Warehouse Fumigant Market Synopsis

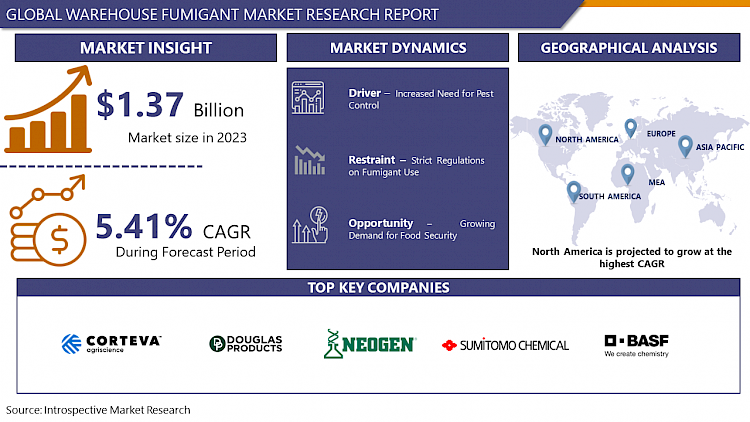

Global Warehouse Fumigant Market Size Was Valued at USD 1.37 Billion in 2023, and is Projected to Reach USD 2.09 Billion by 2032, Growing at a CAGR of 5.41% From 2024-2032.

Warehouse fumigants, and chemical substances applied in storage facilities, eradicate pests and pathogens by infiltrating commodities, targeting pests across all developmental stages. By interrupting their life cycles, these agents efficiently manage infestations, guaranteeing product integrity and adherence to safety regulations.

- Warehouse fumigants are vital for protecting stored goods against pests and pathogens. Applied across various storage facilities, they deeply penetrate commodities to target pests at every life stage, ensuring product quality and compliance with safety standards.

- They provide a comprehensive pest control solution, reducing the need for multiple treatments and cutting operational costs for businesses. Moreover, their residue-free nature maintains the safety of treated items, making them suitable for consumption or use. Additionally, fumigation proves adaptable to a wide array of commodities, spanning grains, cereals, spices, and dried fruits.

- Future demand for warehouse fumigants is set to rise significantly. With the continual expansion of global trade and commerce, effective pest management in storage facilities becomes increasingly crucial. Heightened regulatory standards and consumer expectations regarding product safety and quality will further propel the adoption of advanced fumigation technologies. Anticipated innovations in fumigant formulations and application methods will bolster efficiency and sustainability, cementing warehouse fumigants as indispensable assets in modern agricultural and commercial practices.

Warehouse Fumigant Market Trend Analysis:

Increased Need for Pest Control

- The surge in demand for pest control stands out as a primary catalyst driving the growth of the warehouse fumigant market. With the escalation of global trade and the expansion of supply chains, the risk of pest infestations in storage facilities intensifies, necessitating robust protective measures for stored goods. Warehouse fumigants emerge as indispensable remedies, adept at combating pests at various life stages and ensuring the integrity of stored products.

- Moreover, stringent regulatory mandates and growing consumer awareness regarding food safety propel the need for enhanced pest management protocols. As global food trade increases and consumer expectations rise, stakeholders prioritize measures to prevent contamination and maintain quality standards. Warehouse fumigants offer a dependable avenue to fulfill these objectives, delivering comprehensive pest control while mitigating the risk of residual contamination.

- Furthermore, the dynamic behavior of pest populations, coupled with their propensity to develop resistance to traditional control methods, underscores the significance of innovative pest management approaches. Warehouse fumigants, renowned for their effectiveness in targeting a diverse array of pest species, present a sustainable solution to confront evolving pest challenges. the warehouse fumigant market is poised for sustained growth, driven by the urgent imperative for effective pest control strategies in an increasingly interconnected global arena.

Growing Demand for Food Security

- The rising need for food security represents a significant opening for the expansion of the warehouse fumigant market. With burgeoning populations and rapid urbanization, ensuring a dependable and safe food supply becomes increasingly crucial. This heightened emphasis on food security spurs demand for robust pest management solutions to safeguard stored goods from contamination and spoilage.

