Surgical Staplers Market Synopsis

Surgical Staplers Market Size Was Valued at USD 4.27 Billion in 2023 and is Projected to Reach USD 6.81 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

Surgical staplers are medical instruments used in surgery to close wounds or cuts. They function similarly to traditional sutures but have several advantages, including faster closure times and less tissue trauma. Surgical staplers are commonly used in procedures that require multiple staples, such as gastrointestinal, lung, and skin surgeries.

- The rising prevalence of chronic diseases, as well as the growing elderly population, are driving up demand for surgical procedures and increasing the need for surgical staplers. shift towards minimally invasive surgeries (MIS), which provide several benefits such as faster recovery times, less pain, and smaller incisions. Surgical staplers play an important role in these procedures, which drives market growth.

- Stapler design advancements like enhanced tissue compatibility, automated features, and improved ergonomics make these tools more effective and user-friendly for surgeons. Surgical staplers are becoming increasingly popular because they provide quicker closure times than traditional sutures, possibly less blood loss, and a possibly decreased risk of infection.

- Ongoing research and development efforts aimed at improving the safety and efficacy of surgical staplers further propel market growth, increasing investments in healthcare infrastructure, growing awareness of the benefits of surgical staplers among healthcare professionals, and rising healthcare expenditure worldwide are expected to sustain market growth in the foreseeable future.

Surgical Staplers Market Trend Analysis

Rising Demand for Surgical Procedures

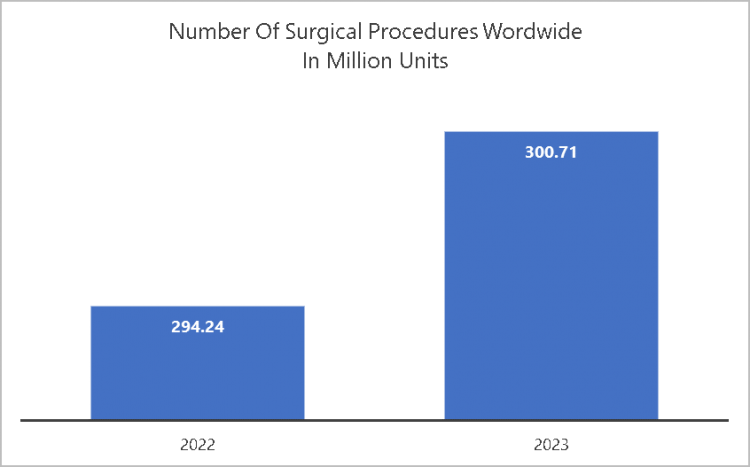

- Surgery becomes even more necessary as chronic diseases become more common as a result of unhealthy lifestyle choices such as smoking, poor eating, and lack of exercise. As the global population ages, chronic diseases such as diabetes, heart disease, and cancer become more prevalent. The need for surgeries to treat or manage these conditions frequently increases the demand for surgical procedures.

- Furthermore, as healthcare systems strive to improve patient outcomes while lowering costs, there is an increasing emphasis on minimally invasive surgical procedures. Minimally invasive techniques, aided by surgical staplers, provide advantages such as shorter hospital stays, faster recovery times, and fewer post-operative complications than traditional open surgeries. As a result, surgeons and healthcare facilities are increasingly implementing minimally invasive approaches in a variety of surgical specialties, driving up demand for surgical staplers.

- The expanding scope of surgical procedures beyond traditional surgeries, such as robotic-assisted surgeries and single-incision laparoscopic procedures, is boosting the surgical stapler’s market. These innovative surgical techniques necessitate the use of specialized staplers designed to meet the specific needs of advanced procedures, which fuels the demand for advanced surgical stapling devices. The surgical staplers market is experiencing significant growth due to rising demand for surgical procedures, as well as growing adoption of minimally invasive techniques and innovative surgical approaches.

Development of Specialized Staplers

- The surgical stapler market is seeing an increase in the development of specialized staplers designed to meet specific surgical needs. This trend is being driven by the growing popularity of minimally invasive surgeries and the demand for better surgical outcomes. These specialized staplers have a smaller size for easier maneuverability in laparoscopic procedures, specific jaw designs for delicate tissues in cardiac surgeries, and even integration with technology for real-time feedback and accuracy.

