Seed Treatment Market Synopsis

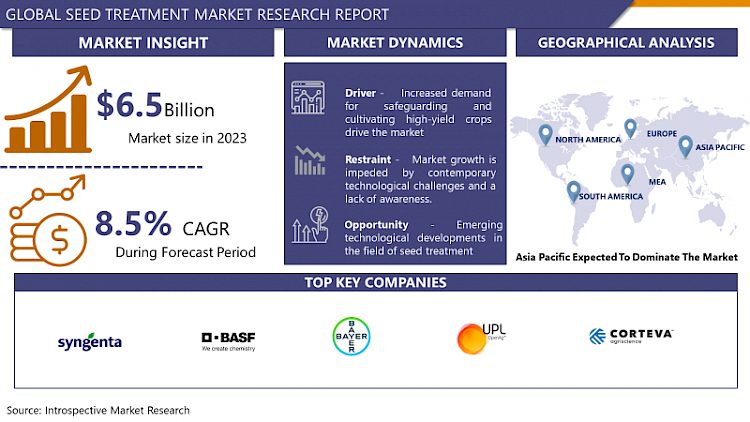

Seed Treatment Market Size Was Valued at USD 6.5 Billion in 2023, and is Projected to Reach USD 13.5 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

Seed treatment also known as seed coating not only as revolutionized the agricultural sector from production of single inputs to a system approach to combat a host of challenges which hinders quantity and quality of crops but has also helped to reduce post-harvest losses and green house emission. Therefore, seed treatment plays an imperatively pivotal position in the agricultural sector. In case of developed countries where the market is moving towards the direction of sustainable, systemic and adequate products, the treated seeds are sure to have a wide range of future growth for this established markets. As previously indicated, the emergence of new technologies during the coming years is presumed to account for the growth of the global market via the appropriation of methods that are both affordable and effective that also contribute to the enhancement of crop productivity sustainability.

- Indeed, seed treatments are found to be effective in managing both soil-borne and seed-borne diseases, soil-borne pathogens can, however, move past the roots of the plant and into the soil. Organic seed treatment nowadays becomes a preferable source for removing harmful chemical residue from our cereals, agricultural products. and the public is raising the awareness about significance food security and agricultural production.

- Scientists recently have been drawing researchers' attention to the fact that seed treatment use, and especially in developing countries, has been increasing in order to get higher yield of vine fruits and vegetables. This trend is set to grow world-wide given the high demand for fruits and vegetable products in the line of business. This development leads to contraction in the industrial development, resulting into fluctuations in demand and supply, which ultimately drives the price of insecticide and pesticide products high.

- Seed treatment around the world is, conversely, gradually growing greater because of the rise in the necessity to save and improve the crops with highest yields. The desired markets for agricProfile are mostly occupied by the developed economies, which include Europe and the United States. These countries, along with the rest of the leading producers of premium agricultural goods, control the market. In order to reduce the drop of post-harvest crops, keep pace with the growing of integrated pest management, generate seed treatment, meet requirements for pest resistance, and provide organic agricultural solution, bio-based seed treatment has become more common.

- An examination of this Asia-Pacific nation-region is expected to show that an increase in agricultural manufacturing and exporting of superior farm products will correspond with a need for seed treatment. Correspondingly, this result was anticipated to provide an impetus to the growth of the international sector over the course of the horizon.

Seed Treatment Market Trend Analysis

Substantial surge in agricultural output

- The world as a whole is led by the agricultural sector facing a serious increase in the output as well. The forecasted contribution of the agriculture sector to net domestic product would be 18 per cent. 8% contribution from National Income (GVA) as presented by the Government of India in recent year 2021-22. At the end of the last two years, its growth graph is illustrated in wavy manner.

- As for me, it grew around 3%. However, with GDP growth rates of 7.8% in FY 21-22 and 9% growth predicted for FY 22-23, we are well on the road to pre-pandemic levels of private sector engagement. 6% in 2020-21. The outstanding increase in agriculture production can in turn be explained by the utilization of novel technologies, hot news,and nanoprocesses within the farm industry.

- Synthetic chemicals or biological agents are being used in the coating of seedlings. This provides for excellent harvest in the long run and as a result, many sustainable and healthy crops are provided for healthy breakfast, lunch and dinner.

