Refrigerated Trailers Market Synopsis

Refrigerated Trailers Market Size Was Valued at USD 5.15 Billion in 2023, and is Projected to Reach USD 8.92 Billion by 2032, Growing at a CAGR of 6.3 % From 2024-2032.

Refrigerated trailers are essential transportation units for storing perishable goods, ensuring their freshness and preservation during transit. They are equipped with refrigeration systems to regulate the temperature within the cargo area, playing a crucial role in the cold chain logistics industry, and facilitating the distribution of temperature-sensitive goods.

- Refrigerated trailers, also known as reefer trailers, are essential for the transportation and storage of temperature-sensitive goods. They are equipped with cooling systems to maintain specific temperature ranges, ensuring the quality and integrity of the items during transit. These trailers preserve the quality and freshness of perishable items like fruits, vegetables, dairy products, and pharmaceuticals. They also extend the shelf life of these goods by controlling temperature and humidity levels and reducing spoilage and waste. They cater to various industries, including food and beverage, pharmaceuticals, floral, and certain chemicals, and can be adjusted to accommodate various temperature requirements.

- The demand for refrigerated trailers is increasing due to the growing global demand for perishable goods, consumer preferences for fresh produce, advancements in cold chain logistics, and expanding international trade. They are commonly used for transporting fresh produce, frozen foods, pharmaceuticals, flowers, and other temperature-sensitive items. Recent market trends include the adoption of advanced cooling technologies for improved energy efficiency and temperature control, the development of eco-friendly refrigeration systems, and the demand for telematics and monitoring solutions to enhance visibility and traceability in cold chain logistics. The refrigerated trailer market is expected to continue expanding due to evolving industry needs and refrigeration technology advancements.

- Refrigerated trailers are crucial for food safety by minimizing bacterial growth and contamination, ensuring compliance with global regulations. They also facilitate the transportation of goods across vast distances, ensuring perishable items are available in distant markets, and promoting global trade and economic growth. As consumer preferences evolve towards healthier food options, the demand for refrigerated transportation solutions is expected to increase, driving innovation and investment in the industry.

Refrigerated Trailers Market Trend Analysis

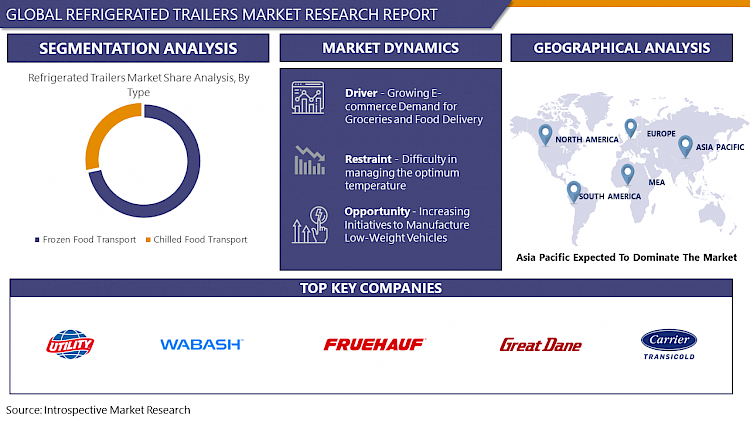

Growing E-commerce Demand for Groceries and Food Delivery

- The increasing demand for e-commerce groceries and food delivery services is a primary catalyst for the rising reliance on refrigerated trailers. With consumers increasingly choosing the convenience of online shopping for groceries and meals, there is a pressing need for dependable transportation methods to ensure the freshness and safety of perishable items during transport.

- Refrigerated trailers play a crucial role in meeting this demand by offering temperature-controlled environments that preserve the quality of perishable goods throughout the supply chain. Whether it's fresh produce, dairy products, or frozen foods, these trailers maintain optimal temperature conditions to prevent spoilage and uphold product integrity.

- The surge in last-mile delivery services, driven by the growth of e-commerce, necessitates the use of refrigerated trailers to transport goods from distribution centers to consumers' homes. This shift towards online grocery shopping and food delivery is reshaping consumer habits and fueling the need for efficient and dependable refrigerated transportation solutions to support the increasing demand for fresh and perishable items in the digital era.

