Surimi Market Synopsis

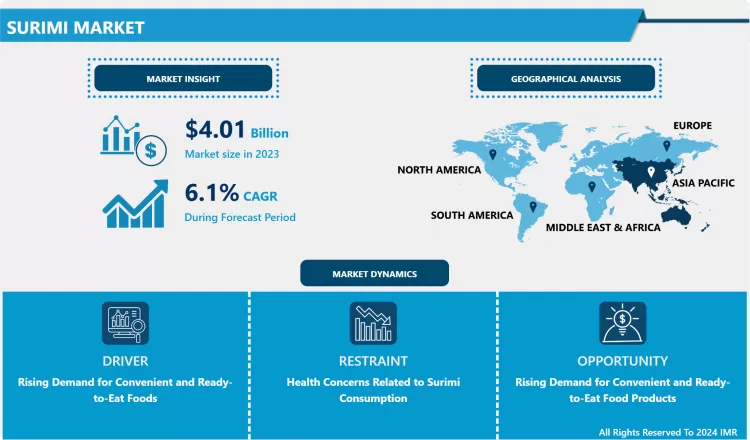

Surimi Market Size is Valued at USD 4.01 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

The Surimi Market consists of products related to surimi, which is a processed seafood primarily constituted of fish and an ingredient in several foods. Generally, surimi is used in preparation of several products such as seafood products imitation, convenience food products and snacks products. The market is classified by types like crab, fish, by applications like seafood products, sauces, by distribution channels like supermarkets, through online retailing and forms like frozen, chilled etc. The criteria disclosed that it depends on aspects like consumer preference towards convenience foods and increase in seafood options in different areas.

- The market for surimi is largely boosted by the protective consumption of seafood products especially in areas where fish and seafood make up portions of the common diet. The following are the factors; Growing consumer trends of healthy and realistic food products have boosted the use of processed food made from seafood and surimi. Since the products produced from the surimi are cheaper yet having similar taste and texture to the real seafood such as imitation crab meat, the products are widely accepted by consumers hence driving the market. Also, augment in the food service segment and the increasing popularity of processed and convenience foods are some of significant factors paving the way for surimi.

- Another factor that will drive the surimi market is increase in Global Aquaculture that will ensure steady supply of raw material for surimi. New innovations in surimi production and stabilization methods have made the products more appealing and fetched more demand in the market among the producers and sellers. In addition, the awareness level of the health prospect linked to the use of seafood; high protein, low fat all contribute to this market. The globalization of surimi products and new inventions in the various sectors of food also aid in the expansion of the surimi market.

Surimi Market Trend Analysis

The Evolution of Surimi, Market Trends and Consumer Insights

- The market for surimi is growing at a healthy rate, primarily caused by the growing need for convenient and high in protein products. Recent, production methods used have helped in enhancing the mouth-feel and flavor of surimi thus making surimi products more attractive for use in a variety of food products including seafood imitations and convenience foods. The enhanced consumer consciousness regarding health is another factor through which the market is benefiting due to the perception that surimi is healthier than normal meats. Also, rising trends in Asian food consumption, where surimi is widely used, provide favorable conditions for the market’s expansion.

- However, it has some issues like the volatility of raw materials and, and competition from other sources of proteins. Environmental issues linked to production of seafood are let the producers look for sustainable ways of harvesting seafood and the related certifications. Nevertheless, society has become more concerned about quality, demanding more transparency in products to different extents thus, the brand has had to introduce a clean label as well as embrace responsible sourcing.

Unlocking the Potential of Surimi, Market Trends and Opportunities for Success

- It means that there are massive opportunities for further development of surimi due to the increasing consumer desire for easy-to-use, high in protein, and multifunctional foods. Thus, as the trend with the consumption of healthy and low-fat foods grows, the role of surimi, recognized in terms of its protein qualities and low cost, also expands beyond such dishes as seafood. Moreover, the increasing application of surimi in the ready-to-eat meals, snacks and sauces creates new opportunities for the market. Furthermore, new technologies used in surimi processing and new surimi products will bring new customers and open up the possibilities for value added goods.

