Insomnia Market Synopsis

U.S. Insomnia Market Size Was Valued at USD 4.65 Billion in 2023 and is Projected to Reach USD 7.4 Billion by 2032, Growing at a CAGR of 5.3 % From 2024-2032.

U.S. Insomnia upsets your rest, making it challenging to nod off or stay unconscious. This prompts daytime weakness, affecting state of mind, concentration, and wellbeing. Transient a sleeping disorder can be brought about by pressure or timetable changes, while persistent sleep deprivation might be connected to ailments, emotional well-being, or meds. Assuming you suspect a sleeping disorder, converse with your primary care physician to track down the reason and seek treatment for better rest and generally prosperity.

- The U.S. insomnia market envelops a different cluster of items and administrations pointed toward tending to rest unsettling influences experienced by a huge part of the populace. Sleep deprivation, described by trouble nodding off, staying unconscious, or encountering non-helpful rest, is a typical rest problem with colossal ramifications for wellbeing and prosperity. In that capacity, the market for a sleeping disorder items and medicines is significant and keeps on developing to satisfy the developing need for compelling arrangements.

- The U.S. an insomnia market envelops a different cluster of items and administrations pointed toward tending to rest unsettling influences experienced by a huge part of the populace. Sleep deprivation, described by trouble nodding off, staying unconscious, or encountering non-helpful rest, is a typical rest problem with colossal ramifications for wellbeing and prosperity. In that capacity, the market for a sleeping disorder items and medicines is significant and keeps on developing to satisfy the developing need for compelling arrangements.

- The U.S. an insomnia market is multi-layered and dynamic, driven by the high commonness of rest aggravations, progressions in treatment modalities, developing buyer inclinations, and administrative contemplations. As endeavors to address the weight of sleep deprivation proceed, partners across the medical services environment will assume a fundamental part in molding the eventual fate of sleep deprivation care through development, coordinated effort, and proof-based practice.

The U.S. Insomnia Market Trend Analysis

Growing Social Media Promotions and Celebrity Endorsements

The prevalence of different types of sleep disorders, such as insomnia and parasomnias, an increase in mental depression, and other painful conditions drives the growth of the insomnia market. Mental depression results in difficulty in sleep. For instance, the World Health Organization (WHO) reported that around 280 million population suffer from depression. Thus, the increase in mental depression across the population enhanced the market CAGR across the globe in recent years.

- Long-term medication use for chronic disease treatment has some side effects that are thought to affect the patient's sleep quality. As a result, an increase in the prevalence of chronic diseases such as cancer drives market growth. According to the National Institute of Cancer (NIC), an estimated 1,806,590 new cancer cases will be diagnosed in the United States in 2020. Cancer chemotherapy has a variety of side effects on the patient's body, including a reduction in sleep quality, which is driving the growth of insomnia market revenue.

- Furthermore, the rise in work-related stress contributes to the growth of the insomnia market. Workload increases and hectic work schedules result in poor sleep quality. Many people, such as security officers, work odd shifts, and the manufacturing industries are open 24 hours a day. These odd-time work shifts have an impact on sleep quality and cycle. An increase in the number of insomnia treatment centers and sleep diagnostic centers contributes to market growth. Insomnia treatment centers help people improve their sleep quality, while sleep diagnostic centers serve as diagnostic labs for detecting sleep disorders.

- Increasing non-pharmacological sleep therapy adoption drives market growth. Insomnia is frequently linked to a person's mental health. As a result, non-pharmacological therapies like hypnotherapy, yoga, and cognitive behavioral therapy focus on improving a person's mental state and driving the insomnia industry.

Telemedicine and Virtual Sleep Clinics

- The Insomnia Market in the United States is witnessing a notable opportunity through the emergence of telemedicine and virtual sleep clinics. Insomnia, a common sleep disorder affecting millions of Americans, has prompted a growing demand for convenient and accessible healthcare solutions. Telemedicine, enabled by advancements in technology and the widespread availability of high-speed internet, offers a promising avenue for addressing the healthcare needs of insomnia patients remotely. Telemedicine has revolutionized the way healthcare is delivered, providing a platform for patients to consult with healthcare professionals virtually. For individuals struggling with insomnia, the ability to access sleep experts and specialists from the comfort of their homes presents a game-changing opportunity. Through telemedicine platforms, patients can schedule video consultations, obtain personalized sleep assessments, and receive tailored treatment plans without the need for in-person visits to sleep clinics.

