Pruritus Therapeutic Market Synopsis

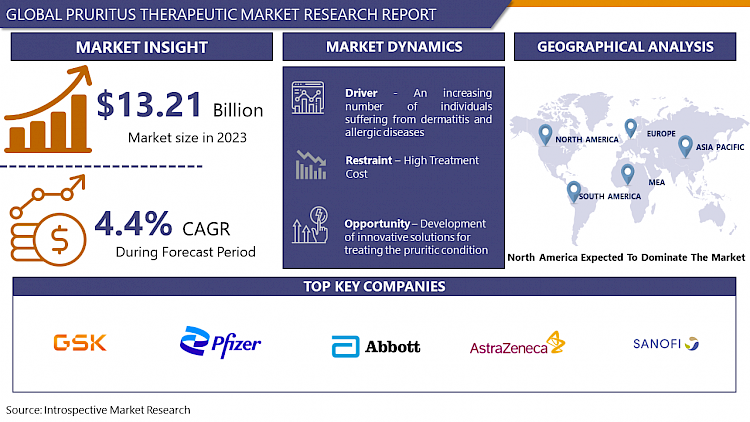

The Pruritus Therapeutic market estimated at USD 13.21 Billion in the year 2023, is projected to reach a revised size of USD 19.44 Billion by 2032, growing at a CAGR of 4.4% over the analysis period 2024-2032.

Dry skin is a common cause of itchy skin, also known as pruritus. It's more frequent in older people since their skin dries out with age. Antibiotics, antifungals, anticonvulsants, and a few natural remedies such as topical application of coconut oil, vitamin E, and honey are utilized to treat pruritus.

- Innovations in drug development and increasing awareness about pruritus as a standalone condition or a symptom of other diseases were driving the market. Topical corticosteroids, antihistamines, and immunosuppressants were among the commonly prescribed treatments, while research efforts were underway to identify new therapeutic targets.

- The market dynamics were influenced by factors such as the prevalence of skin disorders, autoimmune diseases, and the aging population. Companies were investing in research and development to introduce novel therapies, including biologics and small molecules, to cater to the evolving needs of patients suffering from pruritus. Collaboration between pharmaceutical companies, academic institutions, and healthcare organizations played a crucial role in advancing the understanding and treatment options for pruritus.

Pruritus Therapeutic Market Trend Analysis

An increasing number of individuals suffering from dermatitis and allergic diseases

- The rising prevalence of dermatitis and allergic diseases has emerged as a pivotal driver for the Pruritus Therapeutic Market. Dermatitis, characterized by inflammation of the skin, and allergic conditions, often associated with hypersensitivity reactions, contribute to a growing population of individuals experiencing pruritus, or itching. This escalating number of cases has fueled the demand for effective therapeutic interventions to alleviate pruritus and enhance the quality of life for affected individuals.

- As the awareness of these conditions expands and diagnostic capabilities improve, more individuals seek medical attention for pruritus-related symptoms. Consequently, pharmaceutical and healthcare companies are investing in research and development to introduce novel and targeted therapies for pruritus management. The market is witnessing a surge in the introduction of advanced medications and treatment modalities designed to address the underlying causes of pruritus, offering relief to patients and healthcare providers alike.

- In addition to pharmaceutical interventions, there is a growing focus on holistic approaches, including lifestyle modifications and topical treatments, to manage pruritus effectively. The Pruritus Therapeutic Market is expected to witness sustained growth as healthcare professionals and stakeholders strive to meet the increasing demand for innovative and comprehensive solutions to tackle pruritus associated with dermatitis and allergic diseases.

Development of innovative solutions for treating the pruritic condition Creates an Opportunity

- The increasing prevalence of pruritic conditions, characterized by persistent itching, has spurred the development of innovative solutions, creating a significant opportunity factor for the Pruritus Therapeutic Market. Pruritus, commonly associated with various dermatological and systemic disorders, poses a substantial burden on patients' quality of life, necessitating effective therapeutic interventions.

- In recent years, advancements in medical research and technology have paved the way for novel treatment approaches targeting the underlying causes of pruritus. Pharmaceutical companies and research institutions are actively engaged in the discovery and development of drugs that not only alleviate itching symptoms but also address the root causes, providing a more comprehensive and lasting solution for patients.

- Biotechnological innovations, such as the identification of specific molecular pathways involved in pruritus, have enabled the design of targeted therapies with improved efficacy and reduced side effects. This burgeoning research landscape, coupled with a growing understanding of the neurobiological mechanisms behind itching, is fostering the creation of cutting-edge pharmaceuticals.

