Robotic Paint Booth Market Synopsis

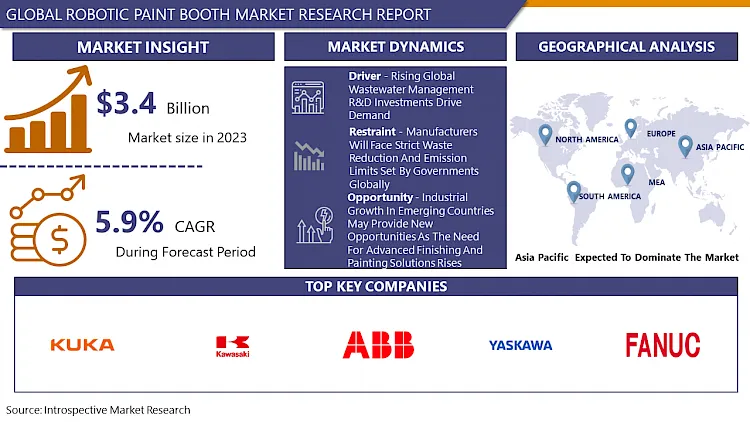

Robotic Paint Booth Market Size Was Valued at USD 3.4 Billion in 2023, and is Projected to Reach USD 5.7 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.

A robotic paint booth is an automated apparatus designed to execute a range of painting procedures, including priming, glazing, and finishing. Additionally, it can be utilized to discharge solvents, powders, and water. This product can cover recesses, curves, complex parts, and shapes of any dimension effectively. It finds extensive applicability in the automotive industry. However, it finds applicability in sectors beyond automotive, including aerospace, defense, and military. In environments designed specifically for the safe and efficient operation of booths and paint machines, these systems are implemented. They are explosion-proof robotic limbs that are a component of paint automation and guarantee the safe and effective application of coatings with minimal risk to end users.

- Demand for robotic painting booths is at an all-time high as major manufacturers implement efficiency-enhancing management tools like Six Sigma. The efficacy with which a robot painting studio executes intricate designs and patterns increases the range of potential applications. It contributes to increased cost and time efficiency, waste reduction, decreased training expenses, and fewer manufacturing defects, all of which are significant growth drivers for the industry. The robotics paint booth market is principally bolstered by the expanding use of automation and robotics technology across numerous industries. The substantial financial, time, and resource demands for robotic technology R&D continue to impede the market's expansion. Global defense expenditures have increased due to the shifting dynamics of global forces. This represents a positive indicator for the market's growth in robot painting booths over the period of forecast.

- One of the primary drivers of market expansion is the increasing implementation of automated production technology in diverse sectors, which is complemented by the expanding use of robotics. This equipment reduces the likelihood of errors while increasing the overall efficiency and cost-effectiveness of the process. In addition, a substantial surge in product demand can be attributed to the fact that mechanized paint booths are extremely customizable and require minimal training. Moreover, rising expenditures in the automotive and defense sectors are an additional significant growth driver. Various components within the defense industry are camouflaged with the aid of this technology. It is utilized in the automotive industry to paint the interiors and exteriors of vehicles in a manner that is consistent and of high quality, without producing any debris. Furthermore, market expansion is aided by technological developments such as auto-learning programming, which empowers robotics to accurately replicate the operator's movements while painting by recording and memorizing them.

Robotic Paint Booth Market Trend Analysis

Advancements in robotic paint booth technology will stimulate market expansion.

- Prominent organizations, including ABB Ltd., KUKA AG, Durr Group, and Yaskawa Electric Corporation, are involved in the provision of products that incorporate cutting-edge technologies, including the Internet of Things. Furthermore, the increasing adoption of industry 4.0 practices serves as the most recent market trend. By integrating machine learning algorithms and Artificial Intelligence (AI), these apparatuses aim to optimize paint usage, enhance the quality of paint application, and minimize waste. Predictive maintenance can be facilitated by these technologies, thereby ensuring the robots function optimally and experience minimal periods of inactivity.

