Global Specialty Printing Consumables Market Overview

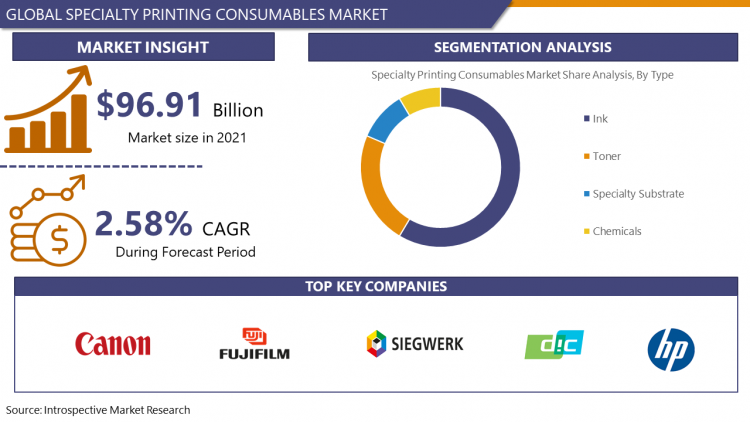

Global Specialty Printing Consumables Market was valued at USD 96.91 Billion in 2021 and is expected to reach USD 115.83 Billion by the year 2028, at a CAGR of 2.58%.

Printing is executed on any material except paper referred to as specialty printing. Inks, toners, specialty substrates, and chemicals are some of the consumables utilized for specialty printing. The global Specialty Printing Consumables market is expected to show significant growth avenues over the forecast period. The key reason behind this projection is the increased application of Specialty Printing Consumables in offices, professional service firms, and institutions for large-scale printing requirements. Furthermore, a printing substrate is a physical material on which an image is printed. It can be utilized for different applications. For example, conventional solvent and eco-solvent printing provide crisp images with dark colors. Nevertheless, specialty printing substrates can be used in the most startling places such as floors in corporate lobbies and display areas, pools and aquariums, windows in shops and vehicles, and walls.

Additionally, substrate synthetic paper is a long-lasting and lamination-friendly solution that is arranged to accomplish many specialty printing applications from waterproof menus and tear-resistant maps to heavy-duty manuals for industrial job sites. Bright silver, clear, and white pressure-sensitive papers are against chemicals. These have great bond strength. They have long-term adhesion indoors and outdoors and have superior surface smoothness and conformability. Consequently, these factors help to increase the growth of the market during the projected period.

COVID-19 Impact on Specialty Printing Consumables Market

As long as the COVID-19 virus outbreak in December 2019, the World Health Organization announced it was a public health emergency. The disease has spread to over 100 countries and caused massive losses of lives around the globe. Primarily the global manufacturing, tourism, and financial markets have been hit hard. The downward pressure on the world economy that once showed an indication of recovery in the previous period has increased again. The spread of the epidemic has added risk factors to the already weak growth of the global economy. Different international organizations have pointed out that the world economy is in the most adverse period since the financial crisis. The adverse global impacts of the coronavirus are already there, significantly influencing the Specialty Printing Consumables market in 2020.

Market Dynamics and Factors for the Specialty Printing Consumables Market

Drivers:

Growing the application of specialty printing in professional service firms, institutions, and offices for large-scale printing requirements is anticipated to stimulate the market during the forecast period. Moreover, advancements in the media and advertising sectors are projected to trigger the applications of new printing technologies, which include 3D printers, specialty printer ink, and other eco-friendly products in the market.

Additionally, manufacturers of specialty printers have launched products such as advanced printer inks with inventive technology for lithography, flexography, and rotogravure. Modern machinery and software solutions in the printing industry have helped printing service suppliers and their end-users in gaining cost reduction and low wastage of raw materials. It has entitled them to execute complex printing projects in the printing production process.

Growth in the textile printing industry is probably to trigger the application of digital printing technology in the market throughout the forecast period. An increase in the industrial and IT sectors is expected to turn demand for specialty printing consumables needed for business communication activities in their business processes.

The market is also rising owing to increased utilization from commercial printing applications, such as advertisements, magazines, periodicals, newspapers, and labels. Dry toners are used in printer cartridges, although liquid toners are consumed in industrial printing. Toners are being extensively used in fax machines, laser printers, and copiers. This aids in rising demand for the product from different regions.

