Stem Cell Manufacturing Market Synopsis

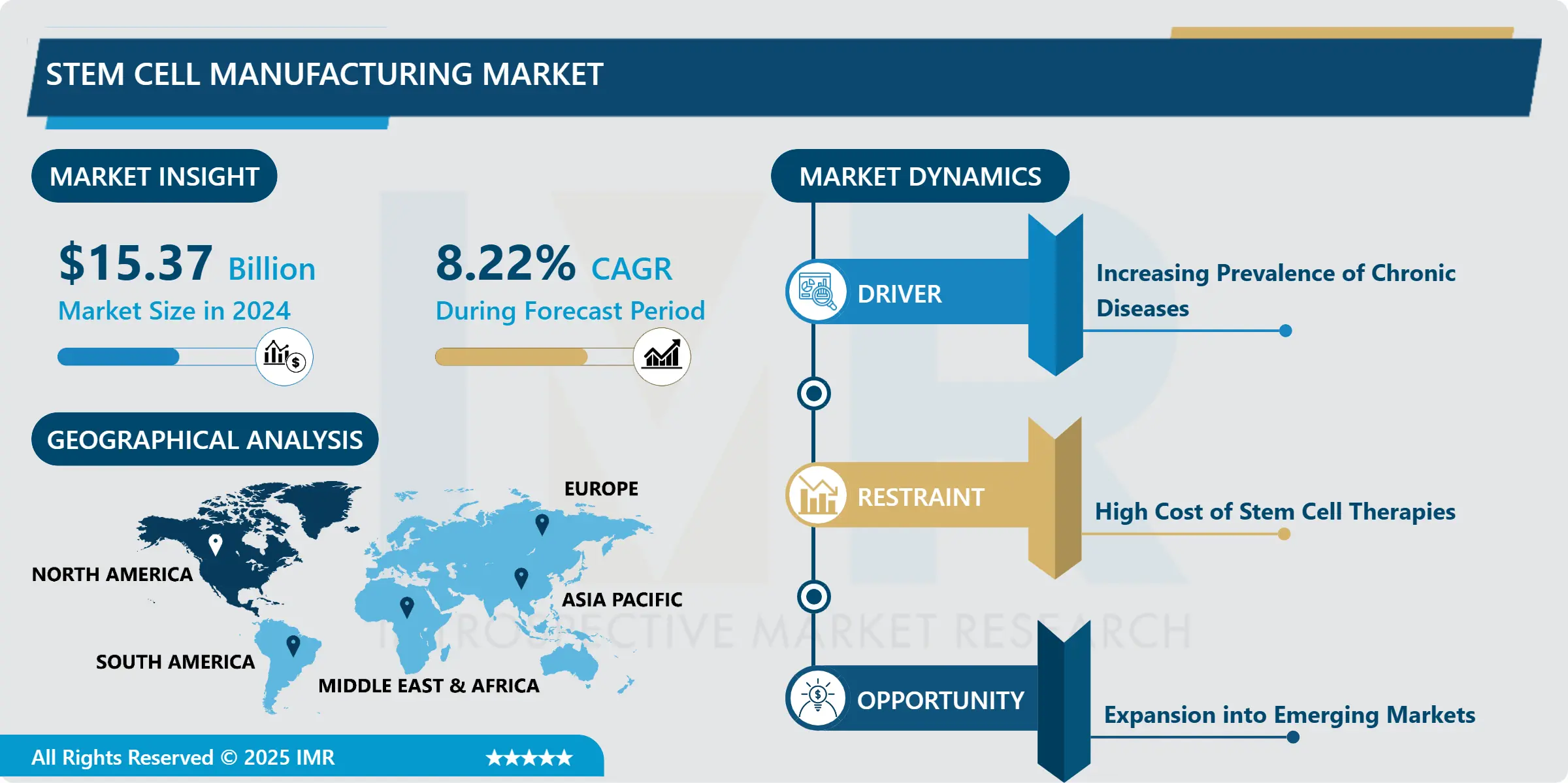

Stem Cell Manufacturing Market Size Was Valued at USD 15.37 Billion in 2024, and is Projected to Reach USD 36.65 Billion by 2035, Growing at a CAGR of 8.22% From 2025-2035.

