Solar Vehicle Market Synopsis

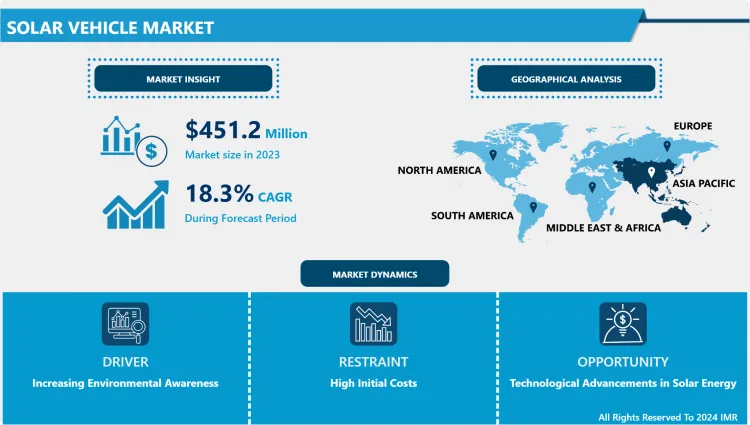

Solar Vehicle Market Size Was Valued at USD 451.2 Million in 2023, and is Projected to Reach USD 2,047.5 Million by 2032, Growing at a CAGR of 18.3% from 2024-2032.

This market has various forms of transportation like, solar car, solar buses and even bicycles. With environmental transformation filtering towards the use of renewable energy forms and the replacement of conventional fuel as a source of energy, innovations in the development of boats with solar energy are sure a worthy invention for an eventual replacement of greenhouse-gas emitting boats powered by fossil fuels. The drivers that have contributed to this market include development in the photovoltaic technology used in the solar panel, development of polices that support the use of clean energy by government and the growing concern that individuals have towards the environmental.

Solar vehicles are a crucial part of the more extensive ecosystem since they lessen the negative impact of emissions on air quality and the longer-term consequences of global warming. The conventional internal combustion engine vehicles release large quantities of carbon dioxide and other hazardous substances, which have positive impacts on global warming and ill health. As for the solar vehicles, they do not emit anything during the trip, which makes them all green. Further, by using sunlight these automobiles eliminate subjecting our society to constantly having to use depleting fuels, thus encouraging energy security. The use of solar energy in transportation is also in harmony with other renewable energy projects enhancing the overall strength of the energy structure.

Thus, the solar vehicle market has a much broader list of benefits as compared to its environmental impact. Socially, the market generates fresh opportunities for investment, ent Throne, and innovation through markets. Those firms that are conducting the research, the designing and the manufacturing of solar vehicles and other related technologies are at the leading edge of one of the most emergent industries. This growth creates economic impulse and drives investments in latest technologies, framework, and supply systems. Furthermore, the application of this market helps advances new material technology and energy storage system that may be used in a wide range of industries. The use of solar vehicles can also have tremendous potential in saving the lives of the consumer since the running and the maintaining cost of solar vehicle is also low compared to those of the normal vehicles.

In conclusion, the concept of the solar vehicle market is essential for the development of the world’s environmentally capable automobile industry. Hence, in as much as solar vehicles relieve the current energy crisis through lesser use of fossil fuel, it’s efficient in balancing conservation of the environment. From a purely economic perspective the market provides a realm for invention and money to be invested creating new technology and employment opportunities. The development of this market is concomitant with significant global initiatives to reduce the effects of climate change and transition to renewable energy, which further underscore the relevance of this market to the future of transport and the wider energy sector. With development of technology and people’s understanding of environmental problems the market of solar vehicles is going to be a decisive factor in creating sustainable world more and more important.

Solar Vehicle Market Trend Analysis

Increasing Adoption of Electric Vehicles (EVs) with Integrated Solar Panels

- The global market for solar cars is rapidly transforming as automakers include solar panels into their electric cars (EVs). The reason for this trend lies in a global quest for making transport green and environment friendly. Solar panels on automobiles can add many miles to the driving range by converting solar energy into electric power thus no need to rely on conventional charging equipments. Besides increasing the comfort of its users, this innovation also decreases greenhouse gas emissions, which high on the list of goals to mitigate climate change.

