Smartphone Security Software Market Synopsis

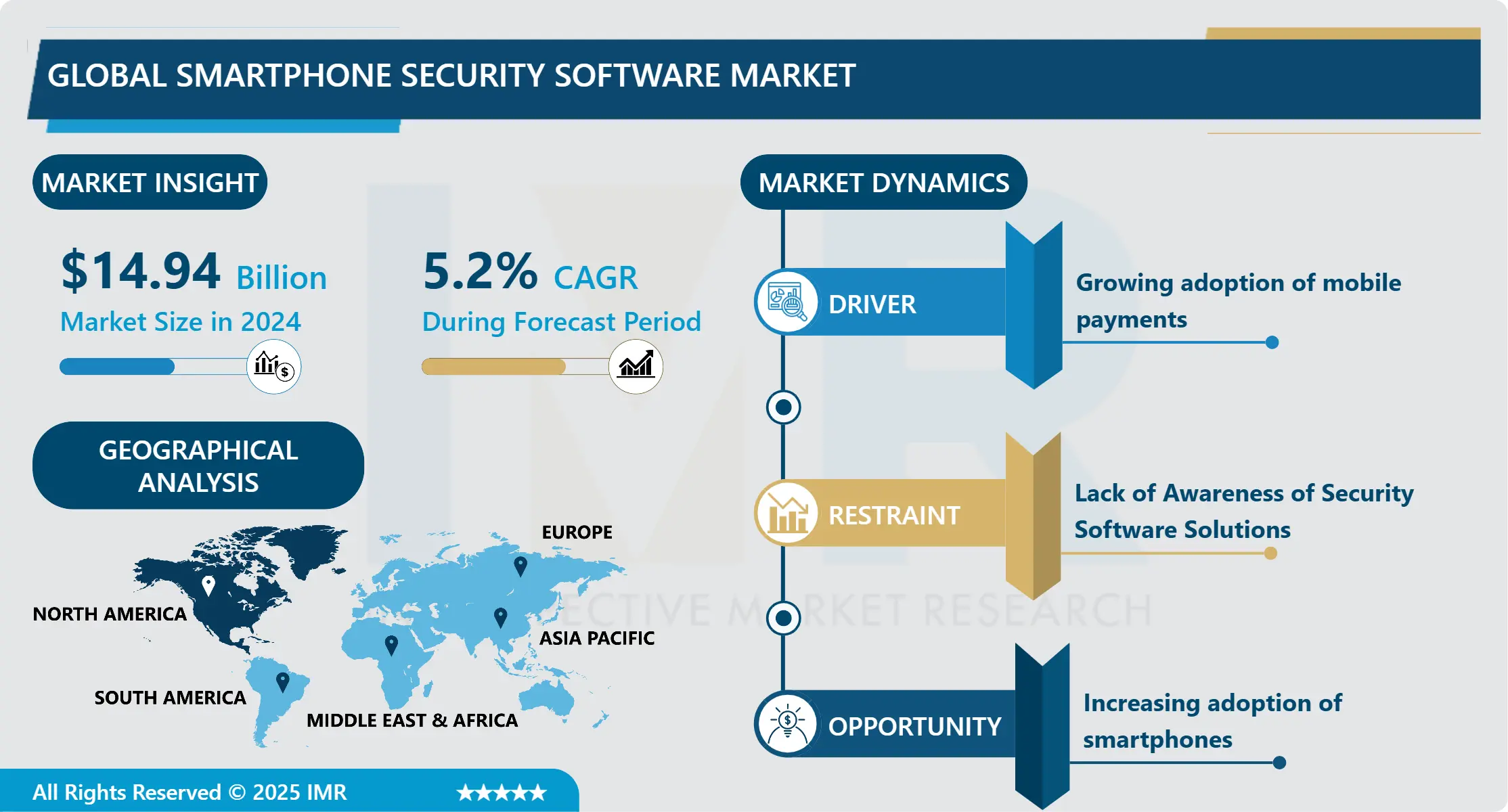

Smartphone Security Software Market Size Was Valued at USD 14.94 Billion in 2024, and is Projected to Reach USD 22.4 Billion by 2032, Growing at a CAGR of 5.2% From 2025-2032.

