Specialty Paper Market Synopsis

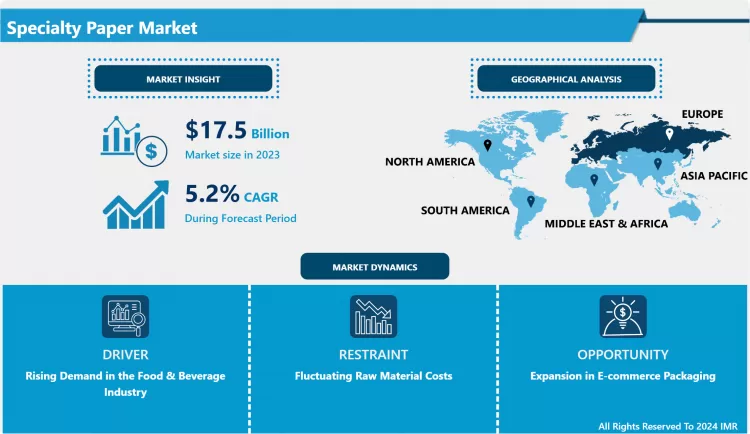

Specialty Paper Market Size Was Valued at USD 17.5 Billion in 2023, and is Projected to Reach USD 27.62 Billion by 2032, Growing at a CAGR of 5.20% From 2024-2032.

Specialty Paper market includes papers that are produced to meet the requirements of a specific end-use that demands enhancing characteristics over the usual paper. They are commonly applied in such sectors as packaging, printing, building, etc., and can be divided into décor, thermal, carbonless, kraft, etc.

- The Specialty Paper Market is on the growth path primarily due to its rising usage by numerous businesses such as packaging, printing, and other industrial uses. Specialty paper is designed and developed to possess or perform certain characteristics and functions which normal or conventional paper cannot always deliver, making specialty paper an essential product in many uses. There is a wide range of specialty papers which make up the market and some of them include; release papers, décor papers, thermal papers and filter papers among others. Demand for green and eco friendly products is regarded as having being one of the major players that is driving the market forward. Now that the consuming public is becoming more sensitive to environmental issues, many industries are turning to specialty papers involving recycled fibers and green manufacturing processes. This shift is further accelerated by strong regulation and policy push to reduce plastic consumption, which is compelling firms to turn to value-added specialty papers for their packaging, labeling and many other applications.

- There are also charming technological advancement in the production of specialty paper, and these are the factors that continue to fuel the market. The paper clarifies that these and many other technologies also include such developments as new coating approaches, surface treatments, and innovations in premium paper grades. For instance, it noted that the printing industry has been struggling with factors such as flood attacks, deteriorating material properties of paper and specialty paper that is offering better printability as well as improved texture and durability. Similarly in the food and beverages market there is an increased use of specialty paper in packing in enhancing the appearance of the packed products and for the safety of such products which show the versatility of the material. Automotive and electronics industries are also the key consumers of the specialty paper; it is used in filtration and insulation. The constant changes in these industries, as well as investment into research and development of specialty paper technology, promising the market stable development in the nearest years.

- Still, one cannot say that there are no obstacles existing in the market of specialty papers. Unstable cost of raw materials mainly the wood pulp used in the production of paper and other related products is one of the biggest threats for the market. There are the questions about environmental costs of paper production – deforestation and water consumption among them – that continue to push paper manufacturers to seek more sustainable sources of raw materials and ways of making the paper. In addition, specialty paper may be costly than conventional paper; therefore, the adaptation to cost-sensitive industries may be negatively impacted by a high price tag. However, the market persists facing these challenges while lots of companies are dedicated to increased application of sustainable approaches including the application of sustainable resources including hemp fiber, bamboo fiber, agricultural residues, among others. They are likely to help alleviate some of the environmental impacts and sustain the market, in the future.

- Regionally, specialty paper market is at varying stages of growth, although North America and Europe remain the largest and most saturated markets for high quality specialty paper and increasing demand for environmentally credible papers. On the other hand, the Asia-Pacific region especially China and India are slated to become a good market for these products because of industrialization, urbanization and growth in the packaging sector. Given that more than 80% of the world’s population lives in these regions and their middle class population coupled with disposable income are on the rise, they are eagerly seeking and are able to afford better quality specialty packaged products, triggering the demand for specialty paper. In addition, positive government policies towards domestic paper production and the global trend toward sustainable packaging are expected to offer further stimulus to the market in these regions. Other markets which are also exhibiting a good future prospect include the Latin American and the Middle Eastern markets because of the rising demand for and awareness of specialty papers across almost all sectors.

