Sickle Cell Disease Market Synopsis

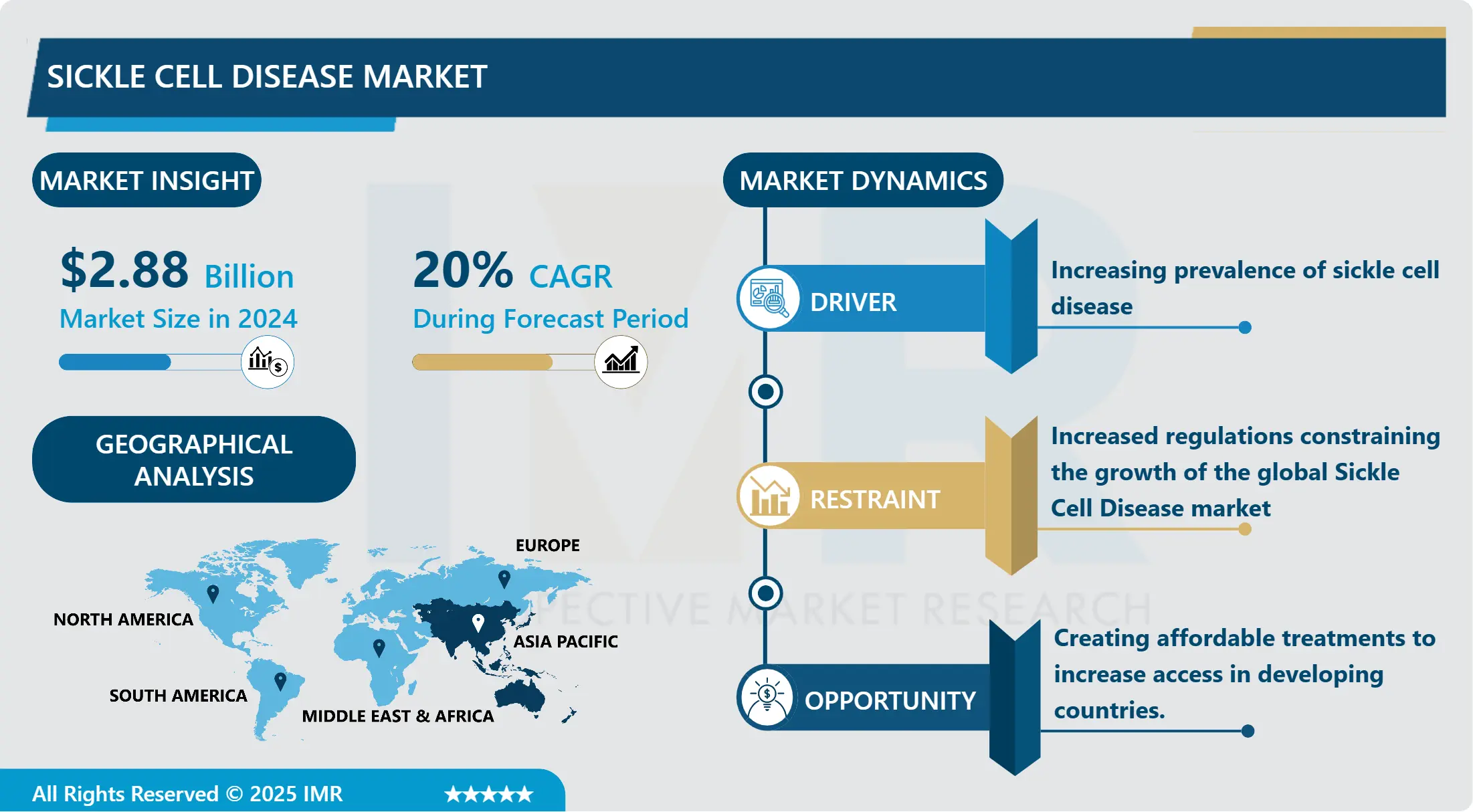

Sickle Cell Disease Market Size Was Valued at USD 2.88 Billion in 2024, and is Projected to Reach USD 12.38 Billion by 2032, Growing at a CAGR of 20.00% From 2025-2032.

