Sweet Dark Chocolate Market Synopsis

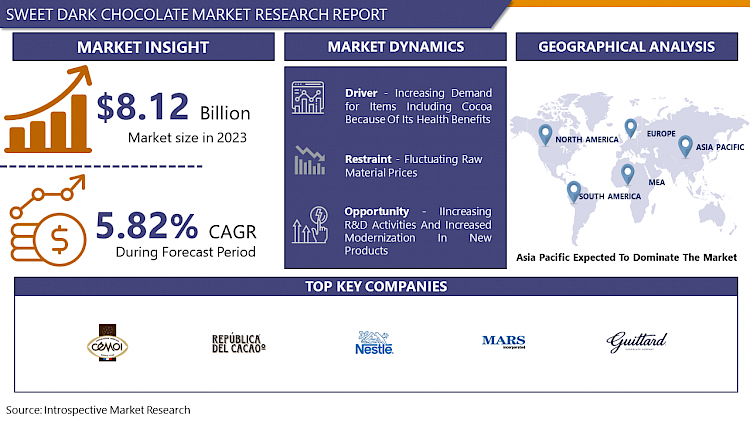

The Global Sweet Dark Chocolate Market size was reasonably estimated to be approximately USD 8.12 Billion in 2023 and is poised to generate revenue over USD 13.52 Billion by the end of 2032, projecting a CAGR of around 5.82% from 2024 to 2032.

An indulgence is thought to be dark chocolate. It is richer than milk chocolate and frequently combined with cheese and wine to provide a mouth-watering experience. Due to its dryness, harsh aftertaste, and gritty texture, dark chocolate has a deeper chocolate flavor than milk chocolate and does not include milk solids. It covers numerous health-promoting capabilities bioactive components polyphenols, flavonoids, procyanidins, theobromines, and nutrients and minerals that control the immune system of humans. It consults safeguards against cardiovascular diseases, certain forms of cancers, and other mind-associated disorders like Alzheimer’s disease, Parkinson’s disease. Dark chocolate is measured as a useful meal because of its anti-diabetic, anti-inflammatory, and anti-microbial properties. It additionally has a properly hooked-up function in weight management and the alteration of a lipid profile in a healthy way.

- The main components of dark chocolate are sugar, cocoa beans, and emulsifiers like lecithin to maintain texture and flavors like vanilla. Dark chocolate is chocolate that doesn't have any additional milk solids.

- Cacao beans, sugar, an emulsifier such as soy lecithin to maintain texture, and flavorings like vanilla make up the basic ingredients. Dark chocolate will taste harsh and have a higher cocoa content and lower sugar content; a small amount is regarded as a healthy snack.

- Its flavor makes it a favorite kind of chocolate for melting and baking a range of sweets. Finding sweet dark chocolate will let you enjoy a superlative experience, even if dark chocolate is typically meant to be bitter compared to milk chocolate. A bar of darker chocolate that has been sweetened can help you satisfy your sweet tooth's yearning and avoid any guilt.

Sweet Dark Chocolate Market Trend Analysis

Increasing Demand for Items Including Cocoa Because Of Its Health Benefits

- Cocoa is the primary ingredient used in the production of chocolate. The segment of society that prioritizes health is against eating chocolate. A nutritionist suggests refraining from chocolate to prevent obesity, and anxious mothers restrict their kids' access to it to prevent dental caries. They are true yet cocoa is one of the foods that are good for your health if you eat chocolate in moderation. Polyphenols, particularly flavonoids with their high antioxidant activity, are abundant in cocoa.

- According to reports, the dry weight percentage of polyphenols in cocoa ranges between 6 and 8%. These flavonoids are thought to be responsible for the positive health effects of cocoa and chocolate. More flavonoids are found in cocoa than in red wine or tea. In many related health conditions, including heart disease, cancer, stroke, disorders of the insulin system, vascular diseases, and many others, high levels of flavonoids improve their benefits.

- Although fine-flavored cocoa only makes up a small percentage of total cocoa production, its demand has recently increased. This is mostly due to end users' increasing preference for specialty or premium chocolate.

- In North America and Western Europe, there is a particularly high demand for premium chocolate. Despite the fact that only a small proportion of customers presently purchase these expensive chocolates due to their high prices, market penetration is increasing steadily. Leading chocolate manufacturers like Ferrero and Mars have invested in expanding their product lines as a result.

