Servo Motors and Drives Market Synopsis

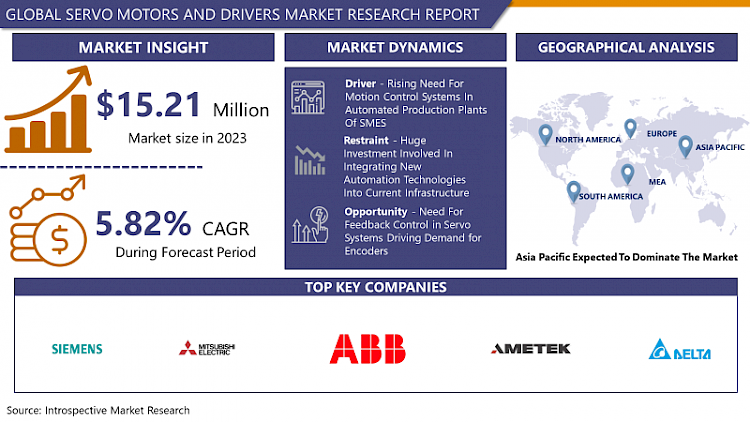

Servo Motors and Drivers Market Size Was Valued at USD 15.21 Billion in 2023, and is Projected to Reach USD 25.31 Billion by 2032, Growing at a CAGR of 5.82 % From 2024-2032.

Servo motors, which can be AC, DC, or linear, have built-in positional feedback. These motors are employed in closed-loop motion control systems that enable precise control of torque, speed, and angular position. Variations in voltage and current between windings are made possible by the use of permanent magnets. A servo drive is an automatic component used with servo motors that automatically adjusts any deviation from the commanded status, enabling the motor to perform precise positioning.

- The efforts being made by industrial organizations to accelerate their digital transformation, including the move toward the "Industry 4.0" concept, which governs a higher adoption of automation, robotics, and advanced solutions, such as AI and IoT in industrial setups, is a significant driving factor behind the growth of the market under study. The use of servo motors, which enable modern industrial machinery and robots to operate with greater efficiency and precision, is expected to grow over the forecast period.

- As servo motors are widely used in industrial robots, such as in robotic welding arms and steering systems of autonomous vehicles, adding dexterity, and actuating movement, the growing adoption of industrial robots may drive their demand during the forecast period.

The Servo Motors and Drives Market Trend Analysis

Rising Need for Motion Control Systems in Automated Production Plants of SME’s

- The rising demand for motion control systems in automated production facilities of Small and Medium Enterprises (SMEs) is a driving force behind the growth of the servo motors and drives market. SMEs play a pivotal role in the global business landscape, representing approximately 90% of all businesses worldwide. To remain competitive, SMEs are increasingly focusing on enhancing key factors such as product quality, production speed, and manufacturing flexibility.

- One of the pivotal solutions empowering SMEs in achieving these objectives is the implementation of servo systems as motion control systems. These systems enable precise control of machinery and processes, leading to improved productivity and cost-efficiency. Industries such as automotive, packaging, and textiles have adopted servo systems to automate production plants, resulting in higher production rates and reduced operational costs.

- An essential catalyst for the adoption of motion control systems in SMEs is the decreasing cost of robot technologies. Surveys by industry organizations, such as Automation, a subsidiary of the International Society of Automation, predict a significant 76% reduction in robot technology prices by 2025 compared to 2010. This cost reduction eliminates a major barrier for SMEs, making motion control systems more accessible and attractive. As a result, these trends are expected to drive substantial growth in the servo motors and drives market as SMEs continue to modernize and optimize their manufacturing processes. These trends are expected to drive the servo motors and drive the market.

Need for Feedback Control in Servo Systems Driving Demand for Encoders

- The growing need for feedback control in servo systems is presenting a significant opportunity for the Servo Motors and Drives Market. As industries across the board increasingly embrace automation, the demand for precise measurement of parameters like speed, torque, and position has surged. This demand is driven by the imperative to maintain high-quality and efficient processes. Encoders, in particular, are emerging as a key solution in meeting these requirements.

- Encoders offer several advantages that make them attractive in automated systems. They streamline control systems by reducing the number of wires and connections required, simplifying installation and maintenance. Encoders enhance safety in machines and automated systems, as they provide accurate feedback to ensure operations stay within specified parameters. Furthermore, their implementation reduces manual labor, enhances overall product quality, minimizes repetitive tasks, and decreases operational costs, making them highly desirable for businesses.