- Therefore it can be concluded that Specialty Paper Market hold enormous potential to grow as the economies of the world are active and specialty papers are used in different fields of industry and have lot of application in the industry. The need for green products and innovations for industries and various sectors is currently a major prospect for manufactures to grow into, as the world shifts towards sustainability. Despite factors that can influence performance such as uneven costs of raw materials and environmental issues the market therein is believed to be stable and thus has the potential for growth. Thus, as the trends in the international environment are developed, the specialty paper segment should become an important element of the paper and packaging market, as it will be actively needed in different sectors.

Specialty Paper Market Trend Analysis

Growth in Sustainable Specialty Papers

- Environmental sustainability is a factor that has been growing in demand within the Specialty Paper Market. There are signs that buyers and commercial customers are demanding products made from environmentally friendly raw material and so plc must invent new specialty papers that are bio-degradable recycles equally from sustainable material. For instance, the increased use of kraft paper is in line with this journey since kraft papers are made from wood pulp that receive a very limited chemical process hence preferred use in packaging. Also innovations in the source of fibers such as agricultural residues and recycled materials are also being developed to enhance the low environmental impact of specialty papers.

- This trend is pronounced by the current and emerging environmental regulations along with business sustainability schemes that force firms to search for environmentally friendly materials and methods of production. .expenditure towards specialty papers being used as substitutes for plastics is further fueling the demand for compostable wraps and bags. All these factors are making sustainable specialty papers as another key growth segment in the market to balance purchasing decisions and market growth programme.

Expansion in E-commerce Packaging

- With the rapid advance in e-commerce and their corresponding growth, the Specialty Paper Market has a major opportunity for growth especially within the packaging segment. However, with the increase in internet purchasing, demand for protective, attractive, and environmentally friendly packaging materials has rose further. Kraft papers as well as thermal papers have gained increased usage for the e-commerce packaging due to their high strength, printability and sustainability. The requirement for packaging not only to provide product protection during transportation but also to be an exciting experience for the customers has become a chief goal for most e-commerce businesses.

- Furthermore, the trend towards the reduction in plastics and general more rigid environmental legislation is forcing manufactures to opt for specialty papers that may be used as plastic substitutes. It is also creating new opportunities for specialty paper makers to create and develop new products suitable to the e-commerce industry. The use of specialty papers in packaging of different products including electronics and clothes is a significantly large growth factor for the market.

Specialty Paper Market Segment Analysis:

- Specialty Paper Market Segmented based on Type, and End User.

By Product Type, Décor segment is expected to dominate the market during the forecast period

- Types of specialty paper include décor, thermal papers, carbonless papers, kraft, and other types with their specific uses. Décor papers are widely applied in furniture and interior design because they offer a stylish and protective veneer to laminates and other fashionable finishes. Thermal papers have wide applicability in POS receipts, labelling and ticketing and hence owing to expansion of digital and retail domains. General utilization of carbonless papers helps in carrying out documentation in business organizations comfortably due to the fact that it eliminates the use of carbon paper to produce multiple copies.

- Kraft papers, as strong and environmentally friendly as they are, dominate the packaging market shares, particularly in online shops where green packaging demand is on the rise. Other specialty papers have more specific uses beyond these uses and are used in security printings and release liners. This arrangement is so strategic since it enables specialty papers to meet a cross-section of industrial requirements hence increasing their demand on the market.

By End Use , Printing & Writing segment held the largest share in 2023

- Applying specialty papers is common in application which includes printing & writing, packaging, building & construction and manufacture industries. Specialty papers used in printing and writing assure high quality, smoothness, and durability that ensure high quality printed materials, and quality writing materials such as stationaries. The packaging sector still forms a substantial end user since the search for multifunctional and sustainable packaging materials continues to grow with specialty papers providing a strong and steady outlook to packaging applications.

- In the building and construction field, specialty papers find their application in laminates, insulation as well as décor and design. Specialty papers which find relevance in industrial uses include filtration papers, masking papers, and technical papers. Therefore, this variety of end-users indicates that specialty papers are essential to a wide range of industries as products with many uses.

Specialty Paper Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is the largest market in Specialty Paper Market due to the increase in the use of higher quality and eco-friendly papers in different end use segments. Relatively strict environmental standards for production have enabled specialty papers that are environmentally friendly in the region taking leadership in the market. Currently European manufacturers are leading in innovative production and especially in creating new biodegradable and recyclable specialty papers, which corresponds to the increased global demand for sustainable packaging materials.

- Furthermore, presence of large number of specialty paper manufacturers and highly developed manufacturing infrastructure contribute to the strength of the European market. Germany, Sweden, and Finland are already developed countries with well developed paper and pulp industries which provide consistent supply for quality raw materials to support the enhancement of the specialty paper market in the region.