Sickle cell disease market includes products and health care solutions intended for prevention, diagnosis, and treatment of sickle cell disease which is an inherited blood disorder caused due to the presence of abnormal haemoglobin which causes red blood cells to become crescent shaped. As it was mentioned earlier this market encompasses pain management therapies, blood transfusion therapies, hydroxyurea and new generations of gene therapies. Some of these factors include; the current global incidence of SCD, research, expansion, and the existing need for treatment procedures in SCD, and animproved consciousness of SCD. This is compounded by regulatory environments, the overall state of the healthcare system, and growing phenomenon of individualization of medicine.

The market for SCD is on the rise due to factors such as the rising prevalence of the SCD disease, enhanced diagnosis rates and better treatment solutions. SCD is a genetic blood disease that results to abnormally shaped red blood cells and leads to several health complications, such as pain crises, infections and organ deterioration. Common in African, Mediterranean, and Middle Eastern patients, the sizeable population of patients suffering from this condition acts as an important driver in the growth of a market. A worldwide increasing importance is attaching to the treatment of SCD, due to which the governments and health organizations provide more attention and funding to the research on SCD and the related public health projects focusing the improved of the life quality of SCD patients.

Current developments in gene therapy together with hydroxyurea treatment regime and new pharmacological agents augers well for managing SCD. Contrary to the previous innovations which solely have treatment as their goal and do not wipe out the disease these innovations attempt at doing so. The market is augmented by a shift towards specific and targeted treatment plans of diseases which reduces the chances of having a patient require multiple medications. Currently, there is a renewed interest due to joint venture pharmaceutical companies research institutions and various healthcare providers’ joining the effort to speed up production of SCD treatments with new therapies set to launch in the market stream in the subsequent years.

However, there are challenges that slow and or dilute the SCD market, these include high treatment cost, disparities in access to healthcare, and patient education on the disease and or treatment regimes. Literature revealed that geographic inequalities in access to health-care services can limit treatment options, especially in LMICs with high burden of SCD. Moreover, the existence of similar health care models addressing the holistic treatment approach that have the medical as well as psychosocial components is also a very big need. In achieving the objectives of this report, several key challenges may be identified By stakeholders to work these challenges, the outlook of SCD market is on a positive note with expectations to continue recording growth pattern through embracing innovation and better patient outcome.

Sickle Cell Disease Market Trend Analysis

Sickle Cell Disease Market Growth Driver- Innovations and Trends in Sickle Cell Disease Management

- In recent years the Sickle Cell disease market appears to have expanded significantly including through innovative therapies. The current management of SCD has significantly changes by the introduction of gene therapy and novel pharmacological agents that is worthwhile changing patient outcome and lives. Consequently, both research and clinical trials improve the information understanding of SCD and progress the creation of specific treatments for outcomes like pain crisis and organ injury. This progressive environment is complemented by massive funding from the pharmaceutical industry armed to meet the emerging market opportunity and needs of affected individuals.

- Beside expanded therapeutic options, new care patterns, which enhance mental and social support, pain control and preventive medicine along with conventional treatments, are of increasing importance. This approach is becoming popular for the healthcare providers and payers corresponding to the understanding of the multifaceted issues in the life of SCD patients. In addition, where patient engagement and accessibility remain a challenge, the use of tele health, mobile applications and Digital Health technologies generally is enhancing care delivery and outreach particularly in developing countries. As people develop increased knowledge about SCD via advocacy campaigns and educational programs, the market has great potential for growth, signifying the interest in patient-centered therapeutic approaches and treatment.

Sickle Cell Disease Market Expansion Opportunity- Comprehensive Care Models and Digital Health Innovations in Sickle Cell Disease Management

- There is another significant shift in the the thinking in SCD market and that relates to a holistic approach to the care of SCD patients that often requires much more than medicines and operations - these includes psychological support, pain management and preventive care among others. This approached is being adopted by more healthcare managers and reimbursement authorities because it recognizes that SCD is a complex condition. Implemented to cover not only the symptoms of the disease but also the effects on a patient’s emotions and psychology, these treatment approaches also have the goal of increasing patients’ quality of life. Of all the areas this shift is more relevant in enhancing more positive patient-physician interaction and guarantee that a patient gets appropriate attention that befits him or her as an individual.

