Vietnam Private Security Market Synopsis

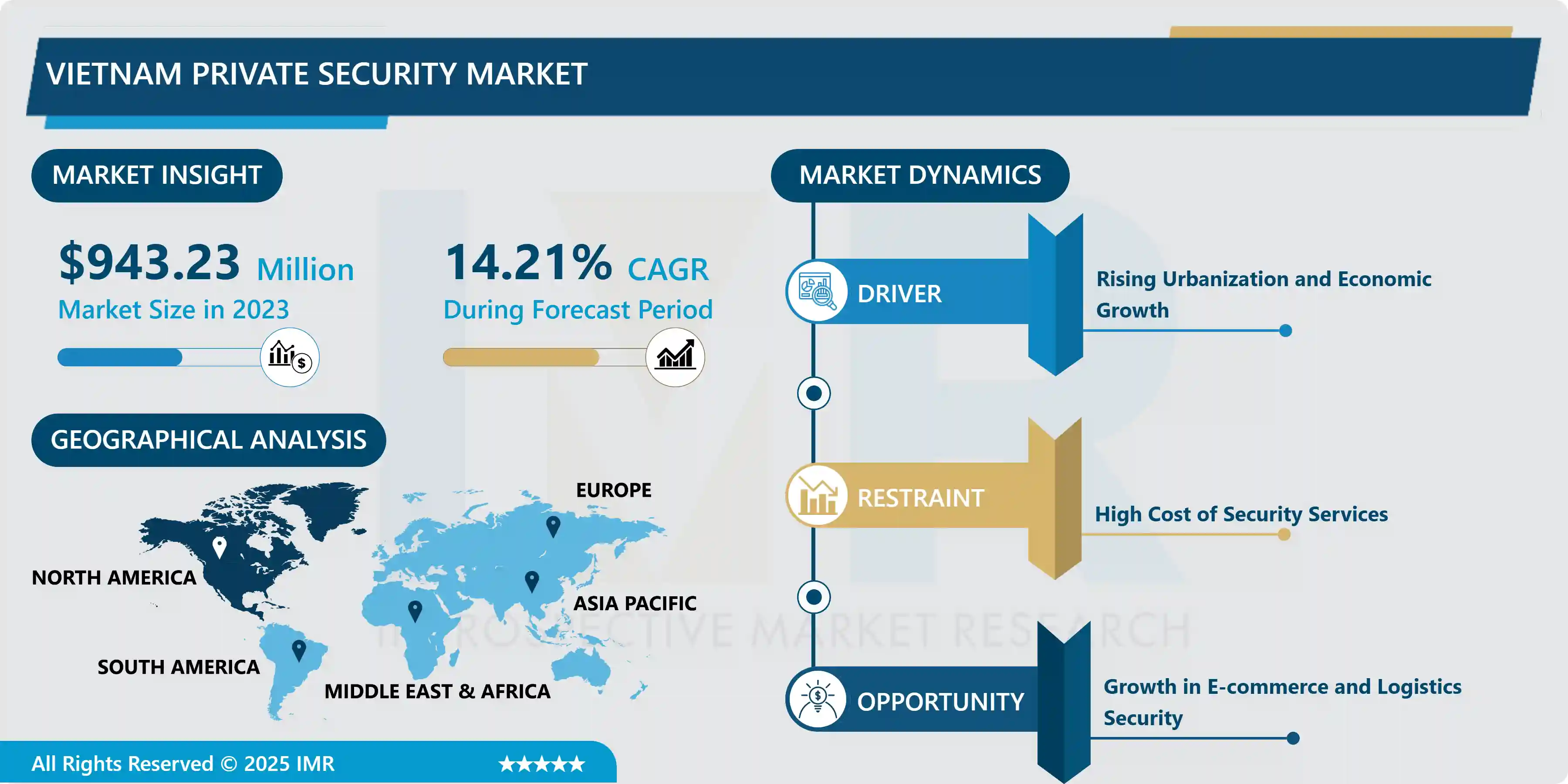

Vietnam's Private Security Market Size Was Valued at USD 943.23 Million in 2023 and is Projected to Reach USD 3,118.56 Million by 2032, Growing at a CAGR of 14.21% From 2024-2032.

