Shrimp Market Synopsis

Shrimp Market Size Was Valued at USD 38.6 Billion in 2022, and is Projected to Reach USD 71.45 Billion by 2030, Growing at a CAGR of 8% From 2023-2030.

The shrimp market encompasses the global trade and consumption of decapod crustaceans, primarily falling under the Caridea and Dendrobranchiata classifications. Characterized by diverse species with elongated bodies and a distinctive swimming mode, the market is driven by the demand for larger shrimp species, notably for human consumption.

- The global shrimp market is characterized by a diverse range of species falling under the Caridean and Dendrobranchiata classifications. Shrimp are decapod crustaceans with elongated bodies, featuring a distinctive swimming movement. Within these classifications, the Caridea group, encompassing smaller species and marine-exclusive variants, serves as a crucial criterion for differentiation. Shrimps, along with prawns, are integral components of the marine food web, boasting stalk-eyed structures, long muscular tails (abdomens), antennae, and slender legs.

- The market dynamics are influenced by the demand for larger shrimp species, particularly in the context of commercial fisheries catering to human consumption. Shrimp farming, a significant aspect of aquaculture in tropical climates, has witnessed growth driven by factors such as increased health awareness regarding the benefits of shrimp consumption, the adoption of environmentally friendly production techniques, the prevalence of contract farming, and adherence to government regulations.

Shrimp Market Trend Analysis

Growing awareness of the health benefits

- Shrimp are recognized for their high nutritional value, serving as a rich source of lean protein, vitamins, and minerals. As consumers increasingly prioritize health-conscious choices, shrimp's profile as a low-calorie, low-fat protein option becomes more appealing. The presence of omega-3 fatty acids in shrimp further enhances their nutritional appeal, contributing to heart health.

- Changing dietary patterns, influenced by a global focus on wellness and healthier lifestyles, contribute to the upward trajectory of the shrimp market. Shrimp's versatility as a lean protein aligns with the preferences of individuals seeking nutritious and balanced dietary options. As wellness trends continue to shape consumer choices, the inclusion of shrimp in diets as a wholesome and flavourful choice gains momentum.

Rising Popularity of Ready-to-Eat and Convenience Products

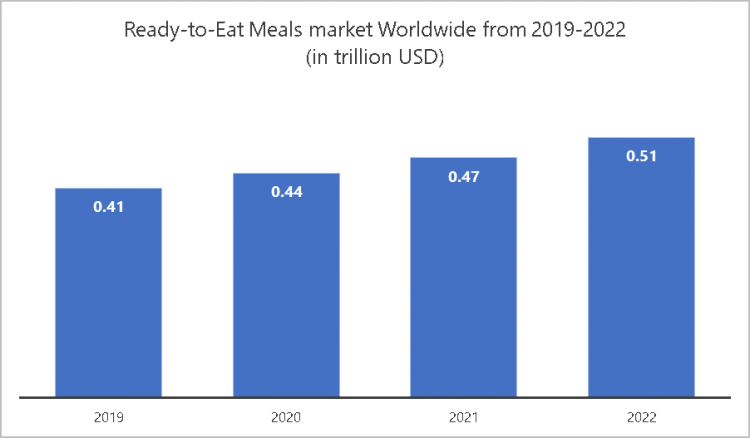

- The shrimp market is witnessing a notable opportunity driven by the rising popularity of ready-to-eat and convenience products. With evolving lifestyles and busy schedules, consumers increasingly seek convenient and time-saving food options. Ready-to-eat shrimp products, including pre-cooked or seasoned varieties, cater to this demand by providing a hassle-free and quick culinary solution.

- The surge in on-the-go consumption trends further amplifies the opportunity in the shrimp market. Ready-to-eat shrimp products align with the modern consumer's desire for portable and easily consumable snacks or meals. This trend is particularly prominent among urban populations, where the demand for convenient, nutritious, and tasty seafood options is on the rise.

