Trade Management Software Market Synopsis

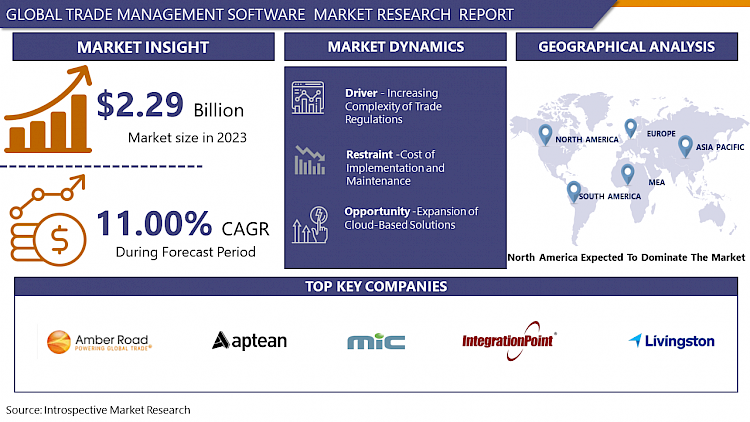

Trade Management Software Market Size Was Valued at USD 2.29 Billion in 2023, and is Projected to Reach USD 5.86 Billion by 2032, Growing at a CAGR of 11.00% From 2024-2032.

Trade management software can be described as a computer application that assists traders in the efficient implementation of financial instrument trading operations. It helps traders and investment companies to place orders, conduct trades, and cope with the further processes which include settlements and preparing reports on compliance. It transforms market data feeds and trading platforms into sources of up-to-date information that supports the decision-making process and verifies the company’s compliance with the regulatory standards, and optimizes business processes and trading operations.

- Trade Management Software or also known as Trade Compliance Software has been experiencing a consistent growth especially over the past several years because of globalization and because of the constantly changing and more stringent rules and regulations when it comes to international trade and businesses. TMS solutions are developed for the purpose of handling and also for the automation of cross-border trade activities in the areas of transactions, customs regulations and logistics. In its turn, integration of such functions can improve the efficiency of the business processes, decrease expenses, as well as meet the requirements of the international trade rules and regulation.

- Pursuant to the quantitative aspect, the volume of international trade remains one of the main stimuli for the growth of the TMS market. On globalisation, the significance of trade management becomes a key factor when business organizations seek new markets and supply materials from different areas. TMS solutions offer assistance to organizations on how to solve the difficulties connected with global trading, such as confidential differences between states, tariffs, and trade treaties. This software offers a real-time tracking of the supply chain making it easy for the business to act on any occurring conditions.

- The last one is another major driver pushing the TMS market forward: compliance and risk management The motivation behind their apparition and their evolution is that companies intensify their work on compliance and risk management more and more. It is for this reason that trade regulations are frequently changing and firms fail to meet these standards end up facing penalties that are costly in terms of time and reputation. TMS solutions provide programmes that will help in compliance with the CBP, UCC and regional Free Trade Agreements. These tools comprise automated documentation, duty and tax calculation, and restricted party screening which minimizes the risks the firm is subjected to in international business.

- Technology has also had a central duty in the development of TMS. AI, machine learning, and big data analytics have boosted the features of TMS solutions. This is possible since these technologies support predictive analytics that determines the demand, stock, and even the supply chain risks in advance. Further, there are new efforts carried out by using blockchain technology to increase transparency and security of an element of trade deals and guarantee the product’s genuine origin.

- The increase in the number of firms conducting their businesses online has also fuelled the need for enhanced TMS solutions. E-tailers and marketplaces are centralized throughout the world and therefore, international trade management is necessary to deal with increased flow of shipments. TMS software can be used by e-commerce companies to sort out the complicated web of logistics requirements, monitor shipments’ status in real-time, and efficiently solve returns and customs issues. This capability is very important especially when it comes to dear customers and retaining the competitive edge in today’s highly dynamic e-commerce environment.