- The innovative developments of features have been essential in EV solar integration. Advancements in photovoltaic (PV) cell technology light weight structure and flexible solar panels have made it possible to integrate solar technology into the vehicle architecture while maintaining the design and function. Currently, there are companies such as Tesla, Lightyear, and Sono Motors that are leading the way and launch models offering increased energy storage by using solar energy to extend the battery power and improve overall energy utilization and car independence.

- Another advantage of having solar panels incorporated in EVs is economic enhancement. By incorporating solar energy into their cars, people can save on the electricity bills that come with charging. Moreover, as the fabrication cost of the solar technology keeps reducing, the overall expenditure on the solar integrated EVs makes an initial investment more affordable for the consumer. It is further believed that this growing trend will help in increasing the sales of solar vehicles and boost the global solar vehicle market.

Expansion of Solar-Powered Public Transportation Systems

- Solar power is gradually proving relevant in public transportation systems thus enhancing sustainability and operation. Modern transport such as buses comfortable trams, and trains are increasingly incorporating solar panels, especially since cities are anxious to lessen pollution and congestion. Currently, cities can adopt solar energy to improve the fuel efficiency of public transport thereby reducing the carbon dioxide emissions to the atmosphere, as compared to the conventional diesel-burning transport systems.

- The use of electricity from solar technology in vehicles is encouraged by the policies from the government that have encouraged the use of renewable energy sources reduced emissions. There is rather extensive information about many cities and municipalities focusing on the purchase of solar-powered buses and trams as a part of their efficient sustainability strategies. For instance, Shenzhen in China—the city that has implemented several electric buses with integrated solar panels—or any of the more than 73 other cities around the world that has implemented solar-powered bus services.

- Advancements in areas such as energy storage and power tracking interfaces have also added more viability to solar powered transport infrastructure. These types of vehicles are fitted with high-capacity batteries and or super capacitors to enable them to draw power from the sun during the day and use it at night or during other times when there is little sun or when the demand for energy is high. This furthermore guarantees that adequate and constant supply of public transport facilities is maintained, thus making solar powered options a favorable option when solving problems of mobility in urban setting.

Solar Vehicle Market Segment Analysis:

Solar Vehicle Market is Segmented based on Electric Vehicle Type, Vehicle Type, Battery Type, and Solar Panel Type

By Electric Vehicle Type, BEV Segment is Expected to Dominate the Market During the Forecast Period

- Battery Electric Vehicles (BEVs) are expected to be major demand drivers since they do not emit any pollutants to the environment as supported by global environmental legislations. The best classification of BEVs stands out because they receive power solely from electricity as opposed to HEVs and PHEVs. This increased focus on cutting excessive use of carbon and managing Climate Change impacts has pushed BEV technology and related infrastructure investments to gain heights. The BEVs are also dominating the global market due to massive incentives and subsidies provided by different governments for the proper adoption of such vehicles.

- Furthermore, the developments in the efficiency and range of batteries used in BEVs are considerably improving consumer’s preference to adopting them. Another factor is the gradually declining cost for lithium-ion battery which is certainly an essential component of BEVs. The second trend whereby various car makers are developing deeper BEV portfolios completely support this statement as companies are seeking to have as many models to cover various clients’ preferences as possible. This widening of the choices, along with increased concern over the environment, is believed to put the BEV segment in the driving seat of the solar vehicle market during the forecast period.

By Vehicle Type, Passenger Cars Segment Held the Largest Share

- The passenger car segment is followed by the largest share in the commercialization of solar vehicles due to increased personal mobility needs. For people, being an individual transportation vehicle, the cars, passengers, tend to integrate the solar technologies to increase their efficiency in terms of power, relative to the fossil energies. The populations ‘urbanization and the enhancement of the middle-class population lead to the usage of more passenger car solar-associated automobiles. Furthermore, using solar panels in cars can greatly enhance their driving distance, and the time between consecutive charging sessions.

- Also, the consciousness of the consumer that normal vehicles are a detriment to the environment is starting to surface hence people are turning to environmentally friendly vehicles. Passenger cars powered by solar energy present possibly the most attractive opportunity to capture energy from the sun. Manufacturers of automobiles are devoting significant funds towards research on how to upgrade the efficiency and appearance of solar panels as an accessory for passenger vehicles to meet environmental and consumer preferences. All the above factors mean that the solar vehicle market is well dominated by the passenger cars segment.

