Running Gear Market Synopsis

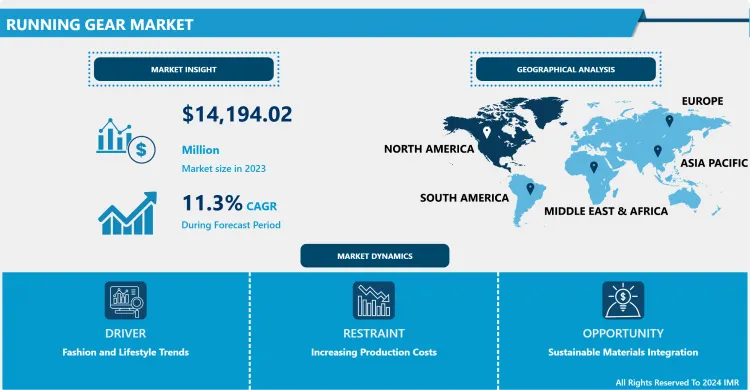

Running Gear Market Size Was Valued at USD 14,194.02 Million in 2023, and is Projected to Reach USD 37,201.62 Million by 2032, Growing at a CAGR of 11.30% From 2024-2032.

The term Running gear in this context encompasses all garments and accessories that are used by runners while performing their activities due to its functionality in improving on the experience, support, comfort and safety. This may consist of moisture management clothing, proper footwear, water storage in vests or belt, foot pod to measure distance and speed, reflective clothing for night use, and flex banners or sock for muscles struggle. Choosing the appropriate shoe can be beneficial in getting the most out of every run, so that they can reduce the chances of injury and improve the overall running experience.

The running gear market is relatively large and has been progressing notably in the past ten years this is because of various reasons such as: health consciousness, improvement in technology, and workout wear culture. Reflecting the specific targeted sport, this market involves, for example, footwear, clothing, accessories, and even technological devices that could be used in running.

Shoes are perhaps the most vital category in the running gear market, as frequent changes in design and type of materials used for the production help to create a large demand among consumers. Many footwear companies have committed their resources in research and development processes to design and produce running shoes with comfort, support and performance that meet the needs of athletes or people nucleating in this activity. For casual barefootish running shoes to maximalistic shoes with extreme cushioning, running shoe manufactures have given consumers many choices. Furthermore, advancements in the use of environmentally friendly and green materials have also contributed to the product innovation, where many firms in the footwear industry have embraced the recycling of materials in the production of their shoes in order to market their products to the environmentally astute consumers.

Similarly, the segment of the apparel focused on running has also had an opportunity to develop due to the fashion and function aspects. Microfiber fabrics that strictly control the movements of moisture, temperature, and compressive strengths have become common in running clothing. Also, the development of reflective elements to increase visibility while exercising in the dark as well as the integration of pockets for the storage of items such as keys and mobile phones has further improved the prospect of running clothes.

When referring to the running gear market, it’s not only narrowly limited to footwear and apparels but also comprehensive range of products for running. This touches on items such as hydration packs, running belts, compression sleeves as well as GPS watches. Technology that a person may wear and carry has also increased its level, smartwatches with GPS for distance tracking, plus heart rate monitor with information on personalized training. In addition to offering key performance indicators directly relatable to the runners, these devices also act as motivational objects that can assist the user in setting the desired exercise targets.

As a result, the advancement of medical technology plays a great role in influencing the provision of healthcare services to the patients. Yet, as restrictions gradually started to be lifted and attention was paid to the practice of outdoor activities, the desire for wear appropriate for jogging returned as well. Coronavirus lockdown restrictions also impacted regular exercise facilities like gyms as well as fitness centers where people had to minimize their training, thus running appeals to be an easy and accessible way of training. This change of attitude towards the practice of performing fitness activities in outdoors is likely to continue having an impact on the market, and the prospects look set to improve in the numerous future years.

Moving forward, several trends can be incorporated into the running gear market at large. As the usage of advanced technologies such as incorporation of Artificial intelligence and machine learning algorithms in the wearable devices in running gears are expected to enhance the performance tracking in the coming years. Furthermore, the current trend of sustainability and ethical manufacturing practices is set to receive further focus, thus putting pressure on firms to use environmentally friendly resources and manufacturing techniques. Pertinently, given the dynamics of the fitness landscape, there is an increased emphasis on creating individualized approaches to training and coaching, which can culminate in hi-tech customized running apparels functional to the unique requirements of every individual. In its totality, the outlook for the running gear market remains cautiously optimistic due to various factors, including product development, shift in people’s life, coupled with the discovery of the value of exercise.