- The contents of the dark cholate help to give benefits to the body. The protein, fat and higher amount of energy are provided through dark chocolate so the consumption of dark chocolate increasing and thus increasing the consumption due to protein, fat, and Energy demand for dark chocolate increasing so these are the factor driving the growth of the Dark chocolate Market.

Increasing R&D Activities and Increased Modernization In New Products

- Manufacturers are focusing on combining natural sugars, such as stevia and coconut sugar, in order to pitch their product to a customer base that is very aware of the food choices they make. The stated emphasis on quality has suggested that manufacturers are currently focusing on including distinctive chocolate beans from Latin American countries.

- Although obtaining these premium ingredients from far-off locations raises the price of the completed product, growing consumer interest in gourmet chocolate is creating profitable market prospects. In the past, the demand for dried fruits used in the production of dark chocolate—such as blueberries and cranberries—has steadily expanded.

- Citrus flavors, vegetables, nuts, cereals, unique fruits, rare cocoa, flowers, flavor combinations, and others are among the latest, cutting-edge components employed in the chocolate industry. The diabetic population has been drawn to chocolate products because they contain healthful ingredients like stevia, honey, lactose-free chocolate ingredients, non-hydrogenated fats, and others. These developments significantly contribute to increasing opportunities in the market for different chocolate products. Innovative new products and consumers attract to new innovations in dark chocolate so expecting major opportunities for the Sweet Dark Chocolate Market.

Segmentation Analysis Of Sweet Dark Chocolate Market

Sweet Dark Chocolate Market segments cover the Type, Product, Application, and Distribution Channel. By Type, 70% Cocoa Dark Chocolate segment is Anticipated to Dominate the Market Over the Forecast period.

- A dark chocolate bar with a 70% cocoa content means that the cocoa bean alone provided 70% of the components used to create the chocolate. The remaining 30% will be made up of additional ingredients, mostly sugar, but they could also contain extremely minor amounts of vanilla flavouring.

- Generally speaking, dark chocolate that contains a larger percentage of cacao solids has fatter than sugar. It is advisable to choose dark chocolate that contains at least 70% cacao solids or more because more cacao also means more flavanols.

- This chocolate bar magically mixes all of your favourite salty, nutty, and sweet flavours into one delicious package. In Boulder, Colorado, in the United States, Chocolove's chocolate is produced using the traditional methods used by the best chocolatiers in Europe. Each Chocolove bar comes with a love poem enclosed in its wrapper and is made "with love" from all-natural ingredients.

Regional Analysis of the Sweet Dark Chocolate Market

Europe is Expected to Dominate the Market Over the Forecast Period.

- Europe dominated the global market in 2021, with a value of USD 19.95 billion. Belgium, the Netherlands, Germany, and Switzerland are home to several of the world's largest industrial chocolate producers, making Europe a center for the manufacturing of industrial chocolate.

- The region is the top producer and consumer of chocolate and chocolate-related goods. Because European consumers source cocoa beans of varied quality and origins to satisfy the need of the cocoa and chocolate industries, the European cocoa market is extremely diverse.

- Europe is the leading importer of cocoa beans worldwide, with 61% of global imports. The Center for the Promotion of Imports from Developing Countries (CBI) estimates that Europe imported 2.3 million tonnes of cocoa beans overall in 2020. Between 2016 and 2020, direct imports to Europe from nations that produce chocolate climbed by 1.4%.

- The demand for chocolate made with responsibly sourced cocoa has also increased as consumers' understanding of sustainable cocoa production has grown. The regional sustainability platforms are working more closely together to increase transparency.

Covid-19 Impact Analysis On Sweet Dark Chocolate Market

- Low sales volumes driven on by the COVID-19 pandemic as well as supply-side problems with quality and certification had an effect on the cocoa market. The Fine Cacao & Chocolate Institute (FCCI) undertook a study on the COVID-19 pandemic's effects on exports, and the findings were alarming. In the Dominican Republic, sources state that the strict lockdown prevented farmers and producers from visiting the plantations for a number of weeks before the government authorized exceptions.

- A growing number of specialized stores are closing for an extended length of time as a result of the disruption in the chain of supply for raw materials, which was then followed by a lockdown, and the amount of luxury chocolates being consumed is dropping.A survey was undertaken by the Fine Cacao and Chocolate Institute (FCCI) to determine how COVID-19 will affect small enterprises that make chocolate.