Pruritus Therapeutic Market Segment Analysis:

Pruritus Therapeutic Market Segmented on the basis of Drug Class, Disease Type, Route Of Administrations.

By Drug Class, corticosteroids segment is expected to dominate the market during the forecast period

- Corticosteroids are anticipated to dominate the Pruritus Therapeutic Market by drug class, exhibiting significant market share and growth. Pruritus, commonly known as itching, is a distressing symptom associated with various medical conditions, including dermatological disorders, allergic reactions, and systemic diseases. Corticosteroids, a class of anti-inflammatory drugs, have proven efficacy in managing pruritus by reducing inflammation and immune responses.

- The dominance of corticosteroids in the Pruritus Therapeutic Market can be attributed to their potent anti-inflammatory properties, which effectively alleviate itching associated with skin disorders. These drugs act by suppressing the immune system and inhibiting the release of inflammatory substances, providing relief to patients suffering from pruritus. Dermatologists often prescribe topical corticosteroids for localized pruritus and may recommend systemic corticosteroids for more widespread or severe cases.

- The market's growth is fueled by the increasing prevalence of pruritus-related conditions, raising awareness about available treatment options, and continuous advancements in drug formulations. However, the dominance of corticosteroids may also be challenged by emerging alternatives and concerns about potential side effects associated with prolonged use.

By Disease Type, atopic dermatitis segment held the largest share of 53.7% in 2022

- Atopic dermatitis, a chronic inflammatory skin condition characterized by itching and eczematous lesions, represents a significant portion of the pruritus patient population. This dominance can be attributed to several factors, including the high prevalence of atopic dermatitis globally and its association with persistent and distressing pruritus.

- The increasing awareness and understanding of atopic dermatitis have led to a growing demand for effective therapeutic interventions to alleviate pruritus symptoms associated with this condition. Pharmaceutical advancements, coupled with ongoing research and development initiatives, are contributing to the emergence of novel and targeted therapies specifically designed to address pruritus in atopic dermatitis patients.

- Moreover, the atopic dermatitis segment's dominance is further fueled by the continuous efforts of pharmaceutical companies to develop innovative treatments that not only provide symptomatic relief but also target the underlying mechanisms of pruritus in this population.

Pruritus Therapeutic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to dominate the Pruritus Therapeutic Market, showcasing a robust and dynamic healthcare landscape. The region's dominance can be attributed to several factors. Firstly, North America boasts advanced healthcare infrastructure and cutting-edge medical technologies, facilitating extensive research and development in the field of pruritus therapeutics. Leading pharmaceutical companies and research institutions in the region actively contribute to the discovery and innovation of novel treatments for pruritus.

- Moreover, a high prevalence of pruritus-related conditions, such as dermatological disorders and chronic diseases, among the North American population, drives the demand for effective therapeutic solutions. The region's aging population, coupled with lifestyle factors, contributes to the increasing incidence of pruritus, further propelling market growth.

- Additionally, favorable regulatory frameworks and reimbursement policies enhance the accessibility of pruritus therapeutics, encouraging both patients and healthcare providers to adopt these treatments. The presence of key market players, collaboration between academia and industry, and a proactive approach to addressing dermatological issues contribute to North America's dominant position in the Pruritus Therapeutic Market.

Pruritus Therapeutic Market Top Key Players:

- GlaxoSmithKline (GSK) (UK)

- Pfizer (USA)

- Sanofi (France)

- Bayer (Germany)

- AstraZeneca (UK)

- Asana BioSciences (USA)

- Vanda Pharmaceuticals (USA)

- Trevi Therapeutics (USA)

- Lumosa Therapeutics (USA)

- Shandong Boan Biotechnology (China)

- Sichuan Haisco Pharmaceutical (China)

- Escient Pharmaceuticals (USA)

- MC2 Therapeutics (Norway)

- Avior Bio (UK)

- AOBiome Therapeutics (USA)

- Clexio Biosciences (USA)

- BioMimetix (Israel)

- Titan Pharmaceuticals (USA)

- Teikoku Pharma Solutions (Japan)

- Tioga Pharmaceuticals (USA)

Key Industry Developments in the Pruritus Therapeutic Market:

-

In June 2023, Ipsen stated that Bylvay has received approval from the United States Food and Drug Administration (FDA) for the treatment of cholestatic pruritus in patients with Alagille syndrome starting at the age of 12 months. Bylvay is an ileal bile acid transport inhibitor (IBATi) that operates locally in the small intestine and has very little systemic exposure. In the United States and for the treatment of progressive familial intrahepatic cholestasis (PFIC) in Europe, Bylvay was authorized as the first medication therapy option in 2021 for individuals suffering from cholestatic pruritus caused by PFIC. For qualified ALGS patients, Bylvay is instantly available by prescription.

