Surgical Pliers Market Synopsis

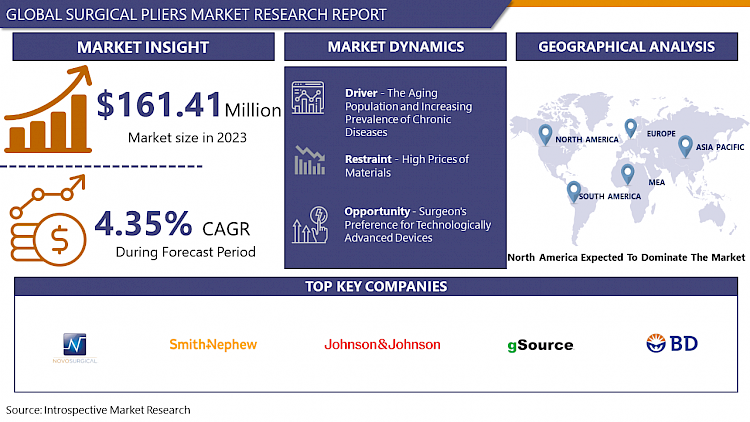

Surgical Pliers Market Size Was Valued at USD 161.41 Million in 2023 and is Projected to Reach USD 236.79 Million by 2032, Growing at a CAGR of 4.35% From 2024-2032.

Orthopaedic Surgical Pliers are used for cutting, twisting, and crimping wires, putting off pins, gripping, and managing tissue, amongst many other capabilities at some stage in hand surgical operations. They're extensively utilized to stiffen the wires or reduce wire in surgical procedures.

- The use of Pliers as medical equipment is important to ensure the accuracy and precision of surgical operations. A new design of clinical Pliers changed into advanced by converting the functions from both bending or shearing courses to an aggregate of bending and shearing handiest. Therefore, the layout changed into simulated by using observing pressure analysis, property prediction with load length version, and cloth choice (i.e., chrome steel, aluminum, and titanium).

- Surgeons rely on surgical Pliers to help them carry out delicate tasks. Surgeons and their assistants wear sterile uniforms. By using surgical Pliers, the health practitioner can keep away from choosing bacteria from the patient. Using a surgical gown is an essential step in stopping the spread of contamination and bacteria. Using surgical Pliers allows users the unfold microorganisms in the course of surgical operation.

- They are made of impermeable material or waterproof, densely woven fabric to decrease the number of microorganisms in the surgical region. Surgical forceps are common equipment for medical professionals working in clean environments. The most common name for safety devices is "isolation handles". Body fluids can contaminate clothing and carry bacteria; therefore, it is necessary to protect yourself by wearing insulating clothing.

Surgical Pliers Market Trend Analysis

The Aging Population and Increasing Prevalence of Chronic Diseases

- According to the World Health Organization, non-communicable sicknesses or chronic sicknesses kill 41 million human beings every 12 months, accounting for 74 % of all deaths worldwide. Every 12 months, 17 million human beings die from non-communicable diseases before the age of 70; 86% of Cardiovascular disorders account for the majority of non-disorder-related deaths, accounting for 17.9 million humans each year, accompanied by cancer (9.3 million), continual breathing ailment (4.1 million) and diabetes (2.0 million), such as diabetes-related kidney ailment as a result of diabetes).

- Chronic diseases consisting of cardiovascular sicknesses, neurological illnesses, urological troubles, and most cancers often require surgical remedy. This increases the call for surgical contraptions, such as pliers, that are used to grasp, reduce, and manipulate tissue, clamping blood vessels, and suture wounds at some stage in those methods. As the prevalence of these persistent diseases increases, surgical pliers designed mainly for these processes are expected to observe health.

- An aging populace is more liable to persistent diseases due to the fact frame functions decline and wear and tear accumulates through the years. This method has a better occurrence of heart sickness, osteoporosis, arthritis, and most cancers among the aged. Therefore, the demand for surgical tactics used to deal with those illnesses is likewise increasing.