- Modern encoders are designed to be rugged and reliable, capable of withstanding harsh industrial environments. This robustness extends their usability across various sectors, from manufacturing to heavy industries. The rising demand for feedback control systems, driven by the increasing trend toward automation, is boosting the adoption of encoders in servo motors and drive systems. This creates a notable growth opportunity for companies in the Servo Motors and Drives Market, particularly those focusing on innovative encoder technologies tailored to the evolving needs of industries.

Servo Motors and Drives Market Segmentation Analysis

Servo Motors and Drives Market segments cover the Type, Drive, and Voltage range and end-users industry. By Type, the AC Servo Motor segment is anticipated to dominate the Market over the Forecast period.

- As AC motors are frequently used in electric vehicles because of their lighter weight and smaller size, it is anticipated that the popularity of these vehicles will play a major role in this growth. Because of their high efficiency and low cost, AC motors are also widely used in a variety of industries, including manufacturing facilities, HVAC systems, and home appliances. They are frequently inexpensive to maintain or even free, which makes them a desirable choice for companies looking to cut operating costs. The market for AC motors is anticipated to grow significantly over the next few years as consumer demand for electric cars and energy-saving equipment increases. The use of AC motors in a range of applications, combined with their superior efficiency and low maintenance costs, make them a highly sought-after technology in the industrial and commercial sectors.

- During the forecast period, the AC motor segment is expected to grow significantly, primarily due to the soaring demand for electric vehicles. AC motors are an appealing option for a variety of industries and applications thanks to their many benefits, including being lightweight, small-sized, economical, and requiring little maintenance.

Servo Motors and Drives Market Regional Analysis

Asia Pacific is expected to dominate the Market over the Forecast period.

- Due to the region's rising demand for energy and power generation, there are now more oil and gas refineries than ever before. The demand for power-efficient voltage systems to support industrialization, urbanization, and population growth in developing nations like China and India is also anticipated to fuel market growth. The servo motors and drives market is anticipated to grow as a result of the demand for goods and services across numerous industry sectors in the area.

According to Statista, the above graph shows that the servomotor market in China has witnessed significant growth, propelled by the expanding Servo Motors and Drives Market. This surge is primarily attributed to the rising demand for automation and precision control systems across various industries, such as manufacturing, robotics, and automotive.

Servo motors and drives play a pivotal role in enhancing operational efficiency and accuracy, driving their adoption. Additionally, China's robust industrial infrastructure and the government's focus on technological advancement have further bolstered this market's expansion. As a result, the servomotor market in China continues to experience a substantial increase in size, reflecting the country's pivotal role in the global automation industry.

COVID-19 Impact Analysis on Servo Motors and Drives Market

The COVID-19 pandemic led to the halting of all manufacturing and production activities which led to major product shortages and business losses. The market was adversely affected on account of the pandemic as there was a major gap in the demand and supply of components. The shortage of raw materials and the disruption of the trade cycles impacted the industry demand. However, with the restrictions being lifted and several sectors focusing on automation, the adoption of servo motors and drives is set to increase in the coming years.

Top Key Players Covered in the Servo Motors and Drives Market

- ABB (Switzerland)

- ADTECH (SHENZHEN)

- AMETEK (US)

- Bosch Rexroth AG (Germany)

- Delta Electronics (Taiwan)

- Emerson Electric Co. (US)

- FANUC (Japan)

- Fuji Electric (Japan)

- Kollmorgen Corporation (US)

- LENZE (Germany)

- Mitsubishi Electric (Japan)

- Moog Inc.

- NIDEC (Japan)

- Omron Corporation (OMRON) (US)

- Oriental Motor Co., Ltd.

- Parker Hannifin Corporation (US)

- Rockwell Automation (US)

- Rozum Robotics Inc. (Belarus)

- Schneider Electric (France)

- SEW Eurodrive (Germany)

- Siemens (Germany)

- Technology Co. Ltd (China)

- WEG (Brazil)

- Yaskawa Electric (Japan), and Other Major Players.

