Global Regenerative Medicine Market Overview

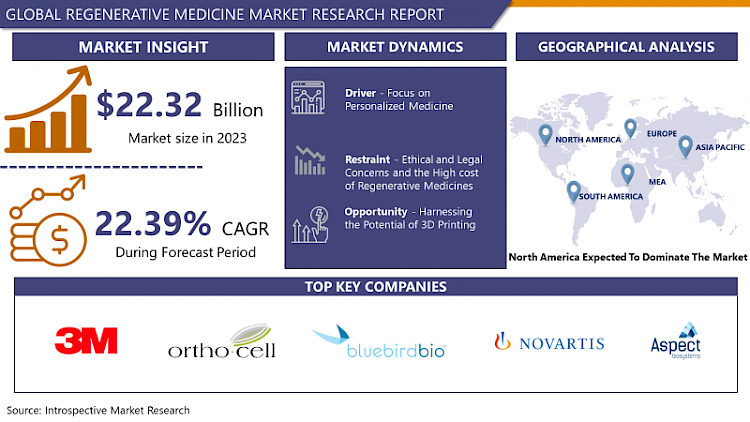

Regenerative Medicine Market Size Was Valued at USD 22.32 Billion in 2023 and is Projected to Reach USD 137.53 Billion by 2032, Growing at a CAGR of 22.39% From 2024-2032

Regenerative medicine is the act of replacing or "regenerating" human cells, tissues, or organs in order to recover or restore normal function. This field has the potential to regenerate damaged tissues and organs in the body by either replacing damaged tissue or activating the body's healing processes to mend tissues or organs. Scientists may also be able to create tissues and organs in the laboratory and safely implant them when the body is unable to cure itself through regenerative medicine. Small molecule drugs, biologics, medical devices, and cell-based treatments are used in regenerative medicine. However, the word regenerative medicine is more commonly used to refer to sophisticated cell-based treatments, tissue engineering, developmental and stem cell biology, gene therapy, cellular medicines, and novel biomaterials. Regenerative medicine has shown promising results in treating several disorders from autoimmune to chronic disorders thus, fueling the growth of the market over the analysis period.

Market Dynamics And Key Factors For Regenerative Medicine Market

Drivers:

Cord blood stem cells are being studied for a variety of applications, including Type 1 diabetes to evaluate if the cells can slow the loss of insulin production in children. In cardiovascular treatment, the cord cells are investigated to determine the migration of cells to injured cardiac tissue, improve function and blood flow at the damaged site, and thus improve the overall functioning of the heart. Cord blood stem cells are anticipated to be a valuable resource as technology moves closer to utilizing the body's cells to treat diseases. Cord blood stem cells are anticipated to be a valuable resource as technology moves closer to using the body's cells for therapy. Autologous cord blood stem cells have been an increasingly significant subject of regenerative medicine research because they can be infused back into a person without being rejected by the body's immune system.

Regenerative medicine can lower pian by avoiding painful surgical procedures. For instance, torn rotator cuffs can be treated with cell therapy rather than surgery. Regenerative medicine therapies also reduce hospital stay time and individuals can return to their normal routine as quickly as possible. During stem cell therapy or any other regenerative medicine procedure, there is no requirement for medication or general anesthesia. Furthermore, it reduces the chances of infection that arises due to an open surgical procedure. Regenerative medicine can be utilized to treat various neurological, chronic, and autoimmune disorders thus, driving the growth of the market over the projected timeframe.

Restraints:

The most significant impediment to the advancement of regenerative medicine is the cost. Because the cost of developing cell-based products and conducting clinical trials is so expensive, it is apparent that massive investment, both from the public and commercial sectors, is critical to the research's long-term viability. Contracts with substantial sums of money have grown in recent years as private businesses compete for this potentially valuable technology. However, the investment in regenerative medicine is risky and may incur a loss to biotechnology firms thus, restricting funding from private organizations. Although these therapies are lifesavers and more successful than traditional treatments, the response to this treatment method is less than expected thus, hampering the development of the regenerative medicine market over the forecasted timeframe.

