Quality Management Software Market Synopsis

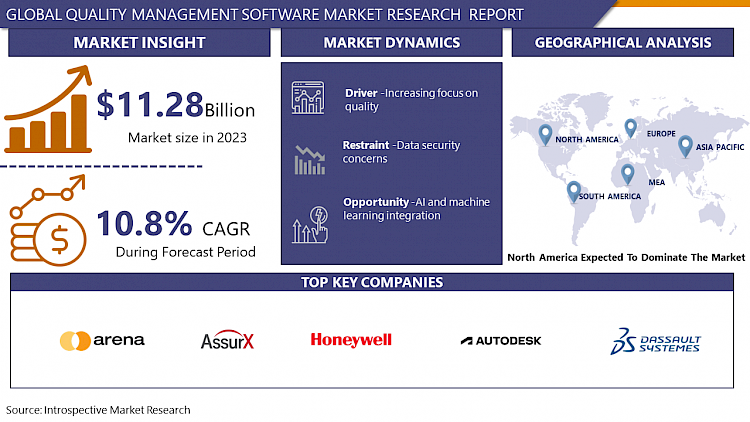

Quality Management Software Market Size Was Valued at USD 11.28 Billion in 2023, and is Projected to Reach USD 28.39 Billion by 2032, Growing at a CAGR of 10.8% From 2024-2032.

It can be defined as a toolbox for organizing and enhancing an organization’s business management processes with a special focus on the quality aspects. It covers various application and features that support the management of quality planning, assurance, and enhancement of quality control criteria throughout various operations. QMS interfaces with other systems in an organization to enhance quality targets with that of the enterprise and regulatory standards, as well as, customer requirements.

- Quality Management Software effectively manages the Quality Control process by integrating the activities, which include; document control, non-conformance, corrective and preventive actions (CAPA), and audits. In essence, QMS improves organization’s overall control and accountability of such processes and makes it easier for organizations to adhere to approved industry standards, codes, guidelines and best practices such as ISO 9001, FDA regulations or any other quality certifications.

- The software also has the features of analytics and reporting that can enable the company to understand trends, monitor results, and even come up with a good decision aimed at improving the quality of the outcomes.

- Thus, QMS helps to increase the level of compliance and operational effectiveness in organizations and fosters the culture of continuous improvement. Thus, it helps in improving collaboration between the teams as data regarding quality is made available to the teams in real-time and since the roles of the different departments involved are harmonized.

- This matrix is not only beneficial in identifying quality issues to address but is also supporting the idea of virtue and improvement of the solutions from the team. Thus, this indicates that organizations that have adopted the QMS are able to produce high quality products, less or no waste, rework, thus satisfying and gaining customer loyalty.

Quality Management Software Market Trend Analysis

Cloud-based deployment

- Cloud based systems have now emerged as a preferred model of deployment in the Quality Management Software (QMS) market because of the several benefits offered by this model over the traditional on-site solutions. The first advantage should be versatility – the model described can be easily scaled to fit much larger organizations. Thus, the QMS solutions are flexible in that organizations can easily expand or reduce the functionality of the solutions without the need for more hardware or other complex IT support.

- Such kind of flexibility is especially useful for the organizations, which have rapidly growing or dynamic business, or have intensive demand, as they can manage their quality processes, not being bound by the space and material limitations possible with the physical infrastructure. Furthermore, another considerable advantage of the QMS in the cloud services is that this kind of system is usually upgraded from time to time, and the companies are always provided with the new amendments and additions to the program, and frequently they get new variants of securities, too.

- In addition, cloud-based QMS has other benefits such as accessibility. Since the cloud deployment, the users are able to access the software from any location in any time with the help of laptop, tablets or smartphones. This is allows enhanced communication between the various teams especially for organizations that have different branches or employees working from home. Another advantage of cloud-based QMS platforms is that data is always real-time, implying that users of the platform always have complete access to the information necessary to make decisions; This leads to efficient tackling of quality problems.