- Surgical Pliers are critical equipment in various surgical approaches done for the elderly. These methods can vary from minimally invasive surgeries which include cataract removal and knee substitute to complex surgical procedures such as hip replacement and cancer resection. The developing aged populace creates a bigger population of sufferers requiring surgical processes, which in a roundabout way will increase the call for surgical Pliers.

Surgeon's Preference for Technologically Advanced Devices

- The health care provider's capabilities within the working room can be improved with the aid of plenty of features supplied by superior surgical instruments. For instance, minimally invasive surgical (MIS) strategies have become increasingly popular because of their benefits to patients.

- MIS methods commonly contain smaller incisions, less tissue harm, and quicker recovery time in comparison to traditional open surgery. Advanced surgical gadgets play a vital position in facilitating MIS techniques by permitting surgeons to operate through these smaller incisions, those elements are developing the marketplace soon.

- Laparoscopic contraptions are mainly made for minimally invasive belly and pelvic surgical procedures. These instruments are skinny and flexible, allowing surgeons to maneuver them via small incisions within the stomach to perform delicate methods like gallbladder removal or hernia repair. Similarly, arthroscopic units are used for MIS methods on joints, inclusive of knee arthroscopy for repairing torn ligaments or meniscus injuries. The advanced capabilities of those units, together with wrist articulation, allow greater dexterity and manipulation in the constrained joint space.

- The growing use of MIS techniques is predicted to create a persistent demand for specialized surgical pliers like-minded with the one's techniques. These pliers may also have functions such as skinny profiles, complex jaw designs, and special coatings that facilitate mild tissue manipulation and limit tissue damage in minimally invasive procedures.

Surgical Pliers Market Segment Analysis:

Surgical Pliers Market is segmented based on type, jaw type, application, end-users, and region.

By Type, Reusable type segment is expected to dominate the market during the forecast period

- The Surgical Pliers Market is experiencing a developing fashion towards reusable contraptions, mainly Pliers. The marketplace is dominated by using reusable pliers due to the fact surgeons prioritize precision and overall performance in important surgical strategies. Reusable Pliers, crafted from remarkable substances like surgical-grade chrome steel, titanium, or top-class alloys, boast superior sturdiness and resistance to corrosion. These substances additionally allow for tighter tolerances, making sure the pliers hold their specific grip through several uses.

- Environmental sustainability is a major concern inside the healthcare enterprise. Reusable Pliers may be sterilized and used repeatedly, minimizing waste material. This aligns with the developing recognition of environmentally pleasant practices in healthcare settings. The demand for reusable surgical pliers stems from their superior performance, durability, and contribution to sustainability efforts, making them a positive preference for surgeons and healthcare centers.

By Application, Holding and Grasping segment is expected to dominate the market during the forecast period

- Holding and Grasping pliers are the maximum flexible devices in the Surgical Pliers Market. They are applied in a wide variety of surgical specialties, encompassing trendy surgical treatment, laparoscopic surgery, neurosurgery, ophthalmology, orthopaedics, and more. Regardless of the particular surgical approach (open, laparoscopic, robot-assisted), retaining and greedy pliers stay vital equipment. Surgeons depend on those pliers for delicate maneuver involving nerves and blood vessels, manipulating tissues during suturing, greedy organs for higher visualization, and retracting tissues to show the surgical area.

- From the preliminary tiers of exposure and tissue manipulation to meticulous suturing and wound closure, maintaining and greedy instruments are instrumental in presenting surgeons with the manipulation and precision required at each step of the operation. The essential role those pliers play in center surgical tasks, no matter the strong point or surgical method, translates to a constant and excessive demand throughout various surgical settings.

