Short-read Sequencing Market Synopsis

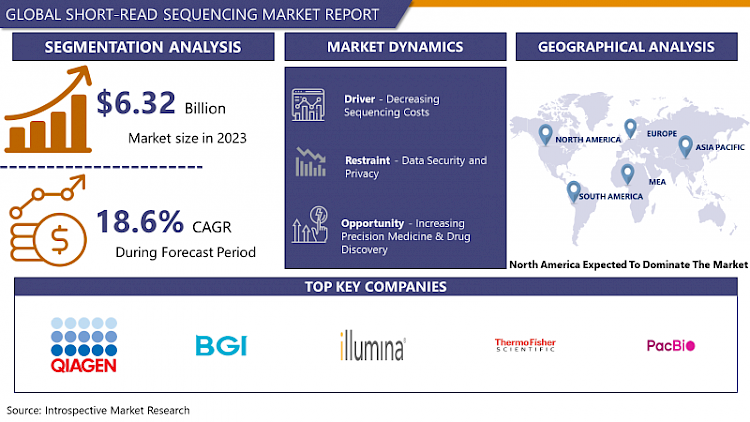

Short-read Sequencing Market Size Was Valued at USD 6.32 Billion in 2023, and is Projected to Reach USD 24.7 Billion by 2032, Growing at a CAGR of 18.6% From 2024-2032.

Short-read sequencing is a high-throughput method used in genomics to determine the nucleotide sequence of DNA or RNA molecules. The process entails the cleavage of extensive DNA or RNA strands into more manageable fragments, which are generally between 50 and 400 base pairs in length. These fragments are subsequently sequenced concurrently. This approach makes use of platforms such as Illumina sequencing, which determines the sequence of nucleotides via fluorescent detection and reversible dye terminators.

The utilization of short-read sequencing is prevalent across a multitude of applications, encompassing epigenomics, transcriptomics, metagenomics, and genome sequencing. Its scalability, high accuracy, and relatively low cost per base render it an essential instrument for investigating a wide range of biological phenomena, including genetic variation, gene expression, and microbial diversity.

- Short-read sequencing has brought about a paradigm shift in the domain of genomics by providing scientists with the capability to efficiently and economically produce extensive quantities of sequencing data. Nevertheless, this method has certain drawbacks, most notably its inability to precisely identify repetitive regions, structural variations, and long-range genomic interactions.

- Notwithstanding these obstacles, cutting-edge computational algorithms and sequencing technologies persistently augment the efficacy and precision of short-read sequencing. Furthermore, the amalgamation of short-read data with additional sequencing technologies, including long-read sequencing and optical mapping, has facilitated the assembly and analysis of genomes that are more exhaustive and precise. With the ongoing progression of sequencing technologies, short-read sequencing continues to be an essential method in genomic research, making significant contributions to our comprehension of the genetic underpinnings of health, disease, and evolutionary mechanisms.

Short-read Sequencing Market Trend Analysis

Increasing demand for personalized medicine

- The growing need for personalized medicine has emerged as a substantial catalyst for the short-read sequencing industry. The goal of personalized medicine is to customize medical interventions according to the unique attributes of every patient, which may include their genetic composition. Short-read sequencing is an essential component of this methodology as it enables expedited and economical retrieval of the genomic data of a patient.

- Through the process of DNA sequencing, clinicians can discern genetic variations that have the potential to impact susceptibility to diseases, response to medications, and overall health outcomes. This data empowers medical practitioners to render more informed judgments concerning preventative measures, treatment alternatives, and dosage plans, thereby facilitating the development of healthcare interventions that are both more efficacious and individualized.

- In addition, short-read sequencing enables progress in numerous fields, including rare disease diagnosis, pharmacogenomics, and precision oncology. The escalating comprehension of the genetic underpinnings of diseases is anticipated to generate an exponential surge in the demand for genomic testing and analysis.

- Furthermore, the expanding capabilities and decreasing expenses of short-read sequencing technologies contribute to their growing availability to researchers and healthcare providers across the globe. As a result, there is a growing trend towards the incorporation of genomic data into clinical practice, which is stimulating the growth of the short-read sequencing industry and advancing advancements in personalized medicine.

