Surgical Kits Market Synopsis

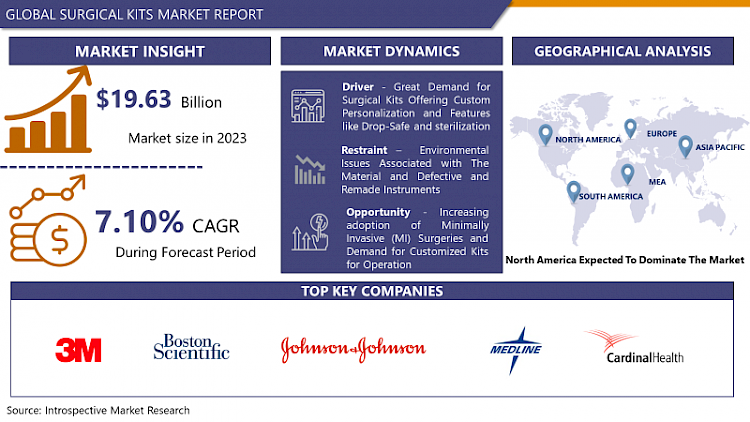

Surgical Kits Market Size Was Valued at USD 19.63 Billion in 2023 and is Projected to Reach USD 36.39 Billion by 2032, Growing at a CAGR of 7.10 % From 2024-2032.

A Surgical kit can be explained as a pre-arranged set of small medical instruments and tools that are used for purposes like medical procedures and surgical preparation of patients or circumcision. Surgical Kits come in very handy as they are already assembled for use and they offer labor & and cost-saving convenience and ensure that the surgeon has easy access to necessary instruments.

- Surgical Kits contain a collection of surgical tools and items selected for a particular type of procedure or surgery. Surgical kits are highly useful in lacerations, critical surgeries like heart surgery and brain surgery, cosmetic surgery, exploratory surgery, and many other medical procedures. Medical Centers need to have surgical kits employed for surgeons and physicians to have the necessary tools for the operation. Medics even carry surgical tools in their emergency bag often if there is ever a need to perform a serious life-saving surgery or even a small intervention.

- Surgical Kits are hugely served in medical procedures including laparoscopies, appendectomies, plastic surgeries, tonsillectomies, Eye surgeries, Neurosurgical-laminectomies, Rectal surgeries, labor delivery, and vaginal tubal ligations, among others. This is due to the reason that surgical kits typically contain most of the supplies and small medical instruments that are required to carry out a surgery. For instance, clamps, towels, forceps, needle holders, probes, retractors, scalpel handles, scissors, bowls, etc.

- Today, many different types of medical procedures and processes demand the handy availability of instruments from the surgeon. And hence, the presence of Surgical Kits is gaining a lot of importance by helping the Central Supply Department which can spend many working hours assembling the items to fill requirements. Such minimization of the cost, labor, and risk of unavailability of the right supplies in inventory is expected to help the sales growth of surgical kits in the global market.

Surgical Kits Market Trend Analysis

Great Demand for Surgical Kits Offering Custom Personalization And Features Like Drop-Safe and Sterilization

- With its advantageous offerings like improved safety, efficiency, reduced costs, and better performance in operating rooms, surgical kits have become a huge priority for surgeons and physicians. The physicians get great help by having surgical kits that include only all the necessary supplies with them.

- Further, innovations in medicine have led to the designing of surgical kits according to the configurations that can be customized as needed and asked by the customer. customized procedure kits contain all the medical equipment that is needed for a specific surgical procedure. By replacing many individual packages these kits help save time and money in minor and extensive surgical procedures. Physicians prefer to buy custom-made surgical instruments to meet their exact specifications. Such demand and availability of customized and personalized kits for surgeries are driving the growth of the market of Surgical Kits.

