Surgery Center Software Market Synopsis

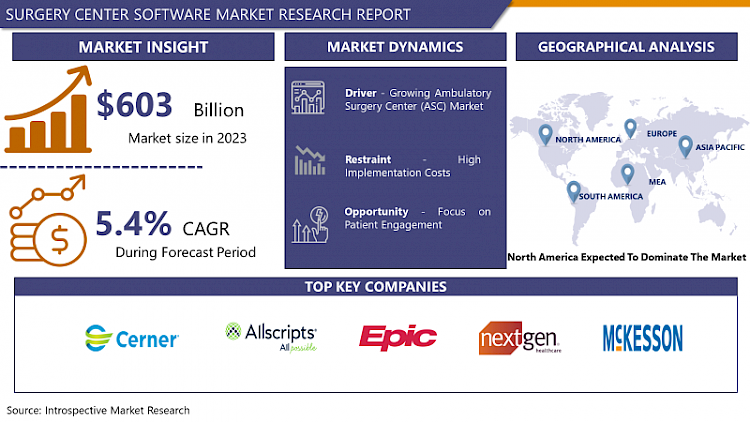

Surgery Center Software Market Size Was Valued at USD 603 Billion in 2023 and is Projected to Reach USD 968.02 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.

Surgery center software is software that is specifically tailored to enhance and support a variety of limited surgical center solutions. These software applications are designed specifically for OUT patient surgical centers and contain rich functionality to improve surgery throughput, Clinic accuracy, and patient care during the entire surgery experience.

- In its most basic form, Surgery Center Software includes features lets to organize scheduling sessions and patient appointments, record and maintain Electronic Health Records, monitor inventory, generate and track bills and invoices and meet regulatory requirements. Through the co-ordinate utilization of these features, the integrated Software for Surgery Centre has an added advantage of reducing all barriers within the centre hence enhancing the effectiveness of the administrators, clinician, and support staff hence enhancing the patients.

- It is through integrating Surgery Center Software into surgical facilities that there is a guarantee that the facilities will perform surgery activities differently by embracing the best practices of efficiency in patient care. From the user interface and externally operable modules of it, this software effectively addresses the versatile weird problems and extraordinary potential of healthcare organizations and concentrates the healthcare providers to deliver comprehensible patient care with less concern about their boring administrative work.

- Furthermore, SST unites teams of specialists across different departments and monitors all the steps of surgical treatment to guarantee the high-quality of work. These solutions cover the range from preoperative checks and evaluations of patient’s status to postoperative meetings and analyses; they are designed to improve efficiency, quality, speed, and adherence to guidelines. In conclusion, Surgery Center Software is a brand-new approach to outpatient surgical facility planning, by means of which the centre can take full advantage of the available resources, as well as ensure efficient and effective work structures while providing high-quality and efficient patient care.

Surgery Center Software Market Trend Analysis :

Rising Adoption of Electronic Health Records (EHRs)

- This is a factor that is expected to encourage the emergence of the demand for the Surgery Center Software market, one of the major trends that has been up and coming is; The use of Electronic Health Records (EHRs) is rapidly growing. An EHR acts as personal health record of patient and contains data like clinical history and diagnosis, medications and treatments, immunization history, allergy history, radiology report, laboratory test results. Due to the growing awareness and practical benefits of converting from the traditionally paper documenting systems of outpatient surgical facilities to electronic ones, Surgery Center Software that is built in with powerful EHR functions has been in high demand within this emerging market.

- To elaborate on this idea, Carayon and Gurses argued that integration of EHRs can facilitate data sharing and the coordination of work among individuals or departments within the surgical center. Furthermore, EHRs protect the patient by decreasing the opportunities for mistakes that come with the paper-based record keeping; Integrating a comprehensive and updated record of the patient at every phase of the operation cycle.

- Moreover, the shift toward using EHRs in surgery centers generalizes the healthcare industry trends toward increasing the level of interoperability and digitization. Interoperability with other EMS including Hospitals, laboratories, and pharma through integrated EHR solutions and can exchange data in real-time to other healthcare stakeholders. This saves time and rework and in addition fosters the value based care and population health management.