- According to the survey, businesses in this market area are reporting declining sales and client demand. These businesses also experience supply and capital flow shortages, which restrict their investment. The supply-demand gap has widened as a result of the lockdown that has been enacted in a number of nations' transportation systems, which has adversely affected both domestic and international supply chains. Thus, it is expected that a lack of raw material supply will slow down the manufacture of dark chocolate, which will have a negative effect on the market's growth.

Top Key Players Covered in Sweet Dark Chocolate Market

- Cemoi Chocolatier (France)

- Republica del Cacao (Ecuador)

- Nestlé S.A. (Switzerland)

- Mars Incorporated (U.S.)

- Fuji Oil Holdings Inc. (Japan)

- Guittard Chocolate Co. (U.S.)

- Ghirardelli Chocolate Co. (U.S.)

- Varihona Inc. (France)

- Barry Callebaut AG (Switzerland)

- Alpezzi Chocolate SA De CV (Mexico)

- Kerry Group Plc (Ireland)

- Olam International Ltd. (Singapore)

- Tcho Ventures Inc. (U.S.)

- The Hershey Company (U.S.)

- Cargill Incorporated (U.S.)

- Blommer Chocolate Company (U.S.)

- Foley's Candies LP (Canada)

- Puratos Group Nv (Belgium)

- Ferrero International S.A. (Italy)

- Mars, Inc, (U.S.)

- Mondelez International (U.S.)

- Meiji Co Ltd (Japan)

- Lindt, Ritter Sport (Switzerland)

- Amul, Blommer Chocolate Company (India)

- Brookside Foods (Canada)

- Chocolate Frey (Switzerland)

- Ezaki Glico (Japan) and Other Major Players

Key Industry Developments in the Sweet Dark Chocolate Market

- In February 2023, Tony Chocolonely, a Dutch ethical chocolate brand, launched its first oat milk chocolate bar. This move caters to the growing demand for plant-based alternatives in the dark chocolate market.

- In March 2023, Theo Chocolate, an American craft chocolate maker, launched its Single Source Madagascar 75% Dark Chocolate. This bar highlights the unique flavor profile of Madagascan cocoa beans and caters to the growing trend of single-origin dark chocolate.

- In May 2023, Swiss chocolate giant Lindt & Sprüngli announced the acquisition of Russel Stover Chocolates, an American confectionery company known for its dark chocolate offerings. This move strengthens Lindt's presence in the North American market and expands its dark chocolate portfolio.

- In June 2023, Hershey's, a major American chocolate company, launched its Special Dark Crafted Collection. This line features three dark chocolate bars infused with unique ingredients like sea salt and almonds, targeting consumers seeking gourmet dark chocolate experiences.

- In July 2023, Nestlé acquired Van Mouten, a Dutch cocoa processor known for its high-quality dark chocolate ingredients. This acquisition gives Nestlé greater control over its supply chain and allows it to develop new dark chocolate products with unique flavors and textures.

|

Global Sweet Dark Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.12 Bn. |

|

Forecast Period 2024 - 32 CAGR: |

5.82% |

Market Size in 2032: |

USD 13.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Product

3.3 By Application

3.4 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Sweet Dark chocolate Market by Type

5.1 Sweet Dark chocolate Market Overview Snapshot and Growth Engine

5.2 Sweet Dark chocolate Market Overview

5.3 70% Cocoa Dark Chocolate

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 70% Cocoa Dark Chocolate: Geographic Segmentation

5.4 75% Cocoa Dark Chocolate

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 75% Cocoa Dark Chocolate: Geographic Segmentation

5.5 80% Cocoa Dark Chocolate

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 80% Cocoa Dark Chocolate: Geographic Segmentation

5.6 90% Cocoa Dark Chocolate

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 90% Cocoa Dark Chocolate: Geographic Segmentation

Chapter 6: Sweet Dark chocolate Market by Product

6.1 Sweet Dark chocolate Market Overview Snapshot and Growth Engine

6.2 Sweet Dark chocolate Market Overview

6.3 Bitter Chocolate

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Bitter Chocolate: Geographic Segmentation

6.4 Pure Bitter Chocolate

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pure Bitter Chocolate: Geographic Segmentation

6.5 Semi-Sweet Chocolate

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Semi-Sweet Chocolate: Geographic Segmentation

6.6 Organic Dark Chocolates

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Organic Dark Chocolates: Geographic Segmentation