- Also, the innovations going on in the medical sector as a whole are leading to the development of cost-efficient and sterile solutions to ensure the safety and hold of surgical tools and prevent sterile items from falling outside of the sterile field. These drop-safe and sterile kits with their added benefits like cost reduction, optimization of workflow, and operating room customization are boosting the sales of such specific products and ultimately helping the market growth.

Increasing Adoption of Minimally Invasive (MI) Surgeries and Demand For Customized Kits For Operation

- Today, Minimally Invasive (MI) Surgery which is less invasive than traditional or open surgery is implemented at every hospital, clinic, or medical center. Minimally Invasive refers to the use of techniques that aid in reaching internal organs without a large incision. This specialized form of surgery that allows surgeons to operate by making a keyhole-sized incision and performing surgeries without leaving any scar is widely adopted across various places. This adoption of MI Surgeries is eventually leading to greater use of Surgical Kits offering comfortable accessibility which is to fuel the market demand for Surgical Kits even in the coming future.

- Moreover, advancements and innovations in medical technology have entailed the use of advanced robotic surgery and image-guided surgery that may be used for specific conditions, which in turn is leading to high flexibility in the composition of the Surgical Kits to optimize the procedures.

- Furthermore, the development of such effective kits for surgeries not only simplifies the procedures in the operating room but also speeds up the organization and operations by having everything immediately available and at hand, in a single kit. Most studies have shown that medical institutions that have switched to using surgical packs have increased their daily operations by 30-40%.

Surgical Kits Market Segment Analysis:

Surgical Kits Market Segmented on the basis of Type, Procedure, and End-User.

By Type, Disposable segment is expected to dominate the market during the forecast period

- Based on the type of Surgical kits, they can be divided into reusable and disposable kits, of which Disposable Surgical Kits have higher sales due to their higher usage in hospitals and specialty clinics. Disposable or single-use surgical kits are the ones that can only be used once and then need to be discarded.

- To offer efficient healthcare services, hygiene, and sanitation are the two most important factors that show up. Even if there are a multitude of sterilization and cleaning methods like chemical sterilization and heat sterilization there is always a scope of contamination left behind which may eventually turn into a life-threatening factor.

- To be broadly explained, around 234 million surgical procedures are conducted worldwide, approximately 10% of which have a risk of acquiring surgical site infection. Such site infections increase the average length of stay of every patient by around 9.7 days and lastly around 28% of the surgical site infections caused were attributed to equipment cleaning and sterilization. Hence, this leaves the healthcare sector with no choice and the only way that eliminate the chance of contamination is the use of disposable instruments.

- Moreover, disposable surgical kits have an edge over reusable ones even when it comes to cost-cutting, this is because reusable surgical kits have a high cost which further increases due to the need to purchase additional accessories. Also, the regular cleaning and maintenance bid extra cost for their regular sterilization.

By Procedure, the General Surgery segment held the largest share of 25.2% in 2022

- The dominance of the General Surgery segment in the Surgical Kits market is rooted in several key factors. Foremost is the sheer volume of general surgical procedures, spanning appendectomies, cholecystectomies, and hernia repairs. This high demand for kits tailored to diverse interventions establishes the General Surgery segment as a market leader.

- The versatility and cost-effectiveness of these kits contribute significantly. With a comprehensive range of instruments applicable to various procedures, they eliminate the need for specialized kits, reducing costs for healthcare facilities. Their affordability expands accessibility, further solidifying market share.

- Comparatively lower costs enhance their attractiveness, making General Surgery kits more economically viable for a broad range of healthcare institutions. The rise of minimally invasive techniques, particularly in laparoscopic surgeries within the general surgery domain, bolsters the market share of these kits.

- The broader usage settings, spanning hospitals, clinics, and ambulatory surgery centers, amplify their market presence. The aging global population, prone to age-related surgical issues, indirectly fuels demand for general surgery, sustaining the segment's market dominance.

