Soybean Market Synopsis

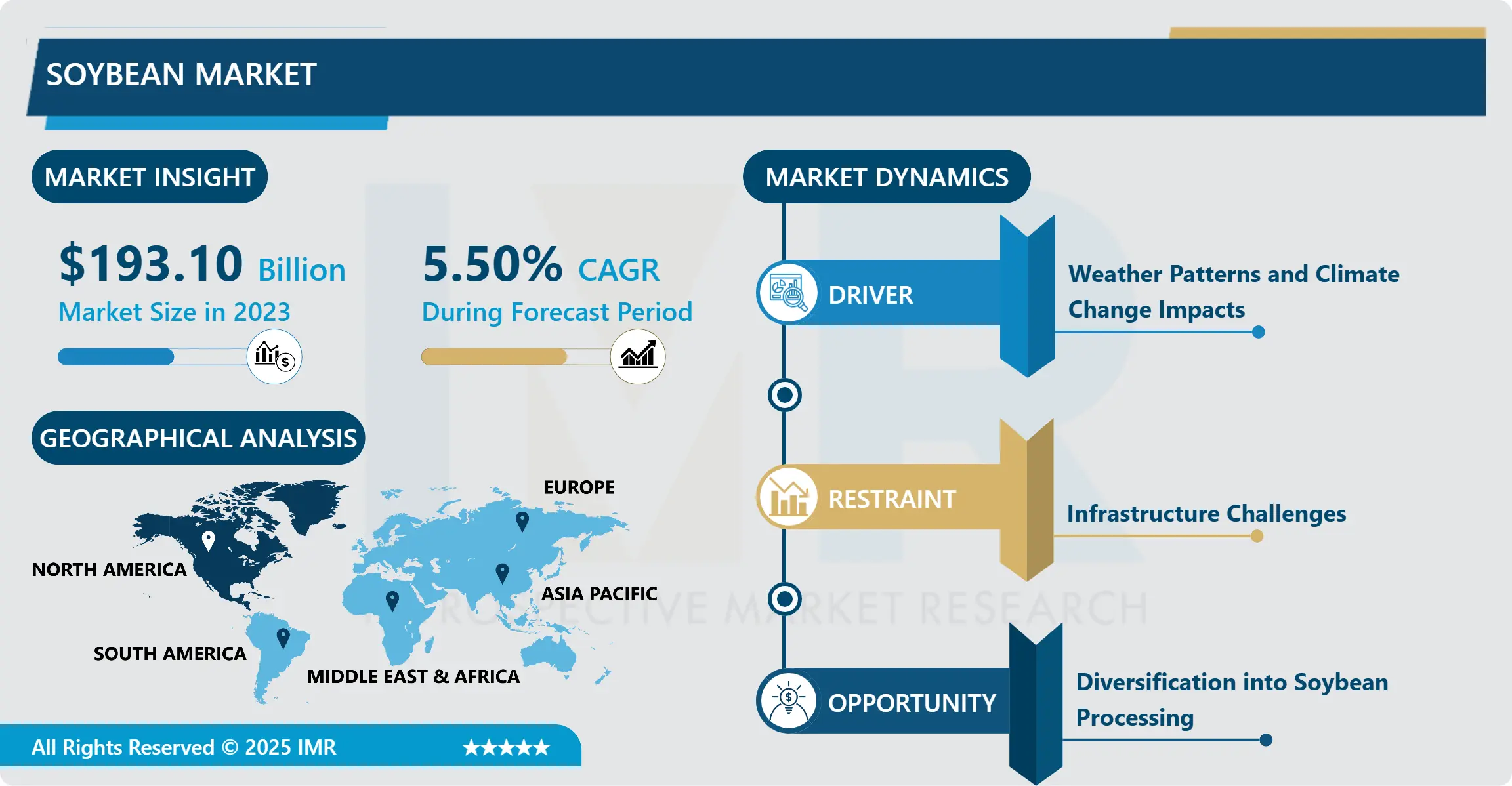

Soybean Market Size Was Valued at USD 193.10 Billion in 2023, and is Projected to Reach USD 312.65 Billion by 2032, Growing at a CAGR of 5.50% From 2024-2032.

Soybean is a legume crop of East Asian origin used for its protein content and has many culinary uses around the globe. Otherwise referred as soybeans, is scientifically categorized as Glycine max, being a vital ingredient in vegetarian diets and a common protein source. Apart from its utility in cooking, soybeans form part of industrial use through biodiesel and as an animal feed because of its richness in nutrients and economical value.