Surgical Pliers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the global plier surgical device marketplace, and the growing incidence of continual illnesses like cardiovascular, neurological, and cancerous situations is a key motive force of this marketplace growth. North America faces a massive burden of chronic illnesses. These conditions regularly require surgical intervention for prognosis, remedy, or management. This in flip fuels the demand for diverse surgical gadgets, such as surgical pliers.

- North America boasts properly mounted hospitals, clinics, and surgical centers geared up with the cutting-edge surgical generation. This advanced infrastructure necessitates a consistent delivery of surgical instruments like pliers to assist in a high extent of surgeries. Developed international locations like those in North America commonly have better healthcare spending compared to developing areas. This suggests an increased willingness to spend money on current surgical technologies and devices, including surgical pliers. Several outstanding producers of surgical instruments are primarily based in North America.

Active Key Players in the Surgical Pliers Market

- Novo Surgical Inc. (US)

- Eurotek Surgical Co. (US)

- Millennium Surgical Corp. (US)

- Integra Life Sciences Corporation (US)

- Vital Surgical Technologies, Inc. (US)

- Key Surgical (US)

- Karl Schumacher (US)

- Sklar Surgical Instruments (US)

- Zimmer Biomet (US)

- Smith & Nephew (US)

- Johnson & Johnson Services, Inc (US)

- Becton, Dickinson and Company (US)

- Cooper Surgical, Inc. (US)

- Thompson Surgical Instruments Inc. (US)

- Aspen Surgical (US)

- Integra Life Sciences Corporation (US)

- Stryker (US)

- gSource, LLC. (New Jersey)

- Fine Science Tools Inc. (California)

- Trewavis Surgical (Australia)

- B. Braun Melsungen AG (Germany)

- Medtronic, plc (Ireland)

- Shanghai Bojin Medical Instrument Co. Ltd (China)

- KLS Martin Group (Germany)

- Cousin-Biotech (France), and Other Active Players

Key Industry Developments in the Surgical Pliers Market:

- In April 2024, MOLLI Surgical continues to push the boundaries of surgical care with the release of OncoPen™, a minimally invasive surgical device designed to empower surgeons and improve results for patients affected with breast cancers. The smooth, pen-like wand seamlessly integrates with the award-triumphing MOLLI® 2 System, offering state-of-the-art equipment for precisely targeting and getting rid of cancerous lesions.

- In August 2023, the surgical gadgets, laparoscopic instrumentation, and sterilization container properties from BD (Becton, Dickinson, and Company) (NYSE: BDX) were obtained by using STERIS plc.

|

Global Surgical Pliers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 161.41 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.35 % |

Market Size in 2032: |

USD 236.79 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Jaw Type |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL PLIERS MARKET BY TYPE (2017-2032)

- SURGICAL PLIERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISPOSABLE TYPE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE TYPE

- SURGICAL PLIERS MARKET BY JAW TYPE (2017-2032)

- SURGICAL PLIERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRAIGHT PLIERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CURVED PLIERS

- ANGLED PLIERS

- TISSUE FORCEPS

- SURGICAL PLIERS MARKET BY APPLICATION (2017-2032)

- SURGICAL PLIERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLAMPING AND OCCLUDING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISSECTING AND CUTTING

- HOLDING AND GRASPING

- SURGICAL PLIERS MARKET BY END USE (2017-2032)

- SURGICAL PLIERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AMBULATORY SURGICAL CENTERS

- DIAGNOSTIC CENTERS

- CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Surgical Pliers Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NOVO SURGICAL INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- EUROTEK SURGICAL CO. (US)

- MILLENNIUM SURGICAL CORP. (US)

- INTEGRA LIFE SCIENCES CORPORATION (US)

- VITAL SURGICAL TECHNOLOGIES, INC. (US)

- KEY SURGICAL (US)

- KARL SCHUMACHER (US)

- SKLAR SURGICAL INSTRUMENTS (US)

- ZIMMER BIOMET (US)

- SMITH & NEPHEW (US)

