Tobacco Packaging Market Synopsis

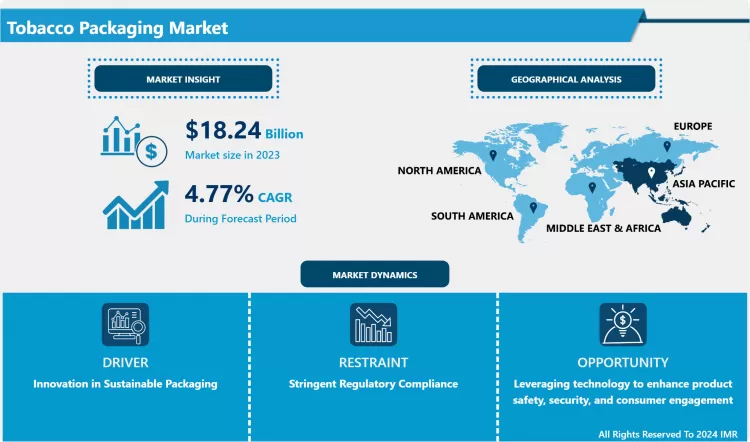

Tobacco Packaging Market Size Was Valued at USD 18.24 Billion in 2023 and is Projected to Reach USD 27.74 Billion by 2032, Growing at a CAGR of 4.77% From 2024-2032.

Tobacco packaging as a strategic asset entails the materials and characterization of the outer and internal covers or wraps of tobacco products including the cigarette, cigars, and pipe tobacco. It fulfills both the functional and informative uses to present the tobacco product and communicate brand ing and health information as well as regulatory warnings to the consumer. The features often embedded within the packaging include logoing the brand, colors, graphics, health warnings, and messages will be produced following the legal requirements of certain countries or agreed terms of international organizations. Such warnings are meant to guide the public on the health consequences of tobacco use; including cancer and heart ailments. Nevertheless, dimensions and positions of the package and the logo can also require certain regulation of the dimensions and locations of the health warnings. Therefore, the packaging of tobacco products is an essential element in the process of marketing tobacco, the creation of awareness, and other concerns of public health, which are linked with the use of tobacco.

- This market deals with various products and customization in the packaging material and design of the cigarettes, cigars, smokeless tobacco and other related products. Technological developments, customer demands, and expansion of rules are some of the factors that impact this segment within the packaging sector. Other important points, related to key factors of this market, include tendencies for using the products, which have lower negative impact on environment, due to the higher level of people’s consciousness as well as requirements of the government. Furthermore, new technologies in packaging seek to improve the utility of packaging and thus the preservation and functionality of the product for human consumption in relation to the health warnings and brand message mandates set down by authorities globally.

- It is important to understand that various market factors influencing the tobacco packaging industry are constantly changing due to fluctuations in consumer spending patterns in different regions and increased government scrutiny. The consumers are gradually pressing for packaging that adheres to health concerns, probably due to efforts being made towards reducing the rate of health complications caused by tobacco use. Further, the choice and role of branding and marketing strategies is highly significant; in particular packaging continues to be seen as a key method of communicating brands and reaching out to the consumers in a saturated market. Especially when the governments of different countries continue to put restrictive requirements on the advertising and packaging of tobacco products, the manufacturers are under pressure to be creative while adhering to the requirements outlined by guidelines and policies which create a shifting landscape where technology is continuously introduced and the regulations that accompany those technologies are also introduced.

Tobacco Packaging Market Trend Analysis

Increasing adoption of sustainable packaging solutions

- One of the most important trends which end users of tobacco packaging are getting more interested in sustainable packaging solutions. This is because as the world becomes more conscious of its impact towards the environment, the pressure to cut on the greenhouse emissions and to refrain from unnecessary production of waste by manufacturers and producers such as the tobacco industries cannot be overlooked. As a result, tobacco and packaging companies are already innovating on using environment saving materials and packaging structures.

- Reduce packaging elements that may harm the environment; use of recyclable materials or biodegradable packs in tobacco products. They also added that it is more common to see manufacturers paying attention to enhancing packaging to be efficient in packaging processes and transportation most likely to support sustainable manufacturing techniques.