Opportunities:

Treatment options based on regenerative medicine have the potential to deliver long-term relief and, in some circumstances, even curative outcomes. However, if such techniques use highly tailored medicines or address narrow patient groups, reimbursement levels may need to be quite high to justify the enormous investments required to create such treatments. Traditional coding, coverage, and payment systems are often not structured to support the quick adoption or coverage of such techniques, even when they have the potential to alter medical treatment and patient outcomes. Thus, market players have to work closely with the insurance providers to evaluate the worth of these medications to meet patient demands. With the insurance companies providing coverage for this innovative treatment procedure, the demand for regenerative medicine is anticipated to increase in the forecast period thereby, creating opportunities for market players.

Market Segmentation

Segmentation Analysis of Regenerative Medicine Market:

By product type, the cell therapy segment is expected to have the highest share of the regenerative medicine market and is projected to reach USD 25.4 billion by 2027, growing at a CAGR of 23.3% over the analysis period. Due to cardiovascular diseases, there is the formation of scar tissues which alters blood pressure or blood flow to the heart. Cell therapy can be employed in such situations and studies have shown that cell therapy can repair damaged blood vessels and heart tissues by secretion of numerous growth factors. Moreover, cell therapy can also be utilized to treat neurodegenerative diseases such as Parkinson's and Huntington's by the formation of new brain neurons, cells, and synapses after brain injuries or cognitive degeneration. Orthopedic and autoimmune disorders can also be treated with cell therapy thus bolstering the segment's growth.

By material type, the genetically engineered tissue segment is expected to have a lion's share of the regenerative medicine market and is projected to develop at a CAGR of 21% in the forecast period. The technological advancement in molecular biology has led to the formation of new tools necessary for the design of gene-based strategies for skeletal tissue repair. Genetic engineering has emerged as a viable tool for meeting the demand for long-term and strong cellular differentiation and extracellular matrix formation. As a result, gene therapy has become a standard approach to enhancing cellular activity for skeletal tissue repair. Additionally, the increasing adoption of genetically engineered tissue products for the treatment of burns, and chronic wounds has boosted the segment's growth.

By application, the musculoskeletal segment is predicted to dominate the regenerative medicine market during the analysis period. According to WHO, approximately 1.7 billion individuals are suffering from musculoskeletal disorders globally. Low back pain is the single largest cause of disability in 160 countries, making musculoskeletal diseases the leading contributor to disability globally. With the increasing population and aging, the prevalence of the musculoskeletal disorder is rapidly increasing. Many market players have pipeline products that can treat this disorder with stem cell therapy products. In addition, the continuous R&D to develop novel regenerative medicine for treating the musculoskeletal disorder is consolidating this segment's expansion.

Regional Analysis of Regenerative Medicine Market:

The North American region is forecasted to have the highest share of the regenerative medicine market due to the presence of prominent market players present in this region. The regenerative medicine market was estimated at USD 3.7 billion in 2020. The Food and Drug Administration of the United States continues to enable the development and distribution of innovative medical products, such as regenerative medicine therapies, that have the potential to treat or even cure illnesses or disorders for which there are few viable treatment alternatives. The growing usage of advanced technologies to devise new treatment methods and the support by government authorities are the two main factors supporting the growth of the regenerative medicine market in this region.

The European region is anticipated to have the second-highest share of the regenerative medicine market during the projected timeframe. The highly developed healthcare infrastructure, and the continuous research programs to evaluate the efficiency of regenerative medicine on medical disorders such as musculoskeletal, dermatology, and cardiovascular. Recent changes in the regulatory processes, coupled with an increasing political interest may improve the marketing strategies of regenerative medicine thus, strengthening the expansion of the market in the forecasted timeframe.

The regenerative medicine market in the Asia-Pacific region is expected to develop at the highest CAGR during the analysis period. The market in this region is anticipated to reach USD 5.9 billion by the end of the projected timeframe. According to Gil Van Bokkelen, chief executive of the biotechnology company Athersys, Japan has become the center for the development of innovative therapies such as stem cells and many others. The expansion of the regenerative medicine market in this region can be attributed to the rising tissue engineering, and drug discovery programs. The growing expenditure on healthcare services and the increasing prevalence of chronic diseases have boosted the development of the market in this region.