- Other factors that influence the sourcing of cloud-based QMS include cost factor; going for a cost-effective system is possible with a cloud-based QMS. On-premises concepts are usually expensive mostly at the initial stages of acquisition where one has to purchase hardware and software, and expense has to met on continuation basis on maintenance and support.

- On the other hand, the cloud services are normally subscription basis hence the expenses are spread in a certain duration hence they do not require much capital investment. This pay as you use solution also enables businesses to plan and optimize costs in a much better way. Also, pressure on internal IT departments is lessened; thus, organisations can shift more attention to their operations while the QMS provider deals with the system support and upgrades.

Mobile QMS solutions

- Mobile Quality Management System (QMS) solutions present a significant opportunity for the Quality Management Software market due to their ability to enhance accessibility, efficiency, and real-time data handling. With the proliferation of mobile devices, businesses can leverage mobile QMS to ensure that quality management processes are not confined to desktop computers.

- This flexibility allows for seamless access to QMS functionalities anywhere and anytime, which is particularly beneficial for industries requiring frequent audits, inspections, and compliance checks. Mobile QMS solutions can also streamline workflows by enabling employees to log data, report issues, and track corrective actions directly from their mobile devices, thus reducing delays and improving responsiveness.

- Moreover, mobile QMS solutions facilitate real-time data collection and analysis, a critical aspect for maintaining high-quality standards. The ability to capture data on the go and immediately upload it to a central system ensures that all stakeholders have up-to-date information. This immediacy aids in faster decision-making and helps in identifying and addressing quality issues promptly before they escalate. Additionally, real-time data access enables trend analysis and predictive insights, which are essential for continuous improvement and proactive quality management. Companies can better monitor performance metrics and compliance with industry standards, thus reducing the risk of non-conformance and associated costs.

- The adoption of mobile QMS solutions also supports the growing trend of remote work and decentralized operations. As more organizations embrace flexible working arrangements, mobile QMS ensures that quality management processes remain consistent and effective regardless of the physical location of the workforce. This adaptability not only enhances employee productivity but also ensures that quality control measures are uniformly implemented across various sites and departments.

- Consequently, mobile QMS solutions can lead to significant cost savings by reducing the need for extensive IT infrastructure and minimizing downtime due to system constraints. This evolution towards mobile-centric quality management is poised to drive substantial growth in the Quality Management Software market, offering businesses a competitive edge in maintaining superior quality standards.

Quality Management Software Market Segment Analysis:

Quality Management Software Market is Segmented based on Solution, Deployment, Enterprise Size, End-use and Application.

By Solution, Document Control is expected to dominate the market during the forecast period

- In the QMS market, the Document Control segment stands out because of its accountability for managing documents and staying compliant to the industry standards that support quality management. Document control, also known as document management, shall be implemented to address the processes of developing, reviewing, approving, distributing, and storing of documents and records, which are critical processes in quality management.

- This segment assists the organizations to keep an updated archive of the quality documents and keeps any updated information related to quality which is helpful to the stakeholders. Through the application of the document control feature, QMS solutions help minimize the number of errors in the processes, improve organization and productivity and help compliance with legal requirements ideal for industries like pharmaceuticals, healthcare, and aerospace.

- The dominance of the Document Control segment is still felt through continual growth in the quantity, size, and complexity of documentation involving a solid regulatory configuration for business operations. The administrative resources of any organization include a huge number of documents starting from the standard operating procedures, work instructions, quality manuals and ending with audit reports and other compliance records.

- The provision of the documents and more importantly their management and control would greatly assist the quality assurance of documents and reach to all employees. This is because QMS solutions that support document management as a key component, enable element such as version control, automated workflows, electronic signatures and audit trails all of which improve the organization’s degree of transparency, traceability and accountability in document control.

- Additionally, as organisations have pressurised more on the options of digital change and moving away from paper-based documentation, have expanded the necessity for better papers control. Since managers and other employees attempt to enhance organizational productivity and earnings’ reduction, the implementation of such systems appears to be highly beneficial.