6.7 Inorganic Dark Chocolates

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Inorganic Dark Chocolates: Geographic Segmentation

Chapter 7: Sweet Dark chocolate Market by Application

7.1 Sweet Dark chocolate Market Overview Snapshot and Growth Engine

7.2 Sweet Dark chocolate Market Overview

7.3 Beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Beverages: Geographic Segmentation

7.4 Food And bakery

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Food And bakery: Geographic Segmentation

7.5 Personal Care & Cosmetics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Personal Care & Cosmetics: Geographic Segmentation

7.6 Pharmaceuticals

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Pharmaceuticals: Geographic Segmentation

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation

Chapter 8: Sweet Dark chocolate Market by Distribution Channel

8.1 Sweet Dark chocolate Market Overview Snapshot and Growth Engine

8.2 Sweet Dark chocolate Market Overview

8.3 Supermarket/Hypermarket

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Supermarket/Hypermarket: Geographic Segmentation

8.4 Speciality Store

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Speciality Store: Geographic Segmentation

8.5 Convenience Store

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Convenience Store: Geographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Sweet Dark chocolate Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Sweet Dark chocolate Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Sweet Dark chocolate Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CEMOI CHOCOLATIER (FRANCE)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 REPUBLICA DEL CACAO (ECUADOR)

9.4 NESTLÉ S.A. (SWITZERLAND)

9.5 MARS INCORPORATED (U.S.)

9.6 FUJI OIL HOLDINGS INC. (JAPAN)

9.7 GUITTARD CHOCOLATE CO. (U.S.)

9.8 GHIRARDELLI CHOCOLATE CO. (U.S.)

9.9 VARIHONA INC. (FRANCE)

9.10 BARRY CALLEBAUT AG (SWITZERLAND)

9.11 ALPEZZI CHOCOLATE SA DE CV (MEXICO)

9.12 KERRY GROUP PLC (IRELAND)

9.13 OLAM INTERNATIONAL LTD. (SINGAPORE)

9.14 TCHO VENTURES INC. (U.S.)

9.15 THE HERSHEY COMPANY (U.S.)

9.16 CARGILL INCORPORATED (U.S.)

9.17 OTHER MAJOR PLAYERS

Chapter 10: Global Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 70% Cocoa Dark Chocolate

10.2.2 75% Cocoa Dark Chocolate

10.2.3 80% Cocoa Dark Chocolate

10.2.4 90% Cocoa Dark Chocolate

10.3 Historic and Forecasted Market Size By Product

10.3.1 Bitter Chocolate

10.3.2 Pure Bitter Chocolate

10.3.3 Semi-Sweet Chocolate

10.3.4 Organic Dark Chocolates

10.3.5 Inorganic Dark Chocolates

10.4 Historic and Forecasted Market Size By Application

10.4.1 Beverages

10.4.2 Food And bakery

10.4.3 Personal Care & Cosmetics

10.4.4 Pharmaceuticals

10.4.5 Others

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Supermarket/Hypermarket

10.5.2 Speciality Store

10.5.3 Convenience Store

10.5.4 Others

Chapter 11: North America Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 70% Cocoa Dark Chocolate

11.4.2 75% Cocoa Dark Chocolate

11.4.3 80% Cocoa Dark Chocolate

11.4.4 90% Cocoa Dark Chocolate

11.5 Historic and Forecasted Market Size By Product

11.5.1 Bitter Chocolate

11.5.2 Pure Bitter Chocolate

11.5.3 Semi-Sweet Chocolate

11.5.4 Organic Dark Chocolates

11.5.5 Inorganic Dark Chocolates

11.6 Historic and Forecasted Market Size By Application

11.6.1 Beverages

11.6.2 Food And bakery

11.6.3 Personal Care & Cosmetics

11.6.4 Pharmaceuticals

11.6.5 Others

11.7 Historic and Forecasted Market Size By Distribution Channel

11.7.1 Supermarket/Hypermarket

11.7.2 Speciality Store

11.7.3 Convenience Store

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 US

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Eastern Europe Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 70% Cocoa Dark Chocolate