- Moreover, telemedicine offers flexibility and convenience, especially for patients residing in remote or underserved areas, where access to specialized sleep clinics may be limited. By eliminating geographical barriers, telemedicine enables insomnia patients across the United States to connect with sleep experts regardless of their location, thereby widening access to quality healthcare services. Virtual sleep clinics are an extension of telemedicine, catering specifically to sleep disorders such as insomnia. These specialized online platforms are equipped with advanced technologies, including sleep tracking devices, to remotely monitor patients' sleep patterns and gather essential data for accurate diagnoses and treatment planning. Through virtual sleep clinics, insomnia patients can participate in sleep studies and receive real-time feedback from sleep specialists, enhancing the overall efficacy of treatment.

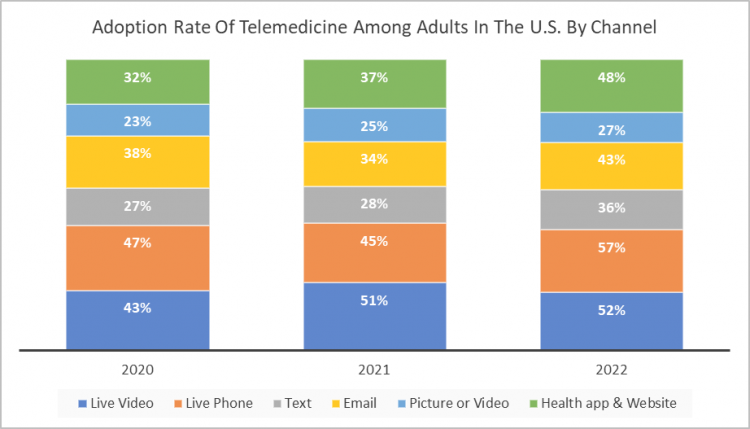

The rise in telemedicine adoption among adults in the United States has had a significant impact on the Insomnia Market. Telemedicine has transformed healthcare accessibility by allowing patients to receive medical consultations via virtual platforms, including for sleep-related issues such as insomnia. Because of the convenience and ease of access, more adults are seeking professional help for sleep problems.

U.S. Insomnia Market Segment Analysis:

By therapy Type, Pharmacological Therapy segment is expected to dominate the market during the forecast period

- The high occurrence of insomnia in the United States highlights the importance of using medication to treat it. Insomnia, which is defined as having trouble either falling asleep or staying asleep, impacts a significant number of people, resulting in a strong need for treatments that work well. Pharmacological treatments, like prescribed drugs, provide rapid relief for people dealing with sleep problems, making them a popular option for both patients and healthcare professionals.

- Progress in pharmaceutical research and development has resulted in the creation of new drugs focused on treating insomnia. These drugs frequently highlight enhanced effectiveness and safety characteristics, addressing changing patient requirements and increasing the market reach of pharmacological treatments. Moreover, the existing framework for producing, delivering, and recommending drugs within the healthcare system in the United States contributes to the strong presence of pharmacological treatments in the market for insomnia.

- Additionally, the easy access to and widespread availability of pharmaceutical treatments enhances their importance in the field of therapy. Medications, unlike non-pharmacological options like CBT-I, can be easily prescribed by primary care doctors or specialists, making them more accessible for patients with insomnia.

By Drug Class, Antidepressants segment held the largest share

- The use of antidepressants to treat insomnia showcases the link between mental health and sleep problems. Insomnia often happens at the same time as mood disorders like depression and anxiety, and antidepressant drugs can help by treating both issues at once. This double-effect feature of antidepressants is appealing to medical professionals looking to relieve insomnia symptoms while also dealing with the root cause of psychological distress.

- Some antidepressants have pharmacological properties that make them effective for treating insomnia. SSRIs and SNRIs, types of antidepressants often given for anxiety and depression, have calming effects that aid in falling asleep and staying asleep. Moreover, tricyclic antidepressants (TCAs) have strong sedative properties that may be helpful for individuals dealing with insomnia, despite being prescribed less frequently because of their side effects.