Key Industry Developments in the Servo Motors and Drives Market

- In May 2023, Siemens launched the SINAMICS S200 servo drive system, designed for many common applications in electronics, batteries, and other sectors. Its accurate servo drive, strong servo motors, and simple-to-use wires provide high dynamic performance. The new servo drive system is especially useful for applications that need accuracy in speed and torque, such as winding and unwinding machines used in battery manufacture and cell assembly.

- In July 2022, Yaskawa launched JL-L000A communications ASIC for supporting MECHATROLINK-4, which is a new-generation industrial network for achieving four times the transmission efficiency. This communication interface will be compatible with the controllers and servo packs.

|

Servo Motors and Drives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.82% |

Market Size in 2032: |

USD 25.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Drive |

|

||

|

By Voltage Range |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SERVO MOTORS AND DRIVES MARKET BY TYPE (2017-2030)

- SERVO MOTORS AND DRIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AC SERVO MOTOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DC BRUSH LESS SERVO MOTOR

- BRUSHED DC SERVO MOTOR

- LINEAR SERVO MOTOR

- SERVO MOTORS AND DRIVES MARKET BY DRIVE (2017-2030)

- SERVO MOTORS AND DRIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AC SERVO DRIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DC SERVO DRIVE

- ADJUSTABLE SERVO DRIVE

- SERVO MOTORS AND DRIVES MARKET BY VOLTAGE RANGE (2017-2030)

- SERVO MOTORS AND DRIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW-VOLTAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM VOLTAGE

- HIGH VOLTAGE

- SERVO MOTORS AND DRIVES MARKET BY END-USER INDUSTRY (2017-2030)

- SERVO MOTORS AND DRIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OIL AND GAS

- HEALTHCARE

- PACKAGING

- SEMICONDUCTOR & ELECTRONICS

- CHEMICALS & PETROCHEMICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SERVO MOTORS AND DRIVES Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB (Switzerland)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Adtech (Shenzhen)

- Ametek (US)

- Bosch Rexroth AG (Germany)

- Delta Electronics (Taiwan)

- Emerson Electric Co.

- FANUC (Japan)

- Fuji Electric (Japan)

- Kollmorgen Corporation (US)

- LENZE (Germany)

- Mitsubishi Electric (Japan)

- Moog Inc.

- NIDEC (Japan)

- Omron Corporation (OMRON) (US)

- Oriental Motor Co., Ltd.

- Parker Hannifin Corporation (US)

- Rockwell Automation (US)

- Rozum Robotics Inc. (Belarus)

- Schneider Electric (France)

- SEW Eurodrive (Germany)

- Siemens (Germany)

- Technology Co. Ltd (China)

- WEG (Brazil)

- Yaskawa Electric (Japan), and Other Major Players.

- COMPETITIVE LANDSCAPE

- GLOBAL SERVO MOTORS AND DRIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Servo Motors and Drives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.82% |

Market Size in 2032: |

USD 25.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Drive |

|

||

|

By Voltage Range |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SERVO MOTORS AND DRIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SERVO MOTORS AND DRIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SERVO MOTORS AND DRIVES MARKET COMPETITIVE RIVALRY

TABLE 005. SERVO MOTORS AND DRIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. SERVO MOTORS AND DRIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. SERVO MOTORS AND DRIVES MARKET BY TYPE

TABLE 008. AC SERVO MOTOR MARKET OVERVIEW (2016-2030)

TABLE 009. DC BRUSH LESS SERVO MOTOR MARKET OVERVIEW (2016-2030)

TABLE 010. BRUSHED DC SERVO MOTOR MARKET OVERVIEW (2016-2030)

TABLE 011. LINEAR SERVO MOTOR MARKET OVERVIEW (2016-2030)

TABLE 012. SERVO MOTORS AND DRIVES MARKET BY DRIVE

TABLE 013. AC SERVO DRIVE MARKET OVERVIEW (2016-2030)

TABLE 014. DC SERVO DRIVE MARKET OVERVIEW (2016-2030)

TABLE 015. ADJUSTABLE SERVO DRIVE MARKET OVERVIEW (2016-2030)

TABLE 016. SERVO MOTORS AND DRIVES MARKET BY VOLTAGE RANGE

TABLE 017. LOW-VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 018. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 019. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 020. SERVO MOTORS AND DRIVES MARKET BY END-USER INDUSTRY