- These staplers lower the possibility of problems like leaks and strictures by making it easier to create accurate and consistent anastomoses. In the field of thoracic surgery, which involves frequent lung resections and bronchial surgeries, sophisticated linear staplers featuring articulating jaws and sophisticated cutting mechanisms have been developed to facilitate accurate tissue dissection and staple formation in constricted areas.

- The development of specialized staplers is expected to remain a major growth driver in the surgical stapler market. Advances in technology, materials science, and increased demand for minimally invasive and targeted surgical procedures will pave the way for more innovation in this field. Manufacturers that can effectively address the challenges associated with the development and gain surgeon acceptance through robust clinical data and training programs are likely to succeed in this changing market landscape.

Surgical Staplers Market Segment Analysis:

Surgical Staplers Market Segmented based on Product Type, Mechanism, Usability, and Application.

By Product Type, Linear Staplers segment is expected to dominate the market during the forecast period

- The growing use of minimally invasive surgical techniques has contributed to increased demand for linear staplers. Linear staplers are commonly used in laparoscopic and robotic-assisted surgeries, which provide advantages such as shorter hospital stays, faster recovery times, and fewer postoperative complications. Manufacturers are constantly innovating to create advanced linear staplers with better features like ergonomic designs, improved stapling mechanisms, and integrated cutting capabilities.

- These technological advancements improve the performance and efficiency of linear staplers, making them more appealing to surgeons and medical professionals. Linear staplers are versatile tools used in surgical specialties other than gastrointestinal surgery, such as thoracic, gynecological, and urological procedures. Linear staplers are increasingly used in a variety of surgical disciplines due to their versatility and ability to effectively seal and divide tissues in a straight line.

- The growth of healthcare infrastructure, particularly in emerging economies, is driving the use of advanced surgical techniques and tools, such as linear staplers. As healthcare facilities improve their surgical capabilities and invest in modern equipment, demand for linear staplers is expected to rise. The linear stapler segment in the surgical stapler market is growing due to technological advancements, expanding applications, and a shift towards minimally invasive surgical approaches.

By Application, General Surgery segment is expected to dominate the market during the forecast period

- General surgery refers to a wide range of procedures involving different organs and structures in the abdominal cavity. Many of these procedures require precise tissue approximation and secure closure, which surgical staplers excel at. Gastrointestinal surgeries such as bowel resections, gastric bypass surgery, and appendectomies frequently require multiple staple lines for resection, anastomosis, and tissue layer closure. Surgical staplers allow surgeons to perform these procedures efficiently and with consistent outcomes.

- The growing popularity of minimally invasive surgical techniques in general surgery has boosted the use of surgical staplers. In laparoscopic and robotic-assisted procedures, where access to the surgical site is limited, surgical staplers allow for precise tissue manipulation and closure via small incisions. Surgical staplers are essential tools in minimally invasive general surgery, allowing surgeons to carry out complex procedures with greater precision and safety.

- Surgical staplers come in a variety of sizes and configurations to suit different tissue thicknesses and surgical needs. Surgical staplers are indispensable in general surgery due to their efficiency, precision, and safety. Their widespread use in a variety of procedures emphasizes their significance in modern surgical practice, where improving patient outcomes and streamlining surgical workflows are essential.

Surgical Staplers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- North America's geriatric population is growing, increasing demand for surgeries such as joint replacements and cardiac procedures, both of which rely heavily on surgical staplers. The prevalence of chronic diseases such as cancer and obesity is increasing, necessitating more surgeries for treatment and management, which drives up demand for staplers. Minimally invasive surgeries (MIS) are gaining popularity due to advantages such as shorter recovery times and smaller incisions.

- North America is home to several leading surgical stapler manufacturers, including Ethicon, Medtronic, and Intuitive Surgical. These companies invest heavily in R&D, resulting in continuous innovation and the introduction of advanced stapler technologies. Surgeons and hospitals in North America are generally more open to implementing new and advanced medical technologies, such as innovative surgical staples.

