Traffic Safety System Market Synopsis

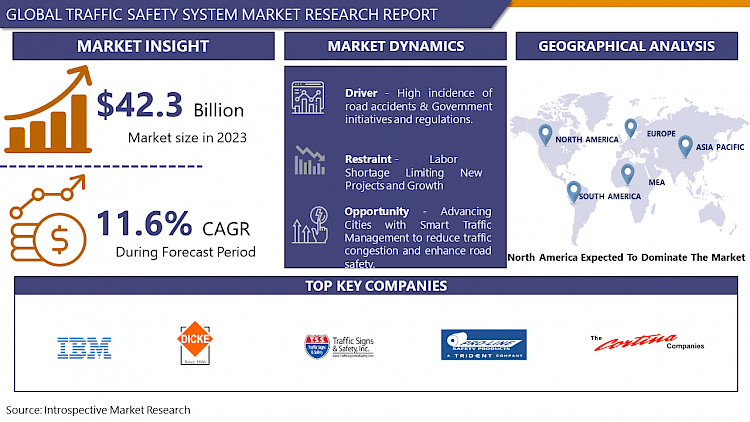

Traffic Safety System Market Size Was Valued at USD 42.3 Billion in 2023, and is Projected to Reach USD 113.58 Billion by 2032, Growing at a CAGR of 11.6% from 2024-2032.

A traffic management system is a cultivated, united system that strives to promote safety, improve traffic flow, and increase overall transportation system effectiveness. To gather and analyse real-time data concerning traffic conditions, it relies on cutting-edge technology like sensors, cameras, communication networks, Automatic Number Plate Detection, and others. Using traffic lights, road signs, and other traffic control equipment and tools, this data is utilized and used to control traffic flow and to give vehicle drivers real-time information on accidents, traffic congestion, and other problems related to traffic.

Reducing traffic jams, improving safety, and boosting the performance of the transportation system as a whole are the main objectives of a traffic management system. The technology can contribute to cutting commute times, lowering fuel consumption and emissions, and improving the general quality of life for city dwellers by streamlining traffic and easing congestion.

- The device can also help to lower the chance of accidents and other occurrences by giving drivers real-time traffic information, hence improving safety and security on the roadways.

- Overall, a traffic management system is a crucial part of transportation infrastructure, and as traffic volumes grow and urban populations rise, so will the significance of this component. To maintain and manage the security, effectiveness, and sustainability of our transportation networks, traffic management system development and deployment must be given top priority by transportation planners, politicians, and Government bodies.

Traffic Safety System Market Trend Analysis

High incidence of road accidents & Government initiatives and regulations

- According to the data from WHO, Road crashes are the leading killer of children and youth, and they typically strike during our most productive years, causing huge health, social, and economic harm throughout society Since 2010, deaths from road crashes have fallen slightly to 1.19 million per year. More than half of all UN Member States, including some of the worst-affected countries, report a decline in deaths. Road traffic deaths and injuries remain a major global health and development challenge.

- Globally, 28% of all fatalities occur in the WHO South-East Asia Region, 25% in the Western Pacific Region, 19% in the African Region, 12% in the Region of the Americas, 11% in the Eastern Mediterranean Region, and 5% in the European Region. As of 2019, road traffic crashes are the leading killer of children and youth aged 5 to 29 years and are the 12th leading cause of death when all ages are considered. traffic deaths in 2021 – a 5% drop when compared to the 1.25 million deaths in 2010. More than half of all United Nations Member States reduced road traffic deaths between 2010 and 2021.

- Report of the Ministry of Road Transport and Highways (2022) states that During 2022, a total of 4,61,312 accidents were recorded in the country, of which, 1,51,997 (32.9%) took place on the National Highways (NH) including Expressways, 1,06,682 (23.1%) on State Highways (SH) and the remaining 2,02,633 (43.9%) on Other Roads. Out of the total of 1,68,491 fatalities reported in 2022, 61,038 (36.2%) were on National Highways, 41,012 (24.3%) were on State Highways and 66,441 (39.4%) were on Other Roads. Out of the total, 1,55,781 fatal accidents reported in 2022, 55,571 (35.7%) were on National Highways, 37,861 (24.3%) were on State Highways and 62,349 (40%) were on Other Roads.