Players Covered in Regenerative Medicine Market are:

- 3M (US)

- Orthocell Limited (Australia)

- bluebird bio (US)

- Kite Pharma (US)

- Integra LifeSciences Holdings Corporation (US)

- Spark Therapeutics (US)

- Novartis AG (Switzerland)

- Anterogen Co. Ltd. (South Korea)

- Medtronic plc (Ireland)

- Aspect Biosystems (Canada)

- Organogenesis Inc. (US)

- MiMedx Group (US)

- Misonix (US)

- Amgen Inc. (the US)

- MEDIPOST Co. Ltd. (South Korea)

- Corestem Inc. (South Korea)

Key Industry Developments in Regenerative Medicine Market

- In March 2024, NeuExcell Therapeutics, a leading biotechnology company focused on in vivo neural regenerative therapies, announced the successful dosing of the first patient with the first-in-class NeuroD1 gene therapy product NXL-004. This milestone represents significant progress in developing new treatments for malignant glioma patients.

- In December 2023, Bluebird Bio, Inc. announced its U.S. commercial infrastructure for LYFGENIA™, an FDA-approved gene therapy for patients aged 12 and older with sickle cell disease and vaso-occlusive events. The launch builds on Bluebird's success in delivering ex vivo gene therapies in the U.S. and includes outcomes-based contract offerings for payers and a personalized patient support program.

|

Global Regenerative Medicine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.39% |

Market Size in 2032: |

USD 137.53 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Material

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Regenerative Medicine Market by Product Type

4.1 Regenerative Medicine Market Overview Snapshot and Growth Engine

4.2 Regenerative Medicine Market Overview

4.3 Cell Therapy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cell Therapy: Grographic Segmentation

4.4 Gene Therapy

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Gene Therapy: Grographic Segmentation

4.5 Tissue Engineering

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Tissue Engineering: Grographic Segmentation

4.6 Other

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Other: Grographic Segmentation

Chapter 5: Regenerative Medicine Market by Material

5.1 Regenerative Medicine Market Overview Snapshot and Growth Engine

5.2 Regenerative Medicine Market Overview

5.3 Biologically Derived

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Biologically Derived: Grographic Segmentation

5.4 Synthetic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Synthetic: Grographic Segmentation

5.5 Genetically Engineered Tissue

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Genetically Engineered Tissue: Grographic Segmentation

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Grographic Segmentation

Chapter 6: Regenerative Medicine Market by Application

6.1 Regenerative Medicine Market Overview Snapshot and Growth Engine

6.2 Regenerative Medicine Market Overview

6.3 Musculoskeletal

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Musculoskeletal: Grographic Segmentation

6.4 Oncology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Oncology: Grographic Segmentation

6.5 Cardiovascular

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cardiovascular: Grographic Segmentation

6.6 Dermatology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Dermatology: Grographic Segmentation

6.7 Ophthalmology

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Ophthalmology: Grographic Segmentation

6.8 Other

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Other: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Regenerative Medicine Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Regenerative Medicine Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Regenerative Medicine Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 3M (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 ORTHOCELL LIMITED (AUSTRALIA)

7.4 BLUEBIRD BIO (US)

7.5 KITE PHARMA (US)

7.6 INTEGRA LIFESCIENCES HOLDINGS CORPORATION (US)

7.7 SPARK THERAPEUTICS (US)

7.8 NOVARTIS AG (SWITZERLAND)

7.9 ANTEROGEN CO. LTD. (SOUTH KOREA)

7.10 MEDTRONIC PLC (IRELAND)

7.11 ASPECT BIOSYSTEMS (CANADA)

7.12 ORGANOGENESIS INC. (US)

7.13 MIMEDX GROUP (US)

7.14 MISONIX (US)

7.15 AMGEN INC. (THE US)

7.16 MEDIPOST CO. LTD. (SOUTH KOREA)

7.17 CORESTEM INC. (SOUTH KOREA)

Chapter 8: Global Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product Type

