Rotational Moulding Powders Market Synopsis

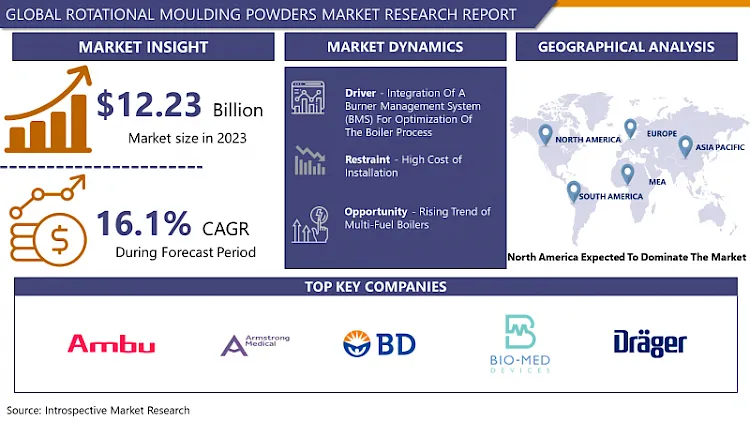

Rotational Moulding Powders Market Size Was Valued at USD 12.23 Billion in 2023 and is Projected to Reach USD 63.18 Billion by 2032, Growing at a CAGR of 16.1% From 2024-2032.

The rotational molding employs specialised material, which is usually powders; which also can be termed rotomolding or rotational molding powders. The process involves heating a mold with bits and pieces of the material while rocking it slowly around in multiple axes at the same time. The powder melts and applies a layer to the interior space of the mold, that solidifies with the rotation of the mold producing the required shape. This technique of the rotational molding has several advantages, including the ability of making huge, hollow, homogeneous pieces and complex structures with same wall thickness. Besides the recoloration additives, UV stabilizers, and flame-retardant additives, the rotational molding powders are mainly made from thermoplastic polymers such as polyethylene, polypropylene, and PVC. Such compounds are used in the formulation of the powder to attain improved performance properties of the final end product.

- The powders for rotational molding have to be tailored in such a way that the final items acquire desired properties with respect to both thermal performance, mechanical characteristics, and physical appearances. Manufacturers apply attention to detail while making their selection of raw materials and additives through the consideration of factors such as the end-use applications, the desired characteristics of the product, and the process requirements. For instance, powder HDPE (high-density polyethylene) containers are aimed at protection against high chemical aggression and performance at impact.

- However, PVC powders appear to provide advantages for use in vehicle and entertainment amusement equipment that are characterized by the need for exquisite ignition prevention. Of course, the composition of rotational molding powders has to find a good balance between the implications for processing, the material properties, and the economic efficiency for the needs that the diverse sectors such as automotive, aerospace, consumer products, and leisure equipment imply.

Rotational Moulding Powders Market Trend Analysis

Rising Demand for Hollow Plastic Products

- The rotational molding employs specialised material, which is usually powders; which also can be termed rotomolding or rotational molding powders. The process involves heating a mold with bits and pieces of the material while rocking it slowly around in multiple axes at the same time. The powder melts and applies a layer to the interior space of the mold, that solidifies with the rotation of the mold producing the required shape.

- This technique of the rotational molding has several advantages, including the ability of making huge, hollow, homogeneous pieces and complex structures with same wall thickness. Besides the recoloration additives, UV stabilizers, and flame-retardant additives, the rotational molding powders are mainly made from thermoplastic polymers such as polyethylene, polypropylene, and PVC. Such compounds are used in the formulation of the powder to attain improved performance properties of the final end product.

- The powders for rotational molding have to be tailored in such a way that the final items acquire desired properties with respect to both thermal performance, mechanical characteristics, and physical appearances. Manufacturers apply attention to detail while making their selection of raw materials and additives through the consideration of factors such as the end-use applications, the desired characteristics of the product, and the process requirements. For instance, powder HDPE (high-density polyethylene) containers are aimed at protection against high chemical aggression and performance at impact.

- However, PVC powders appear to provide advantages for use in vehicle and entertainment amusement equipment that are characterized by the need for exquisite ignition prevention. Of course, the composition of rotational molding powders has to find a good balance between the implications for processing, the material properties, and the economic efficiency for the needs that the diverse sectors such as automotive, aerospace, consumer products, and leisure equipment imply.

Innovation in Rotational Molding Techniques

- The market for rotational molding granules comes into prominence along with the growth of rotational molding techniques. As a result of technology advancements such as improved mold design, process automation, and control systems, the rotational molding process has been revolutionized and now features augmented capability and increased efficiency.