- No matter what approach (conventional or organic) you adapt, seed treatment has gained popularity and is seen as a pivotal part. To be honest, the majority of the seeds used in industrial farming, which are usually treated with chemicals or biotechnological processes (BFP).

- Perceiving the inefficiency of traditional agricultural practices, seeing the uncertainty of the future climate conditions, and valuing the natural resources which are non-renewable, the market is just at this point seen as appealing by the public.

Enabling a Regulatory and Policy Framework to Boost Productivity and Reduce the Disease

- Through the public sector's endeavors for the increased profitability of agriculture and by its support on agricultural policies, the world seed treatment market will keep on expanding .

- The level of support governments and regulatory bodies offer for farmers are increasing across the world, highlighting that certain agri-dependent developing markets already have profitable subsidization.

- Everyone understands the important role seed treatment plays in governments all over the world, by both developed and developing countries. Ultimately it is to ensure a good crop emergence.

- Differently from others application of other mineral inputs through drenching them, sowing them with biochemical or biological answers is a specific and effective way to avoid diseases and maximize production.

Seed Treatment Market Segment Analysis:

Seed Treatment Market is Segmented based on Type, Function, Application Technique, Stage of Seed, and Crop Type.

By Crop Type, Cereals segment is expected to dominate the market during the forecast period

- Market is segmented according to the crop category, including World’s major Crop shuffling start with cereals, oilseeds as, fruits & vegetables and others.

- The cereals sector is anticipated to maintain its leading market share in the designing countries as it has got the top priority from the government due to the great influence of the government on ensuring food security in developing nation.

- Correspondingly cereals provision is broadening as its great dimensional applications in the kitchen are experiencing a hike.

- The growing urbanization in developing countries and recent expectations of shift from conventional meals involving more processed foods are some factors responsible for increasing the demand of the vegetable oils. Among all global markets, there are strong indications that the oilseed sector has gained considerable popularity. It is expected that India’s proportion of per capita vegetable oil consumption would have a very high growth of about 2.

- Of the total food intake, I estimate 6 percent per year in the coming 10 years, coming to 14 kg per capita in 2030 as per the OECD- FAO Agricultural Outlook 2021-2030. It will follow, therefore, that imports will be the attractees in the market of that size at 3 times. 4% per year.

By Type, Synthetic chemicals segment held the largest in 2023

- The market is divided into synthetic compounds and biologicals according to type.

- The forecast of synthetic products overtakes the biological treatments in sales performance because of their limited time in summarizing diseases and insect pests. Thanks to the presence of many automated screening devices, the spaces occupied by the workers at this stage are much less, due to a labor shortage.

- While synthesized fungicides and insecticides are applied to seeds and seedlings to avert fungal and insect diseases, they may affect beneficial organisms. Large expenditure incurred on the genetically modified seed beds covers creditably for the development of chemical chemicals.

- In order to make the seeds resistant to the chemicals used to induce resistance, they are impregnated with specific reagents such as salicylic acid, jasmonic acid etc during various growth phases.

- Considering that these treatments are made up the renewable resources like widely-occurring active compounds destined to counter soil-borne pathogens, alleviate abiotic stress, and stimulate plant growth, the biological component is theorized to show the impressive development.

Seed Treatment Market Regional Insights:

Active Key Players in the Seed Treatment Market

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Bayer AG (Germany)

- UPL ltd. (India)

- Corteva Agriscience (U.S.)

- NuFarm Ltd. (Australia)

- FMC Corporation (U.S.)

- Sumitomo Chemical Co. Ltd. (Japan)

- Croda Int. PLC (U.K.)

- Germain's Seed Technology, Inc. (U.S.)

- Other Key Players

Key Industry Developments in the Seed Treatment Market:

- BASF and Poncho Votivo partnered with the movie site to promote their products by staging a marketing event at Field of Dreams Movie Site, a cornfield which is famous in the United States, in August 2022. The nematode-resist and multi-insect-control features make Poncho Votivo a performance crop yielding protector.