Smartphone security software involves a set of application and utilities that aims at shielding smartphones and tablets from possible security risks. These are normally antivirus and anti-malware tools for identifying and eliminating viruses and other malware in the devices, firewalls to regulate the flow of traffic and control access to the device, and anti-theft mechanisms for tracking, freezing, or erasing the device in the event that it gets lost or stolen. Encryption keeps the data resident on the device or on the actual networks safe, and secure browser tools guard against malicious activity like phishing. Further, app permission controls and backup options provide ways for users to control data access and to secure their data. In summary, smartphone security software has the objective of enhancing device security, safeguarding the privacy of the owners, and warding off cyber incidents successfully.

The global market for ‘smartphone security software’ is in a phase of high growth due to the trends of ‘smartphone adoption’ and ‘secure mobile computing’. Such a trend has been fuelled by increasing use of mobile devices, advancement in cyber-crimes, and enhanced protection of data and information by the business entities and individuals.

The market is stimulated by the necessity of business application and data security from more complicated cyber threats and mobility. But, consumers are getting more and more aware of the necessity of having secured mobile devices and as a result the demand for security solutions for the smartphones is on the rise. Global smartphone security software market will again witness high growth in the coming years primarily due to adopting secured mobile computing, rising need for businesses to safeguard data from cyber threats, and growing consciousness towards mobile security among the users.

Further, high growth in the mobile device market and enhanced levels of cybersecurity threats, along with enhanced awareness of mobile security are anticipated to bolster the global smartphone security software market. Therefore, the global smartphone security software market has the potential of experiencing significant growth in the near future due to several factors such as growing need for secure mobile computing, the need for organizations to safeguard their data from hackers, and rising consumer awareness regarding the importance of mobile security.

Smartphone Security Software Market Trend Analysis

Increasing trend in the Mobile Malware

- With an increased uptake of smartphone devices around the globe, the rate of mobile malwares is also on the rise. The advancement in mobile technology in the last decade has seen a rapid increase in mobile malware threats where new threats emerge every day. Mobile malware can be of the following types; Trojan, ransomware, and spy, through which one can steal information, hijack a device, or else blackmail for money. Consequently, Mobile security solutions are something that has gained importance and is especially important for business users.

Rise in the demand for the secure mobile applications

- Mobile devices are increasingly being used in performing different tasks, and this has necessitated the need for more secure and efficient mobile applications. Enterprises will also need to make sure that the applications they employ to run their operations are safe and compliant with the latest standards. Further, users have to be very cautious so that they only download and install apps that are not hazardous to the device. Consequently, the smartphone security software market is experiencing growth due to the growing need for mobile applications that are secure.

Smartphone Security Software Market Segment Analysis:

Smartphone Security Software Market is Segmented based on, Deployment Model, Organization Size, End-User and Vertical.

By Deployment Model, On-Premise segment is expected to dominate the market during the forecast period

- The ubiquitous presence of the On-Premise deployment model in the smartphone security software market in the forecast period will lead to a rising demand on these solutions for several reasons. On-Premise solutions are preferred by businesses and organizations because they allow customizing smartphone security solutions for corporate needs meeting particular regulation requirements and internal policies. The ability to manage data and set out strict security standards is especially attractive in industries with high regulatory requirements, including financial and medical. In addition, as the world becomes more conscious of data breaches and other cyber risks, On-Premise deployments provide more robust data privacy guarantees. Collectively the mentioned factors help in increasing the demand for smartphone security software solutions to grow the market in the next few years.

