Smart Plantation Management System Market Overview

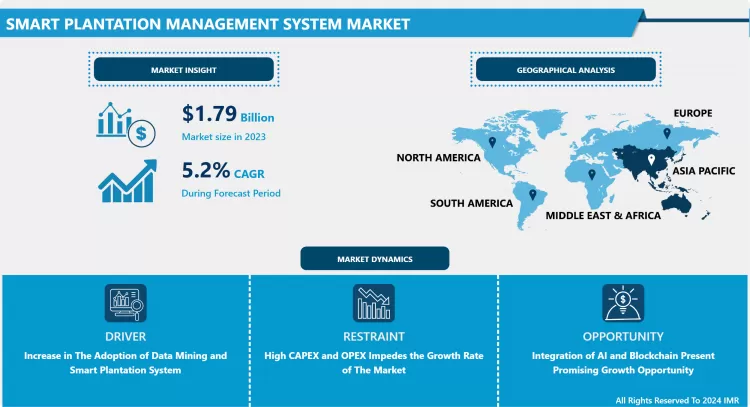

Smart Plantation Management System Market Size Was Valued at USD 1.79 Billion in 2023, and is Projected to Reach USD 2.35 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

The smart plantation management system is an intelligent system based on the information collected by the sensors. A smart plantation system is the incorporation of information and communication technologies into machinery equipment and sensors in the agricultural production system. It includes temperature, humidity, soil moisture, soil temperature in the farm or greenhouse using wireless or weird transmission to send the information to the convertor through the sensor and connected to the computer system. The application of the management system will effectively and systematically manage the farm, greenhouse with monitoring methods. Moreover, farmers globally are increasingly adopting plantation systems which will increase the market growth during the forecast period. For instance, according to agricultural robotics laboratory (ARL) report, it has been reported that around 10% to 15% of US farmers are using smart farming solutions across the 1200 million ha and on 250000 farms, which is expected to increase agricultural productivity over the forecast period.

Market Dynamics and Factor for The Smart Plantation Management System Market:

Drivers:

Increase in the adoption of data mining and smart plantation system by the farmers which is growth driver preeminent to connect crops, agricultural production tools, and farmers. The smart plantation management system market is influenced by the irrigation system segment due to the greater adoption and application of systems in wide varieties of the plantation. For instance, drip irrigation technology is currently one of the commonly used techniques for cultivation but an automatic frequency conversion irrigation system uses to automatically start and stops the pump owing to the market growth during the forecast period.

Furthermore, reduction in wastage of resources and manpower reduces the cost of cultivation of farmers is one of the driving factors that stimulate the market growth during the projected period. Government initiatives in the form of schemes support the farmers to implement the advanced technologies and plantation management system which is the dominant driver for agriculture. For instance, in India, the Asia Pacific region government scheme "Pradhan Mantri Krishi Sinchayee Yojana" (PMKSY) supports the farmers to invest in the irrigation sector at the field level. Moreover, the rising adoption of new technologies such as the 3NV nozzle system, pivot control panel, soil moisture sensors, and remote sensing technology in irrigation systems will enhance the market growth near future period. For Instance, In January 2018, WaterBit (US) launched a pressure sensor that would ensure that water is delivered in the right amount. It is an important component of the company's cloud-based solutions.

Restraints:

High capital investment in the deployment of the smart plantation, data aggregation, and lack of awareness associated with smart plantation management systems are hampering the market growth over the forecast period.

Market Segmentation

Based on the Type, the irrigation systems held the maximum market share of the smart plantation management systems market in 2020 and are probably to lead the market over the forecast period. Smart irrigation systems control the process of water flow for planting crops based on the accessible data received by sensors. Furthermore, smart irrigation systems also support minimizing the amount of water required for irrigation of plants, which results in the declined operational cost, particularly in the case of large farmland. One of the key factors that are turning the demand for smart irrigation systems in the market is its saving of 20% more water than the traditional irrigation systems.