In August 2023, VeopozTM, also known as CD55-deficient protein-losing enteropathy, was authorized by the U.S. Food and Drug Administration (FDA) for the treatment of adult and pediatric patients 1 year of age and older with CHAPLE disease, according to Regeneron Pharmaceuticals, Inc. The first and only remedy suggested especially for CHAPLE is Veopoz. The pre-approval inspection concerns about the aflibercept 8 mg BLA have been resolved with the consent of Veopoz. In the next weeks, FDA action on the aflibercept 8 mg BLA is anticipated.

|

Global Pruritus Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.21 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.4% |

Market Size in 2032: |

USD 19.44 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease Type |

|

||

|

By Route Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PRURITUS THERAPEUTIC MARKET BY DRUG CLASS (2016-2030)

- PRURITUS THERAPEUTIC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CALCINEURIN INHIBITORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CORTICOSTEROIDS

- COUNTERIRRITANTS

- IMMUNOSUPPRESSANT

- ANTIHISTAMINES

- PRURITUS THERAPEUTIC MARKET BY DISEASE TYPE (2016-2030)

- PRURITUS THERAPEUTIC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ALLERGIC CONTACT DERMATITIS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ATOPIC DERMATITIS

- PSORIASIS

- URTICARIA

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PRURITUS THERAPEUTIC Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GLAXOSMITHKLINE (GSK) (UK)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PFIZER (USA)

- SANOFI (FRANCE)

- BAYER (GERMANY)

- ASTRAZENECA (UK)

- ASANA BIOSCIENCES (USA)

- VANDA PHARMACEUTICALS (USA)

- TREVI THERAPEUTICS (USA)

- LUMOSA THERAPEUTICS (USA)

- SHANDONG BOAN BIOTECHNOLOGY (CHINA)

- SICHUAN HAISCO PHARMACEUTICAL (CHINA)

- ESCIENT PHARMACEUTICALS (USA)

- MC2 THERAPEUTICS (NORWAY)

- AVIOR BIO (UK)

- AOBIOME THERAPEUTICS (USA)

- CLEXIO BIOSCIENCES (USA)

- BIOMIMETIX (ISRAEL)

- TITAN PHARMACEUTICALS (USA)

- TEIKOKU PHARMA SOLUTIONS (JAPAN)

- TIOGA PHARMACEUTICALS (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL PRURITUS THERAPEUTIC MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Drug Class

- Historic And Forecasted Market Size By Disease Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Pruritus Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.21 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.4% |

Market Size in 2032: |

USD 19.44 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease Type |

|

||

|

By Route Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PRURITUS THERAPEUTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PRURITUS THERAPEUTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PRURITUS THERAPEUTICS MARKET COMPETITIVE RIVALRY

TABLE 005. PRURITUS THERAPEUTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. PRURITUS THERAPEUTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. PRURITUS THERAPEUTICS MARKET BY DRUG CLASS

TABLE 008. CALCINEURIN INHIBITORS MARKET OVERVIEW (2016-2028)

TABLE 009. CORTICOSTEROIDS MARKET OVERVIEW (2016-2028)

TABLE 010. COUNTERIRRITANTS MARKET OVERVIEW (2016-2028)

TABLE 011. IMMUNOSUPPRESSANT MARKET OVERVIEW (2016-2028)

TABLE 012. ANTIHISTAMINES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. PRURITUS THERAPEUTICS MARKET BY DISEASE TYPE

TABLE 015. ALLERGIC CONTACT DERMATITIS MARKET OVERVIEW (2016-2028)

TABLE 016. ATOPIC DERMATITIS MARKET OVERVIEW (2016-2028)

TABLE 017. PSORIASIS MARKET OVERVIEW (2016-2028)

TABLE 018. URTICARIA MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. PRURITUS THERAPEUTICS MARKET BY ROUTE OF ADMINISTRATION

TABLE 021. ORAL MARKET OVERVIEW (2016-2028)

TABLE 022. PARENTERAL MARKET OVERVIEW (2016-2028)