12.4.2 75% Cocoa Dark Chocolate

12.4.3 80% Cocoa Dark Chocolate

12.4.4 90% Cocoa Dark Chocolate

12.5 Historic and Forecasted Market Size By Product

12.5.1 Bitter Chocolate

12.5.2 Pure Bitter Chocolate

12.5.3 Semi-Sweet Chocolate

12.5.4 Organic Dark Chocolates

12.5.5 Inorganic Dark Chocolates

12.6 Historic and Forecasted Market Size By Application

12.6.1 Beverages

12.6.2 Food And bakery

12.6.3 Personal Care & Cosmetics

12.6.4 Pharmaceuticals

12.6.5 Others

12.7 Historic and Forecasted Market Size By Distribution Channel

12.7.1 Supermarket/Hypermarket

12.7.2 Speciality Store

12.7.3 Convenience Store

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Bulgaria

12.8.2 The Czech Republic

12.8.3 Hungary

12.8.4 Poland

12.8.5 Romania

12.8.6 Rest of Eastern Europe

Chapter 13: Western Europe Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 70% Cocoa Dark Chocolate

13.4.2 75% Cocoa Dark Chocolate

13.4.3 80% Cocoa Dark Chocolate

13.4.4 90% Cocoa Dark Chocolate

13.5 Historic and Forecasted Market Size By Product

13.5.1 Bitter Chocolate

13.5.2 Pure Bitter Chocolate

13.5.3 Semi-Sweet Chocolate

13.5.4 Organic Dark Chocolates

13.5.5 Inorganic Dark Chocolates

13.6 Historic and Forecasted Market Size By Application

13.6.1 Beverages

13.6.2 Food And bakery

13.6.3 Personal Care & Cosmetics

13.6.4 Pharmaceuticals

13.6.5 Others

13.7 Historic and Forecasted Market Size By Distribution Channel

13.7.1 Supermarket/Hypermarket

13.7.2 Speciality Store

13.7.3 Convenience Store

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Germany

13.8.2 UK

13.8.3 France

13.8.4 Netherlands

13.8.5 Italy

13.8.6 Russia

13.8.7 Spain

13.8.8 Rest of Western Europe

Chapter 14: Asia Pacific Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 70% Cocoa Dark Chocolate

14.4.2 75% Cocoa Dark Chocolate

14.4.3 80% Cocoa Dark Chocolate

14.4.4 90% Cocoa Dark Chocolate

14.5 Historic and Forecasted Market Size By Product

14.5.1 Bitter Chocolate

14.5.2 Pure Bitter Chocolate

14.5.3 Semi-Sweet Chocolate

14.5.4 Organic Dark Chocolates

14.5.5 Inorganic Dark Chocolates

14.6 Historic and Forecasted Market Size By Application

14.6.1 Beverages

14.6.2 Food And bakery

14.6.3 Personal Care & Cosmetics

14.6.4 Pharmaceuticals

14.6.5 Others

14.7 Historic and Forecasted Market Size By Distribution Channel

14.7.1 Supermarket/Hypermarket

14.7.2 Speciality Store

14.7.3 Convenience Store

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 China

14.8.2 India

14.8.3 Japan

14.8.4 South Korea

14.8.5 Malaysia

14.8.6 Thailand

14.8.7 Vietnam

14.8.8 The Philippines

14.8.9 Australia

14.8.10 New Zealand

14.8.11 Rest of APAC

Chapter 15: Middle East & Africa Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 70% Cocoa Dark Chocolate

15.4.2 75% Cocoa Dark Chocolate

15.4.3 80% Cocoa Dark Chocolate

15.4.4 90% Cocoa Dark Chocolate

15.5 Historic and Forecasted Market Size By Product

15.5.1 Bitter Chocolate

15.5.2 Pure Bitter Chocolate

15.5.3 Semi-Sweet Chocolate

15.5.4 Organic Dark Chocolates

15.5.5 Inorganic Dark Chocolates

15.6 Historic and Forecasted Market Size By Application

15.6.1 Beverages

15.6.2 Food And bakery

15.6.3 Personal Care & Cosmetics

15.6.4 Pharmaceuticals

15.6.5 Others

15.7 Historic and Forecasted Market Size By Distribution Channel

15.7.1 Supermarket/Hypermarket

15.7.2 Speciality Store

15.7.3 Convenience Store

15.7.4 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Turkey

15.8.2 Bahrain

15.8.3 Kuwait

15.8.4 Saudi Arabia

15.8.5 Qatar

15.8.6 UAE

15.8.7 Israel

15.8.8 South Africa

Chapter 16: South America Sweet Dark chocolate Market Analysis, Insights and Forecast, 2017-2032