- North American countries, particularly the United States, allocate a higher percentage of GDP to healthcare than many other regions. This leads to increased investment in medical equipment, such as surgical staplers. Insurance companies and government healthcare programs in North America frequently reimburse for surgeries that use surgical staplers, making them more accessible to patients and encouraging their use.

Surgical Staplers Market Top Key Players:

- Ethicon (US)

- Intuitive Surgical (US)

- Teleflex Incorporated (US)

- Zimmer Biomet (US)

- CONMED Corporation (US)

- Applied Medical (US)

- Intuitive Surgical (US)

- Becton, Dickinson (US)

- Zimmer Biomet (US)

- Stryker (US)

- DJO Surgical (US)

- Lexington Medical (US)

- Dextera Surgical Inc. (US)

- B. Braun (Germany)

- Smith+Nephew (UK)

- Purple Surgical (UK)

- Welfare Medical Ltd. (UK)

- Grena Ltd. (UK)

- Medtronic (Ireland)

- Meril life (India)

- Frankenman International Limited (Hong Kong)

- Touchstone International Medical Science Co. Ltd. (China)

- Reach Surgical Inc. (China), and other major players

Key Industry Developments in the Surgical Staplers Market:

- In August 2023, Teleflex acquired Standard Bariatrics for $300m. US-based Standard Bariatrics developed the Titan SGS stapler, which is designed to assist in achieving more consistent and symmetrical sleeve pouch anatomy. It offers the longest continuous 23cm staple cutline and was developed to address unmet needs in sleeve gastrectomy.

- In June 2023, ETHICON launched the Next Generation Echelon™ 3000 Staple, designed for superior access and control. ECHELON 3000 is designed with a 39% greater jaw aperture and a 27% greater articulation span, giving surgeons better access and control over each transection, even in tight spaces and on challenging tissue.

|

Global Surgical Staplers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

6 % |

Market Size in 2032: |

USD 6.81 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Mechanism |

|

||

|

By Usability |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL STEPLERS MARKET BY PRODUCT TYPE (2017-2032)

- SURGICAL STEPLERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LINEAR STAPLERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CIRCULAR STAPLERS

- SKIN STAPLERS

- ENDOSCOPIC STAPLERS

- OTHERS

- SURGICAL STEPLERS MARKET BY MECHANISM (2017-2032)

- SURGICAL STEPLERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POWERED

- SURGICAL STEPLERS MARKET BY USABILITY (2017-2032)

- SURGICAL STEPLERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISPOSABLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE

- SURGICAL STEPLERS MARKET BY APPLICATION (2017-2032)

- SURGICAL STEPLERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GENERAL SURGERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ABDOMINAL & PELVIC SURGERY

- CARDIAC & THORACIC SURGERY

- ORTHOPEDIC SURGERY

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surgical Steplers Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ETHICON (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- INTUITIVE SURGICAL (US)

- TELEFLEX INCORPORATED (US)

- ZIMMER BIOMET (US)

- CONMED CORPORATION (US)

- APPLIED MEDICAL (US)

- INTUITIVE SURGICAL (US)

- BECTON, DICKINSON (US)

- ZIMMER BIOMET (US)

- STRYKER (US)

- DJO SURGICAL (US)

- LEXINGTON MEDICAL (US)

- DEXTERA SURGICAL INC. (US)

- B. BRAUN (GERMANY)

- SMITH+NEPHEW (UK)

- PURPLE SURGICAL (UK)

- WELFARE MEDICAL LTD. (UK)

- GRENA LTD. (UK)

- MEDTRONIC (IRELAND)

- MERIL LIFE (INDIA)

- FRANKENMAN INTERNATIONAL LIMITED (HONG KONG)

- TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO. LTD. (CHINA)

- REACH SURGICAL INC. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL STEPLERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Mechanism

- Historic And Forecasted Market Size By Usability

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Staplers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