- These systems do more than optimize the processes of document control but also allow the integration of other quality management practices such as CAPA, audits, training, and others. Thus, when organizations recognize that the QMS solutions introduced for document control meet and complement their specific needs, it will contribute to enhancing the Quality Management System and its processes in general, while also ensuring improvements in compliance levels and sustainability.

By Deployment, Cloud segment held the largest share

- The cloud segment leads in the QMS market since the software’s deployment in this mode is more flexible, scalable, as well as cost-efficient. One of the key benefits being that cloud-based QMS solutions are far less complicated to implement as compared to the on-premise solutions that require the establishment of an infrastructure first before some mapped solution can be implemented.

- Two Cloud based QMS benefits for organizations are realization of QMS without large capex proposals in hardware and IT frameworks and fast deployment of cloud based QMS. Due to the provided characteristics of deployment these solutions can be of great interest to the SMEs which do not have enough resources for elaborate IT support.

- To elaborate, the future of cloud deployment segment depends mostly on the continuously increasing distance and distributed working practice. Employees can access the cloud-based QMS solution from anywhere there is a web connection, thus, improving cohesiveness and continuity of the quality management regardless of employee locations. This capability has recently emerged as crucial in today’s digital society and even more critical during the COVID-19 crisis that has driven up the number of employees who work from home. The approaches and possibilities delivered by underlying remedies help organizations to continue providing enhanced standards of quality management even if they work on the cloud.

- Cloud QMS solutions can go with certain inherent advantages of QMS which are automatic renewal and update by the vendor and therefore external IT support is not required frequently and the QMS is always up to date with the most efficient features and security protocols available in the market. This continuous improvement and support are some of the factors that boost the overall reliability and security of the QMS making it to serve as a hub for organizations that are in the process of implementing reliable quality management.

- Moreover, cloud solutions often have a flexible pricing scheme which means that an organization pays for consuming a definite amount of the services or resources which in the long run helps to cut expenses. This scalability also implies that the QMS will be to scale and adapt within the organization and therefore be useful in achieving long-term goals of the business.

Quality Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The factor of technological advancement and the high level of digital transformation, which is characteristic of most North American companies, can be considered as the key reason for the leadership of this region in the Quality Management Software (QMS) market. Many top information technology companies and innovation centers are located in the region, predominantly in the United States and Canada because, combined with technological advances, they identify top trends and introduce advanced QMS solutions. The cited technological environment promotes further QMS evolution and new features additions to provide more reliable and effective solutions for business to develop and improve the quality management systems.

- In addition, legal and market rules and regulations in North America compel industries to implement QMS to avert legal risks and end up paying hefty prices. Business professions, for example, pharmaceutical, aerospace, auto mobile and health care need to follow strict quality management standards since they fall under highly regulated industries. The following standards like ISO 9001, FDA and other requirements put pressure on the organizations to find high class and efficient QMS solutions that will help them on being complaint with the standards and also in managing their QMS effectively.

- Finally, there is the fact that North American companies act within a rather rosy economic environment and, therefore, have sufficient resources to invest in the implementation of cutting-edge QMS tools. There has traditionally been a sufficient financial backing for the acquisition of robust global quality management systems and a competent human resource base to support these technologies on the business sector in the region. Furthermore, the intense and competitive business environment in North America will still call for firms to step up their corporate operations and products quality as a way of surviving the market thereby increasing the demand for QMS solutions.

Active Key Players in the Quality Management Software Market

- Arena Solutions, Inc. (USA)

- AssurX, Inc. (USA)

- Autodesk Inc. (USA)

- Cority (formerly Medgate) (Canada)

- Dassault Systèmes (France)

- Honeywell International Inc. (USA)

- IBM Corporation (USA)

- Intelex Technologies Inc. (Canada)

- IQMS (USA)

- MasterControl, Inc. (USA)

- MetricStream Inc. (USA)

- Microsoft Corporation (USA)

- Oracle Corporation (USA)

- Pilgrim Quality Solutions, Inc. (USA)

