARTESIAN ROBOTS MARKET OVERVIEW (2016-2028)

TABLE 012. ROBOTIC ARMS MARKET OVERVIEW (2016-2028)

TABLE 013. COLLABORATIVE BOTS {CO-BOTS} MARKET OVERVIEW (2016-2028)

TABLE 014. MOBILE RACK GOODS-TO-PERSON {GTP} AMR MARKET OVERVIEW (2016-2028)

TABLE 015. ROAMING SHUTTLE AMRS MARKET OVERVIEW (2016-2028)

TABLE 016. BOT SORTER AMRS MARKET OVERVIEW (2016-2028)

TABLE 017. SORTATION SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 018. CONVEYORS MARKET OVERVIEW (2016-2028)

TABLE 019. PALLETIZERS MARKET OVERVIEW (2016-2028)

TABLE 020. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. WAREHOUSE ROBOTICS MARKET BY FUNCTION

TABLE 022. PICK & PLACE MARKET OVERVIEW (2016-2028)

TABLE 023. PALLETIZING & DEPALLETIZING MARKET OVERVIEW (2016-2028)

TABLE 024. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 025. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 026. WAREHOUSE ROBOTICS MARKET BY PAYLOAD CAPACITY

TABLE 027. BELOW 10 KG MARKET OVERVIEW (2016-2028)

TABLE 028. 11 KG TO 80 KG MARKET OVERVIEW (2016-2028)

TABLE 029. 81 KG TO 400 KG MARKET OVERVIEW (2016-2028)

TABLE 030. 401 KG TO 900 KG MARKET OVERVIEW (2016-2028)

TABLE 031. ABOVE 900 KG MARKET OVERVIEW (2016-2028)

TABLE 032. WAREHOUSE ROBOTICS MARKET BY PAYLOAD CAPACITY

TABLE 033. WAREHOUSE MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 034. WAREHOUSE CONTROL SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 035. AND WAREHOUSE EXECUTION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 036. WAREHOUSE ROBOTICS MARKET BY APPLICATION

TABLE 037. E-COMMERCE MARKET OVERVIEW (2016-2028)

TABLE 038. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 039. ELECTRICAL & ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 040. METAL & MACHINERY MARKET OVERVIEW (2016-2028)

TABLE 041. CHEMICAL MARKET OVERVIEW (2016-2028)

TABLE 042. RUBBER AND PLASTICS MARKET OVERVIEW (2016-2028)

TABLE 043. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 044. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 045. OTHER MARKET OVERVIEW (2016-2028)

TABLE 046. NORTH AMERICA WAREHOUSE ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 047. NORTH AMERICA WAREHOUSE ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 048. NORTH AMERICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 049. NORTH AMERICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 050. NORTH AMERICA WAREHOUSE ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 051. N WAREHOUSE ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 052. EUROPE WAREHOUSE ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 053. EUROPE WAREHOUSE ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 054. EUROPE WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 055. EUROPE WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 056. EUROPE WAREHOUSE ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 057. WAREHOUSE ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 058. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 059. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 060. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 061. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 062. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 063. WAREHOUSE ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 064. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 065. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 066. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 067. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 068. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 069. WAREHOUSE ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 070. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET, BY TYPE (2016-2028)

TABLE 071. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET, BY FUNCTION (2016-2028)

TABLE 072. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 073. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY (2016-2028)

TABLE 074. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 075. WAREHOUSE ROBOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 076. ABB LTD. (SWITZERLAND): SNAPSHOT

TABLE 077. ABB LTD. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 078. ABB LTD. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 079. ABB LTD. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. KUKA AG (GERMANY): SNAPSHOT

TABLE 080. KUKA AG (GERMANY): BUSINESS PERFORMANCE

TABLE 081. KUKA AG (GERMANY): PRODUCT PORTFOLIO

TABLE 082. KUKA AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. KION GROUP AG (GERMANY): SNAPSHOT

TABLE 083. KION GROUP AG (GERMANY): BUSINESS PERFORMANCE

TABLE 084. KION GROUP AG (GERMANY): PRODUCT PORTFOLIO

TABLE 085. KION GROUP AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. DAIFUKU (JAPAN): SNAPSHOT