- Regarding the UPL Ltd. , the global company of sustainable agriculture products and solutions and the seed and plant health sector, it introduced a technology-driven and seed treatment product called Electron 3-WM three-way mix in its product line in October 2021. Economic benefits arise from tools’ applicability in reducing the costs of initial foliar applications by replacing them with seed applications, thus diminishing the production expenses.

- In March 2021 Syntegna launched Vayantis fungicide, a seed treatment for maize for which there is no other alternative. Even a fungicide Picarbatex a particular as part of the product’s technology and was purposely used to combat important blight and leaf muscular diseases. Following the introduction of this product, producers using the crop will effectively defend themselves from the root pathogen of the fungal species Pythium.

- BASF expanded its range of treatments for soybean seeds in October 2020 through the introduction of three novel products: Vault IPLP, Poncho XC and Relenya are the next quality skincare. Soybean producers are now able to manage soybean pests thereby enhancing their productivity through insect and disease safeguarding.

- In May 2020, BASF held a fungicide demonstration targeting Chinese customers, introducing them to the Melyra brand. From the mentioned product above, Kemira has designed three new products responding to the needs of the Chinese market on the basis of their existing fungicide Revysol.

|

Global Seed Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2024–32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 13.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application Technique |

|

||

|

Stage of Seed |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SEED TREATMENT MARKET BY TYPE (2017-2032)

- SEED TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SYNTHETIC CHEMICALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIOLOGICALS

- SEED TREATMENT MARKET BY FUNCTION (2017-2032)

- SEED TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEED PROTECTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEED ENHANCEMENT

- SEED TREATMENT MARKET BY APPLICATION TECHNIQUE (2017-2032)

- SEED TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEED DRESSING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEED COATING

- SEED PELLETING

- SEED TREATMENT MARKET BY STAGE OF SEED (2017-2032)

- SEED TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-FARM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFF-FARM

- SEED TREATMENT MARKET BY CROP TYPE (2017-2032)

- SEED TREATMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CEREALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OILSEEDS

- FRUITS & VEGETABLES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SYNGENTA AG (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BASF SE (GERMANY)

- BAYER AG (GERMANY)

- UPL LTD. (INDIA)

- CORTEVA AGRISCIENCE (U.S.)

- NUFARM LTD. (AUSTRALIA)

- FMC CORPORATION (U.S.)

- SUMITOMO CHEMICAL CO. LTD. (JAPAN)

- CRODA INT. PLC (U.K.)

- GERMAIN'S SEED TECHNOLOGY, INC. (U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL SEED TREATMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Application Technique

- Historic And Forecasted Market Size By Stage of Seed

- Historic And Forecasted Market Size By Crop Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Seed Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2024–32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 13.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application Technique |

|

||

|

Stage of Seed |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001: EXECUTIVE SUMMARY

TABLE 002. SEED TREATMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SEED TREATMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SEED TREATMENT MARKET COMPETITIVE RIVALRY

TABLE 005. SEED TREATMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. SEED TREATMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. SEED TREATMENT MARKET BY TYPE

TABLE 008. CHEMICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 009. BIOLOGICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 010. PHYSICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 011. SEED TREATMENT MARKET BY APPLICATION

TABLE 012. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

TABLE 013. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER CROPS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA SEED TREATMENT MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA SEED TREATMENT MARKET, BY APPLICATION (2016-2028)

TABLE 017. N SEED TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE SEED TREATMENT MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE SEED TREATMENT MARKET, BY APPLICATION (2016-2028)

TABLE 020. SEED TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC SEED TREATMENT MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC SEED TREATMENT MARKET, BY APPLICATION (2016-2028)

TABLE 023. SEED TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SEED TREATMENT MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA SEED TREATMENT MARKET, BY APPLICATION (2016-2028)

TABLE 026. SEED TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA SEED TREATMENT MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA SEED TREATMENT MARKET, BY APPLICATION (2016-2028)

TABLE 029. SEED TREATMENT MARKET, BY COUNTRY (2016-2028)

TABLE 030. BAYER: SNAPSHOT

TABLE 031. BAYER: BUSINESS PERFORMANCE

TABLE 032. BAYER: PRODUCT PORTFOLIO

TABLE 033. BAYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. Syngene: SNAPSHOT

TABLE 034. SYNGENTA: BUSINESS PERFORMANCE

TABLE 035. SYNGENTA: PRODUCT PORTFOLIO

TABLE 036. SYNGENTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BASF: SNAPSHOT

