Global Smart Home Solutions Market Synopsis

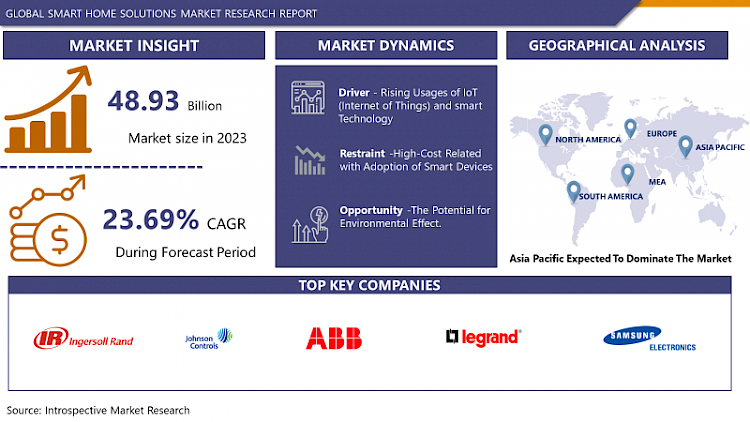

Global Smart Home Solutions Market size was valued at USD 48.93 Million in 2023 and is projected to reach USD 331.58 Million by 2032, growing at a CAGR of 23.69% from 2023 to 2032.

Smart Home Solutions completely transform the traditional notion of living at home by smoothly incorporating technology into daily habits. A smart home is essentially characterized by its use of Internet of Things (IoT) gadgets and connected systems to automate and improve different parts of household living.

- The greatest advantage of smart home solutions is their unmatched convenience. By being able to remotely oversee and manipulate devices through smartphone applications or voice prompts, homeowners can easily regulate their surroundings from any location.

- Furthermore, intelligent home technologies also lead to considerable energy conservation and enhanced effectiveness. Automating energy usage according to occupancy patterns and preferences optimizes heating, cooling, and lighting, leading to lower utility bills and a decreased carbon footprint.

- Moreover, implementing smart home technology can increase the worth and appeal of real estate. As the desire for connected homes increases, homes with built-in smart technologies are more appealing to buyers looking for modern conveniences and improved security measures.

Market Dynamics And Factors For Smart Home Solutions Market

Drivers:

Augmenting Usages of IoT and Smart Technology

The fast expansion of internet connection and growing usage of the internet of things (IoT) driving the growth of the smart home solution market. IoT technology enables various devices to connect with the internet and exchange data with each other with minimum human intervention. More than 15% of the IoT market was driven by the smart home segment. Furthermore, the government is also supporting IoT through various policies and fiscal budget allocations. Developing countries have opened a way for many international companies to file IoT patents in their countries, especially in the United States which also helps in the expansion of the market. The IoT has already more than 200 known applications in different sectors. For example, it includes setting complex heating and lighting systems in advance and setting alarms and home security controls, all connected to the mobile application. This advancement in the IoT technologies that contribute to smart home solutions also helps to expand the market growth.

Restraints:

High-Cost Require For Adoption of Smart Devices

Smart devices, or the Internet of Things (IoT), are network-enabled devices that automate processes. The cost requires for automation of the entire home goes on the higher side. A smart home automates all the processes involved in a home. E.g. lights turn on when a car comes up the driveway, the smart mattress optimizes the amount of support you need for perfect sleep, and the adoption of this technology involves both high initial cost and high maintenance which is the barrier to the growth of the market. The adoption of smart home solutions involves high initial costs and other upfront costs like installation and maintenance. The high cost limits the adoption and acceptance of smart devices by customers, including many organizations. Further, several people are using smart devices like thermostats, smart meters, HVAC controls, and lighting control for a long time but they do not replace all the equipment with smart homes due to the high product switching cost. The low smart device replacement rate hampers the growth of the market.

