Space Tourism Market Synopsis

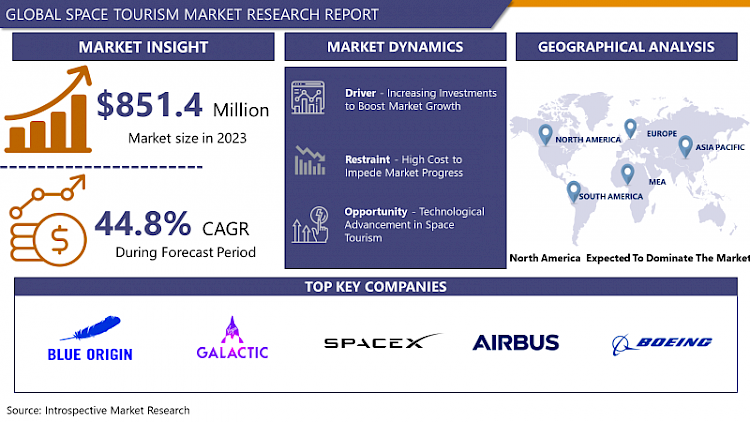

Space Tourism Market Size Was Valued at USD 851.4 Million in 2023 and is Projected to Reach USD 23,826 million by 2032, Growing at a CAGR of 44.8% From 2024-2032.

Space tourism means the travel in space either for entertainment, leisure or a holiday by different or single individuals. It covers such services as suborbital and orbital space flights, lunar or deep space, and other similar kinds of space tourism that enable passengers to pay for a ticket and travel to space and explore it independently.

- The level of innovation in space tourism industry is relatively high as companies are constantly on the lookout for new unique concepts and new technologies that can revolutionize the space tourism. This innovation also decides modifications in propulsion systems, safety procedures, consumer engagement techniques, and designs of the spaceship. This sector is devising promising solutions that would redefine space tourism services, attracting a broad range of customers and propelling sustainable growth due to persistent investments in research and innovation.

- The factors such as increasing use of technology, increasing trends of adventure traveler, HNWI people to travel Space, and increasing Research and development activities by government and Private research institutions are some of the factors that are driving the market. Space tourism can thus be defined as the use of space and or space vehicles within the orbit of the earth or outside it for tourism, leisure or business reasons. Space tourism is expected to become common to lay and non-astronaut persons in the near future. The industry is growing at a rapid growth rate given the advances in technology and the changing preferences of users towards space exploration.

- The key factors of the global space tourism market include the growing interest in space exploration, the rising competition among private space providers, and the evolving consumer appetite for extraordinary sensations beyond the Earth’s atmosphere.

Space Tourism Market Trend Analysis

Growing funds for space tourism

- The increasing spending capacity for traveling and tourism is expected to augment the demand for space tourism market across the world in the forecast period. The growing funds for space tourism are anticipated to boost the space tourism market even more. Similarly, the passengers having an interest in space investigation and progressive events in space exploration are also expected to closely create new events for the space tourism market during the forecast period. The investment associations for a more available, less costly reach into outer space could be significant, with probable opportunities in terrains like satellite broadband, high-speed product delivery, and potentially even manned space travel.

- The growing interest in travelling to other worlds is one of the most significant factors that contribute the space tourism market progression. Space exploration is the travel of celestial bodies and the colonization of space by various space organizations and corporations. In so doing, people develop the kind of curiosity that would lead to travelling through space. This is due to increasing curiosity which leads to the demand for space tourism as people wish to be part of the exploration. For instance, SpaceX contributes to the increased concern with space exploration by conducting daily broadcasts of launches and landings, maintaining active accounts in social networks, and organizing, for example, the Inspiration4 – several days of people’s trips into space. Further, growing media interest, technological advancements and reducing costs of exploring space are factors making it easier for more people to travel to outer space. hence these factors have made it easier for many people to get involved with this kind of business since they have opened up such regions.

The Emergence of Technological innovation

- On the technological aspect, the space tourism market is experiencing sophistication, opening up further opportunities for growth. Advancements in technology have improved spacecraft safety, effectiveness and even comfort for the passengers. The reusable rockets and spacecrafts have cut down the costs of launching and transportation hence making the space travel even cheaper and affordable to a cross section of the society. Increased complexity of the life support system, better designed habitats, and better medical support system on board has been helpful in instilling confidence among the prospective space tourists regarding the safety and comfort associated with the space travel.