TABLE 037. BASF: BUSINESS PERFORMANCE

TABLE 038. BASF: PRODUCT PORTFOLIO

TABLE 039. BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DOWDUPONT: SNAPSHOT

TABLE 040. DOWDUPONT: BUSINESS PERFORMANCE

TABLE 041. DOWDUPONT: PRODUCT PORTFOLIO

TABLE 042. DOWDUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NUFARM: SNAPSHOT

TABLE 043. NUFARM: BUSINESS PERFORMANCE

TABLE 044. NUFARM: PRODUCT PORTFOLIO

TABLE 045. NUFARM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. FMC: SNAPSHOT

TABLE 046. FMC: BUSINESS PERFORMANCE

TABLE 047. FMC: PRODUCT PORTFOLIO

TABLE 048. FMC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ARYSTA LIFESCIENCE: SNAPSHOT

TABLE 049. ARYSTA LIFESCIENCE: BUSINESS PERFORMANCE

TABLE 050. ARYSTA LIFESCIENCE: PRODUCT PORTFOLIO

TABLE 051. ARYSTA LIFESCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SUMITOMO CHEMICAL: SNAPSHOT

TABLE 052. SUMITOMO CHEMICAL: BUSINESS PERFORMANCE

TABLE 053. SUMITOMO CHEMICAL: PRODUCT PORTFOLIO

TABLE 054. SUMITOMO CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. UPL: SNAPSHOT

TABLE 055. UPL: BUSINESS PERFORMANCE

TABLE 056. UPL: PRODUCT PORTFOLIO

TABLE 057: UPL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057: INCOTEC: SNAPSHOT

TABLE 058: INCOTEC: BUSINESS PERFORMANCE

TABLE 059. INCOTEC: PRODUCT PORTFOLIO

TABLE 060. INCOTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. GERMAINS: SNAPSHOT

TABLE 061. GERMAINS: BUSINESS PERFORMANCE

TABLE 062. GERMAINS: PRODUCT PORTFOLIO

TABLE 063. GERMAINS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001: YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SEED TREATMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SEED TREATMENT MARKET OVERVIEW BY TYPE

FIGURE 012. CHEMICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOLOGICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. PHYSICAL SEED TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 015. SEED TREATMENT MARKET OVERVIEW BY APPLICATION

FIGURE 016. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

FIGURE 017. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER CROPS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA SEED TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE SEED TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC SEED TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA SEED TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA SEED TREATMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Seed Treatment Market research report is 2024–2032.

Syngenta AG (Switzerland) BASF SE (Germany) Bayer AG (Germany) UPL Ltd. . (India) Corteva Agriscience (U.S.) NuFarm Ltd. (Australia) FMC Corporation (U.S.) and Sumitomo Chemical Co. Ltd. (Japan) Croda Int. PLC (U.K.), Germain's Seed Technology, Inc. (U.S.), and Other Major Players.

The Seed Treatment Market is segmented into type, function, application technique, stage of seed, crop type, and region. By type, the market is categorized into Synthetic Chemicals, Biologicals. By function, the market is categorized into Seed Protection, and Seed Enhancement. By application technique, the market is categorized into Seed Coating, Seed Dressing, and Seed Pelleting. By stage of seed, the market is categorized into On-Farm, and Off-Farm. By crop type, the market is categorized into Cereals, Oilseeds, Fruits and Vegetables, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In agricultural practice, seed treatment is crucial for improving the quality and efficacy of seeds prior to sowing. Seed protection entails the administration of an extensive variety of coatings and treatments to shield them from environmental stresses, pests, and diseases. In addition to fungicides and insecticides, it may also include micronutrients or growth promoters. By forming a barrier around the seed, it effectively safeguards against potential hazards that may impede germination and early plant development. Furthermore, it delivers protection precisely where it is needed, thereby reducing the environmental impact of chemical usage. Additionally, it frequently demonstrates enhanced uniformity and vitality, which may lead to more robust plants and potentially greater agricultural harvests.

Seed Treatment Market Size Was Valued at USD 6.5 Billion in 2023, and is Projected to Reach USD 13.5 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.