Surgical Kits Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America with the countries like the US has arisen as a region with the most surgical procedures undertaken. For the past few years, the region is been experiencing a surge in the number of surgeries most common among them are Cataract Removal, C-Section, Circumcision, Hysterectomy, Heart Bypass Surgery, and Angioplasty and Atherectomy.

- Further, the continuous technological developments and the rising adoption of minimally invasive surgeries to perform these surgeries are leading to increased use of Effective Surgical Kits. Primarily driven by the adoption of new technologies and growing surgeries the regional healthcare businesses focus a lot on the number of surgeries that can be undertaken in the minimal possible time due to which the Surgical Kits that can help in reducing organizing and operating time serve a big purpose which is in conclusion expected to benefit the market in the upcoming period.

- North America is poised to dominate the Surgical Kits market over the forecast period. In 2022, liposuction emerged as the leading surgical cosmetic procedure in the US, reflecting a substantial demand for associated surgical kits. The region's prominence in cosmetic procedures, including neurotoxin treatments generating a revenue of $3.3 billion, underscores a robust market. With liposuction also ranking as the most-performed surgical cosmetic procedure globally in 2021, North America's influence is evident on a global scale. The region's sustained demand for cosmetic interventions and established market trends position it as a key driver in the evolving landscape of surgical kits.

Surgical Kits Market Top Key Players:

- 3M Company (US)

- Boston Scientific Corporation (US)

- Johnson & Johnson Services Inc. (US)

- Medline Industries LP (US)

- Cardinal Health Inc. (US)

- Stradis Healthcare (US)

- Stryker Corporation (US)

- Zimmer Biomet (US)

- Xenco Medical (US)

- Surgical Specialties Corporation (US)

- Integra LifeSciences (US)

- Dextera Surgical Inc. (US)

- Teleflex Incorporated (US)

- CONMED Corporation (US)

- CooperSurgical (US)

- Henry Schein (US)

- BD (Becton, Dickinson and Company) (US)

- B. Braun Melsungen AG (Germany)

- Medtronic PLC (Ireland)

- Novartis AG (Switzerland)

- Mölnlycke Health Care AB (Sweden)

- Paul Hartmann AG (Germany)

- Smith & Nephew PLC (United Kingdom)

- HOGY Medical Co. Ltd. (Japan)

- Olympus Corporation (Japan), and Other Major Players.

Key Industry Developments in the Surgical Kits Market:

- In April 2024, MOLLI Surgical unveils OncoPen™, a new minimally invasive tool enhancing precision and confidence in breast cancer surgeries. Designed to empower surgeons and improve patient outcomes, OncoPen™ integrates seamlessly with the award-winning MOLLI® 2 System. This sleek, pen-like wand provides sophisticated tools for precisely targeting and removing cancerous lesions, pushing the boundaries of surgical care.

- In November 2023, Cardinal Health announced today the U.S. launch of its SmartGown™ EDGE Breathable Surgical Gown with ASSIST™ Instrument Pockets, created to provide surgical teams safe and convenient instrument access in the operating room. Exclusively available from Cardinal Health, the gown is designed to hold one recommended instrument per pocket during surgical procedures, helping to provide handling efficiency and enabling clinical teams to focus on delivering safe patient care.

- In June 2022, Rayner entered into a commercial partnership with Brussels-based medical device company HASA OPTIX, a leading manufacturer of high-quality, recyclable single-use ophthalmic surgical instruments and instrument sets.