Use Of Advanced Genetic Treatments Extend Profitable

- The use of advanced genetic treatments presents a significant opportunity for the short-read sequencing market. With the increasing sophistication and prevalence of genetic therapies, including gene therapy and editing, there is an expanding demand for precise and all-encompassing genomic data to inform treatment choices. In this particular context, short-read sequencing is of the utmost importance as it furnishes comprehensive insights into the genetic variations that underlie maladies.

- This enables medical professionals to discern viable candidates for genetic treatments and customize interventions according to the unique genetic profiles of each patient. Additionally, short-read sequencing permits the detection of emergent resistance or adverse effects and the monitoring of treatment efficacy, thereby optimizing patient outcomes and enabling timely adjustments to treatment strategies. It is anticipated that the demand for short-read sequencing will rise in tandem with the development of genetic treatments, thereby stimulating market expansion and fostering innovation in genomic technologies.

- An additional factor contributing to the sustained viability of the short-read sequencing industry is the proliferation of genomic data uses that transcend clinical diagnostics. Pharmaceuticals, biotechnology, and agriculture are progressively placing greater reliance on genomic data to facilitate, among other things, drug discovery and development and crop enhancement.

- Short-read sequencing offers a scalable and economical approach to producing substantial quantities of genomic data, facilitating the acquisition of knowledge by industry participants and researchers regarding molecular mechanisms that govern biological processes, trait inheritance, and genetic diversity. By capitalizing on the capabilities of short-read sequencing technologies, organizations can expedite their research and development endeavors, augment product innovation, and optimize operational efficiency. Consequently, this generates prospects for market expansion across various industries and novel revenue streams.

Short-read Sequencing Market Segment Analysis:

Short-read Sequencing Market Segmented based on Product, Workflow Application, and End-user.

By Product, the consumables segment is expected to dominate the market during the forecast period

- Consumables usually constitute the majority of the short-read sequencing market. Consumables consist of cartridges, reagents, and packages that are necessary for sequencing reactions, library construction, and sample preparation. Although sequencing instruments may require laboratories and research facilities to make a substantial initial investment, the recurring demand for consumables provides companies in this sector with consistent revenue.

- The ongoing production of substantial volumes of data by short-read sequencing platforms necessitates consumables that supplement sequencing operations and guarantee dependable and superior outcomes. Moreover, progress in the fields of sequencing chemistry and library preparation protocols facilitates the creation of novel and enhanced consumables, thereby fostering innovation and propelling market expansion. Continual demand for sequencing services and the recurring nature of consumable purchases position the consumables segment to maintain its dominance in the short-read sequencing market.

- While consumables comprise a considerable proportion of the short-read sequencing market, the services sector is equally influential, especially in terms of delivering sequencing services, data analysis, and bioinformatics assistance. A considerable number of research institutions, clinical laboratories, and biotechnology companies choose to delegate their sequencing requirements to specialized service providers to gain entry to cutting-edge sequencing technologies and expertise without requiring significant financial investment.

- Furthermore, the intricacy associated with the analysis and interpretation of sequencing data frequently requires the assistance of specialized bioinformatics services to derive significant insights from genomic datasets. As a result, the provision of services complements the sale of instruments and consumables, thereby contributing to the overall expansion and financial success of the short-read sequencing market and offering customers additional value.

By Application, the sequencing segment held the largest share in 2023

- In the short-read sequencing market, the sequencing workflow segment tends to dominate. The fundamental procedure involves the utilization of a sequencing apparatus to analyze DNA or RNA samples to ascertain their nucleotide sequence. Illumina-provided short-read sequencing platforms efficiently and economically produce enormous volumes of sequencing data, rendering them essential instruments in the fields of genomics research, clinical diagnostics, and diverse other implementations.

- Consequently, sequencing instruments, consumables, and services that support this critical workflow phase are in high demand. In addition, progress in sequencing technologies, exemplified by enhancements in read lengths, throughput, and accuracy, remains a catalyst for market expansion and innovation in this particular sector.

