Global Silent Earbuds Market Overview

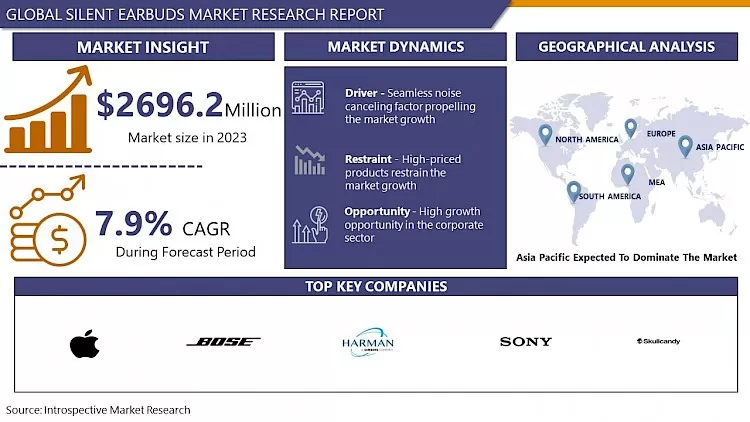

Silent Earbuds Market Size Was Valued at USD 2696.2 Million in 2023 and is Projected to Reach USD 5344.97 Million by 2032, Growing at a CAGR of 7.9 % From 2024-2032.

Silent earbuds, also known as noise-canceling or noise-isolating earbuds, are designed to minimize unwanted ambient sounds, allowing users to focus on their audio content or enjoy silence. These devices use active noise-canceling (ANC) technology, which involves microphones that pick up external sounds and then generate sound waves that are phase-inverted to cancel out the noise. This results in a significant reduction in background sounds like traffic, chatter, or airplane engines.

Silent earbuds are popular among commuters, frequent travelers, and people who work in noisy environments. They can enhance the listening experience for music, podcasts, and audiobooks by providing a clearer sound without external interference. Additionally, they offer a way to achieve a quiet environment for concentration or relaxation without playing any audio content. Many models also include features such as customizable sound settings, long battery life, and a comfortable fit for extended wear.

The silent earbuds market is a niche but rapidly growing segment within the broader audio device industry. These earbuds are designed to provide a silent listening experience by employing advanced noise-cancellation technologies and transparent mode features, catering to users seeking a distraction-free environment. The demand is driven by various factors, including increasing urbanization, rising awareness about hearing health, and the growing prevalence of remote work and online education, which necessitate environments free from external noise.

Dynamics And Factors Of The Silent Earbuds Market

Drivers:

Seamless Noise Cancelling Factor Propelling the Market Growth

Silent earbuds are getting popular due to their ability to cancel the external noises and sounds which can help to hear crisp sounds from the earbuds. In the loud workspace environment, silent earbuds prove their worth as communication becomes a major challenge in such a fast pace and loud workspace. Active noise-canceling headphones are becoming more popular as Tinnitus, a hearing disease brought on by repeated exposure to loud noises in a work environment, becomes more common. The electrical circuitry in these headphones reduces outside noise, allowing the user to listen to audio at low volumes. As a result, increased hearing impairments and growing awareness of noise-induced hearing loss (NIHL) are fueling the global market for active noise-canceling headphones. A major factor driving up demand for wireless headphones globally is the expanding fitness sector. The demand for wireless active noise-canceling headphones, which enable the user to fully control sound allowance and ambient noise, is anticipated to be driven by the rising number of fitness club memberships, which will also contribute to the growth of the active noise-canceling headphones market globally.

Restraints:

High-Priced Products Restrain the Market Growth

Silent earbuds can be distinguished from normal headsets due to the special Active Noise Canceling chipset. The ANC chipset gives a far higher capability to the silent earbuds as active noise cancelation becomes the major USP of the product because of the chipset. However, active noise-canceling earbuds come at a higher cost which restricts the major large number of consumers from buying such products. Premium silent earbuds cost between USD 200-500 for a brand such as Sony, Apple, Bose, Sennheiser, and Bang & Olufsen. Therefore, noise-canceling headphones have positioned themselves as a premium electronic product and it restricts the growth of the market.

Opportunities:

High Growth Opportunity in The Corporate Sector

As the corporate sector returned to normal in terms of work from the office and loud workspaces began to fill with employees. To communicate better, silent earbuds can help the employees to hear clearly and convey messages promptly due to active noise canceling technology. Companies are keen to provide high-performing gear for higher output which is likely to boost the sales of silent earbuds. Also, there is a high demand for domestic use as silent earbuds helps to sleep better due to noise cancellation. There is a large number of populations who have trouble sleeping at night due to external noises and a loud environment. This presents a bright opportunity to target affordable silent earbuds which are expected to propel the growth of the Silent Earbuds Market.

