Speciality Proteins Market Synopsis

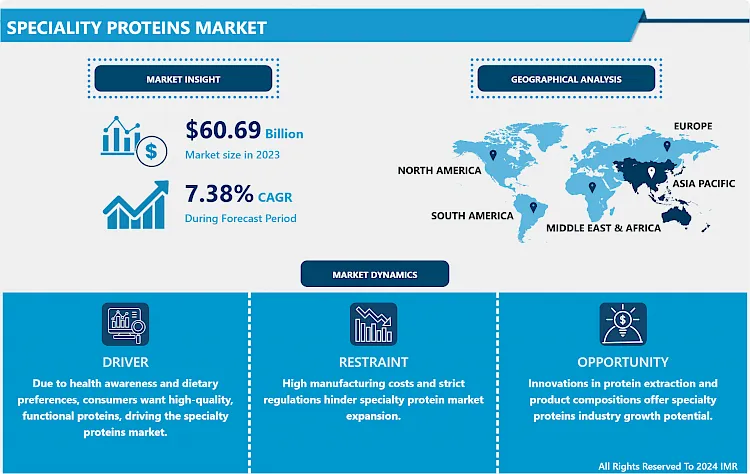

Speciality Proteins Market Size Was Valued at USD 60.69 Billion in 2023 and is Projected to Reach USD 115.19 Billion by 2032, Growing at a CAGR of 7.38 % From 2024-2032.

The Specialty Proteins Market focuses on high-value proteins with unique functionalities, derived from plant, animal, or microbial sources. These proteins are used across food, beverage, nutraceutical, and pharmaceutical industries to enhance nutritional profiles, improve texture, and meet dietary needs.

The Specialty Proteins Market has experienced significant growth, driven by the increasing consumer demand for health-conscious and sustainable food options. Specialty proteins, derived from diverse sources such as plants, animals, and emerging technologies like fermentation and cell culture, cater to specific dietary needs. These proteins are essential for tissue repair and development in the human body and play a key role in applications ranging from nutrition bars to meat alternatives. The rise of veganism, flexitarian diets, and an increased focus on functional foods has accelerated the market's expansion.

Within the market, protein isolates, concentrates, and textured proteins are commonly used in food and beverage products. Companies are continuously innovating to improve the nutritional content and sensory qualities of specialty protein products, responding to consumer preferences for clean labels and minimal processing. This shift aligns with the growing demand for healthier, environmentally friendly ingredients that contribute to overall wellness. With consumers increasingly seeking transparency in their food choices, manufacturers are focusing on delivering high-quality proteins with enhanced functionality.

Technological advancements in protein extraction and purification techniques have also fueled market growth. These innovations improve the functional properties of specialty proteins, such as solubility, emulsification, and texture, enabling manufacturers to create a broader range of products. As the market continues to evolve, the integration of specialty proteins in various food and beverage applications, including sports nutrition, infant formula, and functional foods, is poised for further growth.

.webp)

Speciality Proteins Market Trend Analysis

Increased Demand for Plant-Based Proteins

- The trend toward increased demand for plant-based proteins has substantially impacted the specialty protein market. Due to their perceived health benefits and sustainability, plant-based proteins are gaining popularity as consumers become more environmentally conscious and health-conscious.

- Companies are expanding their offerings to include a variety of plant-based options, such as pea, soy, and hemp proteins, as a result of this transition, which is driving innovation and investment in the specialty proteins sector. Companies are integrating these proteins into a range of products, such as protein-enriched snacks and animal substitutes, to cater to the needs of both vegetarians and flexitarians.

- Additionally, companies are advancing protein processing technologies and formulation methods in response to the increasing prevalence of plant-based diets. In order to better align with consumer expectations, companies are emphasizing the enhancement of the nutritional profile, texture, and flavor of plant-based proteins.

- Consequently, the specialty protein market is undergoing substantial development, with forecasts suggesting that it will continue to expand as a result of the growing popularity of plant-based diets and the demand for sustainable food solutions.

Focus on Personalized Nutrition

- The specialty protein market is undergoing a transformation due to the trend toward personalized nutrition, which is fostering growth and innovation. Customized nutritional solutions tailored to individual health requirements, preferences, and genetic profiles are increasingly attracting consumer interest. This change is promoting a surge in demand for specialty proteins that provide specific benefits, such as improved metabolic health, weight management, or enhanced muscle recovery. Companies are utilizing cutting-edge technologies, such as AI and genomics, to create personalized protein products that are in accordance with their individual health objectives and dietary needs.

- The specialty proteins market is experiencing a diversification of offerings in response to this trend, ranging from highly specialized formulations to plant-based and bioengineered proteins. In addition to fostering increased investment in research and development, this evolution is also broadening its market opportunities. The specialty protein market is on the brink of significant growth as personalization becomes a critical factor in consumer decision-making. A growing emphasis on providing science-based, targeted nutrition solutions is driving this growth.

Speciality Proteins Market Segment Analysis:

Speciality Proteins Market Segmented on the basis of By Type, and By Application.

By Type, Plant Based Protein segment is expected to dominate the market during the forecast period

- Plant-based and animal-based proteins make up the two segments of the protein market. The design of each segment caters to a diverse range of dietary preferences and health concerns. Plant-based proteins, derived from sources such as legumes, nuts, and cereals, are gaining traction primarily due to their environmental sustainability and appeal to vegetarian and vegan consumers.

