Surgical Equipment Market Synopsis

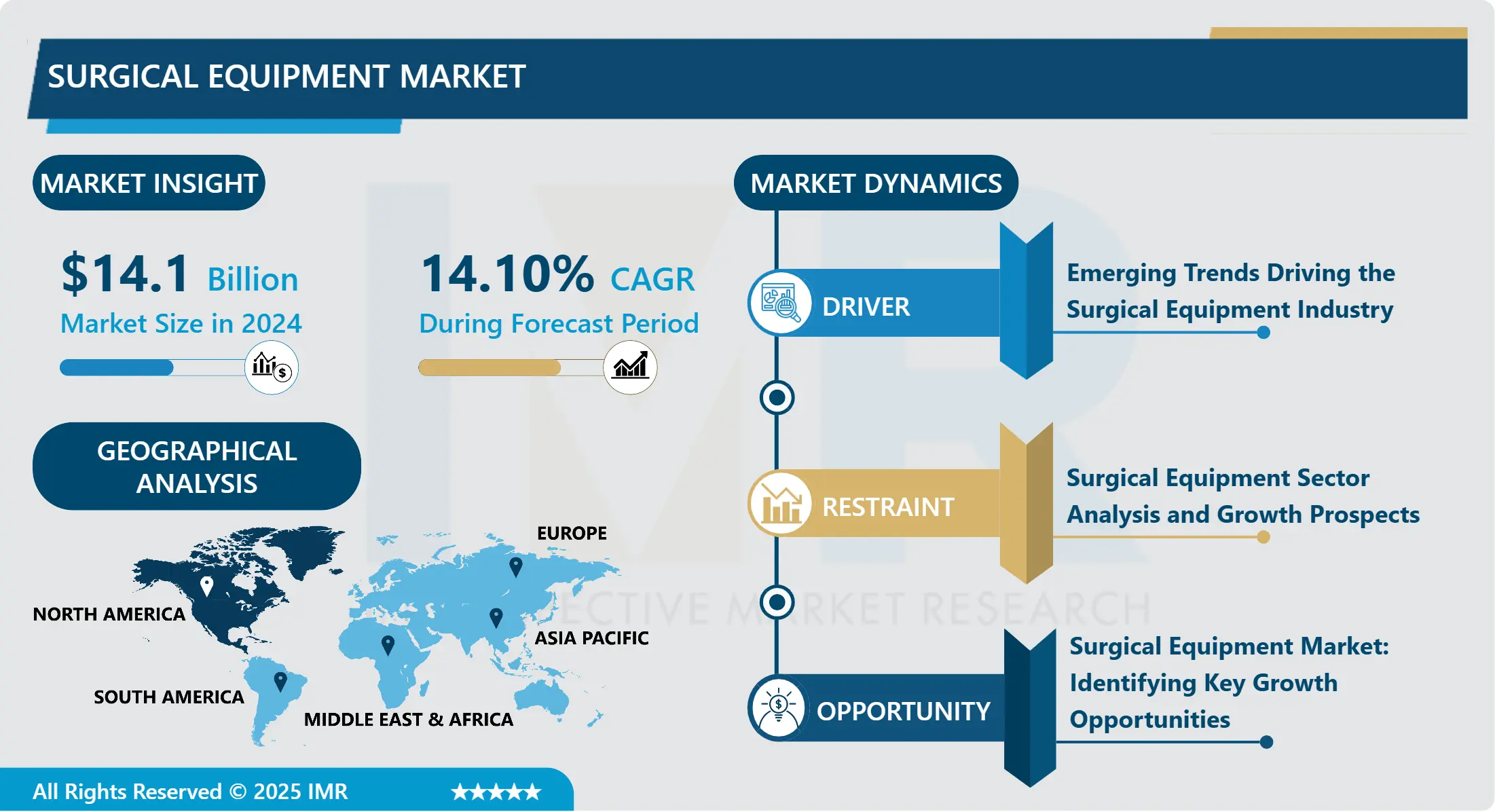

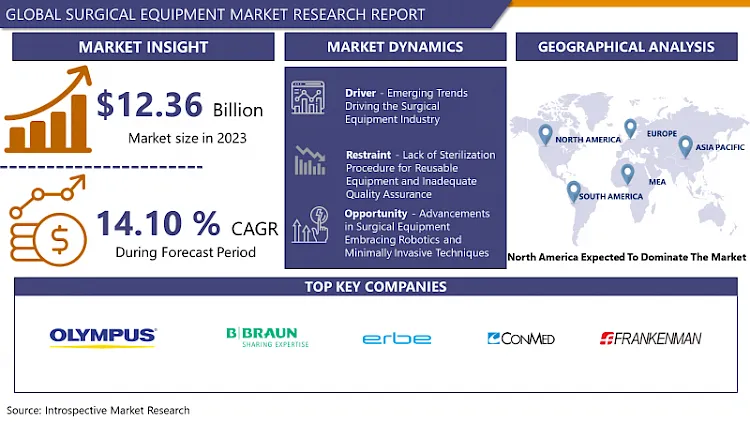

Surgical Equipment Market Size is Valued at USD 14.1 Billion in 2024, and is Projected to Reach USD 40.5 Billion by 2032, Growing at a CAGR of 14.10% From 2025-2032.