The given graph shows that the increasing popularity of ready-to-eat products signifies a shift in consumer preferences towards convenient and time-saving food options. Shrimp, being a versatile and easily adaptable ingredient, aligns seamlessly with this trend, becoming a favored choice for inclusion in ready-to-eat offerings. The convenience and accessibility of shrimp in various forms, such as pre-cooked or seasoned options, cater to the modern consumer's demand for hassle-free yet high-quality seafood solutions. This synergy between the burgeoning ready-to-eat market and the versatility of shrimp positions the shrimp industry on a growth trajectory, capitalizing on evolving consumer behaviors and preferences.

Shrimp Market Segment Analysis:

Shrimp Market Segmented on the basis of Species, Form, Size, Distribution Channel and Application.

By Species, Farmed White Leg shrimp segment is expected to dominate the market during the forecast period

- The dominance of the Farmed white-leg shrimp segment in the shrimp market can be attributed to its high demand and controlled production. Farmed white-leg shrimp, also known as Litopenaeus vannamei, is favored for its fast growth rate and adaptability to aquaculture conditions. This species has become a cornerstone of the shrimp farming industry due to its ability to thrive in various environments and reach marketable sizes quickly.

- This species is known for its mild flavor, firm texture, and white meat, making it adaptable to various culinary styles and preferences worldwide. Its neutral taste profile makes it an ideal choice for diverse recipes and cuisines, contributing to its popularity in the food industry. Additionally, Farmed White Leg shrimp's widespread availability and consistent quality make it a preferred option for consumers, retailers, and food service providers, enhancing its position as a dominant force in the shrimp market.

By Form, Frozen segment held the largest share of 68.2% in 2022

- The dominance of the frozen segment in the shrimp market can be attributed to the inherent advantages it offers, particularly in terms of prolonged shelf life and enhanced convenience. Frozen shrimp products retain their freshness and quality for an extended period, allowing for efficient storage, distribution, and consumption. This aligns with consumer preferences for seafood that can be easily preserved without compromising taste or texture.

- The global dominance of the frozen shrimp segment is also influenced by its ability to facilitate widespread distribution and ensure year-round availability. Frozen shrimp can be transported over long distances without compromising quality, enabling global trade and meeting the demand in diverse markets. This not only expands the market reach but also allows consumers in regions without direct access to shrimp-producing areas to enjoy a consistent supply.

Shrimp Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific's dominance in the shrimp market is rooted in its robust aquaculture practices, with a primary focus on the production of vannamei shrimp. Countries such as China, Vietnam, India, Thailand, Indonesia, and Bangladesh have invested significantly in aquaculture infrastructure and technology, enabling them to efficiently cultivate large quantities of shrimp.

- The dominance of the Asia-Pacific region in both production and consumption of shrimp is closely tied to cultural preferences and high per capita consumption of seafood. In many Asian countries, seafood, including shrimp, holds a central place in culinary traditions. The cultural significance of seafood, combined with the accessibility and affordability of domestically produced shrimp, results in elevated per capita consumption rates.

Shrimp Market Top Key Players:

- High Liner Foods (USA)

- Gulf Shrimp Company (USA)

- CenSea (USA)

- Blue Star Foods Corp (USA)

- Trident Seafoods (USA)

- Austevoll Seafood ASA (Norway)

- Mowi ASA (Norway)

- Iglo Group (United Kingdom)

- Marine Harvest (Norway)

- Lerøy Seafood Group (Norway)

- Thai Union Europe (Thailand)

- Thai Union Group (Thailand)

- Charoen Pokphand Foods (Thailand)

- Vietnam Fisheries Company (Vietnam)

- Avanti Feeds Ltd (India)

- PT. Charoen Pokphand Indonesia (Indonesia)

- Zhanjiang Guolian Aquatic Products (China)

- Grobest Group (Taiwan)

- Nissui Group (Japan)

- High Hope Zhongding Corporation (China)

- Waterbase Ltd (India)

- Maruha Nichiro Corporation (Japan)

- Apex Frozen Foods Ltd (India)