- PTC Inc. (USA)

- SAP Ariba (USA)

- SAP SE (Germany)

- Siemens AG (Germany)

- Sparta Systems, Inc. (USA)

- Unipoint Software Inc. (Canada)

- Other Key Players

Key Industry Developments in the Quality Management Software Market:

- In April 2023, Cloud-based software solutions developer Greenlight Guru , which specializes in helping MedTech companies manage their documents, announced it has released the Export API. The new feature allows the customers to download the data from the QMS platform to such software as CRM, ERP, and BI tools. In addition, the new API ensured that the functionality of the user was enhanced concerning the issue of efficiency.

- In April 2023, Cloud-based software solutions developer Greenlight Guru , which specializes in helping MedTech companies manage their documents, announced it has released the Export API. The new feature allows the customers to download the data from the QMS platform to such software as CRM, ERP, and BI tools. In addition, the new API ensured that the functionality of the user was enhanced concerning the issue of efficiency.

|

Global Quality Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.28 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.8 % |

Market Size in 2032: |

USD 28.39 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- QUALITY MANAGEMENT SOFTWARE MARKET BY SOLUTION (2017-2032)

- QUALITY MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DOCUMENT CONTROL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- NON-CONFORMANCES/CORRECTIVE & PREVENTATIVE

- COMPLAINT HANDLING, EMPLOYEE TRAINING

- QUALITY INSPECTIONS (PPAP & FAI)

- AUDIT MANAGEMENT

- SUPPLIER QUALITY MANAGEMENT,

- CALIBRATION MANAGEMENT

- CHANGE MANAGEMENT

- MOBILE INCIDENTS

- EVENT REPORTING

- QUALITY MANAGEMENT SOFTWARE MARKET BY DEPLOYMENT (2017-2032)

- QUALITY MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- QUALITY MANAGEMENT SOFTWARE MARKET BY END USERS (2017-2032)

- QUALITY MANAGEMENT SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT & TELECOM LIFE SCIENCES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIFE SCIENCES

- TRANSPORTATION & LOGISTICS

- CONSUMER GOODS & RETAIL

- FOOD & BEVERAGE

- DEFENSE & AEROSPACE,

- MANUFACTURING & HEAVY INDUSTRY

- UTILITIES

- GOVERNMENT

- HEALTHCARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Quality Management Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARENA SOLUTIONS, INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ARENA SOLUTIONS, INC. (USA)

- ASSURX, INC. (USA)

- AUTODESK INC. (USA)

- CORITY (FORMERLY MEDGATE) (CANADA)

- DASSAULT SYSTÈMES (FRANCE)

- HONEYWELL INTERNATIONAL INC. (USA)

- IBM CORPORATION (USA)

- INTELEX TECHNOLOGIES INC. (CANADA)

- IQMS (USA)

- MASTERCONTROL, INC. (USA)

- METRICSTREAM INC. (USA)

- MICROSOFT CORPORATION (USA)

- ORACLE CORPORATION (USA)

- PILGRIM QUALITY SOLUTIONS, INC. (USA)

- PTC INC. (USA)

- SAP ARIBA (USA)

- SAP SE (GERMANY)

- SIEMENS AG (GERMANY)

- SPARTA SYSTEMS, INC. (USA)

- UNIPOINT SOFTWARE INC. (CANADA)

- COMPETITIVE LANDSCAPE

- GLOBAL QUALITY MANAGEMENT SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Quality Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.28 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.8 % |

Market Size in 2032: |

USD 28.39 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. QUALITY MANAGEMENT SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. QUALITY MANAGEMENT SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. QUALITY MANAGEMENT SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. QUALITY MANAGEMENT SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. QUALITY MANAGEMENT SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. QUALITY MANAGEMENT SOFTWARE MARKET BY TYPE

TABLE 008. ON PREMISE MARKET OVERVIEW (2016-2028)