- Such improvements provide the basis for manufacturing finished goods with tighter tolerances, more sophisticated geometries, and high quality levels. Hence, the demand for rotational moulding materials that can withstand these advanced moulding methods' performance requirements has been on the rise.

- Also, the emergence of revolutionary rotational molding methods as technology gives rise to demand for the newly developed rotational molding granules which, in turn, brings new markets and new applications of hollow plastic products. More industries, such as aerospace, healthcare, and electronics, are incorporating rotational molding into their production process, which helps to create customized, lightweight, and durable components.

- The incorporation of rotational moulding granules is of fundamental importance in the production process of these specific products, as they offer the needed material characteristics and processable attributes. Through creating formulations that are tailored to the specific needs of the different applications manufacturers of rotational moulding powders enable themselves to increase their market share and stimulate the growth of rotational moulding powders market.

Rotational Moulding Powders Market Segment Analysis:

Rotational Moulding Powders Market is Segmented on the basis of Product, Application, and End User.

By Type, the polyethylene segment is expected to dominate the market during the forecast period

- The biggest contribution to the type of polyethylene segment for rotational molding powders is its ability to lead the market. When it comes to the rotational molding, polyethylene covers a wide range of advantages from its high resistance to damage and chemicals as well as from its processing flexibility. It finds its greatest application in the manufacture of hollow plastic items, such as containers, recreational equipment, car parts and reservoirs.

- In addition to this, the rotational moulding powders made of polyethylene are available in various categories, such as LDPE, HDPE and LLDPE, thus making them user-friendly to a multitude of applications. Instability of polyethylene is also due to the fact that its costs are relatively low compared to other materials. This feature is, therefore, a favorite option for manufacturers who are looking for alternatives with a possibility to maintain excellence and functionality without compromising on cost.

- Although polyethylene occupies the leading place among the rotation molding powders market, polycarbonate and PVC plastisol also manage to secure considerable contributions, although not as versatile as the main actor. Its astonishing temperature resistance, impact resistance, and transparency properties make polycarbonate perfect for high-end applications, such as clear viewports, lamps, and medical equipment housings.

- Unlike the hard PVC that comes as a sheet of material, PVC plastisol is a liquid state of PVC that solidifies when exposed to heat. The characteristics of PVC plastisol include the flexibility, durability, and resistance to flames. It is used in products that may require heat and/or sound insulation and also soft touch surfaces. The material also provides protection properties. However, these segments do not aim to imitate the dominance of polyethylene in terms of market share. They target certain sectors and applications where the unique properties of these emerging materials are of utter importance. Furthermore, they contributes to the widening as well as the range of the rotational moulding powders market as a whole.

By Applications, Consumer Good segment held the largest share

- Consumer goods industry holds a key market segment in the rotational molding materials industry. This part of the interior design process is subdivided into commonplace items mainly including storage tanks, bins, containers, furniture, games, and recreation equipment. With the wide range of hollow large porous items of various design complexities and uniform wall thickness, rotational molding is suitable for consumers in many industries with their ever-evolving needs.

- In addition to this, polyethylene is broadly used in consumer products rotational molding due to chemical resistance, impact resistance and cost-effectiveness. Finally, rotational moulding powders are characterized by adaptability that enables manufacturing processes that involve personalization with product specifics.

- While the cylinders of the rotational moulding granules are used in the consumer goods segment, the sectors of aircraft parts and auto parts also play important roles. Automotive industry uses rotational molding in fabrication of different parts particularly interior trims and fueltanks and bumpers. Concurrently, within the area of aircraft parts, it makes rotational molding that results in the production of durable and lightweight components such as interior panels, fairings, and ducting.

- On the contrary, these industries may not grab a large market share like the consumer goods market, but they are the pillars of the economy that need excellent materials and processing to adhere with strict safety, durability, and regulatory standards. In general, the existence of consumer goods implies the intensive operation and assimilation of rotational molding materials in many businesses.

Rotational Moulding Powders Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the most significant share of the rotational moulding powders marketplace due to a number of factors. Firstly, the industry of rotational molding in this region has developed into a strong and steady part of the business infrastructure and manufacturing base. Based on a tradition of innovation and expertise in rotational molding, the North American industry can pride itself with excellence in technology, a highly qualified labor force and stable supply networks. These guidelines allow makers to produce the numerous hollow plastic things swiftly and at lower cost with the application of rotational molding dusts.