Running Gear Market Trend Analysis

Technology Integration Enhances Performance and Experience

- The use of technology has sparked a major evolution in running gear particularly by improving the wearer’s experience as well as the technology’s functionality. technology ranging from superior materials used in making athletes’ wears to the presence of sensors and smart connectivity has changed the world of running for the better. Contemporary fabrics and materials used in the designing of sleeved shirts for athletes to wick away moisture, increase breathability, and enhance durability have made it possible for athletes to perform to the optimum level without worrying about the next stage and the pains involved due to wear and tear. Use of implantable sensors and wearable gadgets are urge specific information concerning various aspects such as pulse, speed, cadence and even gait to the runners with a view of enabling them to make wise decision making when it comes to the training and the way they run.

- Also, the GPS tracking and route planning capabilities allow runners to discover new routes without compromising their safety or drainage, which will also help measure their efficiency in completing the path. Additionally, the growth in the smart coaching platforms and the virtual training programs which makes use of the data analytics and artificial intelligence makes coaching to be more individualized because it provides the runner with advice, feedback, and schedules to enhance their likelihood of getting to the set goals in the shortest time possible. In general, the idea of applying technology on running gears is not only beneficial in accumulating more data and improving performance but also offers a better approach and a tool to motivate every occasional and professional runner in the field.

Sustainable Materials Integration

- That regard, the use of sustainable materials in the running gear market is the right approach towards promoting environmental values within the athletic sector. This shift is due to the rising concern of the environment through the awareness of environmental consequences of conventional manufacturing processes and products. Through the use of recycled materials like recycled polyester, more environmentally friendly natural fibers like organic cotton, and environment-friendly man-made fibers, the manufacturers of running gears can decrease on their use of raw material that has been deemed scarce hence slashing the production’s carbon footprint.

- Further, embracing sustainability in the materials is done to respond to the changing market inclination where many people are now conscious of the environment. This proved not only an adherence to sustainable design, but an efficient conceptual tool for market differentiation as well. Moreover, the use of sustainable materials can in some ways optimize performance and endurance of running gear, thus, there is no concern about using eco-friendly fabrics. What this means is that consumers are slowly developing a consciousness about the kind of product they wish to spend their money on, and so the brands focusing on sustainability are set for future growth in both market share and public perception. Altogether, the appearance of sustainable materials within the running gear market exemplifies a shift for the better of being environmentally friendly and ethically produced for the benefit of consumers and the nature surrounding the production of the product.

Running Gear Market Segment Analysis:

Running Gear Market Segmented based on By Type and By Dustribution Channel.

By Type, Running Footwears segment is expected to dominate the market during the forecast period

- The market of running gears is a vibrant market place that is reared up by various aspects, escalating the running apparels and running footwear of the market. A/R apparels consist of moisture-wicking T-shirts, breathable athletic shorts, compression tights, and rain-resistant superior wearing apparels mostly meant for running, to make their outfit comfortable and suited for any climatic condition/terrain they are going to be exposed to. These apparels often employ tact technologies such as moisture management, thermal regulation, and anti-odour technologies thus serving a variety of athletes needs. On the other hand, running footwear refers to the type of footwear that are specifically designed for running sports and hence they have specialized features that help the runner in case of support, cushioning and traction among others. Fashion-inspired minimal shoes for barefoot activity to protect feet during natural movement to high cushioned shoes for protection during long distance; in the footwear sector, innovation is consequent with performance elements. In both segments, there is a trend in the sense that more eco-friendly and sustainably sourced components are being used in the manufacturing of clothing and accessories, evidence of the rising consciousness of buyers when it comes to the responsibly made merchandise.

- Furthermore, it also discussed the influence of smart textile and wearable technology integration which again has made changes such as the moisture-sensing shirts, GPS-enabled watches, biomechanics-tracking insoles etc. In conclusion, extant literature indicates that the running gear market remains dynamic and is spurred by technological innovation, changing customer preferences and demands, and quest for improved athletic performance.

By Distribution Channel , Online Sale Segment held the largest share in 2023

- In case of Running Gear Market, distribution channels are always of significant importance due to the variations in consumer needs and buying attitudes. Online sales channels have also posted strong growth, as such procurement opportunities let the shoppers browse and make purchases in the comfort of their homes. This can be attributed to increased use of the interment as well as other mobile applications that make it easier for consumers to purchase running gear products. Furthermore, this type of channels offers a rich setting for brands to reach their target consumers by so personalized communication and smooth purchasing processes for targeted consumers. On the other hand, while online sales platforms are developed as the engine for sales growth, the offline ones including specialty running stores or stores for sports apparels, accessories and department stores are still significant for customers who prefer touch and feel or seek advice on choosing good and appropriate sizes from sales staff. These offline modes are also important for the branding and customer acquaintance with the brand through boastful advertisements, seasonal sales, and product demonstrations within the stores.

