Global Push to Talk (PTT) Market Overview

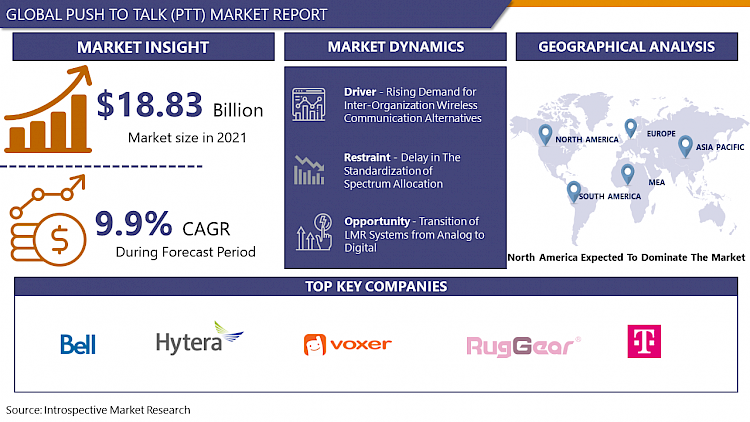

The Global Push to Talk (PTT) Market was valued at USD 18.83 billion in 2021 and is expected to reach USD 36.46 billion by the year 2028, at a CAGR of 9.9%.

Push-to-talk (PTT) is a telecommunication technique that works like a "walkie-talkie" and is a two-way communication service. When compared to mobile phone conversations, which are full-duplex and allow both parties to hear each other, PTT is half-duplex, which means communication can only be delivered in one direction at a time. It's a one-to-many or one-to-one mobile communications system that eliminates the processes of dialling, ringing, and responding that a traditional phone call entail.

PTT requires the speaker to hold down a certain button while speaking and then release it when finished. After that, the listener might respond by following the same processes. The system will be able to determine which direction the information should be delivered in this fashion. People may also choose who speaks and is heard. The push-to-talk mechanism is most commonly found in police radios, air traffic control systems, and cellular technology. It's also employed in industry, public safety, and transportation, among other things. With the growing use of PTT in such industries, the market is expected to grow substantially during the forecasted period.

Market Dynamics and Factors:

Drivers

Growing use of digital LMR systems pushing the market growth.

Because of its advantages over analog items, there is a growing demand for digitalized products. Machine-to-Machine (M2M) assistance and other high-end Industrial Internet of Things (IIoT) applications are facilitated by digitalized goods, which offer a strong communication experience as well as improved spectrum efficiency. Industries can provide voice and data services, including M2M applications, over a highly dependable network that covers the full-service region by using modern digital mission-critical LMR systems. LMR is the first and most commonly used technology created specifically for PTT communication over a private network in a given place. Digital Mobile Radio (DMR), Project 25 (P25), Terrestrial Trunked Radio (TETRA), and NXDN are examples of modern LMR technologies that are built on an open standard architecture and can operate over conventional radio frequencies.

Rising demand for inter-organisation wireless communication alternatives

The increased need for wireless push-to-talk devices across different industries, such as businesses and commercial, and aerospace and defence, is one of the major market drivers. Wireless device use is increasing, which helps to improve overall security and productivity by providing end-to-end encryption. Inter- departmental communication in specific sectors require immediate response with teams at different location such as factories, production floor, project site, in such situations PTT enables excellent communication alternative compare to any other devices. In addition, the need for PTT software among smartphone users to link groups and members using this communications medium has bolstered the push-to-talk market growth tremendously. Furthermore, the market is expected to grow as the number of network devices grows, as well as the adoption of accessories such as wireless speakers and microphones. These devices contain buttons that allow the user to switch from voice transmission to voice receiving mode. Devices such as an integrated digital enhanced network (iDEN), land mobile radio (LMR), broadband PTT, and MCPTT use this application.

Restraints

The demand for PTT is being stifled by the presence of latency and tiny communication gaps when engaging in a two-way conversation. Users utilizing LMR technology may have minor time delays when conversing. Users may encounter a delay or lag during communications in places where network infrastructure is lacking or inadequate, for example. Furthermore, the deployment of PTT technology has resulted in greater network expenses and prices for customers. Furthermore, the market's growth is hampered by a lack of appropriate network infrastructure and a lack of understanding regarding PTT solutions. However, with the introduction of modern networking technologies such as LTE and G, latency and communication gaps have decreased.