- Geographically, the surimi market is expected to grow in such countries as Asia Pacific and North America since the cuisine in these regions demand seafood and there is growing awareness on the people’s healthy diet. Surimi products in Asia Pacific especially in Japan and South Korea are considered staple food hence pose future sustained growth potential. As to North America, there is a constantly increasing trend towards the inclusion of seafood in various dishes and Region of convenient solutions to meals. With changing demand of consumers across the globe the giant surimi market has all the potential and future to expand its business.

Surimi Market Segment Analysis:

Surimi Market Segmented on the basis of type, Form and Application.

By Type, Crab Surimi segment is expected to dominate the market during the forecast period

- The surimi market is segmented by type into three main categories: such as crab surimi, fish surimi and other types of surimi. Crab surimi usually used with imitation crab meat is well preferred for its seafood flavor to be included in different recipes. Some of the examples of surimi used in food products include fish surimi which is made from diverse species of fish and is considered to be flavorless and virtually suitable for many food preparations. Other surimi is any seafood or protein formed item made from a sea food or a combination of sea foods other than the prior mentioned as they suit different consumer tastes and uses in the kitchen.

By Application, Seafood Products segment held the largest share in 2024

- The surimi market uses comprise seafood products, ready to eat meals, snacks, sauces and dressings, and others. Surimi is widely applied in seafood industry, and is a primary component of the crab stick and other seafood merchandise. It is also used in freshly made meals for ease and in meals that supplement protein. It also used in snacks, adding flavor and texture to it and in sauces and dressings, where it provides a fuller flavor. That is why the ‘others’ category encompasses numerous specific applications and new trends in the food industry.

Surimi Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific is the largest and fastest-growing region for surimi market due to the higher seafood consumption and the inclination towards processed fish products. Common markets in this part of the world are Japan, South Korea, China and Thailand since surimi is a fundamental ingredient in traditional preparations and processed foods. Thus, factors such as the growing popularity of convenient food products, the growth of the urban population, and increased disposable income promote the development of the surimi market. Currently, Japan and South Korea have the largest surimi markets, due to their developed surimi processing technologies and distribution channels.

- Also, the Asia Pacific region enjoys a sound seafood production and export market of surimi products. New generation trade liberalisation in terms of extending foreign relations and increasing health consciousness regarding the consumption of sea foods also propels the market. However, there are several limitations that are likely to affect the market; for instance, changes in the raw material costs and issues to do with fishing and sustainability. In summary it can be concluded that the Asia Pacific market for surimi will remain on the rise due to the regional demand and new product differentiation.

Active Key Players in the Surimi Market

- Nippon Suisan Kaisha, Ltd. (Japan)

- Maruha Nichiro Corporation (Japan)

- StarKist Co. (United States)

- Surimi Holdings, LLC (United States)

- Kawasho Foods Co., Ltd. (Japan)

- Thai Union Group PCL (Thailand)

- Ise Foods Inc. (Japan)

- Nissui (Japan)

- Pacific Seafood Group (United States)

- Seafood Processing Plant, Inc. (United States)

- Others

|

Global Surimi Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surimi Market by Type (2018-2032)

4.1 Surimi Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Crab Surimi

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fish Surimi

4.5 Other Surimi

Chapter 5: Surimi Market by Form (2018-2032)

5.1 Surimi Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Frozen

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Chilled

5.5 Canned

Chapter 6: Surimi Market by Application (2018-2032)

6.1 Surimi Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Seafood Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ready-to-Eat Meals

6.5 Snacks

6.6 Sauces and Dressings

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surimi Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NIPPON SUISAN KAISHA LTD. (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MARUHA NICHIRO CORPORATION (JAPAN)