- The prevalent utilization of antidepressants in the US plays a role in the prevalence of this sector in the market for insomnia products. Antidepressants are commonly prescribed medications in the country due to their effectiveness in treating different psychiatric conditions. Healthcare providers' knowledge of these medications and their proven safety make it easier to include them in insomnia treatment plans.

COVID-19 Impact Analysis On U.S. Insomnia Market

The COVID-19 pandemic had a significant impact on the US insomnia market. As the pandemic changed daily routines, work patterns, and overall stress levels, it also caused an increase in sleep disturbances and insomnia cases across the country. The pandemic's uncertainty and anxiety increased sleeplessness, exacerbating existing sleep disorders and even causing new cases of insomnia.

The disruption of regular schedules and routines was one of the primary factors contributing to the increase in insomnia cases. Individuals faced challenges in separating work life from personal life as remote work became the norm for many, resulting in irregular sleep patterns and difficulties winding down at the end of the day. Furthermore, the isolation and social distancing measures used to control the virus's spread had a negative impact on mental health, causing increased stress, anxiety, and depression, all of which are known triggers for insomnia.

The impact of the pandemic on access to healthcare services also had an impact on the insomnia market. In many areas, non-urgent medical visits were postponed or canceled, causing delays in seeking treatment for sleep disorders. Furthermore, during the pandemic, the shift toward telemedicine presented both opportunities and challenges for the insomnia market.

Top Key Players Covered in The U.S. Insomnia Market

- Eisai Co. Ltd. (Japan)

- Merck & Co., Inc. (U.S.)

- Meda Consumer Healthcare Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Currax Pharmaceuticals LLC

- Sanofi (France)

- Takeda Pharmaceutical Company Ltd. (Japan)

- Pernix Therapeutics (U.S.)

- Vanda Pharmaceuticals, Inc.

- Viatris, Inc.

- Purdue Pharma L.P. (U.S.) and Other Major Players

Key Industry Developments in the U.S. Insomnia Market

- In March 2024, Merck known as MSD outside of the United States and Canada, announced the completion of the acquisition of Harpoon Therapeutics, Inc. Harpoon became a wholly-owned subsidiary of Merck, and Harpoon’s common stock ceased to be publicly traded or listed on the Nasdaq Stock Market.

- In January 2024, Sanofi and Inhibrx, Inc, a publicly traded clinical-stage biopharmaceutical company focused on developing a broad pipeline of novel biologic therapeutic candidates, entered into a definitive agreement under which Sanofi agreed to acquire Inhibrx following the spin-off of non-INBRX-101 assets into New Inhibrx. INBRX-101, a human recombinant protein, held the promise of allowing Alpha-1 Antitrypsin Deficiency (AATD) patients to achieve normalization of serum AAT levels with less frequent dosing

|

U.S Insomnia Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.65 Bn. |

|

Forecast Period 2024-2032 CAGR: |

5.3% |

Market Size in 2032: |

USD 7.4 Bn. |

|

Segments Covered: |

By Therapy Type |

|

|

|

By Drug Class |

|

||

|

By End-User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- U.S. INSOMNIA MARKET BY THERAPY TYPE (2017-2032)

- U.S. INSOMNIA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NON-PHARMACOLOGICAL THERAPY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACOLOGICAL THERAPY

- U.S. INSOMNIA MARKET BY DRUG CLASS (2017-2032)

- U.S. INSOMNIA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANTIDEPRESSANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MELATONIN ANTAGONIST

- BENZODIAZEPINES

- NONBENZODIAZEPINES

- OTHERS

- U.S. INSOMNIA MARKET BY END-USER (2017-2032)

- U.S. INSOMNIA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOMECARE

- SPECIALTY CLINICS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- INSOMNIA Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- EISAI CO. LTD. (JAPAN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MERCK & CO. INC. (U.S.)

- MEDA CONSUMER HEALTHCARE INC. (U.S.)

- PFIZER INC. (U.S.)

- CURRAX PHARMACEUTICALS LLC

- SANOFI (FRANCE)

- TAKEDA PHARMACEUTICAL COMPANY LTD. (JAPAN)

- PERNIX THERAPEUTICS (U.S.)

- VANDA PHARMACEUTICALS, INC.

- VIATRIS INC.

- PURDUE PHARMA L.P. (U.S.)

- OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

U.S Insomnia Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.65 Bn. |

|

Forecast Period 2024-2032 CAGR: |

5.3% |

Market Size in 2032: |

USD 7.4 Bn. |

|

Segments Covered: |

By Therapy Type |

|

|

|

By Drug Class |

|

||

|

By End-User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. US INSOMNIA MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. US INSOMNIA MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. US INSOMNIA MARKET COMPETITIVE RIVALRY

TABLE 005. US INSOMNIA MARKET THREAT OF NEW ENTRANTS

TABLE 006. US INSOMNIA MARKET THREAT OF SUBSTITUTES

TABLE 007. US INSOMNIA MARKET BY THERAPY TYPE

TABLE 008. NON-PHARMACOLOGICAL THERAPY MARKET OVERVIEW (2016-2030)

TABLE 009. PHARMACOLOGICAL THERAPY MARKET OVERVIEW (2016-2030)

TABLE 010. US INSOMNIA MARKET BY DRUG CLASS

TABLE 011. ANTIDEPRESSANTS MARKET OVERVIEW (2016-2030)

TABLE 012. MELATONIN ANTAGONIST MARKET OVERVIEW (2016-2030)

TABLE 013. BENZODIAZEPINES MARKET OVERVIEW (2016-2030)

TABLE 014. NONBENZODIAZEPINES MARKET OVERVIEW (2016-2030)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 016. US INSOMNIA MARKET BY END-USER

TABLE 017. HOSPITALS MARKET OVERVIEW (2016-2030)

TABLE 018. HOMECARE MARKET OVERVIEW (2016-2030)

TABLE 019. SPECIALTY CLINICS MARKET OVERVIEW (2016-2030)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 021. US INSOMNIA MARKET, BY THERAPY TYPE (2016-2030)

TABLE 022. US INSOMNIA MARKET, BY DRUG CLASS (2016-2030)

TABLE 023. US INSOMNIA MARKET, BY END-USER (2016-2030)

TABLE 024. US INSOMNIA MARKET, BY COUNTRY (2016-2030)

TABLE 025. EISAI CO. LTD. (JAPAN): SNAPSHOT

TABLE 026. EISAI CO. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 027. EISAI CO. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 028. EISAI CO. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 028. MERCK & CO.: SNAPSHOT

TABLE 029. MERCK & CO.: BUSINESS PERFORMANCE

TABLE 030. MERCK & CO.: PRODUCT PORTFOLIO

TABLE 031. MERCK & CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. INC. (U.S.): SNAPSHOT

TABLE 032. INC. (U.S.): BUSINESS PERFORMANCE

TABLE 033. INC. (U.S.): PRODUCT PORTFOLIO

TABLE 034. INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. MEDA CONSUMER HEALTHCARE INC. (U.S.): SNAPSHOT

TABLE 035. MEDA CONSUMER HEALTHCARE INC. (U.S.): BUSINESS PERFORMANCE

TABLE 036. MEDA CONSUMER HEALTHCARE INC. (U.S.): PRODUCT PORTFOLIO

TABLE 037. MEDA CONSUMER HEALTHCARE INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. PFIZER INC. (U.S.): SNAPSHOT

TABLE 038. PFIZER INC. (U.S.): BUSINESS PERFORMANCE

TABLE 039. PFIZER INC. (U.S.): PRODUCT PORTFOLIO

TABLE 040. PFIZER INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. CURRAX PHARMACEUTICALS LLC: SNAPSHOT

TABLE 041. CURRAX PHARMACEUTICALS LLC: BUSINESS PERFORMANCE

TABLE 042. CURRAX PHARMACEUTICALS LLC: PRODUCT PORTFOLIO

TABLE 043. CURRAX PHARMACEUTICALS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SANOFI (FRANCE): SNAPSHOT

TABLE 044. SANOFI (FRANCE): BUSINESS PERFORMANCE

TABLE 045. SANOFI (FRANCE): PRODUCT PORTFOLIO

TABLE 046. SANOFI (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. TAKEDA PHARMACEUTICAL COMPANY LTD. (JAPAN): SNAPSHOT

TABLE 047. TAKEDA PHARMACEUTICAL COMPANY LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 048. TAKEDA PHARMACEUTICAL COMPANY LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 049. TAKEDA PHARMACEUTICAL COMPANY LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. PERNIX THERAPEUTICS (U.S.): SNAPSHOT