- Moreover, lots of different industries are based in North America where rotational molding is used extensively for manufacture of a lot of products and smaller components. Among the sectors with a significant impact on the demand for rotational molding granules re the subsectors of consumer goods, construction, aerospace and automotive which are the biggest consumers in the region. These industries rely on the advantages which rotational molding offers including the ability to produce elaborate parts, continuous uniform thickness, and streamlined design. Therefore, this situation suggests that the rotational moulding powder manufacturers of North America constantly devote their resources into the R&D of introducing new materials and processes which eventually strengthens the market presence of the region.

- Moreover, North America benefits from the regulatory framework that supports the manufacturing of durable and high-quality plastic products as well as the market demand for them. The sustainable and environmental preservation perspective of the region only supports the formulation of the rotational moulding, which is beneficial in the manufacturing of recyclable and environmentally friendly goods. It is the result of the diverse industrial landscape, supportive market conditions and the overall leadership in rotational molding technologies, that North America holds the role as the leader of rotational molding powders.

Active Key Players in the Rotational Moulding Powders Market

- BASF (Ludwigshafen, Germany)

- Phychem Technologies (Missouri, USA)

- Reliance Industries (Mumbai, India)

- SABIC (Riyadh, Saudi Arabia)

- DowDuPont (Midland, Michigan, USA)

- Chevron Phillips Chemical (The Woodlands, Texas, USA)

- D&M Plastics (Burlington, Ontario, Canada)

- ExxonMobil (Irving, Texas, USA)

- EcoPolymers (Atlanta, Georgia, USA)

- Pacific Poly Plast (Mumbai, India)

- Lyondell Basell (Houston, Texas, USA)

- GreenAge Industries (Indiana, USA)

- Matrix Polymers (Liverpool, UK)

- Petrotech Group (Johannesburg, South Africa)

- Other Major Players

|

Global Rotational Moulding Powders Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.1% |

Market Size in 2032: |

USD 63.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ROTATIONAL MOULDING POWDERS MARKET BY TYPE (2017-2032)

- ROTATIONAL MOULDING POWDERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYETHYLENE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYCARBONATE

- PVC PLASTISOL

- ROTATIONAL MOULDING POWDERS MARKET BY APPLICATION (2017-2032)

- ROTATIONAL MOULDING POWDERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSUMER GOODS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTO PARTS

- AIRCRAFT PARTS

- MILITARY SUPPLIES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Rotational Moulding Powders Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BASF (LUDWIGSHAFEN, GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PHYCHEM TECHNOLOGIES (MISSOURI, USA)

- RELIANCE INDUSTRIES (MUMBAI, INDIA)

- SABIC (RIYADH, SAUDI ARABIA)

- DOWDUPONT (MIDLAND, MICHIGAN, USA)

- CHEVRON PHILLIPS CHEMICAL (THE WOODLANDS, TEXAS, USA)

- D&M PLASTICS (BURLINGTON, ONTARIO, CANADA)

- EXXONMOBIL (IRVING, TEXAS, USA)

- ECOPOLYMERS (ATLANTA, GEORGIA, USA)

- PACIFIC POLY PLAST (MUMBAI, INDIA)

- LYONDELL BASELL (HOUSTON, TEXAS, USA)

- GREENAGE INDUSTRIES (INDIANA, USA)

- MATRIX POLYMERS (LIVERPOOL, UK)

- PETROTECH GROUP (JOHANNESBURG, SOUTH AFRICA)

- COMPETITIVE LANDSCAPE

- GLOBAL ROTATIONAL MOULDING POWDERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Rotational Moulding Powders Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.23 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.1% |

Market Size in 2032: |

USD 63.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Rotational Moulding Powders Market research report is 2024-2032.

BASF, Phychem Technologies, Reliance Industries, SABIC, DowDuPont, Chevron Phillips Chemical, D&M Plastics, ExxonMobil, EcoPolymers, Pacific Poly Plast, Lyondell Basell, GreenAge Industries, Matrix Polymers, Petrotech Group, Perfect Poly Plast, Shivalik Polyadd Industries and Other Major Players.

The Rotational Moulding Powders Market is segmented into Type, Application, and region. By Type, the market is categorized into Polyethylene, Polycarbonate, PVC Plastisol. By Application, the market is categorized into Consumer Goods, Auto Parts, Aircraft Parts, Military Supplies, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Rotational moulding powders are specialized materials used in the rotational molding process to create hollow plastic products. By being heated within a rotating mold, these powders, which are typically thermoplastic polymers such as polyethylene, saturate the interior surface and solidify into the desired shape.

Rotational Moulding Powders Market Size Was Valued at USD 12.23 Billion in 2023 and is Projected to Reach USD 63.18 Billion by 2032, Growing at a CAGR of 16.1% From 2024-2032.