- Amiya Foods (India)

- Fuzhou Yihua Aquatic Products (China)

- Pescanova Asia (Singapore)

Key Industry Developments in the Shrimp Market:

- In January 2023 High Liner Foods strategically unveiled a pioneering line of sustainable shrimp products, marked by a commitment to sourcing from farms certified by the prestigious Aquaculture Stewardship Council (ASC). This move underscores the company's dedication to environmentally responsible practices within the aquaculture industry. By introducing this new product line, High Liner Foods not only aligns itself with the principles of the ASC but also responds proactively to the growing consumer demand for ethically sourced and environmentally conscious seafood options.

- In February 2022 Thai Union began piloting the use of satellite imaging for shrimp farming operations in collaboration with Sea Warden - a satellite data analytics company and Wholechain - a supply chain traceability company to support sustainable farming practices through insights into shrimp populations, farm health, contamination.

|

Shrimp Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 38.6 Bn. |

|

|

CAGR (2023-2030): |

8% |

Market Size in 2030: |

USD 71.45 Bn. |

|

|

Segments Covered: |

By Species |

|

|

|

|

By Form |

|

|

||

|

By Size |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Application |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SHRIMP MARKET BY SPECIES (2016-2030)

- SHRIMP MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GULF SHRIMPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FARMED WHITE LEG SHRIMPS

- BANDED CORAL SHRIMPS

- ROYAL RED SHRIMP

- SHRIMP MARKET BY FORM (2016-2030)

- SHRIMP MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FROZEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CANNED

- BREADED

- COOKED

- PEELED

- SHRIMP MARKET BY SIZE (2016-2030)

- SHRIMP MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXTRA-LARGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE

- MEDIUM

- SMALL

- SHRIMP MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- SHRIMP MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFFLINE

- SHRIMP MARKET BY APPLICATION (2016-2030)

- SHRIMP MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICAL

- COSMETICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SHRIMP Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HIGH LINER FOODS

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GULF SHRIMP COMPANY

- CENSEA

- BLUE STAR FOODS CORP

- TRIDENT SEAFOODS

- AUSTEVOLL SEAFOOD ASA

- MOWI ASA

- IGLO GROUP

- MARINE HARVEST

- LERØY SEAFOOD GROUP

- THAI UNION EUROPE

- THAI UNION GROUP

- CHAROEN POKPHAND FOODS

- VIETNAM FISHERIES COMPANY

- AVANTI FEEDS LTD

- PT. CHAROEN POKPHAND INDONESIA

- ZHANJIANG GUOLIAN AQUATIC PRODUCTS

- GROBEST GROUP

- NISSUI GROUP

- HIGH HOPE ZHONGDING CORPORATION

- WATERBASE LTD

- MARUHA NICHIRO CORPORATION

- APEX FROZEN FOODS LTD

- AMIYA FOODS

- FUZHOU YIHUA AQUATIC PRODUCTS

- PESCANOVA ASIA

- COMPETITIVE LANDSCAPE

- GLOBAL SHRIMP MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By SPECIES

- Historic And Forecasted Market Size By FORM

- Historic And Forecasted Market Size By SIZE

- Historic And Forecasted Market Size By DISTRIBUTION CHANNEL

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Shrimp Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 38.6 Bn. |

|

|

CAGR (2023-2030): |

8% |

Market Size in 2030: |

USD 71.45 Bn. |

|

|

Segments Covered: |

By Species |

|

|

|

|

By Form |

|

|

||

|

By Size |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Application |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SHRIMP MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SHRIMP MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SHRIMP MARKET COMPETITIVE RIVALRY

TABLE 005. SHRIMP MARKET THREAT OF NEW ENTRANTS

TABLE 006. SHRIMP MARKET THREAT OF SUBSTITUTES

TABLE 007. SHRIMP MARKET BY SHRIMP

TABLE 008. GULF SHRIMPS MARKET OVERVIEW (2016-2028)