TABLE 021. AUTOMOTIVE MARKET OVERVIEW (2016-2030)

TABLE 022. OIL AND GAS MARKET OVERVIEW (2016-2030)

TABLE 023. HEALTHCARE MARKET OVERVIEW (2016-2030)

TABLE 024. PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 025. SEMICONDUCTOR & ELECTRONICS MARKET OVERVIEW (2016-2030)

TABLE 026. CHEMICALS & PETROCHEMICALS MARKET OVERVIEW (2016-2030)

TABLE 027. NORTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 028. NORTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 029. NORTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 030. NORTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 031. N SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 032. EASTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 033. EASTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 034. EASTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 035. EASTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 036. SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 037. WESTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 038. WESTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 039. WESTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 040. WESTERN EUROPE SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 041. SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 042. ASIA PACIFIC SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 043. ASIA PACIFIC SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 044. ASIA PACIFIC SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 045. ASIA PACIFIC SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 046. SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 051. SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 052. SOUTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY TYPE (2016-2030)

TABLE 053. SOUTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY DRIVE (2016-2030)

TABLE 054. SOUTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY VOLTAGE RANGE (2016-2030)

TABLE 055. SOUTH AMERICA SERVO MOTORS AND DRIVES MARKET, BY END-USER INDUSTRY (2016-2030)

TABLE 056. SERVO MOTORS AND DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 057. ABB (SWITZERLAND): SNAPSHOT

TABLE 058. ABB (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 059. ABB (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 060. ABB (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ADTECH (SHENZHEN): SNAPSHOT

TABLE 061. ADTECH (SHENZHEN): BUSINESS PERFORMANCE

TABLE 062. ADTECH (SHENZHEN): PRODUCT PORTFOLIO

TABLE 063. ADTECH (SHENZHEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. AMETEK (US): SNAPSHOT

TABLE 064. AMETEK (US): BUSINESS PERFORMANCE

TABLE 065. AMETEK (US): PRODUCT PORTFOLIO

TABLE 066. AMETEK (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BOSCH REXROTH AG (GERMANY): SNAPSHOT

TABLE 067. BOSCH REXROTH AG (GERMANY): BUSINESS PERFORMANCE

TABLE 068. BOSCH REXROTH AG (GERMANY): PRODUCT PORTFOLIO

TABLE 069. BOSCH REXROTH AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DELTA ELECTRONICS (TAIWAN): SNAPSHOT

TABLE 070. DELTA ELECTRONICS (TAIWAN): BUSINESS PERFORMANCE

TABLE 071. DELTA ELECTRONICS (TAIWAN): PRODUCT PORTFOLIO

TABLE 072. DELTA ELECTRONICS (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. EMERSON ELECTRIC CO.: SNAPSHOT

TABLE 073. EMERSON ELECTRIC CO.: BUSINESS PERFORMANCE

TABLE 074. EMERSON ELECTRIC CO.: PRODUCT PORTFOLIO

TABLE 075. EMERSON ELECTRIC CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. FANUC (JAPAN): SNAPSHOT

TABLE 076. FANUC (JAPAN): BUSINESS PERFORMANCE

TABLE 077. FANUC (JAPAN): PRODUCT PORTFOLIO

TABLE 078. FANUC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. FUJI ELECTRIC (JAPAN): SNAPSHOT

TABLE 079. FUJI ELECTRIC (JAPAN): BUSINESS PERFORMANCE

TABLE 080. FUJI ELECTRIC (JAPAN): PRODUCT PORTFOLIO

TABLE 081. FUJI ELECTRIC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. KOLLMORGEN CORPORATION (US): SNAPSHOT

TABLE 082. KOLLMORGEN CORPORATION (US): BUSINESS PERFORMANCE

TABLE 083. KOLLMORGEN CORPORATION (US): PRODUCT PORTFOLIO

TABLE 084. KOLLMORGEN CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. LENZE (GERMANY): SNAPSHOT

TABLE 085. LENZE (GERMANY): BUSINESS PERFORMANCE

TABLE 086. LENZE (GERMANY): PRODUCT PORTFOLIO

TABLE 087. LENZE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. MITSUBISHI ELECTRIC (JAPAN): SNAPSHOT

TABLE 088. MITSUBISHI ELECTRIC (JAPAN): BUSINESS PERFORMANCE

TABLE 089. MITSUBISHI ELECTRIC (JAPAN): PRODUCT PORTFOLIO

TABLE 090. MITSUBISHI ELECTRIC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. MOOG INC.: SNAPSHOT

TABLE 091. MOOG INC.: BUSINESS PERFORMANCE

TABLE 092. MOOG INC.: PRODUCT PORTFOLIO

TABLE 093. MOOG INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. NIDEC (JAPAN): SNAPSHOT

