Targeted Sequencing and Resequencing Market Synopsis

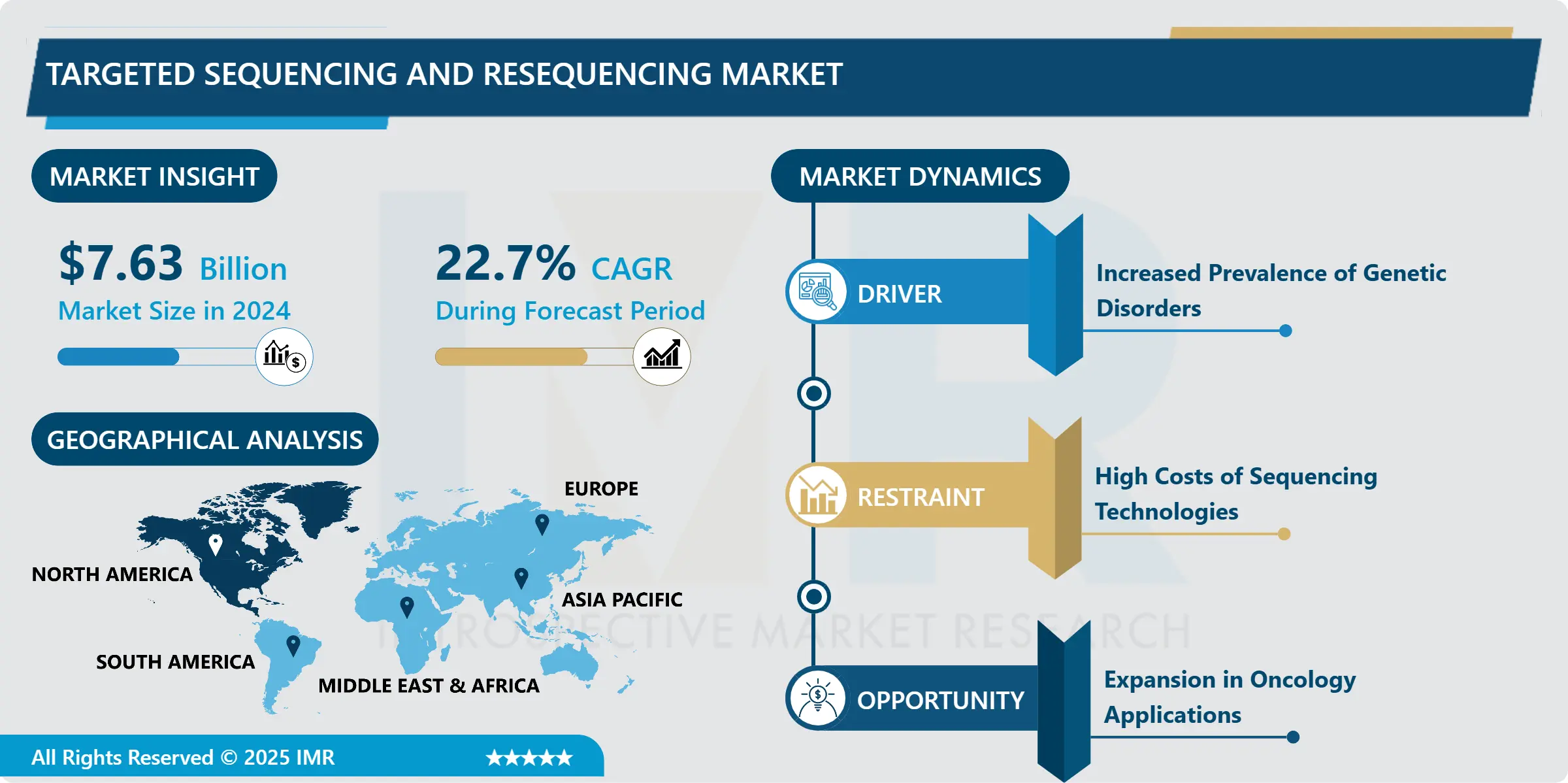

Targeted Sequencing and Resequencing Market Size is Valued at USD 7.63 Billion in 2024, and is Projected to Reach USD 72.41 Billion by 2035, Growing at a CAGR of 22.7% From 2025-2035.