Opportunities

Beyond existing mobile broadband networks, 5G-enabled high-speed networks are predicted to have a substantial influence on innovation, productivity, and efficiency improvements. Although 5G networks are still in their beginning, services such as mission-critical communications are currently accessible on LTE networks, as defined by 3GPP Release 13 and above. The launch of 5G networks, on the other hand, is projected to increase performance in low latency applications such as mission-critical communications. First responders will be able to prioritize mission-critical traffic more effectively with 5G networks, which will also provide additional benefits such as push-to-video, video sharing, group chat, file sharing, location sharing, and more.

Market Segmentation

By Component, the Device segment is dominating in the Push to Talk (PTT) Market. The presence of key market players such as AT&T Intellectual Property, Bell Canada, ESChat, and Azetti Networks, among others, is significantly contributing to the growth of this segment. Also, the rising adoption of a rugged push to talk devices with inventive technologies is anticipated to supplement the market growth. Various manufacturers are offering devices enabled with innovative features and technologies such as larger displays, multimedia storage, enhanced communication systems, and battery backup. Several companies are focusing on the development of innovative and flexible devices. For instance, in 2019, AT&T Intellectual Property launched rugged PTT devices to meet the performance and functionality standards of the 3GPP for MCPTT. Also, rising awareness of public safety in the advanced PTT technology and features is expected to drive the market.

By Network Type, Land Mobile Radio dominates the network type segment in the Push to Talk (PTT) Market. Because of the increased focus on enhancing communication technologies among public safety organizations and law enforcement agencies, the land mobile radio segment is expected to have a large market share. Leading firms are working on providing customized apps and solutions to meet expanding client demands. Law enforcement, defense, and public safety, among other fields, rely heavily on LMR systems. Rising demand for LMR systems in rising economies such as Latin America, the Middle East, Africa (LAMEA), and Asia-Pacific, as well as heightened security measures in the face of terrorist attacks and natural disasters, are likely to boost market expansion.

By Application, The market is likely to be driven by the increased acceptance of these devices in the public safety and security arena, such as specialized ultra-rugged devices, feature phones, and smartphones. Due to their revolutionary benefits and features, push-to-talk systems are used by several public safety firms throughout the world, including Phoenix Health and Safety, Honeywell, and 3M. Moreover, during crises, public officials communicate utilizing these devices, such as walkie-talkies. The market's major players are concentrating on releasing new items to expand their geographic reach. For example, AT&T announced MCPTT-based FirstNet and Assured Wireless certified high-power user equipment (HPUE) solutions for public safety applications in March 2020. PTT is being gradually implemented by the government and defense sector, in response to rising worries about border security and the advancement of advanced surveillance technologies. Furthermore, during the projected period, the transportation & logistics, energy & utilities, and travel & hospitality categories are predicted to increase considerably.

Players Covered in Push to Talk (PTT) market are :

- AT&T (US)

- Verizon Wireless (US)

- Motorola Solutions Inc. (US)

- T-Mobile (US)

- Qualcomm Incorporated (US)

- Bell Canada (Canada)

- Iridium Satellite LLC (US)

- Tait Communications (New Zealand)

- Zebra Technologies Corporation (US)

- Telstra Corporation Limited (Australia)

- Hytera Communications Corporation Limited (China)

- Simoco Wireless Solutions Limited (England)

- GroupTalk (Sweden)

- Orion Labs Inc. (US)

- Zello Inc (US)

- Yiip Inc. VoiceLayer (US)

- VoxerNet LLC (US)

- International Push to Talk Ltd (iPTT) (England)

- Enterprise Secure Chat (ESChat) (US)

- AINA Wireless (US)

- S.L. (Azetti Networks) (Spain)

- ServiceMax Inc. (US)

- PeakPTT (US)

- RugGear (China)

- TeamConnect (US)

Regional Analysis of Push to Talk (PTT) Market

North America dominates the Push to Talk (PTT) Market. North America is expected to have the largest share of the PTT market in 2021. The Push-to-Talk market in North America is expected to be the largest in the world. The United States controls a large percentage of the market. In terms of Push-to-Talk-based hardware, solutions, and services, North America dominates the worldwide market. The economies of the United States and Canada are both stable and well-established, allowing them to invest heavily in R&D and so contribute to the creation of new technology. Because of the increased use of push-to-talk solutions across numerous end-use industries such as public safety organizations, government and defense, healthcare, and others, the United States owns the majority share of the North American market. As a result, the market's major players are concentrating on product development to fulfill the growing need for efficient and cost-effective push-to-talk solutions.