Increasing Automotive Sector Utilization of Robotics and Automated Production Methods to Fuel Market Expansion

- Automobile, construction, and aerospace are a few of the many sectors that employ robotic coating booths. Consequently, the foremost enterprises in this industry have established production facilities in diverse geographical areas, with particular emphasis on Malaysia, Mexico, China, and India. The market is primarily propelled by the expanding adoption of automated manufacturing technologies and the utilization of robotics across diverse industries. Automation and robotics have the potential to decrease human error and increase machine performance for a variety of applications. Increasing utilization of these booths in the automotive industry and other related sectors will also contribute to the expansion of the market. For example, as stated in a report by McKinsey, the valuation of the worldwide autonomous vehicle industry will increase to between USD 300 and $400 billion by 2025. These elements will contribute to the expansion of the market.

Robotic Paint Booth Market Segment Analysis:

Robotic Paint Booth Market Segmented based on type, application, and end user.

By type, explosion-proof type segment is expected to dominate the market during the forecast period

- The market share of robotic paint booths is dominated by the explosion-proof type segment, which is anticipated to experience significant growth over the period of the forecast. The reason for this is that these systems offer numerous advantages, including fire resistance and the ability to impede the ignition of combustible substances within the cubicle. This system is also utilized extensively in the aerospace and automotive industries.

- The non-explosion-proof type segment is anticipated to experience substantial growth as the automotive, aerospace, and furniture industries increase their demand for these booths. This category of cubicle is utilized for coating and general painting. When the painting process does not involve the presence of combustible substances, this method is frequently more economical and appropriate. These factors will drive the expansion of the segment.

By application, paint booth segment held the largest share in 2023

- The market is dominated by paint booths, which are anticipated to experience substantial growth over the period of the forecast. This is due to the fact that it can be applied as a coating and a varnish. By containing overspray, fumes, and paint particulates, they guarantee that the painting process remains clean and under control. Paint booths find application in diverse sectors, including aerospace, automotive manufacturing, woodworking, metal fabrication, and others, where environmental control and the production of superior coatings are critical.

- Paint booth robots are anticipated to experience growth potential throughout the period of forecast. Paint booths find application in diverse sectors, including aerospace, automotive manufacturing, woodworking, metal fabrication, and others, where environmental control and the production of superior coatings are critical. In addition, these products are associated with a number of advantages, including safety, efficiency, and precision. All such elements contribute to the expansion of the market.

Robotic Paint Booth Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific is anticipated to maintain its market leadership throughout the forecast period due to the increasing demand for mechanized paint booths in the furniture, aerospace, and automotive industries. A number of nations, including South Korea, China, India, and Japan, have been at the forefront of the region's accelerated industrialization. As a consequence, there has been a surge in the need for sophisticated manufacturing and automation solutions. Moreover, the expansion of the market during the forecast period will be propelled by the expansion of the automotive industries in China, India, and Japan. An example of this can be seen in the 8.5% expansion of South Korea's automotive industry in 2022, as reported by Daxue Consulting, in comparison to 2021. This factor will contribute to the growth of the domestic market.

Active Key Players in the Robotic Paint Booth Market

- ABB Ltd. (Switzerland)

- Yaskawa Electric Corporation (Japan)

- Effort Intelligence Equipment Co. Ltd. (China)

- Staubli International AG (Switzerland)

- Kawasaki Heavy Industry Co. Ltd. (Japan)

- Durr Group (Germany)

- GIFFIN (U.S.)

- Fanuc Corporation (Japan)

- KUKA AG (Germany)

- SAIMA Meccanica S.p.A. (Italy), and Other Key Players

Key Industry Developments in the Robotic Paint Booth Market:

- Durr Group unveiled a novel Industry 4.0 robotic paint booth in September 2022 for the Wuhu, China-based automobile manufacturer Chery Automobiles Co. Ltd. This category of system would be implemented to portray a variety of automobiles and SUV components.