By Battery, Lithium-ion Segment is Expected to Dominate the Market During the Forecast Period

- The lithium-ion battery is projected to celebrate the largest-size share in market due to its characteristic features such as high energy density, efficiency, and long-life cycle compare to lead-acid and lead carbon battery. Such batteries are lighter, have more charge density than the normal ones and also have more energy density which makes it suitable for use in solar vehicles. New discoveries on the lithium-ion battery technology have also led to cheap prices on the solar vehicles making them affordable to the consumers. Lithium-ion batteries are also longer lasting and need less of attention, which greatly improves on the general appeal of solar vehicles with lithium-ion batteries.

- The rise of dependencies on electrical vehicles and other similar automobiles and the need for higher efficiency in batteries is another factor increasing the share of the lithium-ion segment in the market. Since solar vehicles need to incorporate effective energy storage system that guarantees optimal performance, lithium-ion batteries fit in perfectly. However, there is increase in production of lithium-ion batteries due to the growth in the electric car market due to economies of scales benefiting from the reduction of costs. These benefits make lithium-ion batteries the most ideal for solar vehicle manufacturers, guaranteeing their monopoly on the market for the forseeable future.

By Solar Panel, Monocrystalline Segment is Expected to Dominate the Market During the Forecast Period

- Monocrystalline PV panels are predicted to lead the market owing to their better efficiency and superior performance characteristics over polycrystalline modules. These are fabricated out of silicon and because these can be made from very high purity silicon they are able to achieve higher efficiency rates, thus they are most suitable for use where space is very limited as in the solar cars. Monocrystalline panels are also long-lasting and produce more energy during poorly lit days making solar vehicles more efficient and reliable.

- Monocrystalline panels find application in the solar vehicle market because of the higher efficiency and low profile required for the solar panels. Because of the design of the solar vehicles which demand maximum utilization of the available space for capturing the solar energy then monocrystalline panels are more efficient than the Mult crystalline ones. However, continuous advancements through new research and development are making monocrystalline cells better off, cheaper and more efficient in power conversion. This continuous advancement with the increasing concern towards sustainability and renewable energy makes monocrystalline segment to dominate the solar vehicle market in the forecast period.

Solar Vehicle Market Regional Insights:

Asia-Pacific Region is Expected to Dominate the Market Over the Forecast Period

- On the same note, the increasing consciousness around the environment problems by the consumers in the Asia-Pacific region is driving the uptake of sustainable transportation. Large populations and industrialization increase elevated emissions from vehicles in essential cities, causing governments to impel higher emission standards and encourage the use of environmentally friendly cars. Due to their zero-emission feature, solar vehicles are becoming a popular option to help reduce pollutions and to reduce the use of fossil fuel; thus, consumers are starting to demand the new products.

- Lastly, the Asia Pacific region has a healthy automotive manufacture industry, many of the top automotive companies are based in the region. Most of these firms are incorporating solar technology in their vehicle production lines so as to provide for the growing market of green mobility solutions. In addition, the low cost of solar panels as well as enhanced battery systems available in the region is also exerting pressure to have solar vehicles. Strong industrial outlook and friendly policies coupled up with rising concern amongst the consumers marks the Asia-Pacific region as the most significant player in the solar vehicle market over the forecast time frame.

Active Key Players in the Solar Vehicle Market

- Volkswagen

- Toyota

- Ford

- Mahindra

- Nissan

- GM

- Sono Motors

- Cruise Car

- Solar Electric Vehicle Company and Other Major Players

|

Solar Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 451.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.3% |

Market Size in 2032: |

USD 2,047.5 Mn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Vehicle Type |

|

||

|

By Battery |

|

||

|

By Solar Panel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Market Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Solar Vehicle Market by Electric Vehicle Type (2018-2032)

4.1 Solar Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 BEV

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 HEV

4.5 PHEV

Chapter 5: Solar Vehicle Market by Vehicle Type (2018-2032)

5.1 Solar Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

Chapter 6: Solar Vehicle Market by Battery (2018-2032)

6.1 Solar Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Lithium-ion

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Lead-Acid

6.5 Lead carbon

Chapter 7: Solar Vehicle Market by Solar Panel (2018-2032)

7.1 Solar Vehicle Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Monocrystalline

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Polycrystalline

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Solar Vehicle Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 VOLKSWAGEN

