Used Cooking Oil Market Overview

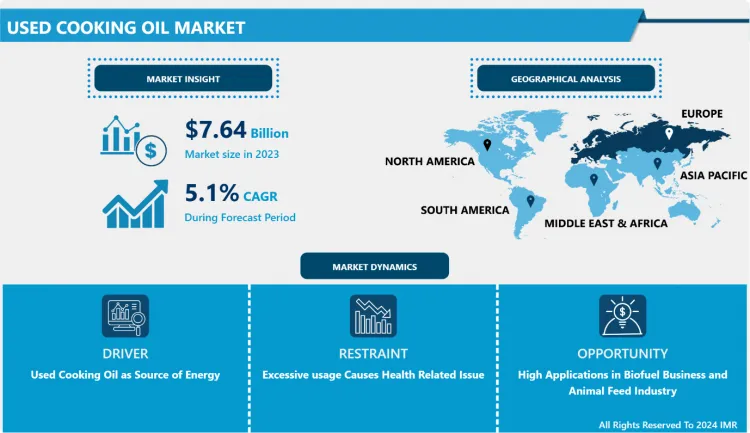

Used Cooking Oil Market Size Was Valued at USD 7.64 Billion in 2023 and is Projected to Reach USD 11.95 Billion by 2032, Growing at a CAGR of 5.1% From 2024-2032.

The global Used Cooking Oil (UCO) market is poised for significant growth, driven by increasing awareness of sustainable energy solutions and environmental conservation. UCO, derived from waste cooking oil, is gaining prominence in various applications, including biodiesel production, oleochemical products, and animal feed. Advancements in technology that enhance the conversion of UCO into high-quality refined oils are further fueling the market's expansion. Additionally, the burgeoning food and foodservice industries, which generate substantial quantities of used cooking oil, are playing a pivotal role in shaping market dynamics.

A key driver of the UCO market is the global push towards renewable energy sources. Governments across the globe are implementing regulations and offering incentives to encourage the recycling of UCO for biodiesel production. Biodiesel, recognized for its eco-friendly properties, is an effective alternative to fossil fuels, significantly reducing greenhouse gas emissions and supporting renewable energy goals. This trend is particularly pronounced in regions like Europe and North America, where stringent environmental policies are promoting the adoption of biodiesel, thereby boosting the demand for UCO.

The market is further bolstered by increasing government initiatives aimed at promoting the industrial utilization of UCO. From biodiesel to oleochemical products, UCO's versatility and potential to replace traditional resources in various industries highlight its importance in achieving sustainability goals. With technological advancements and growing awareness of environmental benefits, the UCO market is expected to thrive in the coming years, aligning with global efforts to transition to greener energy solutions.

Market Dynamics And Factors of Used Cooking Oil Market

Drivers:

Used Cooking Oil as Source of Energy

- Sustainable production methods for new generation fuels like biofuels and hydrogen are now being investigated more intently to lower greenhouse gas emissions. Due to the increasing depletion of fossil fuels, the concept of waste-to-energy is gaining traction. Alternative fuels, which are largely based on the waste-to-energy idea, typically use agricultural waste or other forms of used oils such as WCO (waste lubricating oil), used transformer oil, and used engine or gear oil as source materials. UCO is a possible raw material for energy generation because it produces biodiesel, bio methanol, hydrogen gas, H2/CO, and low molecular weight hydrocarbons like methane. These items can also be utilized to generate electricity or power vehicles or machinery. As a result, energy generation from UCO can be viewed as both a waste management approach and a useful form of energy recovery. Rudolph Diesel was the first to show that vegetable oils could be utilized to power motors. Dilution with diesel fuel or solvents, micro emulsification, Transesterification, and pyrolysis are some of the procedures used to improve the characteristics of UCO so that it can be used as a source of energy. The market is primarily driven by the rising demand for recycled UCO for biodiesel generation. The recycling process produces by-products that can be used to make soap and glycerin, increasing the demand for these items. Global biodiesel supply reached 39,654 million liters in 2015, according to the Biomass Board of Research and Development, and is predicted to reach 50,334 million liters by 2025.

Restraints:

- Excessive usage of used cooking oil can result in hazardous health issues for animals due to its use in animal feed products, which could stifle the market's expansion over the forecast period. However, an increase in used cooking oil theft and a lack of understanding about the proper use of used cooking oil are expected to stifle the market's growth in the coming years.

Opportunities:

- Used cooking oil provides a sustainable solution in the biofuel business and may also be used for animal feed, giving producers more options to promote used cooking oil in the market and capitalize on the market's potential growth. Furthermore, providing used cooking oil to rising countries can help to increase the global demand for used cooking oil. Spreading awareness about the possible solutions for used cooking oil could help to improve the growth of used cooking oil manufacturers, as well as the market for used cooking oil.

Market Segmentation

Segmentation Analysis of Used Cooking Oil Market:

- By Source, the food manufacture segment is anticipated to dominate the used cooking oil market over the forecast period. Restaurants and food businesses provide the majority of used cooking oil. To make many of our favorite snacks, deep fryers require vast vats of oil. To maintain food sanitary and fresh-tasting, this oil must be replenished regularly. Businesses are left with enormous amounts of waste oil due to continual refilling. Restaurants, diners, and fast food joints are the most common producers of business grease waste, according to most people. While SeQuential gets a lot of leftover cooking oil from places like these, you might be surprised at how many different oil recyclers there are. Oil is used in deep fryers and other food preparation in universities, schools, and corporate cafeterias. Food companies also generate a significant volume of leftover cooking oil behind the scenes. Oil is also required to manufacture potato chips, zoo corn dogs, amusement park funnel cakes, and other foods.