Restraints:

Accessibility of low-priced substitutes is a key restrain of the specialty printing substrates market. In addition, the penetration of less time-consuming and economical products probably poses a threat to the specialty printing consumables market.

Opportunities:

Ink, toners, chemicals, and specialty substrates are the major products of the global Specialty Printing Consumables market. These products produce an application in various industries. Increased applications of these products in offices and other institutes indicate the opportunity for penetration of new players to accomplish the rising requirement. Commercial printing, publishing, and consumer and packaging are some of the major sectors that cater to great avenues for the growth of the global Specialty Printing Consumables market. While liquid toners find applications in industrial printing, dry toners are used in printer cartridges. Rising usages of toners in copiers, laser printers, and fax machines are expected to accelerate the Specialty Printing Consumables market growth.

Furthermore, some vendors are surging investments in research activities. The main motive of this move is to provide superior quality products for consumers. These leads are anticipated to push the global Specialty Printing Consumables market in the upcoming years. For, instance, Xerox Corporation, Eastman Kodak Co., DIC Corporation, HP, and Canon Inc. are some of the major suppliers in this market.

Market Segmentation

Segmentation Analysis of Specialty Printing Consumables Market:

Based on Product Type, the ink product segment is expected to dominate the market during the forecast period. The typical inkjet printer utilizes fluid ink to produce text and pictures and has a larger market compared to other types of printers available. Dye-based inks are utilized for print ATM receipts as the ink is lower cost and the printed text disappears over time. Therefore, applications such as these will increase the growth of printing ink in the forecast period.

Based on Applications, the office and professional application segment are registering the maximum market share due to heavy requirements on an everyday basis has helped to an increased demand for specialty printing consumables in this category. Furthermore, with the growing younger population, the number of schools and colleges is also on the rise. This would help to a higher demand for printed study material thereby increasing the growth.

Based on the Printing Process, lithographic printing, as well as digital printing, will expect to continue to have a remarkable influence on the Specialty Printing Consumables market, be it specialty substrates, toners, inks, and chemicals.

Based on the Distribution Channel, the online segment is expected to grow at a significant market share. The online segment is rising owing to the growing infiltration of the internet in developing economies. The spout in the adoption of online shopping and e-commerce is also influencing the growth of the market positively. Online shopping caters significance such as easy comparison of various products, convenience, reasonable prices, and availability to a larger portfolio of information and products. Furthermore, the offline segment holds a maximum share in the specialty printing consumables market, but there is a significant change from the offline to the online segment. The COVID-19 pandemic has influenced production, which has helped to a maximum consumer base preferring for online stores. Consumers are purchasing from online stores after realizing the significance of the platform.

Regional Analysis of Specialty Printing Consumables Market:

North America is expected to dominate the market throughout the forecast timeline. There is a constant growth in demand for specialty substrates in the U.S owing to the accelerating construction and healthcare segment. With advancements and inventions in construction technology, the regional market is expected to remarkable growth in this section. Concerning this, Economy, a U.S-built construction giant collaborated with Russian 3D printers Apis Cor to create 3D printed houses over the region. This 3D printing machine uses eight kW of electricity during construction and it entails additional manufacturing to prevent waste generation. The machine is building such that it can easily be carried in a truck while changing sites.

In Latin America, Brazil and Argentina are the leading consumers of printing consumables owing to higher outdoor advertising, ad spending, personalization, and specialization in converting packaging provide growth opportunities. The region is expected to record significant growth over the forecast years. For example, Siegwerk Druckfarben AG & Co. KGaA has signed an agreement to acquire family-owned Tupahue Tintas, one of the Brazilian market leaders for flexo and gravure printing inks and varnishes headquartered in Diadema. This acquisition will support companies observe growth opportunities in Brazil.

Europe's market for specialty printing consumables gained the most significant market share in its revenues from sales throughout Germany. Factors such as increasing industrialization and the resultant growth in the advertising and media sectors in the country have helped to a promising market for specialty printing in the professional and publishing industry. Nevertheless, the market for specialty printing consumables in the country is anticipated to grow at a stable rate during the projected period. Growing labor costs and increasing preference for digitization are anticipated to be the key factors stimulating the situation.

Players Covered in Specialty Printing Consumables Market are:

- Canon Inc.

- Sun Chemical Corporation

- Saati S.p.A.