16.1 Key Market Trends, Growth Factors and Opportunities

16.2 Impact of Covid-19

16.3 Key Players

16.4 Key Market Trends, Growth Factors and Opportunities

16.4 Historic and Forecasted Market Size By Type

16.4.1 70% Cocoa Dark Chocolate

16.4.2 75% Cocoa Dark Chocolate

16.4.3 80% Cocoa Dark Chocolate

16.4.4 90% Cocoa Dark Chocolate

16.5 Historic and Forecasted Market Size By Product

16.5.1 Bitter Chocolate

16.5.2 Pure Bitter Chocolate

16.5.3 Semi-Sweet Chocolate

16.5.4 Organic Dark Chocolates

16.5.5 Inorganic Dark Chocolates

16.6 Historic and Forecasted Market Size By Application

16.6.1 Beverages

16.6.2 Food And bakery

16.6.3 Personal Care & Cosmetics

16.6.4 Pharmaceuticals

16.6.5 Others

16.7 Historic and Forecasted Market Size By Distribution Channel

16.7.1 Supermarket/Hypermarket

16.7.2 Speciality Store

16.7.3 Convenience Store

16.7.4 Others

16.8 Historic and Forecast Market Size by Country

16.8.1 Brazil

16.8.2 Argentina

16.8.3 Rest of SA

Chapter 17 Investment Analysis

Chapter 18 Analyst Viewpoint and Conclusion

|

Global Sweet Dark Chocolate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.12 Bn. |

|

Forecast Period 2024 - 32 CAGR: |

5.82% |

Market Size in 2032: |

USD 13.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SWEET DARK CHOCOLATE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SWEET DARK CHOCOLATE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SWEET DARK CHOCOLATE MARKET COMPETITIVE RIVALRY

TABLE 005. SWEET DARK CHOCOLATE MARKET THREAT OF NEW ENTRANTS

TABLE 006. SWEET DARK CHOCOLATE MARKET THREAT OF SUBSTITUTES

TABLE 007. SWEET DARK CHOCOLATE MARKET BY TYPE

TABLE 008. 70% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 009. 75% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 010. 80% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 011. 90% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 012. SWEET DARK CHOCOLATE MARKET BY PRODUCT

TABLE 013. BITTER CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 014. PURE BITTER CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 015. SEMI-SWEET CHOCOLATE MARKET OVERVIEW (2016-2030)

TABLE 016. ORGANIC DARK CHOCOLATES MARKET OVERVIEW (2016-2030)

TABLE 017. INORGANIC DARK CHOCOLATES MARKET OVERVIEW (2016-2030)

TABLE 018. SWEET DARK CHOCOLATE MARKET BY APPLICATION

TABLE 019. BEVERAGES MARKET OVERVIEW (2016-2030)

TABLE 020. FOOD AND BAKERY MARKET OVERVIEW (2016-2030)

TABLE 021. PERSONAL CARE & COSMETICS MARKET OVERVIEW (2016-2030)

TABLE 022. PHARMACEUTICALS MARKET OVERVIEW (2016-2030)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 024. SWEET DARK CHOCOLATE MARKET BY DISTRIBUTION CHANNEL

TABLE 025. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2030)

TABLE 026. SPECIALITY STORE MARKET OVERVIEW (2016-2030)

TABLE 027. CONVENIENCE STORE MARKET OVERVIEW (2016-2030)

TABLE 028. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 029. NORTH AMERICA SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 030. NORTH AMERICA SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 031. NORTH AMERICA SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 032. NORTH AMERICA SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 033. N SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 034. EASTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 035. EASTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 036. EASTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 037. EASTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 038. SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 039. WESTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 040. WESTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 041. WESTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 042. WESTERN EUROPE SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 043. SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 044. ASIA PACIFIC SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 045. ASIA PACIFIC SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 046. ASIA PACIFIC SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 047. ASIA PACIFIC SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 048. SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 052. MIDDLE EAST & AFRICA SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 053. SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 054. SOUTH AMERICA SWEET DARK CHOCOLATE MARKET, BY TYPE (2016-2030)

TABLE 055. SOUTH AMERICA SWEET DARK CHOCOLATE MARKET, BY PRODUCT (2016-2030)

TABLE 056. SOUTH AMERICA SWEET DARK CHOCOLATE MARKET, BY APPLICATION (2016-2030)