The market in Asia-Pacific is expected to develop at the fastest CAGR. The progress in IT infrastructure and increased coordination between distributors and major stakeholders are credited with this expansion. China and India, Asia's two fastest-growing economies, are constantly investing in arming public safety organizations like the police and military with these gadgets. To acquire a competitive advantage in the industry, key firms are focusing on releasing new goods. For example, Kyocera Corporation, a Japanese electronics manufacturer and supplier, announced the "DuraForce PRO 2," a 4G LTE Android smartphone with Verizon Wireless that is military-grade, ultra-rugged, and waterproof. This gadget is suitable for use in a variety of sectors, including construction and transportation. As a result, market expansion is expected in the Asia Pacific during the forecasted period.

Europe held a substantial share of the market, due to the presence of prominent companies such as (International Ltd.) iPTT and Azetti Networks. To develop their business and associated offers, these significant companies are focused on initiatives such as new product releases. International Push to Talk, a telecommunications equipment supplier based in the United Kingdom, released the "iPTT P500" hand portable PTT-over-cellular (PoC) radio, which is intended for use in a variety of industries including hospitality, traffic management, construction, public safety, and transportation.

Key Developments of Push to Talk (PTT) Market

- April 2020, ESChat announced the launch of ESChat broadband Push-to-Talk (PTT) service on the TELUS wireless network.

- February 2021, to offer out 5G services in India, Bharti Airtel teamed with Qualcomm Technologies. Airtel will employ Qualcomm's Radio Access Network (RAN) infrastructure as part of the new cooperation. Airtel will deploy virtualized and Open RAN-based 5G networks using Qualcomm 5G RAN Platforms.

- December 2020, FirstNet-AT&T has landed a communications contract with the Federal Bureau of Investigations that expands the bureau’s use of FirstNet to cover day-to-day communications as well as emergency operations.

Covid19 Impact on Push to Talk (PTT) Market

The COVID-19 pandemic has wreaked havoc on a variety of industries throughout the world. Various public health guidelines were adopted in various nations throughout the world to limit the number of cases and decrease the spread of the coronavirus. Declaring national emergencies, enforcing stay-at-home orders, closing non-essential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders, are all examples of COVID-19 protocols. Furthermore, creating a secure half-duplex Wi-Fi network for employees at every remote site in such a short time is difficult for businesses. Consumers and businesses will be forced to migrate to the internet world as a result of the ongoing crisis. For PTT service providers, the COVID19 has spurred a distant work revolution and social alienation. For example, in April 2020, ESChat supplied law enforcement and emergency medical service (EMS) workforces across North America with mission-critical broadband PTT (MCPTT) communication. The COVID-19 situation encouraged the expansion of such service. As a consequence, production would improve and new possibilities for the workforce may arise. Solution suppliers have significant potential during such a period.

|

Global Push to Talk (PTT) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 18.83 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.9% |

Market Size in 2028: |

USD 36.46 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Network Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Network Component

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Push to Talk (PTT) Market by Component

5.1 Push to Talk (PTT) Market Overview Snapshot and Growth Engine

5.2 Push to Talk (PTT) Market Overview

5.3 Device

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Device: Grographic Segmentation

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Grographic Segmentation

5.5 Service

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Service: Grographic Segmentation

Chapter 6: Push to Talk (PTT) Market by Network Component

6.1 Push to Talk (PTT) Market Overview Snapshot and Growth Engine

6.2 Push to Talk (PTT) Market Overview

6.3 Cellular or PoC Double-Sided

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cellular or PoC Double-Sided: Grographic Segmentation

6.4 Land mobile radio

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Land mobile radio: Grographic Segmentation

Chapter 7: Push to Talk (PTT) Market by Application

7.1 Push to Talk (PTT) Market Overview Snapshot and Growth Engine

7.2 Push to Talk (PTT) Market Overview

7.3 Public safety & security

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Public safety & security: Grographic Segmentation