- Although the sequencing workflow segment maintains a prominent market share, the data analysis segment is equally significant in the realm of short-read sequencing. Data analysis comprises the systematic procedures of processing, interpreting, and visualizing sequencing data to derive significant insights about biological processes, gene expression, and genetic variation. The escalating complexity of genomic datasets and the swift proliferation of sequencing applications have generated an expanding need for advanced bioinformatics tools and services to accurately interpret and analyze sequencing data.

- This demand is met by organizations that specialize in data analysis and bioinformatics software; they equip clinicians and researchers with the knowledge and tools required to extract actionable insights from genomic data. As a result, although sequencing continues to be the central focus of the short-read sequencing workflow, the data analysis phase serves to enhance this process by providing additional insights and facilitating the conversion of sequencing data into biological knowledge.

Short-read Sequencing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has emerged as a dominant force in the short-read sequencing market for several reasons. To begin with, the region is distinguished by a strong network of healthcare providers, biotechnology firms, and research institutions that foster genomic technology adoption and innovation. North America is renowned for its prominent academic and research establishments, including the National Institutes of Health (NIH), the Broad Institute, and Harvard University, all of which contribute to the advancement of genomic research and development.

- The consolidation of knowledge and skills in this area promotes cooperation and the sharing of insights, which expedites the progress of technology and the commercialization of sequencing platforms and services. Furthermore, significant investments in healthcare infrastructure and research funding are advantageous to North America, as they facilitate the extensive availability of sequencing technologies and stimulate the expansion of the market.

- Furthermore, the fact that significant market participants are based in North America reinforces the region's hegemony in the short-read sequencing industry. Pacific Biosciences, Thermo Fisher Scientific, and Illumina are leading the way in the development and commercialization of sequencing platforms, reagents, and software solutions. These prominent entities in the industry capitalize on their technological prowess, broad distribution systems, and strategic alliances to secure a substantial portion of the market and foster groundbreaking approaches.

- In addition, the implementation of genomic technologies in clinical practice is facilitated by favorable regulatory frameworks and government initiatives, such as the Precision Medicine Initiative in the United States, which contribute to the expansion of the market in North America. The aforementioned elements collectively contribute to the region's dominant position in the short-read sequencing market and establish it as a pivotal catalyst for advancements and expansion in personalized medicine and genomic research on a global scale.

Active Key Players in the Short-read Sequencing Market

- Illumina, Inc. (San Diego, California, USA)

- Thermo Fisher Scientific, Inc. (Waltham, Massachusetts, USA)

- Pacific Biosciences of California, Inc. (Menlo Park, California, USA)

- BGI (Shenzhen, Guangdong, China)

- QIAGEN (Hilden, Germany)

- Agilent Technologies (Santa Clara, California, USA)

- Psomagen (Rockville, Maryland, USA)

- Azenta US, Inc. (GENEWIZ) (South Plainfield, New Jersey, USA)

- PerkinElmer, Inc. (Waltham, Massachusetts, USA)

- ProPhase Labs, Inc. (Nebula Genomics) (Ambler, Pennsylvania, USA), and Other Key Players

Key Industry Developments in the Short-read Sequencing Market :

- In January 2024, Illumina Inc. expanded its partnership with Janssen Research & Development, LLC (Janssen) to advance a molecular residual disease (MRD) cancer test. This collaboration marks the initiation of Illumina's MRD assay development, employing whole-genome sequencing (WGS) to detect circulating tumor DNA (ctDNA), aiding in tracking disease persistence or recurrence post-treatment.

- In August 2023, PacBio announced its acquisition of Apton Biosystems, aiming to expedite the creation of a next-gen, high-throughput, short-read sequencer. Combining Apton's advanced optics and image processing with PacBio's SBB™ chemistry, the merger aims to develop a sequencer capable of billions of reads per flow cell. This move aligns with PacBio's strategy to broaden its sequencing portfolio and tap into a larger market share. The seamless integration of SBB chemistry into Apton's system promises accelerated development timelines.

|

Global Short-read Sequencing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6327.3 Mn. |

|

Forecast Period 2024-33 CAGR: |

18.6 % |

Market Size in 2032: |

USD 24797.5 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Workflow |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SHORT-READ SEQUENCING MARKET BY PRODUCT (2017-2032)

- SHORT-READ SEQUENCING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INSTRUMENTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONSUMABLES

- SERVICES

- SHORT-READ SEQUENCING MARKET BY WORKFLOW (2017-2032)

- SHORT-READ SEQUENCING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRE-SEQUENCING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEQUENCING

- DATA ANALYSIS

- SHORT-READ SEQUENCING MARKET BY APPLICATION (2017-2032)

- SHORT-READ SEQUENCING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WHOLE GENOME SEQUENCING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TARGETED SEQUENCING & RESEQUENCING

- DNA-BASED

- RNA-BASED

- OTHERS

- SHORT-READ SEQUENCING MARKET BY END-USER (2017-2032)

- SHORT-READ SEQUENCING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACADEMIC & RESEARCH INSTITUTES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOSPITALS & CLINICS

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SHORT-READ SEQUENCING Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ILLUMINA, INC. (SAN DIEGO, CALIFORNIA, USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- THERMO FISHER SCIENTIFIC, INC. (WALTHAM, MASSACHUSETTS, USA)

- PACIFIC BIOSCIENCES OF CALIFORNIA, INC. (MENLO PARK, CALIFORNIA, USA)

- BGI (SHENZHEN, GUANGDONG, CHINA)

- QIAGEN (HILDEN, GERMANY)

- AGILENT TECHNOLOGIES (SANTA CLARA, CALIFORNIA, USA)

- PSOMAGEN (ROCKVILLE, MARYLAND, USA)

- AZENTA US, INC. (GENEWIZ) (SOUTH PLAINFIELD, NEW JERSEY, USA)

- PERKINELMER, INC. (WALTHAM, MASSACHUSETTS, USA)

- PROPHASE LABS, INC. (NEBULA GENOMICS) (AMBLER, PENNSYLVANIA, USA)

- COMPETITIVE LANDSCAPE

- GLOBAL SHORT-READ SEQUENCING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Workflow

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Short-read Sequencing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6327.3 Mn. |

|

Forecast Period 2024-33 CAGR: |

18.6 % |

Market Size in 2032: |

USD 24797.5 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Workflow |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SHORT-READ SEQUENCING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SHORT-READ SEQUENCING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SHORT-READ SEQUENCING MARKET COMPETITIVE RIVALRY

TABLE 005. SHORT-READ SEQUENCING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SHORT-READ SEQUENCING MARKET THREAT OF SUBSTITUTES

TABLE 007. SHORT-READ SEQUENCING MARKET BY TYPE

TABLE 008. INSTRUMENTS MARKET OVERVIEW (2016-2028)

TABLE 009. CONSUMABLES MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. SHORT-READ SEQUENCING MARKET BY APPLICATION

TABLE 012. ACADEMIC RESEARCH MARKET OVERVIEW (2016-2028)

TABLE 013. CLINICAL RESEARCH MARKET OVERVIEW (2016-2028)

TABLE 014. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

TABLE 015. PHARMA & BIOTECH ENTITIES MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA SHORT-READ SEQUENCING MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA SHORT-READ SEQUENCING MARKET, BY APPLICATION (2016-2028)

TABLE 019. N SHORT-READ SEQUENCING MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE SHORT-READ SEQUENCING MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE SHORT-READ SEQUENCING MARKET, BY APPLICATION (2016-2028)

TABLE 022. SHORT-READ SEQUENCING MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC SHORT-READ SEQUENCING MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC SHORT-READ SEQUENCING MARKET, BY APPLICATION (2016-2028)

TABLE 025. SHORT-READ SEQUENCING MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA SHORT-READ SEQUENCING MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA SHORT-READ SEQUENCING MARKET, BY APPLICATION (2016-2028)

TABLE 028. SHORT-READ SEQUENCING MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA SHORT-READ SEQUENCING MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA SHORT-READ SEQUENCING MARKET, BY APPLICATION (2016-2028)

TABLE 031. SHORT-READ SEQUENCING MARKET, BY COUNTRY (2016-2028)

TABLE 032. THERMO FISHER SCIENTIFIC: SNAPSHOT

TABLE 033. THERMO FISHER SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 034. THERMO FISHER SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 035. THERMO FISHER SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. HOFFMANN-LA ROCHE AG: SNAPSHOT

