Smart Grid Data Analytics Market Synopsis

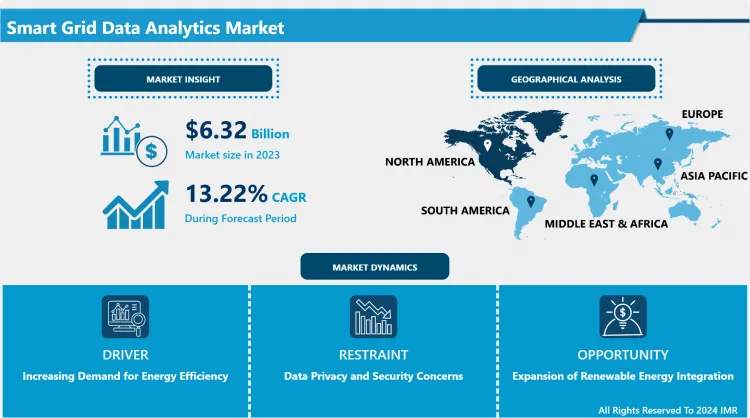

Smart Grid Data Analytics Market Size Was Valued at USD 6.32 Billion in 2023, and is Projected to Reach USD 19.32 Billion by 2032, Growing at a CAGR of 13.22% From 2024-2032.

Smart Grid Data Analytics Market relates to applying advanced data analytics technologies for the optimization, dependability, and greener electrical power systems. This includes real-time accumulation, manipulation and interpretation of data derived from systems such as smart meters, sensors and IoT in order to optimize intelligent power grids and energy management as well as demand in order to support the decision making process.

- The Smart Grid Data Analytics Market founds itself as a significant sub-sector of the smart grid industry space given the need and consequently the capability of the energy management processes. Smart grids apply intricate techniques in accessing, transmitting, and utilizing power, with reference to consumer-unit providers, regardless of the direction of the flow. The use of renewable energy sources, ellectric cars and distributed generation increases the amount of data produced in smart grid domains significantly. This invariably demands that the right and robust analytical tools are used in the handling and sorting out of the large data streams which in the process often leads to enhanced decision making and organizational performance. Smart grid data analytics refers to the numerous approaches and processes through which utilities can predict energy demand and transform the grid to make it more reliable. In this way, utilities can get real-time data on potential outages, improve load Factor balancing and reduce operational costs of maintenance hence improving on service delivery to the consumers.

- In addition, the constantly growing numbers of IoT devices and sensors integrated into smart grids are enhancing the demands for enhanced analytic solutions. These devices give real-time feedbacks of the power usage behavior, grid health and environmental status which analytics solution software can analyze and translate to actionable intelligence. In the context of emerging strategies for utilities to move toward more efficiently and sustainably generated energy, predictive analytics became popular, which help companies to forecast the variability of energy demand and include renewable energy into their systems in a more effective way. Moreover, more implementation is observed in performance improvement by engaging consumer data, as utilities could report them on energy consumption and encourage efficient practices. With global regulatory agencies demanding the adoption of Smart energy systems and moving towards sustainability, the Smart Grid Data Analytics Market is predicted to grow with the application of NAI and MLI strengthening analytical proficiency.

- The business organisation map of the Smart Grid Data Analytics Market is complex and involves technology companies offering analytics services as well as new start up ventures along with several traditional utility companies getting into analytics services. Industry players are therefore keen on forming new partnerships as well as affiliations that will help in the development of both the breadth and depth of services being offered in the marketplace. Moreover, technology requisite investments in new research and development are important to drive further the analytics technology, so that firms can respond adequately to the up-growth of analytics requirement in the energy industry. As the need for a smart grid is fast emerging across the globe toward the optimization of energy consumption and carbon footprint, the Smart Grid Data Analytics Market is set to grow exponentially to enhance the prospects of energy management and reinforce the reliability of power systems.

- The Smart Grid Data Analytics Market is central to the transformation of the energy sector and the provision of utilities to optimize their resource use, build competencies on data analysis to improve efficiency and engage the customer effectively. Among them, the most significant will be the development of the increased sales of advanced analytics solutions which will contribute to addressing the challenges regarding growing energy intensity and transition to the generation of clean energy. In future, aggressive advancement of the various market sectors will be paramount for development of the smart grid technology as well as advancing technologies and analytics methodologies.