TABLE 009. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 010. QUALITY MANAGEMENT SOFTWARE MARKET BY APPLICATION

TABLE 011. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 012. HEALTHCARE AND LIFE SCIENCE MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE QUALITY MANAGEMENT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 018. QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC QUALITY MANAGEMENT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 021. QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA QUALITY MANAGEMENT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 024. QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 027. QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. IQS: SNAPSHOT

TABLE 029. IQS: BUSINESS PERFORMANCE

TABLE 030. IQS: PRODUCT PORTFOLIO

TABLE 031. IQS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. INC: SNAPSHOT

TABLE 032. INC: BUSINESS PERFORMANCE

TABLE 033. INC: PRODUCT PORTFOLIO

TABLE 034. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. MASTERCONTROL: SNAPSHOT

TABLE 035. MASTERCONTROL: BUSINESS PERFORMANCE

TABLE 036. MASTERCONTROL: PRODUCT PORTFOLIO

TABLE 037. MASTERCONTROL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. INC: SNAPSHOT

TABLE 038. INC: BUSINESS PERFORMANCE

TABLE 039. INC: PRODUCT PORTFOLIO

TABLE 040. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. INTELEX TECHNOLOGIES: SNAPSHOT

TABLE 041. INTELEX TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 042. INTELEX TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 043. INTELEX TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. PILGRIM QUALITY SOLUTIONS: SNAPSHOT

TABLE 044. PILGRIM QUALITY SOLUTIONS: BUSINESS PERFORMANCE

TABLE 045. PILGRIM QUALITY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 046. PILGRIM QUALITY SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. METRICSTREAM INC: SNAPSHOT

TABLE 047. METRICSTREAM INC: BUSINESS PERFORMANCE

TABLE 048. METRICSTREAM INC: PRODUCT PORTFOLIO

TABLE 049. METRICSTREAM INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SPARTA SYSTEMS: SNAPSHOT

TABLE 050. SPARTA SYSTEMS: BUSINESS PERFORMANCE

TABLE 051. SPARTA SYSTEMS: PRODUCT PORTFOLIO

TABLE 052. SPARTA SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. INC: SNAPSHOT

TABLE 053. INC: BUSINESS PERFORMANCE

TABLE 054. INC: PRODUCT PORTFOLIO

TABLE 055. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SAP SE: SNAPSHOT

TABLE 056. SAP SE: BUSINESS PERFORMANCE

TABLE 057. SAP SE: PRODUCT PORTFOLIO

TABLE 058. SAP SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ARENA SOLUTIONS INC: SNAPSHOT

TABLE 059. ARENA SOLUTIONS INC: BUSINESS PERFORMANCE

TABLE 060. ARENA SOLUTIONS INC: PRODUCT PORTFOLIO

TABLE 061. ARENA SOLUTIONS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. AUTODESK INC.: SNAPSHOT

TABLE 062. AUTODESK INC.: BUSINESS PERFORMANCE

TABLE 063. AUTODESK INC.: PRODUCT PORTFOLIO

TABLE 064. AUTODESK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ETQ: SNAPSHOT

TABLE 065. ETQ: BUSINESS PERFORMANCE

TABLE 066. ETQ: PRODUCT PORTFOLIO

TABLE 067. ETQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ORACLE: SNAPSHOT

TABLE 068. ORACLE: BUSINESS PERFORMANCE

TABLE 069. ORACLE: PRODUCT PORTFOLIO

TABLE 070. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ARAS: SNAPSHOT

TABLE 071. ARAS: BUSINESS PERFORMANCE

TABLE 072. ARAS: PRODUCT PORTFOLIO

TABLE 073. ARAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ASSURX: SNAPSHOT

TABLE 074. ASSURX: BUSINESS PERFORMANCE

TABLE 075. ASSURX: PRODUCT PORTFOLIO

TABLE 076. ASSURX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INC: SNAPSHOT

TABLE 077. INC: BUSINESS PERFORMANCE

TABLE 078. INC: PRODUCT PORTFOLIO

TABLE 079. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. PLEX SYSTEMS: SNAPSHOT