8.2.1 Cell Therapy

8.2.2 Gene Therapy

8.2.3 Tissue Engineering

8.2.4 Other

8.3 Historic and Forecasted Market Size By Material

8.3.1 Biologically Derived

8.3.2 Synthetic

8.3.3 Genetically Engineered Tissue

8.3.4 Other

8.4 Historic and Forecasted Market Size By Application

8.4.1 Musculoskeletal

8.4.2 Oncology

8.4.3 Cardiovascular

8.4.4 Dermatology

8.4.5 Ophthalmology

8.4.6 Other

Chapter 9: North America Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product Type

9.4.1 Cell Therapy

9.4.2 Gene Therapy

9.4.3 Tissue Engineering

9.4.4 Other

9.5 Historic and Forecasted Market Size By Material

9.5.1 Biologically Derived

9.5.2 Synthetic

9.5.3 Genetically Engineered Tissue

9.5.4 Other

9.6 Historic and Forecasted Market Size By Application

9.6.1 Musculoskeletal

9.6.2 Oncology

9.6.3 Cardiovascular

9.6.4 Dermatology

9.6.5 Ophthalmology

9.6.6 Other

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product Type

10.4.1 Cell Therapy

10.4.2 Gene Therapy

10.4.3 Tissue Engineering

10.4.4 Other

10.5 Historic and Forecasted Market Size By Material

10.5.1 Biologically Derived

10.5.2 Synthetic

10.5.3 Genetically Engineered Tissue

10.5.4 Other

10.6 Historic and Forecasted Market Size By Application

10.6.1 Musculoskeletal

10.6.2 Oncology

10.6.3 Cardiovascular

10.6.4 Dermatology

10.6.5 Ophthalmology

10.6.6 Other

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Cell Therapy

11.4.2 Gene Therapy

11.4.3 Tissue Engineering

11.4.4 Other

11.5 Historic and Forecasted Market Size By Material

11.5.1 Biologically Derived

11.5.2 Synthetic

11.5.3 Genetically Engineered Tissue

11.5.4 Other

11.6 Historic and Forecasted Market Size By Application

11.6.1 Musculoskeletal

11.6.2 Oncology

11.6.3 Cardiovascular

11.6.4 Dermatology

11.6.5 Ophthalmology

11.6.6 Other

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Cell Therapy

12.4.2 Gene Therapy

12.4.3 Tissue Engineering

12.4.4 Other

12.5 Historic and Forecasted Market Size By Material

12.5.1 Biologically Derived

12.5.2 Synthetic

12.5.3 Genetically Engineered Tissue

12.5.4 Other

12.6 Historic and Forecasted Market Size By Application

12.6.1 Musculoskeletal

12.6.2 Oncology

12.6.3 Cardiovascular

12.6.4 Dermatology

12.6.5 Ophthalmology

12.6.6 Other

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Regenerative Medicine Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Cell Therapy

13.4.2 Gene Therapy

13.4.3 Tissue Engineering

13.4.4 Other

13.5 Historic and Forecasted Market Size By Material

13.5.1 Biologically Derived

13.5.2 Synthetic

13.5.3 Genetically Engineered Tissue

13.5.4 Other

13.6 Historic and Forecasted Market Size By Application

13.6.1 Musculoskeletal

13.6.2 Oncology

13.6.3 Cardiovascular

13.6.4 Dermatology

13.6.5 Ophthalmology

13.6.6 Other

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Regenerative Medicine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.39% |

Market Size in 2032: |

USD 137.53 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. REGENERATIVE MEDICINE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. REGENERATIVE MEDICINE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. REGENERATIVE MEDICINE MARKET COMPETITIVE RIVALRY

TABLE 005. REGENERATIVE MEDICINE MARKET THREAT OF NEW ENTRANTS

TABLE 006. REGENERATIVE MEDICINE MARKET THREAT OF SUBSTITUTES

TABLE 007. REGENERATIVE MEDICINE MARKET BY PRODUCT TYPE

TABLE 008. CELL THERAPY MARKET OVERVIEW (2016-2028)

TABLE 009. GENE THERAPY MARKET OVERVIEW (2016-2028)