This report is focusing on Targeted Sequencing and Resequencing market, which is a subset of genomic analysis, is expected to be more efficient and comparatively cheaper to whole-genome sequencing. This market contains different technologies such as amplicon and hybridization-based sequencing and find its usage in many fields like oncology, rare genetic disorder, immunology and infectious disease. Buyers are academic and research labs, pharmaceutical and biotechnology firms, hospitals, and diagnostic centers. The market can also be categorized in terms of geography as its application in the regions namely North America, Europe, Asia-Pacific, Latin America and the Middle East-Africa.

The targeted sequencing and resequencing market is mainly defined by the growing incidence of genetic disorders and cancer, which requires accurate diagnostic and treatment solutions. The increasing need for a better understanding of the patient’s variation and the consequent increase in genetically based treatments, aka personalized medicine, pushes the market forward at a tremendous rate. Other factors include; improvements in sequencing methods increasing the accuracy, the time taken to complete sequencing, and the cost of the process. Targeted sequencing in oncology, immunology, infectious diseases, and many other fields have shown increasing interest and demand for their use and thus boost the market growth.

Also, the increasing focus on investing in genomics and expansion in the number of partnerships between academic institutions and pharma companies propels the market growth. The importance of expanding the use of next-generation sequencing (NGS) in clinical diagnostics, and the creation of sophisticated tools for bioinformatics analysis of the obtained data are also driving this market. In addition, the availability of government grants and reimbursement for genomic analysis, the growing understanding of the value of accurate early disease detection and tailored treatments, and technological advances will propel the market’s growth.

Targeted Sequencing and Resequencing Market Trend Analysis

Precision Medicine and Its Impact on the Targeted Sequencing Industry

- The Targeted Sequencing and Resequencing Market is growing at a rapid pace because of the developments in the new sequencing technologies and for shifting focus on precision medicine. It remains that one of the critical factors stimulating this market is the increasing use of NGS techniques that provide increased accuracy, speed, and cost, compared to conventional methods. As a result, their use has increased in clinical diagnostics, especially in oncology; where Next Generation Sequencing is employed for targeted sequencing for various genes that are related with different types off cancer. Also, growing cases of genetic disorders, increasing importance and awareness about the need for genetic testing for early and custom treatment plans are also fueling the market. Other trends that expand the opportunities and effectiveness of targeted sequencing and resequing include the emergence of new generation sequencing platforms and the application of AI and bioinformatics tools for data processing.

- Another big trend is in the growth of the scope of target sequencing not only in oncology but also in immunology, infection diseases, and other rare hereditary diseases. Major events such as the COVID-19 pandemic ascended the utilization that was previously set for the precise sequencing in analyzing the mutation and spread of the virus. Also, the academic organizations’ collaboration with the pharmaceutical industries and diagnostic labs has helped in increasing its market share. This is because regulatory approvals have been giving and funding in the genomics market has been availing, both of which fuel the market. In the same regard, the enhanced medical implementation of personalized medicine as well as better understanding of the opportunity by the healthcare practitioners and patients should provide a stable market growth in the following years.

Unlocking Genomic Potential, Opportunities in the Targeted Sequencing and Resequencing Market

- Based on these factors, the Targeted Sequencing and Resequencing Market is expected to grow at a tremendous rate mainly because of the development in genomic studies and the incidence of hereditary diseases. This need is rationalized by the current demand for precision medicine, of which efficient and accurate sequencing forms the core need. It is important at this juncture to discuss that targeted sequencing is another process that is fast and cheap compared to the whole-genome sequencing but can sequence only a particular region of the genome. This has resulted to its popularity in functions such as in oncology where it is used for detecting mutations associated with cancer and in diagnosing rare genetic diseases. Furthermore, the combination of bioinformatics and the emergence of new sequencing platforms ensures that targeted sequencing is gaining increased accuracy and quickening of such sequencing, thereby making it even more versatile.