TABLE 050. PERNIX THERAPEUTICS (U.S.): BUSINESS PERFORMANCE

TABLE 051. PERNIX THERAPEUTICS (U.S.): PRODUCT PORTFOLIO

TABLE 052. PERNIX THERAPEUTICS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. VANDA PHARMACEUTICALS: SNAPSHOT

TABLE 053. VANDA PHARMACEUTICALS: BUSINESS PERFORMANCE

TABLE 054. VANDA PHARMACEUTICALS: PRODUCT PORTFOLIO

TABLE 055. VANDA PHARMACEUTICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. INC.: SNAPSHOT

TABLE 056. INC.: BUSINESS PERFORMANCE

TABLE 057. INC.: PRODUCT PORTFOLIO

TABLE 058. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. VIATRIS: SNAPSHOT

TABLE 059. VIATRIS: BUSINESS PERFORMANCE

TABLE 060. VIATRIS: PRODUCT PORTFOLIO

TABLE 061. VIATRIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INC.: SNAPSHOT

TABLE 062. INC.: BUSINESS PERFORMANCE

TABLE 063. INC.: PRODUCT PORTFOLIO

TABLE 064. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. PURDUE PHARMA L.P. (U.S.): SNAPSHOT

TABLE 065. PURDUE PHARMA L.P. (U.S.): BUSINESS PERFORMANCE

TABLE 066. PURDUE PHARMA L.P. (U.S.): PRODUCT PORTFOLIO

TABLE 067. PURDUE PHARMA L.P. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. US INSOMNIA MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. US INSOMNIA MARKET OVERVIEW BY THERAPY TYPE

FIGURE 012. NON-PHARMACOLOGICAL THERAPY MARKET OVERVIEW (2016-2030)

FIGURE 013. PHARMACOLOGICAL THERAPY MARKET OVERVIEW (2016-2030)

FIGURE 014. US INSOMNIA MARKET OVERVIEW BY DRUG CLASS

FIGURE 015. ANTIDEPRESSANTS MARKET OVERVIEW (2016-2030)

FIGURE 016. MELATONIN ANTAGONIST MARKET OVERVIEW (2016-2030)

FIGURE 017. BENZODIAZEPINES MARKET OVERVIEW (2016-2030)

FIGURE 018. NONBENZODIAZEPINES MARKET OVERVIEW (2016-2030)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 020. US INSOMNIA MARKET OVERVIEW BY END-USER

FIGURE 021. HOSPITALS MARKET OVERVIEW (2016-2030)

FIGURE 022. HOMECARE MARKET OVERVIEW (2016-2030)

FIGURE 023. SPECIALTY CLINICS MARKET OVERVIEW (2016-2030)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 025. US INSOMNIA MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Insomnia Market research report is 2023-2030.

Eisai Co. Ltd. (Japan), Merck & Co., Inc. (U.S.), Meda Consumer Healthcare Inc. (U.S.), Pfizer Inc. (U.S.), Currax Pharmaceuticals LLC, Sanofi (France), Takeda Pharmaceutical Company Ltd. (Japan), Pernix Therapeutics (U.S.), Vanda Pharmaceuticals, Inc., Viatris, Inc., Purdue Pharma L.P. (U.S.), and Other Major Players.

The Insomnia Market has been segmented into Therapy Type, Drug Class, End-User, and region. By Therapy Type, the market is categorized into Non-Pharmacological Therapy, Pharmacological Therapy. By Drug Class, the market is categorized into Antidepressants, Melatonin Antagonist, Benzodiazepines, Nonbenzodiazepines, Others. By End-Users, the market is categorized into Hospitals, Homecare, Specialty Clinics, Others.

Insomnia is a sleep disorder that makes it difficult to fall asleep or stay asleep. A person may also wake up too early and not be able to get back to sleep. Low stamina, daytime sleepiness, depression, and irritability are among the symptoms. It is a very common disorder that affects millions of people all over the world. Circadian rhythm disruption, chronic pain, hyperthyroidism, menopause, psychological stress, and other medical conditions all contribute to insomnia. Excessive use of drugs such as caffeine, alcohol, and nicotine may result in insomnia. Various diagnostic devices are used in sleep laboratories to diagnose this disorder.

The Insomnia Market is expected to grow at a significant growth rate, and the analysis period is 2024-2032, considering the base year as 2023.