- This information reveals an alarming lack of progress in advancing laws and rising demand for Road and traffic safety management systems and standards.

Advancing Cities with Smart Traffic Management to reduce traffic congestion and enhance road safety.

- Smart Traffic Management Systems are technology solutions that municipalities and government bodies can integrate into their traffic cabinets and intersections today for fast, cost-effective improvements in safety and traffic flow on their city streets. Intelligent transportation systems (ITS), or smart traffic management systems, provide an organized, integrated approach to lessening traffic problems, congestion, and accidents, and improving safety on city streets through connected technology.

- These systems apply sensors, cameras, cellular routers, and automation to monitor and automatically direct traffic and reduce congestion. The right technology solution can be scaled to any size and painlessly upgraded at any time. Simultaneously, these technology solutions prepare Smart Cities for coming technological evolutions, including Connected Vehicles and the full deployment of 5G networks.

Traffic Safety System Market Segment Analysis:

Traffic Safety System Market is Segmented based on By Solution, Services, System, and End User.

By System, Automatic Number Plate Recognition (ANPR) segment is expected to dominate the market during the forecast period

- The Automatic Number Plate Recognition (ANPR) phase is the highest contributor to the street safety marketplace and is expected to grow all through the forecast length. Users like malls, theatres, restaurants, parking masses, avenue intersections, faculties, and private land, among others, contribute notably to the ALPR section's sales proportion. It is also used widely to get a car back if it's been stolen or used illegally.

- This more and more in-call feature can come across and examine license plates to make it a good deal simpler for customers, or the authorities, to quickly pick out any car at the scene.

By End User, the Government Agencies segment held the largest share in 2023

- Governments everywhere concentrate on maintaining traffic order and guaranteeing commuter safety to reduce worryingly high traffic-related deaths. Government Agencies are the important thing and vital customers of traffic system management. They use these systems to alter and They use these systems to regulate traffic laws and increase safety on public roads. The scope of those systems typically includes speed and light enforcement, computerized road safety, traffic Congestion control, Traffic data collection, and different traffic management services.

- Government authorities need traffic system to monitor the complete highway by various sensors & technologies to take corrective actions that ultimately result in the assurance of safe journeys for road users, enhanced efficiency, productivity, mobility, and better highway traffic

Traffic Safety System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North American Countries like the United States and Canada are reducing traffic congestion by changing their transportation infrastructure. Telematics service providers in the region aim to develop new solutions and services. The US Department of Transportation (DOT) is taking several initiatives and stands for smart cities and advanced transportation technologies.

- For vehicles in traffic management systems, solutions such as wireless safety communication and integrated hands-free mobile phones are being developed to improve safety.

Active Key Players in the Traffic Safety System Market

- IBM (U.S.)

- Dicke Safety Products (U.S.)

- Traffic Signs & Safety (U.S.)

- Roadtech Manufacturing (U.S.)

- Pro-Line Safety Products (U.S.)

- The Cortina Companies (U.S.)

- 3M (U.S.)

- Honeywell International Inc. (U.S.)

- Pexco LLC. (U.S.)

- Emedco (U.S.)

- Cubic Corporation (U.S.)

- FLIR Systems (U.S.)

- Iteris Inc. (U.S.)

- Zumar Industries Inc. (U.S.)