- The TMS market is rather heterogeneous and consists of traditional software giants and newcomers from the startup industry. These solutions are provided by companies like SAP, Oracle, and Infor, as they are the key TMS providers that are integrated into the enterprise resource planning systems. At the same time, there are some specialized TMS providers which enter the market with quite narrow specialization such as Amber Road, Descartes and GT Nexus offering tools to manage separate aspects of trade. There are also observed more and more mergers and acquisitions because companies want to enhance their complements and territory.

- The current and future growth for Trade Management Software market still has a lot of potential – as globalization establishes more complex rules, increases the pressure to keep trading risk under control, avails the latest technologies, and welcomes new shapes of buying, such as e-commerce trade. Business entities irrespective of their industry type are experiencing benefits from implementation of TMS solutions in managing supply chain activities, controlling operational expenses, and meeting the complex rules of trade operations. Thus, it can be stated that in the future, there will be more developments and improvements in the TMS that will positively assist in the proper circulation of products in the market.

Trade Management Software Market Trend Analysis

Integration of Artificial Intelligence and Machine Learning

- AI and ML technologies have now become a common part of trade management software and have drastically improved the functionality of the software by increasing the speed and accuracy of results, along with offering better decision support. Real time data is fed to the AI and ML algorithms which automatically analyze large data volumes to discover patterns which would have been hard to detect, therefore enhancing the efficiency of the trading process. These technologies enable predictions to help the traders or investors understand when a specific investment is likely to mature or when its value is likely to deteriorate, hence enabling one to take corrective measures in advance.

- In the same manner, AI & ML enhance trade generated through the implementation of automated procedures that minimize errors, time needed for each trade and increase the accessibility to large quantity of information. They can also enhance risk management, as AI-powered systems can quickly identify the irregularities and threats that may lead to regulation violation and revenues’ loss. Not only the near perfect integration between AI and ML but also essentially enhances the productivity and provides a competitive defensive edge by presenting superior metrics and intelligence besides making the trade management a far more efficient and intelligent domain than before.

Expansion of Cloud-Based Solutions

- Several considerations have therefore therefore remained key to the general advancement of the cloud-based solutions available in the trade management software market and these are outlined as follows; The uptake of the cloud-based trade management solutions has remained high due to efficiency, compliance and costs factors available. Such solutions are also scalable, flexible and compatible with other enterprise systems which may be useful for complex and constantly developing supply chain systems.

- Other reasons that have made organizations adopt the cloud-based trade management software include developing in cloud technologies such as security and data analysis. Furthermore, due to the impacts of the COVID-19 pandemic lockdown measures, digital transformation is even more evident across industries; and, thus, organizations have embraced cloud solutions with the purpose of continuing their operations and avoiding more losses. In conclusion, trade management is on the verge of moving to cloud since organizations are in quest for solutions aimed at increasing operation efficiency, compliance and flexibility of their trade processes.

Trade Management Software Market Segment Analysis:

Trade Management Software Market is segmented based on Component, Deployement and End-User.

By Component , Service segment is expected to dominate the market during the forecast period

- In the context of the Trade Management Software Market, solutions and services are the primary elements of the components. Challenges within this market focus on solutions where often they consist of software platforms that support some or all the aspects of trade management, such as the actual trade execution, trade compliance, and risk management. Many of such solutions incorporate elements such as order management, trade analytics, and reporting to help the businesses involved in cross-border trade to improve their processes and decisions.

- On the other hand, the services offered in this market comprise of implementing, adapting, training, and supporting trade management software solutions offered by vendors to several clients. The current structure of the trade management software which is solutions and services is a fundamental framework to the market in responding to various industries’ needs, starting from big organizations such as the multinational companies and extending to small and medium business entities that look forward to improving their trade operations while at the same time enhancing and compliance measures.