TABLE 010. TISSUE ENGINEERING MARKET OVERVIEW (2016-2028)

TABLE 011. OTHER MARKET OVERVIEW (2016-2028)

TABLE 012. REGENERATIVE MEDICINE MARKET BY MATERIAL

TABLE 013. BIOLOGICALLY DERIVED MARKET OVERVIEW (2016-2028)

TABLE 014. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 015. GENETICALLY ENGINEERED TISSUE MARKET OVERVIEW (2016-2028)

TABLE 016. OTHER MARKET OVERVIEW (2016-2028)

TABLE 017. REGENERATIVE MEDICINE MARKET BY APPLICATION

TABLE 018. MUSCULOSKELETAL MARKET OVERVIEW (2016-2028)

TABLE 019. ONCOLOGY MARKET OVERVIEW (2016-2028)

TABLE 020. CARDIOVASCULAR MARKET OVERVIEW (2016-2028)

TABLE 021. DERMATOLOGY MARKET OVERVIEW (2016-2028)

TABLE 022. OPHTHALMOLOGY MARKET OVERVIEW (2016-2028)

TABLE 023. OTHER MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA REGENERATIVE MEDICINE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. NORTH AMERICA REGENERATIVE MEDICINE MARKET, BY MATERIAL (2016-2028)

TABLE 026. NORTH AMERICA REGENERATIVE MEDICINE MARKET, BY APPLICATION (2016-2028)

TABLE 027. N REGENERATIVE MEDICINE MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE REGENERATIVE MEDICINE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. EUROPE REGENERATIVE MEDICINE MARKET, BY MATERIAL (2016-2028)

TABLE 030. EUROPE REGENERATIVE MEDICINE MARKET, BY APPLICATION (2016-2028)

TABLE 031. REGENERATIVE MEDICINE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC REGENERATIVE MEDICINE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. ASIA PACIFIC REGENERATIVE MEDICINE MARKET, BY MATERIAL (2016-2028)

TABLE 034. ASIA PACIFIC REGENERATIVE MEDICINE MARKET, BY APPLICATION (2016-2028)

TABLE 035. REGENERATIVE MEDICINE MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET, BY MATERIAL (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET, BY APPLICATION (2016-2028)

TABLE 039. REGENERATIVE MEDICINE MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA REGENERATIVE MEDICINE MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 041. SOUTH AMERICA REGENERATIVE MEDICINE MARKET, BY MATERIAL (2016-2028)

TABLE 042. SOUTH AMERICA REGENERATIVE MEDICINE MARKET, BY APPLICATION (2016-2028)

TABLE 043. REGENERATIVE MEDICINE MARKET, BY COUNTRY (2016-2028)

TABLE 044. 3M (US): SNAPSHOT

TABLE 045. 3M (US): BUSINESS PERFORMANCE

TABLE 046. 3M (US): PRODUCT PORTFOLIO

TABLE 047. 3M (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ORTHOCELL LIMITED (AUSTRALIA): SNAPSHOT

TABLE 048. ORTHOCELL LIMITED (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 049. ORTHOCELL LIMITED (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 050. ORTHOCELL LIMITED (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BLUEBIRD BIO (US): SNAPSHOT

TABLE 051. BLUEBIRD BIO (US): BUSINESS PERFORMANCE

TABLE 052. BLUEBIRD BIO (US): PRODUCT PORTFOLIO

TABLE 053. BLUEBIRD BIO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. KITE PHARMA (US): SNAPSHOT

TABLE 054. KITE PHARMA (US): BUSINESS PERFORMANCE

TABLE 055. KITE PHARMA (US): PRODUCT PORTFOLIO

TABLE 056. KITE PHARMA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. INTEGRA LIFESCIENCES HOLDINGS CORPORATION (US): SNAPSHOT

TABLE 057. INTEGRA LIFESCIENCES HOLDINGS CORPORATION (US): BUSINESS PERFORMANCE

TABLE 058. INTEGRA LIFESCIENCES HOLDINGS CORPORATION (US): PRODUCT PORTFOLIO

TABLE 059. INTEGRA LIFESCIENCES HOLDINGS CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SPARK THERAPEUTICS (US): SNAPSHOT