- Further, the increasing adoption of telemedicine and mobile health applications has made it easy for a patient to access a health care provider as well as even engage in the health care seeking process. Such tools help enhance disease control since patients can observe their health changes and interact with healthcare givers in real time. This is an important time to intervene to avoid complications and for controlling the pain crisis well. Sickle cell disease patients blindly trust and accept the sickle cell disease information given to them by the health facilities, stressing that as the awareness of sickle cell disease increases due to the encouragement from sickle cell disease advocates and educational sickle cell disease campaigns, the market will experience increased growth. This changing environment embraces health literate SCD patients, comprehensive management and newer treatment paradigms – characteristics congruent with the objectives of enhancing the health related quality of life for SCD patients.

Sickle Cell Disease Market Segment Analysis:

Sickle Cell Disease Market Segmented based on Type, Diagnosis, Complications Type, Treatment Type, End-Users, and Region.

By Type, Sickle Cell Anemia, Sickle Hemoglobin-C Disease segment is expected to dominate the market during the forecast period

- Sickle Cell Anemia (SCA) is a genetic blood disease that is defined by the occurrence of a non normal type of hemoglobin referred to as hemoglobin S (HbS). This condition is due to a mutation of the HBB gene which belongs to the group of globin and codes for the beta-globin subunit of haemoglobin. Patients with SCA have two copies of the changed gene – one they inherit from each parent – and produce HbS instead of the normal hemoglobin A (HbA). In an environment with low oxygen concentrations, HbS has a tendency of polymerization with concomitant deformation of the red blood cells into, sickle shaped. These sickle-shaped cells also lack the resiliency necessary to ensure that they pass easily through narrow capillaries to deliver and collect blood that can cause suffering, increase prone to infections, and organ dysfunctions such as in pain crises.

- Sickle cell anemia disease differs in severity depending on the patients and certain factors including genetic predisposition and other physical factors. Some of the common manifestations are periodic pains referred to as the ‘pain crisess’ and are precipitated by such factors as; low oxygen levels, stress, changes in temperature amongst other factors. They include acute chest syndrome, stroke, sepsis or any complication arising from splenic dysfunction. Like with any chronic condition, management of SCA might be complex and include pain control, transfusions and evidence-based therapies such as hydroxyurea which can prevent the crises and thus improve survival. It is established from research that Sickle Cell Anemia takes the general quality of life of a patient including the psychological health of a patient hence the need for constant care.

By End-Users, Hospitals segment held the largest share in 2024

- Hospitals are institutions, which perform significant functions in the acute and comprehensive care of the patients with Sickle Cell Anemia; especially during the manifestation of acute vaso-occlusive crisis. Emergency visits are frequent for pain crises that are severe and disabling, which mandates a response. Pain in the hospital can be managed through administration of IV drugs, fluids and supportive care. Also primary care is provided at hospitals; the AC is commonly managed at the hospital where complications cited like acute chest syndrome and stroke may require oxygen treatment, blood transfusion or even critical care for patients in critical condition. Patient centered care through the hematologist, pain management specialist and competent social worker enhance care delivery according to patient’s need.

- In addition to the initial, acute intervention, they also play a role in continuous care of Sickle Cell Disease. They provide routine follow up services and maintenance so that they can minimize on the occurrences of crises and adverse effects. Most patients with SCD can attend outpatient clinics for long-term care plan and disease-modifying factors such as hydroxyurea, genetic counseling. Tutorials on the disease and its symptoms, as well as changes patients and their families need to make to enhance their lifestyles are sometimes organized by hospitals. This multifaceted strategy goes further beyond the pragmatic health issues of patients and shows authorization to the role of the hospital in the coping of Sickle Cell Anemia.

Sickle Cell Disease Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific area has gradually seen an enhanced acknowledgment of Sickle Cell Disease (SCD) or SCD-like condition than an Asia-Pacific specific disease especially in India and Pakistan where genetic disorders are a major source of morbidity and mortality. As SCD is particularly frequent in these areas and as the understanding of its consequences is on the rise, attempts to enhance the awareness of healthcare workers and the population have been made. However, some issues remain unresolved, and include; poor health care facilities, poor treatment for the diseases, and the absence of well-coordinated screening. These barriers limit diagnosis and management of SCD, and therefore morbidity and mortality are high.