Opportunity:

The Potential for Environmental Effect Is One of the Biggest Opportunities for the Rising Smart Home Solutions Industry

Eco-Friendly Smart Devices help to reduce the harmful impact of devices on the environment. This potential for environmental effects is providing lucrative opportunities for the rising smart home solutions industry. Smart devices and automated homes can help with home energy efficiency and cost savings, which can be a great value proposition for homeowners looking to maximize their technology. The smart solution includes many small, simple sensors that ensure the different factors such as lights control and temperature control, this sensor only turned on the lights when they are needed, which helps to reduce energy waste and also save money. After recognizing the growing demand for eco-friendly devices, market players are providing advanced devices to reduce the environmental effect in 2020, Nest Thermostat, launched an easy-to-use, energy-saving thermostat that people can control from anywhere with the Google Home app. This product brings energy savings solutions to people in a sleek and beautiful way to provide eco-friendly smart home solutions. Thus, increasing the adoption of eco-friendly smart devices brings the biggest opportunities to the growth of the smart home solutions market.

Challenges:

Growing Privacy and Security Related Concerns

The passive nature of IoT devices makes it difficult for individuals to maintain their personal information. The devices in a smart home are connected to the internet and if all data saved on devices get in the wrong hands then it creates problems. The increasing expertise in hacking provides a valid cause for growing privacy and security-related concerns. Smart homes are vulnerable to a high number of data attacks. Hackers can unlock IoT-enabled doors, remotely turn on and stream video from smart cameras, and also they do fraudulent transactions. However, this challenge can be overcome through the installation of high-quality smart devices, adding strong passwords to routers and all devices, using the guest network to set up smart home devices when possible, Enabling two-factor authentication, and using the highest-level encryption on the router. These are some ways that help to remove access points for hackers and ensure secure communication between users and devices.

Segmentation Analysis Of the Smart Home Solutions Market

By Component, The service segment is expected to acquire the highest market share in the smart home solutions market. Internet of Things (IoT) is implemented by smart home services for bringing various intelligent devices and integrating critical data to process with innovative preferences. Now, a perfect home is addressed with high-end modernization techniques and the installation of different device facilities with the help of digitalization. Also, managed services are expected to highly contribute to the growth of the service segment in the smart home solution market.

By End-User, The energy management systems segment is expected to hold the maximum share of the market. There are hundreds of brands and over 5,000 smart devices already present in the market such as smart lights, smart appliances, smart dishwashers, HVAC controls, Smart speakers, Smart Kitchen, and Smart Furniture, by connecting these devices with a technology platform comprised of both hardware and software that allows the user to monitor energy usage and production. Further, these devices carry out complex functions such as electric utility benefits, such as controlling energy usage to reduce peak demand and support load shifting. With rising energy costs, increasing demand, and volatile energy markets most people prefer energy management systems in their homes which supports the growth of the segment and also the growth of the smart home solution market in the upcoming years.

Regional Analysis Of the Smart Home Solutions Market

North America dominates the market growth for smart home solutions, owing to the high adoption of smart home solutions for safety reasons. People living in this region are well-educated and economically stable so they are flexible and prefer comfort over money. Region owns developed technologically advanced countries, Also, there are an increased number of working individuals in families which helps to increase disposable income. The people are financially capable of using these solutions at home and are driving the smart home solutions market in North America. According to Statista, in 2019, around 157.53 million people were employed in the US. It is expected that there will be 2 million more employed people by 2023. Moreover, Honeywell International Inc., Lutron Electronics Co., Inc., Crestron Electronics, Inc., CONTROL4 Corporation, Johnson Controls, Acuity Brands, Inc., and Nest Laboratories are some of the main companies in the smart home solutions market in the North American region that provides an advanced, effective and affordable solution for smart home solution market in the region which supports the growth of the market.

The Asia Pacific is expected to develop at a significant growth rate in the smart home solutions market over the projected period owing to the increasing demand for automation solutions in the countries of the Asia Pacific region. For instance, India has the second-largest digital market in the world. Providers want to make people's life simple and secure. According to Statista, the smart home market in India was estimated to grow significantly and become a 9 billion U.S. dollar market. In 2020, India ranked the third highest number of smart homes owing country around the world. Moreover, Japan and South Korea are countries in this region that owns a leading position in terms of technological advancements in smart homes. Due to the unstable environmental conditions this country needs an advanced smart home solution for safety. One emerging smart home companies in Japan are DG Takano, in 2020, DG Takano’s Bubble90 is a water-saving nozzle that conserves up to 95% water and requires no electricity to function. The Bubble90 is used by top restaurant chains in Japan in more than 24,000 different locations. The increasing digitalization, high adoption of smart devices, and innovation in technology in the countries of this region anticipated the growth of the smart home solutions market during the forecast period.