- Also, partnerships with the brick and mortar stores allow brands to open new markets that are within a particular region. In conclusion, the essential channels for the distribution that should be adopted by running gear brands are both online and offline channels because they would combine to nurture the market, communicate with the targeted audience, and create sales and brand reputation in the contemporary marketplace.

Running Gear Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Regarding the geographical analysis of the running gear market, North America is likely to exhibit considerable dominance over the course of the forecast period for several reasons. Increased economic development the awareness levels and disposable income in the specified region the preference for healthy lifestyle and workouts demands an array of apparels and accessories essential for running and related activities. In addition, North America has a very developed sporting environment and framework and experiencing ever growing number of Marathons, races and fitness events to name a few this perpetually increases the demand for running wears for participants who are enthusiasts and professional athletes.

- Moreover, growing consciousness about health and the need for consuming balanced, healthy diets, combined with the prevalence of the problem of obesity and diseases relatable to it, acts as a catalyst for boosting the sales of running apparel across the region. In addition, changing technologies and trends as well as advancement in materials, designs and functionality of running gear products remain a reason that appeals the consumers hence expanding the market’s pattern in the future. Altogether, said factors throw North America into strong light of the running gear industry during the forecast period and holds a sturdy assurance as well as large potential for the market participants to establish their authority and revenues in the region’s thriving market.

Active Key Players in the Running Gear Market

- Adidas Group (Germany)

- Nike (United States)

- New Balance (United States)

- ASICS (Japan)

- SKECHERS USA (United States)

- Garmin (United States)

- VF Corporation (United States)

- The Rockport Group (United States)

- Puma (Germany)

- Newton Running (United States)

- Berkshire Hathaway (United States)

- Columbia Sportswear Company (United States)

- British Knights (Netherlands)

- Amer Sports (Finland)

- Fitbit (United States)

- Under Armour (United States)

- Wolverine World Wide (United States)

- Other Key Players

Key Industry Developments in the Running Gear Market

- October, 2021: Manufacturers of running equipment continue to invest in research and development to create innovative materials that enhance performance, comfort, and sustainability. This includes the use of lightweight, moisture-wicking fabrics, breathable meshes, and eco-friendly materials such as recycled polyester and nylon. Running equipment is increasingly incorporating advanced technologies and features to improve functionality and user experience. This includes the integration of wearable technology such as GPS tracking, heart rate monitoring, and activity tracking into running shoes, apparel, and accessories.

|

Global Running Gear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 15,797.94 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.30% |

Market Size in 2032: |

USD 37,201.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Running Gear Market by Type (2018-2032)

4.1 Running Gear Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Running Apparels

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Running Footwears

Chapter 5: Running Gear Market by Distribution Channel (2018-2032)

5.1 Running Gear Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online Sale

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline Sale

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Running Gear Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADIDAS GROUP (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NIKE (UNITED STATES)

6.4 NEW BALANCE (UNITED STATES)

6.5 ASICS (JAPAN)

6.6 SKECHERS USA (UNITED STATES)

6.7 GARMIN (UNITED STATES)

6.8 VF CORPORATION (UNITED STATES)

6.9 THE ROCKPORT GROUP (UNITED STATES)

6.10 PUMA (GERMANY)

6.11 NEWTON RUNNING (UNITED STATES)

6.12 BERKSHIRE HATHAWAY (UNITED STATES)

6.13 COLUMBIA SPORTSWEAR COMPANY (UNITED STATES)

6.14 BRITISH KNIGHTS (NETHERLANDS)

6.15 AMER SPORTS (FINLAND)

6.16 FITBIT (UNITED STATES)

6.17 UNDER ARMOUR (UNITED STATES)

6.18 WOLVERINE WORLD WIDE (UNITED STATES)

6.19 OTHER KEY PLAYERS

Chapter 7: Global Running Gear Market By Region

7.1 Overview

7.2. North America Running Gear Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Running Apparels

7.2.4.2 Running Footwears

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Online Sale

7.2.5.2 Offline Sale

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Running Gear Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Running Apparels

7.3.4.2 Running Footwears

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Online Sale

7.3.5.2 Offline Sale

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Running Gear Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Running Apparels

7.4.4.2 Running Footwears

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Online Sale

7.4.5.2 Offline Sale

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Running Gear Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Running Apparels

7.5.4.2 Running Footwears

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Online Sale

7.5.5.2 Offline Sale

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Running Gear Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Running Apparels

7.6.4.2 Running Footwears

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Online Sale

7.6.5.2 Offline Sale

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Running Gear Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Running Apparels

7.7.4.2 Running Footwears

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Online Sale

7.7.5.2 Offline Sale

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Running Gear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 15,797.94 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.30% |

Market Size in 2032: |

USD 37,201.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||