- By Application, the biodiesel segment is expected to register a significant market share over the forecast period. This is owing to the low cost of spent cooking oil compared to vegetable oil, which encourages biodiesel producers to utilize it as a primary feedstock in biodiesel manufacturing. As a result, the market for leftover cooking oil is growing. Furthermore, the manufacturing of biodiesel from spent cooking oil is increasing since it saves 21% of fossil energy when compared to crude oil and 96 percent of energy when compared to fossil diesel production. This has also made used cooking oil attractive among biodiesel producers, increasing its use in the manufacturing of biodiesel.

Regional Analysis of Used Cooking Oil Market:

- In Europe, the EU is also putting in significant efforts to boost biodiesel production. According to the European Commission, biodiesel will replace a significant portion of diesel usage in the EU27 by 2025. Governments in this region are developing legislation to encourage the collection and processing of waste cooking oils from cafés, restaurants, hotels, catering companies, and hotels. The expansion of the market in the region is also fueled by promotional initiatives in the region that raise awareness about the recycling of waste cooking oil. Furthermore, rising demand for biodiesel and increased awareness of animal health has driven the market's expansion in this region.

- Due to rising awareness about environmental welfare and sustainable energy resources, the market in the Asia Pacific is predicted to rise significantly. In this region, a rising number of enterprises are collecting, refining, and processing waste cooking oil, which will boost growth. To meet their raw material need for biodiesel manufacturing, companies in North America and Europe invest in UCO procurement from Asian countries. Market expansion is further aided by the evolution of the food and foodservice industry in the region.

- Many countries in the Middle East and Africa are moving from traditional energy sources to more efficient energy sources. Entrepreneurs in African countries, particularly those in informal and rural settlements, have a major chance to generate and resell biodiesel using cooking oil or food oils. A young entrepreneur in Zambia has developed his biodiesel business from 200 liters per month to 3,000 liters per month, supplying it to local consumers for use in automobiles and machinery. More projects like this are likely to increase the use of this oil in biodiesel production.

Players Covered In Used Cooking Oil Market are:

- Waste Oil Recyclers Inc. (US)

- Brocklesby Limited (UK)

- Greasecycle (US)

- Baker Commodities Inc. (US)

- Veolia Environnment S.A. (France)

- Darling Ingredients Inc. (US)

- Arrows Oils Ltd (UK)

- Olleco Ltd. (UK)

- Argent Energy (UK)

- Grand Natural Inc. (US)

- Averda (Dubai) and others major players.

Key Industry Developments in the Used Cooking Oil Market

-

In November 2024, Darling Ingredients Inc., a global leader in transforming food waste into sustainable products, announced the launch of DarLinQ, an innovative technology enhancing used cooking oil (UCO) management. The system, powered by advanced sonar and Bluetooth technologies, provided real-time monitoring of UCO storage containers, enabling accurate oil-level tracking. This breakthrough improved operational efficiency, increased oil recovery, and enhanced security against theft. The DarLinQ system also optimized fleet operations and supported environmental sustainability.

-

In February 2023, Olleco announced the opening of a state-of-the-art used cooking oil processing plant in East London at the Stolthaven Terminals facility in Dagenham. This milestone bolstered Olleco’s capacity to serve customers across the south-east of England while fostering new opportunities through its partnership with Olleco Bunge in the EU. The facility underscored Olleco’s commitment to sustainable innovation and enhanced its ability to support a circular economy.

|

Used Cooking Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.1% |

Market Size in 2032: |

USD 11.95 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Used Cooking Oil Market by Source (2018-2032)

4.1 Used Cooking Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Food Manufacturers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Household

Chapter 5: Used Cooking Oil Market by Application (2018-2032)

5.1 Used Cooking Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Biodiesel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oleochemical Products

5.5 Animal Feed

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Used Cooking Oil Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 WISK (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 LILIUM (GERMANY)

6.4 EHANG (CHINA.)

6.5 VOLOCOPTER (GERMANY)

6.6 AIRBUS A CUBED (US)

Chapter 7: Global Used Cooking Oil Market By Region

7.1 Overview

7.2. North America Used Cooking Oil Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Source

7.2.4.1 Food Manufacturers

7.2.4.2 Household

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Biodiesel

7.2.5.2 Oleochemical Products

7.2.5.3 Animal Feed

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Used Cooking Oil Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Source

7.3.4.1 Food Manufacturers

7.3.4.2 Household

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Biodiesel

7.3.5.2 Oleochemical Products

7.3.5.3 Animal Feed

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Used Cooking Oil Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Source

7.4.4.1 Food Manufacturers

7.4.4.2 Household

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Biodiesel

7.4.5.2 Oleochemical Products

7.4.5.3 Animal Feed

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Used Cooking Oil Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Source

7.5.4.1 Food Manufacturers

7.5.4.2 Household

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Biodiesel

7.5.5.2 Oleochemical Products

7.5.5.3 Animal Feed

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Used Cooking Oil Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Source

7.6.4.1 Food Manufacturers

7.6.4.2 Household

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Biodiesel

7.6.5.2 Oleochemical Products

7.6.5.3 Animal Feed

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Used Cooking Oil Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Source

7.7.4.1 Food Manufacturers

7.7.4.2 Household

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Biodiesel

7.7.5.2 Oleochemical Products

7.7.5.3 Animal Feed

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Used Cooking Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.1% |

Market Size in 2032: |

USD 11.95 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||