7.4 STARKIST CO. (UNITED STATES)

7.5 SURIMI HOLDINGS

7.6 LLC (UNITED STATES)

7.7 KAWASHO FOODS COLTD. (JAPAN)

7.8 THAI UNION GROUP PCL (THAILAND)

7.9 ISE FOODS INC. (JAPAN)

7.10 NISSUI (JAPAN)

7.11 PACIFIC SEAFOOD GROUP (UNITED STATES)

7.12 SEAFOOD PROCESSING PLANT INC. (UNITED STATES)

7.13 OTHERS

Chapter 8: Global Surimi Market By Region

8.1 Overview

8.2. North America Surimi Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Crab Surimi

8.2.4.2 Fish Surimi

8.2.4.3 Other Surimi

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Frozen

8.2.5.2 Chilled

8.2.5.3 Canned

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Seafood Products

8.2.6.2 Ready-to-Eat Meals

8.2.6.3 Snacks

8.2.6.4 Sauces and Dressings

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surimi Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Crab Surimi

8.3.4.2 Fish Surimi

8.3.4.3 Other Surimi

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Frozen

8.3.5.2 Chilled

8.3.5.3 Canned

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Seafood Products

8.3.6.2 Ready-to-Eat Meals

8.3.6.3 Snacks

8.3.6.4 Sauces and Dressings

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surimi Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Crab Surimi

8.4.4.2 Fish Surimi

8.4.4.3 Other Surimi

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Frozen

8.4.5.2 Chilled

8.4.5.3 Canned

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Seafood Products

8.4.6.2 Ready-to-Eat Meals

8.4.6.3 Snacks

8.4.6.4 Sauces and Dressings

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surimi Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Crab Surimi

8.5.4.2 Fish Surimi

8.5.4.3 Other Surimi

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Frozen

8.5.5.2 Chilled

8.5.5.3 Canned

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Seafood Products

8.5.6.2 Ready-to-Eat Meals

8.5.6.3 Snacks

8.5.6.4 Sauces and Dressings

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surimi Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Crab Surimi

8.6.4.2 Fish Surimi

8.6.4.3 Other Surimi

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Frozen

8.6.5.2 Chilled

8.6.5.3 Canned

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Seafood Products

8.6.6.2 Ready-to-Eat Meals

8.6.6.3 Snacks

8.6.6.4 Sauces and Dressings

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surimi Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Crab Surimi

8.7.4.2 Fish Surimi

8.7.4.3 Other Surimi

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Frozen

8.7.5.2 Chilled

8.7.5.3 Canned

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Seafood Products

8.7.6.2 Ready-to-Eat Meals

8.7.6.3 Snacks

8.7.6.4 Sauces and Dressings

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Surimi Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.10 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Surimi Market research report is 2024-2032.

Nippon Suisan Kaisha, Ltd. (Japan), Maruha Nichiro Corporation (Japan), StarKist Co. (United States), Surimi Holdings, LLC (United States), Kawasho Foods Co., Ltd. (Japan), Thai Union Group PCL (Thailand), Ise Foods Inc. (Japan), Nissui (Japan), Pacific Seafood Group (United States), Seafood Processing Plant, Inc. (United States) and Other Major Players.

The Surimi Market is segmented into by Type (Crab Surimi, Fish Surimi, Other Surimi), by Form (Frozen, Chilled, Canned), Application (Seafood Products, Ready-to-Eat Meals, Snacks, Sauces and Dressings, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Surimi Market consists of products related to surimi, which is a processed seafood primarily constituted of fish and an ingredient in several foods. Generally, surimi is used in preparation of several products such as seafood products imitation, convenience food products and snacks products. The market is classified by types like crab, fish, by applications like seafood products, sauces, by distribution channels like supermarkets, through online retailing and forms like frozen, chilled etc. The criteria disclosed that it depends on aspects like consumer preference towards convenience foods and increase in seafood options in different areas.

Surimi Market Size is Valued at USD 4.01 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.