By Vertical, BFSI segment held the largest share

- The Europeans BFSI (Banking, Financial Services and Insurance) segment holds a major market share and is expected to drive demand in the Smartphone Security Software market in the coming year as the sector needs high-end security due to growing mobile banking and financial services. With increased need to protect customer information as well as adhere to the credit reporting agencies regulations, effective smartphone security tools are now a necessity among the financial institutions. They also include such enhanced tools as secure login, credit card protection, and shield against mobile threats and malicious URLs. Thus, the further advancement of digital processes and the increasing popularity of applications for mobile banking are the key factors that will force the BFSI sector to maintain the relevance of reliable smartphone security solutions, thus promoting the development of peripherals and their application.

Smartphone Security Software Market Regional Insights:

North Americca is Expected to Dominate the Market Over the Forecast period

- The Smartphone Security Software Market in North America has a considerable growth rate at the present time. This is due to the rising admires for security solution especially for mobile devices by both the users and companies. This area encompasses some of the top technology companies in the world that are actively working toward improving security solutions. Also, in this area, there is a high penetration of technology-savvy consumers, and thus there is great market potential for mobile security.

- The growth of the market is further supported by the increase in disposable income and increasing economic growth in the region. It seems that consumers are ready to spend money on enhancing the mobile security in order to protect data and devices. In addition, the mobile device usage in the region is high and therefore the need for mobile security is on a rise. Another factor contributing to the growth of the market is the strict laws concerning data privacy in the region.

- Business entities are using mobile security solutions to be in compliance with these regulations. Also, the number of mobile devices used in the region is quite high, influencing the need for mobile security products. In general, the Smartphone Security Software Market in the North America region is growing at a very fast pace due to the mobile security applications demand among the customer as well as business, economic growth, and strong regulation privacy policies present in North America region.

Active Key Players in the Smartphone Security Software Market

- Juniper Networks

- Columbitech

- BullGuard

- ESET

- Symantec

- Sophos

- Lookout

- Doctor Web

- SMobile

- AVG

- Intel

- Kaspersky

- F-Secure

- Trend Micro

- Other Active Players

|

Global Smartphone Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.94 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 22.4 Bn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Organization Size |

|

||

|

By End-User |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smartphone Security Software Market by Deployment Model (2018-2032)

4.1 Smartphone Security Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premise

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud

Chapter 5: Smartphone Security Software Market by Organization Size (2018-2032)

5.1 Smartphone Security Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small & Medium Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Smartphone Security Software Market by End-User (2018-2032)

6.1 Smartphone Security Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Individuals

Chapter 7: Smartphone Security Software Market by Vertical (2018-2032)

7.1 Smartphone Security Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Banking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Financial Services

7.5 and Insurance (BFSI)

7.6 Government & Public Sector

7.7 Healthcare & Life Sciences

7.8 Retail & eCommerce

7.9 Telecom & IT

7.10 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smartphone Security Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TOSHIBA GLOBAL COMMERCE SOLUTIONS

8.4 365 RETAIL MARKETS

8.5 ADVANTECH CO.LTDBAYSCAN TECHNOLOGIES

8.6 ECR SOFTWARE (ECRS) CORPORATION

8.7 HISENSE INTELLIGENT COMMERCIAL SYSTEM CO. LTDMASHGIN

8.8 NCR CORPORATION

8.9 SHELFX INCPAN-OSTON

8.10 TRUNO RETAIL TECHNOLOGY SOLUTIONS

8.11 VERSATILE CREDIT INCOLEA KIOSKS INCFUJITSU LIMITED

8.12 ELASTIC PATH SOFTWARE INCCRANE PAYMENT INNOVATIONS AND OT

Chapter 9: Global Smartphone Security Software Market By Region

9.1 Overview

9.2. North America Smartphone Security Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment Model

9.2.4.1 On-Premise

9.2.4.2 Cloud

9.2.5 Historic and Forecasted Market Size by Organization Size

9.2.5.1 Small & Medium Enterprises

9.2.5.2 Large Enterprises

9.2.6 Historic and Forecasted Market Size by End-User

9.2.6.1 Enterprises

9.2.6.2 Individuals

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 Banking

9.2.7.2 Financial Services

9.2.7.3 and Insurance (BFSI)