- H.P. Development Co.

- Siegwerk Druckfarben AG & Co. KgaA

- DIC Corporation

- Xerox Corporation

- Fuji Photo Film Company Limited

- Hewlett-Packard Development Company LP

- Sun Chemical Corp.

- Eastman Kodak Company

- Lexmark International, Inc.

- Marabu GmbH & Co. KG

- Nazdar Ink Technologies

Key Industry Developments in Specialty Printing Consumables Market

- In July 2019, H.P. declared that it would invest USD 500 Million in India for the growth and its operations and to starting production in the country. H.P. also declared that it would expand a new plant in the city of Bengaluru that would have the capacity to house 10,000 employees. This aids in market growth, as H.P. would be able to serve a larger consumer base through this expansion.

- In June 2019, Xerox. Corp acquired Rabbit Office Automation, a California-based copy machine provider. This would allow Xerox to extend its local footprint and to cater to its customers with the industry's most comprehensive providing portfolio.

|

Global Specialty Printing Consumables Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 96.91 Bn. |

|

Forecast Period 2022-28 CAGR: |

2.58% |

Market Size in 2028: |

USD 115.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Printing Process |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Distribution Channels

3.4 By Printing Process

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Specialty Printing Consumables Market by Type

5.1 Specialty Printing Consumables Market Overview Snapshot and Growth Engine

5.2 Specialty Printing Consumables Market Overview

5.3 Ink

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Ink: Grographic Segmentation

5.4 Toner

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Toner: Grographic Segmentation

5.5 Specialty Substrate

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Specialty Substrate: Grographic Segmentation

5.6 Chemicals

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Chemicals: Grographic Segmentation

Chapter 6: Specialty Printing Consumables Market by Application

6.1 Specialty Printing Consumables Market Overview Snapshot and Growth Engine

6.2 Specialty Printing Consumables Market Overview

6.3 Office & Professional Application

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Office & Professional Application: Grographic Segmentation

6.4 Commercial Printing & Publishing Application

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial Printing & Publishing Application: Grographic Segmentation

6.5 Other

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other: Grographic Segmentation

Chapter 7: Specialty Printing Consumables Market by Distribution Channels

7.1 Specialty Printing Consumables Market Overview Snapshot and Growth Engine

7.2 Specialty Printing Consumables Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online: Grographic Segmentation

7.4 Offline

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offline: Grographic Segmentation

Chapter 8: Specialty Printing Consumables Market by Printing Process

8.1 Specialty Printing Consumables Market Overview Snapshot and Growth Engine

8.2 Specialty Printing Consumables Market Overview

8.3 Lithographic Printing

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Lithographic Printing: Grographic Segmentation

8.4 Flexographic Printing

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Flexographic Printing: Grographic Segmentation

8.5 Rotogravure Printing

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Rotogravure Printing: Grographic Segmentation

8.6 Digital Printing

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Digital Printing: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Specialty Printing Consumables Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Specialty Printing Consumables Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Specialty Printing Consumables Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CANON INC.

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 SUN CHEMICAL CORPORATION

9.4 SAATI S.P.A.

9.5 H.P. DEVELOPMENT CO.

9.6 SIEGWERK DRUCKFARBEN AG & CO. KGAA

9.7 DIC CORPORATION

9.8 XEROX CORPORATION

9.9 FUJI PHOTO FILM COMPANY LIMITED

9.10 HEWLETT-PACKARD DEVELOPMENT COMPANY LP

9.11 SUN CHEMICAL CORP.

9.12 EASTMAN KODAK COMPANY

9.13 LEXMARK INTERNATIONAL INC.

9.14 MARABU GMBH & CO. KG

9.15 NAZDAR INK TECHNOLOGIES

9.16 OTHER MAJOR PLAYERS

Chapter 10: Global Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Ink

10.2.2 Toner

10.2.3 Specialty Substrate

10.2.4 Chemicals

10.3 Historic and Forecasted Market Size By Application

10.3.1 Office & Professional Application

10.3.2 Commercial Printing & Publishing Application

10.3.3 Other

10.4 Historic and Forecasted Market Size By Distribution Channels

10.4.1 Online

10.4.2 Offline

10.5 Historic and Forecasted Market Size By Printing Process

10.5.1 Lithographic Printing

10.5.2 Flexographic Printing

10.5.3 Rotogravure Printing

10.5.4 Digital Printing

Chapter 11: North America Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Ink