By End User ,Retail segment held the largest share in 2023

- The Trade Management Software Market has the large numbers of application areas across different end-user industries such as energy, government, healthcare, manufacturing, retail, transportation & logistics, and others. Ongoing regulatory challenges find energy sectors sourcing for trade management software to enhance trade supply chain, compliance, and trade trade operations. It is through these solutions that governments improve trade surveillance, tariffs, and customs requirements by leveraging them. Trade management software is useful for healthcare entities as it helps automate many aspects of procurement, be it the actual purchasing or ensuring adherence to local laws and managing the inventory when moving through borders.

- In manufacturing, these tools help in managing supplies and procurement and compliance throughout the different operations in the global arena. Retail industries get value from trade management applications for supply chain, inventory control, and customs requirements. These solutions are widely adopted by the transportation & logistics market for freight management, logistics planning and documentation control. Other industries such as banking, and the consumer goods’ industries also consider and find the use of trade management software relevant in managing trade processes, achieving cost savings, and compliance to regulations which acts as a key to better operations and competitive advantage in the global economy.

Trade Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- It might be noted that North America would continue to dominate the trade management software market during the course of the forecast period. There are some reasons that can explain this leadership Club Slovan is a large company with many employees Every company has to deal with some kinds of problems Sometimes companies have to use services of some other companies and it is very important to choose partners successfully main activity Club Slovan is one of the biggest companies of the Republic of Belarus Club Slovan works in construction industry In the first place, the chosen geographical region, the North America, reveals high and competitive development in software, creating the right conditions for the further formation of trade management solutions. The United States and Canada are two giants of the global economy with a large number of MNEs who conduct intensive cross-border transactions, which creates the need for the implementation of efficient software to manage and improve the efficiency of trade activities.

- Also, the industries such as the finance and banking sector, the healthcare sector, and manufacturing industries require strict trade compliance solutions mainly emanating from regulatory bodies that set general standards for trades. Also, the regional adoption of the cloud computing, big data analytics, and artificial intelligence technologies makes trade management software solutions more scalable and efficient to the various industries needs. Thus, North America is anticipated to retain dominance in the trade management software market due to technology implementation, compliance rules, and vast market prospects throughout numerous industries.

Active Key Players in the Trade Management Software Market

- Amber Road Inc. (USA)

- Aptean Inc. (USA)

- Integration Point Inc. (USA)

- Livingston International Inc. (Canada)

- MIC Customs Solutions (Germany)

- MIQ Logistics (USA)

- Oracle Corporation (USA)

- Precision Software (Ireland)

- QuestaWeb Inc. (USA)

- SAP SE (Germany)

- Other Key Players

Key Industry Developments in the Trade Management Software Market

- In February 2024, Oracle Corporation announced that Oracle Fusion Cloud Supply Chain and Manufacturing has added new business intelligence capabilities for logistics and transportation management. The new capabilities are aimed at managing the flow and distribution of goods, as the transportation and global trade functionalities are built on the same platform.

- In July 2022, Livingston International, a supplier of customs brokerage, freight forwarding, and worldwide trade consultancy services, introduced Livingston Direct. This entirely digital, user-directed tool allows US importers better visibility and control over online customs clearance. The introduction of Livingston Direct is the company's newest move in its continuous drive to deliver expanded digital services to businesses wishing to streamline customs procedures.

|

Global Trade Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.29 Billion. |

|

Forecast Period 2024-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 5.86 Billion. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TRADE MANAGEMENT SOFTWARE MARKET BY COMPONENT (2017-2032)

- TRADE MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- SERVICES

- TRADE MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT (2017-2032)

- TRADE MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- TRADE MANAGEMENT SOFTWARE MARKET BY END USE (2017-2032)

- TRADE MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENERGY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- HEALTHCARE

- MANUFACTURING

- RETAIL

- TRANSPORTATION & LOGISTICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Trade Management Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMBER ROAD INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- APTEAN INC. (USA)