Increasing Initiatives to Manufacture Low-Weight Vehicles

- The increasing efforts to produce lightweight vehicles offer a significant opportunity for the refrigerated trailers sector. With manufacturers aiming to decrease vehicle weight, advancements in materials and engineering techniques enable the creation of trailers that are lighter yet still robust. This shift toward lighter vehicles brings several advantages for refrigerated trailers.

- lighter trailers lead to enhanced fuel efficiency, lowering operating expenses and reducing carbon emissions associated with transportation. This aligns with the growing focus on sustainability and environmental consciousness in the logistics field. Additionally, reduced vehicle weight allows for increased payload capacity, enabling more goods to be transported per trip, thus boosting operational efficiency and profitability for businesses. lightweight trailers improve maneuverability and agility on the road, enhancing overall transportation efficiency and safety. They also provide opportunities for fleet managers to optimize route planning and resource allocation.

- The refrigerated trailers industry is benefiting from technological advancements in materials and engineering, leading to lighter, more resilient trailers. This shift enhances fuel efficiency, reduces operational costs, and reduces carbon emissions, aligning with sustainability and environmental awareness. It also allows for greater payload capacity, increasing operational efficiency and profitability. Lightweight trailers also enhance road maneuverability, safety, and resource allocation, providing fleet managers with opportunities to refine route planning and resource allocation.

Refrigerated Trailers Market Segment Analysis:

Refrigerated Trailers Market Segmented on the basis of type, application, and end-users.

By Type, Chilled Food Transport segment is expected to dominate the market during the forecast period

- The refrigerated trailers market is anticipated to be predominantly led by the chilled food transport segment, driven by several significant factors. Firstly, there is a rising consumer inclination towards fresh and perishable food items such as fruits, vegetables, dairy, meat, and seafood, spurred by evolving lifestyles, dietary choices, and heightened health consciousness worldwide. Advancements in cold chain logistics and refrigeration technologies have facilitated the efficient transportation of chilled food products across longer distances while preserving their quality and safety. Refrigerated trailers play a pivotal role in maintaining optimal temperature and humidity levels throughout the transportation process, safeguarding the freshness and integrity of chilled food items.

- The proliferation of retail chains, supermarkets, and online grocery platforms has fueled the demand for refrigerated transportation services to cater to the supply of perishable goods to these distribution channels. Additionally, stringent food safety regulations and quality standards necessitate the utilization of refrigerated trailers to adhere to temperature control mandates and ensure food safety across the supply chain. Consequently, the dominance of the chilled food transport segment in the refrigerated trailers market is anticipated due to these burgeoning demands and industry dynamics.

By End-User, Meat and Seafood segment is expected to dominate the market during the forecast period

- The dominance of the meat and seafood segment in the refrigerated trailers market can be attributed to several factors. Firstly, there is a rising global demand for meat and seafood products, fueled by population growth, increasing disposable incomes, and evolving dietary preferences. As consumers increasingly prioritize fresh and high-quality meat and seafood, the necessity for efficient transportation and storage solutions, like refrigerated trailers, becomes essential.

- Meat and seafood are highly perishable items requiring precise temperature control throughout the supply chain to preserve freshness and safety. Refrigerated trailers offer an optimal solution for transporting these temperature-sensitive goods over various distances while maintaining their quality.

- The meat and seafood industry entails intricate supply chains, involving international trade and distribution networks. Refrigerated trailers play a pivotal role in facilitating the smooth movement of meat and seafood products from production sites to distribution centers, retail outlets, and ultimately, to consumers. This ensures timely delivery and minimizes the risks of spoilage or contamination. These combined factors underline the dominance of the meat and seafood segment in the refrigerated trailers market.

Refrigerated Trailers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to lead the refrigerated trailers market due to several pivotal reasons. Firstly, the region's burgeoning population, along with increasing urbanization and rising disposable incomes, is propelling demand for perishable goods like fresh produce, dairy items, and pharmaceuticals. This surge in demand underscores the necessity for efficient cold chain logistics infrastructure, where refrigerated trailers play a vital role in transporting temperature-sensitive products.