Europe is expected to hold a high market share in smart home solutions during the projected period. Europe is a prominent market for smart home solutions due to the Internet explosion and the rising popularity of networkable household and mobile communication devices. There is a high presence of consumer electronics manufacturers, smart home builders, smart housing equipment manufacturers, and smart communication manufacturers in the country which have a high contribution to the development of the smart home solution market. Furthermore, most of the population in the country is working and requires a smart solution to maintain an effective and comfortable working space. In October 2020, Johnson Controls launched Tyco Illustra Insight, an intelligent frictionless access management solution for work environments. The increasing popularity and high adoption of smart solutions in the workplace are expected to drive the demand for the market in the Europe region.

Covid-19 Impact Analysis On Smart Home Solutions Market

COVID-19 has harmed markets such as the US & China, resulting in a drop in demand for smart home systems. The temporary shutdown of manufacturing facilities resulted in a decreasing number of new construction projects which hampered the market. Smart home system installs have decreased because certain smart home products require expert on-site installation and programming, purchasers are hesitant to install these systems to avoid outside contact during this period. As a result, low adoption of smart home systems during the pandemic period. Furthermore, during the coronavirus pandemic, people are more concerned about necessities like food, and medicines. The market experiences steady growth after vaccination due to the pandemic has made the home more important than ever. Home is the place where families stay safe, work, play, and study. So the market already is expanding after the pandemic.

Top Key Players Covered In Smart Home Solutions Market

- Ingersoll-Rand (US)

- Johnson Controls (Ireland)

- ABB (Switzerland)

- Legrand (France)

- Samsung Electronics (South Korea)

- Siemens (Germany)

- United Technologies (US)

- General Electric (US)

- Schneider Electric (France)

- Honeywell International (US)

- Honeywell International Inc. (U.S.)

- Siemens (Germany)

- Johnson Controls (Ireland)

- Axis Communications AB (Sweden)

- Schneider Electric (France)

- ASSA ABLOY (Sweden)

- Amazon (U.S.)

- Apple Inc. (U.S.)

- ADT (U.S.)

- ABB (Switzerland)

- Robert Bosch GmbH (Germany)

- Sony Corporation (Japan)

- Samsung (South Korea)

- Ooma Inc. (U.S.)

- Delta Controls (Canada)

- Comcast (U.S.)

- Crestron Electronics Inc. (U.S.)

- SimpliSafe Inc. (U.S.)

- Armorax (U.S.)

- LG Electronics (South Korea)

- Lutron Electronics Co., Inc (U.S.)

- Legrand (France)

- Acuity Brands (US), and other major players.

Key Industry Development In The Smart Home Solutions Market

- In April 2024, Resideo Technologies Inc a prominent manufacturer and distributor of technology-driven solutions, and Snap One Holdings Corp. (Nasdaq: SNPO), a leading provider of smart-living products, services, and software to professional integrators, announced a definitive agreement. Resideo had agreed to acquire Snap One for $10.75 per share in cash, totaling approximately $1.4 billion, inclusive of net debt. Upon closing, Snap One integrated into Resideo's ADI Global Distribution business. This move aimed to expand Resideo's presence in smart living products and distribution channels, solidifying its position in the market.

- In February 2024, Ayla Networks and Meari Technology announced a strategic partnership aimed at advancing smart home solutions with video capabilities. This move enhanced the smart home experience by integrating world-class video solutions with Ayla's broad product offering. Meari Technology, a global manufacturer of camera and video products, collaborated with Ayla Networks, a pioneering smart home platform company, to achieve this. The partnership integrated innovative video solutions with a wide range of smart devices, delivering a seamless and enriched home automation experience.

|

Global Smart Home Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.93 Million. |

|

Forecast Period 2022-28 CAGR: |

23.69% |

Market Size in 2032: |

USD 331.58 Million. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Smart Home Solutions Market by Component