TABLE 086. DAIFUKU (JAPAN): BUSINESS PERFORMANCE

TABLE 087. DAIFUKU (JAPAN): PRODUCT PORTFOLIO

TABLE 088. DAIFUKU (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. FANUC CORPORATION (JAPAN): SNAPSHOT

TABLE 089. FANUC CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 090. FANUC CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 091. FANUC CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. GEEKPLUS TECHNOLOGY (CHINA): SNAPSHOT

TABLE 092. GEEKPLUS TECHNOLOGY (CHINA): BUSINESS PERFORMANCE

TABLE 093. GEEKPLUS TECHNOLOGY (CHINA): PRODUCT PORTFOLIO

TABLE 094. GEEKPLUS TECHNOLOGY (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. GREYORANGE PTE. LTD. (US): SNAPSHOT

TABLE 095. GREYORANGE PTE. LTD. (US): BUSINESS PERFORMANCE

TABLE 096. GREYORANGE PTE. LTD. (US): PRODUCT PORTFOLIO

TABLE 097. GREYORANGE PTE. LTD. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. MURATA MACHINERY LTD. (JAPAN): SNAPSHOT

TABLE 098. MURATA MACHINERY LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 099. MURATA MACHINERY LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 100. MURATA MACHINERY LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. OMRON CORPORATION (JAPAN): SNAPSHOT

TABLE 101. OMRON CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 102. OMRON CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 103. OMRON CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. TOYOTA INDUSTRIES CORPORATION (JAPAN): SNAPSHOT

TABLE 104. TOYOTA INDUSTRIES CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 105. TOYOTA INDUSTRIES CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 106. TOYOTA INDUSTRIES CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. SHOPIFY INC. (CANADA): SNAPSHOT

TABLE 107. SHOPIFY INC. (CANADA): BUSINESS PERFORMANCE

TABLE 108. SHOPIFY INC. (CANADA): PRODUCT PORTFOLIO

TABLE 109. SHOPIFY INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. HIKROBOT (CHINA): SNAPSHOT

TABLE 110. HIKROBOT (CHINA): BUSINESS PERFORMANCE

TABLE 111. HIKROBOT (CHINA): PRODUCT PORTFOLIO

TABLE 112. HIKROBOT (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. IAM ROBOTICS (US): SNAPSHOT

TABLE 113. IAM ROBOTICS (US): BUSINESS PERFORMANCE

TABLE 114. IAM ROBOTICS (US): PRODUCT PORTFOLIO

TABLE 115. IAM ROBOTICS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. INVIA ROBOTICS INC. (US): SNAPSHOT

TABLE 116. INVIA ROBOTICS INC. (US): BUSINESS PERFORMANCE

TABLE 117. INVIA ROBOTICS INC. (US): PRODUCT PORTFOLIO

TABLE 118. INVIA ROBOTICS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. JBT (US): SNAPSHOT

TABLE 119. JBT (US): BUSINESS PERFORMANCE

TABLE 120. JBT (US): PRODUCT PORTFOLIO

TABLE 121. JBT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. KNAPP AG (AUSTRIA): SNAPSHOT

TABLE 122. KNAPP AG (AUSTRIA): BUSINESS PERFORMANCE

TABLE 123. KNAPP AG (AUSTRIA): PRODUCT PORTFOLIO

TABLE 124. KNAPP AG (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 124. LOCUS ROBOTICS (US): SNAPSHOT

TABLE 125. LOCUS ROBOTICS (US): BUSINESS PERFORMANCE

TABLE 126. LOCUS ROBOTICS (US): PRODUCT PORTFOLIO

TABLE 127. LOCUS ROBOTICS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127. MAGAZINO GMBH (GERMANY): SNAPSHOT

TABLE 128. MAGAZINO GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 129. MAGAZINO GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 130. MAGAZINO GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 130. SCALLOG (FRANCE): SNAPSHOT