TABLE 009. FARMED WHITE LEG SHRIMPS MARKET OVERVIEW (2016-2028)

TABLE 010. BANDED CORAL SHRIMPS MARKET OVERVIEW (2016-2028)

TABLE 011. ROYAL RED SHRIMP MARKET OVERVIEW (2016-2028)

TABLE 012. SHRIMP MARKET BY FORM

TABLE 013. CANNED MARKET OVERVIEW (2016-2028)

TABLE 014. BREADED MARKET OVERVIEW (2016-2028)

TABLE 015. PEELED MARKET OVERVIEW (2016-2028)

TABLE 016. COOKED & PEELED MARKET OVERVIEW (2016-2028)

TABLE 017. SHRIMP MARKET BY DISTRIBUTION CHANNEL

TABLE 018. DIRECT MARKET OVERVIEW (2016-2028)

TABLE 019. INDIRECT MARKET OVERVIEW (2016-2028)

TABLE 020. SHRIMP MARKET BY APPLICATION

TABLE 021. FOOD MARKET OVERVIEW (2016-2028)

TABLE 022. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 023. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA SHRIMP MARKET, BY SHRIMP (2016-2028)

TABLE 025. NORTH AMERICA SHRIMP MARKET, BY FORM (2016-2028)

TABLE 026. NORTH AMERICA SHRIMP MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. NORTH AMERICA SHRIMP MARKET, BY APPLICATION (2016-2028)

TABLE 028. N SHRIMP MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE SHRIMP MARKET, BY SHRIMP (2016-2028)

TABLE 030. EUROPE SHRIMP MARKET, BY FORM (2016-2028)

TABLE 031. EUROPE SHRIMP MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. EUROPE SHRIMP MARKET, BY APPLICATION (2016-2028)

TABLE 033. SHRIMP MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC SHRIMP MARKET, BY SHRIMP (2016-2028)

TABLE 035. ASIA PACIFIC SHRIMP MARKET, BY FORM (2016-2028)

TABLE 036. ASIA PACIFIC SHRIMP MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. ASIA PACIFIC SHRIMP MARKET, BY APPLICATION (2016-2028)

TABLE 038. SHRIMP MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA SHRIMP MARKET, BY SHRIMP (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA SHRIMP MARKET, BY FORM (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA SHRIMP MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA SHRIMP MARKET, BY APPLICATION (2016-2028)

TABLE 043. SHRIMP MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA SHRIMP MARKET, BY SHRIMP (2016-2028)

TABLE 045. SOUTH AMERICA SHRIMP MARKET, BY FORM (2016-2028)

TABLE 046. SOUTH AMERICA SHRIMP MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 047. SOUTH AMERICA SHRIMP MARKET, BY APPLICATION (2016-2028)

TABLE 048. SHRIMP MARKET, BY COUNTRY (2016-2028)

TABLE 049. CHAROEN POKPHAND FOOD PCL: SNAPSHOT

TABLE 050. CHAROEN POKPHAND FOOD PCL: BUSINESS PERFORMANCE

TABLE 051. CHAROEN POKPHAND FOOD PCL: PRODUCT PORTFOLIO

TABLE 052. CHAROEN POKPHAND FOOD PCL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. THE CLOVER LEAF SEAFOODS FAMILY: SNAPSHOT

TABLE 053. THE CLOVER LEAF SEAFOODS FAMILY: BUSINESS PERFORMANCE

TABLE 054. THE CLOVER LEAF SEAFOODS FAMILY: PRODUCT PORTFOLIO

TABLE 055. THE CLOVER LEAF SEAFOODS FAMILY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. NIPPON SUISAN KAISHA LTD.: SNAPSHOT