7.4 Government & Defense

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Government & Defense: Grographic Segmentation

7.5 Transportation & Logistics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Transportation & Logistics: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Push to Talk (PTT) Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Push to Talk (PTT) Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Push to Talk (PTT) Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AT&T

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 VERIZON WIRELESS

8.4 MOTOROLA SOLUTIONS INC.

8.5 T-MOBILE

8.6 QUALCOMM INCORPORATED

8.7 BELL CANADA

8.8 IRIDIUM SATELLITE LLC

8.9 TAIT COMMUNICATIONS

8.10 ZEBRA TECHNOLOGIES CORPORATION

8.11 TELSTRA CORPORATION LIMITED

8.12 HYTERA COMMUNICATIONS CORPORATION LIMITED

8.13 SIMOCO WIRELESS SOLUTIONS LIMITED

8.14 GROUPTALK

8.15 ORION LABS INC.

8.16 ZELLO INC.

8.17 YIIP INC. VOICELAYER

8.18 VOXERNET LLC

8.19 INTERNATIONAL PUSH TO TALK LTD (IPTT)

8.20 ENTERPRISE SECURE CHAT (ESCHAT)

8.21 AINA WIRELESS

8.22 S.L. (AZETTI NETWORKS)

8.23 SERVICEMAX INC.

8.24 PEAKPTT

8.25 RUGGEAR

8.26 TEAMCONNECT

8.27 OTHER MAJOR PLAYERS

Chapter 9: Global Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Component

9.2.1 Device

9.2.2 Software

9.2.3 Service

9.3 Historic and Forecasted Market Size By Network Component

9.3.1 Cellular or PoC Double-Sided

9.3.2 Land mobile radio

9.4 Historic and Forecasted Market Size By Application

9.4.1 Public safety & security

9.4.2 Government & Defense

9.4.3 Transportation & Logistics

9.4.4 Others

Chapter 10: North America Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Component

10.4.1 Device

10.4.2 Software

10.4.3 Service

10.5 Historic and Forecasted Market Size By Network Component

10.5.1 Cellular or PoC Double-Sided

10.5.2 Land mobile radio

10.6 Historic and Forecasted Market Size By Application

10.6.1 Public safety & security

10.6.2 Government & Defense

10.6.3 Transportation & Logistics

10.6.4 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Device

11.4.2 Software

11.4.3 Service

11.5 Historic and Forecasted Market Size By Network Component

11.5.1 Cellular or PoC Double-Sided

11.5.2 Land mobile radio

11.6 Historic and Forecasted Market Size By Application

11.6.1 Public safety & security

11.6.2 Government & Defense

11.6.3 Transportation & Logistics

11.6.4 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Device

12.4.2 Software

12.4.3 Service

12.5 Historic and Forecasted Market Size By Network Component

12.5.1 Cellular or PoC Double-Sided

12.5.2 Land mobile radio

12.6 Historic and Forecasted Market Size By Application

12.6.1 Public safety & security

12.6.2 Government & Defense

12.6.3 Transportation & Logistics

12.6.4 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Device

13.4.2 Software

13.4.3 Service

13.5 Historic and Forecasted Market Size By Network Component

13.5.1 Cellular or PoC Double-Sided

13.5.2 Land mobile radio

13.6 Historic and Forecasted Market Size By Application

13.6.1 Public safety & security

13.6.2 Government & Defense

13.6.3 Transportation & Logistics

13.6.4 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Push to Talk (PTT) Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Device

14.4.2 Software

14.4.3 Service

14.5 Historic and Forecasted Market Size By Network Component

14.5.1 Cellular or PoC Double-Sided

14.5.2 Land mobile radio

14.6 Historic and Forecasted Market Size By Application

14.6.1 Public safety & security

14.6.2 Government & Defense

14.6.3 Transportation & Logistics

14.6.4 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Push to Talk (PTT) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 18.83 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.9% |

Market Size in 2028: |

USD 36.46 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Network Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PUSH TO TALK (PTT) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PUSH TO TALK (PTT) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PUSH TO TALK (PTT) MARKET COMPETITIVE RIVALRY

