Vein Finder Market Synopsis

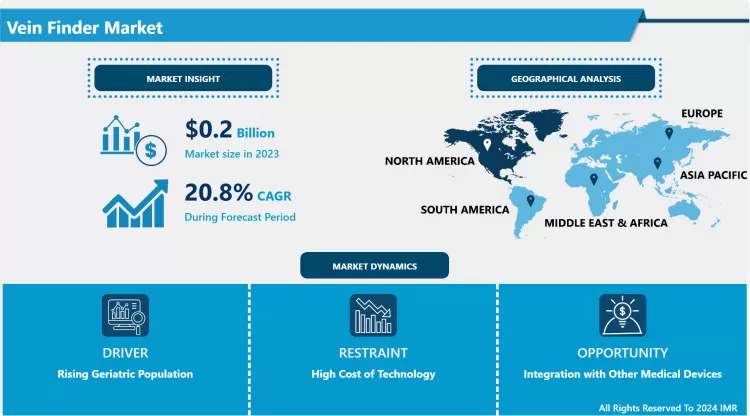

Vein Finder Market Size is Valued at USD 0.20 Billion in 2023, and is Projected to Reach USD 1.12 Billion by 2032, Growing at a CAGR of 20.8% From 2024-2032.

The vein finder market encompasses devices and technologies designed to enhance the visibility of veins within the human body, typically for use in medical procedures such as intravenous (IV) catheter insertion. These devices use various imaging techniques, including infrared light and near-infrared technology, to project images of veins onto the skin's surface, improving the accuracy and efficiency of vein access. The market is driven by the growing demand for improved patient care, advancements in medical technology, and increasing prevalence of chronic diseases requiring frequent venous access.

- The vein finder market has seen significant growth due to its essential role in improving the accuracy and efficiency of vein access procedures, particularly in healthcare settings. Vein finders utilize infrared or near-infrared light to visualize veins, which enhances the ability to locate veins with precision, reducing the risk of complications and improving patient comfort.

- The market is driven by the increasing demand for non-invasive diagnostic and therapeutic procedures, a growing geriatric population, and advancements in medical technology. Hospitals, clinics, and diagnostic centers are adopting vein finders to streamline procedures, decrease procedure time, and enhance overall patient care. Additionally, the rising prevalence of chronic diseases that require frequent venipuncture, such as diabetes, is further fueling the market's expansion.

- Geographically, North America holds a significant share of the market, driven by the presence of advanced healthcare infrastructure, high adoption rates of medical technology, and substantial investments in healthcare innovation. However, the Asia-Pacific region is anticipated to exhibit the highest growth rate due to increasing healthcare expenditures, rising healthcare awareness, and expanding medical facilities in emerging economies.

- Despite the positive outlook, the market faces challenges including the high cost of advanced vein finder devices and the need for skilled operators. Moreover, the adoption of vein finders in low-resource settings remains limited, which may impact overall market growth. Nevertheless, ongoing technological advancements and innovations are expected to mitigate these challenges and drive future growth.

- Overall, the vein finder market is poised for continued growth as healthcare providers increasingly recognize the benefits of these devices in improving patient outcomes and optimizing procedural efficiency. The market's future will likely be shaped by advancements in technology, expanding applications, and increased healthcare investments globally.

Vein Finder Market Trend Analysis

Growing Adoption of Infrared and Near-Infrared Vein Finders

- One significant trend in the vein finder market is the growing adoption of infrared and near-infrared vein finders, which are revolutionizing the accuracy and efficiency of vein localization. These advanced technologies leverage infrared light to create a detailed image of veins beneath the skin's surface. By emitting near-infrared light, these devices penetrate the skin and are absorbed differently by the hemoglobin in veins compared to surrounding tissues. This differential absorption results in a clearer, more distinct visualization of the veins, making it easier for healthcare professionals to identify and access veins accurately. This enhanced visibility significantly reduces the number of attempts required for procedures such as blood draws and intravenous insertions, leading to improved patient outcomes and reduced procedural discomfort.

- Furthermore, the integration of infrared and near-infrared technologies into vein finders aligns with the broader trend towards non-invasive and patient-centered care. Traditional methods of vein localization, such as palpation and visual inspection, often fall short in terms of precision, particularly in challenging cases involving patients with small or difficult-to-locate veins. Infrared vein finders address these limitations by providing a real-time, high-resolution view of the veins, which is especially beneficial in pediatric and geriatric care where vein access is often problematic. This technological advancement not only enhances the efficiency of medical procedures but also contributes to a more positive patient experience by minimizing the discomfort and anxiety associated with multiple needle attempts. As a result, the adoption of infrared and near-infrared vein finders is expected to continue growing, driven by their proven benefits in improving procedural accuracy and patient care.