TABLE 094. NIDEC (JAPAN): BUSINESS PERFORMANCE

TABLE 095. NIDEC (JAPAN): PRODUCT PORTFOLIO

TABLE 096. NIDEC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. OMRON CORPORATION (OMRON) (US): SNAPSHOT

TABLE 097. OMRON CORPORATION (OMRON) (US): BUSINESS PERFORMANCE

TABLE 098. OMRON CORPORATION (OMRON) (US): PRODUCT PORTFOLIO

TABLE 099. OMRON CORPORATION (OMRON) (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. ORIENTAL MOTOR CO.: SNAPSHOT

TABLE 100. ORIENTAL MOTOR CO.: BUSINESS PERFORMANCE

TABLE 101. ORIENTAL MOTOR CO.: PRODUCT PORTFOLIO

TABLE 102. ORIENTAL MOTOR CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. LTD.: SNAPSHOT

TABLE 103. LTD.: BUSINESS PERFORMANCE

TABLE 104. LTD.: PRODUCT PORTFOLIO

TABLE 105. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. PARKER HANNIFIN CORPORATION (US): SNAPSHOT

TABLE 106. PARKER HANNIFIN CORPORATION (US): BUSINESS PERFORMANCE

TABLE 107. PARKER HANNIFIN CORPORATION (US): PRODUCT PORTFOLIO

TABLE 108. PARKER HANNIFIN CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. ROCKWELL AUTOMATION (US): SNAPSHOT

TABLE 109. ROCKWELL AUTOMATION (US): BUSINESS PERFORMANCE

TABLE 110. ROCKWELL AUTOMATION (US): PRODUCT PORTFOLIO

TABLE 111. ROCKWELL AUTOMATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. ROZUM ROBOTICS INC. (BELARUS): SNAPSHOT

TABLE 112. ROZUM ROBOTICS INC. (BELARUS): BUSINESS PERFORMANCE

TABLE 113. ROZUM ROBOTICS INC. (BELARUS): PRODUCT PORTFOLIO

TABLE 114. ROZUM ROBOTICS INC. (BELARUS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. SCHNEIDER ELECTRIC (FRANCE): SNAPSHOT

TABLE 115. SCHNEIDER ELECTRIC (FRANCE): BUSINESS PERFORMANCE

TABLE 116. SCHNEIDER ELECTRIC (FRANCE): PRODUCT PORTFOLIO

TABLE 117. SCHNEIDER ELECTRIC (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. SEW EURODRIVE (GERMANY): SNAPSHOT

TABLE 118. SEW EURODRIVE (GERMANY): BUSINESS PERFORMANCE

TABLE 119. SEW EURODRIVE (GERMANY): PRODUCT PORTFOLIO

TABLE 120. SEW EURODRIVE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. SIEMENS (GERMANY): SNAPSHOT

TABLE 121. SIEMENS (GERMANY): BUSINESS PERFORMANCE

TABLE 122. SIEMENS (GERMANY): PRODUCT PORTFOLIO

TABLE 123. SIEMENS (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. TECHNOLOGY CO. LTD (CHINA): SNAPSHOT

TABLE 124. TECHNOLOGY CO. LTD (CHINA): BUSINESS PERFORMANCE

TABLE 125. TECHNOLOGY CO. LTD (CHINA): PRODUCT PORTFOLIO

TABLE 126. TECHNOLOGY CO. LTD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. WEG (BRAZIL): SNAPSHOT

TABLE 127. WEG (BRAZIL): BUSINESS PERFORMANCE

TABLE 128. WEG (BRAZIL): PRODUCT PORTFOLIO

TABLE 129. WEG (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 129. YASKAWA ELECTRIC (JAPAN): SNAPSHOT

TABLE 130. YASKAWA ELECTRIC (JAPAN): BUSINESS PERFORMANCE

TABLE 131. YASKAWA ELECTRIC (JAPAN): PRODUCT PORTFOLIO

TABLE 132. YASKAWA ELECTRIC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 132. AND OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 133. AND OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 134. AND OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 135. AND OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SERVO MOTORS AND DRIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SERVO MOTORS AND DRIVES MARKET OVERVIEW BY TYPE