TABLE 005. PUSH TO TALK (PTT) MARKET THREAT OF NEW ENTRANTS

TABLE 006. PUSH TO TALK (PTT) MARKET THREAT OF SUBSTITUTES

TABLE 007. PUSH TO TALK (PTT) MARKET BY COMPONENT

TABLE 008. DEVICE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. PUSH TO TALK (PTT) MARKET BY NETWORK COMPONENT

TABLE 012. CELLULAR OR POC DOUBLE-SIDED MARKET OVERVIEW (2016-2028)

TABLE 013. LAND MOBILE RADIO MARKET OVERVIEW (2016-2028)

TABLE 014. PUSH TO TALK (PTT) MARKET BY APPLICATION

TABLE 015. PUBLIC SAFETY & SECURITY MARKET OVERVIEW (2016-2028)

TABLE 016. GOVERNMENT & DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 017. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA PUSH TO TALK (PTT) MARKET, BY COMPONENT (2016-2028)

TABLE 020. NORTH AMERICA PUSH TO TALK (PTT) MARKET, BY NETWORK COMPONENT (2016-2028)

TABLE 021. NORTH AMERICA PUSH TO TALK (PTT) MARKET, BY APPLICATION (2016-2028)

TABLE 022. N PUSH TO TALK (PTT) MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE PUSH TO TALK (PTT) MARKET, BY COMPONENT (2016-2028)

TABLE 024. EUROPE PUSH TO TALK (PTT) MARKET, BY NETWORK COMPONENT (2016-2028)

TABLE 025. EUROPE PUSH TO TALK (PTT) MARKET, BY APPLICATION (2016-2028)

TABLE 026. PUSH TO TALK (PTT) MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC PUSH TO TALK (PTT) MARKET, BY COMPONENT (2016-2028)

TABLE 028. ASIA PACIFIC PUSH TO TALK (PTT) MARKET, BY NETWORK COMPONENT (2016-2028)

TABLE 029. ASIA PACIFIC PUSH TO TALK (PTT) MARKET, BY APPLICATION (2016-2028)

TABLE 030. PUSH TO TALK (PTT) MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA PUSH TO TALK (PTT) MARKET, BY COMPONENT (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA PUSH TO TALK (PTT) MARKET, BY NETWORK COMPONENT (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA PUSH TO TALK (PTT) MARKET, BY APPLICATION (2016-2028)

TABLE 034. PUSH TO TALK (PTT) MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA PUSH TO TALK (PTT) MARKET, BY COMPONENT (2016-2028)

TABLE 036. SOUTH AMERICA PUSH TO TALK (PTT) MARKET, BY NETWORK COMPONENT (2016-2028)

TABLE 037. SOUTH AMERICA PUSH TO TALK (PTT) MARKET, BY APPLICATION (2016-2028)

TABLE 038. PUSH TO TALK (PTT) MARKET, BY COUNTRY (2016-2028)

TABLE 039. AT&T: SNAPSHOT

TABLE 040. AT&T: BUSINESS PERFORMANCE

TABLE 041. AT&T: PRODUCT PORTFOLIO

TABLE 042. AT&T: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. VERIZON WIRELESS: SNAPSHOT

TABLE 043. VERIZON WIRELESS: BUSINESS PERFORMANCE

TABLE 044. VERIZON WIRELESS: PRODUCT PORTFOLIO

TABLE 045. VERIZON WIRELESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. MOTOROLA SOLUTIONS INC.: SNAPSHOT

TABLE 046. MOTOROLA SOLUTIONS INC.: BUSINESS PERFORMANCE

TABLE 047. MOTOROLA SOLUTIONS INC.: PRODUCT PORTFOLIO

TABLE 048. MOTOROLA SOLUTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. T-MOBILE: SNAPSHOT

TABLE 049. T-MOBILE: BUSINESS PERFORMANCE

TABLE 050. T-MOBILE: PRODUCT PORTFOLIO

TABLE 051. T-MOBILE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. QUALCOMM INCORPORATED: SNAPSHOT

TABLE 052. QUALCOMM INCORPORATED: BUSINESS PERFORMANCE

TABLE 053. QUALCOMM INCORPORATED: PRODUCT PORTFOLIO

TABLE 054. QUALCOMM INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BELL CANADA: SNAPSHOT