TABLE 036. HOFFMANN-LA ROCHE AG: BUSINESS PERFORMANCE

TABLE 037. HOFFMANN-LA ROCHE AG: PRODUCT PORTFOLIO

TABLE 038. HOFFMANN-LA ROCHE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. GE HEALTHCARE: SNAPSHOT

TABLE 039. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 040. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 041. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. FASTERIS SA: SNAPSHOT

TABLE 042. FASTERIS SA: BUSINESS PERFORMANCE

TABLE 043. FASTERIS SA: PRODUCT PORTFOLIO

TABLE 044. FASTERIS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BGI GENOMICS: SNAPSHOT

TABLE 045. BGI GENOMICS: BUSINESS PERFORMANCE

TABLE 046. BGI GENOMICS: PRODUCT PORTFOLIO

TABLE 047. BGI GENOMICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. AGILENT TECHNOLOGIES: SNAPSHOT

TABLE 048. AGILENT TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 049. AGILENT TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 050. AGILENT TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GENSCRIPT BIOTECH CORPORATION: SNAPSHOT

TABLE 051. GENSCRIPT BIOTECH CORPORATION: BUSINESS PERFORMANCE

TABLE 052. GENSCRIPT BIOTECH CORPORATION: PRODUCT PORTFOLIO

TABLE 053. GENSCRIPT BIOTECH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. MACROGEN: SNAPSHOT

TABLE 054. MACROGEN: BUSINESS PERFORMANCE

TABLE 055. MACROGEN: PRODUCT PORTFOLIO

TABLE 056. MACROGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GENEWIZ: SNAPSHOT

TABLE 057. GENEWIZ: BUSINESS PERFORMANCE

TABLE 058. GENEWIZ: PRODUCT PORTFOLIO

TABLE 059. GENEWIZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. QIAGEN: SNAPSHOT

TABLE 060. QIAGEN: BUSINESS PERFORMANCE

TABLE 061. QIAGEN: PRODUCT PORTFOLIO

TABLE 062. QIAGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ILLUMINA: SNAPSHOT

TABLE 063. ILLUMINA: BUSINESS PERFORMANCE

TABLE 064. ILLUMINA: PRODUCT PORTFOLIO

TABLE 065. ILLUMINA: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SHORT-READ SEQUENCING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SHORT-READ SEQUENCING MARKET OVERVIEW BY TYPE

FIGURE 012. INSTRUMENTS MARKET OVERVIEW (2016-2028)

FIGURE 013. CONSUMABLES MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. SHORT-READ SEQUENCING MARKET OVERVIEW BY APPLICATION

FIGURE 016. ACADEMIC RESEARCH MARKET OVERVIEW (2016-2028)

FIGURE 017. CLINICAL RESEARCH MARKET OVERVIEW (2016-2028)

FIGURE 018. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 019. PHARMA & BIOTECH ENTITIES MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA SHORT-READ SEQUENCING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE SHORT-READ SEQUENCING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC SHORT-READ SEQUENCING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA SHORT-READ SEQUENCING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA SHORT-READ SEQUENCING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Short-read Sequencing Market research report is 2024-2032.

Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Inc., BGI, QIAGEN, Agilent Technologies, Psomagen, Azenta US, Inc. (GENEWIZ), PerkinElmer, Inc., ProPhase Labs, Inc and Other Major Players.

The Short-read Sequencing Market is segmented into Product, Workflow, Application, End-Use, and region. By Product, the market is categorized into Instruments, Consumables, and Services. By Workflow, the market is categorized into Pre-Sequencing, Sequencing, and Data Analysis. By Applications, the market is categorized into Whole Genome Sequencing, Whole Exome Sequencing, Targeted Sequencing & Resequencing {DNA-based, RNA-based} Others. By End-Use, the market is categorized into Academic & Research Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Short-read sequencing is a high-throughput method used to determine the nucleotide sequence of DNA or RNA fragments. It involves breaking long strands into shorter pieces and sequencing them simultaneously. Widely used in genomics, it enables rapid and cost-effective analysis of genetic information.

Short-read Sequencing Market Size Was Valued at USD 6.32 Billion in 2023, and is Projected to Reach USD 24.7 Billion by 2032, Growing at a CAGR of 18.6% From 2024-2032.