- Nevertheless, the challenges are emerging in increasing investments in the health care and research that would be essential to promote the nurturing of such therapies and improvement of diagnostic services. Coordination of efforts, especially through the private as well as the public sector partnership is appearing as an important approaches that can be used in the strengthening of SCD management. These collaborations aim at promoting the effectiveness of the screening programmes; education of the patient; and access to the treatments. Thus, as these programs progress, they may radically enhance the prospects for SCD patients on the territory of the Asia-Pacific region and contribute to the development of the market and the promotion of health care.

Active Key Players in the Sickle Cell Disease Market

- Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Allergan (Ireland)

- AstraZeneca (U.K.)

- Johnson & Johnson Private Limited (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Reddy's Laboratories Ltd. (India)

- Gilead Sciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- Lupin (India

- Other Active Players

Key Industry Developments in the Sickle Cell Disease Market:

- In March, 2024 Pharmaceutical manufacturers Akums announced that it had launched the India’s first indigenous hydroxyurea oral solution, used for the treatment of sickle cell disease in children. Akums said the drug will be provided to the government at the cost of R600, which is nearly 1% of the R77,000 that the medicine currently available globally costs.

- In June, 2024, The Indian Council of Medical Research (ICMR) has invited Expressions of Interest (EoI) from eligible organizations for the “joint development and commercialization” of low dose or pediatric oral formulation of hydroxyurea to treat sickle cell disease in India.

- In August, 2024 The RUBY clinical trial which aims to evaluate the efficacy, safety, and tolerability of reni-cel in 45 people with severe SCD, ages 12 through 50 has completed the enrollment in the adolescent group of the Phase 1/2/3 RUBY clinical trial testing Editas Medicine’s gene-editing therapy, renizgamglogene autogedtemcel (reni-cel), in people with sickle cell disease (SCD).

- In June, 2024 The FDA has established a new specialized office to address a wide range of decisions regarding cell and gene therapies, which encompasses the potential introduction of the first CRISPR therapy as well as the inaugural gene therapy for Duchenne muscular dystrophy.

|

Global Sickle Cell Disease Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.88 Bn. |

|

Forecast Period 2025-32 CAGR: |

20.00% |

Market Size in 2032: |

USD 12.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Diagnosis |

|

||

|

By Complications Type |

|

||

|

By Treatment Type |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sickle Cell Disease Market by Type (2018-2032)

4.1 Sickle Cell Disease Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sickle Cell Anemia

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sickle Hemoglobin-C Disease

4.5 Sickle Beta-Plus Thalassemia

4.6 Sickle Hemoglobin-D Disease

4.7 Sickle Hemoglobin-O Disease

4.8 Others

Chapter 5: Sickle Cell Disease Market by Diagnosis (2018-2032)

5.1 Sickle Cell Disease Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Screening Tests

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 New-born Screening

5.5 Prenatal Screening

5.6 Others

Chapter 6: Sickle Cell Disease Market by Complications Type (2018-2032)

6.1 Sickle Cell Disease Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Stroke

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Acute Chest Syndrome

6.5 Pulmonary Hypertension

6.6 Organ Damage

6.7 Others

Chapter 7: Sickle Cell Disease Market by Treatment Type (2018-2032)

7.1 Sickle Cell Disease Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Medication

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Blood Transfusion

7.5 Bone Marrow Transplantation

7.6 Others

Chapter 8: Sickle Cell Disease Market by End-Users (2018-2032)

8.1 Sickle Cell Disease Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Specialty Clinics

8.5 Homecare

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Sickle Cell Disease Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MYLAN N.V. (U.S.)