TABLE 055. BELL CANADA: BUSINESS PERFORMANCE

TABLE 056. BELL CANADA: PRODUCT PORTFOLIO

TABLE 057. BELL CANADA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. IRIDIUM SATELLITE LLC: SNAPSHOT

TABLE 058. IRIDIUM SATELLITE LLC: BUSINESS PERFORMANCE

TABLE 059. IRIDIUM SATELLITE LLC: PRODUCT PORTFOLIO

TABLE 060. IRIDIUM SATELLITE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. TAIT COMMUNICATIONS: SNAPSHOT

TABLE 061. TAIT COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 062. TAIT COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 063. TAIT COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ZEBRA TECHNOLOGIES CORPORATION: SNAPSHOT

TABLE 064. ZEBRA TECHNOLOGIES CORPORATION: BUSINESS PERFORMANCE

TABLE 065. ZEBRA TECHNOLOGIES CORPORATION: PRODUCT PORTFOLIO

TABLE 066. ZEBRA TECHNOLOGIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TELSTRA CORPORATION LIMITED: SNAPSHOT

TABLE 067. TELSTRA CORPORATION LIMITED: BUSINESS PERFORMANCE

TABLE 068. TELSTRA CORPORATION LIMITED: PRODUCT PORTFOLIO

TABLE 069. TELSTRA CORPORATION LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HYTERA COMMUNICATIONS CORPORATION LIMITED: SNAPSHOT

TABLE 070. HYTERA COMMUNICATIONS CORPORATION LIMITED: BUSINESS PERFORMANCE

TABLE 071. HYTERA COMMUNICATIONS CORPORATION LIMITED: PRODUCT PORTFOLIO

TABLE 072. HYTERA COMMUNICATIONS CORPORATION LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SIMOCO WIRELESS SOLUTIONS LIMITED: SNAPSHOT

TABLE 073. SIMOCO WIRELESS SOLUTIONS LIMITED: BUSINESS PERFORMANCE

TABLE 074. SIMOCO WIRELESS SOLUTIONS LIMITED: PRODUCT PORTFOLIO

TABLE 075. SIMOCO WIRELESS SOLUTIONS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GROUPTALK: SNAPSHOT

TABLE 076. GROUPTALK: BUSINESS PERFORMANCE

TABLE 077. GROUPTALK: PRODUCT PORTFOLIO

TABLE 078. GROUPTALK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ORION LABS INC.: SNAPSHOT

TABLE 079. ORION LABS INC.: BUSINESS PERFORMANCE

TABLE 080. ORION LABS INC.: PRODUCT PORTFOLIO

TABLE 081. ORION LABS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. ZELLO INC.: SNAPSHOT

TABLE 082. ZELLO INC.: BUSINESS PERFORMANCE

TABLE 083. ZELLO INC.: PRODUCT PORTFOLIO

TABLE 084. ZELLO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. YIIP INC. VOICELAYER: SNAPSHOT

TABLE 085. YIIP INC. VOICELAYER: BUSINESS PERFORMANCE

TABLE 086. YIIP INC. VOICELAYER: PRODUCT PORTFOLIO

TABLE 087. YIIP INC. VOICELAYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. VOXERNET LLC: SNAPSHOT

TABLE 088. VOXERNET LLC: BUSINESS PERFORMANCE

TABLE 089. VOXERNET LLC: PRODUCT PORTFOLIO

TABLE 090. VOXERNET LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. INTERNATIONAL PUSH TO TALK LTD (IPTT): SNAPSHOT

TABLE 091. INTERNATIONAL PUSH TO TALK LTD (IPTT): BUSINESS PERFORMANCE

TABLE 092. INTERNATIONAL PUSH TO TALK LTD (IPTT): PRODUCT PORTFOLIO

TABLE 093. INTERNATIONAL PUSH TO TALK LTD (IPTT): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. ENTERPRISE SECURE CHAT (ESCHAT): SNAPSHOT

TABLE 094. ENTERPRISE SECURE CHAT (ESCHAT): BUSINESS PERFORMANCE

TABLE 095. ENTERPRISE SECURE CHAT (ESCHAT): PRODUCT PORTFOLIO

TABLE 096. ENTERPRISE SECURE CHAT (ESCHAT): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. AINA WIRELESS: SNAPSHOT