TABLE 056. NIPPON SUISAN KAISHA LTD.: BUSINESS PERFORMANCE

TABLE 057. NIPPON SUISAN KAISHA LTD.: PRODUCT PORTFOLIO

TABLE 058. NIPPON SUISAN KAISHA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MARINE HARVEST ASA: SNAPSHOT

TABLE 059. MARINE HARVEST ASA: BUSINESS PERFORMANCE

TABLE 060. MARINE HARVEST ASA: PRODUCT PORTFOLIO

TABLE 061. MARINE HARVEST ASA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. GULF SHRIMP COMPANY: SNAPSHOT

TABLE 062. GULF SHRIMP COMPANY: BUSINESS PERFORMANCE

TABLE 063. GULF SHRIMP COMPANY: PRODUCT PORTFOLIO

TABLE 064. GULF SHRIMP COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. THAI UNION FROZEN PRODUCTS PLC: SNAPSHOT

TABLE 065. THAI UNION FROZEN PRODUCTS PLC: BUSINESS PERFORMANCE

TABLE 066. THAI UNION FROZEN PRODUCTS PLC: PRODUCT PORTFOLIO

TABLE 067. THAI UNION FROZEN PRODUCTS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BATON ROUGE SHRIMP COMPANY INC.: SNAPSHOT

TABLE 068. BATON ROUGE SHRIMP COMPANY INC.: BUSINESS PERFORMANCE

TABLE 069. BATON ROUGE SHRIMP COMPANY INC.: PRODUCT PORTFOLIO

TABLE 070. BATON ROUGE SHRIMP COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. PESCANOVA S.A: SNAPSHOT

TABLE 071. PESCANOVA S.A: BUSINESS PERFORMANCE

TABLE 072. PESCANOVA S.A: PRODUCT PORTFOLIO

TABLE 073. PESCANOVA S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. GALVESTON SHRIMP COMPANY: SNAPSHOT

TABLE 074. GALVESTON SHRIMP COMPANY: BUSINESS PERFORMANCE

TABLE 075. GALVESTON SHRIMP COMPANY: PRODUCT PORTFOLIO

TABLE 076. GALVESTON SHRIMP COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. LABRADOR FISHERMEN'S UNION SHRIMP COMPANY LTD.: SNAPSHOT

TABLE 077. LABRADOR FISHERMEN'S UNION SHRIMP COMPANY LTD.: BUSINESS PERFORMANCE

TABLE 078. LABRADOR FISHERMEN'S UNION SHRIMP COMPANY LTD.: PRODUCT PORTFOLIO

TABLE 079. LABRADOR FISHERMEN'S UNION SHRIMP COMPANY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OMARSA S.A: SNAPSHOT

TABLE 080. OMARSA S.A: BUSINESS PERFORMANCE

TABLE 081. OMARSA S.A: PRODUCT PORTFOLIO

TABLE 082. OMARSA S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. MSEAFOOD CORP: SNAPSHOT

TABLE 083. MSEAFOOD CORP: BUSINESS PERFORMANCE

TABLE 084. MSEAFOOD CORP: PRODUCT PORTFOLIO

TABLE 085. MSEAFOOD CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. RISTIC GMBH: SNAPSHOT

TABLE 086. RISTIC GMBH: BUSINESS PERFORMANCE

TABLE 087. RISTIC GMBH: PRODUCT PORTFOLIO

TABLE 088. RISTIC GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. VINNBIO INDIA PVT. LTD: SNAPSHOT

TABLE 089. VINNBIO INDIA PVT. LTD: BUSINESS PERFORMANCE

TABLE 090. VINNBIO INDIA PVT. LTD: PRODUCT PORTFOLIO

TABLE 091. VINNBIO INDIA PVT. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SEAJOY GROUP: SNAPSHOT

TABLE 092. SEAJOY GROUP: BUSINESS PERFORMANCE

TABLE 093. SEAJOY GROUP: PRODUCT PORTFOLIO

TABLE 094. SEAJOY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. DOM INTERNATIONAL LIMITED: SNAPSHOT

TABLE 095. DOM INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 096. DOM INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 097. DOM INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. CARRIBBEAN SHRIMP COMPANY LIMITED: SNAPSHOT