TABLE 057. SOUTH AMERICA SWEET DARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 058. SWEET DARK CHOCOLATE MARKET, BY COUNTRY (2016-2030)

TABLE 059. CEMOI CHOCOLATIER (FRANCE): SNAPSHOT

TABLE 060. CEMOI CHOCOLATIER (FRANCE): BUSINESS PERFORMANCE

TABLE 061. CEMOI CHOCOLATIER (FRANCE): PRODUCT PORTFOLIO

TABLE 062. CEMOI CHOCOLATIER (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. REPUBLICA DEL CACAO (ECUADOR): SNAPSHOT

TABLE 063. REPUBLICA DEL CACAO (ECUADOR): BUSINESS PERFORMANCE

TABLE 064. REPUBLICA DEL CACAO (ECUADOR): PRODUCT PORTFOLIO

TABLE 065. REPUBLICA DEL CACAO (ECUADOR): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. NESTLÉ S.A. (SWITZERLAND): SNAPSHOT

TABLE 066. NESTLÉ S.A. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 067. NESTLÉ S.A. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 068. NESTLÉ S.A. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MARS INCORPORATED (U.S.): SNAPSHOT

TABLE 069. MARS INCORPORATED (U.S.): BUSINESS PERFORMANCE

TABLE 070. MARS INCORPORATED (U.S.): PRODUCT PORTFOLIO

TABLE 071. MARS INCORPORATED (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. FUJI OIL HOLDINGS INC. (JAPAN): SNAPSHOT

TABLE 072. FUJI OIL HOLDINGS INC. (JAPAN): BUSINESS PERFORMANCE

TABLE 073. FUJI OIL HOLDINGS INC. (JAPAN): PRODUCT PORTFOLIO

TABLE 074. FUJI OIL HOLDINGS INC. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. GUITTARD CHOCOLATE CO. (U.S.): SNAPSHOT

TABLE 075. GUITTARD CHOCOLATE CO. (U.S.): BUSINESS PERFORMANCE

TABLE 076. GUITTARD CHOCOLATE CO. (U.S.): PRODUCT PORTFOLIO

TABLE 077. GUITTARD CHOCOLATE CO. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. GHIRARDELLI CHOCOLATE CO. (U.S.): SNAPSHOT

TABLE 078. GHIRARDELLI CHOCOLATE CO. (U.S.): BUSINESS PERFORMANCE

TABLE 079. GHIRARDELLI CHOCOLATE CO. (U.S.): PRODUCT PORTFOLIO

TABLE 080. GHIRARDELLI CHOCOLATE CO. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. VARIHONA INC. (FRANCE): SNAPSHOT

TABLE 081. VARIHONA INC. (FRANCE): BUSINESS PERFORMANCE

TABLE 082. VARIHONA INC. (FRANCE): PRODUCT PORTFOLIO

TABLE 083. VARIHONA INC. (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. BARRY CALLEBAUT AG (SWITZERLAND): SNAPSHOT

TABLE 084. BARRY CALLEBAUT AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 085. BARRY CALLEBAUT AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 086. BARRY CALLEBAUT AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ALPEZZI CHOCOLATE SA DE CV (MEXICO): SNAPSHOT

TABLE 087. ALPEZZI CHOCOLATE SA DE CV (MEXICO): BUSINESS PERFORMANCE

TABLE 088. ALPEZZI CHOCOLATE SA DE CV (MEXICO): PRODUCT PORTFOLIO

TABLE 089. ALPEZZI CHOCOLATE SA DE CV (MEXICO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. KERRY GROUP PLC (IRELAND): SNAPSHOT

TABLE 090. KERRY GROUP PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 091. KERRY GROUP PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 092. KERRY GROUP PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. OLAM INTERNATIONAL LTD. (SINGAPORE): SNAPSHOT

TABLE 093. OLAM INTERNATIONAL LTD. (SINGAPORE): BUSINESS PERFORMANCE

TABLE 094. OLAM INTERNATIONAL LTD. (SINGAPORE): PRODUCT PORTFOLIO

TABLE 095. OLAM INTERNATIONAL LTD. (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. TCHO VENTURES INC. (U.S.): SNAPSHOT