6 % |

Market Size in 2032: |

USD 6.81 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Mechanism |

|

||

|

By Usability |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL STAPLERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL STAPLERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL STAPLERS MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL STAPLERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL STAPLERS MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL STAPLERS MARKET BY TEST TYPE

TABLE 008. ELISA MARKET OVERVIEW (2016-2028)

TABLE 009. COLORIMETRIC MARKET OVERVIEW (2016-2028)

TABLE 010. SPECTROPHOTOMETRIC MARKET OVERVIEW (2016-2028)

TABLE 011. SURGICAL STAPLERS MARKET BY APPLICATION

TABLE 012. HOSPITAL MARKET OVERVIEW (2016-2028)

TABLE 013. LABORATORY MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA SURGICAL STAPLERS MARKET, BY TEST TYPE (2016-2028)

TABLE 015. NORTH AMERICA SURGICAL STAPLERS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N SURGICAL STAPLERS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE SURGICAL STAPLERS MARKET, BY TEST TYPE (2016-2028)

TABLE 018. EUROPE SURGICAL STAPLERS MARKET, BY APPLICATION (2016-2028)

TABLE 019. SURGICAL STAPLERS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC SURGICAL STAPLERS MARKET, BY TEST TYPE (2016-2028)

TABLE 021. ASIA PACIFIC SURGICAL STAPLERS MARKET, BY APPLICATION (2016-2028)

TABLE 022. SURGICAL STAPLERS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA SURGICAL STAPLERS MARKET, BY TEST TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SURGICAL STAPLERS MARKET, BY APPLICATION (2016-2028)

TABLE 025. SURGICAL STAPLERS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA SURGICAL STAPLERS MARKET, BY TEST TYPE (2016-2028)

TABLE 027. SOUTH AMERICA SURGICAL STAPLERS MARKET, BY APPLICATION (2016-2028)

TABLE 028. SURGICAL STAPLERS MARKET, BY COUNTRY (2016-2028)

TABLE 029. ETHICON LLC: SNAPSHOT

TABLE 030. ETHICON LLC: BUSINESS PERFORMANCE

TABLE 031. ETHICON LLC: PRODUCT PORTFOLIO

TABLE 032. ETHICON LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. MEDTRONIC: SNAPSHOT

TABLE 033. MEDTRONIC: BUSINESS PERFORMANCE

TABLE 034. MEDTRONIC: PRODUCT PORTFOLIO

TABLE 035. MEDTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. INTUITIVE SURGICAL: SNAPSHOT

TABLE 036. INTUITIVE SURGICAL: BUSINESS PERFORMANCE

TABLE 037. INTUITIVE SURGICAL: PRODUCT PORTFOLIO

TABLE 038. INTUITIVE SURGICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CONMED CORPORATION: SNAPSHOT

TABLE 039. CONMED CORPORATION: BUSINESS PERFORMANCE

TABLE 040. CONMED CORPORATION: PRODUCT PORTFOLIO

TABLE 041. CONMED CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. SMITH+NEPHEW: SNAPSHOT

TABLE 042. SMITH+NEPHEW: BUSINESS PERFORMANCE

TABLE 043. SMITH+NEPHEW: PRODUCT PORTFOLIO

TABLE 044. SMITH+NEPHEW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BD: SNAPSHOT

TABLE 045. BD: BUSINESS PERFORMANCE

TABLE 046. BD: PRODUCT PORTFOLIO

TABLE 047. BD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. 3M: SNAPSHOT

TABLE 048. 3M: BUSINESS PERFORMANCE

TABLE 049. 3M: PRODUCT PORTFOLIO

TABLE 050. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. B. BRAUN MELSUNGEN AG: SNAPSHOT

TABLE 051. B. BRAUN MELSUNGEN AG: BUSINESS PERFORMANCE

TABLE 052. B. BRAUN MELSUNGEN AG: PRODUCT PORTFOLIO

TABLE 053. B. BRAUN MELSUNGEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. PURPLE SURGICAL: SNAPSHOT

TABLE 054. PURPLE SURGICAL: BUSINESS PERFORMANCE

TABLE 055. PURPLE SURGICAL: PRODUCT PORTFOLIO

TABLE 056. PURPLE SURGICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. FRANKENMAN INTERNATIONAL LIMITED: SNAPSHOT