- Furthermore, customer’s taste has evolved that the companies who are caring for the environment are also being selected by the customers. This does not only correspond to current regulatory requirements in several locations but likewise constitutes prospects as to how companies may create a competitive advantage in the market place through traditional environmentally friendly packaging products for merchandise that clearly are becoming more sensitive to ecological issues. Therefore, sustainable packaging is one of the key factors that help in setting the pace for the packaging industry’s growth and competitiveness in the tobacco packaging market.

Leveraging technology to enhance product safety, security, and consumer engagement

- In the tobacco packaging market, the best opportunity available for growth is the integration of technology and innovations to improve safety of the product and security of the pack as wells appeals to the consumer. Other advanced packaging methods like smart packaging, security features, and interactivity are opens to creativity.

- For instance, smart packaging is a system that uses sensors or RFID that may help in noting the freshness of foods or the variety of products that are in circulation or any rule and regulation violation. This cutting-edge helps not only in increasing product quality and its shelf-life but in increasing the chain transparency and supply as well.

- Security solutions involving the use of two-dimensional codes using quick response (QR) codes, holographic images, or distinct numerical or alphabetical code numbers to prevent counterfeit goods, a big problem facing the tobacco industry. They have these features that would allow consumers and authorities to check for its validity making sure that brands are protected and consumers would be secured from fakes.

Tobacco Packaging Market Segment Analysis:

Tobacco Packaging Market Segmented on the basis of type and application.

By Type, Cartons Material segment is expected to dominate the market during the forecast period

- It is further identified that cartons material segment is expected to emerge as a fastest growing segment in tobacco packaging market during the forecast period for the following reasons. Cigarette, cigar, and smokeless tobacco packages, being a carton, provides effective and durable ways of packaging. They offer a large area for imprinting brand images and messages, health information and other legal requirements that may be permitted by different courts in various countries. Moreover, cartons can be branded with superior quality graphic for print, innovative finishing techniques that appeals to the eye and creates better visibility at the physical shops.

- In addition, cartons are preferred due to the shield they portray in preserving the qualities of products and offered services throughout the chain. It also notes that consumer preferences together with government regulations are likely to change with time; an aspect in which cartons has the flexibility for the use of sustainable material as well as designs as consumer and government preference for sustainability increase. Hence, the cartons material segment is predicted to uphold its leadership in the tobacco packaging market due to the factors such as functionality, flexibility and receptiveness to market stimuli.

By Application, Cigarette Factory segment expected to held the largest share

- Accordingly, the preponderance of the cigarette factory segment within the tobacco packaging market indicates its significance to satisfy the massive global market for cigarettes. The largest application segment is represented by cigarette factories, which contribute to the packaging production rates while showing distinctive needs regarding the design, strength, and legislational adherence. Such manufacturers have to address the challenges such as legal requirements for health warnings, policies on branding and the consumer trends and concerns when selecting the packaging type and material.

- Furthermore, given the volume of cigarettes produced, there must be proper packaging solutions that will help in maintaining the quality, freshness, and overall attractiveness of the product, all within the framework of sustainability and cost-control initiatives. Thus, it remains instrumental in defining the tobacco packaging market, more broadly, considering on-going technology progresses and regulatory changes in the segment of the cigarette factory and its products.

Tobacco Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In the coming years, it can be stated that Asia Pacific will account for the largest share of the tobacco packaging market due to the several dynamics. This is due to the higher demands in this region that come from a larger and growing population who are experiencing urbanisation and whose disposable income is steadily improving and hence, the demand for adequate packaging for tobacco products increases. More to the point, new regulations that focus on exploring increased measures of packaging and enhanced cautionary logos inclusive of countries like Australia, India, and China have an impact on the market. In addition to shaping the branding visuals that we observe on packaging, these regulations impact the development of environmentally friendly and conformant solutions.

- Moreover, the existence of a strategic manufacturing share and progression in packaging materials, and machinery in Asia Pacific unearths the region as a critical maker for novel tobacco packaging. Meanwhile, Asia Pacific continues to dominate the tobacco packaging market and is expected to protect high growth prospects for vendors within the region as these trends continue to unfold.