Private security has been described as the protection of property, and tangible and human assets from theft, damage or harm through the use of resources by private players. It primarily consists of a number of functions that are almost spatial and cover a condition of guarding and monitoring that is unique from that of public police.

The Vietnam private security market has grown rapidly as well as changed over the past few years, driven by several factors including economic development, urbanization, and growing security issues. Services in this market include manned guarding, electronic security systems, and consulting services, of which the trend indicates an increased demand for integrated security solutions. This kind of growth trajectory is for strong correlation with the rapid process of urbanization and economic development in Vietnam that enhances demand for security services in residential and commercial buildings. It is indicated that the development of more and more high profile projects and the rapid growth of shops and mall, office and industrial parks means that there is more requirement for more advanced security technologies and professional security services.

The economic development in Vietnam has been lively in the case of the nation, and now Vietnam is on the process of developing as a leading nation of the South Eastern region. Both infrastructure investments and real estate investments have been made based on growing market for private security service. Rising middle classes that demand better security standards for homes and businesses are the driving factors, coupled with the growing prevalence of high-value assets that have to be protected. This is further enhanced by international companies expanding in the country and foreign businesses coming into the Vietnamese market, bringing with them rigorous security needs and standards.

The private security market in Vietnam is far from the previous homogeneous lot of service providers who could be either local firms or multinational corporations. Manned guarding is another still large area of business, including security officers for both the protection of premises, for controlling and granting access, and for emergency responseHowever closed circuit television, alarm systems and access control systems are becoming popular. The last is the electronic security systems that the security business is now more and more obsessed with since it has evolved with changing technology and the user’s expectation of immediate response to any occurring incident. There is a recent trend for integrating such technologies into cohesive security solutions because businesses and residential areas are looking for an overarching protection strategy.

Regulatory frameworks and standards also influence the private security market in Vietnam. For example, government standards concerning licensing requirements in respect of security personnel contribute to ensuring professionalism and effectiveness on the part of security services. These regulations have been designed to enhance the service quality and also address issues on the training of security persons, ethical conduct, and standards in operation. A greater emphasis on complying with international security standards has influenced market dynamics as most providers of multinational security within the region have to comply with the enhanced standards.

Positive growth prospects notwithstanding, the sector has challenges of competition between the service providers, pressure on pricing and a constant need to reinvest in technology and trainings. Companies operating in the Vietnamese private security market will need to overcome these challenges to address the new needs of customers. Market differentiation may more likely be valued through technological innovation and emphasis on the integration of advanced security solutions. These would shape the dynamics of competition as well as the services being offered.

In summary, the Vietnam private security market is growing since it is supported by economic development, urbanization, and increased security demands. Focusing more on the needs of residential and commercial clients, this sector grows because of technology and integrated security solutions. Challenges may be in abundance, but significant business opportunities do exist for service providers who can adjust to changing trends and requirements imposed by legal frameworks.

Vietnam Private Security Market Trend Analysis

Increasing Demand for Integrated Security Solutions

- The private security market of Vietnam is presently experiencing a most significant growth phase primarily due to increased demand from fully integrated security solutions, mainly because of the growing safety and security concerns in urban areas and rural settings across the nation. This growth mainly traces its roots to quick economic growth, ever-increasing urbanization, and the growth of the middle class, which has led to heightened demand for sophisticated security measures. In recent years, integrated security solutions, where physical security is assimilated along with high-tech implementations like surveillance systems, access control, and alarm systems, have gained popularity as they offer comprehensive protection for commercial, residential, and industrial premises. Greater awareness of the presence of security risks and demand for streamlined and efficient security management are other factors contributing to this trend.