TABLE 023. TOPICAL MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA PRURITUS THERAPEUTICS MARKET, BY DRUG CLASS (2016-2028)

TABLE 025. NORTH AMERICA PRURITUS THERAPEUTICS MARKET, BY DISEASE TYPE (2016-2028)

TABLE 026. NORTH AMERICA PRURITUS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 027. N PRURITUS THERAPEUTICS MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE PRURITUS THERAPEUTICS MARKET, BY DRUG CLASS (2016-2028)

TABLE 029. EUROPE PRURITUS THERAPEUTICS MARKET, BY DISEASE TYPE (2016-2028)

TABLE 030. EUROPE PRURITUS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 031. PRURITUS THERAPEUTICS MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC PRURITUS THERAPEUTICS MARKET, BY DRUG CLASS (2016-2028)

TABLE 033. ASIA PACIFIC PRURITUS THERAPEUTICS MARKET, BY DISEASE TYPE (2016-2028)

TABLE 034. ASIA PACIFIC PRURITUS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 035. PRURITUS THERAPEUTICS MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA PRURITUS THERAPEUTICS MARKET, BY DRUG CLASS (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA PRURITUS THERAPEUTICS MARKET, BY DISEASE TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA PRURITUS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 039. PRURITUS THERAPEUTICS MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA PRURITUS THERAPEUTICS MARKET, BY DRUG CLASS (2016-2028)

TABLE 041. SOUTH AMERICA PRURITUS THERAPEUTICS MARKET, BY DISEASE TYPE (2016-2028)

TABLE 042. SOUTH AMERICA PRURITUS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (2016-2028)

TABLE 043. PRURITUS THERAPEUTICS MARKET, BY COUNTRY (2016-2028)

TABLE 044. ABBVIE INC.: SNAPSHOT

TABLE 045. ABBVIE INC.: BUSINESS PERFORMANCE

TABLE 046. ABBVIE INC.: PRODUCT PORTFOLIO

TABLE 047. ABBVIE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SANOFI SA: SNAPSHOT

TABLE 048. SANOFI SA: BUSINESS PERFORMANCE

TABLE 049. SANOFI SA: PRODUCT PORTFOLIO

TABLE 050. SANOFI SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GALDERMA LABORATORIES LP: SNAPSHOT

TABLE 051. GALDERMA LABORATORIES LP: BUSINESS PERFORMANCE

TABLE 052. GALDERMA LABORATORIES LP: PRODUCT PORTFOLIO

TABLE 053. GALDERMA LABORATORIES LP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. EPI HEALTH LLC: SNAPSHOT

TABLE 054. EPI HEALTH LLC: BUSINESS PERFORMANCE

TABLE 055. EPI HEALTH LLC: PRODUCT PORTFOLIO

TABLE 056. EPI HEALTH LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CARA THERAPEUTICS: SNAPSHOT

TABLE 057. CARA THERAPEUTICS: BUSINESS PERFORMANCE

TABLE 058. CARA THERAPEUTICS: PRODUCT PORTFOLIO

TABLE 059. CARA THERAPEUTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ACTAVIS: SNAPSHOT

TABLE 060. ACTAVIS: BUSINESS PERFORMANCE

TABLE 061. ACTAVIS: PRODUCT PORTFOLIO

TABLE 062. ACTAVIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. TREVI THERAPEUTICS: SNAPSHOT

TABLE 063. TREVI THERAPEUTICS: BUSINESS PERFORMANCE

TABLE 064. TREVI THERAPEUTICS: PRODUCT PORTFOLIO

TABLE 065. TREVI THERAPEUTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. NOVARTIS AG: SNAPSHOT

TABLE 066. NOVARTIS AG: BUSINESS PERFORMANCE

TABLE 067. NOVARTIS AG: PRODUCT PORTFOLIO

TABLE 068. NOVARTIS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PFIZER INC.: SNAPSHOT

TABLE 069. PFIZER INC.: BUSINESS PERFORMANCE

TABLE 070. PFIZER INC.: PRODUCT PORTFOLIO

TABLE 071. PFIZER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. MERCK & CO INC.: SNAPSHOT