9.4 TEVA PHARMACEUTICAL INDUSTRIES LTD. (IRELAND)

9.5 SANOFI (FRANCE)

9.6 PFIZER INC. (U.S.)

9.7 GLAXOSMITHKLINE PLC (U.K.)

9.8 NOVARTIS AG (SWITZERLAND)

9.9 MERCK & COINC. (U.S.)

9.10 ALLERGAN (IRELAND)

9.11 ASTRAZENECA (U.K.)

9.12 JOHNSON & JOHNSON PRIVATE LIMITED (U.S.)

9.13 HIKMA PHARMACEUTICALS PLC (U.K.)

9.14 BRISTOL-MYERS SQUIBB COMPANY (U.S.)

9.15 BAYER AG (GERMANY)

9.16 BOEHRINGER INGELHEIM INTERNATIONAL GMBH (GERMANY)

9.17 REDDY'S LABORATORIES LTD. (INDIA)

9.18 GILEAD SCIENCES INC. (U.S.)

9.19 AMGEN INC. (U.S.)

9.20 ELI LILLY AND COMPANY (U.S.)

9.21 ABBVIE INC. (U.S.)

9.22 LUPIN (INDIA

9.23 OTHER KEY PLAYERS

Chapter 10: Global Sickle Cell Disease Market By Region

10.1 Overview

10.2. North America Sickle Cell Disease Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Sickle Cell Anemia

10.2.4.2 Sickle Hemoglobin-C Disease

10.2.4.3 Sickle Beta-Plus Thalassemia

10.2.4.4 Sickle Hemoglobin-D Disease

10.2.4.5 Sickle Hemoglobin-O Disease

10.2.4.6 Others

10.2.5 Historic and Forecasted Market Size by Diagnosis

10.2.5.1 Screening Tests

10.2.5.2 New-born Screening

10.2.5.3 Prenatal Screening

10.2.5.4 Others

10.2.6 Historic and Forecasted Market Size by Complications Type

10.2.6.1 Stroke

10.2.6.2 Acute Chest Syndrome

10.2.6.3 Pulmonary Hypertension

10.2.6.4 Organ Damage

10.2.6.5 Others

10.2.7 Historic and Forecasted Market Size by Treatment Type

10.2.7.1 Medication

10.2.7.2 Blood Transfusion

10.2.7.3 Bone Marrow Transplantation

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size by End-Users

10.2.8.1 Hospitals

10.2.8.2 Specialty Clinics

10.2.8.3 Homecare

10.2.8.4 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Sickle Cell Disease Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Sickle Cell Anemia

10.3.4.2 Sickle Hemoglobin-C Disease

10.3.4.3 Sickle Beta-Plus Thalassemia

10.3.4.4 Sickle Hemoglobin-D Disease

10.3.4.5 Sickle Hemoglobin-O Disease

10.3.4.6 Others

10.3.5 Historic and Forecasted Market Size by Diagnosis

10.3.5.1 Screening Tests

10.3.5.2 New-born Screening

10.3.5.3 Prenatal Screening

10.3.5.4 Others

10.3.6 Historic and Forecasted Market Size by Complications Type

10.3.6.1 Stroke

10.3.6.2 Acute Chest Syndrome

10.3.6.3 Pulmonary Hypertension

10.3.6.4 Organ Damage

10.3.6.5 Others

10.3.7 Historic and Forecasted Market Size by Treatment Type

10.3.7.1 Medication

10.3.7.2 Blood Transfusion

10.3.7.3 Bone Marrow Transplantation

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size by End-Users

10.3.8.1 Hospitals

10.3.8.2 Specialty Clinics

10.3.8.3 Homecare

10.3.8.4 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Sickle Cell Disease Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Sickle Cell Anemia

10.4.4.2 Sickle Hemoglobin-C Disease

10.4.4.3 Sickle Beta-Plus Thalassemia

10.4.4.4 Sickle Hemoglobin-D Disease

10.4.4.5 Sickle Hemoglobin-O Disease

10.4.4.6 Others

10.4.5 Historic and Forecasted Market Size by Diagnosis

10.4.5.1 Screening Tests

10.4.5.2 New-born Screening

10.4.5.3 Prenatal Screening

10.4.5.4 Others

10.4.6 Historic and Forecasted Market Size by Complications Type

10.4.6.1 Stroke

10.4.6.2 Acute Chest Syndrome

10.4.6.3 Pulmonary Hypertension

10.4.6.4 Organ Damage

10.4.6.5 Others

10.4.7 Historic and Forecasted Market Size by Treatment Type

10.4.7.1 Medication

10.4.7.2 Blood Transfusion

10.4.7.3 Bone Marrow Transplantation

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size by End-Users

10.4.8.1 Hospitals

10.4.8.2 Specialty Clinics

10.4.8.3 Homecare

10.4.8.4 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Sickle Cell Disease Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Sickle Cell Anemia