- JOHNSON & JOHNSON SERVICES, INC (US)

- BECTON, DICKINSON, AND COMPANY (US)

- COOPER SURGICAL, INC. (US)

- THOMPSON SURGICAL INSTRUMENTS INC. (US)

- ASPEN SURGICAL (US)

- INTEGRA LIFE SCIENCES CORPORATION (US)

- STRYKER (US)

- GSOURCE, LLC. (NEW JERSEY)

- FINE SCIENCE TOOLS INC. (CALIFORNIA)

- TREWAVIS SURGICAL (AUSTRALIA)

- B. BRAUN MELSUNGEN AG (GERMANY)

- MEDTRONIC, PLC (IRELAND)

- SHANGHAI BOJIN MEDICAL INSTRUMENT CO. LTD (CHINA)

- KLS MARTIN GROUP (GERMANY)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL PLIERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Jaw Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-Use

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Pliers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 161.41 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.35 % |

Market Size in 2032: |

USD 236.79 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Jaw Type |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL PLIERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL PLIERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL PLIERS MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL PLIERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL PLIERS MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL PLIERS MARKET BY PRODUCT TYPE

TABLE 008. REUSABLE MARKET OVERVIEW (2016-2028)

TABLE 009. DISPOSABLE MARKET OVERVIEW (2016-2028)

TABLE 010. SURGICAL PLIERS MARKET BY END-USER

TABLE 011. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 012. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

TABLE 013. DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

TABLE 014. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA SURGICAL PLIERS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 017. NORTH AMERICA SURGICAL PLIERS MARKET, BY END-USER (2016-2028)

TABLE 018. N SURGICAL PLIERS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE SURGICAL PLIERS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 020. EUROPE SURGICAL PLIERS MARKET, BY END-USER (2016-2028)

TABLE 021. SURGICAL PLIERS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC SURGICAL PLIERS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 023. ASIA PACIFIC SURGICAL PLIERS MARKET, BY END-USER (2016-2028)

TABLE 024. SURGICAL PLIERS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA SURGICAL PLIERS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA SURGICAL PLIERS MARKET, BY END-USER (2016-2028)

TABLE 027. SURGICAL PLIERS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA SURGICAL PLIERS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. SOUTH AMERICA SURGICAL PLIERS MARKET, BY END-USER (2016-2028)

TABLE 030. SURGICAL PLIERS MARKET, BY COUNTRY (2016-2028)

TABLE 031. NOVO SURGICAL INC. (UNITED STATES): SNAPSHOT

TABLE 032. NOVO SURGICAL INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 033. NOVO SURGICAL INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 034. NOVO SURGICAL INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. GSOURCE LLC. (NEW JERSEY): SNAPSHOT

TABLE 035. GSOURCE LLC. (NEW JERSEY): BUSINESS PERFORMANCE

TABLE 036. GSOURCE LLC. (NEW JERSEY): PRODUCT PORTFOLIO

TABLE 037. GSOURCE LLC. (NEW JERSEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. EUROTEK SURGICAL CO. (UNITED STATES): SNAPSHOT

TABLE 038. EUROTEK SURGICAL CO. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 039. EUROTEK SURGICAL CO. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 040. EUROTEK SURGICAL CO. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. MILLENNIUM SURGICAL CORP. (UNITED STATES): SNAPSHOT

TABLE 041. MILLENNIUM SURGICAL CORP. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 042. MILLENNIUM SURGICAL CORP. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 043. MILLENNIUM SURGICAL CORP. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. FINE SCIENCE TOOLS INC. (CALIFORNIA): SNAPSHOT

TABLE 044. FINE SCIENCE TOOLS INC. (CALIFORNIA): BUSINESS PERFORMANCE

TABLE 045. FINE SCIENCE TOOLS INC. (CALIFORNIA): PRODUCT PORTFOLIO

TABLE 046. FINE SCIENCE TOOLS INC. (CALIFORNIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. INTEGRA LIFESCIENCES CORPORATION (UNITED STATES): SNAPSHOT