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TOYOTA

8.4 FORD

8.5 MAHINDRA

8.6 NISSAN

8.7 GM

8.8 SONO MOTORS

8.9 CRUISE CAR

8.10 SOLAR ELECTRIC VEHICLE COMPANY

Chapter 9: Global Solar Vehicle Market By Region

9.1 Overview

9.2. North America Solar Vehicle Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.2.4.1 BEV

9.2.4.2 HEV

9.2.4.3 PHEV

9.2.5 Historic and Forecasted Market Size by Vehicle Type

9.2.5.1 Passenger Cars

9.2.5.2 Commercial Vehicles

9.2.6 Historic and Forecasted Market Size by Battery

9.2.6.1 Lithium-ion

9.2.6.2 Lead-Acid

9.2.6.3 Lead carbon

9.2.7 Historic and Forecasted Market Size by Solar Panel

9.2.7.1 Monocrystalline

9.2.7.2 Polycrystalline

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Solar Vehicle Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.3.4.1 BEV

9.3.4.2 HEV

9.3.4.3 PHEV

9.3.5 Historic and Forecasted Market Size by Vehicle Type

9.3.5.1 Passenger Cars

9.3.5.2 Commercial Vehicles

9.3.6 Historic and Forecasted Market Size by Battery

9.3.6.1 Lithium-ion

9.3.6.2 Lead-Acid

9.3.6.3 Lead carbon

9.3.7 Historic and Forecasted Market Size by Solar Panel

9.3.7.1 Monocrystalline

9.3.7.2 Polycrystalline

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Solar Vehicle Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.4.4.1 BEV

9.4.4.2 HEV

9.4.4.3 PHEV

9.4.5 Historic and Forecasted Market Size by Vehicle Type

9.4.5.1 Passenger Cars

9.4.5.2 Commercial Vehicles

9.4.6 Historic and Forecasted Market Size by Battery

9.4.6.1 Lithium-ion

9.4.6.2 Lead-Acid

9.4.6.3 Lead carbon

9.4.7 Historic and Forecasted Market Size by Solar Panel

9.4.7.1 Monocrystalline

9.4.7.2 Polycrystalline

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Solar Vehicle Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.5.4.1 BEV

9.5.4.2 HEV

9.5.4.3 PHEV

9.5.5 Historic and Forecasted Market Size by Vehicle Type

9.5.5.1 Passenger Cars

9.5.5.2 Commercial Vehicles

9.5.6 Historic and Forecasted Market Size by Battery

9.5.6.1 Lithium-ion

9.5.6.2 Lead-Acid

9.5.6.3 Lead carbon

9.5.7 Historic and Forecasted Market Size by Solar Panel

9.5.7.1 Monocrystalline

9.5.7.2 Polycrystalline

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Solar Vehicle Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.6.4.1 BEV

9.6.4.2 HEV

9.6.4.3 PHEV

9.6.5 Historic and Forecasted Market Size by Vehicle Type

9.6.5.1 Passenger Cars

9.6.5.2 Commercial Vehicles

9.6.6 Historic and Forecasted Market Size by Battery

9.6.6.1 Lithium-ion

9.6.6.2 Lead-Acid

9.6.6.3 Lead carbon

9.6.7 Historic and Forecasted Market Size by Solar Panel

9.6.7.1 Monocrystalline

9.6.7.2 Polycrystalline

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Solar Vehicle Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Electric Vehicle Type

9.7.4.1 BEV

9.7.4.2 HEV

9.7.4.3 PHEV

9.7.5 Historic and Forecasted Market Size by Vehicle Type

9.7.5.1 Passenger Cars

9.7.5.2 Commercial Vehicles

9.7.6 Historic and Forecasted Market Size by Battery

9.7.6.1 Lithium-ion

9.7.6.2 Lead-Acid

9.7.6.3 Lead carbon

9.7.7 Historic and Forecasted Market Size by Solar Panel

9.7.7.1 Monocrystalline

9.7.7.2 Polycrystalline

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Solar Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 451.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.3% |

Market Size in 2032: |

USD 2,047.5 Mn. |

|

Segments Covered: |

By Electric Vehicle Type |

|

|

|

By Vehicle Type |

|

||

|

By Battery |

|

||

|

By Solar Panel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Market Opportunities: |

|

||

|

Companies Covered in the report: |

|

||