- Moreover, EHRs have an analytical characteristic that provides capabilities that help the surgical centers to understand the challenges and respond to them in accordance with the evidence-based practices, monitor its performance, and pursue quality improvement aims and goals. In general, a growing surge of surgery centers’ adoption of EHRs is indicative of the critical impact of applied technology in the advancement of efficient, quality, and patient-centered care within the health-care space.

Growing Artificial Intelligence (AI) and Machine Learning (ML)

- AI and ML remain a promising development for the Surgery Center Software market as they can help enhance this market with their upgraded performances, accuracy, and positive impact on patient conditions. HL7 interfacing can allow the gadgets to assimilate large volumes of information produced in surgery centers such as records, imaging studies, and surgery outcomes to make valuable patterns, trends, and predictive analytics. Some of the key functions that can be improved by Applying Machine Learning include; Setting of appointment schedules, resource management and inventory management since Machine Learning algorithms can take data from the past to inform current and real-time operations of the surgical center efficiently.

- Furthermore, systems like diagnostics or AI-based decision support systems are useful for the doctor and their clinical decision-making to enhance diagnostic accuracy, identification of treatment plans, and procedural results of surgeries. Considering that Surgery Center Software has the potential to incorporate such AI and ML features, providers could potentially transform some medical work processes for the better and find new ways of cost reduction while providing highly individualized, evidence-based care to patients.

- Additionally, AI and machine learning are poised to become game changers in the surgical space and could spur technology trends and improvements in areas such as minimally invasive surgery, robotics, and image-guiding surgery. Surgical assist robotic systems using AI can process intraoperative data obtained from surgical instruments, medical images, and the patient’s physiological parameters, to give practical advice to surgeons to minimize errors, especially in critical surgeries.

- Also, ML algorithms can work on SMA records to determine the best practices with respect to surgical procedures, enhance approaches to performing surgeries, and adapt treatment modalities according to patients’ circumstances. With further developments in AI and ML applications for Surgery Center Software, there is enormous potential for the improvement of fluid and closed-loop management of the center and more effective delivery of patient care, making these technologies strategic to innovation and growth in the market.

Surgery Center Software Market Segment Analysis:

Surgery Center Software Market is segmented based on Type, Applications.

By Type, 2-Bay segment is expected to dominate the market during the forecast period

- Specifically, the segment, which is identified as Software Solutions to support the work of the doctors and administrative staff, occupies a rather significant place in the sphere of Surgery Center Software. This is a variety of software solutions that provide a vast range of features, custom designed for use in an outpatient surgical center.

- In another methodology, it has been identified that software solutions affect the many facets of surgical centers such as patient scheduling, EHR, inventory, billing, and even compliance with legal requirements. These solutions are aimed at increasing efficiency, improving accuracy, and improving patient care during such processes, allowing profiles COs focus more on the provision of high-quality services and less on paperwork.

- Due to the interaction minimization with other non-clinician personnel and ability to present more flexible and individual approaches, the use of software solutions, and due to that, solutions can facilitate the interaction between the clinicians and the non-clinician staff members in order to optimize the most potential result for patients.

- Although services are indeed essential to help support the adoption and utilization of Surgery Center Software, it is the Software Solutions segment that has the most market share because it is capable of revolutionizing the management of center’s outpatient surgeries. Not only does the application enhance and simplify the communication and collaboration of the various distributed teams but also enhances documentation and compliance with strict regulatory guidelines.

- Furthermore, these solutions are connected as flexible and able to adapt to the constant change in the needs and issues experienced by surgery centers, that makes it impossible to not see these tools as valuable assets in the fight for higher quality of work and general center’s performance improvement. The trend is also likely to remain unchanged in the future due to the growing demand for technology-based solutions in the healthcare sector leading to continued dominance of Software Solutions in the surgery center software market along with its focus on the development of new and improved methods of Outpatient surgical management.