Integration of Vein Finders with Mobile and Handheld Devices

- Another notable trend in the vein finder market is the integration of vein finders with mobile and handheld devices, which has significantly enhanced their accessibility and user-friendliness across various healthcare settings. This shift towards portable and compact vein finders reflects a broader movement within the medical industry towards more flexible and versatile tools that can adapt to different environments. By incorporating vein finders into mobile and handheld formats, healthcare professionals can now easily transport these devices between different locations within a clinic, hospital, or emergency care setting. This increased mobility facilitates immediate and efficient vein assessment, especially in fast-paced or resource-limited scenarios where traditional vein localization methods might be inadequate.

- The rise of handheld and mobile vein finders also addresses challenges related to patient accessibility and comfort. In settings such as emergency care, where quick and accurate vein access is critical, the availability of portable vein finders ensures that medical staff can perform procedures with greater ease and precision. Additionally, the compact nature of these devices allows for more personalized patient care, as they can be used in various positions and settings, including bedside care and remote locations. This adaptability not only improves the overall efficiency of medical procedures but also enhances the patient experience by reducing the need for multiple needle insertions and minimizing procedural stress. As technology continues to evolve, the trend towards integrating vein finders with mobile and handheld devices is expected to grow, further advancing the capabilities and applications of these essential tools in diverse healthcare environments.

Vein Finder Market Segment Analysis:

Vein Finder Market Segmented based on By Product Type, By Technology and By End-user

By End-user, Hospitals segment is expected to dominate the market during the forecast period

- Hospitals dominate the end-user market due to their extensive diagnostic needs and high patient throughput. The need for advanced and reliable diagnostic equipment is critical in these settings to manage a wide range of medical conditions effectively. Hospitals rely on both portable and benchtop devices to meet diverse diagnostic requirements, from routine checks to complex analyses, ensuring they can provide comprehensive care to their patients.

- Furthermore, hospitals benefit from substantial budgets and prioritize high-quality care, which fuels their demand for sophisticated diagnostic technologies. Their significant financial resources allow them to invest in state-of-the-art equipment, which in turn reinforces their position as the largest segment in the market. This focus on precision and efficiency in patient care ensures that hospitals consistently hold the largest market share for diagnostic devices.

By Technology, Ultrasound segment held the largest share in 2023

- Ultrasound technology commands a significant portion of the market due to its remarkable versatility and broad applicability in medical diagnostics. Its ability to provide real-time imaging while remaining non-invasive makes it an indispensable tool for a variety of diagnostic applications. This includes prenatal care, where it is used to monitor fetal development, as well as internal examinations for assessing organs and tissues. The non-invasive nature of ultrasound ensures patient comfort and safety, further enhancing its appeal and widespread adoption.

- The extensive use of ultrasound across multiple medical disciplines solidifies its dominance in the diagnostic market. Its adaptability to different clinical scenarios, coupled with advancements in technology that improve image clarity and diagnostic accuracy, has cemented its role as a key player. As a result, ultrasound continues to be a preferred choice for healthcare providers, contributing significantly to its substantial market share.

Vein Finder Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is a dominant force in the Vein Finder market, largely due to its sophisticated healthcare infrastructure and a strong inclination towards adopting cutting-edge medical technologies. The United States, in particular, leads this segment with considerable investments in healthcare innovation, driven by the need to address a high prevalence of chronic diseases that require frequent venipunctures. The robust healthcare system and the high level of technological advancement in medical devices contribute significantly to the growth of the Vein Finder market in this region.

- The extensive network of healthcare facilities across North America, coupled with a well-established medical device industry, plays a crucial role in supporting the market expansion. The region's commitment to enhancing patient care and procedural efficiency further accelerates the adoption of vein finding technologies. This strong market presence is bolstered by continuous advancements and innovations in vein finder devices, which cater to the increasing demand for effective and comfortable venipuncture procedures.

Active Key Players in the Vein Finder Market

- AccuVein Inc.

- Christie Medical Holdings, Inc.

- Near Infrared Imaging LLC

- Shenzhen Bestman Instrument Co., Ltd.

- Gentherm Inc.

- Sunny Medical Equipment Limited

- Translite LLC / Veinlite

- Venoscope LLC

- ZD Medical

- Infinium Medical

- NextVein

- International Biomedical

- Shenzhen Vivolight Medical Device & Technology Co., Ltd.

- BLZ Technology Inc.

- iiSM Inc.

- Other Key Players

Key Industry Developments in the Vein Finder Market:

- In June 2023, Merz Aesthetics, the leading medical aesthetics business globally, and AccuVein entered an exclusive partnership. This collaboration grants Merz Aesthetics exclusive rights as the sole authorized distributor of AccuVein's vein visualization system in the aesthetics market of the United States.