- Moreover, amidst the challenges posed by climate change and evolving agricultural methods, the threat of pest infestations and post-harvest losses grows. Recognizing the urgency, stakeholders in the food industry are compelled to adopt effective strategies to maintain food quality and reduce wastage. Warehouse fumigants emerge as essential tools in this effort, offering comprehensive pest control solutions that prolong the shelf life of stored items while upholding food safety standards.

- Additionally, as both regulatory authorities and consumers prioritize food safety and quality assurance, the for stringent pest management practices intensifies. Warehouse fumigants, renowned for their effectiveness in eradicating pests across various life stages, offer a dependable means to meet these demands. The escalating focus on food security, combined with the versatility and efficacy of warehouse fumigants, positions the market for substantial growth prospects in the foreseeable future.

Warehouse Fumigant Market Segment Analysis:

Warehouse Fumigant Market Segmented on the basis of Type, Form, and Application.

By Form, Solid segment is expected to dominate the market during the forecast period

- The Warehouse Fumigant Market is anticipated to witness the solid segment asserting dominance in its growth trajectory. This trend is propelled by various factors, notably the versatility and effectiveness of solid fumigants in controlling pests across different storage environments. Solid fumigants offer clear advantages such as ease of application, minimized risk of leakage or spillage, and prolonged efficacy, making them a favored option among stakeholders.

- Furthermore, the solid segment's prominence is reinforced by advancements in fumigant formulations and application methods, which enhance their perSolidnce and safety profiles. With industries increasingly prioritizing efficient pest management practices to uphold product quality and meet regulatory requirements, the demand for solid fumigants is anticipated to see continuous growth. With their established efficacy and expanding applications in diverse storage contexts, solid fumigants are poised to maintain their leading position in the Warehouse Fumigant Market.

By Type, Phosphine segment held the largest share of 31.33% in 2022

- The phosphine segment asserts itself as the primary driver of growth in the Warehouse Fumigant Market, commanding the largest portion of the market share. This dominance stems from phosphine's extensive utility and effectiveness in pest control across diverse storage facilities. Phosphine fumigants exhibit remarkable efficacy against a wide spectrum of pests and are renowned for their ability to deeply penetrate commodities, ensuring thorough pest eradication.

- Moreover, the phosphine segment's substantial market share is reinforced by its versatility and comparative application when compared to alternative fumigants. With industries increasingly seeking efficient pest management solutions to safeguard stored products and uphold quality standards, phosphine fumigants emerge as the preferred option. Ongoing research and development endeavors aimed at refining phosphine formulations and application techniques further solidify the segment's position for sustained growth in the Warehouse Fumigant Market.

Warehouse Fumigant Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is positioned to lead the Warehouse Fumigant Market's growth, driven by various factors such as its robust storage and logistics infrastructure, stringent regulatory requirements, and widespread adoption of advanced pest control methods. This creates an environment conducive to the uptake and application of warehouse fumigants across diverse industries.

- Additionally, the escalating emphasis on food safety and quality assurance in North America accentuates the necessity for efficient pest management strategies in storage facilities. As consumers increasingly prioritize the safety and integrity of food products, stakeholders in the region prioritize investments in cutting-edge fumigation technologies. Consequently, North America is anticipated to uphold its dominant role in the Warehouse Fumigant Market.

Warehouse Fumigant Market Top Key Players:

- Corteva Agriscience (U.S.)

- Reddick Fumigants, LLC (U.S.)

- Douglas Products and Packaging Products LLC (U.S.)

- Neogen Corporation (U.S.)

- Industrial Fumigation Company LLC (U.S.)

- Degesch America Inc. (U.S.)

- BASF SE (Germany)

- Lanxess (Germany)

- Cytec Solvay Group (Belgium)

- Rentokil Initial plc (UK)

- Ikeda Kogyo Co., Ltd. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nippon Chemical Industrial Co. Ltd (Japan)

- ADAMA Agricultural Solutions Ltd (Israel)

- Vietnam Fumigation Joint Stock Company (Vietnam)

- UPL Group (India)

- Fumigation Services Pvt. Ltd (India)

- Nufarm Limited (Australia), and Other Major Players

Key Industry Developments in the Warehouse Fumigant Market:

- In September 2023, Altamont Capital Partners announced the sale of Douglas Products ("Douglas"), a specialty products manufacturer and marketer of high-quality brands in the global agriculture production and structural pest control markets, to private equity firm Brightstar Capital Partners ("Brightstar")