10.5.4.2 Sickle Hemoglobin-C Disease

10.5.4.3 Sickle Beta-Plus Thalassemia

10.5.4.4 Sickle Hemoglobin-D Disease

10.5.4.5 Sickle Hemoglobin-O Disease

10.5.4.6 Others

10.5.5 Historic and Forecasted Market Size by Diagnosis

10.5.5.1 Screening Tests

10.5.5.2 New-born Screening

10.5.5.3 Prenatal Screening

10.5.5.4 Others

10.5.6 Historic and Forecasted Market Size by Complications Type

10.5.6.1 Stroke

10.5.6.2 Acute Chest Syndrome

10.5.6.3 Pulmonary Hypertension

10.5.6.4 Organ Damage

10.5.6.5 Others

10.5.7 Historic and Forecasted Market Size by Treatment Type

10.5.7.1 Medication

10.5.7.2 Blood Transfusion

10.5.7.3 Bone Marrow Transplantation

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size by End-Users

10.5.8.1 Hospitals

10.5.8.2 Specialty Clinics

10.5.8.3 Homecare

10.5.8.4 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Sickle Cell Disease Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Sickle Cell Anemia

10.6.4.2 Sickle Hemoglobin-C Disease

10.6.4.3 Sickle Beta-Plus Thalassemia

10.6.4.4 Sickle Hemoglobin-D Disease

10.6.4.5 Sickle Hemoglobin-O Disease

10.6.4.6 Others

10.6.5 Historic and Forecasted Market Size by Diagnosis

10.6.5.1 Screening Tests

10.6.5.2 New-born Screening

10.6.5.3 Prenatal Screening

10.6.5.4 Others

10.6.6 Historic and Forecasted Market Size by Complications Type

10.6.6.1 Stroke

10.6.6.2 Acute Chest Syndrome

10.6.6.3 Pulmonary Hypertension

10.6.6.4 Organ Damage

10.6.6.5 Others

10.6.7 Historic and Forecasted Market Size by Treatment Type

10.6.7.1 Medication

10.6.7.2 Blood Transfusion

10.6.7.3 Bone Marrow Transplantation

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size by End-Users

10.6.8.1 Hospitals

10.6.8.2 Specialty Clinics

10.6.8.3 Homecare

10.6.8.4 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Sickle Cell Disease Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Sickle Cell Anemia

10.7.4.2 Sickle Hemoglobin-C Disease

10.7.4.3 Sickle Beta-Plus Thalassemia

10.7.4.4 Sickle Hemoglobin-D Disease

10.7.4.5 Sickle Hemoglobin-O Disease

10.7.4.6 Others

10.7.5 Historic and Forecasted Market Size by Diagnosis

10.7.5.1 Screening Tests

10.7.5.2 New-born Screening

10.7.5.3 Prenatal Screening

10.7.5.4 Others

10.7.6 Historic and Forecasted Market Size by Complications Type

10.7.6.1 Stroke

10.7.6.2 Acute Chest Syndrome

10.7.6.3 Pulmonary Hypertension

10.7.6.4 Organ Damage

10.7.6.5 Others

10.7.7 Historic and Forecasted Market Size by Treatment Type

10.7.7.1 Medication

10.7.7.2 Blood Transfusion

10.7.7.3 Bone Marrow Transplantation

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size by End-Users

10.7.8.1 Hospitals

10.7.8.2 Specialty Clinics

10.7.8.3 Homecare

10.7.8.4 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Sickle Cell Disease Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.88 Bn. |

|

Forecast Period 2025-32 CAGR: |

20.00% |

Market Size in 2032: |

USD 12.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Diagnosis |

|

||

|

By Complications Type |

|

||

|

By Treatment Type |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||