Smart Grid Data Analytics Market Trend Analysis

Increasing Adoption of Artificial Intelligence in Smart Grid Data Analytics

- The Smart Grid Data Analytics Market has seen a shift in its paradigm through the incorporation of AI technologies to the market place. AI algorithms allow utilities to take advantage of Big data to analyze much bigger datasets and derive far more important insights than classic analysis tools can provide. The effective marriage of machine learning and predictive analytics enable utilities install a clearer vision into the dynamics of energy demand while improving on resource management and grid stability. What is even more fascinating with this trend is that, it eases operations and on the other hand gives utilities the powers to effectuate decisions on data that enhance service delivery and also efficiency.

- Furthermore, the use of analytics for, allows real-time monitoring and fault detection under the smart grid systems powered by artificial intelligence. Using sophisticated algorithms, utilities can predict when problems are likely to occur and, therefore, avoid interruption of service. This trend is inline with the overall objective of improving on grid reliability and resilience hence AI become pivotal in smart Grid technology. While currently implemented AI applications in smart grid data analysis are quite significant, growth is anticipated to become even deeper in the future due to advances in technology.

Expansion of Renewable Energy Integration

- The following is a major opportunity, present within the Smart Grid Data Analytics Market: the continuous augmentation of renewable energy sources into the energy grid. Given the fact that countries are currently operating towards their sustainability goals and shifting from the use of fossil fuel, need for proper consumption of renewable power has led to increased demand for sophisticated analytics solutions to riddle with integration challenges. Smart grid data analytics also allows utilities to understand the variable nature of renewable energy and the stability of a generation by providing generation patterns.

- Moreover, the bioenergy generation provides an outstanding chance for optimizing in utilities energy storage and demand response. Data analytics can be used to improve these systems meaning utilities balance supply demand a lot better than with fluctuating renewable generation away from precisely when is needed. It also helps the utilities to build future investments that support the shift to a higher share of renewables and diversification of energy systems which in turns leads to smart grid data analytics as a growing business model.

Smart Grid Data Analytics Market Segment Analysis:

Smart Grid Data Analytics Market Segmented based on Type, Application, and End User.

By Component, Services segment is expected to dominate the market during the forecast period

- The component segment of the Smart Grid Data Analytics Market is split into solutions and service, both of which are critical in the market’s growth. Solutions extend from a broad class of software and applications used for the analysis and management of data gathered by smart grid systems. These solutions range from analytics tools, to maintenance applications, to some real time monitoring solutions. These solutions can be helpful for the utilities as more of them implement such solutions in order to maximize their operational performance, usage and management of resources as well as the overall stability of the grid.

- While, on the other hand, from the smart grid data analytics services, one can include professional and managed services associated with the further implementation, integration, and maintenance of analytics solutions. Professional services refer to the consultancy and training that enables the utilities to efficient utilize the information and data analysis when making decisions. Managed services on the other hand are long term engagements that mean that utilities can constantly gain optimum use from the smart grid systems. The value of solutions and services signifies that a unique combination is necessary for smart grid data analytics, which has already been instrumental in progressing the energy industry.

By Application , Demand Response Analysis Grid Optimization Analysis segment held the largest share in 2023

- The application segment of the Smart Grid Data Analytics Market include analysis of AMI that is important for the utilities who wants to improve the energy efficiency and consumer engagement. AMI stands for Automatic Meter Infrastructure, this is a complete assembly of smart meters, communication networks, and data management systems used for two way interaction between utilities and consumers. AMI acquired data can hopefully be used by utilities to understand those tendencies, diagnose whether the consumption is higher during some periods than others, and therefore adjust their energy delivery in response.

- In addition, AMI analysis supports the utilities to adopt demand response programs in order to make the consumers reduce energy consumption during peak periods. It not only assists the regulation of the grid demand but also offers the consumers a chance to cut their energy bills. Given growing public and political pressure for utilities to offer sustainable power generation and distribution, AMI analysis will remain a critical component for utilities to comprehend the performance and evolving nature of grids to achieve better results.