TABLE 096. TCHO VENTURES INC. (U.S.): BUSINESS PERFORMANCE

TABLE 097. TCHO VENTURES INC. (U.S.): PRODUCT PORTFOLIO

TABLE 098. TCHO VENTURES INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. THE HERSHEY COMPANY (U.S.): SNAPSHOT

TABLE 099. THE HERSHEY COMPANY (U.S.): BUSINESS PERFORMANCE

TABLE 100. THE HERSHEY COMPANY (U.S.): PRODUCT PORTFOLIO

TABLE 101. THE HERSHEY COMPANY (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. CARGILL INCORPORATED (U.S.): SNAPSHOT

TABLE 102. CARGILL INCORPORATED (U.S.): BUSINESS PERFORMANCE

TABLE 103. CARGILL INCORPORATED (U.S.): PRODUCT PORTFOLIO

TABLE 104. CARGILL INCORPORATED (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 105. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 106. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 107. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SWEET DARK CHOCOLATE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SWEET DARK CHOCOLATE MARKET OVERVIEW BY TYPE

FIGURE 012. 70% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 013. 75% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 014. 80% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 015. 90% COCOA DARK CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 016. SWEET DARK CHOCOLATE MARKET OVERVIEW BY PRODUCT

FIGURE 017. BITTER CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 018. PURE BITTER CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 019. SEMI-SWEET CHOCOLATE MARKET OVERVIEW (2016-2030)

FIGURE 020. ORGANIC DARK CHOCOLATES MARKET OVERVIEW (2016-2030)

FIGURE 021. INORGANIC DARK CHOCOLATES MARKET OVERVIEW (2016-2030)

FIGURE 022. SWEET DARK CHOCOLATE MARKET OVERVIEW BY APPLICATION

FIGURE 023. BEVERAGES MARKET OVERVIEW (2016-2030)

FIGURE 024. FOOD AND BAKERY MARKET OVERVIEW (2016-2030)

FIGURE 025. PERSONAL CARE & COSMETICS MARKET OVERVIEW (2016-2030)

FIGURE 026. PHARMACEUTICALS MARKET OVERVIEW (2016-2030)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 028. SWEET DARK CHOCOLATE MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 029. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2030)

FIGURE 030. SPECIALITY STORE MARKET OVERVIEW (2016-2030)

FIGURE 031. CONVENIENCE STORE MARKET OVERVIEW (2016-2030)

FIGURE 032. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 033. NORTH AMERICA SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. EASTERN EUROPE SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. WESTERN EUROPE SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. ASIA PACIFIC SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. MIDDLE EAST & AFRICA SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 038. SOUTH AMERICA SWEET DARK CHOCOLATE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Sweet Dark Chocolate Market research report is 2024-2032.

Cemoi Chocolatier (France), Republica del Cacao (Ecuador), Nestlé S.A. (Switzerland), Mars Incorporated (U.S.), Fuji Oil Holdings Inc. (Japan), Guittard Chocolate Co. (U.S.), Ghirardelli Chocolate Co. (U.S.), Varihona Inc. (France), Barry Callebaut AG (Switzerland), Alpezzi Chocolate SA De CV (Mexico), Kerry Group Plc (Ireland), Olam International Ltd. (Singapore), Tcho Ventures Inc. (U.S.), The Hershey Company (U.S.), Cargill Incorporated (U.S.) and Other key players.

Sweet Dark Chocolate Market is segmented into Type, Product, Application, Distribution Channel, and region. By Type, the market is categorized into 70% Cocoa Dark Chocolate, 75% Cocoa Dark Chocolate, 80% Cocoa Dark Chocolate, 90% Cocoa Dark Chocolate. By Product, the market is categorized into Bitter Chocolate, Pure Bitter Chocolate, Semi-Sweet Chocolate, Organic Dark chocolate, and Inorganic Dark chocolate. By Application, the Market is Categorized into Beverages, Food And bakery, Personal Care & Cosmetics, Pharmaceuticals, and Others. By Distribution Channel, the market is categorized into Supermarkets/hypermarkets, Specialty Stores, Convenience Stores, and Others. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

An indulgence is thought to be dark chocolate. It is richer than milk chocolate and frequently combined with cheese and wine to provide a mouthwatering experience. Due to its dryness, harsh aftertaste, and gritty texture, dark chocolate has a deeper chocolate flavor than milk chocolate and does not include milk solids.

The Global Sweet Dark Chocolate Market size was reasonably estimated to be approximately USD 8.12 Billion in 2023 and is poised to generate revenue over USD 13.52 Billion by the end of 2032, projecting a CAGR of around 5.82% from 2024 to 2032.