11.4.2 Toner

11.4.3 Specialty Substrate

11.4.4 Chemicals

11.5 Historic and Forecasted Market Size By Application

11.5.1 Office & Professional Application

11.5.2 Commercial Printing & Publishing Application

11.5.3 Other

11.6 Historic and Forecasted Market Size By Distribution Channels

11.6.1 Online

11.6.2 Offline

11.7 Historic and Forecasted Market Size By Printing Process

11.7.1 Lithographic Printing

11.7.2 Flexographic Printing

11.7.3 Rotogravure Printing

11.7.4 Digital Printing

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Ink

12.4.2 Toner

12.4.3 Specialty Substrate

12.4.4 Chemicals

12.5 Historic and Forecasted Market Size By Application

12.5.1 Office & Professional Application

12.5.2 Commercial Printing & Publishing Application

12.5.3 Other

12.6 Historic and Forecasted Market Size By Distribution Channels

12.6.1 Online

12.6.2 Offline

12.7 Historic and Forecasted Market Size By Printing Process

12.7.1 Lithographic Printing

12.7.2 Flexographic Printing

12.7.3 Rotogravure Printing

12.7.4 Digital Printing

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Ink

13.4.2 Toner

13.4.3 Specialty Substrate

13.4.4 Chemicals

13.5 Historic and Forecasted Market Size By Application

13.5.1 Office & Professional Application

13.5.2 Commercial Printing & Publishing Application

13.5.3 Other

13.6 Historic and Forecasted Market Size By Distribution Channels

13.6.1 Online

13.6.2 Offline

13.7 Historic and Forecasted Market Size By Printing Process

13.7.1 Lithographic Printing

13.7.2 Flexographic Printing

13.7.3 Rotogravure Printing

13.7.4 Digital Printing

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Ink

14.4.2 Toner

14.4.3 Specialty Substrate

14.4.4 Chemicals

14.5 Historic and Forecasted Market Size By Application

14.5.1 Office & Professional Application

14.5.2 Commercial Printing & Publishing Application

14.5.3 Other

14.6 Historic and Forecasted Market Size By Distribution Channels

14.6.1 Online

14.6.2 Offline

14.7 Historic and Forecasted Market Size By Printing Process

14.7.1 Lithographic Printing

14.7.2 Flexographic Printing

14.7.3 Rotogravure Printing

14.7.4 Digital Printing

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Specialty Printing Consumables Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Ink

15.4.2 Toner

15.4.3 Specialty Substrate

15.4.4 Chemicals

15.5 Historic and Forecasted Market Size By Application

15.5.1 Office & Professional Application

15.5.2 Commercial Printing & Publishing Application

15.5.3 Other

15.6 Historic and Forecasted Market Size By Distribution Channels

15.6.1 Online

15.6.2 Offline

15.7 Historic and Forecasted Market Size By Printing Process

15.7.1 Lithographic Printing

15.7.2 Flexographic Printing

15.7.3 Rotogravure Printing

15.7.4 Digital Printing

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Specialty Printing Consumables Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 96.91 Bn. |

|

Forecast Period 2022-28 CAGR: |

2.58% |

Market Size in 2028: |

USD 115.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Printing Process |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SPECIALTY PRINTING CONSUMABLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SPECIALTY PRINTING CONSUMABLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SPECIALTY PRINTING CONSUMABLES MARKET COMPETITIVE RIVALRY

TABLE 005. SPECIALTY PRINTING CONSUMABLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. SPECIALTY PRINTING CONSUMABLES MARKET THREAT OF SUBSTITUTES

TABLE 007. SPECIALTY PRINTING CONSUMABLES MARKET BY TYPE

TABLE 008. INK MARKET OVERVIEW (2016-2028)

TABLE 009. TONER MARKET OVERVIEW (2016-2028)

TABLE 010. SPECIALTY SUBSTRATE MARKET OVERVIEW (2016-2028)

TABLE 011. CHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 012. SPECIALTY PRINTING CONSUMABLES MARKET BY APPLICATION

TABLE 013. OFFICE & PROFESSIONAL APPLICATION MARKET OVERVIEW (2016-2028)

TABLE 014. COMMERCIAL PRINTING & PUBLISHING APPLICATION MARKET OVERVIEW (2016-2028)