Stem cell manufacturing can be defined as the ex vivo culturing process of stem cells to produce them in large numbers to meet the research, therapeutic and clinical demands. They give importance for regeneration medicine, individualized treatment and new approach therapies. The stem cell manufacturing market is growing very at a very fast rate as a result of development in the biotechnology sector and increased need for regenerative medicine. Stem cell therapies have been developed because of the growing rate of chronic diseases and individual approaches to treatment. Governments and private companies are spending billions of dollars in stem cell research for the purpose of making them more productively manufacturable. It is divided by region by the consumables, instruments, and stem cell lines and its applications are research and clinical. Following the technological enhancements, issues related to the production of sufficient quantities of stem cells without compromising their quality have turned into a big concern.

Stem cell research is used in drug development and toxicology by most pharmaceutical companies and research institutions. In terms of clinical application segment, it is estimated that there would be a remarkable growth as stem cell treatments have emerged as an effective cure of diseases like cardiovascular diseases, neurodegenerative disorders and various types of cancer. Moreover, a new focus on the industrialisation and business-like application of stem cell production is expected to reduce costs and expand therapeutic availability. People suffering from diseases such as diabetes, Parkinson’s disease and Alzheimer’s, the increasing aging population and the need to replace worn out organs has also contributed to the perception that stem cell therapy addresses many unsolved healthcare needs.

The market is also affected by improvements in gene editing tools including CRISPR, which make it possible to get better control stem cell. However, there is increased collaboration between universities and players in the market to close the research and market research gap. North America is the largest and most important market because it has well-developed healthcare systems and favorable policies to support the development of related industries; however, regions such as Asia-Pacific remain opportunities for future development due to increased investment in healthcare and the rapid development of biopharmaceutical industries. The major market is expected to post a fast-growing advance as scientific advancements and approvals keep on increasing.

Stem Cell Manufacturing Market Trend Analysis

Advancements in 3D Bioprinting for Stem Cell Applications

- 3D bioprinting in combination with stem cells is rapidly evolving as a key element of regenerative medicine: with the help of 3D bioprinting technology the layering of stem cells and different kinds of biomaterials for creating tissue constructs can be performed. This technology has been employed for the creation of tissues and organs whose structure complements that, of the human body; enabling new approaches to custom treatment. With progress in the functional tissue print capability, automation is said to become a major step towards eventually replacing animal testing in drug development.

- In addition, high-throughput production of tissues is possible due to 3D bioprinting which also amplifies scalability of stem cell manufacturing. Scientists investigate the possibility of using 3D bioprinted issues for transplants, for promoting the skin, heart or organ repair and creation of tissue models of diseases. This is expected to get more advanced especially with improved bioprinting technologies in future and thus can be a challenge to what stem cell therapies can deliver in the clinical practice..

Expansion into Emerging Markets

- New markets are also opening up widely in developed countries; however developing countries such as China, India and Brazil are have vast opportunities for stem cell manufacturing. They are the regions which are experiencing a growth of health care expenditure due to the growth of people’s income, the raise of the average age, and the government’s actions in the framework of the development of health care. LMCs are also cheaper to conduct clinical trials, which also pose an advantage to international entities who may want to venture into stem cell research and production.

- Secondly, legal environments in these regions are improving and governments are supporting stem cells related research and therapies advancement. This means that as demand for regenerative medicine grows in these countries, several market players will be immersed in setting up manufacturing plants and research links with the prospect of penetrating unexplored markets, thus enhancing their revenue prospects.

Stem Cell Manufacturing Market Segment Analysis:

- Stem Cell Manufacturing Market Segmented based on Product , Application, and End User.

By Product , Consumables segment is expected to dominate the market during the forecast period

- Stem cell manufacturing market is characterized based on consumables, instruments, and stem cell lines. Media and reagents with the sub-group of culture systems make up the largest consumable category since they are repeatedly utilized in stem cell investigations and therapy. These products are essential for cell survival and other processes of cell growth and developmental including expansion and differentiation. They are constantly necessary for research and therapeutics applications which makes this the leading product category.