TABLE 131. SCALLOG (FRANCE): BUSINESS PERFORMANCE

TABLE 132. SCALLOG (FRANCE): PRODUCT PORTFOLIO

TABLE 133. SCALLOG (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 133. SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO. LTD. (CHINA): SNAPSHOT

TABLE 134. SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 135. SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 136. SHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 136. SSI SCHAEFER AG (GERMANY): SNAPSHOT

TABLE 137. SSI SCHAEFER AG (GERMANY): BUSINESS PERFORMANCE

TABLE 138. SSI SCHAEFER AG (GERMANY): PRODUCT PORTFOLIO

TABLE 139. SSI SCHAEFER AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 139. TERADYNE INC. (US): SNAPSHOT

TABLE 140. TERADYNE INC. (US): BUSINESS PERFORMANCE

TABLE 141. TERADYNE INC. (US): PRODUCT PORTFOLIO

TABLE 142. TERADYNE INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 142. VECNA ROBOTICS (US): SNAPSHOT

TABLE 143. VECNA ROBOTICS (US): BUSINESS PERFORMANCE

TABLE 144. VECNA ROBOTICS (US): PRODUCT PORTFOLIO

TABLE 145. VECNA ROBOTICS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 145. YASKAWA ELECTRIC CORPORATION (JAPAN): SNAPSHOT

TABLE 146. YASKAWA ELECTRIC CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 147. YASKAWA ELECTRIC CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 148. YASKAWA ELECTRIC CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 148. AND ZEBRA TECHNOLOGIES CORP. (US): SNAPSHOT

TABLE 149. AND ZEBRA TECHNOLOGIES CORP. (US): BUSINESS PERFORMANCE

TABLE 150. AND ZEBRA TECHNOLOGIES CORP. (US): PRODUCT PORTFOLIO

TABLE 151. AND ZEBRA TECHNOLOGIES CORP. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WAREHOUSE ROBOTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WAREHOUSE ROBOTICS MARKET OVERVIEW BY TYPE

FIGURE 012. AUTOMATIC STORAGE & RETRIEVAL SYSTEM {AS/RS} MARKET OVERVIEW (2016-2028)

FIGURE 013. AUTOMATED GUIDED VEHICLES {AGV} MARKET OVERVIEW (2016-2028)

FIGURE 014. UNIT LOAD TRANSPORT AUTONOMOUS MOBILE ROBOTS {AMR} MARKET OVERVIEW (2016-2028)

FIGURE 015. CARTESIAN ROBOTS MARKET OVERVIEW (2016-2028)

FIGURE 016. ROBOTIC ARMS MARKET OVERVIEW (2016-2028)

FIGURE 017. COLLABORATIVE BOTS {CO-BOTS} MARKET OVERVIEW (2016-2028)

FIGURE 018. MOBILE RACK GOODS-TO-PERSON {GTP} AMR MARKET OVERVIEW (2016-2028)

FIGURE 019. ROAMING SHUTTLE AMRS MARKET OVERVIEW (2016-2028)

FIGURE 020. BOT SORTER AMRS MARKET OVERVIEW (2016-2028)

FIGURE 021. SORTATION SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 022. CONVEYORS MARKET OVERVIEW (2016-2028)

FIGURE 023. PALLETIZERS MARKET OVERVIEW (2016-2028)

FIGURE 024. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. WAREHOUSE ROBOTICS MARKET OVERVIEW BY FUNCTION

FIGURE 026. PICK & PLACE MARKET OVERVIEW (2016-2028)

FIGURE 027. PALLETIZING & DEPALLETIZING MARKET OVERVIEW (2016-2028)

FIGURE 028. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 029. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 030. WAREHOUSE ROBOTICS MARKET OVERVIEW BY PAYLOAD CAPACITY

FIGURE 031. BELOW 10 KG MARKET OVERVIEW (2016-2028)

FIGURE 032. 11 KG TO 80 KG MARKET OVERVIEW (2016-2028)