- In addition, Vietnamese government focus on infrastructure development and smart city initiatives further boosts the growing market of integrated security solutions. The increased expansion in cities with modernizations creates the desire for security systems that integrate well with existing systems to offer a real-time monitoring and management platform. Private security firms are aggressively using this trend with the assistance of advanced solutions that can have artificial intelligence, data analytics, and IoT applied within them. This trend is likely to be continued since it will continue to increase the market due to the demand from more businesses and homeowners to get reliable and sophisticated security solutions for their assets as well as safety.

Growth in E-commerce and Logistics Security

- With the growth of e-commerce and logistics in Vietnam, the private security market has been significantly affected. There is a huge demand for secure logistics and supply chain management as online shopping becomes more in demand due to the growth of internet penetration and consumer preference. Despite this, online transactions and deliveries have gone viral in recent years and focus more on protecting goods during their delivery period, protecting warehouses from being invaded, and keeping delivery personnel safe. For this reason, private security companies in Vietnam demand advanced security solutions; hence, they are in greater need to acquire more modern surveillance systems, access control, and training of personnel for these emerging needs.

- Firms, therefore, seek for other security systems which incorporate both physical security and cyber security to help shield them from other mishaps for instance theft, vandalism and cyber terrorism. This is helping increase the specialized security firms and acceptance of new technologies in operations such as AI-driven surveillance systems, real time tracking system, and other even more advance alarm systems. The new trend demonstrates the need to modify security strategies according to new dynamics that result from this e-commerce and logistics expansion.

Vietnam Private Security Market Segment Analysis:

Vietnam Private Security Market Segmented based on Service, and End User.

By Service, Security Systems segment is expected to dominate the market during the forecast period

- The private security market in Vietnam is diverse: manned guarding, security systems, cash solutions, guard services, and other services play a significant role. Manned guarding continues to be at the heart of private security in Vietnam, fuelled by escalating demand for physical presence on commercial properties, industrial sites, and residential areas. As urbanization and economic development increase, companies and individuals need strong on-site security measures to decrease risks, hence sustaining the growth of manned guarding services. Security systems- surveillance cameras, alarm systems-and are also increasing in size with developments in technology that make such devices more available and effective. Sophisticated technology-integrated security solutions for both commercial and residential purposes continue to meet the diversified needs of clients through increased safety and efficiency in operations.

- Cash-specific security solutions - cash solutions and guard services - address security needs specific to cash. Cash solutions refer to cash-in-transit and cash management services that are fundamental because financial transactions and retail activities are on the rise in Vietnam. As cash handling and economic transaction heighten, safe cash logistics becomes a necessity. Guard services are tailored to include mobile patrol services and event security services, which meet specific client needs and support total market growth. The "others" category presents niche services, as well as new security solutions, that reflect the flexibility of the market to face up to emerging difficulties and innovations. As Vietnam's security landscape evolves, so do its diversified service lines, responding to the broader demands of an evolving and growing economy.

By End User , Industrial segment held the largest share in 2023

- In Vietnam, the private security market is characterized by distinct demand from various end users, each contributing uniquely to the sector's growth. The residential segment is experiencing increased demand as households prioritize safety and security amidst rising urbanization and economic development. Since more and more people and their families decide to have high-end security systems for home and close ones, this segment presents the opportunity for growth. The products like surveillance cameras, alarms systems, smart home systems require demand due to burglar and personal security concerns especially in the populated regions of the country.

- The industrial and commercial segments are relatively much larger due to increase in industrial activities and the growing number of commercial organizations in Vietnam. With increased industry and commerce requiring manufacturing, logistics, and continuous business operations, and with the increased commercial aspects of retail and office business, there must be enhanced security for the commodities and structures. As another type of client, government also have significant demands in terms of security for the important information and infrastructures. This segment’s demand includes sophisticated access control systems and comprehensive surveillance solutions. As Vietnam continues its economic growth and modernization, the private security market's end-user segments are expected to evolve, with each segment driving unique trends and innovations in security solutions.