TABLE 060. SPARK THERAPEUTICS (US): BUSINESS PERFORMANCE

TABLE 061. SPARK THERAPEUTICS (US): PRODUCT PORTFOLIO

TABLE 062. SPARK THERAPEUTICS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NOVARTIS AG (SWITZERLAND): SNAPSHOT

TABLE 063. NOVARTIS AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 064. NOVARTIS AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 065. NOVARTIS AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ANTEROGEN CO. LTD. (SOUTH KOREA): SNAPSHOT

TABLE 066. ANTEROGEN CO. LTD. (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 067. ANTEROGEN CO. LTD. (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 068. ANTEROGEN CO. LTD. (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MEDTRONIC PLC (IRELAND): SNAPSHOT

TABLE 069. MEDTRONIC PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 070. MEDTRONIC PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 071. MEDTRONIC PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ASPECT BIOSYSTEMS (CANADA): SNAPSHOT

TABLE 072. ASPECT BIOSYSTEMS (CANADA): BUSINESS PERFORMANCE

TABLE 073. ASPECT BIOSYSTEMS (CANADA): PRODUCT PORTFOLIO

TABLE 074. ASPECT BIOSYSTEMS (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ORGANOGENESIS INC. (US): SNAPSHOT

TABLE 075. ORGANOGENESIS INC. (US): BUSINESS PERFORMANCE

TABLE 076. ORGANOGENESIS INC. (US): PRODUCT PORTFOLIO

TABLE 077. ORGANOGENESIS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MIMEDX GROUP (US): SNAPSHOT

TABLE 078. MIMEDX GROUP (US): BUSINESS PERFORMANCE

TABLE 079. MIMEDX GROUP (US): PRODUCT PORTFOLIO

TABLE 080. MIMEDX GROUP (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. MISONIX (US): SNAPSHOT

TABLE 081. MISONIX (US): BUSINESS PERFORMANCE

TABLE 082. MISONIX (US): PRODUCT PORTFOLIO

TABLE 083. MISONIX (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. AMGEN INC. (THE US): SNAPSHOT

TABLE 084. AMGEN INC. (THE US): BUSINESS PERFORMANCE

TABLE 085. AMGEN INC. (THE US): PRODUCT PORTFOLIO

TABLE 086. AMGEN INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. MEDIPOST CO. LTD. (SOUTH KOREA): SNAPSHOT

TABLE 087. MEDIPOST CO. LTD. (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 088. MEDIPOST CO. LTD. (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 089. MEDIPOST CO. LTD. (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. CORESTEM INC. (SOUTH KOREA): SNAPSHOT

TABLE 090. CORESTEM INC. (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 091. CORESTEM INC. (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 092. CORESTEM INC. (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. REGENERATIVE MEDICINE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. REGENERATIVE MEDICINE MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. CELL THERAPY MARKET OVERVIEW (2016-2028)

FIGURE 013. GENE THERAPY MARKET OVERVIEW (2016-2028)

FIGURE 014. TISSUE ENGINEERING MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 016. REGENERATIVE MEDICINE MARKET OVERVIEW BY MATERIAL

FIGURE 017. BIOLOGICALLY DERIVED MARKET OVERVIEW (2016-2028)

FIGURE 018. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 019. GENETICALLY ENGINEERED TISSUE MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 021. REGENERATIVE MEDICINE MARKET OVERVIEW BY APPLICATION

FIGURE 022. MUSCULOSKELETAL MARKET OVERVIEW (2016-2028)

FIGURE 023. ONCOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 024. CARDIOVASCULAR MARKET OVERVIEW (2016-2028)

FIGURE 025. DERMATOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 026. OPHTHALMOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA REGENERATIVE MEDICINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE REGENERATIVE MEDICINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC REGENERATIVE MEDICINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA REGENERATIVE MEDICINE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024-2032.

Regenerative Medicine Market Size Was Valued at USD 22.32 Billion in 2023 and is Projected to Reach USD 137.53 Billion by 2032, Growing at a CAGR of 22.39% From 2024-2032