TABLE 047. INTEGRA LIFESCIENCES CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 048. INTEGRA LIFESCIENCES CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 049. INTEGRA LIFESCIENCES CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. VITAL SURGICAL TECHNOLOGIES INC. (UNITED STATES): SNAPSHOT

TABLE 050. VITAL SURGICAL TECHNOLOGIES INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 051. VITAL SURGICAL TECHNOLOGIES INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 052. VITAL SURGICAL TECHNOLOGIES INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. KEY SURGICAL (UNITED STATES): SNAPSHOT

TABLE 053. KEY SURGICAL (UNITED STATES): BUSINESS PERFORMANCE

TABLE 054. KEY SURGICAL (UNITED STATES): PRODUCT PORTFOLIO

TABLE 055. KEY SURGICAL (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. KARL SCHUMACHER (UNITED STATES): SNAPSHOT

TABLE 056. KARL SCHUMACHER (UNITED STATES): BUSINESS PERFORMANCE

TABLE 057. KARL SCHUMACHER (UNITED STATES): PRODUCT PORTFOLIO

TABLE 058. KARL SCHUMACHER (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. TREWAVIS SURGICAL (AUSTRALIA): SNAPSHOT

TABLE 059. TREWAVIS SURGICAL (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 060. TREWAVIS SURGICAL (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 061. TREWAVIS SURGICAL (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 062. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 063. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 064. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL PLIERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL PLIERS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. REUSABLE MARKET OVERVIEW (2016-2028)

FIGURE 013. DISPOSABLE MARKET OVERVIEW (2016-2028)

FIGURE 014. SURGICAL PLIERS MARKET OVERVIEW BY END-USER

FIGURE 015. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 016. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 017. DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 018. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA SURGICAL PLIERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE SURGICAL PLIERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC SURGICAL PLIERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA SURGICAL PLIERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA SURGICAL PLIERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Pliers Market research report is 2024-2032.

Novo Surgical Inc. (US), Eurotek Surgical Co. (US), Millennium Surgical Corp. (US), Integra Life Sciences Corporation (US), Vital Surgical Technologies, Inc. (US), Key Surgical (US), Karl Schumacher (US), Sklar Surgical Instruments (US), Zimmer Biomet (US), Smith & Nephew (US), Johnson & Johnson Services, Inc (US), Becton, Dickinson and Company (US), Cooper Surgical, Inc. (US), Thompson Surgical Instruments Inc. (US), Aspen Surgical (US), Integra Life Sciences Corporation (US), Stryker (US), gSource, LLC. (New Jersey), Fine Science Tools Inc. (California), Trewavis Surgical (Australia), B. Braun Melsungen AG (Germany), Medtronic, p.C (Ireland), Shanghai Bojin Medical Instrument Co. Ltd (China), KLS Martin Group (Germany), Cousin-Biotech (France), and Other Active Players.

The Surgical Pliers Market is segmented into Type, Jaw Type, Application, End-User, and region. By Type, the market is categorized into Disposable Type & Reusable Type. By Jaw Type, the market is categorized into Straight Pliers, Curved Pliers, Angled Pliers & Tissue Forceps. By Application, the market is categorized into Clamping and Occluding, Dissecting and Cutting, and Holding and Grasping. By End-User, the market is categorized into Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, and Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Orthopedic Surgical Pliers are used for cutting, twisting, and crimping wires, putting off pins, gripping, and managing tissue, amongst many other capabilities at some stage in hand surgical operations. They're extensively utilized to stiffen the wires or reduce wire in surgical procedures.

Surgical Pliers Market Size Was Valued at USD 161.41 Million in 2023 and is Projected to Reach USD 236.79 Million by 2032, Growing at a CAGR of 4.35% From 2024-2032