It is apparent that the soybean market is an essential cog in the wheel of the international agricultural complex, carrying a strategic significance as one of the key food/feed and industrial crops. This commodity is very efficient in the production of soyfoods, fuel, feed, meal and oil for cooking, and biodiesel for cars and other industries. , market forces that coat soybeans include demand and supply factors, effects of climatic factors, regulatory measures put in place by the governments, shifts in trade relations among countries.

Another aspect which makes the market of soybean sensitive to the external factors is the fact that its main driving force is global demand which includes the growth of population, changes in their diet, and the levels of economic development. When populations grow and/or the incomes rise, most individuals, particularly those in the developing/transitioning countries, seek for proteins from meat and dairy products. Due to this, it is evident that, the demand for soybeans increase with the increase in demand of animal products since soybeans are mainly used in formulation of animal feeds.

Light also has a major influence in growing of soybeans since soybeans are largely produced in areas that have suitable climate for their production. Meteorological risks like drought, flood or extreme weather may also affect the number of yields thus have an impact on markets supply. Likewise, unfavourable weather on the other hand can have damaging effects and vice-versa, it increases produce production hence increase stock which in turn exert pressure on prices.

Strings originating from policies of federal and state governments of individual countries and policies of the global community also affect the soybean market. Subsidies, tariffs and trade agreements can affect choices of production, exports, imports and prices of that goods in the international market. For instance, government support for the biofuel industry raises demand for soybeans for their consumption through subsidies for their production, or duties on soybean imports may assist domestic producers but upset trade.

Soybean being one of the widely traded agricultural commodities relies heavily on international trade relationships with the key producer countries, including the United States of America, Brazil and Argentina. These countries not only grow large quantities of soybeans but also act as supplier exporting to various international markets. Any tensions or disruptions in trade, for instance from tariffs or trade disagreements, may cause fluctuating soybean prices and shifting of the market.

There was some instability in the soybean market, both concerning challenges and opportunities in the recent few years. For instance, traditional markets movements, such as those between the United States and China, the world’s biggest consumers and producers of soybeans, are not open to direct trading due to tensions that affect prices. Moreover, due to the growth in the consumers’ demand for environmental and natural products the some farmers switch to the application of dense planting, contract growing, organic farming or agroecology which may impact on soybean production and market.

Risks future soybean market may become more diversified based on consumers’ preferences and innovative technologies as well as prejudices to environmental impact. Policies in sustainable farming, the advance in seed genetics and precision farming, and transition to consuming less meat and more plant derived foods are some of the scenarios that may be potential for the soybean market in the future. In summary, the soybeans market continues to be a highly fluid and delicate balance which is influenced by a host of factors and actors in various ways so as to arrive at adjusted price levels, supply, and demand chains.

Soybean Market Trend Analysis

Increasing Global Demand Driving Soybean Market Growth

- Currently, the soybean market has healthy growth rates, the main reason for which is the increased demand from consumers worldwide. Soybeans have now adopted itself in numerous industries as food, feed and fuel on account of its versatile nature and nutrition. Soybeans occupy the central place in the food industry as they are used in a broad range of products as soy milk, tofu, soy sauce and appealing to vegetarians and people who tend to have a healthy meal. Furthermore, the importance of protein as a requirement for human consumption as well as an input in the production of other goods and services has risen due to the ever increasing population especially in the emerging economies hence the need to look for cheaper sources of high quality protein and soynut is one of them.

- The growth of a livestock farming, the worldwide market has reported a strong demand for soybean meal, an essential ingredient that is incorporated in feeds for livestock. As more people in the developing countries gain disposable income and transition to urban life especially in the Asian region there is rising consumption of meat and dairy products that have in turn encouraged demand of soybean meal as feed. Increased consciousness of the hazards posed to the environment by the emission of pollutants and global shift towards the use of renewable energy sources have contributed to the increased usage of biodiesel produced from soybeans. Owing to various policies that are being enacted across the globe with an aim of controlling greenhouse emissions, especially those affecting the energy sector, there is anticipated to be increased demand for biodiesel feed stocks such as soybean oil. All in all, the soybean market in the future will have a good demand-forces because the soybean can meet the changing needs of various industries and overcome the dietary, agricultural, and environmental issues all over the world

Diversification into Soybean Processing

- Soybean processing business can thus prove to be a strategic move for a company if it wants to expand into a new product processing market. Firstly, it offers the benefit of being able to exercise more control over the flow of operations, especially in ensuring that firms have full control over the flow of goods and services right from the supply of raw materials, processing all the way to the delivery of the final goods and services. Such control helps to reduce various threats for the company connected with changes in prices and supply challenges since the company becomes less reliant on outside suppliers. Secondly, processing of soybeans presents possibilities for development of value added products and/or specialist requirements of the customers. When it comes to soybean processing it enables the production of soybean oil, soy flour, soy protein isolates which results in the creation of the group of products that is characterized by the difference in the demand and the profitability.