- The Asia Pacific region is experiencing notable economic growth and industrial expansion, fostering increased trade activities within the region and globally. As international trade continues to flourish, there is a growing requirement for dependable refrigerated transportation solutions to safeguard the quality and integrity of perishable goods during transit.

- Ongoing investments in transportation infrastructure, encompassing roads, ports, and cold storage facilities, are further propelling the growth of the refrigerated trailers market in the region. These infrastructure enhancements improve connectivity and facilitate smooth goods movement, cementing Asia Pacific's dominance in the global refrigerated trailers market.

Refrigerated Trailers Market Top Key Players:

- Utility Trailer Manufacturing Company (US)

- Wabash National Corporation (US)

- Great Dane Trailers (US)

- Thermo King Corporation (US)

- Carrier Transicold (US)

- Hyundai Translead (US)

- Paccar Inc. (US)

- Stoughton Trailers, LLC (US)

- Heil Trailer International (US)

- Trailmobile Canada Limited (Canada)

- Titan Trailer Manufacturing Inc. (Canada)

- Fruehauf de Mexico (Mexico)

- CIMC Vehicles Group Co., Ltd. (China)

- Schmitz Cargobull AG (Germany)

- Krone Commercial Vehicle Group (Germany)

- Kögel Trailer GmbH & Co. KG (Germany)

- Kogel Trailer GmbH & Co. KG (Germany)

- Montracon Ltd. (UK)

- Lamberet UK Ltd. (UK)

- Refrigerated Trailer Rentals Ltd. (UK)

- Gray & Adams Ltd. (UK)

- Chereau SAS (France)

- Lamberet SAS (France)

- Furgocar S.A. (Spain)

- CIMC Reefer Trailer Co., Ltd. (China), and Other Major Players.

Key Industry Developments in the Refrigerated Trailers Market:

In February 2023, the TIP Group introduced a new line of refrigerated trailers equipped with innovative battery and solar-powered technology. This launch marks a significant advancement for the industry, with two groundbreaking innovations unveiled: the "E-reefer," which harnesses solar energy to charge its battery, and the AxlePower system, which utilizes the reefer's wasted energy to power its refrigeration unit.

|

Global Refrigerated Trailers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 8.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size and Capacity |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- REFRIGERATED TRAILERS MARKET BY TYPE (2017-2032)

- REFRIGERATED TRAILERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FROZEN FOOD TRANSPORT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHILLED FOOD TRANSPORT

- REFRIGERATED TRAILERS MARKET BY SIZE AND CAPACITY (2017-2032)

- REFRIGERATED TRAILERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL TRAILERS (UNDER 20 FEET)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM TRAILERS (20-40 FEET)

- LARGE TRAILERS (OVER 40 FEET)

- REFRIGERATED TRAILERS MARKET BY END-USER (2017-2032)

- REFRIGERATED TRAILERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DAIRY PRODUCTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FRUITS AND VEGETABLES

- MEAT AND SEAFOOD

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Refrigerated Trailers Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- UTILITY TRAILER MANUFACTURING COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- WABASH NATIONAL CORPORATION (US)

- GREAT DANE TRAILERS (US)

- THERMO KING CORPORATION (US)

- CARRIER TRANSICOLD (US)

- HYUNDAI TRANSLEAD (US)

- PACCAR INC. (US)

- STOUGHTON TRAILERS, LLC (US)

- HEIL TRAILER INTERNATIONAL (US)

- TRAILMOBILE CANADA LIMITED (CANADA)

- TITAN TRAILER MANUFACTURING INC. (CANADA)

- FRUEHAUF DE MEXICO (MEXICO)

- CIMC VEHICLES GROUP CO., LTD. (CHINA)

- SCHMITZ CARGOBULL AG (GERMANY)

- KRONE COMMERCIAL VEHICLE GROUP (GERMANY)

- KÖGEL TRAILER GMBH & CO. KG (GERMANY)

- KOGEL TRAILER GMBH & CO. KG (GERMANY)

- MONTRACON LTD. (UK)

- LAMBERET UK LTD. (UK)

- REFRIGERATED TRAILER RENTALS LTD. (UK)

- GRAY & ADAMS LTD. (UK)

