Vinyl Ester Market Synopsis

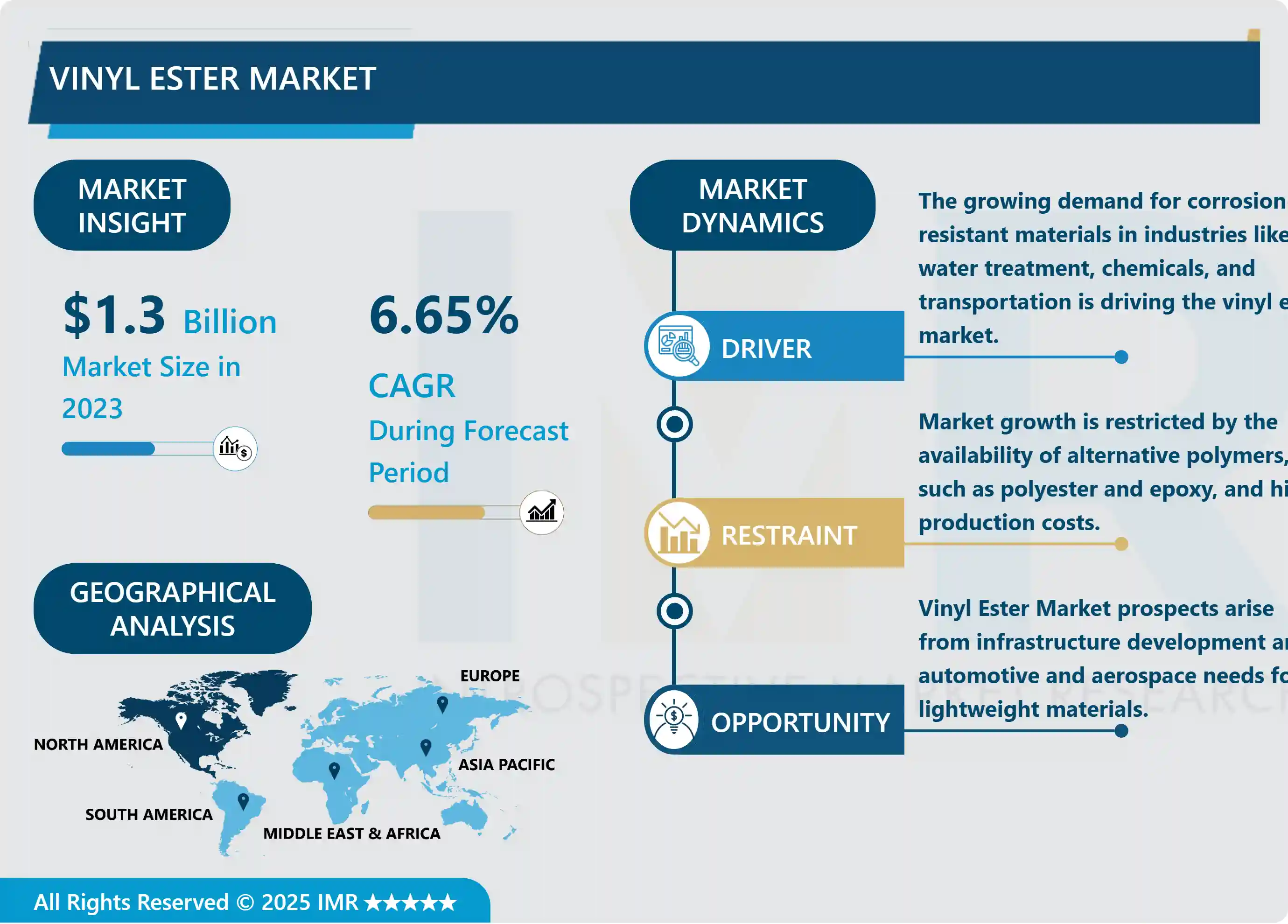

Vinyl Ester Market Size is Valued at USD 1.30 Billion in 2023, and is Projected to Reach USD 2.17 Billion by 2032, Growing at a CAGR of 6.65% From 2024-2032.

The vinyl ester market has grown tremendously in recent past due to the variety of uses that the product offers, and its unique characteristics. Unsaturated monocarboxylic acids can co-react with epoxy resins to yield vinyl esters which are synthetic resins. Such are perfect for use in automotive, aerospace, marine and construction industries because of their stability at high temperatures, resistance to corrosion and the mechanical properties. The vinyl ester market is almost ready to grow as global need for hale and tender products persist to rise.

In recent years, high-performance materials have emerged as essential for use in infrastructure and Construction which in diverse forms acts as the main driver for the Vinyl ester market. The advancement in rate of urbanization and construction of infrastructures has however boosted the demand for materials that can effectively and efficiently the harsh environmental conditions. In structural parts, containers and pipelines, the high temperature and chemical corrosion resistant property of vinyl esters makes it preferred material. Also, market focus on sustainability has supported green vinyl ester materials incorporating into the market and therefore additional growth in the market.