5.1 Smart Home Solutions Market Overview Snapshot and Growth Engine

5.2 Smart Home Solutions Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Geographic Segmentation

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Geographic Segmentation

5.5 Service

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Service: Geographic Segmentation

Chapter 6: Smart Home Solutions Market by Application

6.1 Smart Home Solutions Market Overview Snapshot and Growth Engine

6.2 Smart Home Solutions Market Overview

6.3 Energy Management Systems

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Energy Management Systems: Geographic Segmentation

6.4 Safety & Security Systems

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Safety & Security Systems: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Smart Home Solutions Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Smart Home Solutions Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Smart Home Solutions Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 INGERSOLL-RAND (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 JOHNSON CONTROLS (IRELAND)

7.4 ABB (SWITZERLAND)

7.5 LEGRAND (FRANCE)

7.6 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.7 SIEMENS (GERMANY)

7.8 UNITED TECHNOLOGIES (US)

7.9 GENERAL ELECTRIC (US)

7.10 SCHNEIDER ELECTRIC (FRANCE)

7.11 HONEYWELL INTERNATIONAL (US)

7.12 ACUITY BRANDS (US)

7.13 OTHER MAJOR PLAYERS

Chapter 8: Global Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Component

8.2.1 Hardware

8.2.2 Software

8.2.3 Service

8.3 Historic and Forecasted Market Size By Application

8.3.1 Energy Management Systems

8.3.2 Safety & Security Systems

Chapter 9: North America Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Component

9.4.1 Hardware

9.4.2 Software

9.4.3 Service

9.5 Historic and Forecasted Market Size By Application

9.5.1 Energy Management Systems

9.5.2 Safety & Security Systems

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Component

10.4.1 Hardware

10.4.2 Software

10.4.3 Service

10.5 Historic and Forecasted Market Size By Application

10.5.1 Energy Management Systems

10.5.2 Safety & Security Systems

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Hardware

11.4.2 Software

11.4.3 Service

11.5 Historic and Forecasted Market Size By Application

11.5.1 Energy Management Systems

11.5.2 Safety & Security Systems

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Hardware

12.4.2 Software

12.4.3 Service

12.5 Historic and Forecasted Market Size By Application

12.5.1 Energy Management Systems

12.5.2 Safety & Security Systems

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Smart Home Solutions Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Hardware

13.4.2 Software

13.4.3 Service

13.5 Historic and Forecasted Market Size By Application

13.5.1 Energy Management Systems

13.5.2 Safety & Security Systems

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Smart Home Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.93 Million. |

|

Forecast Period 2022-28 CAGR: |

23.69% |

Market Size in 2032: |

USD 331.58 Million. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART HOME SOLUTIONS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART HOME SOLUTIONS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART HOME SOLUTIONS MARKET COMPETITIVE RIVALRY

TABLE 005. SMART HOME SOLUTIONS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART HOME SOLUTIONS MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART HOME SOLUTIONS MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. SMART HOME SOLUTIONS MARKET BY APPLICATION

TABLE 012. ENERGY MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 013. SAFETY & SECURITY SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA SMART HOME SOLUTIONS MARKET, BY COMPONENT (2016-2028)

TABLE 015. NORTH AMERICA SMART HOME SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N SMART HOME SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE SMART HOME SOLUTIONS MARKET, BY COMPONENT (2016-2028)

TABLE 018. EUROPE SMART HOME SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 019. SMART HOME SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC SMART HOME SOLUTIONS MARKET, BY COMPONENT (2016-2028)

TABLE 021. ASIA PACIFIC SMART HOME SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 022. SMART HOME SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA SMART HOME SOLUTIONS MARKET, BY COMPONENT (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SMART HOME SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 025. SMART HOME SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA SMART HOME SOLUTIONS MARKET, BY COMPONENT (2016-2028)

TABLE 027. SOUTH AMERICA SMART HOME SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 028. SMART HOME SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 029. INGERSOLL-RAND (US): SNAPSHOT