- INTEGRATION POINT INC. (USA)

- LIVINGSTON INTERNATIONAL INC. (CANADA)

- MIC CUSTOMS SOLUTIONS (GERMANY)

- MIQ LOGISTICS (USA)

- ORACLE CORPORATION (USA)

- PRECISION SOFTWARE (IRELAND)

- QUESTAWEB INC. (USA)

- SAP SE (GERMANY)

- COMPETITIVE LANDSCAPE

- GLOBAL TRADE MANAGEMENT SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By End Use

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Trade Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.29 Billion. |

|

Forecast Period 2024-32 CAGR: |

11.00% |

Market Size in 2032: |

USD 5.86 Billion. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TRADE MANAGEMENT SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TRADE MANAGEMENT SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TRADE MANAGEMENT SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. TRADE MANAGEMENT SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. TRADE MANAGEMENT SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. TRADE MANAGEMENT SOFTWARE MARKET BY SOLUTION & SERVICE TYPE

TABLE 008. TRADE FUNCTIONS MARKET OVERVIEW (2016-2028)

TABLE 009. VENDOR MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 010. IMPORT/EXPORT MANAGEMENT/ INVOICE MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 011. CONSULTING AND IMPLEMENTATION MARKET OVERVIEW (2016-2028)

TABLE 012. TRADE MANAGEMENT SOFTWARE MARKET BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO

TABLE 013. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 014. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 015. ENERGY MARKET OVERVIEW (2016-2028)

TABLE 016. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 017. LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 018. CONSUMER GOODS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET, BY SOLUTION & SERVICE TYPE (2016-2028)

TABLE 020. NORTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET, BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO (2016-2028)

TABLE 021. N TRADE MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE TRADE MANAGEMENT SOFTWARE MARKET, BY SOLUTION & SERVICE TYPE (2016-2028)

TABLE 023. EUROPE TRADE MANAGEMENT SOFTWARE MARKET, BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO (2016-2028)

TABLE 024. TRADE MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC TRADE MANAGEMENT SOFTWARE MARKET, BY SOLUTION & SERVICE TYPE (2016-2028)

TABLE 026. ASIA PACIFIC TRADE MANAGEMENT SOFTWARE MARKET, BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO (2016-2028)

TABLE 027. TRADE MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA TRADE MANAGEMENT SOFTWARE MARKET, BY SOLUTION & SERVICE TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA TRADE MANAGEMENT SOFTWARE MARKET, BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO (2016-2028)

TABLE 030. TRADE MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET, BY SOLUTION & SERVICE TYPE (2016-2028)

TABLE 032. SOUTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET, BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO (2016-2028)

TABLE 033. TRADE MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 034. INTEGRATION POINT: SNAPSHOT

TABLE 035. INTEGRATION POINT: BUSINESS PERFORMANCE

TABLE 036. INTEGRATION POINT: PRODUCT PORTFOLIO

TABLE 037. INTEGRATION POINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. AMBER ROAD: SNAPSHOT

TABLE 038. AMBER ROAD: BUSINESS PERFORMANCE

TABLE 039. AMBER ROAD: PRODUCT PORTFOLIO

TABLE 040. AMBER ROAD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. QUESTAWEB: SNAPSHOT

TABLE 041. QUESTAWEB: BUSINESS PERFORMANCE

TABLE 042. QUESTAWEB: PRODUCT PORTFOLIO

TABLE 043. QUESTAWEB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. DESCARTES: SNAPSHOT

TABLE 044. DESCARTES: BUSINESS PERFORMANCE

TABLE 045. DESCARTES: PRODUCT PORTFOLIO

TABLE 046. DESCARTES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. APTEAN: SNAPSHOT

TABLE 047. APTEAN: BUSINESS PERFORMANCE

TABLE 048. APTEAN: PRODUCT PORTFOLIO

TABLE 049. APTEAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SAP: SNAPSHOT