By Applications, the Operating Room Scheduling Solutions segment held the largest share in 2023

- Among the segments named in the Surgery Center Software market, the Operating Room Scheduling Solutions segment outbursts as the standout one. These solutions are crucial for optimizing operation in surgical centers and maintaining an efficient organization of surgical activities of scheduling the procedures and allocating operating rooms and surgical teams as well as other equipment.

- The Operating Room Scheduling Solutions is useful in resource planning and management of schedules to enable the Operating Rooms to handle multiple procedures at a given instance, avoid long gaps between procedures and reduce the amount of time patients have to wait for their turn hence making the systems more efficient. By this drive to enhance the operating throughput and reduce waiting time in outpatient surgical centers, the need for reliable scheduling software solutions has been on the rise, placing this segment as the dominant force in the market for Surgery Center Software.

- Moreover, segment like Performance Management Solutions also they come into picture which plays a vital role in the Surgery Center Software market. These solutions provide an analytical and reporting solution that allows for the monitoring and assessment of operational KPI which relates to patient outcomes, service effectiveness and financial performance.

- Establishing the use of Performance Management Solutions, surgical centers are able to receive information based on data analysis, which will help them recognize the abilities that require enhancement and distribution of resources to support activities aimed at maintaining high quality.

- Given the trend in healthcare centers in the direction of increasing focus on value-based care delivery, as well as better operational efficiency, the adoption rate of Performance Management Solutions is poised to climb higher; this, in turn, will give the Surgery Center Software market a sense of riding on the coattails of the latter

Surgery Center Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Firstly, the advanced surgical infrastructure across the United States and Canada has positively impacted the growth of the surgery center software market. First of all, it should be mentioned that the health care of the region has a great level as evidence by the number of the outpatient surgical centers and ambulatory care facilities. This network of healthcare providers makes for a vast demand for delicate software solution for intended surgery centers.

- North America holds some of the leading healthcare IT companies that will spearhead in offering major Surgery Center Software solutions. These firms utilize their specialization in healthcare technology as well as their considerable regional standing in order to promote the growth of new business and sales in the area.

- Furthermore, North America has supportive laws and reimbursement policies through the government thus encouraging hospitals and other health care institutions to consider technology solutions aimed at insurance patient care, staff productivity, and compliance with identified guidelines. Another factor is that even the region itself is dedicated towards enhancing health care quality and patient safety; this makes it more inclined towards adopting the Surgeries Center Software.

- On the same note, the identification of proficient IT experts and researchers in many countries globally means that we can innovate and develop new cutting-edge software solutions more frequently. Adding to the whole equation, it is necessary to mention the culture of innovation and entrepreneurship which assists in explaining North America’s leadership in the area of Surgery Center Software Market.

Active Key Players in the Surgery Center Software Market

- Cerner Corporation (United States)

- Allscripts Healthcare Solutions, Inc. (United States)

- Epic Systems Corporation (United States)

- NextGen Healthcare, Inc. (United States)

- McKesson Corporation (United States)

- MEDITECH (United States)

- GE Healthcare (United States)

- Siemens Healthineers (Germany)

- Surgical Information Systems (United States)

- AmkaiSolutions (United States)

- Advantech Co., Ltd. (Taiwan)

- HSTpathways (United States)

- PrognoCIS by Bizmatics (United States)

- Medical Information Technology, Inc. (MEDITECH) (United States)

- QGenda (United States)

- AmkaiOffice (United States)

- Simplify ASC (United States)

- Surgical Information Systems (United States)

- Kareo (United States)

- eClinicalWorks (United States)

- Other Key Players

Global Surgery Center Software Market Scope:

|

Global Surgery Center Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 603 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 968.02 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGERY CENTER SOFTWARE MARKET BY DEPLOYMENT (2017-2032)

- SURGERY CENTER SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SERVICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE SOLUTIONS

- SURGERY CENTER SOFTWARE MARKET BY INDUSTRY (2017-2032)