- CHEREAU SAS (FRANCE)

- LAMBERET SAS (FRANCE)

- FURGOCAR S.A. (SPAIN)

- CIMC REEFER TRAILER CO., LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL REFRIGERATED TRAILERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Size and Capacity

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Refrigerated Trailers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 8.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size and Capacity |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. REFRIGERATED TRAILERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. REFRIGERATED TRAILERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. REFRIGERATED TRAILERS MARKET COMPETITIVE RIVALRY

TABLE 005. REFRIGERATED TRAILERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. REFRIGERATED TRAILERS MARKET THREAT OF SUBSTITUTES

TABLE 007. REFRIGERATED TRAILERS MARKET BY PRODUCT TYPE

TABLE 008. FROZEN FOOD MARKET OVERVIEW (2016-2030)

TABLE 009. CHILLED FOOD MARKET OVERVIEW (2016-2030)

TABLE 010. REFRIGERATED TRAILERS MARKET BY END USERS

TABLE 011. DAIRY PRODUCTS MARKET OVERVIEW (2016-2030)

TABLE 012. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2030)

TABLE 013. MEAT & SEA FOOD MARKET OVERVIEW (2016-2030)

TABLE 014. OTHER MARKET OVERVIEW (2016-2030)

TABLE 015. NORTH AMERICA REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 016. NORTH AMERICA REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 017. N REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 018. EASTERN EUROPE REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 019. EASTERN EUROPE REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 020. REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 021. WESTERN EUROPE REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 022. WESTERN EUROPE REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 023. REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 024. ASIA PACIFIC REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 025. ASIA PACIFIC REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 026. REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 027. MIDDLE EAST & AFRICA REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 028. MIDDLE EAST & AFRICA REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 029. REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 030. SOUTH AMERICA REFRIGERATED TRAILERS MARKET, BY PRODUCT TYPE (2016-2030)

TABLE 031. SOUTH AMERICA REFRIGERATED TRAILERS MARKET, BY END USERS (2016-2030)

TABLE 032. REFRIGERATED TRAILERS MARKET, BY COUNTRY (2016-2030)

TABLE 033. UTILITY TRAILER MANUFACTURING COMPANY: SNAPSHOT

TABLE 034. UTILITY TRAILER MANUFACTURING COMPANY: BUSINESS PERFORMANCE

TABLE 035. UTILITY TRAILER MANUFACTURING COMPANY: PRODUCT PORTFOLIO

TABLE 036. UTILITY TRAILER MANUFACTURING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. SCHMITZ CARGOBULL AG: SNAPSHOT

TABLE 037. SCHMITZ CARGOBULL AG: BUSINESS PERFORMANCE

TABLE 038. SCHMITZ CARGOBULL AG: PRODUCT PORTFOLIO

TABLE 039. SCHMITZ CARGOBULL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. WABASH NATIONAL CORPORATION: SNAPSHOT

TABLE 040. WABASH NATIONAL CORPORATION: BUSINESS PERFORMANCE

TABLE 041. WABASH NATIONAL CORPORATION: PRODUCT PORTFOLIO

TABLE 042. WABASH NATIONAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. GREAT DANE LLC: SNAPSHOT

TABLE 043. GREAT DANE LLC: BUSINESS PERFORMANCE

TABLE 044. GREAT DANE LLC: PRODUCT PORTFOLIO

TABLE 045. GREAT DANE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. FAHRZEUGWERK BERNARD KRONE GMBH: SNAPSHOT

TABLE 046. FAHRZEUGWERK BERNARD KRONE GMBH: BUSINESS PERFORMANCE

TABLE 047. FAHRZEUGWERK BERNARD KRONE GMBH: PRODUCT PORTFOLIO

TABLE 048. FAHRZEUGWERK BERNARD KRONE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. KÖGEL TRAILER GMBH & CO. KG: SNAPSHOT

TABLE 049. KÖGEL TRAILER GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 050. KÖGEL TRAILER GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 051. KÖGEL TRAILER GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. THERMO KING: SNAPSHOT