- Furthermore, there is a probability of an increase in relations between academia, pharma, and diagnostic labs going forward. They are important for the further advancement and the introduction to the market of new sequencing technologies and their uses. Another factor is the growing governmental and private organizations funding in genomics also plays a vital role especially in the North America and Europe. In the emerging economies, the increase of health-care sector and the increased consciousness about the subject of genetics and their examination are the extra opportunities for the market growth. This shows a trend of increase for the usage of this technology in the routine clinical practice and hence promising growth for the stakeholders.

Targeted Sequencing and Resequencing Market Segment Analysis:

Targeted Sequencing and Resequencing Market Segmented on the basis of Technology, application, and end-users.

By Technology, Amplicon Sequencing segment is expected to dominate the market during the forecast period

- The Targeted Sequencing and Resequencing Market is categorized by technology into two main segments: Target Hypothesis Genotyping by Amplicon Sequencing and Hybridization-based Targeted Sequencing. The method of Amplicon Sequencing which encompasses the amplification of some portions of the DNA is commonly used because of its cheap costs and ease in identifying the known variants. Hybridization-based targeted sequencing is the other approach that involves use of probes to selectively isolate and amplify the regions of interest, thus having higher precision and the advantage of identifying new mutations. Both are essential in the improvement of precision medicine and optimization of genetic examination.

By Application, Oncology segment held the largest share in 2024

- The Targeted Sequencing and Resequencing Market is segmented by application into several key areas: Lung cancer in which it is used to detect the cancer-related mutations and design the therapy plans; Rare Genetic Diseases which gives vital information and diagnostic as well as management of diseases; Immunology through which it supports in the work and cure of immunologic diseases; Infectious Diseases through which it supports the identification of the pathogens as well as the tracking of the pathogens; Many other branches of medical and biological science. Essentially, these applications demonstrate the value of targeted sequencing technologies and show that their applications are diverse and extend to virtually all areas of medicine and biology.

Targeted Sequencing and Resequencing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America’s targeted sequencing and resequencing market is growing at a vigorous pace due to the factors such as, presence of prominent companies in biotechnology and pharmaceutical industries, well-developed healthcare system, and higher investment in research and development. A recent objectification in cancer and rare genetic disorders’ frequency has amplified the need for correct diagnosing equipment and individualized medicine that targeted sequencing offers. Market growth has also been accelerated by the advancement of the next-generation sequencing (NGS) technologies in molecular biology research centers as well as clinical laboratories. The leading market players such as Illumina and Thermo Fisher Scientific and Agilent Technologies always strive for new market offerings in terms of products as per the market demand.

- Moreover, the availability of encouraging government policies, and grants and subsidies, particularly in genomics research, drive the market in North America. Various funding organizations such as the U. S. National Institutes of Health (NIH) have advocated for genomic research, which in turn has led to the enhancement of the use of targeted sequencing procedures. Canada also has a great contribution with its growing biotechnology industry and joint research initiative. North America holds a large portion of the targeted sequencing and resequencing market mainly due to the availability of skilled professionals and better technological setup and is expected to grow and develop continuously in the future.

Active Key Players in the Targeted Sequencing and Resequencing Market

- Illumina, Inc. (United States)

- Thermo Fisher Scientific, Inc. (United States)

- Roche Holding AG (Switzerland)

- Agilent Technologies, Inc. (United States)

- QIAGEN N.V. (Netherlands)

- BGI Genomics Co., Ltd. (China)

- Bio-Rad Laboratories, Inc. (United States)

- PerkinElmer, Inc. (United States)

- Oxford Nanopore Technologies Ltd (United Kingdom)

- Guardant Health, Inc. (United States)

- Others

|

Global Targeted Sequencing and Resequencing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.63 Bn. |

|

Forecast Period 2025-35 CAGR: |

22.7 % |

Market Size in 2035: |

USD 72.41 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Targeted Sequencing and Resequencing Market by Technology (2018-2035)

4.1 Targeted Sequencing and Resequencing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Amplicon Sequencing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybridization-based Targeted Sequencing

Chapter 5: Targeted Sequencing and Resequencing Market by Application (2018-2032)

5.1 Targeted Sequencing and Resequencing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rare Genetic Disorders

5.5 Immunology

5.6 Infectious Diseases

5.7 Others

Chapter 6: Targeted Sequencing and Resequencing Market by End User (2018-2035)