TABLE 015. OTHER MARKET OVERVIEW (2016-2028)

TABLE 016. SPECIALTY PRINTING CONSUMABLES MARKET BY DISTRIBUTION CHANNELS

TABLE 017. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 018. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 019. SPECIALTY PRINTING CONSUMABLES MARKET BY PRINTING PROCESS

TABLE 020. LITHOGRAPHIC PRINTING MARKET OVERVIEW (2016-2028)

TABLE 021. FLEXOGRAPHIC PRINTING MARKET OVERVIEW (2016-2028)

TABLE 022. ROTOGRAVURE PRINTING MARKET OVERVIEW (2016-2028)

TABLE 023. DIGITAL PRINTING MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 027. NORTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY PRINTING PROCESS (2016-2028)

TABLE 028. N SPECIALTY PRINTING CONSUMABLES MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE SPECIALTY PRINTING CONSUMABLES MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE SPECIALTY PRINTING CONSUMABLES MARKET, BY APPLICATION (2016-2028)

TABLE 031. EUROPE SPECIALTY PRINTING CONSUMABLES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 032. EUROPE SPECIALTY PRINTING CONSUMABLES MARKET, BY PRINTING PROCESS (2016-2028)

TABLE 033. SPECIALTY PRINTING CONSUMABLES MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC SPECIALTY PRINTING CONSUMABLES MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC SPECIALTY PRINTING CONSUMABLES MARKET, BY APPLICATION (2016-2028)

TABLE 036. ASIA PACIFIC SPECIALTY PRINTING CONSUMABLES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 037. ASIA PACIFIC SPECIALTY PRINTING CONSUMABLES MARKET, BY PRINTING PROCESS (2016-2028)

TABLE 038. SPECIALTY PRINTING CONSUMABLES MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA SPECIALTY PRINTING CONSUMABLES MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA SPECIALTY PRINTING CONSUMABLES MARKET, BY APPLICATION (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA SPECIALTY PRINTING CONSUMABLES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA SPECIALTY PRINTING CONSUMABLES MARKET, BY PRINTING PROCESS (2016-2028)

TABLE 043. SPECIALTY PRINTING CONSUMABLES MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY APPLICATION (2016-2028)

TABLE 046. SOUTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 047. SOUTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET, BY PRINTING PROCESS (2016-2028)

TABLE 048. SPECIALTY PRINTING CONSUMABLES MARKET, BY COUNTRY (2016-2028)

TABLE 049. CANON INC.: SNAPSHOT

TABLE 050. CANON INC.: BUSINESS PERFORMANCE

TABLE 051. CANON INC.: PRODUCT PORTFOLIO

TABLE 052. CANON INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SUN CHEMICAL CORPORATION: SNAPSHOT

TABLE 053. SUN CHEMICAL CORPORATION: BUSINESS PERFORMANCE

TABLE 054. SUN CHEMICAL CORPORATION: PRODUCT PORTFOLIO

TABLE 055. SUN CHEMICAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SAATI S.P.A.: SNAPSHOT

TABLE 056. SAATI S.P.A.: BUSINESS PERFORMANCE

TABLE 057. SAATI S.P.A.: PRODUCT PORTFOLIO

TABLE 058. SAATI S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. H.P. DEVELOPMENT CO.: SNAPSHOT

TABLE 059. H.P. DEVELOPMENT CO.: BUSINESS PERFORMANCE

TABLE 060. H.P. DEVELOPMENT CO.: PRODUCT PORTFOLIO

TABLE 061. H.P. DEVELOPMENT CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SIEGWERK DRUCKFARBEN AG & CO. KGAA: SNAPSHOT

TABLE 062. SIEGWERK DRUCKFARBEN AG & CO. KGAA: BUSINESS PERFORMANCE

TABLE 063. SIEGWERK DRUCKFARBEN AG & CO. KGAA: PRODUCT PORTFOLIO

TABLE 064. SIEGWERK DRUCKFARBEN AG & CO. KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. DIC CORPORATION: SNAPSHOT

TABLE 065. DIC CORPORATION: BUSINESS PERFORMANCE

TABLE 066. DIC CORPORATION: PRODUCT PORTFOLIO

TABLE 067. DIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. XEROX CORPORATION: SNAPSHOT