Smart Grid Data Analytics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- At present, the Smart Grid Data Analytics Market is mainly held by North America owing to its huge investment in energy systems and the increasing use of smart grid solutions. It also highlighted several of the leading utilities and technology players who are currently integrating modern advanced analytics solutions for their grids. Additional market growth is supported by the government activities to implement energy saving and sustainability for smart grid, let alone financial resources and subsidies.

- Also, the advanced state in adopting the smart grid technology in North America creates fertile ground for new ideas and cooperation among the players of the market. With utilities shifting their attention towards using more renewables and making the grids more resilient, the need for data analytics to support smart Grids will remain high. Energize management and regulatory support of the area showcase the region as ahead of others in smart grid data analytics worldwide, with future progression identified to have a role in the evolution of energy distribution.

Active Key Players in the Smart Grid Data Analytics Market

- General Electric (USA)

- Siemens (Germany)

- IBM (USA)

- Schneider Electric (France)

- Oracle (USA)

- Honeywell (USA)

- Microsoft (USA)

- Cisco Systems (USA)

- SAP (Germany)

- Accenture (Ireland)

- Others Key Player

Key Industry Developments in the Smart Grid Data Analytics Market

- In June 2024, 360factors announced the launch of Lumify360, a cutting-edge predictive data analytics platform designed to capture, integrate, and enrich key performance indicators (KPIs) and key risk indicators (KRIs) data with strategic goals, business objectives, and risk appetites. This is further helpful in the smart grid data analytics applications that propel the growth of the market.

- November 2022: Siemens Smart Infrastructure partnered with SEW, a prominent cloud platform provider that specializes in digital customer experiences and workforce experiences for utility providers, to support utilities globally, improve the customer and workforce experiences for utility smart meter users, and facilitate the transition to a world powered entirely by renewable energy sources. The companies say that this move could lead to a long-term partnership that will help move forward the new platform paradigm in energy and utilities and speed up the digital transformation process.

- September 2022: The R&D Center of Dubai Electricity and Water Authority (DEWA) is evaluating its Smart Grid Analytics project, which utilizes voltage and current data from critical substations to identify and anticipate medium-voltage (MV) disruptions. The R&D Center will also assess the "dInsight" Analytics Platform, which offers complete visual analytics of the grid, loads, and supplies.

- July 2022: Siemens Smart Infrastructure partnered with Esri, a geographic information systems (GIS) and location intelligence platform, to broaden its ecosystem of partners for its grid software business. In this partnership, Esri's mapping and spatial analytics tools and Siemens' knowledge of electrical topology will be used to help grid operators build, run, and fix power networks better.

|

Global Smart Grid Data Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.22% |

Market Size in 2032: |

USD 19.32 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Grid Data Analytics Market by Component (2018-2032)

4.1 Smart Grid Data Analytics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

4.5 Professional

4.6 Managed

Chapter 5: Smart Grid Data Analytics Market by Deployment (2018-2032)

5.1 Smart Grid Data Analytics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premises

5.5 Hybrid

Chapter 6: Smart Grid Data Analytics Market by Application (2018-2032)

6.1 Smart Grid Data Analytics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Advanced Metering Infrastructure Analysis

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Demand Response Analysis Grid Optimization Analysis

6.5 Others

Chapter 7: Smart Grid Data Analytics Market by End User (2018-2032)

7.1 Smart Grid Data Analytics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Public Sector

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprise

7.5 Small And Medium Enterprises

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smart Grid Data Analytics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GENERAL ELECTRIC (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SIEMENS (GERMANY)

8.4 IBM (USA)

8.5 SCHNEIDER ELECTRIC (FRANCE)

8.6 ORACLE (USA)

8.7 HONEYWELL (USA)

8.8 MICROSOFT (USA)

8.9 CISCO SYSTEMS (USA)

8.10 SAP (GERMANY)

8.11 ACCENTURE (IRELAND)

8.12 OTHERS KEY PLAYER

Chapter 9: Global Smart Grid Data Analytics Market By Region

9.1 Overview

9.2. North America Smart Grid Data Analytics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Solutions

9.2.4.2 Services

9.2.4.3 Professional

9.2.4.4 Managed

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 Cloud-based

9.2.5.2 On-premises

9.2.5.3 Hybrid

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Advanced Metering Infrastructure Analysis