6.1 Targeted Sequencing and Resequencing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Academic and Research Institutions

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceutical and Biotechnology Companies

6.5 Hospitals and Clinics

6.6 Diagnostic Laboratories

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Targeted Sequencing and Resequencing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ILLUMINA INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

7.4 ROCHE HOLDING AG (SWITZERLAND)

7.5 AGILENT TECHNOLOGIES INC. (UNITED STATES)

7.6 QIAGEN N.V. (NETHERLANDS)

7.7 BGI GENOMICS COLTD. (CHINA)

7.8 BIO-RAD LABORATORIES INC. (UNITED STATES)

7.9 PERKINELMER INC. (UNITED STATES)

7.10 OXFORD NANOPORE TECHNOLOGIES LTD (UNITED KINGDOM)

7.11 GUARDANT HEALTH INC. (UNITED STATES)

7.12 OTHERS

Chapter 8: Global Targeted Sequencing and Resequencing Market By Region

8.1 Overview

8.2. North America Targeted Sequencing and Resequencing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Technology

8.2.4.1 Amplicon Sequencing

8.2.4.2 Hybridization-based Targeted Sequencing

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Oncology

8.2.5.2 Rare Genetic Disorders

8.2.5.3 Immunology

8.2.5.4 Infectious Diseases

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Academic and Research Institutions

8.2.6.2 Pharmaceutical and Biotechnology Companies

8.2.6.3 Hospitals and Clinics

8.2.6.4 Diagnostic Laboratories

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Targeted Sequencing and Resequencing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Technology

8.3.4.1 Amplicon Sequencing

8.3.4.2 Hybridization-based Targeted Sequencing

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Oncology

8.3.5.2 Rare Genetic Disorders

8.3.5.3 Immunology

8.3.5.4 Infectious Diseases

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Academic and Research Institutions

8.3.6.2 Pharmaceutical and Biotechnology Companies

8.3.6.3 Hospitals and Clinics

8.3.6.4 Diagnostic Laboratories

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Targeted Sequencing and Resequencing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Technology

8.4.4.1 Amplicon Sequencing

8.4.4.2 Hybridization-based Targeted Sequencing

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Oncology

8.4.5.2 Rare Genetic Disorders

8.4.5.3 Immunology

8.4.5.4 Infectious Diseases

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Academic and Research Institutions

8.4.6.2 Pharmaceutical and Biotechnology Companies

8.4.6.3 Hospitals and Clinics

8.4.6.4 Diagnostic Laboratories

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Targeted Sequencing and Resequencing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Technology

8.5.4.1 Amplicon Sequencing

8.5.4.2 Hybridization-based Targeted Sequencing

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Oncology

8.5.5.2 Rare Genetic Disorders

8.5.5.3 Immunology

8.5.5.4 Infectious Diseases

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Academic and Research Institutions

8.5.6.2 Pharmaceutical and Biotechnology Companies

8.5.6.3 Hospitals and Clinics

8.5.6.4 Diagnostic Laboratories

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Targeted Sequencing and Resequencing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Technology

8.6.4.1 Amplicon Sequencing

8.6.4.2 Hybridization-based Targeted Sequencing

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Oncology

8.6.5.2 Rare Genetic Disorders

8.6.5.3 Immunology

8.6.5.4 Infectious Diseases

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Academic and Research Institutions

8.6.6.2 Pharmaceutical and Biotechnology Companies

8.6.6.3 Hospitals and Clinics

8.6.6.4 Diagnostic Laboratories

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Targeted Sequencing and Resequencing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Technology

8.7.4.1 Amplicon Sequencing

8.7.4.2 Hybridization-based Targeted Sequencing

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Oncology

8.7.5.2 Rare Genetic Disorders

8.7.5.3 Immunology

8.7.5.4 Infectious Diseases

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Academic and Research Institutions

8.7.6.2 Pharmaceutical and Biotechnology Companies

8.7.6.3 Hospitals and Clinics

8.7.6.4 Diagnostic Laboratories

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Targeted Sequencing and Resequencing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7.63 Bn. |

|

Forecast Period 2025-35 CAGR: |

22.7 % |

Market Size in 2035: |

USD 72.41 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||