Surgical equipment refers to the tools, devices, and instruments used in surgeries and the market for surgical equipment is quite broad. It comprises of sharp instruments like scalpels, forceps, scissors, retractors, suture carriers as well as other non-sharp instruments like electrosurgical devices. This market is fostered by factors such as the rising prevalence of surgeries, innovation in technologies that make surgical procedures more accurate and less invasive, and the rising trend in ambulatory surgeries. Other factors affecting the market include: development of healthcare infrastructure, increase in geriatric population and prevalence of chronic diseases.

The major factors that are fueling the growth of the surgical equipment market at global level are technological development, rise in the number of patients suffering from chronic diseases, and increasing population of geriatrics. Advancements in technology have made it possible to perform surgeries through small incisions in the body, and this has made it possible to reap some benefits like low post-operative complications, short hospital stays, and quick recovery periods. Furthermore, the higher incidence of chronic diseases including cardiovascular diseases, cancer, and neurological disorders has led to a higher demand for surgeries, which in turn has bolstered the market growth.

Furthermore, the increasing number of surgical procedures across the globe is also playing a significant role in the growth of the market for surgical equipment. Older people are at higher risk of developing different chronic diseases and often need surgical procedures more often than people of other age. The number of elderly people is increasing day by day, especially in developed countries, and this factor will increase the requirement of surgical procedures and equipment in the future years and thus fuel the growth of the market.

Surgical Equipment Market Trend Analysis

Advancements in Surgical Equipment, Embracing Robotics and Minimally Invasive Techniques

- Currently, the surgical equipment market is experiencing a shift towards the incorporation of more innovative technologies in the field to improve effectiveness of surgical operations. One of the significant innovations is the introduction of surgical robots that provide the surgeon with enhanced accuracy, dexterity, and reach. These systems are being implemented at a rising rate in different fields of surgery such as orthopedic, urological, and general surgery, which in turn is propelling the market growth.

- Another of the trends is the continuing increase in the use of minimally invasive surgical (MIS) procedures as they offer a number of advantages over traditional surgery, including shorter hospital stays, faster recovery, and less post-operative discomfort. This trend is pushing the development of dedicated instruments and equipment for MIS such as endoscopies, trocars, and robotic systems. Also, the rising incidence of chronic ailments and the aging populace is also driving the demand for surgical equipment, which is positively contributing to the market growth.

Seizing Growth Opportunities, The Evolving Landscape of the Global Surgical Equipment Market

- The global market for surgical equipment is likely to expand at a steady pace in the near future due to the following factors. Technological innovations in surgical instruments and equipment including the robotic surgery systems are improving on the accuracy of surgery operations while at the same time reducing the number of days needed for recovery hence the high demand for these products. Furthermore, the global rise in the number of chronic diseases and an aging population will continue to create a demand for surgeries to be performed, thereby expanding the market.

- Additionally, the outbreak of the COVID-19 pandemic has also placed emphasis on the need for surgical equipment in various health facilities, thus increasing its demand. There is also a trend towards less invasive surgeries, which need specialized equipment and therefore stimulate the use of new and improved instruments. In general, the market for surgical equipment is full of opportunities for producers and suppliers to introduce new products into the market and develop a range of new products to meet the needs of this rapidly growing segment of the healthcare industry.

Surgical Equipment Market Segment Analysis:

Surgical Equipment Market Segmented on the basis of Product, Application, End-users, and Region.

By Product, Handheld Device segment is expected to dominate the market during the forecast period

- The surgical equipment market has been classified by product type as handheld surgical devices, surgical sutures and staplers, electrosurgical devices, and others. Surgical tools, such as scalpels, forceps, and scissors, are handheld instruments that are widely used in surgeries for precision and grip. Surgical sutures and staplers are important tools when it comes to closure of wounds and they enhance fast healing and minimizes chances of infections. Electrosurgical devices include generators and electrodes and they are employed in surgery for cutting, coagulation and sealing tissues. Other categories of surgical instruments include surgical retractors, trocar and dilators which are used in various surgical operations in accordance with the roles they play in the operations as a whole.

- All these product segments are critical in contemporary surgery with constant advancements in technology improving their efficiency and safety. Since the importance of minimally invasive surgeries is increasing gradually, the manufacturers are coming up with new products that are small in size, more accurate and easier to handle which is again pushing the evolution of the global surgical equipment market.

By Application, General Surgery segment held the largest share in 2024

- Based on the application, the global surgical equipment market is segmented into cardiovascular, neurology, gynecology, general surgery, and others. Cardiovascular surgery is a type of surgery that involves the heart and blood vessels, and requires the use of specific instruments such as stents, catheters, and heart lung machines. Neurology surgery is conducted on the nervous system and involves the use of specialized instruments, including microscopes, drills, and nerve stimulators. Gynecology surgery deals with the female reproductive system and involves the use of devices such as speculums, forceps, and colposcopes.