9.2.6.2 Demand Response Analysis Grid Optimization Analysis

9.2.6.3 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Public Sector

9.2.7.2 Large Enterprise

9.2.7.3 Small And Medium Enterprises

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Smart Grid Data Analytics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Solutions

9.3.4.2 Services

9.3.4.3 Professional

9.3.4.4 Managed

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 Cloud-based

9.3.5.2 On-premises

9.3.5.3 Hybrid

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Advanced Metering Infrastructure Analysis

9.3.6.2 Demand Response Analysis Grid Optimization Analysis

9.3.6.3 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Public Sector

9.3.7.2 Large Enterprise

9.3.7.3 Small And Medium Enterprises

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Smart Grid Data Analytics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Solutions

9.4.4.2 Services

9.4.4.3 Professional

9.4.4.4 Managed

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 Cloud-based

9.4.5.2 On-premises

9.4.5.3 Hybrid

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Advanced Metering Infrastructure Analysis

9.4.6.2 Demand Response Analysis Grid Optimization Analysis

9.4.6.3 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Public Sector

9.4.7.2 Large Enterprise

9.4.7.3 Small And Medium Enterprises

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Smart Grid Data Analytics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Solutions

9.5.4.2 Services

9.5.4.3 Professional

9.5.4.4 Managed

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 Cloud-based

9.5.5.2 On-premises

9.5.5.3 Hybrid

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Advanced Metering Infrastructure Analysis

9.5.6.2 Demand Response Analysis Grid Optimization Analysis

9.5.6.3 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Public Sector

9.5.7.2 Large Enterprise

9.5.7.3 Small And Medium Enterprises

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Smart Grid Data Analytics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Solutions

9.6.4.2 Services

9.6.4.3 Professional

9.6.4.4 Managed

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 Cloud-based

9.6.5.2 On-premises

9.6.5.3 Hybrid

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Advanced Metering Infrastructure Analysis

9.6.6.2 Demand Response Analysis Grid Optimization Analysis

9.6.6.3 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Public Sector

9.6.7.2 Large Enterprise

9.6.7.3 Small And Medium Enterprises

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Smart Grid Data Analytics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Solutions

9.7.4.2 Services

9.7.4.3 Professional

9.7.4.4 Managed

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 Cloud-based

9.7.5.2 On-premises

9.7.5.3 Hybrid

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Advanced Metering Infrastructure Analysis

9.7.6.2 Demand Response Analysis Grid Optimization Analysis

9.7.6.3 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Public Sector

9.7.7.2 Large Enterprise

9.7.7.3 Small And Medium Enterprises

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Smart Grid Data Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.22% |

Market Size in 2032: |

USD 19.32 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Smart Grid Data Analytics Market research report is 2024-2032.

General Electric (USA),Siemens (Germany),IBM (USA),Schneider Electric (France),Oracle (USA),Honeywell (USA),Microsoft (USA),Cisco Systems (USA),SAP (Germany),and Other Major Players.

The Smart Grid Data Analytics Market is segmented into Component ,Deployment , Application,End User and Region. By Component, the market is categorized into Solutions, Services, Professional, Managed.By Deployment, the market is categorized into Cloud-based, On-premises, Hybrid. By Application,the market is categorized into Advanced Metering Infrastructure Analysis, Demand Response Analysis Grid Optimization Analysis, Others. By End-use, the market is categorized into Public Sector, Large Enterprise, Small And Medium Enterprises. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart Grid Data Analytics Market relates to applying advanced data analytics technologies for the optimization, dependability, and greener electrical power systems. This includes real-time accumulation, manipulation and interpretation of data derived from systems such as smart meters, sensors and IoT in order to optimize intelligent power grids and energy management as well as demand in order to support the decision making process.

Smart Grid Data Analytics Market Size Was Valued at USD 6.32 Billion in 2023, and is Projected to Reach USD 19.32 Billion by 2032, Growing at a CAGR of 13.22% From 2024-2032.