TABLE 098. CARRIBBEAN SHRIMP COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 099. CARRIBBEAN SHRIMP COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 100. CARRIBBEAN SHRIMP COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. ARTISANFISH LLC: SNAPSHOT

TABLE 101. ARTISANFISH LLC: BUSINESS PERFORMANCE

TABLE 102. ARTISANFISH LLC: PRODUCT PORTFOLIO

TABLE 103. ARTISANFISH LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. ANANDA GROUP: SNAPSHOT

TABLE 104. ANANDA GROUP: BUSINESS PERFORMANCE

TABLE 105. ANANDA GROUP: PRODUCT PORTFOLIO

TABLE 106. ANANDA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. ORCHID MARINE: SNAPSHOT

TABLE 107. ORCHID MARINE: BUSINESS PERFORMANCE

TABLE 108. ORCHID MARINE: PRODUCT PORTFOLIO

TABLE 109. ORCHID MARINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SHRIMP MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SHRIMP MARKET OVERVIEW BY SHRIMP

FIGURE 012. GULF SHRIMPS MARKET OVERVIEW (2016-2028)

FIGURE 013. FARMED WHITE LEG SHRIMPS MARKET OVERVIEW (2016-2028)

FIGURE 014. BANDED CORAL SHRIMPS MARKET OVERVIEW (2016-2028)

FIGURE 015. ROYAL RED SHRIMP MARKET OVERVIEW (2016-2028)

FIGURE 016. SHRIMP MARKET OVERVIEW BY FORM

FIGURE 017. CANNED MARKET OVERVIEW (2016-2028)

FIGURE 018. BREADED MARKET OVERVIEW (2016-2028)

FIGURE 019. PEELED MARKET OVERVIEW (2016-2028)

FIGURE 020. COOKED & PEELED MARKET OVERVIEW (2016-2028)

FIGURE 021. SHRIMP MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 022. DIRECT MARKET OVERVIEW (2016-2028)

FIGURE 023. INDIRECT MARKET OVERVIEW (2016-2028)

FIGURE 024. SHRIMP MARKET OVERVIEW BY APPLICATION

FIGURE 025. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 026. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 027. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA SHRIMP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE SHRIMP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC SHRIMP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA SHRIMP MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA SHRIMP MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Shrimp Market research report is 2023-2030.

High Liner Foods, Gulf Shrimp Company, CenSea, Blue Star Foods Corp, Trident Seafoods, Austevoll Seafood ASA, Mowi ASA, Iglo Group, Marine Harvest, Lerøy Seafood Group, Thai Union Europe, Thai Union Group, Charoen Pokphand Foods, Vietnam Fisheries Company, Avanti Feeds Ltd, PT. Charoen Pokphand Indonesia, Zhanjiang Guolian Aquatic Products, Grobest Group, Nissui Group, High Hope Zhongding Corporation, Waterbase Ltd, Maruha Nichiro Corporation, Apex Frozen Foods Ltd, Amiya Foods, Fuzhou Yihua Aquatic Products, Pescanova Asia and Other Major Players.

The Shrimp Market is segmented into Species, Form, Size, Distribution Channel, Application, and region. By Species, the market is categorized into Gulf Shrimps, Farmed White leg Shrimps, Banded Coral Shrimps, and Royal Red Shrimp. By Form, the market is categorized into Frozen, Canned, Breaded, Cooked, and Peeled. By Size, the market is categorized into Extra-large, Large, Medium, and Small. By Distribution Channel, the market is categorized into Online, and offline. By Application, the market is categorized into Food, Pharmaceutical, and Cosmetics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The shrimp market encompasses the global trade and consumption of decapod crustaceans, primarily falling under the Caridea and Dendrobranchiata classifications. Characterized by diverse species with elongated bodies and a distinctive swimming mode, the market is driven by the demand for larger shrimp species, notably for human consumption.

Shrimp Market Size Was Valued at USD 38.6 Billion in 2022, and is Projected to Reach USD 71.45 Billion by 2030, Growing at a CAGR of 8% From 2023-2030.