- Additionally, market entry in the soybean processing market is sustainable too, since soybeans are a renewable resource and have a low impact on the environment as a protein and oil ingredient. This paper discusses how the firm can apply efficient processing techniques, which improve their brand image, and embrace environmental concerns, appealing to the conscience of environmentally conscious consumers. In conclusion, soybean processing look like a rather sound strategy for Bunge to pursue diversification to mitigate volatility of its cash cow business & to adapt to shifts in competition & consumer preferences into a new and necessary form of differentiation.

Soybean Market Segment Analysis:

Soybean Market Segmented based on By Nature , By Form and By End Use.

By Nature, GMO segment is expected to dominate the market during the forecast period

- In this paper, market dynamics of the two segments—GMO and non GMO soybeans are discussed separately—thus propelling an analysis of the market in a multifaceted context. Technological advancement has played a major role in production improvement through phenotypes like the genetically modified organisms, GMOs, used in cultivation of soybean; offering qualities like the herbicide tolerance and insect resistance that boost productivity and lower expenses. Thus, GMO soybeans have received a warm acceptance by farmers all over the world and can be regarded as rather popular now. The market for non-GMO soybeans is equally buoyant, and it has a major push from the consumer’s side who seem to gravitate more towards naturally occurring and minimally processed products. This demand has especially been very high in some parts of the world and particular markets that consumers focus on organic and non-GMO labels on foods. Therefore, while there are GMO soybeans available in the market, there are equal brands of non GMO soybeans in the market fulfilling other specific customer and market segment needs.

- However, there are differences in legislations that surround GMO and this also plays down the market concerns. Whereas in some regions there are specific rules or labels that must be followed by GMO products, which in turn generate extra challenges for the market stakeholders. Still, these constraints did not hinder the dynamics and changes in the market of soybeans combined with the changes in demand, development of technologies in plant breeding and genetic engineering, and the changes in the legislation that stress the increased need to understand and manage the interaction between GMO and non-GMO soybeans for the benefit of all participants in the value chain.

By Form, Raw segment held the largest share in 2023

- When segmented according to market form, which comprises of raw soybean and processed soybean products, a clearer perspective is obvious. Soybeans in its most basic form, as raw beans, is the component on which the price of this essential food product is dependent on the generally changing trends of the climate, traditions, and policies as well as the increasing markets where this product is consumed. While unprocessed soybeans refers to beans that are yet to undergo processing, processed soybeans include a whole range of products from soybean oil to soy protein isolates, which are widely used in the food processing industries, cosmetics as well as the enhancement of biofuel production.

- The raw forms tend to have dynamics similar to those in agricultural contexts where factors such as the planting season and anticipated yields infuse the structure, whereas the processed forms change based on factors including user preferences, technological developments with regards to processing and preserving the substance, and regulatory requirements. Fluctuations in one form can affect the supply and demand chain of the soybeans thereby ultimately affecting the prices and trades. In that regard, there is a need to conduct an assessment of both the raw soybean market and the processed soybean market so as to appreciate the dynamics that inform the behavior of prices within the market.

Soybean Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- This report cites several factors that propel North America to assume the position of the market leader in the global soybean market in the years to come. Firstly, the area isioxidized in farming efficiency and has the right farming tractors for soybean farming especially in the regions of America and Canada. Further, liberal climate in most regions of North America contributes to high productivity output and production consistency. Moreover, better seeds, efficient agriculture practices, and reliable farming equipment have enhanced productivity in this specific area of soybean farming. On the economic side, domestic consumption is strong for soybeans within North America as well as for their applications in animal feed, soy food and oil, bio-fuels, and industrial products.