- Greenlite (Canada)

- WSP Global (Canada)

- Siemens Mobility (Germany)

- Lacroix Group (France)

- Thales Group (France)

- Kapsch TrafficCom (Austria)

- Swarco AG (Austria)

- Swarco Traffic (Austria)

- TomTom (Netherlands)

- Delmon Group of Companies (UAE)

- Zhejiang Traffic Safety Products (China)

Key Industry Developments in the Traffic Safety System Market:

- In March 2024, IBM acquires Pliant to further enhance network IT automation capabilities. IBM announced that it has acquired Pliant, a leading provider of network and IT infrastructure automation products. Pliant adds essential features to automate network and IT infrastructure tasks and bring those features to the application layer, giving applications (and developers) maximum control oversimplifying and managing infrastructure directly within applications.

- In June 2023, Siemens Mobility acquired Optrail to expand the functionality of its train planning system. Siemens Mobility has completed the Italian technology company Optrail S.r.l. an acquisition that provides traffic management systems - TMS - with unique algorithms based on mathematical optimization methods and operational research. The acquisition complements Siemens Mobility's existing train planning system - TPS portfolio and strengthens its position as a leading provider of software solutions for railway customers.

|

Global Traffic Safety System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 42.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.6 % |

Market Size in 2032: |

USD 113.58 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Services |

|

||

|

By System |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TRAFFIC SAFETY SYSTEM MARKET BY SOLUTION (2017-2032)

- TRAFFIC SAFETY SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RED LIGHT ENFORCEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPEED ENFORCEMENT

- BUS LANE ENFORCEMENT

- INCIDENT DETECTION AND RESPONSE

- TRAFFIC SAFETY SYSTEM MARKET BY SERVICES (2017-2032)

- TRAFFIC SAFETY SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSULTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPPORT AND MAINTENANCE

- INTEGRATION AND DEPLOYMENT

- TRAFFIC SAFETY SYSTEM MARKET BY SYSTEM (2017-2032)

- TRAFFIC SAFETY SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SPEED ENFORCEMENT SYSTEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VIDEO SURVEILLANCE SYSTEM

- CONGESTION MANAGEMENT SYSTEMS

- VARIABLE MESSAGE SIGNS (VMS)

- TRAFFIC COUNTERS AND CLASSIFIERS

- INCIDENT DETECTION SYSTEMS

- AUTOMATIC NUMBER PLATE RECOGNITION (ANPR)

- TRAFFIC SAFETY SYSTEM MARKET BY END-USER (2017-2032)

- TRAFFIC SAFETY SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GOVERNMENT AGENCIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONSTRUCTION COMPANIES

- TRANSPORTATION COMPANIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- TRAFFIC SAFETY SYSTEM Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IBM (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Dicke Safety Products (U.S.)

- Traffic Signs & Safety (U.S.)

- Roadtech Manufacturing (U.S.)

- Pro-Line Safety Products (U.S.)

- The Cortina Companies (U.S.)

- 3M (U.S.)

- Honeywell International Inc. (U.S.)

- Pexco LLC. (U.S.)

- Emedco (U.S.)

- Cubic Corporation (U.S.)

- FLIR Systems (U.S.)

- Iteris Inc. (U.S.)

- Zumar Industries Inc. (U.S.)

- Greenlite (Canada)

- WSP Global (Canada)

- Siemens Mobility (Germany)

- Lacroix Group (France)

- Thales Group (France)

- Kapsch TrafficCom (Austria)

- Swarco AG (Austria)

- Swarco Traffic (Austria)

- TomTom (Netherlands)

- Delmon Group of Companies (UAE)

- Zhejiang Traffic Safety Products (China)

- COMPETITIVE LANDSCAPE

- GLOBAL TRAFFIC SAFETY SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution

- Historic And Forecasted Market Size By Services

- Historic And Forecasted Market Size By System

- Historic And Forecasted Market Size By End User

-

-

-

- USA

- Canada

- Mexico

-

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

-

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Traffic Safety System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 42.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.6 % |

Market Size in 2032: |

USD 113.58 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Services |

|

||

|

By System |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TRAFFIC SAFETY SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TRAFFIC SAFETY SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TRAFFIC SAFETY SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. TRAFFIC SAFETY SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. TRAFFIC SAFETY SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. TRAFFIC SAFETY SYSTEM MARKET BY TYPE