- ABB Ltd. introduced a novel robotic paint booth designed for painting applications in July 2022. Utilizing this eco-friendly system would guarantee the absence of any defects in the product. It is anticipated that this category of product will be utilized to increase production capacity. It reduces air consumption by 20% and increases efficacy and color-changing capability by 10% and 75%, respectively.

- ABB Ltd. unveiled a novel robotic solution designed specifically for automotive applications in February 2022. This application aims to reduce overall production costs by one-third, thereby increasing the sustainability of automotive paint facilities and resulting in cost savings.

- The Durr Group acquired Teamtechnik Maschinen und Analgen GmbH, a provider of assembly and functional test systems, in December 2020. The purpose of the acquisition was to enhance the product portfolio and supply chain of the organization.

- ABB Ltd. introduced PixelPaint, the future of robotic painting, in September 2020. This system has characteristics including increased production capacity and decreased operational expenses. Moreover, this system eliminates paint booth obstructions

|

Global Robotic Paint Booth Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9 % |

Market Size in 2032: |

USD 5.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ROBOTIC PAINT BOOTH MARKET BY TYPE (2017-2032)

- ROBOTIC PAINT BOOTH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXPLOSION PROOF TYPE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-EXPLOSION PROOF TYPE

- ROBOTIC PAINT BOOTH MARKET BY APPLICATION (2017-2032)

- ROBOTIC PAINT BOOTH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PAINT BOOTH

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAINT BOOTH ROBOTS

- ROBOTIC PAINT BOOTH MARKET BY END USER (2017-2032)

- ROBOTIC PAINT BOOTH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-AUTOMOTIVE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ROBOTIC PAINT BOOTH Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB LTD. (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- YASKAWA ELECTRIC CORPORATION (JAPAN)

- EFFORT INTELLIGENCE EQUIPMENT CO. LTD. (CHINA)

- STAUBLI INTERNATIONAL AG (SWITZERLAND)

- KAWASAKI HEAVY INDUSTRY CO. LTD. (JAPAN)

- DURR GROUP (GERMANY)

- GIFFIN (U.S.)

- FANUC CORPORATION (JAPAN)

- KUKA AG (GERMANY)

- SAIMA MECCANICA S.P.A. (ITALY)

- COMPETITIVE LANDSCAPE

- GLOBAL ROBOTIC PAINT BOOTH MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Robotic Paint Booth Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.9 % |

Market Size in 2032: |

USD 5.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Robotic Paint Booth Market research report is 2024-2032.

ABB Ltd. (Switzerland) Yaskawa Electric Corporation (Japan) Effort Intelligence Equipment Co. Ltd. (China) Staubli International AG (Switzerland) Kawasaki Heavy Industry Co. Ltd. (Japan) Durr Group (Germany) GIFFIN (U.S.) Fanuc Corporation (Japan) KUKA AG (Germany) SAIMA Meccanica S.p.A. (Italy), and Other Major Players..

The Robotic Paint Booth Market is segmented into type, application, end user, and region. By type, the market is categorized into explosion-proof type and non-explosion-proof type. By application, the market is categorized into paint booths and paint booth robots. By end user, the market is categorized into automotive and non-automotive sectors. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A robotic paint booth is a mechanized apparatus designed to execute a multitude of painting operations, including the application of primer, base, clear, and finish layers. Additionally, it is employed to spray disperse substances containing water, solvents, and powders. Paint booths can cover intricate components, recesses, curves, and shapes of any size with efficiency. With speed and precision, an effectively programmed robot can uniformly apply intricate spray patterns of differing film thickness while delivering the highest quality finish. As a result of advantages such as decreased operational expenses, waste production, and human exposure to hazardous volatile organic compound (VOC) emissions, end users are favoring mechanized paint booths.

Robotic Paint Booth Market Size Was Valued at USD 3.4 Billion in 2023, and is Projected to Reach USD 5.7 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.