TABLE 072. MERCK & CO INC.: BUSINESS PERFORMANCE

TABLE 073. MERCK & CO INC.: PRODUCT PORTFOLIO

TABLE 074. MERCK & CO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SUN PHARMACEUTICAL: SNAPSHOT

TABLE 075. SUN PHARMACEUTICAL: BUSINESS PERFORMANCE

TABLE 076. SUN PHARMACEUTICAL: PRODUCT PORTFOLIO

TABLE 077. SUN PHARMACEUTICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. GLAXOSMITHKLINE PLC: SNAPSHOT

TABLE 078. GLAXOSMITHKLINE PLC: BUSINESS PERFORMANCE

TABLE 079. GLAXOSMITHKLINE PLC: PRODUCT PORTFOLIO

TABLE 080. GLAXOSMITHKLINE PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. GLENMARK PHARMACEUTICALS LTD.: SNAPSHOT

TABLE 081. GLENMARK PHARMACEUTICALS LTD.: BUSINESS PERFORMANCE

TABLE 082. GLENMARK PHARMACEUTICALS LTD.: PRODUCT PORTFOLIO

TABLE 083. GLENMARK PHARMACEUTICALS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. ABBOTT LABORATORIES: SNAPSHOT

TABLE 084. ABBOTT LABORATORIES: BUSINESS PERFORMANCE

TABLE 085. ABBOTT LABORATORIES: PRODUCT PORTFOLIO

TABLE 086. ABBOTT LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PRURITUS THERAPEUTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PRURITUS THERAPEUTICS MARKET OVERVIEW BY DRUG CLASS

FIGURE 012. CALCINEURIN INHIBITORS MARKET OVERVIEW (2016-2028)

FIGURE 013. CORTICOSTEROIDS MARKET OVERVIEW (2016-2028)

FIGURE 014. COUNTERIRRITANTS MARKET OVERVIEW (2016-2028)

FIGURE 015. IMMUNOSUPPRESSANT MARKET OVERVIEW (2016-2028)

FIGURE 016. ANTIHISTAMINES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. PRURITUS THERAPEUTICS MARKET OVERVIEW BY DISEASE TYPE

FIGURE 019. ALLERGIC CONTACT DERMATITIS MARKET OVERVIEW (2016-2028)

FIGURE 020. ATOPIC DERMATITIS MARKET OVERVIEW (2016-2028)

FIGURE 021. PSORIASIS MARKET OVERVIEW (2016-2028)

FIGURE 022. URTICARIA MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. PRURITUS THERAPEUTICS MARKET OVERVIEW BY ROUTE OF ADMINISTRATION

FIGURE 025. ORAL MARKET OVERVIEW (2016-2028)

FIGURE 026. PARENTERAL MARKET OVERVIEW (2016-2028)

FIGURE 027. TOPICAL MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA PRURITUS THERAPEUTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE PRURITUS THERAPEUTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC PRURITUS THERAPEUTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA PRURITUS THERAPEUTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA PRURITUS THERAPEUTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Pruritus Therapeutic Market research report is 2024-2032.

GlaxoSmithKline (GSK) (UK), Pfizer (USA), Sanofi (France), Bayer (Germany), AstraZeneca (UK), Asana BioSciences (USA), Vanda Pharmaceuticals (USA), Trevi Therapeutics (USA), Lumosa Therapeutics (USA), Shandong Boan Biotechnology (China), Sichuan Haisco Pharmaceutical (China), Escient Pharmaceuticals (USA), MC2 Therapeutics (Norway), Avior Bio (UK), AOBiome Therapeutics (USA), Clexio Biosciences (USA), BioMimetix (Israel), Titan Pharmaceuticals (USA), Teikoku Pharma Solutions (Japan), Tioga Pharmaceuticals (USA) and Other Major Players.

The Pruritus Therapeutics Market is segmented into Drug Class, Disease Type, Route Of Administrations and region. By Drug Class, the market is categorized into Calcineurin Inhibitors, Corticosteroids, Counterirritants, Immunosuppressant, Antihistamines, and Others. By Disease Type, the market is categorized into Allergic Contact Dermatitis, Atopic Dermatitis, Psoriasis, Urticaria, and Others. By Route Of Administration, the market is categorized into Oral, Parenteral, and Topical. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dry skin is a common cause of itchy skin, also known as pruritus. It's more frequent in older people since their skin dries out with age. Antibiotics, antifungals, anticonvulsants, and a few natural remedies such as topical application of coconut oil, vitamin E, and honey are utilized to treat pruritus.

The Pruritus Therapeutic market estimated at USD 13.21 Billion in the year 2023, is projected to reach a revised size of USD 19.44 Billion by 2032, growing at a CAGR of 4.4% over the analysis period 2024-2032.