- Supported by the manufacturing instruments such as bioreactors, cell separation systems, and cryopreservation equipment, stem cell manufacturing performs an instrumental function too. Enhancements in robotic handling systems and process control have enhanced scalability of stem cells to other production levels, and standardization. With increasing numbers of stem cell based product moving from the research phase to commercialization, the requirement for sophisticated manufacturing instruments in clinical grade manufacturing facilities will also continue to grow.

By Application , Research Applications Clinical Application segment held the largest share in 2024

- Stem cell manufacturing is implemented in research, clinical use, and cell and tissue banking contexts. Research applications continue to be the biggest category as stem cells are utilized in drug development, cytotoxicity assessment, and disease modeling. This ability of making use of stem cells to understand human biology varies is a feature that still makes them be demanded in academic and industrial research. With the increasing study of stem cells, stem cell-based therapies are developed further opening up more possibilities to the market.

- Clinical applications are on the rise as stem cell treatments are being passed as treatments for different conditions. These cells are being used in stem cell transplantation, clinical uses of regenerative medicine and gene therapy. However, cell and tissue banking finding its uses more prominence in the use of cryopreservation and storage of stem cells for future use in patients guarantee a standard source of releasable cells for health purposes.

Stem Cell Manufacturing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the maximum market share of the overall stem cell manufacturing market, mainly owing to its advanced healthcare technology, increased governmental and private funding, and key market players. The United States, for instance, has the most advanced and progressive stem cell market along with a sound policy environment that can clear modern stem cell treatments and products rapidly. Academic and research institutions of the region also have a very important role to play in shaping up new technologies in stem cell.

- In addition, the high-incidence chronic illness and increasing usage of the regenerative medicine in North America are expected to fuel the stem cell manufacturing market. With the developing demand for having clinical-grade stem cells there are a lot of business in US and Canada which are trying to work out large scale production. Herdlinger Ongoing investment in research and development coupled with accommodating government policies will continue to keep North America in the lead in this market.

Active Key Players in the Stem Cell Manufacturing Market

- Thermo Fisher Scientific (USA)

- Merck KGaA (Germany)

- Lonza Group (Switzerland)

- Becton, Dickinson and Company (USA)

- STEMCELL Technologies (Canada)

- Miltenyi Biotec (Germany)

- Takara Bio Inc. (Japan)

- Bio-Techne Corporation (USA)

- Corning Incorporated (USA)

- Fujifilm Holdings Corporation (Japan)

- Pluristem Therapeutics (Israel)

- Cellular Dynamics International (USA)

- Astellas Pharma Inc. (Japan)

- ReproCell (Japan)

- PromoCell GmbH (Germany) Others Key Player

Key Industry Developments in the Stem Cell Manufacturing Market

- In August 2022, Applied StemCell, Inc. (ASC), a cell and gene therapy CRO/CDMO focused on supporting the research community and biotechnology industry for their needs in developing and manufacturing cell and gene products, expanded its Current Good Manufacturing (cGMP) facility. ASC has successfully carried out cell banking and product manufacturing projects in its current cGMP suite and is now set on building 4 additional cGMP cleanrooms, cryo-storage space, process development, and QC/QA space.

- In January 2022, Stem Cell Manufacturing startup Cellino Biotech raised a USD 80 million Series A financing round led by Leaps by Bayer along with 8VC, Humboldt Fund, and new investors including Felicis Ventures and Khosla Ventures, that could fix a problem holding the biotech industry back. Cellino plans to expand access to stem cell-based therapies with the goal to build the first autonomous human cell foundry in 2025.

|

Stem Cell Manufacturing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.37 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.22% |

Market Size in 2035: |

USD 36.65 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Stem Cell Manufacturing Market by Product (2018-2035)

4.1 Stem Cell Manufacturing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Consumables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Instruments

4.5 Stem Cell Lines

Chapter 5: Stem Cell Manufacturing Market by Application (2018-2035)

5.1 Stem Cell Manufacturing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Research Applications Clinical Application

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cell and Tissue Banking Applications

Chapter 6: Stem Cell Manufacturing Market by End User (2018-2035)

6.1 Stem Cell Manufacturing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical & Biotechnology Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Academic Institutes