- In April 2023, Rollins, Inc. (NYSE: ROL) announced the completion of its acquisition of FPC Holdings, LLC, known as Fox Pest Control. With over 1,300 associates, Fox Pest Control was recognized as the 13th largest pest management company. The acquisition provided Rollins with an efficient entry point to new markets and expanded services for Fox Pest Control's existing customers. Rollins' President and CEO, Jerry Gahlhoff, Jr., emphasized the acquisition's complementary nature, facilitating growth across various regions.

|

Global Warehouse Fumigant Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.41% |

Market Size in 2032: |

USD 2.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WAREHOUSE FUMIGANT MARKET BY TYPE (2017-2032)

- WAREHOUSE FUMIGANT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- METHYL BROMIDE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SULFURYL FLUORIDE

- PHOSPHINE

- MAGNESIUM PHOSPHIDE

- ALUMINIUM PHOSPHIDE

- WAREHOUSE FUMIGANT MARKET BY FORM (2017-2030)

- WAREHOUSE FUMIGANT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- GAS

- WAREHOUSE FUMIGANT MARKET BY APPLICATION (2017-2030)

- WAREHOUSE FUMIGANT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRUCTURAL FUMIGATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMODITY STORAGE PROTECTION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Warehouse Fumigant Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CORTEVA AGRISCIENCE (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business PerSolidnce (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- REDDICK FUMIGANTS, LLC (U.S.)

- DOUGLAS PRODUCTS AND PACKAGING PRODUCTS LLC (U.S.)

- NEOGEN CORPORATION (U.S.)

- INDUSTRIAL FUMIGATION COMPANY LLC (U.S.)

- DEGESCH AMERICA INC. (U.S.)

- BASF SE (GERMANY)

- LANXESS (GERMANY)

- CYTEC SOLVAY GROUP (BELGIUM)

- RENTOKIL INITIAL PLC (UK)

- IKEDA KOGYO CO., LTD. (JAPAN)

- SUMITOMO CHEMICAL CO., LTD. (JAPAN)

- NIPPON CHEMICAL INDUSTRIAL CO. LTD (JAPAN)

- ADAMA AGRICULTURAL SOLUTIONS LTD (ISRAEL)

- VIETNAM FUMIGATION JOINT STOCK COMPANY (VIETNAM)

- UPL GROUP (INDIA)

- FUMIGATION SERVICES PVT. LTD (INDIA)

- NUFARM LIMITED (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL WAREHOUSE FUMIGANT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Warehouse Fumigant Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.41% |

Market Size in 2032: |

USD 2.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WAREHOUSE FUMIGANT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WAREHOUSE FUMIGANT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WAREHOUSE FUMIGANT MARKET COMPETITIVE RIVALRY

TABLE 005. WAREHOUSE FUMIGANT MARKET THREAT OF NEW ENTRANTS

TABLE 006. WAREHOUSE FUMIGANT MARKET THREAT OF SUBSTITUTES

TABLE 007. WAREHOUSE FUMIGANT MARKET BY TYPE

TABLE 008. ALUMINIUM PHOSPHIDE MARKET OVERVIEW (2016-2028)

TABLE 009. MAGNESIUM PHOSPHIDE MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. WAREHOUSE FUMIGANT MARKET BY APPLICATION

TABLE 012. GRAIN MARKET OVERVIEW (2016-2028)

TABLE 013. VEGETABLE AND FRUIT MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA WAREHOUSE FUMIGANT MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA WAREHOUSE FUMIGANT MARKET, BY APPLICATION (2016-2028)

TABLE 017. N WAREHOUSE FUMIGANT MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE WAREHOUSE FUMIGANT MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE WAREHOUSE FUMIGANT MARKET, BY APPLICATION (2016-2028)

TABLE 020. WAREHOUSE FUMIGANT MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC WAREHOUSE FUMIGANT MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC WAREHOUSE FUMIGANT MARKET, BY APPLICATION (2016-2028)

TABLE 023. WAREHOUSE FUMIGANT MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA WAREHOUSE FUMIGANT MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA WAREHOUSE FUMIGANT MARKET, BY APPLICATION (2016-2028)

TABLE 026. WAREHOUSE FUMIGANT MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA WAREHOUSE FUMIGANT MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA WAREHOUSE FUMIGANT MARKET, BY APPLICATION (2016-2028)