9.2.7.4 Government & Public Sector

9.2.7.5 Healthcare & Life Sciences

9.2.7.6 Retail & eCommerce

9.2.7.7 Telecom & IT

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Smartphone Security Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment Model

9.3.4.1 On-Premise

9.3.4.2 Cloud

9.3.5 Historic and Forecasted Market Size by Organization Size

9.3.5.1 Small & Medium Enterprises

9.3.5.2 Large Enterprises

9.3.6 Historic and Forecasted Market Size by End-User

9.3.6.1 Enterprises

9.3.6.2 Individuals

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 Banking

9.3.7.2 Financial Services

9.3.7.3 and Insurance (BFSI)

9.3.7.4 Government & Public Sector

9.3.7.5 Healthcare & Life Sciences

9.3.7.6 Retail & eCommerce

9.3.7.7 Telecom & IT

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Smartphone Security Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment Model

9.4.4.1 On-Premise

9.4.4.2 Cloud

9.4.5 Historic and Forecasted Market Size by Organization Size

9.4.5.1 Small & Medium Enterprises

9.4.5.2 Large Enterprises

9.4.6 Historic and Forecasted Market Size by End-User

9.4.6.1 Enterprises

9.4.6.2 Individuals

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 Banking

9.4.7.2 Financial Services

9.4.7.3 and Insurance (BFSI)

9.4.7.4 Government & Public Sector

9.4.7.5 Healthcare & Life Sciences

9.4.7.6 Retail & eCommerce

9.4.7.7 Telecom & IT

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Smartphone Security Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment Model

9.5.4.1 On-Premise

9.5.4.2 Cloud

9.5.5 Historic and Forecasted Market Size by Organization Size

9.5.5.1 Small & Medium Enterprises

9.5.5.2 Large Enterprises

9.5.6 Historic and Forecasted Market Size by End-User

9.5.6.1 Enterprises

9.5.6.2 Individuals

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 Banking

9.5.7.2 Financial Services

9.5.7.3 and Insurance (BFSI)

9.5.7.4 Government & Public Sector

9.5.7.5 Healthcare & Life Sciences

9.5.7.6 Retail & eCommerce

9.5.7.7 Telecom & IT

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Smartphone Security Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment Model

9.6.4.1 On-Premise

9.6.4.2 Cloud

9.6.5 Historic and Forecasted Market Size by Organization Size

9.6.5.1 Small & Medium Enterprises

9.6.5.2 Large Enterprises

9.6.6 Historic and Forecasted Market Size by End-User

9.6.6.1 Enterprises

9.6.6.2 Individuals

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 Banking

9.6.7.2 Financial Services

9.6.7.3 and Insurance (BFSI)

9.6.7.4 Government & Public Sector

9.6.7.5 Healthcare & Life Sciences

9.6.7.6 Retail & eCommerce

9.6.7.7 Telecom & IT

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Smartphone Security Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment Model

9.7.4.1 On-Premise

9.7.4.2 Cloud

9.7.5 Historic and Forecasted Market Size by Organization Size

9.7.5.1 Small & Medium Enterprises

9.7.5.2 Large Enterprises

9.7.6 Historic and Forecasted Market Size by End-User

9.7.6.1 Enterprises

9.7.6.2 Individuals

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 Banking

9.7.7.2 Financial Services

9.7.7.3 and Insurance (BFSI)

9.7.7.4 Government & Public Sector

9.7.7.5 Healthcare & Life Sciences

9.7.7.6 Retail & eCommerce

9.7.7.7 Telecom & IT

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Smartphone Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.94 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 22.4 Bn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Organization Size |

|

||

|

By End-User |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||