- In 2023, Christie Medical Holdings, Inc. partnered with DO-PA A.S. for Turkish distribution of Christie's United States-made VeinViewer Vision2 and VeinViewer® Flex. DO-PA A.S. is one of the oldest medical distribution companies in Türkiye.

|

Global Vein Finder Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.8 % |

Market Size in 2032: |

USD 1.12 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vein Finder Market by Product Type (2018-2032)

4.1 Vein Finder Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Portable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Benchtop

Chapter 5: Vein Finder Market by Technology (2018-2032)

5.1 Vein Finder Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Infrared

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ultrasound

5.5 Transillumination

Chapter 6: Vein Finder Market by End-user (2018-2032)

6.1 Vein Finder Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Ambulatory Surgical Centers

6.6 Diagnostic Centers and Path Labs

6.7 Blood Banks

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Vein Finder Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCUVEIN INCCHRISTIE MEDICAL HOLDINGS INCNEAR INFRARED IMAGING LLC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SHENZHEN BESTMAN INSTRUMENT COLTDGENTHERM INCSUNNY MEDICAL EQUIPMENT LIMITED

7.4 TRANSLITE LLC / VEINLITE

7.5 VENOSCOPE LLC

7.6 ZD MEDICAL

7.7 INFINIUM MEDICAL

7.8 NEXTVEIN

7.9 INTERNATIONAL BIOMEDICAL

7.10 SHENZHEN VIVOLIGHT MEDICAL DEVICE & TECHNOLOGY COLTDBLZ TECHNOLOGY INCIISM INCOTHER KEY PLAYERS

Chapter 8: Global Vein Finder Market By Region

8.1 Overview

8.2. North America Vein Finder Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Portable

8.2.4.2 Benchtop

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Infrared

8.2.5.2 Ultrasound

8.2.5.3 Transillumination

8.2.6 Historic and Forecasted Market Size by End-user

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.6.4 Diagnostic Centers and Path Labs

8.2.6.5 Blood Banks

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Vein Finder Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Portable

8.3.4.2 Benchtop

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Infrared

8.3.5.2 Ultrasound

8.3.5.3 Transillumination

8.3.6 Historic and Forecasted Market Size by End-user

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.6.4 Diagnostic Centers and Path Labs

8.3.6.5 Blood Banks

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Vein Finder Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Portable

8.4.4.2 Benchtop

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Infrared

8.4.5.2 Ultrasound

8.4.5.3 Transillumination

8.4.6 Historic and Forecasted Market Size by End-user

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.6.4 Diagnostic Centers and Path Labs

8.4.6.5 Blood Banks

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Vein Finder Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Portable

8.5.4.2 Benchtop

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Infrared

8.5.5.2 Ultrasound

8.5.5.3 Transillumination

8.5.6 Historic and Forecasted Market Size by End-user

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.6.4 Diagnostic Centers and Path Labs

8.5.6.5 Blood Banks

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Vein Finder Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Portable

8.6.4.2 Benchtop

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Infrared

8.6.5.2 Ultrasound

8.6.5.3 Transillumination

8.6.6 Historic and Forecasted Market Size by End-user

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.6.4 Diagnostic Centers and Path Labs

8.6.6.5 Blood Banks

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Vein Finder Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Portable

8.7.4.2 Benchtop

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Infrared

8.7.5.2 Ultrasound

8.7.5.3 Transillumination

8.7.6 Historic and Forecasted Market Size by End-user

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.6.4 Diagnostic Centers and Path Labs

8.7.6.5 Blood Banks

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Vein Finder Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.8 % |

Market Size in 2032: |

USD 1.12 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Vein Finder Market research report is 2024-2032.

AccuVein Inc., Christie Medical Holdings, Inc., Near Infrared Imaging LLC, Shenzhen Bestman Instrument Co., Ltd., Gentherm Inc., Sunny Medical Equipment Limited, Translite LLC / Veinlite, Venoscope LLC, ZD Medical, Infinium Medical, NextVein, International Biomedical, Shenzhen Vivolight Medical Device & Technology Co., Ltd., BLZ Technology Inc. iiSM Inc., and Other Major Players.

The Vein Finder Market is segmented into By Product Type, By Technology, By End-user and region. By Product Type, the market is categorized into Portable and Benchtop. By Technology, the market is categorized into Infrared, Ultrasound and Transillumination. By End-user, the market is categorized into Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Centers and Path Labs, Blood Banks and Others.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The vein finder market encompasses devices and technologies designed to enhance the visibility of veins within the human body, typically for use in medical procedures such as intravenous (IV) catheter insertion. These devices use various imaging techniques, including infrared light and near-infrared technology, to project images of veins onto the skin's surface, improving the accuracy and efficiency of vein access. The market is driven by the growing demand for improved patient care, advancements in medical technology, and increasing prevalence of chronic diseases requiring frequent venous access.

Vein Finder Market Size is Valued at USD 0.20 Billion in 2023, and is Projected to Reach USD 1.12 Billion by 2032, Growing at a CAGR of 20.8% From 2024-2032.