TABLE 008. TRAFFIC VESTS AND RAINWEAR MARKET OVERVIEW (2016-2028)

TABLE 009. TUBE DELINEATORS MARKET OVERVIEW (2016-2028)

TABLE 010. TRAFFIC CONES MARKET OVERVIEW (2016-2028)

TABLE 011. TRAFFIC BARRICADES MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. TRAFFIC SAFETY SYSTEM MARKET BY APPLICATION

TABLE 014. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 015. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 016. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA TRAFFIC SAFETY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA TRAFFIC SAFETY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 019. N TRAFFIC SAFETY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE TRAFFIC SAFETY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE TRAFFIC SAFETY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 022. TRAFFIC SAFETY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC TRAFFIC SAFETY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC TRAFFIC SAFETY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 025. TRAFFIC SAFETY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA TRAFFIC SAFETY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA TRAFFIC SAFETY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 028. TRAFFIC SAFETY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA TRAFFIC SAFETY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA TRAFFIC SAFETY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 031. TRAFFIC SAFETY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 032. 3M: SNAPSHOT

TABLE 033. 3M: BUSINESS PERFORMANCE

TABLE 034. 3M: PRODUCT PORTFOLIO

TABLE 035. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 036. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 037. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 038. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. EMEDCO: SNAPSHOT

TABLE 039. EMEDCO: BUSINESS PERFORMANCE

TABLE 040. EMEDCO: PRODUCT PORTFOLIO

TABLE 041. EMEDCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PEXCO LLC.: SNAPSHOT

TABLE 042. PEXCO LLC.: BUSINESS PERFORMANCE

TABLE 043. PEXCO LLC.: PRODUCT PORTFOLIO

TABLE 044. PEXCO LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ZUMAR INDUSTRIES: SNAPSHOT

TABLE 045. ZUMAR INDUSTRIES: BUSINESS PERFORMANCE

TABLE 046. ZUMAR INDUSTRIES: PRODUCT PORTFOLIO

TABLE 047. ZUMAR INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. INC.: SNAPSHOT

TABLE 048. INC.: BUSINESS PERFORMANCE

TABLE 049. INC.: PRODUCT PORTFOLIO

TABLE 050. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DELMON GROUP OF COMPANIES: SNAPSHOT

TABLE 051. DELMON GROUP OF COMPANIES: BUSINESS PERFORMANCE

TABLE 052. DELMON GROUP OF COMPANIES: PRODUCT PORTFOLIO

TABLE 053. DELMON GROUP OF COMPANIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SWARCO TRAFFIC: SNAPSHOT

TABLE 054. SWARCO TRAFFIC: BUSINESS PERFORMANCE

TABLE 055. SWARCO TRAFFIC: PRODUCT PORTFOLIO

TABLE 056. SWARCO TRAFFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DICKE SAFETY PRODUCTS: SNAPSHOT

TABLE 057. DICKE SAFETY PRODUCTS: BUSINESS PERFORMANCE

TABLE 058. DICKE SAFETY PRODUCTS: PRODUCT PORTFOLIO

TABLE 059. DICKE SAFETY PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TRAFFIC SIGNS & SAFETY: SNAPSHOT

TABLE 060. TRAFFIC SIGNS & SAFETY: BUSINESS PERFORMANCE

TABLE 061. TRAFFIC SIGNS & SAFETY: PRODUCT PORTFOLIO

TABLE 062. TRAFFIC SIGNS & SAFETY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. GREENLITE: SNAPSHOT

TABLE 063. GREENLITE: BUSINESS PERFORMANCE

TABLE 064. GREENLITE: PRODUCT PORTFOLIO

TABLE 065. GREENLITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. LACROIX GROUP: SNAPSHOT