TABLE 052. THERMO KING: BUSINESS PERFORMANCE

TABLE 053. THERMO KING: PRODUCT PORTFOLIO

TABLE 054. THERMO KING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. RANDON IMPLEMENTOS: SNAPSHOT

TABLE 055. RANDON IMPLEMENTOS: BUSINESS PERFORMANCE

TABLE 056. RANDON IMPLEMENTOS: PRODUCT PORTFOLIO

TABLE 057. RANDON IMPLEMENTOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. GRAY & ADAMS LTD: SNAPSHOT

TABLE 058. GRAY & ADAMS LTD: BUSINESS PERFORMANCE

TABLE 059. GRAY & ADAMS LTD: PRODUCT PORTFOLIO

TABLE 060. GRAY & ADAMS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. LAMBERET REFRIGERATED SAS: SNAPSHOT

TABLE 061. LAMBERET REFRIGERATED SAS: BUSINESS PERFORMANCE

TABLE 062. LAMBERET REFRIGERATED SAS: PRODUCT PORTFOLIO

TABLE 063. LAMBERET REFRIGERATED SAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MONTRACON LTD: SNAPSHOT

TABLE 064. MONTRACON LTD: BUSINESS PERFORMANCE

TABLE 065. MONTRACON LTD: PRODUCT PORTFOLIO

TABLE 066. MONTRACON LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 067. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 068. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 069. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. REFRIGERATED TRAILERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. REFRIGERATED TRAILERS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. FROZEN FOOD MARKET OVERVIEW (2016-2030)

FIGURE 013. CHILLED FOOD MARKET OVERVIEW (2016-2030)

FIGURE 014. REFRIGERATED TRAILERS MARKET OVERVIEW BY END USERS

FIGURE 015. DAIRY PRODUCTS MARKET OVERVIEW (2016-2030)

FIGURE 016. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2030)

FIGURE 017. MEAT & SEA FOOD MARKET OVERVIEW (2016-2030)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 019. NORTH AMERICA REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 020. EASTERN EUROPE REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 021. WESTERN EUROPE REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. ASIA PACIFIC REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. MIDDLE EAST & AFRICA REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. SOUTH AMERICA REFRIGERATED TRAILERS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Refrigerated Trailers Market research report is 2024-2032.

Utility Trailer Manufacturing Company (US), Wabash National Corporation (US), Great Dane Trailers (US), Thermo King Corporation (US), Carrier Transicold (US), Hyundai Translead (US), Paccar Inc. (US), Stoughton Trailers, LLC (US), Heil Trailer International (US), Trailmobile Canada Limited (Canada), Titan Trailer Manufacturing Inc. (Canada), Fruehauf de Mexico (Mexico), CIMC Vehicles Group Co., Ltd. (China), Schmitz Cargobull AG (Germany), Krone Commercial Vehicle Group (Germany), Kögel Trailer GmbH & Co. KG (Germany), Kogel Trailer GmbH & Co. KG (Germany), Montracon Ltd. (UK), Lamberet UK Ltd. (UK), Refrigerated Trailer Rentals Ltd. (UK), Gray & Adams Ltd. (UK), Chereau SAS (France), Lamberet SAS (France), Furgocar S.A. (Spain), CIMC Reefer Trailer Co., Ltd. (China) and Other Major Players.

The Refrigerated Trailers Market is segmented into Type, Size and Capacity, End-User, and region. By Type, the market is categorized into Frozen Food Transport, and Chilled Food Transport. By Size and Capacity, the market is categorized into Small Trailers (Under 20 Feet), Medium Trailers (20-40 Feet), and Large Trailers (Over 40 Feet). By End-User, the market is categorized into Dairy Products, Fruits and Vegetables, Meat and Seafood. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Refrigerated trailers are essential transportation units for storing perishable goods, ensuring their freshness and preservation during transit. They are equipped with refrigeration systems to regulate the temperature within the cargo area, playing a crucial role in the cold chain logistics industry, and facilitating the distribution of temperature-sensitive goods.

Refrigerated Trailers Market Size Was Valued at USD 5.15 Billion in 2023, and is Projected to Reach USD 8.92 Billion by 2032, Growing at a CAGR of 6.3 % From 2024-2032.