Based on the Crop Type, the fruit segment registered for the largest share of the market and is anticipated to remain dominant over the forecast period, as fruits seem to be the main crop for using smart plantation management systems. There are a large number of players that provide smart plantation management systems for fruits and various technologies designed for various kinds of fruits. Fruits such as grapes, apples, and citrus fruits are the major ones having higher utilization in the implementation of smart plantation management systems.

Based on the Component Type, the hardware segment is anticipated to be the dominant segment of the market over the projected period. It includes various components such as sensors, displays, flow meters, GPS devices, and switches, among others. Application of sensors is done on the plants and soil which sense and collect real-time data, which creates reports and maps supplying assistance to the farmers for making better decisions about their crops. Sensors such as water, soil, moisture, weather, wind intensity, and temperature sensors are the main used for plantation crops. The advanced technologies in a software system are turning the growth of hardware components in the market.

Players Covered in Smart Plantation Management System market are :

- Agroweblab Co, Ltd (China)

- Deere and Company (US)

- Netafim Ltd (Israel)

- Phytech, Ltd (Israel)

- Rivulis Irrigation Ltd (Israel)

- Robert Bosch GmbH (Germany)

- Semiosbio Technologies (Canada)

- Synelixis Solutions (Greece)

- Tevatronics (Israel)

- WaterBit Inc (US)

- Jain Irrigation Systems (India)

- AquaSpy (US)

- DTN (US) and other Major Players.

Regional Analysis for Smart Plantation Management System Market:

- Geographically, the smart plantation management system market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- The Asia Pacific detained the largest share in the global smart plantation systems market owing to the favorable climate all over the year. The increasing support from the government to promote the smart plantation management system in farming is contributing significantly to regional growth in the global market. The region has a great capability due to its maximum cultivation of plantation crops, such as tea, cotton, and sugarcane. The distribution of smart plantation management systems in APAC is still in its sprouting stage and is approximate to grow firmly, which in turn, will enhance the crop yield with the improved application of resources for plantation crops. China recorded for the major share of the market due to the existence of large cultivation area, specified majorly for sugarcane, tea, and various types of fruits.

- North America is the developed region in the global market due to the presence of key players in the region. The growing technological developments in the region also fueled the regional market growth.

- European countries adopting various innovative technologies in the agriculture sector including smart plantation management systems which boost the sustainability of the European agriculture sector and are expected to grow during the projected period.

- The Middle East and African countries do not have much investment which is required for advanced technologies. The technology could cost a fortune, and it requires abundant knowledge in this industry to use advanced technology and is expected to grow over the future period.

- In Latin America, the market is approximated to witness significant growth during the projected period. The growth of the region can be attributed to the presence of a substantial number of integrators to customize and promote agriculture technology.

Key Industry Development of Smart Plantation Management System Market:

- In Oct 2024, The International Maize and Wheat Improvement Center (CIMMYT) expanded its climate-smart agricultural interventions in Southern Africa to address the challenges posed by climate change. The initiative focuses on enhancing maize and wheat production through sustainable practices, drought-resistant varieties, and improved soil health. This expansion aims to boost food security, support farmers, and strengthen resilience against climate-related disruptions across the region.

- In Aug 2024, The Prime Minister launched the Monsoon Tree Plantation Drive, aiming to enhance environmental conservation across the country. The initiative focuses on planting millions of trees during the monsoon season to combat deforestation, reduce carbon footprints, and promote biodiversity. The drive encourages active participation from citizens, schools, and local communities, reinforcing the importance of sustainability and a green future for the nation.

|

Smart Plantation Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2022 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 1.79 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.2% |

Market Size in 2032: |

USD 2.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Crop Type |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Plantation Management System Market by Type (2018-2032)

4.1 Smart Plantation Management System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Irrigation Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plant Growth Monitoring Systems

4.5 And Harvesting Systems

Chapter 5: Smart Plantation Management System Market by Crop Type (2018-2032)

5.1 Smart Plantation Management System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coffee

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oilseeds

5.5 Sugarcane

5.6 Fruits

5.7 Cotton

Chapter 6: Smart Plantation Management System Market by Component (2018-2032)