Space Tourism Market Segment Analysis:

Space Tourism Market is segmented based on Type, and End-use.

By type, sub-orbital segment is expected to dominate the market during the forecast period

- Based on type, the market is segmented as orbital, suborbital, and others. The sub-orbital segment emerged as the largest one for the overall market and captured the market share of 49%. 1% in 2023 and experience growth at a Compound Annual Growth Rate (CAGR) of more than 44. 3% for the year 2024 to 2030. Suborbital tourism offers people an opportunity to float and view space without leaving Earth’s orbit. This allows human spaceflight to get to the Karman line without launching the vehicle into orbit.

- Orbital and suborbital flights are differentiated by the speed at which the launch vehicle travels. A suborbital flight is flown at a slower speed than that of an orbital flight. Thus, these flights cannot accelerate enough to reach orbit. These flights are flown to a certain altitude and crashland when the engines cut-off. Organizations are directing their efforts towards starting suborbital flights as these rockets can be used multiple times to reduce on manufacturing costs.

- The orbital segment is expected to have the highest CAGR of 45 percent through the forecast period. 7% from 2024 to 2030. Orbital flights can take from a few days to several weeks, depending on the destination like ISS, moon or Mars. Virgin Galactic and Blue Origin are mainly targeting suborbital space tourism, while SpaceX and Orion Span targets orbital tourism.

- For example, Orion Span, a U. S. -based space travel company, has plans of launching a private commercial space station that will serve as a space hotel. The Aurora Space Station will be located in Low Earth Orbit (LEO) and accommodate no more than six tourists simultaneously

By end use, commercial space segment held the largest share in 2023

- Based on end user, the market segmented into government sector, commercial segment and others. Of these places, commercial space tourism market is expected to exhibit the highest market share of 57% in 2023. while it controlling 0% of the total market share; this segment is expected to grow at a faster CAGR of 45%. HPS with a CAGR of 2% in the forecast period of 2024 to 2030. There were thirteen different missions in space as part of space tourism by several private and government investment in 2021 out of which successful missions happened were seven. Exploration becomes more and more possible for commercialization profit with the help of sociotechnical progress in the industry of space tourism. However, there are still some challenges that remain as the following represents the primary challenge, the high space tourism cost is one of the essential factors that industry players are seeking to address to make such out of earth experiences more attainable to many.

- Bill Gates, Jeff Bezos, Richard Branson, Elon Musk and others have spent millions of dollars trying to reach space and see the Earth from a distance. The ventures that the Virgin Galactic, Blue Origin, SpaceX, and NASA have embarked on are to carry out spaceflight missions with the aim of ferrying non-astronaut citizens in space and take them back to the earth after a planned period. These explorations have provided the following accomplishments: film in terra, first two- part, human-crewed spacecraft, first feature film shot in space, oldest person in space.

Space Tourism Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominated the overall market in 2023 with a market share of 38 % and Europe accounted for 30% of the overall market share. 9 percent. Reading the aforementioned information we can conclude that the region has very well developed infrastructure and possesses a vast R and D base that can make the region the market leader in terms of revenue through out the global market in the forecasted period. Such a solid framework facilitates the faster introduction of innovations and fully-fledged advanced technologies. This is due to the fact that north America is densely populated with small and medium players that provides components and services to companies like SpaceX, Blue origin and Virgin Galactic, which also fueled the growth in the market.

Active Key Players in the Space Tourism Market

- Blue Origin

- Virgin Galactic

- SpaceX

- Airbus

- Boeing

- Zero Gravity Corporation

- Axiom Space

- Rocket Lab USA

- Space Adventures

- Space Perspective

- World View Enterprises, Inc.

- Zero 2 Infinity

- Other Key Players

Key Industry Developments in the Space Tourism Market:

- In June 2023, Virgin Galactic stated that the company has inaugurated the commercial space line service. Short Virgin Galactic’s space tourism was planned for June 27, 2023, to June 30, 2023, and the second tourist space trip Galactic 02 is planned for early August 2023. As for the commercial aspect, plans originally called for monthly space flights following the initial launches.