TABLE 097. AINA WIRELESS: BUSINESS PERFORMANCE

TABLE 098. AINA WIRELESS: PRODUCT PORTFOLIO

TABLE 099. AINA WIRELESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. S.L. (AZETTI NETWORKS): SNAPSHOT

TABLE 100. S.L. (AZETTI NETWORKS): BUSINESS PERFORMANCE

TABLE 101. S.L. (AZETTI NETWORKS): PRODUCT PORTFOLIO

TABLE 102. S.L. (AZETTI NETWORKS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. SERVICEMAX INC.: SNAPSHOT

TABLE 103. SERVICEMAX INC.: BUSINESS PERFORMANCE

TABLE 104. SERVICEMAX INC.: PRODUCT PORTFOLIO

TABLE 105. SERVICEMAX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. PEAKPTT: SNAPSHOT

TABLE 106. PEAKPTT: BUSINESS PERFORMANCE

TABLE 107. PEAKPTT: PRODUCT PORTFOLIO

TABLE 108. PEAKPTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. RUGGEAR: SNAPSHOT

TABLE 109. RUGGEAR: BUSINESS PERFORMANCE

TABLE 110. RUGGEAR: PRODUCT PORTFOLIO

TABLE 111. RUGGEAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. TEAMCONNECT: SNAPSHOT

TABLE 112. TEAMCONNECT: BUSINESS PERFORMANCE

TABLE 113. TEAMCONNECT: PRODUCT PORTFOLIO

TABLE 114. TEAMCONNECT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 115. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 116. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 117. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PUSH TO TALK (PTT) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PUSH TO TALK (PTT) MARKET OVERVIEW BY COMPONENT

FIGURE 012. DEVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. PUSH TO TALK (PTT) MARKET OVERVIEW BY NETWORK COMPONENT

FIGURE 016. CELLULAR OR POC DOUBLE-SIDED MARKET OVERVIEW (2016-2028)

FIGURE 017. LAND MOBILE RADIO MARKET OVERVIEW (2016-2028)

FIGURE 018. PUSH TO TALK (PTT) MARKET OVERVIEW BY APPLICATION

FIGURE 019. PUBLIC SAFETY & SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 020. GOVERNMENT & DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 021. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA PUSH TO TALK (PTT) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE PUSH TO TALK (PTT) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC PUSH TO TALK (PTT) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA PUSH TO TALK (PTT) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA PUSH TO TALK (PTT) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Push to Talk (PTT) Market research report is 2022-2028.

AT&T (US), Verizon Wireless (US), Motorola Solutions Inc. (US),(T-Mobile (US), Qualcomm Incorporated (US), Bell Canada (Canada), Iridium Satellite LLC (US), Tait Communications (New Zealand), Zebra Technologies Corporation (US), Telstra Corporation Limited (Australia), Hytera Communications Corporation Limited (China), Simoco Wireless Solutions Limited (England), GroupTalk (Sweden), Orion Labs Inc. (US), Zello Inc (US), Yiip Inc. VoiceLayer (US), VoxerNet LLC (US), International Push to Talk Ltd (iPTT) (England), Enterprise Secure Chat (ESChat) (US), AINA Wireless (US), S.L. (Azetti Networks) (Spain), ServiceMax Inc. (US), PeakPTT (US), RugGear (China), TeamConnect (US), and other major players.

The Push to Talk (PTT) Market is segmented into Component, Network Component, Application, and region. By Component, the market is categorized into Devices, Software, and Services. By Network Component, the market is categorized into Cellular or PoC Double-Sided, Land mobile radio. By Application, the market is categorized into Public safety & security, Government & Defense, Transportation & Logistics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Push-to-talk (PTT) is a telecommunication technique that works like a "walkie-talkie" and is a two-way communication service. When compared to mobile phone conversations, which are full-duplex and allow both parties to hear each other, PTT is half-duplex, which means communication can only be delivered in one direction at a time. It's a one-to-many or one-to-one mobile communications system that eliminates the processes of dialling, ringing, and responding that a traditional phone call entail.

The Global Push to Talk (PTT) Market was valued at USD 18.83 billion in 2021 and is expected to reach USD 36.46 billion by the year 2028, at a CAGR of 9.9%.