- General surgery is a field of medicine that includes operations on the abdomen, skin, and soft tissues that involve the use of instruments like retractors, scalpels, and suction devices. Other surgeries that require surgical equipment include orthopedic surgeries, ophthalmologic surgeries, and surgeries of the ears, nose, and throat, all of which require specific instruments and equipment. With the development of medical technology, there will be an increase in the need for surgical equipment in these different applications, thus offering growth prospects for market participants to diversify their portfolios.

Surgical Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American surgical equipment market is a promising and competitive segment that is fueled by factors like technological innovation, population aging, and the rise in surgeries. The United States has the highest market share in this segment because of high healthcare spending, well-developed healthcare infrastructure, and a high volume of surgeries performed in the country. In this context, the presence of major market players and the increasing investments in R&D activities also help in boosting the market growth in this region.

- Another important market in North America is Canada, which has a well-developed healthcare sector and a growing demand for sophisticated surgical tools. The growth factors that are currently being observed in the market include the increase in healthcare spending, increasing awareness of minimally invasive surgical procedures, and government policies to enhance healthcare facilities. The North American surgical equipment market is highly saturated and fragmented with the key players aiming at new product development, partnerships, and acquisitions to consolidate their position in the market.

Active Key Players in the Surgical Equipment Market

- Aspen Surgical (US)

- B. Braun Se (Germany)

- Boston Scientific Corporation (US)

- Conmed Corporation (US)

- Erbe Elektromedizin Gmbh (Germany)

- Frankenman International Ltd (China)

- Fuhrmann Gmbh (Germany)

- Geister Medizintechnik Gmbh (US)

- Integra Lifesciences (US)

- Medical Device Business Services, Inc. (US)

- Medtronic (Ireland)

- Meril Life Sciences Pvt. Ltd. (India)

- Olympus Corporation (Japan)

- Stryker (US)

- Zimmer Biomet (US)

- Other Active Players.

|

Global Surgical Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.10 % |

Market Size in 2032: |

USD 40.5 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Equipment Market by Product (2018-2032)

4.1 Surgical Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Handheld Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Surgical Sutures & Staplers

4.5 Electrosurgical Devices

4.6 Others

Chapter 5: Surgical Equipment Market by Application (2018-2032)

5.1 Surgical Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiovascular

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neurology

5.5 Gynecology

5.6 General Surgery

5.7 Others

Chapter 6: Surgical Equipment Market by End User (2018-2032)

6.1 Surgical Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC(IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GE HEALTHCARE (US)

7.4 OLYMPUS CORPORATION (JAPAN)

7.5 SIEMENS AG (GERMANY)

7.6 HOLOGIC INC. (US)

7.7 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

7.8 SURGICAL IMAGING ASSOCIATES LLC (US)

7.9 SHIMADZU CORPORATION (JAPAN)

7.10 GENERAL ELECTRIC (US)

7.11 ALLENGERS MEDICAL SYSTEMS LIMITED (INDIA)

7.12 CONMED CORPORATION (US)

7.13 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

7.14 AGILENT TECHNOLOGIES INC. (US)

Chapter 8: Global Surgical Equipment Market By Region

8.1 Overview

8.2. North America Surgical Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Handheld Devices

8.2.4.2 Surgical Sutures & Staplers

8.2.4.3 Electrosurgical Devices

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cardiovascular

8.2.5.2 Neurology

8.2.5.3 Gynecology

8.2.5.4 General Surgery

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surgical Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Handheld Devices

8.3.4.2 Surgical Sutures & Staplers

8.3.4.3 Electrosurgical Devices

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cardiovascular

8.3.5.2 Neurology

8.3.5.3 Gynecology

8.3.5.4 General Surgery

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surgical Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Handheld Devices

8.4.4.2 Surgical Sutures & Staplers

8.4.4.3 Electrosurgical Devices

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cardiovascular

8.4.5.2 Neurology

8.4.5.3 Gynecology

8.4.5.4 General Surgery

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surgical Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Handheld Devices

8.5.4.2 Surgical Sutures & Staplers

8.5.4.3 Electrosurgical Devices

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cardiovascular

8.5.5.2 Neurology

8.5.5.3 Gynecology

8.5.5.4 General Surgery

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surgical Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Handheld Devices

8.6.4.2 Surgical Sutures & Staplers

8.6.4.3 Electrosurgical Devices

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cardiovascular

8.6.5.2 Neurology

8.6.5.3 Gynecology

8.6.5.4 General Surgery

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surgical Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Handheld Devices

8.7.4.2 Surgical Sutures & Staplers

8.7.4.3 Electrosurgical Devices

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cardiovascular

8.7.5.2 Neurology

8.7.5.3 Gynecology

8.7.5.4 General Surgery

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Surgical Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.10 % |

Market Size in 2032: |

USD 40.5 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||