- In addition, an established position of the region in the global supply chains helps it to take advantage of export growth and foster the expansion of demand in the international market including Asian countries. Nevertheless, emerging threats like the volatility of the prices of the commodity, tension in trading and social backlash due to concerns over the effects of soy bean farming on the environment, particular deforestation for the crop and excessive use of dangerous chemicals like pesticides are potential threats to North America’s Soybean market domination. However, it is assumed that due to constant research, development, implementation of ecological solutions, and constant endeavours of extending to new markets, the leading position of North America in the international soybean market will be defended in the short-term perspective.

Active Key Players in the Soybean Market

- Clarkson Grain Company (USA)

- Willmar International Limited (Singapore)

- SLC Agrícola (Brazil)

- Glencore (Switzerland)

- ADM (USA)

- The Scoular Company (USA)

- Cargill, Incorporated (USA)

- Bunge Limited (USA)

- Louis Dreyfus Company (Netherlands)

- Kohinoor Feeds & Fats Pvt. Ltd. (India)

- Ag Processing, Inc. (USA)

- Other Key Players

Key Industry Developments in the Soybean Market

- In November 2023, Cargill’s integrated soybean crush and refined oils facility in Sidney, Ohio wrapped up the expansion and modernization project, which came online in September. This improved facility is intended to serve farmers better and fulfill the growing soy product demands across feed, food, and renewable fuel markets.

- In November 2021, Ag Processing, Inc. (AGP) expanded soybean processing in Sergeant Bluff, Iowa, with a USD 72 million investment. The expansion benefited soybean producers in Iowa, South Dakota, Nebraska, and Minnesota by creating better markets for their products. AGP is seeking USD 1.5 million in state and local funding for the project.

|

Global Soybean Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 193.10 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 312.65 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Form |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Soybean Market by Nature (2018-2032)

4.1 Soybean Market Snapshot and Growth Engine

4.2 Market Overview

4.3 GMO

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-GMO

Chapter 5: Soybean Market by Form (2018-2032)

5.1 Soybean Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Raw

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Processed

Chapter 6: Soybean Market by End Use (2018-2032)

6.1 Soybean Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Animal Feed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial Use

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Soybean Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CLARKSON GRAIN COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WILLMAR INTERNATIONAL LIMITED (SINGAPORE)

7.4 SLC AGRÍCOLA (BRAZIL)

7.5 GLENCORE (SWITZERLAND)

7.6 ADM (USA)

7.7 THE SCOULAR COMPANY (USA)

7.8 CARGILL INCORPORATED (USA)

7.9 BUNGE LIMITED (USA)

7.10 LOUIS DREYFUS COMPANY (NETHERLANDS)

7.11 KOHINOOR FEEDS & FATS PVT. LTD. (INDIA)

7.12 AG PROCESSING INC. (USA)

7.13 OTHER KEY PLAYERS

Chapter 8: Global Soybean Market By Region

8.1 Overview

8.2. North America Soybean Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Nature

8.2.4.1 GMO

8.2.4.2 Non-GMO

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Raw

8.2.5.2 Processed

8.2.6 Historic and Forecasted Market Size by End Use

8.2.6.1 Animal Feed

8.2.6.2 Industrial Use

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Soybean Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Nature

8.3.4.1 GMO

8.3.4.2 Non-GMO

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Raw

8.3.5.2 Processed

8.3.6 Historic and Forecasted Market Size by End Use

8.3.6.1 Animal Feed

8.3.6.2 Industrial Use

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Soybean Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Nature

8.4.4.1 GMO

8.4.4.2 Non-GMO

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Raw

8.4.5.2 Processed

8.4.6 Historic and Forecasted Market Size by End Use

8.4.6.1 Animal Feed

8.4.6.2 Industrial Use

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Soybean Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Nature

8.5.4.1 GMO

8.5.4.2 Non-GMO

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Raw

8.5.5.2 Processed

8.5.6 Historic and Forecasted Market Size by End Use

8.5.6.1 Animal Feed

8.5.6.2 Industrial Use

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Soybean Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Nature

8.6.4.1 GMO

8.6.4.2 Non-GMO

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Raw

8.6.5.2 Processed

8.6.6 Historic and Forecasted Market Size by End Use

8.6.6.1 Animal Feed

8.6.6.2 Industrial Use

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Soybean Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Nature

8.7.4.1 GMO

8.7.4.2 Non-GMO

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Raw

8.7.5.2 Processed

8.7.6 Historic and Forecasted Market Size by End Use

8.7.6.1 Animal Feed

8.7.6.2 Industrial Use

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Soybean Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 193.10 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 312.65 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Form |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||