TABLE 068. XEROX CORPORATION: BUSINESS PERFORMANCE

TABLE 069. XEROX CORPORATION: PRODUCT PORTFOLIO

TABLE 070. XEROX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FUJI PHOTO FILM COMPANY LIMITED: SNAPSHOT

TABLE 071. FUJI PHOTO FILM COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 072. FUJI PHOTO FILM COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 073. FUJI PHOTO FILM COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. HEWLETT-PACKARD DEVELOPMENT COMPANY LP: SNAPSHOT

TABLE 074. HEWLETT-PACKARD DEVELOPMENT COMPANY LP: BUSINESS PERFORMANCE

TABLE 075. HEWLETT-PACKARD DEVELOPMENT COMPANY LP: PRODUCT PORTFOLIO

TABLE 076. HEWLETT-PACKARD DEVELOPMENT COMPANY LP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SUN CHEMICAL CORP.: SNAPSHOT

TABLE 077. SUN CHEMICAL CORP.: BUSINESS PERFORMANCE

TABLE 078. SUN CHEMICAL CORP.: PRODUCT PORTFOLIO

TABLE 079. SUN CHEMICAL CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. EASTMAN KODAK COMPANY: SNAPSHOT

TABLE 080. EASTMAN KODAK COMPANY: BUSINESS PERFORMANCE

TABLE 081. EASTMAN KODAK COMPANY: PRODUCT PORTFOLIO

TABLE 082. EASTMAN KODAK COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. LEXMARK INTERNATIONAL INC.: SNAPSHOT

TABLE 083. LEXMARK INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 084. LEXMARK INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 085. LEXMARK INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. MARABU GMBH & CO. KG: SNAPSHOT

TABLE 086. MARABU GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 087. MARABU GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 088. MARABU GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. NAZDAR INK TECHNOLOGIES: SNAPSHOT

TABLE 089. NAZDAR INK TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 090. NAZDAR INK TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 091. NAZDAR INK TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY TYPE

FIGURE 012. INK MARKET OVERVIEW (2016-2028)

FIGURE 013. TONER MARKET OVERVIEW (2016-2028)

FIGURE 014. SPECIALTY SUBSTRATE MARKET OVERVIEW (2016-2028)

FIGURE 015. CHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 016. SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY APPLICATION

FIGURE 017. OFFICE & PROFESSIONAL APPLICATION MARKET OVERVIEW (2016-2028)

FIGURE 018. COMMERCIAL PRINTING & PUBLISHING APPLICATION MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 020. SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 021. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 022. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 023. SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY PRINTING PROCESS

FIGURE 024. LITHOGRAPHIC PRINTING MARKET OVERVIEW (2016-2028)

FIGURE 025. FLEXOGRAPHIC PRINTING MARKET OVERVIEW (2016-2028)

FIGURE 026. ROTOGRAVURE PRINTING MARKET OVERVIEW (2016-2028)

FIGURE 027. DIGITAL PRINTING MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA SPECIALTY PRINTING CONSUMABLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Specialty Printing Consumables Market research report is 2022-2028.

Canon Inc., Sun Chemical Corporation, Saati S.p.A., H.P. Development Co., Siegwerk Druckfarben AG & Co. KgaA, DIC Corporation, Xerox Corporation, Fuji Photo Film Company Limited, Hewlett-Packard Development Company LP, Sun Chemical Corp., Eastman Kodak Company, Lexmark International, Inc., Marabu GmbH & Co. KG, Nazdar Ink Technologies, and Other Major Players.

Specialty Printing Consumables Market is segmented into Type, Application, Distribution Channels, Printing Process and region. By Type, the market is categorized into Ink, Toner, Specialty Substrate, Chemicals. By Application, the market is categorized into Office & Professional Application, Commercial Printing & Publishing Application, Other. By Distribution Channel, the market is categorized into Online Retailing, Mass Retailers, and Direct Selling. By Printing Process Market is segmented into Lithographic Printing, Flexographic Printing, Rotogravure Printing, and Digital Printing. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Printing is executed on any material except paper referred to as specialty printing. Inks, toners, specialty substrates, and chemicals are some of the consumables utilized for specialty printing.

Global Specialty Printing Consumables Market was valued at USD 96.91 Billion in 2021 and is expected to reach USD 115.83 Billion by the year 2028, at a CAGR of 2.58%.