Active Key Players in the Specialty Paper Market

- International Paper (USA)

- Mondi Group (UK)

- Nippon Paper Industries (Japan)

- Stora Enso (Finland)

- Sappi Limited (South Africa)

- Smurfit Kappa Group (Ireland)

- UPM-Kymmene Corporation (Finland)

- Domtar Corporation (Canada)

- Fedrigoni (Italy)

- Ahlstrom-Munksjö (Sweden)

- Others Key Player

Key Industry Developments in the Specialty Paper Market

- In March 2022, Stora Enso Oyj launched a renewable high strength material for paper bags named CarrEco Brown. It is made from fresh fibers, provides tear resistance properties, and is safe for food contact packaging.

- In October 2022, Mondi Group announced the investment of 400 million euros in a new Kraft paper machine at the Št?tí mill in the Czech Republic.

|

Global Specialty Paper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 27.62 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Specialty Paper Market by Product Type (2018-2032)

4.1 Specialty Paper Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Décor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermal

4.5 Carbonless

4.6 Kraft

4.7 Other Types

Chapter 5: Specialty Paper Market by End User (2018-2032)

5.1 Specialty Paper Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Printing & Writing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Packaging

5.5 Building & Construction

5.6 Industrial

5.7 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Specialty Paper Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 INTERNATIONAL PAPER (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MONDI GROUP (UK)

6.4 NIPPON PAPER INDUSTRIES (JAPAN)

6.5 STORA ENSO (FINLAND)

6.6 SAPPI LIMITED (SOUTH AFRICA)

6.7 SMURFIT KAPPA GROUP (IRELAND)

6.8 UPM-KYMMENE CORPORATION (FINLAND)

6.9 DOMTAR CORPORATION (CANADA)

6.10 FEDRIGONI (ITALY)

6.11 AHLSTROM-MUNKSJÖ (SWEDEN)

6.12 OTHERS KEY PLAYER

Chapter 7: Global Specialty Paper Market By Region

7.1 Overview

7.2. North America Specialty Paper Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Décor

7.2.4.2 Thermal

7.2.4.3 Carbonless

7.2.4.4 Kraft

7.2.4.5 Other Types

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Printing & Writing

7.2.5.2 Packaging

7.2.5.3 Building & Construction

7.2.5.4 Industrial

7.2.5.5 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Specialty Paper Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Décor

7.3.4.2 Thermal

7.3.4.3 Carbonless

7.3.4.4 Kraft

7.3.4.5 Other Types

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Printing & Writing

7.3.5.2 Packaging

7.3.5.3 Building & Construction

7.3.5.4 Industrial

7.3.5.5 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Specialty Paper Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Décor

7.4.4.2 Thermal

7.4.4.3 Carbonless

7.4.4.4 Kraft

7.4.4.5 Other Types

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Printing & Writing

7.4.5.2 Packaging

7.4.5.3 Building & Construction

7.4.5.4 Industrial

7.4.5.5 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Specialty Paper Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Décor

7.5.4.2 Thermal

7.5.4.3 Carbonless

7.5.4.4 Kraft

7.5.4.5 Other Types

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Printing & Writing

7.5.5.2 Packaging

7.5.5.3 Building & Construction

7.5.5.4 Industrial

7.5.5.5 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Specialty Paper Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Décor

7.6.4.2 Thermal

7.6.4.3 Carbonless

7.6.4.4 Kraft

7.6.4.5 Other Types

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Printing & Writing

7.6.5.2 Packaging

7.6.5.3 Building & Construction

7.6.5.4 Industrial

7.6.5.5 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Specialty Paper Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Décor

7.7.4.2 Thermal

7.7.4.3 Carbonless

7.7.4.4 Kraft

7.7.4.5 Other Types

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Printing & Writing

7.7.5.2 Packaging

7.7.5.3 Building & Construction

7.7.5.4 Industrial

7.7.5.5 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Specialty Paper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 27.62 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Specialty Paper Market research report is 2024-2032.

International Paper (USA),Mondi Group (UK),Nippon Paper Industries (Japan),Stora Enso (Finland),Sappi Limited (South Africa),Smurfit Kappa Group (Ireland),UPM-Kymmene Corporation (Finland),Domtar Corporation (Canada),Fedrigoni (Italy),Ahlstrom-Munksjö (Sweden)and Other Major Players.

The Specialty Paper Market is segmented into Product Type , End User and Region. By Product Type, the market is categorized into Décor,Thermal,Carbonless,Kraft,Other Types.By End Use, the market is categorized into Printing & Writing,Packaging,Building & Construction,Industrial,Other Commercial End Use. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Specialty Paper market includes papers that are produced to meet the requirements of a specific end-use that demands enhancing characteristics over the usual paper. They are commonly applied in such sectors as packaging, printing, building, etc., and can be divided into décor, thermal, carbonless, kraft, etc.

Specialty Paper Market Size Was Valued at USD 17.5 Billion in 2023, and is Projected to Reach USD 27.62 Billion by 2032, Growing at a CAGR of 5.20% From 2024-2032.