- In May 2023, Space brand Blue Origin won a Sustaining Lunar Development contract under the NASA’s NextSTEP-2 Appendix P. In the contract Blue origin’s duties include delivering a lunar lander that is capable of performing pinpoint landings anywhere on the lunar surface and delivering development of a cislunar transporter.

- In April 2023, Axiom Space started subscription based service called the Axiom Space Access Program that enables countries to unlock the potential lucrative long-term benefits microgravity could bring. The program alters the traditional form paradigms as nations no longer have to spend money on constructing or expanding several infrastructure such as launch vehicles, on orbit facilities, training or medical programs as well as support capabilities.

|

Global Space Tourism Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 851.4 Mn. |

|

Forecast Period 2024-32 CAGR: |

44.8 % |

Market Size in 2032: |

USD 23,826 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SPACE TOURISM MARKET BY TYPE (2017-2032)

- SPACE TOURISM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORBITAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUB-ORBITAL

- OTHERS

- SPACE TOURISM MARKET BY END- USER (2017-2032)

- SPACE TOURISM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GOVERNMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Space Tourism Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BLUE ORIGIN

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- VIRGIN GALACTIC

- SPACEX

- AIRBUS

- BOEING

- ZERO GRAVITY CORPORATION

- AXIOM SPACE

- ROCKET LAB USA

- SPACE ADVENTURES

- SPACE PERSPECTIVE

- WORLD VIEW ENTERPRISES, INC.

- ZERO 2 INFINITY

- COMPETITIVE LANDSCAPE

- GLOBAL SPACE TOURISM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Space Tourism Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 851.4 Mn. |

|

Forecast Period 2024-32 CAGR: |

44.8 % |

Market Size in 2032: |

USD 23,826 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SPACE TOURISM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SPACE TOURISM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SPACE TOURISM MARKET COMPETITIVE RIVALRY

TABLE 005. SPACE TOURISM MARKET THREAT OF NEW ENTRANTS

TABLE 006. SPACE TOURISM MARKET THREAT OF SUBSTITUTES

TABLE 007. SPACE TOURISM MARKET BY TYPE

TABLE 008. SUBORBITAL MARKET OVERVIEW (2016-2028)

TABLE 009. ORBITAL MARKET OVERVIEW (2016-2028)

TABLE 010. SPACE TOURISM MARKET BY PRODUCT

TABLE 011. ALTITUDE JET FIGHTER FLIGHTS MARKET OVERVIEW (2016-2028)

TABLE 012. AIRCRAFT REPLACEMENT FLIGHTS MARKET OVERVIEW (2016-2028)

TABLE 013. ATMOSPHERIC ZERO-GRAVITY FLIGHTS MARKET OVERVIEW (2016-2028)

TABLE 014. SPACE TOURISM MARKET BY SERVICE PROVIDERS

TABLE 015. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA SPACE TOURISM MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA SPACE TOURISM MARKET, BY PRODUCT (2016-2028)

TABLE 019. NORTH AMERICA SPACE TOURISM MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 020. N SPACE TOURISM MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE SPACE TOURISM MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE SPACE TOURISM MARKET, BY PRODUCT (2016-2028)

TABLE 023. EUROPE SPACE TOURISM MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 024. SPACE TOURISM MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC SPACE TOURISM MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC SPACE TOURISM MARKET, BY PRODUCT (2016-2028)

TABLE 027. ASIA PACIFIC SPACE TOURISM MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 028. SPACE TOURISM MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SPACE TOURISM MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA SPACE TOURISM MARKET, BY PRODUCT (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA SPACE TOURISM MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 032. SPACE TOURISM MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA SPACE TOURISM MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA SPACE TOURISM MARKET, BY PRODUCT (2016-2028)

TABLE 035. SOUTH AMERICA SPACE TOURISM MARKET, BY SERVICE PROVIDERS (2016-2028)

TABLE 036. SPACE TOURISM MARKET, BY COUNTRY (2016-2028)