- SURGERY CENTER SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANESTHESIA INFORMATION MANAGEMENT SYSTEMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DATA MANAGEMENT AND COMMUNICATION SOLUTIONS

- OPERATING ROOM SUPPLY MANAGEMENT SOLUTIONS

- OPERATING ROOM SCHEDULING SOLUTIONS

- PERFORMANCE MANAGEMENT SOLUTIONS

- OTHER SOLUTIONS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surgery Center Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CERNER CORPORATION (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. (UNITED STATES)

- EPIC SYSTEMS CORPORATION (UNITED STATES)

- NEXTGEN HEALTHCARE, INC. (UNITED STATES)

- MCKESSON CORPORATION (UNITED STATES)

- MEDITECH (UNITED STATES)

- GE HEALTHCARE (UNITED STATES)

- SIEMENS HEALTHINEERS (GERMANY)

- SURGICAL INFORMATION SYSTEMS (UNITED STATES)

- AMKAISOLUTIONS (UNITED STATES)

- ADVANTECH CO., LTD. (TAIWAN)

- HSTPATHWAYS (UNITED STATES)

- PROGNOCIS BY BIZMATICS (UNITED STATES)

- MEDICAL INFORMATION TECHNOLOGY, INC. (MEDITECH) (UNITED STATES)

- QGENDA (UNITED STATES)

- AMKAIOFFICE (UNITED STATES)

- SIMPLIFY ASC (UNITED STATES)

- SURGICAL INFORMATION SYSTEMS (UNITED STATES)

- KAREO (UNITED STATES)

- ECLINICALWORKS (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGERY CENTER SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Surgery Center Software Market Scope:

|

Global Surgery Center Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 603 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 968.02 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGERY CENTER SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGERY CENTER SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGERY CENTER SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. SURGERY CENTER SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGERY CENTER SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGERY CENTER SOFTWARE MARKET BY TYPE

TABLE 008. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 010. SURGERY CENTER SOFTWARE MARKET BY APPLICATION

TABLE 011. ANESTHESIA INFORMATION MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 012. MARKET OVERVIEW (2016-2028)

TABLE 013. DATA MANAGEMENT AND COMMUNICATION SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 014. MARKET OVERVIEW (2016-2028)

TABLE 015. OPERATING ROOM SUPPLY MANAGEMENT SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 016. MARKET OVERVIEW (2016-2028)

TABLE 017. OPERATING ROOM SCHEDULING SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 018. MARKET OVERVIEW (2016-2028)

TABLE 019. PERFORMANCE MANAGEMENT SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA SURGERY CENTER SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA SURGERY CENTER SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 022. N SURGERY CENTER SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE SURGERY CENTER SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE SURGERY CENTER SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 025. SURGERY CENTER SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC SURGERY CENTER SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC SURGERY CENTER SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 028. SURGERY CENTER SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SURGERY CENTER SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA SURGERY CENTER SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 031. SURGERY CENTER SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA SURGERY CENTER SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA SURGERY CENTER SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 034. SURGERY CENTER SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 035. CERNER CORP.: SNAPSHOT

TABLE 036. CERNER CORP.: BUSINESS PERFORMANCE

TABLE 037. CERNER CORP.: PRODUCT PORTFOLIO

TABLE 038. CERNER CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. MCKESSON CORP: SNAPSHOT

TABLE 039. MCKESSON CORP: BUSINESS PERFORMANCE

TABLE 040. MCKESSON CORP: PRODUCT PORTFOLIO

TABLE 041. MCKESSON CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. BD: SNAPSHOT

TABLE 042. BD: BUSINESS PERFORMANCE

TABLE 043. BD: PRODUCT PORTFOLIO

TABLE 044. BD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GE HEALTHCARE: SNAPSHOT

TABLE 045. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 046. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 047. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. OMNICELL INC.: SNAPSHOT

TABLE 048. OMNICELL INC.: BUSINESS PERFORMANCE

TABLE 049. OMNICELL INC.: PRODUCT PORTFOLIO

TABLE 050. OMNICELL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GETINGE AB: SNAPSHOT