TABLE 050. SAP: BUSINESS PERFORMANCE

TABLE 051. SAP: PRODUCT PORTFOLIO

TABLE 052. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. INFOR: SNAPSHOT

TABLE 053. INFOR: BUSINESS PERFORMANCE

TABLE 054. INFOR: PRODUCT PORTFOLIO

TABLE 055. INFOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ORACLE: SNAPSHOT

TABLE 056. ORACLE: BUSINESS PERFORMANCE

TABLE 057. ORACLE: PRODUCT PORTFOLIO

TABLE 058. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PRECISION SOFTWARE: SNAPSHOT

TABLE 059. PRECISION SOFTWARE: BUSINESS PERFORMANCE

TABLE 060. PRECISION SOFTWARE: PRODUCT PORTFOLIO

TABLE 061. PRECISION SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MIC CUSTOM SOLUTIONS: SNAPSHOT

TABLE 062. MIC CUSTOM SOLUTIONS: BUSINESS PERFORMANCE

TABLE 063. MIC CUSTOM SOLUTIONS: PRODUCT PORTFOLIO

TABLE 064. MIC CUSTOM SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CARGOWISE: SNAPSHOT

TABLE 065. CARGOWISE: BUSINESS PERFORMANCE

TABLE 066. CARGOWISE: PRODUCT PORTFOLIO

TABLE 067. CARGOWISE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TRADESTONE SOFTWARE: SNAPSHOT

TABLE 068. TRADESTONE SOFTWARE: BUSINESS PERFORMANCE

TABLE 069. TRADESTONE SOFTWARE: PRODUCT PORTFOLIO

TABLE 070. TRADESTONE SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. KEWILL TECHNOLOGIES: SNAPSHOT

TABLE 071. KEWILL TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 072. KEWILL TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 073. KEWILL TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. MERCURYGATE: SNAPSHOT

TABLE 074. MERCURYGATE: BUSINESS PERFORMANCE

TABLE 075. MERCURYGATE: PRODUCT PORTFOLIO

TABLE 076. MERCURYGATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY SOLUTION & SERVICE TYPE

FIGURE 012. TRADE FUNCTIONS MARKET OVERVIEW (2016-2028)

FIGURE 013. VENDOR MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. IMPORT/EXPORT MANAGEMENT/ INVOICE MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 015. CONSULTING AND IMPLEMENTATION MARKET OVERVIEW (2016-2028)

FIGURE 016. TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY BASED ON THE END-USER INDUSTRY THE MARKET IS DIVIDED INTO

FIGURE 017. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 018. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 019. ENERGY MARKET OVERVIEW (2016-2028)

FIGURE 020. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 021. LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 022. CONSUMER GOODS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Trade Management Software Market research report is 2024-2032.

Amber Road Inc. (USA),Aptean Inc. (USA),Integration Point Inc. (USA),Livingston International Inc. (Canada),MIC Customs Solutions (Germany),MIQ Logistics (USA),and Other Major Players..

The Trade Management Software Market is segmented into Component , Deployement Type, End-User and Region. By Component , the market is categorized into Solutions, Services. By Deployment, the market is categorized into On-premise, Cloud. By End Use, the market is categorized into Energy, Government, Healthcare, Manufacturing, Retail, Transportation & logistics,Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Trade management software can be described as a computer application that assists traders in the efficient implementation of financial instrument trading operations. It helps traders and investment companies to place orders, conduct trades, and cope with the further processes which include settlements and preparing reports on compliance. It transforms market data feeds and trading platforms into sources of up-to-date information that supports the decision-making process and verifies the company’s compliance with the regulatory standards, and optimizes business processes and trading operations.

Trade Management Software Market Size Was Valued at USD 2.29 Billion in 2023, and is Projected to Reach USD 5.86 Billion by 2032, Growing at a CAGR of 11.00% From 2024-2032.