Segmentation Analysis Of Silent Earbuds Market

By Type, the Active segment is dominating the Silent Earbuds Market. In recent years, the use of active noise cancellation (ANC) technology in portable audio devices has increased. According to A true wireless stereo (TWS), the hearable's adoption of ANC has increased from 37 percent for models produced before December 2019 to 72 percent for those released after January 2020, nearly doubling in price for products over USD 100. One special characteristic of active noise cancellation is it has a significant influence on some groups of people. Active noise-canceling headphones are especially useful for commuters, travelers, and those who work in noisy environments like subways, restaurants, or railway stations. Active Noise Cancelling earbuds also made their mark on the corporate workspace, where communication requires on point and due to loud workspace and chances of miscommunication, Active noise canceling earbuds helped employees to communicate better. Therefore, Active noise-canceling earbuds are expected to dominate the Silent Earbuds Market.

By Connectivity, the Wireless segment is expected to dominate the Silent Earbuds Market. Wireless headphones demand has surged exponentially in past years as Bluetooth technology has become cheaper to integrate into the headphones which started the trend of wireless headphones among the young population. Due to easy handling, no risk of wire malfunction, and easy connectivity with other devices boosted the demand for wireless earbuds. Since the advanced technology integration and structured manufacturing process, the cost of wireless silent earbuds has dropped significantly. According to Statista, as developing wireless technologies and a variety of innovative headphones and earbuds, the wireless personal audio market is expanding rapidly. At home, 66 percent of respondents use wireless headphones, compared to 58 percent who use wireless earbuds. In comparison to wireless headphones, they favored wireless earbuds for outdoor use by a margin of 55% to 45%. This attributes to the growth of the wireless segment of the Silent Earbuds Market.

By Distribution Channel, the Online segment is likely to dominate the Silent Earbuds Market. Since the pandemic, online marketplaces have seen exponential growth as a large number of populations shifted to eCommerce and online stores to buy a variety of goods and services. The electronic and electrical product segment has seen high demand through an online platform as easy buying options, discounted rates, and quick delivery surged online sales. Similarly, Silent headphones have seen the trend of online sales boost in past few years. Online retail is the primary means by which consumers purchase headphones due to the rapid growth of online purchasing in emerging nations. The percentage is anticipated to rise even more, particularly as businesses like Amazon and eBay gain popularity in China and India. Therefore, the Online segment is expected to grow significantly during the forecasted period.

Regional Analysis Of Silent Earbuds Market

Asia-Pacific dominates the Silent Earbuds Market and is expected to continue the growth trend during the forecasted period. Due to the sheer volume of customers and demand for electronic products from central and southeast Asian countries making international companies focus on the region. Hence, increased manufacturing facilities and apt marketing practices benefited the key manufacturers of silent earbuds such as Sony, Bose, Apple, and Sennheiser. The area has adopted active noise-canceling headphones on a large scale as a result of these players' presence and the substantial research and development work they have done. Noise-canceling headphones are getting popular among the young population due to their enhanced sound experience which affecting on the high sales volume in the region. To accommodate changing customer needs and draw a sizable consumer base to the area, noise-canceling headphones are now offering cutting-edge technologies from Asia Pacific manufacturers. The market for active noise-canceling headphones has also been boosted by the entry of overseas manufacturers that provide high-end, technologically sophisticated goods and better experiences in the area. Over the projected period, such factors anticipated to fuel market expansion.

North America region is growing at a substantial pace in the Silent Earbuds Market. The growth rate is attributed to the already established market, coupled with high technology penetration in these regions. Companies in this region are focused on investing in R&D and continuous innovation in product development. Furthermore, the presence of major industry players in the region, such as Apple Inc., Bose Corporation, GN Store Nord A/S, Harman International Industries, Incorporated, and Sennheiser GmbH & Co., KG, is expected to drive the market across North America. North America is a prominent market for silent earbuds due to high spending capacity of individuals. Young population tend to choose top brands such and Apple, Bose, Marshall, and Sony which holds the market at top for Silent earbuds. Therefore, North America region likely to grow rapidly during forecasted period.

Covid-19 Impact Analysis On Silent Earbuds Market

The COVID-19 pandemic little affected the earphone and headphone market's expansion. The epidemic forced government organizations to implement strict shutdown policies and travel prohibitions, which disrupted supply chains, production capabilities, and logistics, as well as overall sales. However, as a result of the imposed travel restrictions, consumer interest in online streaming platforms to watch movies, web series, and talk shows rose, greatly pushing earphone use. The need for earbuds and headphones was greatly augmented by work from home. The expanding OTT market will support individual earphones and headphone use. However, the need for security cameras, robots in industrial Connectivity’s, sensor-based devices, and increasing connection and storage capacity in data centers are likely to create tremendous opportunities for earphone and headphone producers.