- In April 2022, Carl Zeiss Meditec acquired two manufacturers of surgical instruments (Kogent Surgical, LLC and Katalyst Surgical, LLC) to strengthen its positioning as a solution provider further.

|

Global Surgical Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.10 % |

Market Size in 2032: |

USD 36.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Procedure |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL KITS MARKET BY TYPE (2017-3032)

- SURGICAL KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISPOSABLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 3032F)

- Historic And Forecasted Market Size in Volume (2017 – 3032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE

- SURGICAL KITS MARKET BY PROCEDURE (2017-3032)

- SURGICAL KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GENERAL SURGERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 3032F)

- Historic And Forecasted Market Size in Volume (2017 – 3032F)

- Key Market Trends, Growth Factors, And Opportunities

- Geographic Segmentation Analysis

- CARDIAC SURGERY

- OPHTHALMOLOGY

- ORTHOPEDIC

- NEUROSURGERY

- GYNECOLOGY

- OTHER PROCEDURES

- SURGICAL KITS MARKET BY END-USER (2017-3032)

- SURGICAL KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 3032F)

- Historic And Forecasted Market Size in Volume (2017 – 3032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY CLINICS

- OTHER END-USERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SURGICAL KITSMarket Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BOSTON SCIENTIFIC CORPORATION (US)

- JOHNSON & JOHNSON SERVICES INC. (US)

- MEDLINE INDUSTRIES LP (US)

- CARDINAL HEALTH INC. (US)

- STRADIS HEALTHCARE (US)

- STRYKER CORPORATION (US)

- ZIMMER BIOMET (US)

- XENCO MEDICAL (US)

- SURGICAL SPECIALTIES CORPORATION (US)

- INTEGRA LIFESCIENCES (US)

- DEXTERA SURGICAL INC. (US)

- TELEFLEX INCORPORATED (US)

- CONMED CORPORATION (US)

- COOPERSURGICAL (US)

- HENRY SCHEIN (US)

- BD (BECTON, DICKINSON AND COMPANY) (US)

- B. BRAUN MELSUNGEN AG (GERMANY)

- MEDTRONIC PLC (IRELAND)

- NOVARTIS AG (SWITZERLAND)

- MÖLNLYCKE HEALTH CARE AB (SWEDEN)

- PAUL HARTMANN AG (GERMANY)

- SMITH & NEPHEW PLC (UNITED KINGDOM)

- HOGY MEDICAL CO. LTD. (JAPAN)

- OLYMPUS CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL KITS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.10 % |

Market Size in 2032: |

USD 36.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Procedure |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Surgical Kits Market research report is 2024-2032.

3M Company (US), Boston Scientific Corporation (US), Johnson & Johnson Services Inc. (US), Medline Industries LP (US), Cardinal Health Inc. (US), Stradis Healthcare (US), Stryker Corporation (US), Zimmer Biomet (US), Xenco Medical (US), Surgical Specialties Corporation (US), Integra LifeSciences (US), Dextera Surgical Inc. (US), Teleflex Incorporated (US), CONMED Corporation (US), CooperSurgical (US), Henry Schein (US), BD (Becton, Dickinson and Company) (US), B. Braun Melsungen AG (Germany), Medtronic PLC (Ireland), Novartis AG (Switzerland), Mölnlycke Health Care AB (Sweden), Paul Hartmann AG (Germany), Smith & Nephew PLC (United Kingdom), HOGY Medical Co. Ltd. (Japan), Olympus Corporation (Japan), and Other Major Players.

The Surgical Kits Market is segmented into Type, Procedure, End-User, and region. By Type, the market is categorized into Disposable and Reusable. By Procedure, the market is categorized into General Surgery, Cardiac Surgery, Ophthalmology, Orthopedic, Neurosurgery, Gynecology, and Other Procedures. By End-User, the market is categorized into Hospitals, Specialty Clinics, and Other End-Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Surgical kit can be explained as a pre-arranged set of small medical instruments and tools that are used for purposes like medical procedures and surgical preparation of patients or circumcision. Surgical Kits come in very handy as they are already assembled for use and they offer labor & and cost-saving convenience and ensure that the surgeon has easy access to necessary instruments.

Surgical Kits Market Size Was Valued at USD 19.63 Billion in 2023 and is Projected to Reach USD 36.39 Billion by 2032, Growing at a CAGR of 7.10 % From 2024-2032.