TABLE 030. INGERSOLL-RAND (US): BUSINESS PERFORMANCE

TABLE 031. INGERSOLL-RAND (US): PRODUCT PORTFOLIO

TABLE 032. INGERSOLL-RAND (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. JOHNSON CONTROLS (IRELAND): SNAPSHOT

TABLE 033. JOHNSON CONTROLS (IRELAND): BUSINESS PERFORMANCE

TABLE 034. JOHNSON CONTROLS (IRELAND): PRODUCT PORTFOLIO

TABLE 035. JOHNSON CONTROLS (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ABB (SWITZERLAND): SNAPSHOT

TABLE 036. ABB (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 037. ABB (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 038. ABB (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LEGRAND (FRANCE): SNAPSHOT

TABLE 039. LEGRAND (FRANCE): BUSINESS PERFORMANCE

TABLE 040. LEGRAND (FRANCE): PRODUCT PORTFOLIO

TABLE 041. LEGRAND (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. SAMSUNG ELECTRONICS (SOUTH KOREA): SNAPSHOT

TABLE 042. SAMSUNG ELECTRONICS (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 043. SAMSUNG ELECTRONICS (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 044. SAMSUNG ELECTRONICS (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SIEMENS (GERMANY): SNAPSHOT

TABLE 045. SIEMENS (GERMANY): BUSINESS PERFORMANCE

TABLE 046. SIEMENS (GERMANY): PRODUCT PORTFOLIO

TABLE 047. SIEMENS (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. UNITED TECHNOLOGIES (US): SNAPSHOT

TABLE 048. UNITED TECHNOLOGIES (US): BUSINESS PERFORMANCE

TABLE 049. UNITED TECHNOLOGIES (US): PRODUCT PORTFOLIO

TABLE 050. UNITED TECHNOLOGIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GENERAL ELECTRIC (US): SNAPSHOT

TABLE 051. GENERAL ELECTRIC (US): BUSINESS PERFORMANCE

TABLE 052. GENERAL ELECTRIC (US): PRODUCT PORTFOLIO

TABLE 053. GENERAL ELECTRIC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SCHNEIDER ELECTRIC (FRANCE): SNAPSHOT

TABLE 054. SCHNEIDER ELECTRIC (FRANCE): BUSINESS PERFORMANCE

TABLE 055. SCHNEIDER ELECTRIC (FRANCE): PRODUCT PORTFOLIO

TABLE 056. SCHNEIDER ELECTRIC (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. HONEYWELL INTERNATIONAL (US): SNAPSHOT

TABLE 057. HONEYWELL INTERNATIONAL (US): BUSINESS PERFORMANCE

TABLE 058. HONEYWELL INTERNATIONAL (US): PRODUCT PORTFOLIO

TABLE 059. HONEYWELL INTERNATIONAL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ACUITY BRANDS (US): SNAPSHOT

TABLE 060. ACUITY BRANDS (US): BUSINESS PERFORMANCE

TABLE 061. ACUITY BRANDS (US): PRODUCT PORTFOLIO

TABLE 062. ACUITY BRANDS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 063. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 064. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 065. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART HOME SOLUTIONS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART HOME SOLUTIONS MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. SMART HOME SOLUTIONS MARKET OVERVIEW BY APPLICATION

FIGURE 016. ENERGY MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 017. SAFETY & SECURITY SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA SMART HOME SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE SMART HOME SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC SMART HOME SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA SMART HOME SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA SMART HOME SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Home Solutions Market research report is 2024-2032.

Siemens, United Technologies, General Electric, Schneider Electric, Honeywell International, Ingersoll-Rand, Johnson Controls, ABB, Legrand, Samsung Electronics, Acuity Brands and other major players.

The Smart Home Solutions Market is segmented into Component, Product and region. By Component, the market is categorized into Hardware, Software, Service. By Product the market is categorized into Energy Management Systems, Safety, Security Systems. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart home solutions are home automation techniques that are activated by computing devices and information technology and attach various gadgets and instruments in the house to respond to occupants' needs. These solutions improve people's lives in a variety of ways, including comfort, protection, entertainment, and convenience.

Global Smart Home Solutions Market size was valued at USD 48.93 Million in 2023 and is projected to reach USD 331.58 Million by 2032, growing at a CAGR of 23.69% from 2023 to 2032.