The automotive industry also has a large effect on the growth of the vinyl ester market. Industry’s usage of vinyl ester composites is steadily increasing since manufacturers work on designing fuel-efficient and light vehicles. These materials are ideal for any part of the car, including the body and framework due to strength yet light weight of these materials. Moreover, due to the shift in the automotive industry amid the global adoption of EVs, the demand for lightweight vehicles is expected to increase more – driving the vinyl ester market.

Vinyl Ester Market Trend Analysis

The vinyl ester market is growing due to industrial Demand for durable and corrosion-resistant materials.

- The Vinyl Ester Market is growing at an exponential rate due to the increasing need in industries requiring materials that demonstrate high dimensional stability and resistance to corrosion. These polymers have the best mechanical properties and chemical resistance and are popular in many industries such as the automotive industry, construction, marine among others. Thanks to the increased concerns about the environment and sustainability, manufacturers are forced to look for materials that will perform well under extreme conditions.

- Furthermore, several industries can produce numerous types of formulations according to their specific needs, due to the versatility inherent in vinyl ester polymers. We expect that markets will remain highly active and growing for advanced materials like vinyl esters, as industries evolves and develops, pushing the boundaries and improving on uses of their products. Such development underscores the critical role played by vinyl ester polymers in meeting new needs of current production.

The use of vinyl ester resin in construction and automotive drives innovation and product development.

- New product development in the Vinyl Ester Market is currently experiencing an upward trend, especially due to the rising need for high-performance and corrosion-immune products in the market. However, this trend is most evident in the construction and automotive industry, as manufacturers in these industries look for new ways to improve the efficiency and durability of their goods. The vinyl ester resins are characterized by good mechanical properties and superior resistance to environmental degradation and thus suitable for use in high performance applications.

- Readily available and with good performance characteristics, the utilization of vinyl ester resin in construction and automotive industries has been instrumental in encouraging product innovation and product enhancement as manufacturers seek to use this material in other formulations and innovative methods. It not only helps to satisfy the increasing requirements of these industries but also promotes the development of the vinyl ester market. Because of their flexibility and technological compatibility, it could thus be projected that as the corporate world remains to fund research and development, new prospects and market for vinyl ester resins are likely to emerge in the future.

Vinyl Ester Market Segment Analysis:

Vinyl Ester Market Segmented on the basis of By Product and By Application

By Product, Brominated Fire Retardant segment is expected to dominate the market during the forecast period

- Bisphenol A, Novolac, Brominated Fire Retardant, and Elastomer Modified Resins are among the numerous product types that significantly influence the Vinyl Ester Market. The automotive, marine, and construction industries extensively employ vinyl esters derived from bisphenol A due to their exceptional chemical resistance and mechanical properties. Novolac polymers, which are renowned for their exceptional thermal stability, are becoming more popular in high-performance applications. Brominated fire retardants, on the other hand, improve fire safety in a variety of products, thereby contributing to a safer end-use experience.

- Elastomer Modified vinyl esters are becoming increasingly popular among manufacturers looking for adaptable solutions because of their improved flexibility and impact resistance. Furthermore, the "Others" category encompasses a range of specialized formulations tailored to niche applications, thereby expanding the market landscape. As industries continue to pursue innovative materials with enhanced performance characteristics, we anticipate an increase in demand for a variety of vinyl ester products in the coming years. We expect this to drive market growth.

By Application, Pipes and Tanks segment held the largest share in 2024

- Product uses in the pulp and paper segment, wind power segment, marine, pipes and tanks, and the flue gas desulfurization (FGD) systems influence the vinyl ester market. It is widely known that vinyl ester resins possess strikingly high levels of corrosion and chemical degradation resistance making them suitable for use in fabricating strong pipeline and tanks that can withstand very tough conditions.

- The marine industry uses these polymers to fabricate light weight but robust parts that help to improve the fuel economy of the vessel and bring down maintenance costs. However, it was also identified that blade fabrication is turning to vinyl ester composites popular in the sector as wind energy due to mechanical strength and reasonable lightweight features for better result and durability.

Vinyl Ester Market Regional Insights:

North America is Expected to Dominate the Vinyl Ester Market

- We expect that North America will remain the largest consumer of vinyl ester due to the region’s increasing investment in exceptional composite materials and sound industrial development. Research and development associated with the product and the installation of a significant number of manufacturers and suppliers are encouraging the development of new formulations of vinyl ester.

- Moreover, North America now constitutes a large part of the market owing to the increasing demand of high-performance materials in these industries including aerospace, automotive, and construction sector.

Active Key Players in the Vinyl Ester Market

- Ashland (U.S.)