TABLE 037. SPACE ADVENTURES: SNAPSHOT

TABLE 038. SPACE ADVENTURES: BUSINESS PERFORMANCE

TABLE 039. SPACE ADVENTURES: PRODUCT PORTFOLIO

TABLE 040. SPACE ADVENTURES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. EADS ASTRIUM: SNAPSHOT

TABLE 041. EADS ASTRIUM: BUSINESS PERFORMANCE

TABLE 042. EADS ASTRIUM: PRODUCT PORTFOLIO

TABLE 043. EADS ASTRIUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. VIRGIN GALACTIC: SNAPSHOT

TABLE 044. VIRGIN GALACTIC: BUSINESS PERFORMANCE

TABLE 045. VIRGIN GALACTIC: PRODUCT PORTFOLIO

TABLE 046. VIRGIN GALACTIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. ARMADILLO AEROSPACE: SNAPSHOT

TABLE 047. ARMADILLO AEROSPACE: BUSINESS PERFORMANCE

TABLE 048. ARMADILLO AEROSPACE: PRODUCT PORTFOLIO

TABLE 049. ARMADILLO AEROSPACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. EXCALIBUR ALMAZ: SNAPSHOT

TABLE 050. EXCALIBUR ALMAZ: BUSINESS PERFORMANCE

TABLE 051. EXCALIBUR ALMAZ: PRODUCT PORTFOLIO

TABLE 052. EXCALIBUR ALMAZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SPACE ISLAND GROUP: SNAPSHOT

TABLE 053. SPACE ISLAND GROUP: BUSINESS PERFORMANCE

TABLE 054. SPACE ISLAND GROUP: PRODUCT PORTFOLIO

TABLE 055. SPACE ISLAND GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SPACEX: SNAPSHOT

TABLE 056. SPACEX: BUSINESS PERFORMANCE

TABLE 057. SPACEX: PRODUCT PORTFOLIO

TABLE 058. SPACEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BOEING: SNAPSHOT

TABLE 059. BOEING: BUSINESS PERFORMANCE

TABLE 060. BOEING: PRODUCT PORTFOLIO

TABLE 061. BOEING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ZERO 2 INFINITY: SNAPSHOT

TABLE 062. ZERO 2 INFINITY: BUSINESS PERFORMANCE

TABLE 063. ZERO 2 INFINITY: PRODUCT PORTFOLIO

TABLE 064. ZERO 2 INFINITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 065. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 066. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 067. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SPACE TOURISM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SPACE TOURISM MARKET OVERVIEW BY TYPE

FIGURE 012. SUBORBITAL MARKET OVERVIEW (2016-2028)

FIGURE 013. ORBITAL MARKET OVERVIEW (2016-2028)

FIGURE 014. SPACE TOURISM MARKET OVERVIEW BY PRODUCT

FIGURE 015. ALTITUDE JET FIGHTER FLIGHTS MARKET OVERVIEW (2016-2028)

FIGURE 016. AIRCRAFT REPLACEMENT FLIGHTS MARKET OVERVIEW (2016-2028)

FIGURE 017. ATMOSPHERIC ZERO-GRAVITY FLIGHTS MARKET OVERVIEW (2016-2028)

FIGURE 018. SPACE TOURISM MARKET OVERVIEW BY SERVICE PROVIDERS

FIGURE 019. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA SPACE TOURISM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE SPACE TOURISM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC SPACE TOURISM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA SPACE TOURISM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA SPACE TOURISM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Space Tourism Market research report is 2024-2032.

Blue Origin; Virgin Galactic; SpaceX; Airbus; Boeing; Zero Gravity Corporation; Axiom Space; Rocket Lab USA; Space Adventures; Space Perspective; World View Enterprises, Inc.; Zero 2 Infinity, and Other Major Players..

The Space Tourism Market is segmented into type, end-user, and region. By Type, the market is categorized into Orbital, Sub-orbital. By End-use, the market is categorized into Government, Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Space tourism can be defined as the use of space for travel and other purposes by individuals with the motive of recreation and entertainment. These activities include suborbital and orbital space tourism, lunar or deep space excursions, and other related space tourism adventures that enable paying individuals to venture into space and be astronauts for a while.

Space Tourism Market Size Was Valued at USD 851.4 Million in 2023, and is Projected to Reach USD 23,826 Million by 2032, Growing at a CAGR of 44.8% From 2024-2032.