FIGURE 033. 81 KG TO 400 KG MARKET OVERVIEW (2016-2028)

FIGURE 034. 401 KG TO 900 KG MARKET OVERVIEW (2016-2028)

FIGURE 035. ABOVE 900 KG MARKET OVERVIEW (2016-2028)

FIGURE 036. WAREHOUSE ROBOTICS MARKET OVERVIEW BY PAYLOAD CAPACITY

FIGURE 037. WAREHOUSE MANAGEMENT SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 038. WAREHOUSE CONTROL SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 039. AND WAREHOUSE EXECUTION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 040. WAREHOUSE ROBOTICS MARKET OVERVIEW BY APPLICATION

FIGURE 041. E-COMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 042. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 043. ELECTRICAL & ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 044. METAL & MACHINERY MARKET OVERVIEW (2016-2028)

FIGURE 045. CHEMICAL MARKET OVERVIEW (2016-2028)

FIGURE 046. RUBBER AND PLASTICS MARKET OVERVIEW (2016-2028)

FIGURE 047. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 048. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 049. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 050. NORTH AMERICA WAREHOUSE ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 051. EUROPE WAREHOUSE ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 052. ASIA PACIFIC WAREHOUSE ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 053. MIDDLE EAST & AFRICA WAREHOUSE ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 054. SOUTH AMERICA WAREHOUSE ROBOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Warehouse Robotics Market research report is 2024-2032.

ABB Ltd. (Switzerland), KUKA AG (Germany), KION GROUP AG (Germany), Daifuku (Japan), FANUC Corporation (Japan), Geekplus Technology (China), GreyOrange Pte. Ltd. (US), Murata Machinery Ltd. (Japan), Omron Corporation (Japan), Toyota Industries Corporation (Japan), Shopify, Inc. (Canada), Hikrobot (China), IAM Robotics (US), inVia Robotics, Inc. (US), JBT (US), Knapp AG (Austria), Locus Robotics (US), Magazino GmbH (Germany), Scallog (France), Shanghai Quicktron Intelligent Technology Co. Ltd. (China), SSI Schaefer AG (Germany), Teradyne, Inc. (US), Vecna Robotics (US), Yaskawa Electric Corporation (Japan), and Zebra Technologies Corp. (US), and Other Major Players.

The Warehouse Robotics Market is segmented into Type, Function, Payload Capacity, Application, and region. By Type, the market is categorized into Automatic Storage & Retrieval System {AS/RS}, Automated Guided Vehicles {AGV}, Unit Load Transport Autonomous Mobile Robots {AMR}, Cartesian Robots, Robotic Arms, Collaborative Bots {CO-BOTS}, Mobile Rack Goods-To-Person {GTP} AMR, Roaming Shuttle AMRS, Bot Sorter AMRS, Sortation Systems, Conveyors, Palletizers, And Others. By Function, the market is categorized into Pick & Place, Palletizing & Depalletizing, Transportation, and Packaging. By Payload Capacity, the market is categorized into Below 10 Kg, 11 Kg To 80 Kg, 81 Kg To 400 Kg, 401 Kg To 900 Kg, and Above 900 Kg. By Payload Capacity, the market is categorized into Warehouse Management System, Warehouse Control System, And Warehouse Execution System. By Application, the market is categorized into E-Commerce, Automotive, Electrical & Electronics, Metal & Machinery, Chemical, Rubber and Plastics, Food & Beverage, Pharmaceutical, and Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Warehouse robotics signifies a significant advancement in industrial automation, utilizing cutting-edge computer-based technologies to enhance and improve warehouse activities. These systems are created to efficiently manage a variety of tasks, from retrieving items and packing to transporting materials and palletizing. Sophisticated machinery and software solutions play a key role in their operations, allowing for autonomous decision-making and execution to significantly boost warehouse productivity.

Warehouse Robotics Market size is projected to reach USD 10.31 billion by 2032 from an estimated USD 4.14 billion in 2023, growing at a CAGR of 10.67% globally.