TABLE 066. LACROIX GROUP: BUSINESS PERFORMANCE

TABLE 067. LACROIX GROUP: PRODUCT PORTFOLIO

TABLE 068. LACROIX GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ROADTECH MANUFACTURING: SNAPSHOT

TABLE 069. ROADTECH MANUFACTURING: BUSINESS PERFORMANCE

TABLE 070. ROADTECH MANUFACTURING: PRODUCT PORTFOLIO

TABLE 071. ROADTECH MANUFACTURING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. PRO-LINE SAFETY PRODUCTS: SNAPSHOT

TABLE 072. PRO-LINE SAFETY PRODUCTS: BUSINESS PERFORMANCE

TABLE 073. PRO-LINE SAFETY PRODUCTS: PRODUCT PORTFOLIO

TABLE 074. PRO-LINE SAFETY PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. THE CORTINA COMPANIES: SNAPSHOT

TABLE 075. THE CORTINA COMPANIES: BUSINESS PERFORMANCE

TABLE 076. THE CORTINA COMPANIES: PRODUCT PORTFOLIO

TABLE 077. THE CORTINA COMPANIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. ZHEJIANG TRAFFIC SAFETY PRODUCTS: SNAPSHOT

TABLE 078. ZHEJIANG TRAFFIC SAFETY PRODUCTS: BUSINESS PERFORMANCE

TABLE 079. ZHEJIANG TRAFFIC SAFETY PRODUCTS: PRODUCT PORTFOLIO

TABLE 080. ZHEJIANG TRAFFIC SAFETY PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. TRAFFIC VESTS AND RAINWEAR MARKET OVERVIEW (2016-2028)

FIGURE 013. TUBE DELINEATORS MARKET OVERVIEW (2016-2028)

FIGURE 014. TRAFFIC CONES MARKET OVERVIEW (2016-2028)

FIGURE 015. TRAFFIC BARRICADES MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 018. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 019. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 020. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA TRAFFIC SAFETY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Traffic Safety System Market research report is 2024-2032.

IBM (U.S.), Dicke Safety Products (U.S.), Traffic Signs & Safety (U.S.), Roadtech Manufacturing (U.S.), Pro-Line Safety Products (U.S.), The Cortina Companies (U.S.), 3M (U.S.), Honeywell International Inc. (U.S.), Pexco LLC. (U.S.), Emedco (U.S.), Cubic Corporation (U.S.), FLIR Systems (U.S.), Iteris Inc. (U.S.), Zumar Industries Inc. (U.S.), Greenlite (Canada), WSP Global (Canada), Siemens Mobility (Germany), Lacroix Group (France), Thales Group (France), Kapsch TrafficCom (Austria), Swarco AG (Austria), Swarco Traffic (Austria), TomTom (Netherlands), Delmon Group of Companies (UAE), Zhejiang Traffic Safety Products (China) and Other Major Players.

The Traffic Safety System Market is segmented into Solutions, Services, Systems, and End User. By Solution, the market is categorized into Red Light Enforcement, Speed Enforcement, Speed Enforcement, Incident Detection, and Response. By Services, the market is categorized into Consulting, Support and Maintenance, Integration, and Deployment. By System, the market is categorized into Speed Enforcement Systems, Video Surveillance Systems, Congestion Management Systems, Variable Message Signs (VMS), Traffic Counters and Classifiers, Incident Detection Systems, and Automatic Number Plate Recognition (ANPR). By End User, the market is categorized into Government Agencies, Construction Companies, and Transportation Companies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Traffic safety systems are highway features designed primarily to reduce the severity of run-off-road collisions, prevent errant vehicles from crossing the median, and decelerate errant cars. One of the main causes of deaths and disability is road accidents which particularly affect the youth and employed citizens and contribute to the exclusion of the working-age population. Children can be involved in such accidents as well. The traffic injury rate has significant consequences for the country as the growing demographic problem poses a threat to safety and vital activities not only of the population but of the entire state.

Traffic Safety System Market Size Was Valued at USD 42.3 Billion in 2023, and is Projected to Reach USD 113.58 Billion by 2032, Growing at a CAGR of 11.6% from 2024-2032.