TABLE 057. FRANKENMAN INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 058. FRANKENMAN INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 059. FRANKENMAN INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. WELFARE MEDICAL LTD.: SNAPSHOT

TABLE 060. WELFARE MEDICAL LTD.: BUSINESS PERFORMANCE

TABLE 061. WELFARE MEDICAL LTD.: PRODUCT PORTFOLIO

TABLE 062. WELFARE MEDICAL LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ZIMMER BIOMET: SNAPSHOT

TABLE 063. ZIMMER BIOMET: BUSINESS PERFORMANCE

TABLE 064. ZIMMER BIOMET: PRODUCT PORTFOLIO

TABLE 065. ZIMMER BIOMET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. STRYKER: SNAPSHOT

TABLE 066. STRYKER: BUSINESS PERFORMANCE

TABLE 067. STRYKER: PRODUCT PORTFOLIO

TABLE 068. STRYKER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MERIL LIFE SCIENCES PVT. LTD.: SNAPSHOT

TABLE 069. MERIL LIFE SCIENCES PVT. LTD.: BUSINESS PERFORMANCE

TABLE 070. MERIL LIFE SCIENCES PVT. LTD.: PRODUCT PORTFOLIO

TABLE 071. MERIL LIFE SCIENCES PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO. LTD.: SNAPSHOT

TABLE 072. TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO. LTD.: BUSINESS PERFORMANCE

TABLE 073. TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO. LTD.: PRODUCT PORTFOLIO

TABLE 074. TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL STAPLERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL STAPLERS MARKET OVERVIEW BY TEST TYPE

FIGURE 012. ELISA MARKET OVERVIEW (2016-2028)

FIGURE 013. COLORIMETRIC MARKET OVERVIEW (2016-2028)

FIGURE 014. SPECTROPHOTOMETRIC MARKET OVERVIEW (2016-2028)

FIGURE 015. SURGICAL STAPLERS MARKET OVERVIEW BY APPLICATION

FIGURE 016. HOSPITAL MARKET OVERVIEW (2016-2028)

FIGURE 017. LABORATORY MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA SURGICAL STAPLERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE SURGICAL STAPLERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC SURGICAL STAPLERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA SURGICAL STAPLERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA SURGICAL STAPLERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Staplers Market research report is 2024-2032.

Ethicon (US), Intuitive Surgical (US), Teleflex Incorporated (US), Zimmer Biomet (US), CONMED Corporation (US), Applied Medical (US), Intuitive Surgical (US), Becton, Dickinson (US), Zimmer Biomet (US), Stryker (US), DJO Surgical (US), Lexington Medical (US), Dextera Surgical Inc. (US), B. Braun (Germany), Smith+Nephew (UK), Purple Surgical (UK), Welfare Medical Ltd. (UK), Grena Ltd. (UK), Medtronic (Ireland), Meril life (India), Frankenman International Limited (Hong Kong), Touchstone International Medical Science Co. Ltd. (China), Reach Surgical Inc. (China) and Other Major Players.

The Surgical Staplers Market is segmented into Product Type, Mechanism, Usability, Application, and region. By Product Type, the market is categorized into Linear Staplers, Circular Staplers, Skin Staplers, Endoscopic Staplers, and Others. By Mechanism, the market is categorized into Manual, and Powered. By Usability, the market is categorized into Disposable and Reusable. By Application, the market is categorized into General Surgery, Abdominal & Pelvic Surgery, Cardiac & Thoracic Surgery, Orthopedic Surgery, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Surgical staplers are medical instruments used in surgery to close wounds or cuts. They function similarly to traditional sutures but have several advantages, including faster closure times and less tissue trauma. Surgical staplers are commonly used in procedures that require multiple staples, such as gastrointestinal, lung, and skin surgeries

Surgical Staplers Market Size Was Valued at USD 4.27 Billion in 2023 and is Projected to Reach USD 6.81 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.