Active Key Players in the Tobacco Packaging Market

- Amcor plc (Australia)

- Ball Corporation (United States)

- Bemis Company, Inc. (United States)

- Berry Global, Inc. (United States)

- Graphic Packaging Holding Company (United States)

- Hindustan Tin Works Ltd (India)

- Huhtamaki Group (Finland)

- Innovia Films Ltd (United Kingdom)

- ITC Limited (India)

- MeadWestvaco Corporation (United States)

- Mondi plc (United Kingdom)

- Reynolds Group Holdings Limited (New Zealand)

- RPC Group plc (United Kingdom)

- Sonoco Products Company (United States)

- WestRock Company (United States), Other key Players.

Tobacco Packaging Market Scope:

|

Global Tobacco Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.77% |

Market Size in 2032: |

USD 27.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tobacco Packaging Market by Type (2018-2032)

4.1 Tobacco Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cartons Material

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Film Material

Chapter 5: Tobacco Packaging Market by Application (2018-2032)

5.1 Tobacco Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cigarette Factory

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Packaging Plant

5.5 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Tobacco Packaging Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMCOR PLC (AUSTRALIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BALL CORPORATION (UNITED STATES)

6.4 BEMIS COMPANY INC. (UNITED STATES)

6.5 BERRY GLOBAL INC. (UNITED STATES)

6.6 GRAPHIC PACKAGING HOLDING COMPANY (UNITED STATES)

6.7 HINDUSTAN TIN WORKS LTD (INDIA)

6.8 HUHTAMAKI GROUP (FINLAND)

6.9 INNOVIA FILMS LTD (UNITED KINGDOM)

6.10 ITC LIMITED (INDIA)

6.11 MEADWESTVACO CORPORATION (UNITED STATES)

6.12 MONDI PLC (UNITED KINGDOM)

6.13 REYNOLDS GROUP HOLDINGS LIMITED (NEW ZEALAND)

6.14 RPC GROUP PLC (UNITED KINGDOM)

6.15 SONOCO PRODUCTS COMPANY (UNITED STATES)

6.16 WESTROCK COMPANY (UNITED STATES)

6.17 OTHER KEY PLAYERS

Chapter 7: Global Tobacco Packaging Market By Region

7.1 Overview

7.2. North America Tobacco Packaging Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Cartons Material

7.2.4.2 Film Material

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Cigarette Factory

7.2.5.2 Packaging Plant

7.2.5.3 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Tobacco Packaging Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Cartons Material

7.3.4.2 Film Material

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Cigarette Factory

7.3.5.2 Packaging Plant

7.3.5.3 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Tobacco Packaging Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Cartons Material

7.4.4.2 Film Material

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Cigarette Factory

7.4.5.2 Packaging Plant

7.4.5.3 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Tobacco Packaging Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Cartons Material

7.5.4.2 Film Material

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Cigarette Factory

7.5.5.2 Packaging Plant

7.5.5.3 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Tobacco Packaging Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Cartons Material

7.6.4.2 Film Material

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Cigarette Factory

7.6.5.2 Packaging Plant

7.6.5.3 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Tobacco Packaging Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Cartons Material

7.7.4.2 Film Material

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Cigarette Factory

7.7.5.2 Packaging Plant

7.7.5.3 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Tobacco Packaging Market Scope:

|

Global Tobacco Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.24 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.77% |

Market Size in 2032: |

USD 27.74 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Tobacco Packaging Market research report is 2024-2032.

Amcor plc (Australia), Ball Corporation (United States), Bemis Company, Inc. (United States), Berry Global, Inc. (United States) and Other Major Players.

The Tobacco Packaging Market is segmented into Type, Application, and region. By Type, the market is categorized into Cartons Material, Film Material. By Application, the market is categorized into Cigarette Factory, Packaging Plant, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Tobacco packaging as a strategic asset entails the materials and characterization of the outer and internal covers or wraps of tobacco products including the cigarette, cigars, and pipe tobacco. It fulfills both the functional and informative uses to present the tobacco product and communicate brand ing and health information as well as regulatory warnings to the consumer. The features often embedded within the packaging include logoing the brand, colors, graphics, health warnings, and messages will be produced following the legal requirements of certain countries or agreed terms of international organizations. Such warnings are meant to guide the public on the health consequences of tobacco use; including cancer and heart ailments. Nevertheless, dimensions and positions of the package and the logo can also require certain regulation of the dimensions and locations of the health warnings. Therefore, the packaging of tobacco products is an essential element in the process of marketing tobacco, the creation of awareness, and other concerns of public health, which are linked with the use of tobacco.