TABLE 029. WAREHOUSE FUMIGANT MARKET, BY COUNTRY (2016-2028)

TABLE 030. DETIA-DEGESCH: SNAPSHOT

TABLE 031. DETIA-DEGESCH: BUSINESS PERFORMANCE

TABLE 032. DETIA-DEGESCH: PRODUCT PORTFOLIO

TABLE 033. DETIA-DEGESCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. UPL GROUP: SNAPSHOT

TABLE 034. UPL GROUP: BUSINESS PERFORMANCE

TABLE 035. UPL GROUP: PRODUCT PORTFOLIO

TABLE 036. UPL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. SHENYANG FENGSHOU: SNAPSHOT

TABLE 037. SHENYANG FENGSHOU: BUSINESS PERFORMANCE

TABLE 038. SHENYANG FENGSHOU: PRODUCT PORTFOLIO

TABLE 039. SHENYANG FENGSHOU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. JINING SHENGCHENG: SNAPSHOT

TABLE 040. JINING SHENGCHENG: BUSINESS PERFORMANCE

TABLE 041. JINING SHENGCHENG: PRODUCT PORTFOLIO

TABLE 042. JINING SHENGCHENG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NATIONAL FUMIGANTS: SNAPSHOT

TABLE 043. NATIONAL FUMIGANTS: BUSINESS PERFORMANCE

TABLE 044. NATIONAL FUMIGANTS: PRODUCT PORTFOLIO

TABLE 045. NATIONAL FUMIGANTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. JIANGSU SHUANGLING: SNAPSHOT

TABLE 046. JIANGSU SHUANGLING: BUSINESS PERFORMANCE

TABLE 047. JIANGSU SHUANGLING: PRODUCT PORTFOLIO

TABLE 048. JIANGSU SHUANGLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WAREHOUSE FUMIGANT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WAREHOUSE FUMIGANT MARKET OVERVIEW BY TYPE

FIGURE 012. ALUMINIUM PHOSPHIDE MARKET OVERVIEW (2016-2028)

FIGURE 013. MAGNESIUM PHOSPHIDE MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. WAREHOUSE FUMIGANT MARKET OVERVIEW BY APPLICATION

FIGURE 016. GRAIN MARKET OVERVIEW (2016-2028)

FIGURE 017. VEGETABLE AND FRUIT MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA WAREHOUSE FUMIGANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE WAREHOUSE FUMIGANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC WAREHOUSE FUMIGANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA WAREHOUSE FUMIGANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA WAREHOUSE FUMIGANT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Warehouse Fumigant Market research report is 2024-2032.

Corteva Agriscience (U.S.), Reddick Fumigants, LLC (U.S.), Douglas Products and Packaging Products LLC (U.S.), Neogen Corporation (U.S.), Industrial Fumigation Company LLC (U.S.), Degesch America Inc. (U.S.), BASF SE (Germany), Lanxess (Germany), Cytec Solvay Group (Belgium), Rentokil Initial plc (UK), Ikeda Kogyo Co., Ltd. (Japan), Sumitomo Chemical Co., Ltd. (Japan), Nippon Chemical Industrial Co. Ltd (Japan), ADAMA Agricultural Solutions Ltd (Israel), Vietnam Fumigation Joint Stock Company (Vietnam), UPL Group (India), Fumigation Services Pvt. Ltd (India), Nufarm Limited (Australia), and Other Major Players.

The Warehouse Fumigant Market is segmented into Type, Form, Application, and region. By Type, the market is categorized into Methyl Bromide, Sulfuryl Fluoride, Phosphine, Magnesium Phosphide, and Aluminium Phosphide. By Form, the market is categorized into Solid, Liquid, and Gas. By Application, the market is categorized into Structural Fumigation and Commodity Storage Protection. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Warehouse fumigants, and chemical substances applied in storage facilities, eradicate pests and pathogens by infiltrating commodities, targeting pests across all developmental stages. By interrupting their life cycles, these agents efficiently manage infestations, guaranteeing product integrity and adherence to safety regulations.

Global Warehouse Fumigant Market Size Was Valued at USD 1.37 Billion in 2023, and is Projected to Reach USD 2.09 Billion by 2032, Growing at a CAGR of 5.41% From 2024-2032.