FIGURE 012. AC SERVO MOTOR MARKET OVERVIEW (2016-2030)

FIGURE 013. DC BRUSH LESS SERVO MOTOR MARKET OVERVIEW (2016-2030)

FIGURE 014. BRUSHED DC SERVO MOTOR MARKET OVERVIEW (2016-2030)

FIGURE 015. LINEAR SERVO MOTOR MARKET OVERVIEW (2016-2030)

FIGURE 016. SERVO MOTORS AND DRIVES MARKET OVERVIEW BY DRIVE

FIGURE 017. AC SERVO DRIVE MARKET OVERVIEW (2016-2030)

FIGURE 018. DC SERVO DRIVE MARKET OVERVIEW (2016-2030)

FIGURE 019. ADJUSTABLE SERVO DRIVE MARKET OVERVIEW (2016-2030)

FIGURE 020. SERVO MOTORS AND DRIVES MARKET OVERVIEW BY VOLTAGE RANGE

FIGURE 021. LOW-VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 022. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 023. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 024. SERVO MOTORS AND DRIVES MARKET OVERVIEW BY END-USER INDUSTRY

FIGURE 025. AUTOMOTIVE MARKET OVERVIEW (2016-2030)

FIGURE 026. OIL AND GAS MARKET OVERVIEW (2016-2030)

FIGURE 027. HEALTHCARE MARKET OVERVIEW (2016-2030)

FIGURE 028. PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 029. SEMICONDUCTOR & ELECTRONICS MARKET OVERVIEW (2016-2030)

FIGURE 030. CHEMICALS & PETROCHEMICALS MARKET OVERVIEW (2016-2030)

FIGURE 031. NORTH AMERICA SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. EASTERN EUROPE SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. WESTERN EUROPE SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. ASIA PACIFIC SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. MIDDLE EAST & AFRICA SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. SOUTH AMERICA SERVO MOTORS AND DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Servo Motors and Drives Market research report is 2024-2032.

ABB (Switzerland), Adtech (Shenzhen), Ametek (US), Bosch Rexroth AG (Germany), Delta Electronics (Taiwan), Emerson Electric Co., Fanuc (Japan), Fuji Electric (Japan), Kollmorgen Corporation (US), LENZE (Germany), Mitsubishi Electric (Japan), Moog Inc., NIDEC (Japan), Omron Corporation (OMRON) (US), Oriental Motor Co., Ltd., Parker Hannifin Corporation (US), Rockwell Automation (US), Rozum Robotics Inc. (Belarus), Schneider Electric (France), SEW Eurodrive (Germany), Siemens (Germany), Technology Co. Ltd (China), WEG (Brazil), Yaskawa Electric (Japan), and Other Major Players.

The Servo Motors and Drives Market is segmented into Type, Drive, Voltage Range, End-use industry, and region. By Type, the market is categorized into AC Servo Motors, DC Brush Less Servo Motor, Brushed DC Servo Motors, and Linear Servo Motor. By Drive, the market is categorized into AC Servo Drive, DC Servo Drive, and Adjustable Servo Drive. By Voltage Range, the market is categorized into Low-voltage, Medium Voltage, and High Voltage. By End-user Industry, the market is categorized into Automotive, Oil and Gas, Healthcare, Packaging, Semiconductor and electronics, Chemicals, and petrochemicals, By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Servo motors, which can be AC, DC, or linear, have built-in positional feedback. These motors are employed in closed-loop motion control systems that enable precise control of torque, speed, and angular position. Variations in voltage and current between windings are made possible by the use of permanent magnets. A servo drive is an automatic component used with servo motors that automatically adjusts any deviation from the commanded status, enabling the motor to perform precise positioning.

Servo Motors and Drivers Market Size Was Valued at USD 15.21 Billion in 2023, and is Projected to Reach USD 25.31 Billion by 2032, Growing at a CAGR of 5.82 % From 2024-2032.