- Health-conscious individuals favor them for their ability to provide a variety of functional advantages, such as improved digestion and cholesterol reduction. On the other hand, animal-based proteins, sourced from meat, dairy, and eggs, remain the most popular due to their high bioavailability and comprehensive amino acid profile, crucial for muscle development and overall nutrition.

- Specialty proteins such as hydrolyzed proteins, isolated proteins, and blended protein formulations further bolster the market. Engineers engineered these proteins to meet specific health requirements and performance standards, such as enhancing protein absorption or improving muscle recovery.

- The increasing demand for customized nutritional solutions and the advancements in protein processing technologies, which offer consumers targeted options for optimal health and wellness, are driving the growth of this segment.

By Application, Bakery Products segment held the largest share in 2024

- There is a growing demand for specialty proteins in a variety of applications, particularly in confectionary and dairy products. In the bakery sector, specialty proteins improve the quality of products by extending their shelf life, enhancing texture, and providing additional nutritional benefits.

- Bakeries that are gluten-free and high in protein are increasingly using specialty proteins to cater to health-conscious consumers and those with dietary restrictions. This change is consistent with the increasing demand for functional foods that provide both health benefits and Flavor.

- In the same way, specialty proteins are essential for developing dairy products with improved nutritional profiles and functionality. They fortify yogurts, cheeses, and milk-based beverages in response to the increasing consumer demand for protein-enriched dairy products.

- As the market continues to evolve, we anticipate that the incorporation of specialty proteins in these applications will fuel growth, satisfying the needs of both health-conscious individuals and the broader consumer market.

Speciality Proteins Market Regional Insights:

Asia-Pacific dominates the speciality proteins market

- Growing populations, rapid industrialization, and increased health awareness are driving the Asia-Pacific region to become the dominant force in the specialty proteins market. The region's dominant position is a result of the increasing demand for high-quality protein sources and the region's diverse dietary preferences. Key markets like China and India are witnessing substantial growth in their food and beverage industries due to the growing utilization of specialty proteins in various applications such as animal feed, functional foods, and nutritional supplements.

- The Asia-Pacific region is able to capitalize on advanced technological advancements and innovation in protein production, in addition to demographic and economic factors. In order to meet the changing demands of health-conscious consumers, companies are making substantial investments in research and development to improve the quality and functionality of protein. This trend emphasizes the region's critical role in the global specialty proteins market and solidifies its status as a significant player in the industry.

Active Key Players in the Speciality Proteins Market

- ADM (United States)

- Gillco Ingredients (United States)

- Milk Specialties Global (United States)

- Roquette Frères (France)

- Cargill (United States)

- DSM (Netherlands)

- Kerry Group ( Ireland)

- General Mills (United States)

- Tatua (New Zealand) and Other Major Players

Key Industry Developments in the Speciality Proteins Market:

- In April 2023, Darling Ingredients’ health brand, Rousselot, showcased its premium collagen peptides solution, PEPTAN, highlighting its holistic well-being benefits. Known for its science-backed health advantages and versatile formulation properties, PEPTAN delivers a superior protein-based solution for various applications. The showcase emphasized Rousselot's commitment to advancing innovative health ingredients that support overall wellness, catering to the growing demand for high-quality, functional products.

- In June 2023, Roquette inaugurated its state-of-the-art Food Innovation Center in Lestrem, France. The facility features a sensory analysis laboratory, a demonstration kitchen, and collaborative labs equipped for pilot-scale testing of plant-based ingredients. This center underscores Roquette’s commitment to innovation and sustainability, providing a space for collaboration and cutting-edge research to develop new, plant-based food solutions.

|

Speciality Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 60.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.38 % |

Market Size in 2032: |

USD 115.19 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Speciality Proteins Market by Type (2018-2032)

4.1 Speciality Proteins Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plant Based Protein

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Animal Based Protein

Chapter 5: Speciality Proteins Market by Application (2018-2032)

5.1 Speciality Proteins Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bakery Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dairy Products

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Speciality Proteins Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADVANCED BIOTECH (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AUGUSTUS OILS (USA)

6.4 AUROCHEMICALS (USA)

6.5 CHARKIT CHEMICAL COMPANY (USA)

6.6 AXXENCE (GERMANY)

6.7 ALFREBRO (MEXICO)

6.8 ASSOCIATE ALLIED CHEMICALS (INDIA)

6.9 ASTRAL EXTRACTS (INDIA)

6.10 BEIJING LYS CHEMICALS (CHINA)

6.11 AMBLES NATURE AND CHEMISTRY (CHINA)

6.12

Chapter 7: Global Speciality Proteins Market By Region

7.1 Overview

7.2. North America Speciality Proteins Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Plant Based Protein

7.2.4.2 Animal Based Protein

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Bakery Products

7.2.5.2 Dairy Products

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Speciality Proteins Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Plant Based Protein

7.3.4.2 Animal Based Protein

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Bakery Products

7.3.5.2 Dairy Products

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Speciality Proteins Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Plant Based Protein

7.4.4.2 Animal Based Protein

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Bakery Products

7.4.5.2 Dairy Products

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Speciality Proteins Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Plant Based Protein

7.5.4.2 Animal Based Protein

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Bakery Products

7.5.5.2 Dairy Products

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Speciality Proteins Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Plant Based Protein

7.6.4.2 Animal Based Protein

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Bakery Products

7.6.5.2 Dairy Products

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Speciality Proteins Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Plant Based Protein

7.7.4.2 Animal Based Protein

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Bakery Products

7.7.5.2 Dairy Products

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Speciality Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 60.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.38 % |

Market Size in 2032: |

USD 115.19 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||