6.1 Smart Plantation Management System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hardware

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Software

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Plantation Management System Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARGILL INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COSCURA GROUPE WARCOING SA (BELGIUM)

7.4 PARHEIM FOODS (CANADA)

7.5 PURIS FOODS (UNITED STATES)

7.6 FELLESKJOPET ROGALAND AGDER (UNITED STATES)

7.7 ROQUETTE FRERES (FRANCE)

7.8 VESTKORN MILLING AS (NORWAY)

7.9 SHANDONG JIANYUAN GROUP (CHINA)

7.10 EMSLAND GROUP (GERMANY)

7.11 INGREDION INCORPORATED (UNITED STATES)

7.12 AXIOM FOODS INC. (UNITED STATES)

7.13 AGT FOOD AND INGREDIENTS (CANADA)

7.14 INGREDION (US) OTHERS MAJOR PLAYERS

Chapter 8: Global Smart Plantation Management System Market By Region

8.1 Overview

8.2. North America Smart Plantation Management System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Irrigation Systems

8.2.4.2 Plant Growth Monitoring Systems

8.2.4.3 And Harvesting Systems

8.2.5 Historic and Forecasted Market Size by Crop Type

8.2.5.1 Coffee

8.2.5.2 Oilseeds

8.2.5.3 Sugarcane

8.2.5.4 Fruits

8.2.5.5 Cotton

8.2.6 Historic and Forecasted Market Size by Component

8.2.6.1 Hardware

8.2.6.2 Software

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Plantation Management System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Irrigation Systems

8.3.4.2 Plant Growth Monitoring Systems

8.3.4.3 And Harvesting Systems

8.3.5 Historic and Forecasted Market Size by Crop Type

8.3.5.1 Coffee

8.3.5.2 Oilseeds

8.3.5.3 Sugarcane

8.3.5.4 Fruits

8.3.5.5 Cotton

8.3.6 Historic and Forecasted Market Size by Component

8.3.6.1 Hardware

8.3.6.2 Software

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Plantation Management System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Irrigation Systems

8.4.4.2 Plant Growth Monitoring Systems

8.4.4.3 And Harvesting Systems

8.4.5 Historic and Forecasted Market Size by Crop Type

8.4.5.1 Coffee

8.4.5.2 Oilseeds

8.4.5.3 Sugarcane

8.4.5.4 Fruits

8.4.5.5 Cotton

8.4.6 Historic and Forecasted Market Size by Component

8.4.6.1 Hardware

8.4.6.2 Software

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Plantation Management System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Irrigation Systems

8.5.4.2 Plant Growth Monitoring Systems

8.5.4.3 And Harvesting Systems

8.5.5 Historic and Forecasted Market Size by Crop Type

8.5.5.1 Coffee

8.5.5.2 Oilseeds

8.5.5.3 Sugarcane

8.5.5.4 Fruits

8.5.5.5 Cotton

8.5.6 Historic and Forecasted Market Size by Component

8.5.6.1 Hardware

8.5.6.2 Software

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Plantation Management System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Irrigation Systems

8.6.4.2 Plant Growth Monitoring Systems

8.6.4.3 And Harvesting Systems

8.6.5 Historic and Forecasted Market Size by Crop Type

8.6.5.1 Coffee

8.6.5.2 Oilseeds

8.6.5.3 Sugarcane

8.6.5.4 Fruits

8.6.5.5 Cotton

8.6.6 Historic and Forecasted Market Size by Component

8.6.6.1 Hardware

8.6.6.2 Software

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Plantation Management System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Irrigation Systems

8.7.4.2 Plant Growth Monitoring Systems

8.7.4.3 And Harvesting Systems

8.7.5 Historic and Forecasted Market Size by Crop Type

8.7.5.1 Coffee

8.7.5.2 Oilseeds

8.7.5.3 Sugarcane

8.7.5.4 Fruits

8.7.5.5 Cotton

8.7.6 Historic and Forecasted Market Size by Component

8.7.6.1 Hardware

8.7.6.2 Software

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Smart Plantation Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2022 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 1.79 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.2% |

Market Size in 2032: |

USD 2.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Crop Type |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||