TABLE 080. PLEX SYSTEMS: BUSINESS PERFORMANCE

TABLE 081. PLEX SYSTEMS: PRODUCT PORTFOLIO

TABLE 082. PLEX SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. INC: SNAPSHOT

TABLE 083. INC: BUSINESS PERFORMANCE

TABLE 084. INC: PRODUCT PORTFOLIO

TABLE 085. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. IQMS: SNAPSHOT

TABLE 086. IQMS: BUSINESS PERFORMANCE

TABLE 087. IQMS: PRODUCT PORTFOLIO

TABLE 088. IQMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. INC: SNAPSHOT

TABLE 089. INC: BUSINESS PERFORMANCE

TABLE 090. INC: PRODUCT PORTFOLIO

TABLE 091. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. UNIPOINT SOFTWARE: SNAPSHOT

TABLE 092. UNIPOINT SOFTWARE: BUSINESS PERFORMANCE

TABLE 093. UNIPOINT SOFTWARE: PRODUCT PORTFOLIO

TABLE 094. UNIPOINT SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. INC: SNAPSHOT

TABLE 095. INC: BUSINESS PERFORMANCE

TABLE 096. INC: PRODUCT PORTFOLIO

TABLE 097. INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. IDEAGEN PLC: SNAPSHOT

TABLE 098. IDEAGEN PLC: BUSINESS PERFORMANCE

TABLE 099. IDEAGEN PLC: PRODUCT PORTFOLIO

TABLE 100. IDEAGEN PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. DASSAULT SYSTÈMES SE: SNAPSHOT

TABLE 101. DASSAULT SYSTÈMES SE: BUSINESS PERFORMANCE

TABLE 102. DASSAULT SYSTÈMES SE: PRODUCT PORTFOLIO

TABLE 103. DASSAULT SYSTÈMES SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. SIEMENS AG: SNAPSHOT

TABLE 104. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 105. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 106. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. ON PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 013. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 016. HEALTHCARE AND LIFE SCIENCE MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Quality Management Software Market research report is 2024-2032.

Arena Solutions, Inc. (USA), AssurX, Inc. (USA), Autodesk Inc. (USA), Cority (formerly Medgate) (Canada), Dassault Systèmes (France), Honeywell International Inc. (USA), IBM Corporation (USA), Intelex Technologies Inc. (Canada), IQMS (USA), MasterControl, Inc. (USA), MetricStream Inc. (USA), Microsoft Corporation (USA), Oracle Corporation (USA), Pilgrim Quality Solutions, Inc. (USA), PTC Inc. (USA), SAP Ariba (USA), SAP SE (Germany), Siemens AG (Germany), Sparta Systems, Inc. (USA), Unipoint Software Inc. (Canada)and Other Major Players.

The Quality Management Software Market is segmented into Solution, Deployment, Enterprise Size, End-use, and region. By Solution, the market is categorized into Document Control, Non-conformances/Corrective & Preventative, Complaint Handling, Employee Training, Quality Inspections (PPAP & FAI), Audit Management, Supplier Quality Management, Calibration Management, Change Management, Mobile Incidents and Event Reporting. By Deployment, the market is categorized into Cloud, On-premise. By Enterprise Size, the market is categorized into Small & Medium Enterprise (SME), Large Enterprise. By End-use, the market is categorized into IT & Telecom, Life Sciences, Transportation & Logistics, Consumer Goods & Retail, Food & Beverage, Defense & Aerospace, Manufacturing & Heavy Industry, Utilities, Government, Healthcare, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

QMS or Quality Management Software fits exclusively in the improvement and management of the quality system in the organization. Such aspects as document control, compliance, audits, non-conformance, and corrective actions are made easy and require minimal intervention. QMS makes certain that goods and services produced and delivered by the organisation are standardized and hence improved quality, organisation and consumer satisfaction.

Quality Management Software Market Size Was Valued at USD 11.28 Billion in 2023, and is Projected to Reach USD 28.39 Billion by 2032, Growing at a CAGR of 10.8% From 2024-2032.