Active Key Players in the Vietnam Private Security Market

- Viet Security Group (Vietnam)

- Securitas Vietnam (Vietnam)

- SPS Security Services (Vietnam)

- Viet Nam Security Service (Vietnam)

- Binh Minh Security (Vietnam)

- TBS Security (Vietnam)

- Elite Security Services (Vietnam)

- SGS Security Solutions (Vietnam)

- K9 Security Services (Vietnam)

- Others Key Player

|

Vietnam Private Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 943.23 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.21% |

Market Size in 2032: |

USD 3,118.56 Mn. |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vietnam Private Security Market by Service (2018-2032)

4.1 Vietnam Private Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Manned Guarding

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Security Systems

4.5 Cash Solutions

4.6 Guard Services

4.7 Others

Chapter 5: Vietnam Private Security Market by End User (2018-2032)

5.1 Vietnam Private Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial

5.5 Commercial

5.6 Government Institutions

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Vietnam Private Security Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 VIET SECURITY GROUP (VIETNAM)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SECURITAS VIETNAM (VIETNAM)

6.4 SPS SECURITY SERVICES (VIETNAM)

6.5 VIET NAM SECURITY SERVICE (VIETNAM)

6.6 BINH MINH SECURITY (VIETNAM)

6.7 TBS SECURITY (VIETNAM)

6.8 ELITE SECURITY SERVICES (VIETNAM)

6.9 SGS SECURITY SOLUTIONS (VIETNAM)

6.10 K9 SECURITY SERVICES (VIETNAM)

6.11 OTHERS KEY PLAYER

6.12

Chapter 7: Global Vietnam Private Security Market By Region

7.1 Overview

7.2. North America Vietnam Private Security Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Service

7.2.4.1 Manned Guarding

7.2.4.2 Security Systems

7.2.4.3 Cash Solutions

7.2.4.4 Guard Services

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Residential

7.2.5.2 Industrial

7.2.5.3 Commercial

7.2.5.4 Government Institutions

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Vietnam Private Security Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Service

7.3.4.1 Manned Guarding

7.3.4.2 Security Systems

7.3.4.3 Cash Solutions

7.3.4.4 Guard Services

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Residential

7.3.5.2 Industrial

7.3.5.3 Commercial

7.3.5.4 Government Institutions

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Vietnam Private Security Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Service

7.4.4.1 Manned Guarding

7.4.4.2 Security Systems

7.4.4.3 Cash Solutions

7.4.4.4 Guard Services

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Residential

7.4.5.2 Industrial

7.4.5.3 Commercial

7.4.5.4 Government Institutions

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Vietnam Private Security Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Service

7.5.4.1 Manned Guarding

7.5.4.2 Security Systems

7.5.4.3 Cash Solutions

7.5.4.4 Guard Services

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Residential

7.5.5.2 Industrial

7.5.5.3 Commercial

7.5.5.4 Government Institutions

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Vietnam Private Security Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Service

7.6.4.1 Manned Guarding

7.6.4.2 Security Systems

7.6.4.3 Cash Solutions

7.6.4.4 Guard Services

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Residential

7.6.5.2 Industrial

7.6.5.3 Commercial

7.6.5.4 Government Institutions

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Vietnam Private Security Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Service

7.7.4.1 Manned Guarding

7.7.4.2 Security Systems

7.7.4.3 Cash Solutions

7.7.4.4 Guard Services

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Residential

7.7.5.2 Industrial

7.7.5.3 Commercial

7.7.5.4 Government Institutions

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Vietnam Private Security Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 943.23 Mn. |

|

Forecast Period 2024-32 CAGR: |

14.21% |

Market Size in 2032: |

USD 3,118.56 Mn. |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||