6.5 Research Laboratories and Contract Research Organizations

6.6 Hospitals and Surgical Centers

6.7 Cell and Tissue banks

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Stem Cell Manufacturing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THERMO FISHER SCIENTIFIC (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MERCK KGAA (GERMANY)

7.4 LONZA GROUP (SWITZERLAND)

7.5 BECTON

7.6 DICKINSON AND COMPANY (USA)

7.7 STEMCELL TECHNOLOGIES (CANADA)

7.8 MILTENYI BIOTEC (GERMANY)

7.9 TAKARA BIO INC. (JAPAN)

7.10 BIO-TECHNE CORPORATION (USA)

7.11 CORNING INCORPORATED (USA)

7.12 FUJIFILM HOLDINGS CORPORATION (JAPAN)

7.13 PLURISTEM THERAPEUTICS (ISRAEL)

7.14 CELLULAR DYNAMICS INTERNATIONAL (USA)

7.15 ASTELLAS PHARMA INC. (JAPAN)

7.16 REPROCELL (JAPAN)

7.17 PROMOCELL GMBH (GERMANY)

7.18 OTHERS KEY PLAYER

Chapter 8: Global Stem Cell Manufacturing Market By Region

8.1 Overview

8.2. North America Stem Cell Manufacturing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Consumables

8.2.4.2 Instruments

8.2.4.3 Stem Cell Lines

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Research Applications Clinical Application

8.2.5.2 Cell and Tissue Banking Applications

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Pharmaceutical & Biotechnology Companies

8.2.6.2 Academic Institutes

8.2.6.3 Research Laboratories and Contract Research Organizations

8.2.6.4 Hospitals and Surgical Centers

8.2.6.5 Cell and Tissue banks

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Stem Cell Manufacturing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Consumables

8.3.4.2 Instruments

8.3.4.3 Stem Cell Lines

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Research Applications Clinical Application

8.3.5.2 Cell and Tissue Banking Applications

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Pharmaceutical & Biotechnology Companies

8.3.6.2 Academic Institutes

8.3.6.3 Research Laboratories and Contract Research Organizations

8.3.6.4 Hospitals and Surgical Centers

8.3.6.5 Cell and Tissue banks

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Stem Cell Manufacturing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Consumables

8.4.4.2 Instruments

8.4.4.3 Stem Cell Lines

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Research Applications Clinical Application

8.4.5.2 Cell and Tissue Banking Applications

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Pharmaceutical & Biotechnology Companies

8.4.6.2 Academic Institutes

8.4.6.3 Research Laboratories and Contract Research Organizations

8.4.6.4 Hospitals and Surgical Centers

8.4.6.5 Cell and Tissue banks

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Stem Cell Manufacturing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Consumables

8.5.4.2 Instruments

8.5.4.3 Stem Cell Lines

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Research Applications Clinical Application

8.5.5.2 Cell and Tissue Banking Applications

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Pharmaceutical & Biotechnology Companies

8.5.6.2 Academic Institutes

8.5.6.3 Research Laboratories and Contract Research Organizations

8.5.6.4 Hospitals and Surgical Centers

8.5.6.5 Cell and Tissue banks

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Stem Cell Manufacturing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Consumables

8.6.4.2 Instruments

8.6.4.3 Stem Cell Lines

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Research Applications Clinical Application

8.6.5.2 Cell and Tissue Banking Applications

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Pharmaceutical & Biotechnology Companies

8.6.6.2 Academic Institutes

8.6.6.3 Research Laboratories and Contract Research Organizations

8.6.6.4 Hospitals and Surgical Centers

8.6.6.5 Cell and Tissue banks

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Stem Cell Manufacturing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Consumables

8.7.4.2 Instruments

8.7.4.3 Stem Cell Lines

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Research Applications Clinical Application

8.7.5.2 Cell and Tissue Banking Applications

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Pharmaceutical & Biotechnology Companies

8.7.6.2 Academic Institutes

8.7.6.3 Research Laboratories and Contract Research Organizations

8.7.6.4 Hospitals and Surgical Centers

8.7.6.5 Cell and Tissue banks

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Stem Cell Manufacturing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.37 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.22% |

Market Size in 2035: |

USD 36.65 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||