TABLE 051. GETINGE AB: BUSINESS PERFORMANCE

TABLE 052. GETINGE AB: PRODUCT PORTFOLIO

TABLE 053. GETINGE AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. RICHARD WOLF GMBH: SNAPSHOT

TABLE 054. RICHARD WOLF GMBH: BUSINESS PERFORMANCE

TABLE 055. RICHARD WOLF GMBH: PRODUCT PORTFOLIO

TABLE 056. RICHARD WOLF GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. STERIS PLC: SNAPSHOT

TABLE 057. STERIS PLC: BUSINESS PERFORMANCE

TABLE 058. STERIS PLC: PRODUCT PORTFOLIO

TABLE 059. STERIS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BARCO NV: SNAPSHOT

TABLE 060. BARCO NV: BUSINESS PERFORMANCE

TABLE 061. BARCO NV: PRODUCT PORTFOLIO

TABLE 062. BARCO NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SURGICAL INFORMATION SYSTEMS: SNAPSHOT

TABLE 063. SURGICAL INFORMATION SYSTEMS: BUSINESS PERFORMANCE

TABLE 064. SURGICAL INFORMATION SYSTEMS: PRODUCT PORTFOLIO

TABLE 065. SURGICAL INFORMATION SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ASCOM: SNAPSHOT

TABLE 066. ASCOM: BUSINESS PERFORMANCE

TABLE 067. ASCOM: PRODUCT PORTFOLIO

TABLE 068. ASCOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGERY CENTER SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGERY CENTER SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 014. SURGERY CENTER SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. ANESTHESIA INFORMATION MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 016. MARKET OVERVIEW (2016-2028)

FIGURE 017. DATA MANAGEMENT AND COMMUNICATION SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 018. MARKET OVERVIEW (2016-2028)

FIGURE 019. OPERATING ROOM SUPPLY MANAGEMENT SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 020. MARKET OVERVIEW (2016-2028)

FIGURE 021. OPERATING ROOM SCHEDULING SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 022. MARKET OVERVIEW (2016-2028)

FIGURE 023. PERFORMANCE MANAGEMENT SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA SURGERY CENTER SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE SURGERY CENTER SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC SURGERY CENTER SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA SURGERY CENTER SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA SURGERY CENTER SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgery Center Software Market research report is 2024-2032.

Cerner Corporation (United States), Allscripts Healthcare Solutions, Inc. (United States), Epic Systems Corporation (United States), NextGen Healthcare, Inc. (United States), McKesson Corporation (United States), MEDITECH (United States), GE Healthcare (United States), Siemens Healthineers (Germany), Surgical Information Systems (United States), AmkaiSolutions (United States), Advantech Co., Ltd. (Taiwan), HSTpathways (United States), PrognoCIS by Bizmatics (United States), Medical Information Technology, Inc. (MEDITECH) (United States), QGenda (United States), AmkaiOffice (United States), Simplify ASC (United States), Surgical Information Systems (United States), Kareo (United States), eClinicalWorks (United States) and Other Major Players.

The Surgery Center Software Market is segmented into Type, Applications, and region. By Type, the market is categorized into Services, Software Solutions. By Applications, the market is categorized into Anesthesia Information Management Systems, Data Management and Communication Solutions, Operating Room Supply Management Solutions, Operating Room Scheduling Solutions, Performance Management Solutions, and Other Solutions. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Surgery Center Software is an outpatient surgical facility specific software tool that is intended for increasing the efficiency of surgical care facilities. It covers features such activities as appointment bookings, electronic health records systems, inventory management, billing and even compliance with industry standards. When implemented holistically and in collaboration with one another, these features create Surgery Center Software to streamline specific activities, increase effectiveness, and strengthen patient experiences across the various stages of surgery.

Surgery Center Software Market Size Was Valued at USD 603 Billion in 2023, and is Projected to Reach USD 968.02 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.