- Swancor Holding Co. (Taiwan)

- Aliancys (Switzerland)

- Reichhold LLC (U.S.)

- Hexion (U.S.)

- DIC CORPORATION (Japan)

- Interplastic Corporation (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Nivitex Fibreglass and Resins (India)

- Sir Industriale (Italy)

- Scott Bader Company Ltd (U.K.)

- Others

Global Vinyl Ester Market Scope:

|

Global Vinyl Ester Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.65% |

Market Size in 2032: |

USD 2.17 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Ashland (U.S.) , Swancor Holding Co. (Taiwan) , Aliancys (Switzerland) , Reichhold LLC (U.S.) , Hexion (U.S.) , DIC CORPORATION (Japan) , Interplastic Corporation (U.S.) , Akzo Nobel N.V. (Netherlands) | Nivitex Fibreglass and Resins (India) , Sir Industriale (Italy) , Scott Bader Company Ltd (U.K.) , Others |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vinyl Ester Market by Product (2018-2032)

4.1 Vinyl Ester Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bisphenol A

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Novolac

4.5 Brominated Fire Retardant

4.6 Elastomer Modified

4.7 Others

Chapter 5: Vinyl Ester Market by Application (2018-2032)

5.1 Vinyl Ester Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pipes and Tanks

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Marine

5.5 Wind Energy

5.6 FGD and Precipitators

5.7 Pulp and Paper

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Vinyl Ester Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ASHLAND (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SWANCOR HOLDING CO. (TAIWAN)

6.4 ALIANCYS (SWITZERLAND)

6.5 REICHHOLD LLC (U.S.)

6.6 HEXION (U.S.)

6.7 DIC CORPORATION (JAPAN)

6.8 INTERPLASTIC CORPORATION (U.S.)

6.9 AKZO NOBEL N.V. (NETHERLANDS)

6.10 NIVITEX FIBREGLASS AND RESINS (INDIA)

6.11 SIR INDUSTRIALE (ITALY)

6.12 SCOTT BADER COMPANY LTD (U.K.)

6.13 OTHERS

6.14

Chapter 7: Global Vinyl Ester Market By Region

7.1 Overview

7.2. North America Vinyl Ester Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Bisphenol A

7.2.4.2 Novolac

7.2.4.3 Brominated Fire Retardant

7.2.4.4 Elastomer Modified

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Pipes and Tanks

7.2.5.2 Marine

7.2.5.3 Wind Energy

7.2.5.4 FGD and Precipitators

7.2.5.5 Pulp and Paper

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Vinyl Ester Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Bisphenol A

7.3.4.2 Novolac

7.3.4.3 Brominated Fire Retardant

7.3.4.4 Elastomer Modified

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Pipes and Tanks

7.3.5.2 Marine

7.3.5.3 Wind Energy

7.3.5.4 FGD and Precipitators

7.3.5.5 Pulp and Paper

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Vinyl Ester Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Bisphenol A

7.4.4.2 Novolac

7.4.4.3 Brominated Fire Retardant

7.4.4.4 Elastomer Modified

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Pipes and Tanks

7.4.5.2 Marine

7.4.5.3 Wind Energy

7.4.5.4 FGD and Precipitators

7.4.5.5 Pulp and Paper

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Vinyl Ester Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Bisphenol A

7.5.4.2 Novolac

7.5.4.3 Brominated Fire Retardant

7.5.4.4 Elastomer Modified

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Pipes and Tanks

7.5.5.2 Marine

7.5.5.3 Wind Energy

7.5.5.4 FGD and Precipitators

7.5.5.5 Pulp and Paper

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Vinyl Ester Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Bisphenol A

7.6.4.2 Novolac

7.6.4.3 Brominated Fire Retardant

7.6.4.4 Elastomer Modified

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Pipes and Tanks

7.6.5.2 Marine

7.6.5.3 Wind Energy

7.6.5.4 FGD and Precipitators

7.6.5.5 Pulp and Paper

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Vinyl Ester Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Bisphenol A

7.7.4.2 Novolac

7.7.4.3 Brominated Fire Retardant

7.7.4.4 Elastomer Modified

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Pipes and Tanks

7.7.5.2 Marine

7.7.5.3 Wind Energy

7.7.5.4 FGD and Precipitators

7.7.5.5 Pulp and Paper

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Global Vinyl Ester Market Scope:

|

Global Vinyl Ester Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.65% |

Market Size in 2032: |

USD 2.17 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Ashland (U.S.) , Swancor Holding Co. (Taiwan) , Aliancys (Switzerland) , Reichhold LLC (U.S.) , Hexion (U.S.) , DIC CORPORATION (Japan) , Interplastic Corporation (U.S.) , Akzo Nobel N.V. (Netherlands) | Nivitex Fibreglass and Resins (India) , Sir Industriale (Italy) , Scott Bader Company Ltd (U.K.) , Others |

||

Frequently Asked Questions :