Top Key Players Covered In Silent Earbuds Market

- Sony

- Apple (AirPods Pro)

- Bose

- Samsung (Galaxy Buds)

- Jabra

- Sennheiser

- Anker (Soundcore)

- Google (Pixel Buds)

- Beats by Dre

- JBL

- Shure

- Bang & Olufsen

- Technics

- Edifier

- EarFun

- Aukey

- Creative

- Huawei

- LG

- OnePlus? (TechRadar)

Key Industry Development In Silent Earbuds Market

- In January 2024, Sony announced INZONE Buds, new truly wireless gaming earbuds packed with Sony’s renowned audio technology designed to help you win. INZONE Buds offers an immersive gaming experience for PC, mobile, and console gameplay thanks to the personalized sound, unrivaled 12 hours of battery life, and low latency.

- In Feb 2024, Bose announced the release of their new Ultra Open Earbuds in February 2024. These earbuds feature a unique cuff-shaped design that rests on the outer ear instead of going inside the ear canal.

|

Silent Earbuds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2696.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 5344.97 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Connectivity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Silent Earbuds Market by Type (2018-2032)

4.1 Silent Earbuds Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Active

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid

4.5 Passive

Chapter 5: Silent Earbuds Market by Connectivity (2018-2032)

5.1 Silent Earbuds Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wired

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wireless

Chapter 6: Silent Earbuds Market by Distribution Channel (2018-2032)

6.1 Silent Earbuds Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Silent Earbuds Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PATISSERIE LA TABLE DOUCE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WESTON FOODS INC

7.4 HOW SWEET IT IS

7.5 PACIFIC DESSERTCO WHOLESALE INC

7.6 GENERAL MILLS INCBIMBO CANADA

7.7 RICH PRODUCTS CORPORATION

7.8 CANADA BREAD COMPANY

7.9 QUALITY IS OUR RECIPE LLC

7.10 FGF BRANDS

7.11 SARA LEE FROZEN BAKERY

7.12 MAPLE LEAF FOODS INCKELLOGG CANADA INCKRAFT FOODS INC

Chapter 8: Global Silent Earbuds Market By Region

8.1 Overview

8.2. North America Silent Earbuds Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Active

8.2.4.2 Hybrid

8.2.4.3 Passive

8.2.5 Historic and Forecasted Market Size by Connectivity

8.2.5.1 Wired

8.2.5.2 Wireless

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Retail

8.2.6.2 Online

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Silent Earbuds Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Active

8.3.4.2 Hybrid

8.3.4.3 Passive

8.3.5 Historic and Forecasted Market Size by Connectivity

8.3.5.1 Wired

8.3.5.2 Wireless

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Retail

8.3.6.2 Online

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Silent Earbuds Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Active

8.4.4.2 Hybrid

8.4.4.3 Passive

8.4.5 Historic and Forecasted Market Size by Connectivity

8.4.5.1 Wired

8.4.5.2 Wireless

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Retail

8.4.6.2 Online

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Silent Earbuds Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Active

8.5.4.2 Hybrid

8.5.4.3 Passive

8.5.5 Historic and Forecasted Market Size by Connectivity

8.5.5.1 Wired

8.5.5.2 Wireless

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Retail

8.5.6.2 Online

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Silent Earbuds Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Active

8.6.4.2 Hybrid

8.6.4.3 Passive

8.6.5 Historic and Forecasted Market Size by Connectivity

8.6.5.1 Wired

8.6.5.2 Wireless

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Retail

8.6.6.2 Online

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Silent Earbuds Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Active

8.7.4.2 Hybrid

8.7.4.3 Passive

8.7.5 Historic and Forecasted Market Size by Connectivity

8.7.5.1 Wired

8.7.5.2 Wireless

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Retail

8.7.6.2 Online

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Silent Earbuds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2696.2 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 5344.97 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Connectivity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Silent Earbuds Market research report is 2024-2032.

Apple Inc., Bose Corporation, Harman International, Sony Corporation and Other Major Players.

The Silent Earbuds Market is segmented into Type, Connectivity, Distribution Channel and region. By Type the market is categorized into Active, Hybrid, and Passive. By Connectivity, the market is categorized into Wired and Wireless. By Distribution Channel, the market is categorized into Retail and Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Silent Earbuds are also known as noise-canceling earbuds which actively cancel or block the surrounding noises with their Active Noise Cancelling technology.

Silent Earbuds Market Size Was Valued at USD 2696.2 Million in 2023 and is Projected to Reach USD 5344.97 Million by 2032, Growing at a CAGR of 7.9 % From 2024-2032.